China Tea Market Size, Share, Trends and Forecast by Product Type, Packaging, Distribution Channel, Application, and Region, 2025-2033

China Tea Market Size and Share:

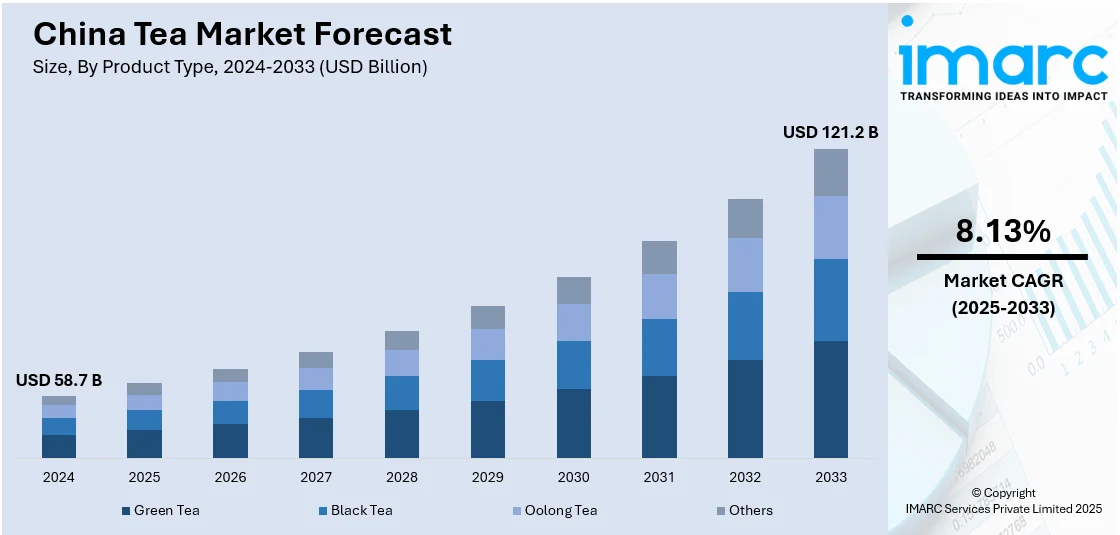

The China tea market size was valued at USD 58.73 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 121.24 Billion by 2033, exhibiting a CAGR of 8.13% from 2025-2033. The China tea market is influenced by rising health consciousness, shifting consumer preferences toward premium products, government support for traditional industries, and expanding online retail channels. Cultural heritage and domestic tourism also sustain demand, while innovation in flavors, packaging, and marketing strategies helps brands appeal to younger demographics and global buyers, thereby expanding the China tea market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 58.73 Billion |

|

Market Forecast in 2033

|

USD 121.24 Billion |

| Market Growth Rate 2025-2033 | 8.13% |

The rising awareness about the health benefits associated with tea consumption is a major factor bolstering the market growth in China. Individuals are increasingly looking for products that match wellness objectives, driving the need for premium and functional teas. This trend encourages the development of both classic and novel tea types focused on enhancing overall lifestyle practices. Additionally, the advancement of contemporary retail infrastructure and the swift expansion of e-commerce platforms are greatly enhancing product availability. Shoppers gain from more options, lower prices, and easier purchasing methods. This growth enables domestic and international brands to access broader audiences, speeding up market entry and improving overall sales across various geographic and demographic groups.

Besides this, brands are concentrating on developing distinct products by utilizing unique flavors, blends, and high-quality standards. The shift towards premiumization draws in consumers looking for enhanced experiences, whereas innovation ensures the category remains vibrant and attractive. Such strategies increase market value, encourage brand switching, and position tea as both an everyday beverage and a refined lifestyle choice. Moreover, policies and initiatives that encourage agricultural advancement, quality certification, and export expansion offer a favorable China tea market outlook. Government support improves production quality and promotes local specialties, boosting both domestic and international visibility. Collaboration between industry stakeholders fosters innovation, improves sustainability practices, and ensures long-term competitiveness, creating a favorable environment for market growth.

China Tea Market Trends:

Health and Wellness Trends

The growing awareness about the health benefits of tea is influencing the market, as consumers are placing more emphasis on drinks that enhance overall wellness. This choice reflects changing lifestyles that prioritize preventive health, equilibrium, and sustained well-being. Tea's reputation as a natural and beneficial choice has reinforced its role in daily consumption, encouraging a shift toward higher-quality and origin-specific products. A survey conducted in 2024 revealed that 62% of Chinese participants value physical health, highlighting the country's shift toward a wellness-centered lifestyle. The growing recognition of tea's nutritional advantages is expanding its attractiveness among various age demographics and income brackets, leading to a consistent rise in the demand. This health-driven preference not only sustains market growth but also fuels product diversification, from traditional varieties to innovative blends. By combining sensory enjoyment with health advantages, tea remains a preferred choice in an increasingly competitive beverage industry, securing its relevance and long-term growth potential in both domestic and international markets.

Sustainability and Environmental Responsibility

The increasing focus on environmental conservation and sustainable practices is bolstering the China tea market growth, as producers are adopting eco-friendly agricultural techniques, reducing chemical usage, and emphasizing resource conservation to satisfy regulatory requirements and consumer demands. Eco-friendly packaging, comprising biodegradable and recyclable substances, is becoming more popular, attracting eco-aware individuals and strengthening brand credibility. In 2024, China launched the OCOP China Tea Programme & International Tea Day Campaign in Dongguan, under the FAO’s One Country One Priority Product initiative. The program promoted eco-friendly, low-carbon tea production and global market development. It aimed to boost sustainability and international recognition of high-quality Chinese tea. Besides this, certifications and clear sourcing details enhance consumer trust in genuineness and ethical practices. By aligning with national and international sustainability goals, the industry strengthens resilience, complies with stricter regulations, and positions tea as a product representing quality, accountability, and environmental care in an increasingly eco-conscious market.

Improved Supply Chain and Distribution Efficiency

One of the major China tea market trends include the improved logistics infrastructure and upgraded distribution systems crucial for ensuring that products retain freshness, quality, and consistency from production to the point of sale. Quicker transport networks, enhanced storage amenities, and climate-controlled systems minimize waste, decrease expenses, and boost reliability, enhancing tea availability in urban and rural areas alike. In 2025, Lipton announced a major investment of over 50 million yuan to build a logistics hub in Huangshan, China, aiming to enhance supply chain efficiency and support its growing tea business. The brand is adapting to shifting consumer trends by expanding into cold brew, rooibos, and loose-leaf teas. This move targets health-conscious consumers and strengthens Lipton’s position amid rising competition. Such effective supply chains enable producers to quickly adapt to shifts in demand and seasonal patterns, fostering a more competitive and robust market environment.

China Tea Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the China tea market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, packaging, distribution channel, and application.

Analysis by Product Type:

- Green Tea

- Black Tea

- Oolong Tea

- Others

Green tea stands as the largest component in 2024, holding 38.7% of the market because of its strong link to health and wellness, aligning with the increasing consumer interest in natural and functional drinks. It is well-known for its advantageous qualities, fostering steady demand among various demographics. The product is well-regarded for its quality, freshness, and purity, enhancing user loyalty and encouraging repeat purchases. The flexibility of green tea in flavor variations and forms makes it attractive to different taste preferences and encourages creativity in product creation. Its connection to cultural traditions enhances its standing in both urban and rural markets. The growing accessibility of high-quality and specialty green tea options via organized retail and online channels is broadening its market presence and share.

Analysis by Packaging:

- Plastic Containers

- Loose Tea

- Paper Boards

- Aluminum Tin

- Tea Bags

- Others

Paper boards hold the biggest market share attributed to their flexibility, affordability, and strong connection to sustainable packaging trends. They offer outstanding protection for tea items, maintaining freshness, fragrance, and quality during storage and shipping. The substance is light but sturdy, making it easy to manage and lowering transportation expenses. Paper boards provide considerable benefits in printability, allowing for appealing branding, clear labeling, and thorough product information that boost consumer engagement and trust. Their eco-friendly and compostable traits attract environmentally aware individuals, aiding corporate sustainability objectives and adherence to regulations. Additionally, paper board packaging can be molded into different shapes and sizes, satisfying varied market needs while preserving aesthetic attractiveness. The blend of practical advantages, marketing opportunities, and sustainable features guarantees that paper boards stay a favored option in the tea industry.

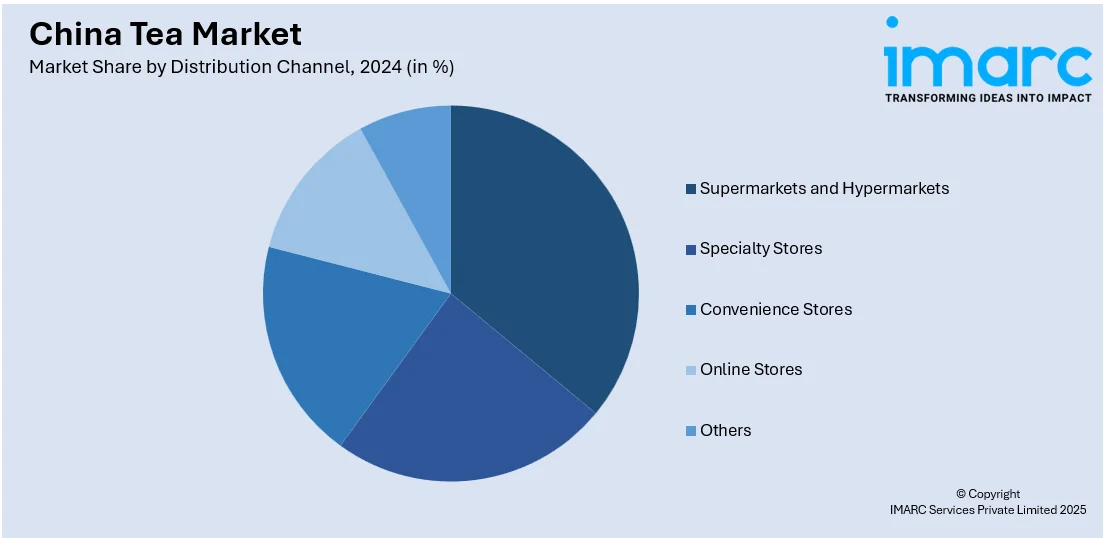

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets represent the largest segment, accounting for 34.9% because of their broad coverage, structured retail framework, and capacity to provide a diverse range of products in one location. These shops offer individuals easy access to a wide selection of tea types, guaranteeing reliable product availability and freshness. Their extensive operations facilitate competitive pricing, appealing promotions, and loyalty initiatives that drive repeat buying. The organized merchandising and distinct product categorization improve the shopping experience, enabling buyers to evaluate quality and make knowledgeable choices. Moreover, the reliability and trust linked to well-known retail chains strengthen consumer assurance in product genuineness and safety. Robust supplier connections and effective inventory control also guarantee a consistent supply, benefiting both high-end and mass-market products. These benefits together establish supermarkets and hypermarkets as the favored option for consumers, reinforcing their leading role in the tea market distribution scene.

Analysis by Application:

- Residential

- Commercial

Residential leads the market with around 63.2% of market share in 2024 owing to robust and steady consumer demand influenced by lifestyle patterns, cultural preferences, and an increasing focus on health and wellness in homes. Frequent tea drinking is firmly embedded in everyday habits, generating a consistent and ongoing demand. The residential sector gains from rising disposable incomes, allowing consumers to choose premium and varied tea products, which boosts market value. Furthermore, enhanced access via structured retail, digital platforms, and streamlined supply chains fosters consistent product availability, promoting regular purchases. The segment also benefits from increasing awareness about product authenticity, origin, and quality standards, encouraging consumers to make educated decisions. Brand loyalty is generally stronger in residential consumption habits, promoting lasting connections between consumers and providers.

Regional Analysis:

- Guangdong

- Jiangsu

- Shandong

- Zhejiang

- Henan

- Others

Guangdong is a crucial segment in the market influenced by its solid economic foundation, significant urbanization, and a varied consumer base with refined preferences. Demand is propelled by premium and specialty teas, with a significant focus on health-focused products. The region's sophisticated retail framework and robust e-commerce uptake enable brands to swiftly experiment with new products and marketing techniques.

Jiangsu benefits from a wealthy consumer demographic and a cultural fondness for tea drinking. Consumers in this market express interest in both classic and modern products, fostering expansion in enhanced goods. Efficient logistics and retail networks render the province an appealing point for brands seeking to ensure reliable supply and availability.

Shandong is shaped by a significant population and increasing disposable incomes, leading to consistent demand for both mainstream and high-end teas. Consumer preferences are shifting towards high-quality and origin-certified products, while offline retail continues to play a vital role alongside the growing digital sales landscape.

Zhejiang is one of China’s key tea production areas, which gives it a distinctive role in the market. Local manufacturing promotes robust brand identities linked to geographical indicators. Indivdiuals in the province frequently emphasize authenticity and skill in tea and are ready to spend on acknowledged quality.

Henan is characterized by a greater appreciation for tea culture and enhanced purchasing power of the middle class. Local shoppers display an increasing curiosity in health benefits, leading to higher sales of specialty and green teas. The province’s enhancing retail networks and access to national brands help expand the variety of products available.

Others include multiple provinces with varying levels of production and consumption, often influenced by regional preferences, cultural traditions, and income levels. These markets collectively present opportunities for penetration through tailored marketing and distribution strategies.

Competitive Landscape:

Main participants in the market are concentrating on enhancing their brand visibility, elevating product quality, and diversifying their selections to adapt to evolving consumer preferences. They are allocating resources to innovative processing methods, contemporary packaging, and focused marketing to increase attractiveness. Numerous businesses are broadening their distribution networks through both domestic and international avenues, utilizing e-commerce and direct-to-consumer (DTC) strategies to enhance their reach. Sustainability efforts, such as ethical sourcing and environment-friendly manufacturing, are gaining greater visibility. Strategic partnerships, product development, and responsiveness to health and wellness trends are vital for sustaining competitiveness in this changing market landscape. In 2025, Alexander Wang launched a limited-edition collaboration with Chinese bubble tea brand Heytea, featuring two specialty drinks and exclusive merchandise. The collection includes the Metabloom and Black Grape Boom teas, along with a rivet-shaped tea canister and a black silicon tote. This partnership blends fashion and tea culture, highlighting bold, clean design and urban style.

The report provides a comprehensive analysis of the competitive landscape in the China tea market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Chinese tea brand Chayanyuese entered the North American market via online platforms like Shopify, Amazon, TikTok Shop, and Walmart. Initially offering 40 products including snacks and tea sets, the company will not sell its signature tea drinks due to regulatory differences and supply chain limitations.

- April 2025: Chinese tea chain Chagee plans to raise USD 396 Million in a U.S. IPO on Nasdaq, targeting a USD 5.2 Billion valuation. Despite trade tensions, investor interest remains strong. Chagee operates 6,440 stores and reported USD 1.7 Billion in 2024 revenue, an 83% store and 167% revenue increase.

- May 2025: Starbucks launched its RTD Coffee Tea in China, blending premium coffee and tea. Designed by agency Marks, the product features an elegant new bottle shape, tactile textures, and refined visual identity to appeal to younger, quality-conscious consumers. It emphasizes simplicity, authenticity, and sensory engagement to boost brand differentiation.

- December 2024: Chinese tea brands like BING CHUN and Mixue expanded globally, with Southeast Asia as a key hub. Mixue operated over 36,000 stores worldwide, nearly 4,000 overseas. Driven by Belt and Road ties, modern tea drinks blended tradition with innovation, augmenting China’s tea culture abroad and consumer appeal.

- August 2024: Yili entered China’s growing RTD tea market with INIKIN Tea, featuring patented twist-cap technology that releases freeze-dried tea into mineral water. The sugar-free, additive-free drink targeted health-conscious consumers.

- July 2024: Nestlé China launched a no-sugar oolong tea containing 750mg of Reducose, a clinically studied mulberry leaf extract proven to lower post-meal blood sugar. Part of its glucose management range, the RTD tea aligned with Chinese meal habits and expands Nestlé’s health-focused beverage portfolio.

China Tea Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Green Tea, Black Tea, Oolong Tea, Others |

| Packagings Covered | Plastic Containers, Loose Tea, Paper Boards, Aluminum Tin, Tea Bags, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Guangdong, Jiangsu, Shandong, Zhejiang, Henan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the China tea market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the China tea market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the China tea industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tea market in China was valued at USD 58.73 Billion in 2024.

The China tea market is projected to exhibit a CAGR of 8.13% during 2025-2033, reaching a value of USD 121.24 Billion by 2033.

The China tea market is influenced by rising health consciousness, shifting consumer preferences toward premium products, growing disposable incomes, government support for traditional industries, and expanding online retail channels. Cultural heritage and domestic tourism also sustain demand, while innovation in flavors, packaging, and marketing strategies helps brands appeal to younger demographics and global buyers.

Green tea stands as the largest component in 2024, holding 38.7% of the market owing to its strong link to health and wellness, aligning with the increasing consumer interest in natural and functional drinks.

Supermarkets and hypermarkets represent the largest segment, accounting for 34.9% because of their broad coverage, structured retail framework, and capacity to provide a diverse range of products in one location.

Paper boards hold the biggest market share owing to their flexibility, affordability, and strong connection to sustainable packaging trends. They offer outstanding protection for tea items, maintaining freshness, fragrance, and quality during storage and shipping.

Residential leads the market with around 63.2% of market share in 2024 owing to robust and steady consumer demand influenced by lifestyle patterns, cultural preferences, and an increasing focus on health and wellness in homes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)