China Palm Oil Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

China Palm Oil Market Overview:

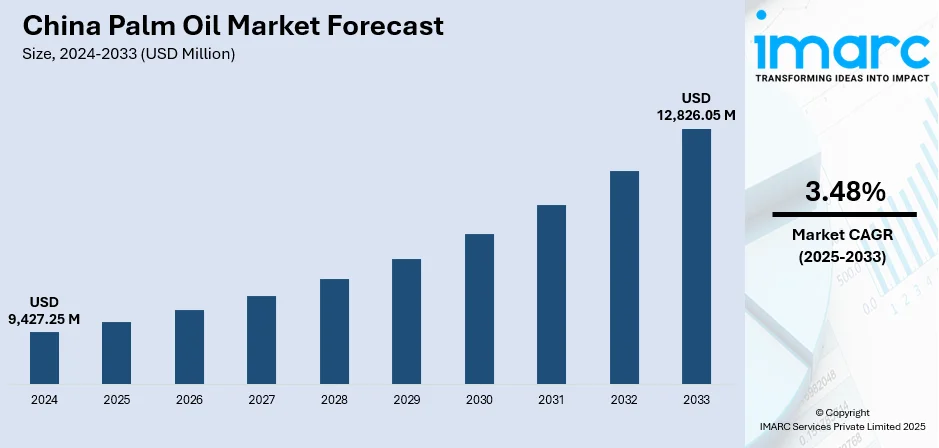

The China palm oil market size reached USD 9,427.25 Million in 2024. Looking forward, the market is expected to reach USD 12,826.05 Million by 2033, exhibiting a growth rate (CAGR) of 3.48% during 2025-2033. The market is shaped by strong import reliance, mainly from Indonesia and Malaysia, catering to food, cosmetic, and oleochemical industries. Price-sensitive dynamics favor cheaper edible oils such as soybean oil, causing demand volatility. Consumer and private-sector interest in certified sustainable sourcing is emerging slowly, influencing trade patterns and strategies in the China palm oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9,427.25 Million |

| Market Forecast in 2033 | USD 12,826.05 Million |

| Market Growth Rate 2025-2033 | 3.48% |

China Palm Oil Market Trends:

High Demand from the Food Processing Industry

The massive food industry in China also contributes to the palm oil demand. The diversity, shelf life and economic benefit of palm oil in instant noodles, bake goods, and sweet and frying have led it to be the choice of ingredient. The usage of products that contain palm oil keeps increasing as the urban population of the country and the living standards of consumers become more inclined towards accessible and pre-cooked viands. Also, the semi-solid quality of palm oil that results at room temperature simply means that palm oil does not have to be hydrogenated, which takes away the allure to use it as a substitute for oils with trans fat. This industrial preference, along with steady growth in domestic food manufacturing and retail sectors, reinforces palm oil’s vital role in China’s edible oil mix and strengthens overall market demand.

To get more information on this market, Request Sample

Trade Relationships and Strategic Imports

China’s palm oil market is heavily influenced by its strategic import relationships with major producers such as Indonesia and Malaysia. As domestic palm oil production is virtually nonexistent, China relies entirely on imports to meet industrial and consumer demand. Long-standing trade agreements and logistical efficiencies support consistent supply chains, while the Belt and Road Initiative has further deepened cooperation between China and palm oil-exporting nations. Partnerships such as joint laboratories and memorandums of understanding are also enhancing technological exchange and market integration. These initiatives ensure stable access to palm oil, support pricing negotiations, and improve bilateral ties, all of which are essential for sustaining and expanding China’s palm oil market.

Industrial and Oleochemical Applications

Beyond food, palm oil plays a crucial role in China’s growing oleochemical and industrial sectors. Palm derivatives are widely used in the production of soaps, detergents, cosmetics, lubricants, and even biofuels. As China advances its manufacturing base and expands environmentally friendly product lines, palm oil serves as a key raw material due to its chemical properties and relatively lower cost. The rise in demand for personal care items and sustainable cleaning products further fuels consumption of palm-based ingredients. Additionally, policy support for green and biodegradable industrial solutions encourages manufacturers to opt for palm oil-derived inputs. This non-food application base contributes significantly to diversifying demand and driving the of China palm oil market growth.

China Palm Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application.

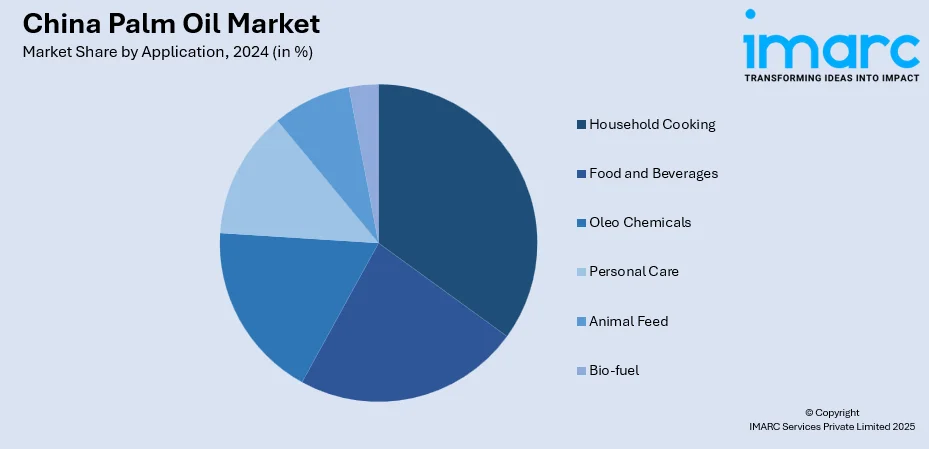

Application Insights:

- Household Cooking

- Food and Beverages

- Oleo Chemicals

- Personal Care

- Animal Feed

- Bio-fuel

The report has provided a detailed breakup and analysis of the market based on the application. This includes household cooking, food and beverages, oleo chemicals, personal care, animal feed, and bio-fuel.

Regional Insights:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

The report has also provided a comprehensive analysis of all the major regional markets, which include North China, East China, South Central China, Southwest China, Northwest China, and Northeast China.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

China Palm Oil Market News:

- In June 2025, the first China-Malaysia joint laboratory focused on oils and fats processing and safety convened its inaugural meeting. Established under the Belt and Road Initiative (BRI), this pioneering collaboration between the two nations marks a significant step toward strengthening palm oil trade and fostering wider industrial partnerships between China and Malaysia.

- In April 2023, Malaysia signed a memorandum of understanding with a Chinese government-linked trade organization to enhance cooperation and promote palm oil trade between the two nations. As stated by the Malaysian Palm Oil Board, the partnership with the China Chamber of Commerce for Import and Export of Foodstuffs, Native Produce, and Animal By-Products is intended to support Malaysia in regaining its palm oil market share in China, the most populous country in the world.

China Palm Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Household Cooking, Food and Beverages, Oleo Chemicals, Personal Care, Animal Feed, Bio-fuel |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the China palm oil market performed so far and how will it perform in the coming years?

- What is the breakup of the China palm oil market on the basis of application?

- What is the breakup of the China palm oil market on the basis of region?

- What are the various stages in the value chain of the China palm oil market?

- What are the key driving factors and challenges in the China palm oil market?

- What is the structure of the China palm oil market and who are the key players?

- What is the degree of competition in the China palm oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China palm oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the China palm oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China palm oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)