China Home Fitness Equipment Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

China Home Fitness Equipment Market Summary:

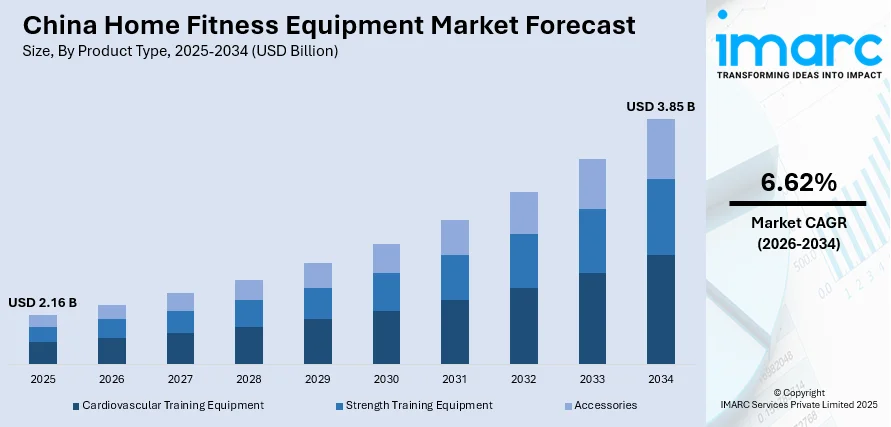

The China home fitness equipment market size was valued at USD 2.16 Billion in 2025 and is projected to reach USD 3.85 Billion by 2034, growing at a compound annual growth rate of 6.62% from 2026-2034.

The China home fitness equipment market is experiencing robust growth driven by rising health consciousness among the expanding middle class, government initiatives under the National Fitness Plan (2021-2025), and increasing preference for convenient home workout solutions. Growing urbanization, higher disposable incomes, and the integration of smart technology into fitness equipment are further accelerating adoption rates. The proliferation of fitness applications and digital workout platforms is complementing home equipment purchases, creating a comprehensive ecosystem that supports the China home fitness equipment market share.

Key Takeaways and Insights:

- By Product Type: Cardiovascular Training Equipment dominates the market with a share of 60.23% in 2025, driven by widespread consumer preference for cardio workouts that improve heart health and support weight management goals.

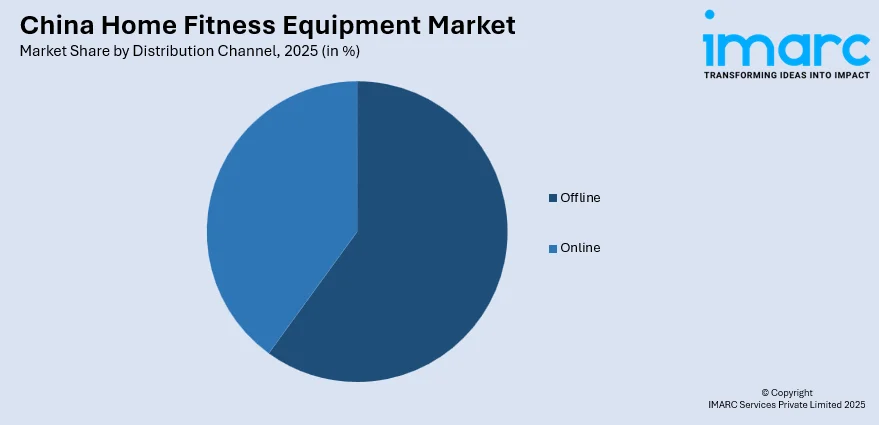

- By Distribution Channel: Offline leads the market with a share of 56.25% in 2025, as consumers prefer in-store experiences for testing equipment quality and receiving expert guidance before purchase.

- Key Players: The China home fitness equipment market exhibits moderate fragmentation with domestic manufacturers competing alongside established international brands across product categories and price segments. Market consolidation is accelerating as leading companies expand distribution networks, enhance product innovation capabilities, and invest in smart technology integration to capture growing consumer demand.

To get more information on this market Request Sample

The China home fitness equipment market has witnessed remarkable transformation as consumer preferences shift toward integrated health and wellness solutions. The market benefits from supportive government policies, including the Healthy China 2030 initiative, which promotes physical activity as a national priority. Infrastructure development has accelerated significantly, with China's per capita sports venue area reaching 3.0 square meters in 2024, according to data from the General Administration of Sport. By the end of 2024, there were 152,000 gyms and 171,800 fitness trails totaling 407,600 kilometers nationwide, creating a comprehensive fitness ecosystem that drives complementary home equipment purchases.

China Home Fitness Equipment Market Trends:

Smart and Connected Fitness Equipment Integration

The integration of IoT and artificial intelligence into home fitness equipment is transforming consumer workout experiences across China. Smart treadmills, connected exercise bikes, and AI-powered training systems offer real-time performance tracking, personalized workout recommendations, and interactive training content that adapts to individual fitness levels. Leading manufacturers are launching comprehensive smart fitness lineups featuring voice-activated controls and app connectivity, enabling users to access virtual coaching sessions and track progress through centralized platforms.

Government-Driven National Fitness Infrastructure Development

Government initiatives under the National Fitness Plan (2021-2025) are creating a supportive ecosystem for home fitness equipment adoption. The State Council's plan targets full coverage of fitness facilities across all counties, towns, and villages, establishing "15-minute fitness circles" for residents. In April 2025, China launched its sixth national physical fitness monitoring campaign across 31 provincial-level regions with 1,877 sampling points, collecting data from 248,000 people aged 3 to 79 to guide fitness policies, demonstrating the government's commitment to improving citizens' health through physical activity.

Rise of Boutique and Digital-First Fitness Models

The fitness industry in China is shifting toward technology-enabled hybrid models combining online and offline experiences. New-model gyms like Supermonkey and LeFit have disrupted traditional fitness business models through digitization and pay-per-use pricing. As of January 2024, Supermonkey operated 245 venues across nine cities with cumulative membership exceeding 30 million users, demonstrating consumer preference for flexible fitness options that complement home equipment usage with digital connectivity and community features.

Market Outlook 2026-2034:

The China home fitness equipment market is positioned for sustained growth as urbanization accelerates and health consciousness permeates broader demographics beyond tier-one cities. Government initiatives targeting nationwide fitness facility coverage through 15-minute fitness circles by 2025 are expanding consumer access and awareness. Investment in product innovation, particularly smart connected equipment featuring AI-powered coaching and real-time performance tracking, will drive premiumization and higher average selling prices. Rising disposable incomes among the expanding middle class further support transition toward premium home fitness solutions. The market generated a revenue of USD 2.16 Billion in 2025 and is projected to reach a revenue of USD 3.85 Billion by 2034, growing at a compound annual growth rate of 6.62% from 2026-2034.

China Home Fitness Equipment Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Cardiovascular Training Equipment | 60.23% |

| Distribution Channel | Offline | 56.25% |

Product Type Insights:

- Cardiovascular Training Equipment

- Air Bike

- Elliptical Machines

- Punching Bag

- Rowing Machine

- Treadmill

- Others

- Strength Training Equipment

- Ab Wheel

- Adjustable Dumbbells

- Adjustable Kettlebell

- Medicine Ball

- Mini Resistance Bands

- Pull Up Bars

- Weight-lifting Bench

- Others

- Accessories

- Foam Roller

- Weighted Jump Rope

- Others

The cardiovascular training equipment segment dominates with a market share of 60.23% of the total China home fitness equipment market in 2025.

Cardiovascular training equipment has emerged as the dominant product category in China's home fitness market, driven by widespread consumer awareness of heart health benefits and weight management capabilities. Treadmills, stationary bikes, and elliptical trainers enable effective calorie burning and cardiovascular conditioning in home settings, appealing to health-conscious consumers seeking convenient exercise solutions. 330 million people were predicted to have CVD, according to the Report on Cardiovascular Health and Diseases in China 2023. As a result of the rising prevalence of these lifestyle diseases including obesity, diabetes, and hypertension has accelerated demand for cardio equipment that supports preventive health management.

The cardiovascular equipment segment benefits from continuous technological advancement and product innovation. Smart treadmills with AI coaching, interactive display screens, and connectivity features are commanding premium pricing while attracting tech-savvy consumers. The segment's growth is further supported by the integration of gamification elements and virtual training classes that enhance user engagement and workout adherence. China's growing middle class, characterized by rising disposable incomes and urbanized lifestyles, increasingly views cardiovascular equipment as essential home investments for maintaining health and wellness in space-constrained urban apartments.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Offline

- Online

The offline distribution channel leads with a share of 56.25% of the total China home fitness equipment market in 2025.

Offline distribution channels maintain dominance in China's home fitness equipment market as consumers prioritize hands-on product evaluation before making significant purchases. Specialty fitness retailers and department stores provide essential services including equipment demonstrations, expert consultations, and after-sales support that build consumer confidence. The offline channel benefits from strategic partnerships between manufacturers and regional distributors that have established extensive retail networks across tier-1 and tier-2 cities. Decathlon, one of the leading offline retailers, maintains a strong presence across China with stores offering comprehensive fitness equipment ranges supported by knowledgeable staff.

Physical retail establishments serve critical functions in the consumer purchase journey, particularly for high-value cardiovascular equipment where tactile assessment and spatial visualization are important. Retailers have invested in creating experiential showrooms that allow customers to test treadmills, exercise bikes, and other equipment under realistic conditions. The offline channel also addresses logistical considerations including equipment delivery, installation, and ongoing maintenance support. While e-commerce is growing rapidly, the offline segment's ability to provide comprehensive pre-purchase consultation and post-purchase services ensures its continued significance in the distribution landscape.

Regional Insights:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

North China represents a significant market for home fitness equipment, anchored by Beijing as the capital and major economic center. The region benefits from high health awareness among residents and strong government support for national fitness programs. Beijing is among the top destinations for sports tourism and serves as the "Double Olympic City" following the 2008 and 2022 Olympic Games, driving sustained interest in fitness activities and equipment.

East China dominates the national home fitness equipment market with the highest concentration of fitness infrastructure and consumer spending power. Shanghai serves as a hub for fitness brands and boutique studios, with leading gym chains including Will's and Tera Wellness using the city as their base for expansion. The region exhibited the highest passing rates for national physical fitness standards in 2021, reflecting advanced fitness culture and infrastructure development.

South Central China presents substantial growth opportunities driven by economic development in Guangdong province and surrounding areas. Shenzhen and Guangzhou serve as major markets with high urbanization rates and young, health-conscious populations. The region benefits from proximity to manufacturing hubs in the Pearl River Delta, ensuring efficient distribution and competitive pricing for fitness equipment across diverse consumer segments.

Southwest China demonstrates emerging potential for home fitness equipment as fitness facilities become increasingly common in major cities like Chengdu. Government initiatives are expanding fitness infrastructure to underserved communities through the establishment of 15-minute fitness circles. The region's market development benefits from rising urbanization and growing middle-class populations seeking convenient home workout solutions to complement public fitness facilities.

Northwest China represents a developing market for home fitness equipment with significant growth potential as economic conditions improve. The region faces unique challenges including geographic constraints and transportation infrastructure limitations that affect access to fitness facilities. Government policies prioritize the establishment of 15-minute fitness circles and community sports facilities to address accessibility gaps and promote physical activity among residents.

Northeast China offers growing opportunities for home fitness equipment, particularly during harsh winter months when outdoor exercise becomes challenging. The region's cold climate naturally drives demand for indoor fitness solutions that enable year-round physical activity. Winter sports gained significant popularity following the Beijing 2022 Winter Olympics, creating spillover demand for complementary home fitness equipment among active consumers seeking comprehensive training programs.

Market Dynamics:

Growth Drivers:

Why is the China Home Fitness Equipment Market Growing?

Rising Health Consciousness and Lifestyle Disease Prevention

Increasing awareness of health and fitness benefits among Chinese consumers is driving substantial demand for home fitness equipment. Growing incidences of lifestyle-related diseases including obesity, cardiovascular disorders, and diabetes have prompted individuals to prioritize preventive health measures through regular exercise. The Healthy China 2030 Planning Outline objective of "all-round, full-cycle maintenance and protection to greatly improve people's health" can be achieved more quickly by creating physical activity standards based on the life cycle idea.

Government Policies and National Fitness Infrastructure Investment

Supportive government policies under the National Fitness Plan (2021-2025) are creating favorable conditions for market growth. The State Council's plan mandates full coverage of fitness facilities across all administrative divisions and aims to achieve sports industry value of 5 trillion yuan by 2025. Government investment in sports infrastructure, including the establishment of over 2,000 sports parks and public fitness centers by 2025, increases overall fitness awareness and drives complementary home equipment purchases.

Expanding Middle Class and Rising Disposable Incomes

China's growing middle class with increasing disposable incomes is fueling demand for premium home fitness equipment. Urbanization and economic development have enabled more households to invest in health and wellness products as quality-of-life priorities. Per capita annual disposable income increased 5.3% year-on-year to RMB 41,314 in 2024, supporting higher spending on fitness equipment and related accessories. China's middle-class population in Beijing, Shanghai and Guangdong is 50.08% of the whole of the Chinese mainland, creating substantial market opportunity for home fitness equipment manufacturers targeting health-conscious consumers seeking convenient workout solutions.

Market Restraints:

What Challenges the China Home Fitness Equipment Market is Facing?

High Initial Equipment Costs

Premium cardiovascular and strength training equipment requires significant upfront investment that may deter price-sensitive consumers. Advanced treadmills with smart features can cost several thousand dollars, limiting accessibility for middle and lower-income households. This cost barrier is particularly challenging in tier-3 and tier-4 cities where disposable incomes remain comparatively lower.

Competition from Commercial Fitness Facilities

The proliferation of commercial gyms and boutique fitness studios provides convenient alternatives to home equipment ownership. Budget gym chains offering affordable memberships and flexible payment options attract consumers who prefer professional equipment access without capital investment. The availability of varied group classes and professional guidance at fitness centers creates competitive pressure on home equipment demand.

Space Constraints in Urban Apartments

Limited living space in densely populated urban areas restricts adoption of larger fitness equipment like treadmills and multi-station gyms. Apartment dwellers in major cities face practical challenges accommodating bulky equipment, favoring compact or foldable designs. Space constraints drive demand toward smaller accessories and digital fitness solutions rather than traditional home gym equipment.

Competitive Landscape:

The China home fitness equipment market exhibits moderate fragmentation with domestic manufacturers competing alongside established international brands across product categories and price segments. Leading domestic players have built strong distribution networks spanning retail stores and e-commerce platforms. International brands also maintain premium positioning through advanced technology integration and brand recognition. Competition intensifies as manufacturers invest in smart connected features, product quality improvements, and expanded distribution coverage. Market consolidation continues as larger players acquire regional competitors to strengthen market presence.

Recent Developments:

- August 2025: The State Council released the Opinions on Unlocking the Potential of Sports Consumption and Further Promoting High-Quality Development of the Sports Industry, setting targets for expanding China's sports industry to exceed RMB 7 Trillion by 2030 through infrastructure development and consumption promotion.

China Home Fitness Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Offline, Online |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The China home fitness equipment market size was valued at USD 2.16 Billion in 2025.

The China home fitness equipment market is expected to grow at a compound annual growth rate of 6.62% from 2026-2034 to reach USD 3.85 Billion by 2034.

Cardiovascular training equipment dominated the market with 60.23% share in 2025, driven by rising consumer awareness of heart health benefits and the effectiveness of cardio workouts for weight management and overall fitness improvement.

Key factors driving the China Home Fitness Equipment market include rising health consciousness, government support through the National Fitness Plan, expanding middle class with higher disposable incomes, smart technology integration, and growing preference for convenient home workout solutions.

Major challenges include high upfront equipment costs limiting accessibility, competition from commercial gym facilities offering flexible memberships, space constraints in urban apartments restricting equipment adoption, and the need for continuous product innovation to meet evolving consumer expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)