China Healthcare Cold Chain Logistics Market Size, Share, Trends and Forecast by Product, Service, Temperature Range, Mode of Delivery, End User, and Region, 2026-2034

China Healthcare Cold Chain Logistics Market Overview:

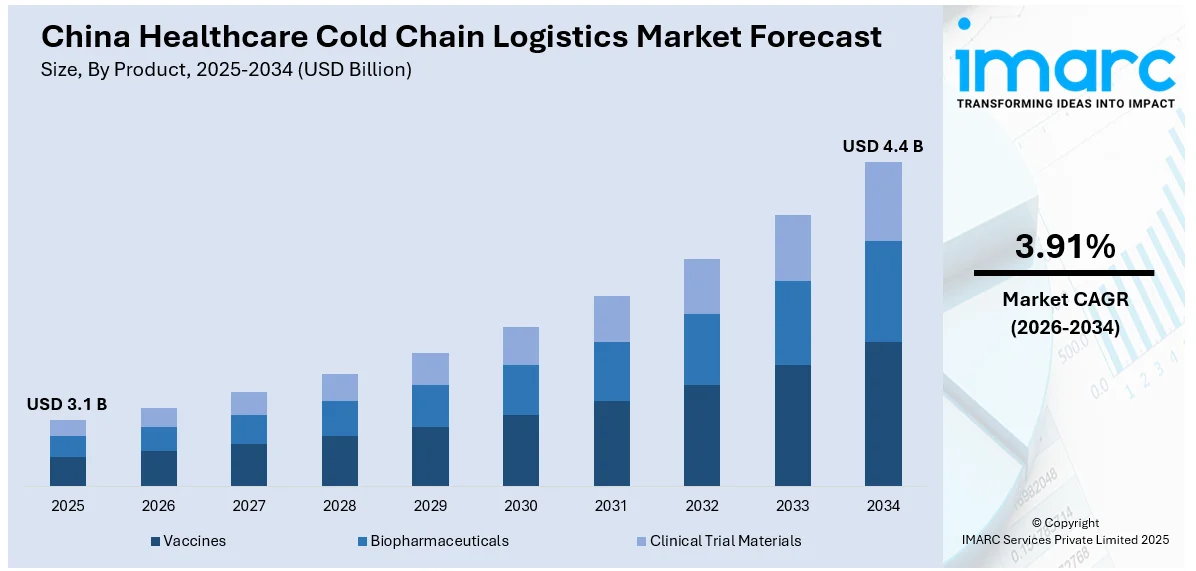

The China healthcare cold chain logistics market size reached USD 3.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.4 Billion by 2034, exhibiting a growth rate (CAGR) of 3.91% during 2026-2034. The growing demand for biopharmaceuticals is offering a favorable market outlook. This trend, along with the heightened innovations in the vaccine distribution programs, is propelling the market growth. Apart from this, the deployment of Internet of Things (IoT) sensors, cloud-based monitoring platforms, and blockchain technologies to improve visibility, accuracy, and accountability in systems is expanding the China healthcare cold chain logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.1 Billion |

| Market Forecast in 2034 | USD 4.4 Billion |

| Market Growth Rate 2026-2034 | 3.91% |

China Healthcare Cold Chain Logistics Market Trends:

Growing Demand for Biopharmaceuticals

The rising need for biopharmaceuticals, which need stringent temperature control along the entire supply chain, is offering a favorable market outlook. With China advancing fast in biotechnology and pharmaceutical innovation, increasing numbers of temperature-sensitive biologics, such as vaccines, monoclonal antibodies, and cell and gene therapies, are developed and shipped. These cutting-edge therapies demand highly specialized logistics solutions to ensure efficacy and meet rigorous regulatory requirements. Businesses are spending money on ultra-low temperature freezers, global positioning system (GPS)-tracking devices, and temperature-controlled packaging to preserve product integrity. Cold chain is emerging as a key infrastructure component to enable clinical trials and commercial distribution. Licensing deals for Chinese drug candidates skyrocketed, with big pharma in-licensing 28% of Chinese biopharma innovator drugs in 2024. The value of total deal for innovator drug licensing agreements with Chinese biopharma licensors increased 66%, from $16.6 billion in 2023 to $41.5 billion in 2024, a five-year high, GlobalData's Pharma Intelligence Center Deals Database reports.

To get more information on this market Request Sample

Expansion of Vaccine Distribution Programs

Heightened innovations in the vaccine distribution programs are propelling the China healthcare cold chain logistics market growth. As the nation is also moving to enhance its national immunization policy, the logistics infrastructure needs to absorb the greater range and numbers of vaccines that need special temperature ranges. As China expands its international ambitions in public health diplomacy, the need for effective, consistent cold chain systems is becoming increasingly stronger. Vaccine manufacturers are engaging third-party logistics providers (3PLs) to be able to deliver to remote locations while providing real-time temperature tracking and adherence to good distribution practices (GDP). The Chinese government’s 14th Five-Year Plan (2021-2025) provides extensive investment in cold chain logistics facilities. In 2024, the government dedicated CNY 100 billion towards developing new refrigerator storage facilities and transportation routes for the purpose of lessening food spoilage as well as making food safer. The project aims to increase the amount of cold storage capacity by 700,000 tons in 2025, with a primary emphasis on agricultural and seafood markets.

Technological Advancements in Cold Chain Infrastructure

The market is experiencing significant transformation due to continuous technological advancements in cold chain infrastructure. Companies are deploying Internet of Things (IoT) sensors, cloud-based monitoring platforms, and blockchain technologies to improve visibility, accuracy, and accountability in the cold chain. These innovations are enabling real-time data collection on temperature, humidity, and handling conditions, thereby reducing spoilage and enhancing compliance with international standards. Artificial intelligence (AI) and big data analytics are also integrated to predict potential risks and optimize routing for time- and temperature-sensitive medical products. Cold storage facilities are becoming increasingly automated, featuring robotic systems for product handling and energy-efficient cooling technologies. These advancements are reducing operational costs while improving service reliability. Moreover, China's push toward digitalization and smart logistics under the “Made in China 2025” initiative is further accelerating the adoption of high-tech solutions in the healthcare cold chain sector, creating new benchmarks for quality and efficiency.

China Healthcare Cold Chain Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, service, temperature range, mode of delivery, and end user.

Product Insights:

- Vaccines

- Biopharmaceuticals

- Clinical Trial Materials

The report has provided a detailed breakup and analysis of the market based on the product. This includes vaccines, biopharmaceuticals, and clinical trial materials.

Service Insights:

- Transportation

- Storage

- Packaging

- Labeling

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes transportation, storage, packaging, labeling, and others.

Temperature Range Insights:

- Ambient

- Refrigerated

- Frozen

- Cryogenic

A detailed breakup and analysis of the market based on the temperature range have also been provided in the report. This includes ambient, refrigerated, frozen, and cryogenic.

Mode of Delivery Insights:

- Last-Mile Delivery

- Hubs-to-Distributor

A detailed breakup and analysis of the market based on the mode of delivery have also been provided in the report. This includes last-mile delivery and hubs-to-distributor.

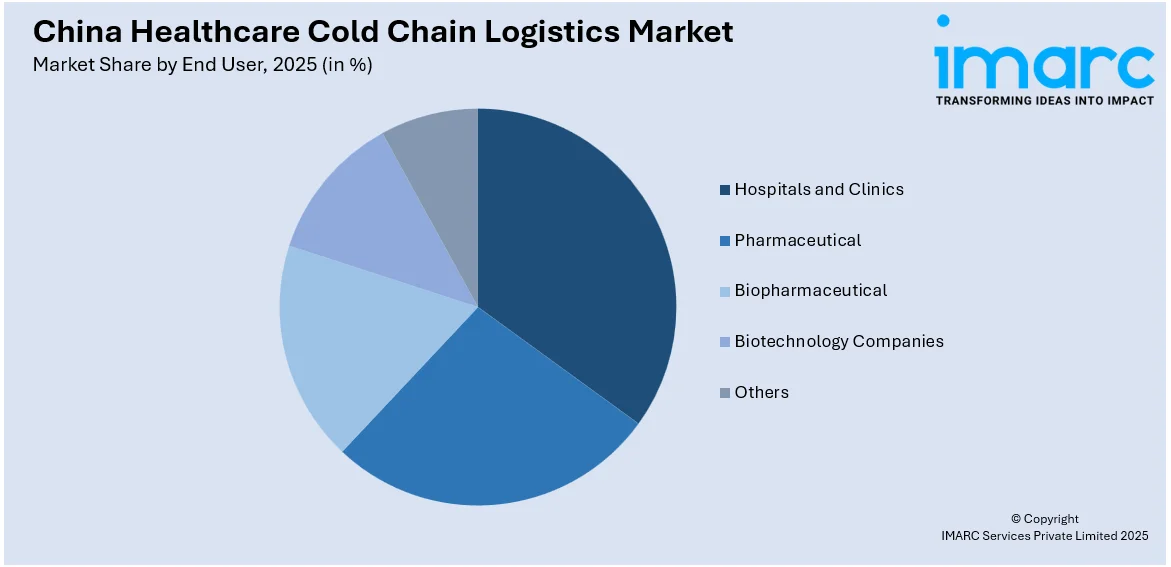

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals and Clinics

- Pharmaceutical

- Biopharmaceutical

- Biotechnology Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, pharmaceutical, biopharmaceutical, biotechnology companies, and others.

Regional Insights:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

The report has also provided a comprehensive analysis of all the major regional markets, which include North China, East China, South Central China, Southwest China, Northwest China, and Northeast China.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

China Healthcare Cold Chain Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Vaccines, Biopharmaceuticals, Clinical Trial Materials |

| Services Covered | Transportation, Storage, Packaging, Labeling, Others |

| Temperature Ranges Covered | Ambient, Refrigerated, Frozen, Cryogenic |

| Mode of Deliveries Covered | Last-Mile Delivery, Hubs-to-Distributor |

| End Users Covered | Hospitals and Clinics, Pharmaceutical, Biopharmaceutical, Biotechnology Companies, Others |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the China healthcare cold chain logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the China healthcare cold chain logistics market on the basis of product?

- What is the breakup of the China healthcare cold chain logistics market on the basis of service?

- What is the breakup of the China healthcare cold chain logistics market on the basis of temperature range?

- What is the breakup of the China healthcare cold chain logistics market on the basis of mode of delivery?

- What is the breakup of the China healthcare cold chain logistics market on the basis of end user?

- What is the breakup of the China healthcare cold chain logistics market on the basis of region?

- What are the various stages in the value chain of the China healthcare cold chain logistics market?

- What are the key driving factors and challenges in the China healthcare cold chain logistics market?

- What is the structure of the China healthcare cold chain logistics market and who are the key players?

- What is the degree of competition in the China healthcare cold chain logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China healthcare cold chain logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the China healthcare cold chain logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China healthcare cold chain logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)