China Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

China Commercial Insurance Market Overview:

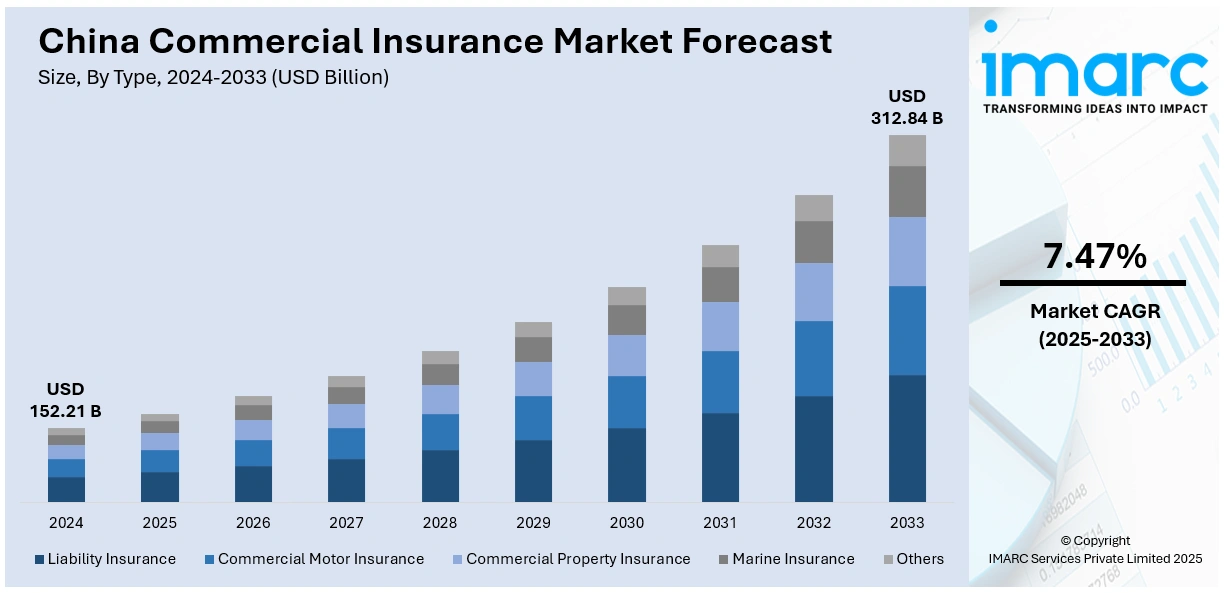

The China commercial insurance market size reached USD 152.21 Billion in 2024. The market is projected to reach USD 312.84 Billion by 2033, exhibiting a growth rate (CAGR) of 7.47% during 2025-2033. The market is expanding due to the growing demand for specialized coverage in emerging sectors such as low-altitude aviation and technology-driven industries. Innovations in digital platforms, AI, and data analytics are supporting China commercial insurance market share, driving both product diversification and accessibility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 152.21 Billion |

| Market Forecast in 2033 | USD 312.84 Billion |

| Market Growth Rate 2025-2033 | 7.47% |

China Commercial Insurance Market Trends:

Rising Demand from SMEs and Corporates

The France commercial insurance market growth is being shaped by the steady rise in demand from small and medium-sized enterprises as well as large corporates. Businesses across sectors such as manufacturing, retail, construction, and logistics are increasingly relying on tailored insurance products to safeguard their operations. The growing awareness of financial risks, whether related to property damage, liability issues, or supply chain disruptions, has created a stronger culture of risk management among French companies. At the same time, regulatory requirements in areas like professional indemnity and workers’ compensation are pushing more firms to secure adequate coverage. Another factor supporting this trend is the shift in perception among businesses that now see insurance not only as a compliance tool but as a strategic investment to ensure resilience and continuity. Recent developments include wider adoption of digital distribution channels, which make policy purchasing and claims processing faster and more accessible for smaller enterprises. Large corporates are also showing greater interest in specialized products that address cross-border trade, cyber risks, and ESG compliance. These factors collectively strengthen the role of commercial insurance as a critical part of corporate planning, while increasing competition among insurers who seek to capture these growing opportunities.

To get more information on this market, Request Sample

Technology Integration and Product Innovation

The French commercial insurance market is experiencing a time of transformation as product innovation and technology adoption redefine the insurer's business model. Insurers are investing in telematics, blockchain, artificial intelligence, and advanced analytics to enhance underwriting and build coverage that mirrors actual business risk. Data-driven models enable insurers to deliver more accurate pricing, with claims efficiency boosted as well. More and more companies now want insurers to provide digital-first platforms for managing policies, so convenience and speed become key to customer expectation. Another force is the need for industry-specific solutions: transportation businesses want telematics-enabled motor coverage, construction businesses require real-time monitoring solutions for construction site risks, and professional service businesses prefer customized liability packages. Recent innovations include the introduction of AI-driven underwriting systems, blockchain-enabled fraud detection platforms, and automated settlement models of claims that slash timelines by a considerable margin. In addition to becoming more efficient for insurers, the innovations also become more transparent and trustworthy to clients. Through embracing such solutions, French insurers are distinguishing themselves on service quality as opposed to purely price. As the digitalization deepens, the market is likely to increasingly move toward customized, technology-facilitated products which enhance long-term client relations and generate sustainable growth opportunities for the providers.

China Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

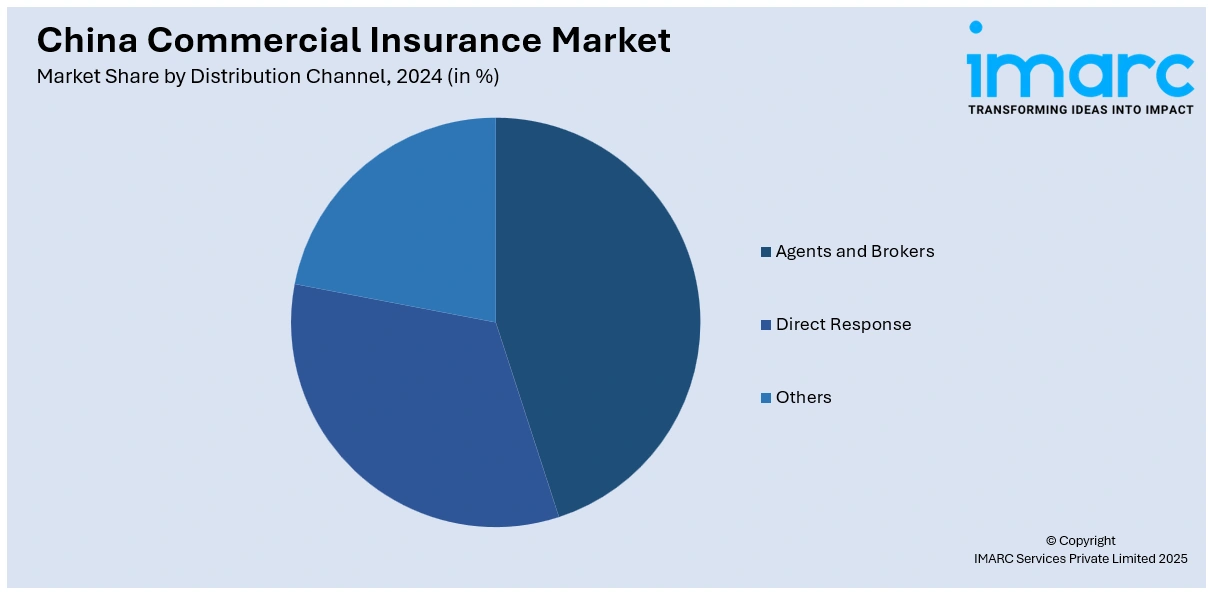

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

The report has also provided a comprehensive analysis of all the major regional markets, which include North China, East China, South Central China, Southwest China, Northwest China, and Northeast China.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

China Commercial Insurance Market News:

- June 2025: Hexiang Insurance launched drone and air taxi insurance products in China, targeting the growing low-altitude aviation sector. Developed in collaboration with Ping An and PICC, these solutions addressed the evolving needs of tourism, logistics, and urban mobility, further expanding China’s commercial insurance market.

- February 2025: China launched a pilot program allowing insurance companies to invest in gold, aiming to optimize asset allocation and enhance asset-liability management. This initiative, involving ten insurers, is expected to foster reforms, contributing to the growth and stability of China’s commercial insurance market.

China Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the China commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the China commercial insurance market on the basis of type?

- What is the breakup of the China commercial insurance market on the basis of enterprise size?

- What is the breakup of the China commercial insurance market on the basis of distribution channel?

- What is the breakup of the China commercial insurance market on the basis of industry vertical?

- What is the breakup of the China commercial insurance market on the basis of region?

- What are the various stages in the value chain of the China commercial insurance market?

- What are the key driving factors and challenges in the China commercial insurance market?

- What is the structure of the China commercial insurance market and who are the key players?

- What is the degree of competition in the China commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the China commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)