China Photonic Integrated Circuit Market Size, Share, Trends and Forecast by Component, Raw Material, Integration, Application, and Region, 2026-2034

China Photonic Integrated Circuit Market Summary:

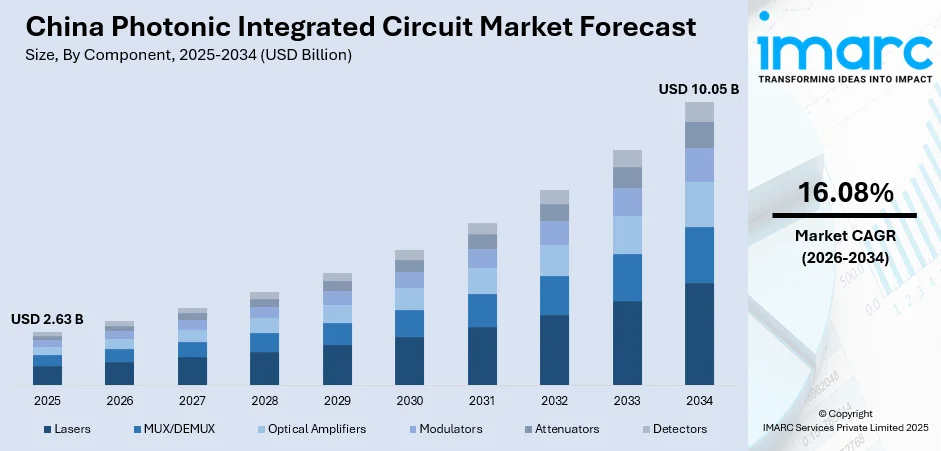

The China photonic integrated circuit market size reached USD 2.63 Billion in 2025 and is projected to reach USD 10.05 Billion by 2034, growing at a compound annual growth rate of 16.08% from 2026-2034.

The China photonic integrated circuit market is experiencing robust expansion driven by escalating demand for high-speed data transmission solutions and energy-efficient optical communication infrastructure. Government initiatives under the Made in China 2025 program are accelerating domestic semiconductor and photonics development, while substantial investments in 5G and 6G network deployment are stimulating adoption across telecommunications and data center applications. Advancements in thin-film lithium niobate technology, rising artificial intelligence workloads, and the integration of photonics into quantum computing research are positioning China as an emerging global hub for next-generation optical chip manufacturing and innovation, strengthening the China photonic integrated circuit market share.

Key Takeaways and Insights:

- By Component: Lasers dominate the market with a share of 25% in 2025, driven by their critical role in optical communication systems and growing demand for high-performance laser sources in data center and telecommunications applications.

- By Raw Material: Indium Phosphide (InP) leads the market with a share of 30% in 2025, owing to its superior light emission and detection properties essential for high-speed optical modulators and photodetectors used in advanced photonic circuits.

- By Integration: Monolithic Integration represents the largest segment with a market share of 44% in 2025, attributed to its cost-effectiveness in mass production and compatibility with existing CMOS manufacturing processes, enabling scalable photonic chip fabrication.

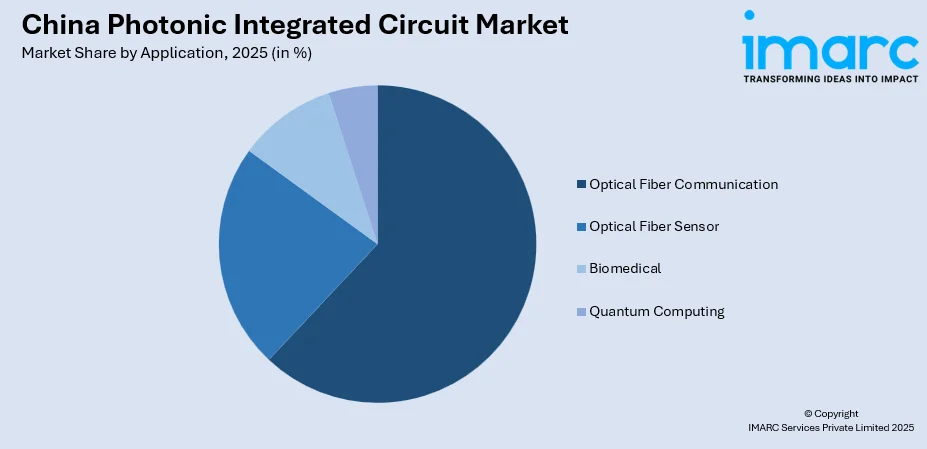

- By Application: Optical Fiber Communication holds the largest share at 62% in 2025, reflecting the massive deployment of high-capacity optical networks to support 5G infrastructure, cloud computing, and hyperscale data center interconnections across China.

- Key Players: The China photonic integrated circuit market exhibits a moderately competitive landscape with domestic manufacturers expanding capabilities alongside global technology leaders. Key participants are investing heavily in silicon photonics research, thin-film lithium niobate development, and strategic partnerships with academic institutions to strengthen market positioning and accelerate the commercialization of advanced photonic solutions.

To get more information on this market Request Sample

The China photonic integrated circuit market is witnessing transformative growth as the country positions itself at the forefront of optical chip innovation. Strong government backing through initiatives like the State Key Laboratory of Optical Communications Technology Research is fostering collaborations between industry and academia. In June 2025, the Shanghai Jiao Tong University Chip Hub for Integrated Photonics launched China's first thin-film lithium niobate photonic chip production line with an annual capacity of 12,000 six-inch wafers, achieving modulation bandwidth exceeding 110 GHz. This milestone underscores China's commitment to reducing foreign technology dependence while establishing domestic manufacturing capabilities for AI, quantum computing, and next-generation telecommunications applications. The rapid expansion of data consumption from IoT devices and advanced 5G networks continues to drive unprecedented demand for high-speed photonic interconnect solutions across the market.

China Photonic Integrated Circuit Market Trends:

Advancement in Domestic Thin-Film Lithium Niobate Manufacturing

China is establishing significant domestic capacity for thin-film lithium niobate photonic chip production, a material prized for ultra-fast electro-optic properties and low signal loss. Manufacturing innovations are enabling faster development cycles and improved integration of optical components onto single substrates. In June 2025, CHIPX at Shanghai Jiao Tong University completed a pilot production line capable of producing wafers with insertion loss below 3.5 decibels and waveguide loss under 0.2 decibels per centimeter, surpassing global performance benchmarks and accelerating China's China photonic integrated circuit market growth.

Silicon Photonics Integration for AI and High-Performance Computing

Silicon photonics technology is gaining significant traction as Chinese researchers develop advanced solutions to address bandwidth bottlenecks in artificial intelligence infrastructure. Multi-dimensional multiplexing techniques are being integrated into on-chip optical interconnects to enhance data transmission throughput while minimizing power consumption. In March 2025, researchers at Fudan University developed a silicon photonic integrated high-order mode multiplexer chip achieving 38 Tbps data transmission speeds, capable of transferring 4.75 trillion large language model parameters per second for AI training applications.

Photonic Quantum Chip Development for Next-Generation Computing

Chinese research institutions are making substantial progress in photonic quantum computing hardware, combining deterministic solid-state atomic single-photon sources with low-loss lithium niobate platforms. These hybrid-integrated chips address scalability challenges by enabling integration of multiple quantum emitters on a single photonic substrate. In November 2025, researchers from the Shanghai Institute of Microsystem and Information Technology developed the largest hybrid-integrated photonic quantum chip using quantum-dot deterministic single-photon sources, achieving an integration density of 67 quantum emitters per millimeter for advanced quantum networking applications.

Market Outlook 2026-2034:

The China photonic integrated circuit market demonstrates exceptional growth potential as strategic investments in photonics infrastructure accelerate across telecommunications, data centers, and emerging quantum computing sectors. Rising AI computing needs and the rapid rollout of 5G networks are significantly boosting interest in high-capacity, energy-efficient optical interconnect technologies. This momentum is encouraging stronger adoption of advanced photonic components, supporting accelerated growth across China’s optical ecosystem. The market generated a revenue of USD 2.63 Billion in 2025 and is projected to reach a revenue of USD 10.05 Billion by 2034, growing at a compound annual growth rate of 16.08% from 2026-2034.

China Photonic Integrated Circuit Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Lasers | 25% |

| Raw Material | Indium Phosphide (InP) | 30% |

| Integration | Monolithic Integration | 44% |

| Application | Optical Fiber Communication | 62% |

Component Insights:

- Lasers

- MUX/DEMUX

- Optical Amplifiers

- Modulators

- Attenuators

- Detectors

The lasers segment dominates with a market share of 25% of the total China photonic integrated circuit market in 2025.

Laser components serve as fundamental building blocks in photonic integrated circuits, providing essential light sources for optical communication and sensing applications. The segment benefits from escalating demand for high-speed data transmission in telecommunications infrastructure and data center networks. Chinese manufacturers are developing advanced laser technologies, including distributed feedback lasers and vertical-cavity surface-emitting lasers, to meet stringent performance requirements. In late 2023, InnoLight achieved 1.6 Tbps transfer speeds in its latest optical transceivers, demonstrating the critical role of advanced laser technology in next-generation photonic solutions.

Rapid expansion of data centers and telecom networks is driving adoption, while domestic companies focus on innovations like distributed feedback and vertical-cavity surface-emitting lasers to enhance efficiency and performance. Breakthroughs in optical transceivers, achieving terabit-level data transfer, highlight the segment’s strategic importance in supporting next-generation photonic technologies and high-capacity network infrastructure.

Raw Material Insights:

- Indium Phosphide (InP)

- Gallium Arsenide (GaAs)

- Lithium Niobate (LiNbO3)

- Silicon

- Silica-on-Silicon

The Indium Phosphide (InP) segment leads the market with a 30% share of the total China photonic integrated circuit market in 2025.

Indium phosphide maintains market leadership owing to its exceptional direct bandgap properties enabling efficient light emission and detection at telecommunications wavelengths. The material platform supports monolithic integration of lasers, modulators, and photodetectors on single substrates, reducing manufacturing complexity and improving device performance. Chinese foundries are expanding InP fabrication capabilities to address growing domestic demand for coherent optical components. Major manufacturers continue investing in InP-based photonic integrated circuits to support high-capacity wavelength-division multiplexing systems deployed across expanding 5G network infrastructure.

Its prominence is driven by the material’s suitability for high-speed optical communication and integration of multiple photonic functions on a single chip. Domestic foundries are ramping up production to meet rising demand for advanced optical components, while key players invest in InP-based solutions to enhance performance and capacity in 5G networks and data center applications, reinforcing its leading position in the market.

Integration Insights:

- Monolithic Integration

- Hybrid Integration

- Module Integration

The monolithic integration segment holds the largest share at 44% of the total China photonic integrated circuit market in 2025.

Monolithic integration maintains market dominance through its compatibility with established CMOS semiconductor manufacturing processes, enabling cost-effective high-volume production of photonic devices. This approach allows all photonic components to be fabricated on a single semiconductor substrate, minimizing assembly complexity and improving device reliability. Chinese manufacturers leverage existing silicon foundry infrastructure to accelerate photonic chip development while achieving economies of scale. The integration method particularly benefits applications requiring compact form factors and consistent performance across large production volumes.

Monolithic integration leads the China photonic integrated circuit market due to its ability to deliver compact, high-performance chips with reduced interconnection losses. By integrating multiple photonic components onto a single substrate, it enhances signal integrity and overall device efficiency. The approach supports advanced applications such as high-speed data transmission and coherent optical networks. Additionally, ongoing investments by domestic foundries in design and fabrication capabilities enable faster development cycles and scalable production, reinforcing its dominant market position.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Optical Fiber Communication

- Optical Fiber Sensor

- Biomedical

- Quantum Computing

The optical fiber communication segment accounts for the highest revenue at 62% of the total China photonic integrated circuit market in 2025.

Optical fiber communication dominates market applications reflecting massive infrastructure investments in telecommunications networks and hyperscale data center facilities. Escalating demand for high-bandwidth connectivity to support 5G deployment, cloud computing expansion, and enterprise networking drives substantial adoption of photonic integrated circuits. Chinese telecom operators are upgrading networks to 400G and 800G optical links to accommodate exponentially growing data traffic. In 2024, ZTE demonstrated on-board modules designed for 1.2T per wavelength transmission supporting distances up to 5,000 km, highlighting advancing capabilities in domestic optical communication technology.

The sector benefits from continuous upgrades in network capacity and efficiency, driven by surging internet traffic and digital services adoption. Domestic manufacturers are increasingly developing integrated solutions for lasers, modulators, and detectors to optimize performance and reduce system costs. Strong government support for next-generation communication infrastructure and growing demand from cloud and enterprise networks further consolidate optical fiber communication as the largest application segment.

Regional Insights:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

Growth in North China’s PIC market is fueled by strong government support for advanced semiconductor technologies, the presence of major research institutions, and expanding 5G infrastructure. Beijing and Tianjin serve as innovation hubs, attracting investments in optical communication, data centers, and AI-enabled networks. Increasing demand for high-speed data transmission across industrial automation and smart city projects further accelerates adoption of photonic integrated circuits in the region.

East China benefits from a mature electronics manufacturing ecosystem, robust industrial supply chains, and heavy investments in optoelectronics. Shanghai, Jiangsu, and Zhejiang host leading fabrication facilities and R&D centers, strengthening the region’s photonics capabilities. Rapid cloud computing expansion, dense data center deployments, and strong demand from telecom operators for high-capacity optical networks support PIC market growth. The region’s thriving consumer electronics and automotive electronics sectors also amplify adoption.

South Central China’s PIC market is driven by fast-growing telecom and data infrastructure, especially in Guangdong’s technology clusters. The region’s extensive manufacturing base—spanning electronics, IoT hardware, and communication devices—creates consistent demand for high-performance optical components. Rising integration of photonics in 5G networks, smart manufacturing, and emerging AI workloads further boosts growth. Strong provincial incentives for semiconductor innovation add additional momentum to PIC deployment.

Southwest China sees increasing PIC adoption due to expanding digital transformation efforts and government-backed investments in new infrastructure. Cities like Chongqing and Chengdu are developing into semiconductor and high-tech centers, attracting photonics R&D activities. Growing demand for optical communication equipment across cloud services, education networks, and public sector digitalization supports the market. The region’s push toward smart transportation and industrial automation also stimulates PIC integration.

PIC market development in Northwest China is supported by rising investments in large-scale data centers, especially in provinces with abundant land and energy resources. The region is increasingly becoming a hub for national cloud and storage facilities, driving the need for high-capacity photonic communication solutions. Government efforts to develop strategic emerging industries, combined with the adoption of photonics in energy, defense, and remote sensing applications, further enhance market growth.

Northeast China’s PIC market is shaped by industrial restructuring and modernization across automotive, heavy machinery, and electronics sectors. The region is enhancing its semiconductor capabilities through new research collaborations and provincial technology programs. Growth in fiber-optic communication networks, cloud computing expansion, and the rising adoption of smart manufacturing systems support PIC utilization. The presence of universities and key laboratories also contributes to advancements in photonics applications.

Market Dynamics:

Growth Drivers:

Why is the China Photonic Integrated Circuit Market Growing?

Strong Government Support for Photonics Self-Sufficiency

The Chinese government has prioritized photonics technology development as part of its broader semiconductor self-reliance strategy, providing substantial funding and policy support to accelerate domestic capabilities. National initiatives under the Made in China 2025 program and the 14th Five-Year Plan emphasize advanced manufacturing and technological innovation in optical communications. Government subsidies totaling CNY 8.2 billion have been allocated for integrated laser-silicon programs to reduce dependence on foreign technology suppliers. Strategic investments are flowing to regional photonics clusters, including Shanghai, Wuhan's Optics Valley, and Suzhou, with provincial governments committing approximately 5 billion euros in funding over the coming years to develop comprehensive photonic industry supply chains.

Explosive Growth in Data Center and AI Infrastructure

The unprecedented expansion of artificial intelligence workloads and cloud computing infrastructure is creating substantial demand for high-bandwidth optical interconnect solutions that traditional copper-based systems cannot efficiently address. Hyperscale data center operators require photonic integrated circuits to support massive data transfer rates essential for AI model training and inference applications. The China data center market size reached USD 35,210.01 Million in 2024. The market is projected to reach USD 79,950.43 Million by 2033, exhibiting a growth rate (CAGR) of 9.54% during 2025-2033. Silicon photonics is driving a new wave of ultra-fast, energy-efficient data transmission, offering clear advantages over traditional electronic solutions. Chinese cloud companies are rapidly expanding their adoption of next-generation optical transceivers, supported by strong demand for high-capacity modules from leading domestic manufacturers.

Accelerated 5G and 6G Network Deployment

China's aggressive rollout of 5G infrastructure and early-stage 6G research activities are driving substantial demand for photonic components in telecommunications networks. High-speed optical modules are essential for 5G front-haul, mid-haul, and backhaul applications requiring dense wavelength-division multiplexing to manage unprecedented data volumes. Telecom operators are increasingly adopting advanced optical networking technologies to handle rising demand from data-heavy services such as high-definition streaming, remote healthcare solutions, and automated industrial systems. As connected devices continue to proliferate, the need for faster and more efficient data transmission is growing, making photonic integrated circuits well suited to enhance the capacity and performance of modern optical fiber networks.

Market Restraints:

What Challenges the China Photonic Integrated Circuit Market is Facing?

High Research and Development Costs

Photonic integrated circuit development requires substantial capital investment in specialized equipment, materials, and highly skilled technical personnel. Production lead times can extend to several months, raising research and development (R&D) cost thresholds and creating barriers for new market entrants. The immature state of photonic design automation tools compared to electronic design automation further lengthens development cycles and increases resource requirements for companies seeking to introduce new products.

Material Supply Chain Vulnerabilities

Critical raw materials, including gallium and germanium, face supply chain risks that expose manufacturers to price volatility and potential shortages. Export controls on strategic materials have resulted in price increases of 75% to 250% following 2024 restrictions. Dependence on specialized materials platforms requires diversified sourcing strategies and regional foundry development to ensure manufacturing continuity and mitigate geopolitical supply disruption risks.

Rapid Technological Evolution and Competition

The photonic integrated circuit industry experiences rapid technological change requiring continuous innovation investment to maintain competitive positioning. International competition intensifies as global manufacturers advance co-packaged optics and next-generation silicon photonics platforms. Incomplete standardization of photonic design kits and limited software interoperability create additional challenges for manufacturers seeking to accelerate product development and commercial deployment timelines.

Competitive Landscape:

The China photonic integrated circuit market demonstrates an increasingly competitive environment as domestic manufacturers expand capabilities while international technology leaders maintain strategic positioning. Chinese companies, including Huawei, ZTE, InnoLight, and Eoptolink are investing substantially in silicon photonics research, advanced transceiver development, and manufacturing capacity expansion. Strategic collaborations between industry participants and leading universities are accelerating technology commercialization and talent development. Domestic manufacturers benefit from strong government support and growing demand from Chinese cloud providers, while competition intensifies around high-performance 400G and 800G optical modules essential for AI infrastructure applications.

Recent Developments:

- November 2025: CHIPX and Turing Quantum unveiled a photonic quantum chip featuring over 1,000 optical components on a six-inch silicon wafer. The chip was recognized at the 2025 World Internet Conference Wuzhen Summit and reportedly accelerates complex calculations by more than a thousandfold compared to conventional computing approaches.

China Photonic Integrated Circuit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Lasers, MUX/DEMUX, Optical Amplifiers, Modulators, Attenuators, Detectors |

| Raw Materials Covered | Indium Phosphide (InP), Gallium Arsenide (GaAs), Lithium Niobate (LiNbO3), Silicon, Silica-on-Silicon |

| Integrations Covered | Monolithic Integration, Hybrid Integration, Module Integration |

| Applications Covered | Optical Fiber Communication, Optical Fiber Sensor, Biomedical, Quantum Computing |

| Regions Covered | North China, East China, South Central China, Southwest China, Northwest China, Northeast China |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The China photonic integrated circuit market size was valued at USD 2.63 Billion in 2025.

The China photonic integrated circuit market is expected to grow at a compound annual growth rate of 16.08% from 2026-2034 to reach USD 10.05 Billion by 2034.

Lasers, holding the largest revenue share of 25% in 2025, remain essential for China's photonic integrated circuit market, providing critical light sources for optical communication systems, data center interconnects, and telecommunications infrastructure supporting 5G and emerging 6G network deployments.

Key factors driving the China photonic integrated circuit market include strong government support for photonics self-sufficiency, explosive growth in AI and data center infrastructure, accelerated 5G/6G network deployment, advancements in thin-film lithium niobate technology, and increasing demand for energy-efficient high-speed optical communication solutions.

Major challenges include high research and development costs with extended production lead times, material supply chain vulnerabilities and price volatility for critical raw materials, rapid technological evolution requiring continuous innovation investment, and immature photonic design automation tools compared to established electronic design workflows.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)