China Maternity Goods Market Size, Share, Trends and Forecast by Duration, Product Type, Distribution Channel, and Province, 2025-2033

China Maternity Goods Market Size and Share:

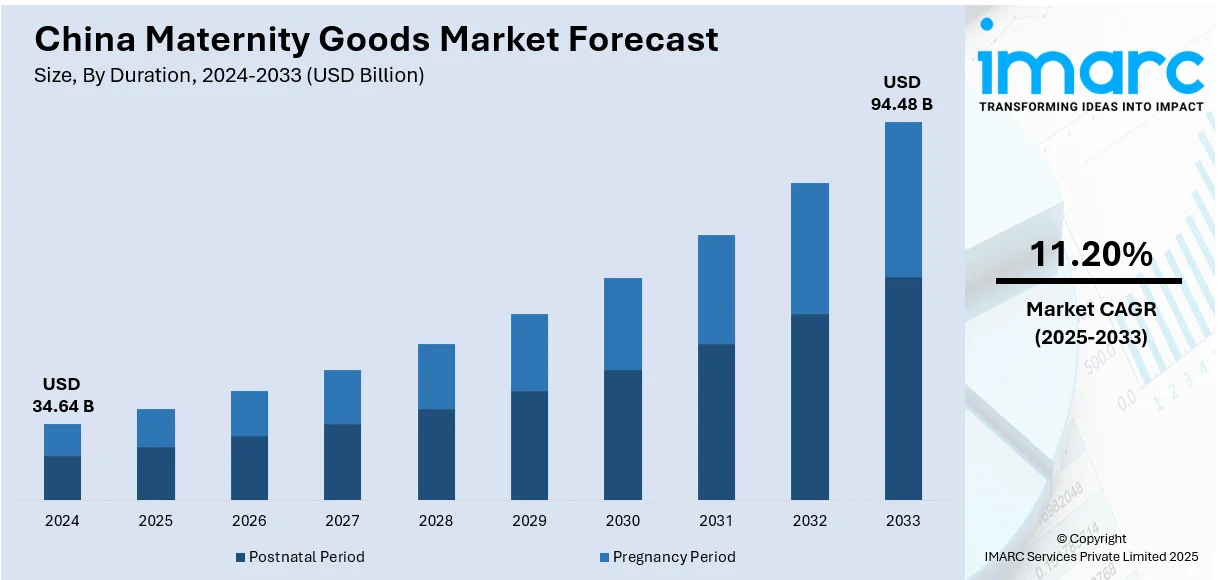

The China maternity goods market size was valued at USD 34.64 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 94.48 Billion by 2033, exhibiting a CAGR of 11.20% from 2025-2033. Guangdong province exhibits a clear dominance in the market due to rising disposable incomes, growing awareness about maternal health, and an increasing number of working women. These factors drive the demand for comfortable, stylish, and high-quality maternity products that cater to both functionality and wellness needs of expectant mothers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 34.64 Billion |

|

Market Forecast in 2033

|

USD 94.48 Billion |

| Market Growth Rate (2025-2033) | 11.20% |

The China maternity goods market is growing rapidly because of increased urbanization and growing disposable incomes among young couples. As families transition to urban areas, they gain access to modern retail channels and diverse maternity product offerings, which is driving market expansion. Heightened awareness of maternal health is prompting consumers to prioritize premium maternity goods, such as nutrition supplements, ergonomic clothing, and innovative baby care products. Moreover, this increase in births also means more use of maternity products and services because of relaxed family planning policies. For example, in October 2024, China introduced 13 new measures to improve birth support, focusing on childcare, education, housing, employment, maternity leave, and healthcare, addressing challenges from a growing geriatric population. Simultaneously, the growing number of working women is altering consumer preferences, with a focus on convenient, high-quality maternity solutions that address their time constraints and lifestyle needs, further propelling the market’s growth.

E-commerce platforms are transforming the accessibility and affordability of maternity goods in both urban and rural regions across China. These platforms provide consumers with competitive pricing, convenient home delivery, and an extensive range of products, effectively boosting China maternity goods market share. Additionally, consumer interest in sustainable and organic products has surged, driven by rising awareness of safety and environmental considerations. Manufacturers are responding to this trend by offering eco-friendly maternity goods, such as organic baby clothing, biodegradable diapers, and chemical-free skincare products. For instance, Pigeon China received the Zero Carbon Exhibition Hall certification from SGS, highlighting its commitment to sustainable business practices. This alignment with evolving consumer preferences, coupled with increasing digital connectivity and trust in online platforms, is fostering sustained market growth. As e-commerce adoption accelerates, these platforms continue to enhance the market landscape by offering tailored product recommendations and improving overall shopping convenience, solidifying their role as key drivers of the maternity goods market.

China Maternity Goods Market Trends:

Growth of E-commerce in Maternity Goods

The e-commerce sector is profoundly transforming the China maternity goods market outlook. With the rapid growth of online shopping platforms, consumers now enjoy easier access to a diverse selection of maternity products, including premium and niche brands. The convenience of online shopping, coupled with features like product reviews, price comparisons, and targeted advertising, is driving demand across both urban and rural regions. Rising internet penetration and smartphone usage are enabling a broader demographic to explore and purchase maternity goods online. Platforms also frequently offer discounts, promotional campaigns, and subscription services, which enhance consumer engagement and loyalty. The integration of artificial intelligence (AI) and data analytics in e-commerce is further personalizing shopping experiences, making it easier for expecting and new parents to find products tailored to their needs.

Increased Demand for Premium Maternity Products

Chinese consumers are demonstrating a growing preference for premium maternity products, driven by higher disposable incomes and a greater focus on quality and safety. Parents are increasingly willing to invest in high-end products such as organic skincare, nutritionally enhanced supplements, and ergonomically designed baby gear to ensure the best care for both mother and child. The rise in luxury baby brands and imported maternity goods reflects this shift toward premiumization. Social media and celebrity endorsements also significantly influence consumer preference, with parents being inspired by trends and recommendations shared online. This trend is encouraging manufacturers to innovate and create products that balance luxury, safety, and functionality, meeting the expectations of an increasingly discerning consumer base.

Emphasis on Sustainability and Eco-friendly Products

The maternity goods market in China is experiencing significant growth in the demand for sustainable and eco-friendly products. With increasing environmental awareness, consumers are prioritizing maternity items made from organic, biodegradable, and non-toxic materials. This trend encompasses products such as eco-friendly diapers, chemical-free skincare, and sustainable baby clothing, reflecting a broader shift toward environmentally responsible choices. For instance, in January 2024, Pigeon launched the "Training Master" baby drink cup series in China, featuring packaging made from 50% sugarcane and 50% wood pulp, showcasing its dedication to sustainability. Moreover, the manufacturers cater to this hike by following sustainable processes in their productions, waste reduction, and using renewable resources. Additionally, government policies and corporate social responsibility initiatives that foster environmental protection also help to align the brand with eco-friendly values. This trend has also gained acceptance among younger parents, such as millennials and Gen Z, who have an inclination towards ethical consumption and sustainability. This is boosting the pace of innovation and competition in the maternity goods market.

China Maternity Goods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China maternity goods market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on duration, product type, and distribution channel.

Analysis by Duration:

- Postnatal Period

- Pregnancy Period

The postnatal segment is a fast-emerging focus area for the maternity products market, wherein new mothers seek products that assist in recovery and ensure optimal care for newborns. This category includes specialized supplements, nursing accessories, postpartum apparel, and baby care essentials. Intensifying concern for maternal and infant health raises demand for premium, safe, and clinically tested postnatal products. Shifting preferences for customized and organic solutions like herbal supplements and chemical-free skincare are changing the way consumers decide. Furthermore, healthcare providers and wellness programs have boosted their focus on postnatal care, motivating families to spend on holistic product solutions. An accelerating e-commerce platform and enhanced product innovation further strengthen this vital segment.

Analysis by Product Type:

- Nutrients and Health Care Products

- Maternity Wear

- Skin Care Products

- Others

Consumers amplified focus on maternal and infant health is giving the nutrients and healthcare products category a significant growth impetus. Prenatal vitamins, DHA supplements, and postnatal nutrition products are high in demand due to their support for healthy pregnancies and recovery postpartum. Escalating campaigns and medical advice have also been found to promote fortified products to eliminate nutritional deficiencies. The trend towards natural and organic supplements, free from artificial additives, is further influencing consumer choices. For example, innovations in product formulation and delivery method include gummies, powders, and liquid capsules aimed at improving comfort and attractiveness. As disposable incomes rise, families are willing to invest in premium healthcare solutions, making this segment a cornerstone of the maternity goods market.

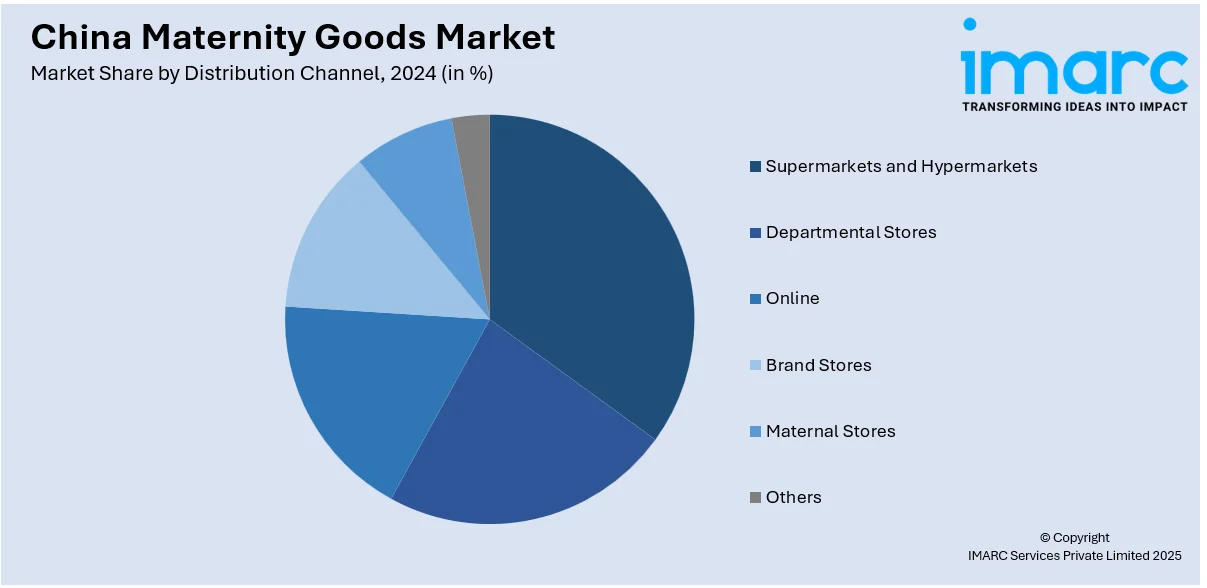

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Departmental Stores

- Online

- Brand Stores

- Maternal Stores

- Others

Supermarkets and hypermarkets, remain a dominant channel of distribution for maternity goods. It helps the consumers to access a wide range of products under one roof. Their extensive presence and carrying everything from prenatal supplements to baby care products makes them convenient shopping destinations for the convenience-focused shopper. Promotions, bulk discounts, and loyalty programs ensure constant footfalls into these outlets. As urbanization increases, modern retail formats are expanding, offering consumers organized shopping environments and access to premium and affordable product options. Dedicated maternity sections, staffed with knowledgeable personnel, enhance the shopping experience. Additionally, partnerships with leading maternity brands ensure that supermarkets and hypermarkets remain pivotal in meeting the diverse needs of the maternity goods market.

Analysis by Province:

- Guangdong

- Jiangsu

- Zhejiang

- Henan

- Sichuan

Guangdong province is an emerging leader in the maternity goods market due to its sizeable population and prosperity. It is home to a high concentration of young, urban families that demand premium maternity and infant care products. Guangdong has developed an advanced retail infrastructure, combining brick-and-mortar stores and e-commerce hubs, to make available a wide range of maternity goods. The consumers in the region prefer quality branded products that are in line with their modern lifestyle and health and safety consciousness. Local government efforts to promote maternal health and wellness also add to the growth of the market. Guangdong's manufacturing capabilities and proximity to major logistics networks make it a critical hub for both production and distribution in the maternity goods sector.

Competitive Landscape:

In China, the competitive landscape of maternity goods is composed of established and emerging players that have a wide array of products to offer. Product innovation, particularly on comfort, design, and functionality, is highly emphasized by companies as they target expectant mothers. Competitive strategies also include expansion in product lines, improvement in online and offline channels of distribution, and marketing efforts that boosts brand awareness. There are heightening concerns towards sustainability practices, such as using environment-friendly materials for products. Due to an escalating number of working mothers, maternity products that are both practical and fashionable, along with versatility, have gained importance and compelled companies to spend on research and development in order to outdo their competition in this competitive marketplace.

The report provides a comprehensive analysis of the competitive landscape in the China maternity goods market with detailed profiles of all major companies, including:

- Health and Happiness (H&H) International Holdings Limited

- Tomson Group Limited

- Real Nutriceutical Group Limited

- Shanghai October Mommy Network Co., Ltd

- Happy House Company

- Mum & Me

- Nanchang Jingqi Clothing Co., Ltd.

- Kangaroo Mother

- Pro Run

- Pigeon Corporation

China Maternity Goods Market News

- In December 2024, Pigeon launched the Natural Botanical Maternity skincare line, featuring 90% naturally-derived ingredients and Dermal Precision Technology, offering safe, effective, and eco-conscious solutions for mothers during pregnancy and postpartum.

- In November 2024, Pigeon showcased its advancements in maternal and infant care at the China International Import Expo (CIIE). The brand introduced the Pigeon Nipple 3S Model and launched a Maternal and Infant Skin Care Research Center in China. Pigeon also emphasized its sustainable practices and local innovation efforts.

China Maternity Goods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Durations Covered | Postnatal Period, Pregnancy Period |

| Product Types Covered | Nutrients and Health Care Products, Maternity Wear, Skin Care Products, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Online, Brand Stores, Maternal Stores, Others |

| Provinces Covered | Guangdong, Jiangsu, Zhejiang, Henan, Sichuan |

| Companies Covered | Health and Happiness (H&H) International Holdings Limited, Tomson Group Limited, Real Nutriceutical Group Limited, Shanghai October Mommy Network Co., Ltd, Happy House Company, Mum &me, Nanchang Jingqi Clothing Co., Ltd., Kangaroo Mother, Pro Run, Pigeon Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China maternity goods market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China maternity goods market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China maternity goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The China maternity goods market was valued at USD 34.64 Billion in 2024.

Rising urbanization, increased levels of disposable incomes, and consciousness about the care of maternal and infant health fuels the China maternity goods market. Relaxation in family planning policy, an expanding number of female working forces, and rising availability of e-commerce platforms have elevated demand further. Consumer preferences of premium, environment-friendly, or eco-friendly products also fuel high growth rates within the maternity segment.

IMARC estimates the China maternity goods market to exhibit a CAGR of 11.20% during 2025-2033.

Supermarkets & hypermarkets is the leading segment by distribution channel, driven by their wide product availability, competitive pricing, and convenient access to essential maternity goods in both urban and suburban areas.

Some of the major players in the China maternity goods market include Health and Happiness (H&H) International Holdings Limited, Tomson Group Limited, Real Nutriceutical Group Limited, Shanghai October Mommy Network Co., Ltd, Happy House Company, Mum &me, Nanchang Jingqi Clothing Co., Ltd., Kangaroo Mother, Pro Run, Pigeon Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)