Chlorine Dioxide Market Size, Share, Trends and Forecast by Type, Method, Application, and Region, 2025-2033

Chlorine Dioxide Market Size and Share:

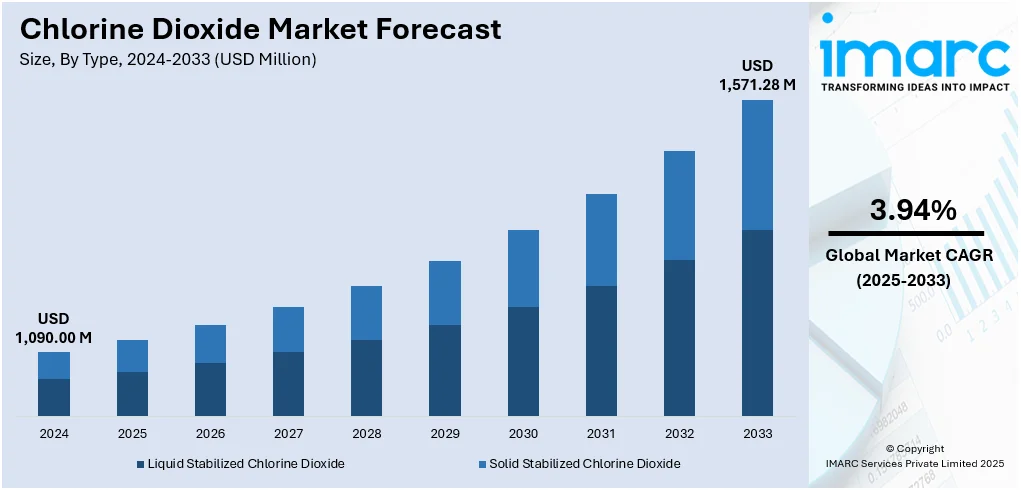

The global chlorine dioxide market size was valued at USD 1,090.00 Million in 2024. Looking forward, the market is expected to reach USD 1,571.28 Million by 2033, exhibiting a CAGR of 3.94% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 36.3% in 2024. The market is fueled by heightened demand for water treatment across municipal and industrial segments, along with its utilization in key industries like food processing and medical. Significant technological advancements in sustainable production techniques and escalating environmental policies are further propelling the chlorine dioxide market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,090.00 Million |

|

Market Forecast in 2033

|

USD 1,571.28 Million |

| Market Growth Rate (2025-2033) | 3.94% |

The chlorine dioxide market is primarily driven by its increasing use as a disinfectant and bleaching agent across diverse industries. In the water treatment sector, growing concerns about safe drinking water and stringent regulations on microbial contamination have accelerated its adoption. The paper and pulp industry also significantly contributes to demand, where chlorine dioxide is preferred for its effectiveness and lower environmental impact compared to traditional chlorine-based bleaching agents. Moreover, rising awareness of hygiene and sanitation in the healthcare and food processing sectors is further propelling market growth. Its efficacy in neutralizing pathogens without forming harmful by-products makes it ideal for surface disinfection. Additionally, urbanization and industrialization are fueling the need for advanced chemical treatments in municipal and industrial wastewater management.

To get more information on this market, Request Sample

In the US, the chlorine dioxide market growth is driven by increasing demand for effective and eco-friendly disinfection solutions across various sectors. Stringent EPA regulations and infrastructure investments are boosting its use in municipal and industrial water treatment. Chlorine dioxide's ability to eliminate pathogens without forming harmful by-products makes it ideal for drinking water purification and wastewater management. In the healthcare and food processing sectors, rising hygiene standards and the need for residue-free sanitization are further fueling adoption. Additionally, its application in pulp and paper bleaching is expanding due to environmental benefits over traditional chlorine-based agents, supporting the shift toward sustainable and compliant industrial practices. For instance, in December 2024, The Chemours Company revealed that PCC Group intends to construct and manage a new chlor-alkali facility within the premises of Chemours’ titanium dioxide (TiO₂) site in DeLisle, Mississippi, USA. As part of this initiative, Chemours and PCC have entered into a chlorine supply agreement, pending standard pre-conditions. The upcoming plant will incorporate advanced, energy-efficient technology and is projected to achieve an annual production capacity of up to 340,000 Metric tons once fully operational. Caustic soda, a by-product of the process, will be marketed by PCC both to strategic partners and through open commercial channels.

Chlorine Dioxide Market Trends:

Increasing Product Adoption in Water Treatment

One key trend in the chlorine dioxide market is its escalating utilization in water treatment plants. Chlorine dioxide is extensively preferred for its exceptional disinfection abilities, yielding less harmful byproducts in comparison to chlorine. Additionally, with amplifying cases of waterborne diseases and reinforcement of stringent environmental policies in various industries and regions, major sectors and municipalities are rapidly inclining towards chlorine dioxide for treating both drinking water and wastewater. According to a research article published in the International Journal of Economics, Finance, and Management Sciences, in September 2024, approximately 150,000 people in Nigeria, including around 117,000 children under the age of five, die each year due to waterborne diseases. Furthermore, water treatment techniques have resulted in 90% reduction of waterborne diseases. According to the chlorine dioxide market forecast, its efficacy in inhibiting biofilm production and lowering microbial growth, while adhering to the safety policies, continues to accelerate its adoption in the global water treatment segment.

Growing Demand in Food and Beverage Sector

According to the chlorine dioxide market report, an escalating product demand has been observed in the food and beverage sector, principally for its exceptional efficiency in disinfection and sanitation applications. Chlorine dioxide has become a preferred solution in the industry due to its effectiveness in controlling the growth of harmful microorganisms, such as E. coli and Salmonella, while leaving minimal chemical residues. According to a research article published in the journal of Earth and Environmental Science, April 2024, the incidence of Salmonella infections has been increasing rapidly, with around 94 million cases reported per year, leading to 155,000 deaths worldwide. Of these cases, 80.3 million are caused by contaminated food consumption. According to the chlorine dioxide market trends, chlorine dioxide is widely used for surface disinfection, equipment cleaning, and even in direct contact with produce. In addition, as global food safety regulations become more stringent, the adoption of chlorine dioxide in food processing environments is expected to increase, ensuring compliance and enhancing product safety.

Advancements in Production Technologies

As per the chlorine dioxide market research report, the chlorine dioxide market is significantly impacted by rapid technological advancements aimed at enhancing both safety and production capacity. Innovations, such as on-site chlorine dioxide generators, facilitate the safe and controlled production, while minimizing the transportation risks associated with its volatile profile. Consequently, such technologies improve the adaptability and eco-friendliness of chlorine dioxide usage, establishing it as an easily accessible chemical for a broader range of sectors, which is further creating a positive chlorine dioxide market outlook. Furthermore, with escalating demand for effective and sustainable disinfection techniques, technological innovations in chlorine dioxide production are rapidly becoming a pivotal trend in the market’s robust growth. According to a research article published by National Institutes of Health, in February 2023, a sustained chlorine dioxide gas-release gel was innovated using degradable materials, such as β-cyclodextrin (βCD), carboxymethyl cellulose, and polyvinyl alcohol, through a crosslinking method for disinfection applications. This gel exhibited an effective release of chlorine dioxide gas for more than 30 days.

Chlorine Dioxide Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global chlorine dioxide market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, method, and application.

Analysis by Type:

- Liquid Stabilized Chlorine Dioxide

- Solid Stabilized Chlorine Dioxide

Liquid stabilized chlorine dioxide stands as the largest type in 2024, holding 56.8% of the market. According to the chlorine dioxide market forecast, liquid stabilized chlorine dioxide is anticipated to sustain its dominance as the most utilized product type in the global market, generally due to its exceptional functionality in odor control and disinfection applications. Furthermore, this formulation preserves its stability for a long period of time, establishing it as an ideal form for numerous municipal as well as industrial purposes. In addition, its prolonged shelf life and ease of delivery position it as a preferred choice for food processing industries, water treatment facilities, and hospitals. Moreover, as various sectors are currently prioritizing both hygiene and safety, the need for liquid stabilized chlorine dioxide is escalating rapidly, further driving substantial growth within this market segment.

Analysis by Method:

- Electrolytic Method

- Chemical Method

The electrolytic method is the most common method deployed for the production of chlorine dioxide by utilizing electric current to yield the chemical from the solution of sodium chlorite. This method is notably gaining prominence in the chlorine dioxide market primarily due to its adaptability, high efficiency, and the capability to carry out and execute the production on-site, resultantly the elimination or minimizing the demand for transportation. In addition, it is especially preferred in large-scale industrial and municipal water treatment facilities where continuous, controlled generation is required. Furthermore, the electrolytic process reduces safety risks associated with storage and handling, contributing to its dominance as a production method in the global chlorine dioxide market.

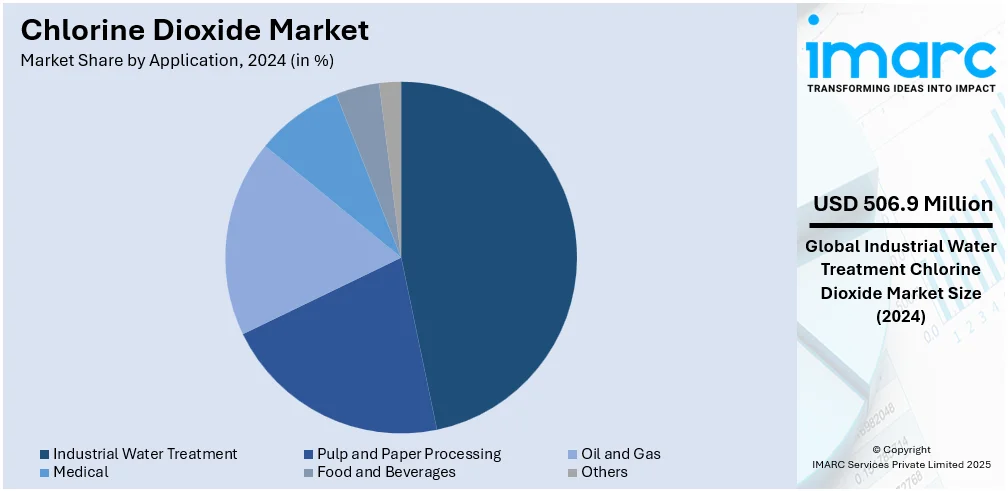

Analysis by Application:

- Industrial Water Treatment

- Pulp and Paper Processing

- Oil and Gas

- Medical

- Food and Beverages

- Others

Industrial water treatment leads the market with 46.5% of market share in 2024. Industrial water treatment accounts for the largest application segment in the global chlorine dioxide market, principally driven by its exceptional capability in inhibiting microbial growth and preventing formation of biofilm in both boilers and cooling systems. Moreover, chlorine dioxide is extremely effective in treating industrial wastewater, facilitating adherence with environmental protocols and sustaining equipment functionality. In addition, it is extensively leveraged in major sectors such as pulp and paper, petrochemical, and food processing, where water quality standards are crucial for operational methods. Furthermore, the escalating emphasis on effective as well as sustainable water treatment solutions continues to bolster the demand for chlorine dioxide in industrial processes.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 36.3%. The Asia-Pacific region has established itself as the leading regional market for chlorine dioxide, majorly driven by the escalating urban growth, industrialization, and magnifying demand for water treatment solutions. Moreover, the implementation of stringent environmental policies in numerous countries, particularly China, India, and Japan, is notably encouraging the adoption of chlorine dioxide in wastewater and drinking water treatment plants. For instance, in December 2023, the Government of India (GoI) announced plans to construct Asia Pacific's largest wastewater treatment plant in Delhi, the capital city, with a capacity to treat 564 liters of sewage daily. In addition, the robust presence of major industries like healthcare, pulp and paper, and food processing further bolsters the chlorine dioxide demand in Asia Pacific. Besides this, the region's market growth is boosted by significant technological innovations and elevated investments in infrastructure ventures across multiple sectors.

Key Regional Takeaways:

North America Chlorine Dioxide Market Analysis

The chlorine dioxide market in North America is driven by stringent environmental regulations and growing demand for advanced water treatment solutions. Regulatory bodies like the EPA enforce strict guidelines on drinking water and wastewater, prompting municipalities and industries to adopt chlorine dioxide for its high disinfection efficacy and minimal harmful by-products. Industrial growth in sectors such as oil & gas, pulp & paper, and food processing is further increasing its usage for microbial control and bleaching. Additionally, heightened post-pandemic hygiene awareness is driving its adoption in healthcare and sanitation. Technological advancements in on-site chlorine dioxide generation systems are enhancing safety, efficiency, and cost-effectiveness, supporting broader usage. Sustainability goals also make chlorine dioxide a preferred alternative to traditional chlorine-based chemicals.

United States Chlorine Dioxide Market Analysis

In 2024, the United States accounted for 87.80% of the chlorine dioxide market in North America. The United States chlorine dioxide market is primarily driven by its increasing adoption in water treatment applications, where it is used to effectively disinfect municipal and industrial water supplies. According to an industry report, the value of the nation’s sewer systems is estimated to exceed USD 1 Trillion, encompassing nearly 17,500 wastewater treatment plants that play a crucial role in safeguarding public health and ensuring the well-being of communities. In line with this, rising environmental sustainability concerns are promoting the use of chlorine dioxide as a safer alternative to traditional chemicals. The growing demand for chlorine dioxide in the food and beverage industry for sanitization purposes is also fostering market expansion. Furthermore, the healthcare sector's ongoing need for effective sterilization of medical equipment is strengthening chlorine dioxide market demand. The increasing awareness of waterborne diseases is prompting higher investments in chlorine dioxide-based water purification systems. Additionally, stricter wastewater treatment regulations, which drive the use in industrial applications, are stimulating market appeal. Moreover, the pharmaceutical industry's increasing demand for chlorine dioxide due to its chemical properties is expanding the market scope.

Europe Chlorine Dioxide Market Analysis

The market in Europe is experiencing growth due to increasing regulatory requirements for water quality. In accordance with this, the rising demand for chlorine dioxide in the paper and pulp industry for bleaching processes is driving market expansion. Similarly, the growing preference for sustainable alternatives to chlorine-based chemicals across various industries is propelling market growth. The expanding use in the pharmaceutical sector for sterilization and microbial control is also contributing to market development. Furthermore, increasing effectiveness in controlling biofilm formation in industrial water systems is enhancing the market demand. The ongoing focus on hygiene and infection control in healthcare settings, amplified by global health concerns, is further accelerating market adoption. A recent industry survey revealed that NHS England experiences approximately 834,000 healthcare-associated infections (HCAIs) each year. These infections are linked to around 28,500 patient deaths and account for 7.1 million bed days, representing 21% of the total annual occupancy. The financial impact exceeds GBP 2.7 billion annually. Additionally, HCAIs contribute to a significant workforce strain, causing an estimated 79,700 lost workdays among healthcare professionals due to illness-related absences. Additionally, continual advancements in chlorine dioxide generation technologies are improving accessibility and efficiency in the market. Besides this, the growing role in improving wastewater treatment and urban sanitation is providing an impetus to the market.

Asia Pacific Chlorine Dioxide Market Analysis

The Asia Pacific chlorine dioxide market is predominantly propelled by rapid industrialization, which increases demand for effective water treatment solutions in sectors such as oil, gas, and mining. Additionally, the region’s growing population and urbanization, which increases the demand for enhanced municipal water treatment systems, is impelling the market. The expanding food processing industry is further encouraging the use of chlorine dioxide for sanitation and disinfection. Similarly, growing awareness of waterborne diseases is facilitating investments in advanced disinfection technologies, which is strengthening market demand. The state health department reported 1,622 waterborne disease cases in 2021, 3,792 in 2022, and 1,293 in 2023. This year, 1,474 diarrhea, 1,028 cholera, 669 gastroenteritis, and 820 jaundice cases occurred, with 15 deaths. The heightened demand in the pulp and paper industry, particularly for bleaching processes, is also contributing to the market’s expansion. Furthermore, stricter environmental regulations on wastewater treatment are prompting industries to adopt chlorine dioxide-based solutions, thereby accelerating market presence.

Latin America Chlorine Dioxide Market Analysis

In Latin America, the market is advancing due to increased efforts to improve drinking water quality, particularly in rural and urban areas that face contamination issues. The SISAGUA 2022 report highlighted those concerns over lenient legislation regarding pesticide contamination in drinking water, with 60% of Brazilian municipalities (1,609) detecting at least one pesticide. Also, 210 municipalities found all 27 pesticides tested in their water supply. Furthermore, the rising demand for safe irrigation water in agriculture is impelling the market. Additionally, the expansion of industrial applications, particularly in the textiles and leather processing sectors, is contributing to market growth. Apart from this, stricter environmental regulations on wastewater treatment are encouraging the adoption of chlorine dioxide as a reliable and eco-friendly disinfection solution.

Middle East and Africa Chlorine Dioxide Market Analysis

The chlorine dioxide market in the Middle East and Africa is significantly influenced by increasing investments in desalination plants aimed at combating water scarcity. As such, in September 2024, ACWA Power agreed with the Sharjah Electricity, Water and Gas Authority to establish the emirate’s inaugural Independent Water Project. The plant will produce 410,000 m³/day of desalinated water by 2028, serving 1.4 million people. Furthermore, the region's growing focus on healthcare infrastructure, which promotes the use of the product in medical sterilization, is enhancing market appeal. Similarly, the expanding mining industry, especially in South Africa, is encouraging the adoption of chlorine dioxide for water treatment and mineral processing. Besides this, stringent environmental regulations regarding wastewater treatment are driving industries to develop eco-friendly disinfection solutions, thereby influencing market trends.

Competitive Landscape:

The chlorine dioxide market is moderately consolidated, with several key players competing because of product quality, technological innovation, and regional reach. Leading companies such as Ecolab Inc., Evoqua Water Technologies, Grundfos, ProMinent GmbH, and CDG Environmental dominate through strong distribution networks and proprietary chlorine dioxide generation systems. These firms focus heavily on water treatment solutions for municipal, industrial, and healthcare sectors. Smaller regional players also exist, often catering to niche applications or offering cost-effective alternatives. Strategic collaborations, long-term supply agreements, and research and development (R&D) investments are common strategies to gain market share. As demand for sustainable and efficient disinfection rises, companies are also prioritizing low-risk, on-site generation technologies and expanding their presence in emerging markets with evolving regulatory standards.

The report provides a comprehensive analysis of the competitive landscape in the global chlorine dioxide market with detailed profiles of all major companies, including:

- Accepta LLC

- AquaPulse Systems

- CDG Environmental LLC

- Ecolab Inc.

- Evoqua Water Technologies LLC

- Grundfos Pumps Corporation

- Iotronic Elektrogerätebau GmbH

- ProMinent GmbH

- Sabre Technologies LLC

- Tecme Srl

- Vasu Chemicals LLP

Latest News and Developments:

- April 2025: Arxada launched NUGEN HLD-CD, a ready-to-use disinfectant based on stabilized chlorine dioxide. It offers broad-spectrum efficacy against bacteria, viruses, spores, and tuberculosis, making it ideal for critical healthcare areas. With rapid action and excellent material compatibility, it’s designed for medical device surface disinfection.

- March 2025: Whitewater Management acquired Orion Water Solutions, enhancing its water treatment capabilities with advanced technologies like Dissolved Air Flotation and Chlorine Dioxide. This acquisition strengthens Whitewater's position in industries such as oil & gas, mining, and municipal infrastructure, and supports its North American expansion.

- February 2025: The AAMI updated its standard to recognize chlorine dioxide foam for high-level disinfection of medical devices. Tristel ULT, a chlorine dioxide-based product, was FDA-cleared in 2023 and is praised for its rapid, efficient, and cost-effective disinfection, enhancing patient care in healthcare settings.

- December 2024: Chorus launched Chorus Gro, a chlorine dioxide-powered system for indoor cannabis cultivation. It improves air quality, controls odors, and offers real-time monitoring through integrated sensors and apps. The system provides a non-corrosive, scalable solution for healthier grow environments, enhancing sustainability and cleanliness in cultivation facilities.

- December 2024: ABB launched the ChloroStar family of chlorine analyzers, designed for accurate chlorine measurement in water and wastewater treatment. Featuring self-cleaning sensors, modular installation, and predictive maintenance, ChloroStar enhances treatment efficiency, reduces maintenance costs, and ensures reliable, long-term chlorine control in challenging environments.

- November 2024: Erma First Group acquired Ecochlor, expanding its ballast water treatment portfolio. The acquisition strengthens Erma First’s position as a leading BWTS provider, combining Ecochlor’s chlorine dioxide-based systems with its own offerings. The deal enhances service capabilities and market reach, supporting compliance with environmental regulations in shipping.

Chlorine Dioxide Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liquid Stabilized Chlorine Dioxide, Solid Stabilized Chlorine Dioxide |

| Methods Covered | Electrolytic Method, Chemical Method |

| Applications Covered | Industrial Water Treatment, Pulp and Paper Processing, Oil and Gas, Medical, Food and Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accepta LLC, AquaPulse Systems, CDG Environmental LLC, Ecolab Inc., Evoqua Water Technologies LLC, Grundfos Pumps Corporation, Iotronic Elektrogerätebau GmbH, ProMinent GmbH, Sabre Technologies LLC, Tecme Srl, Vasu Chemicals LLP, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the chlorine dioxide market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global chlorine dioxide market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the chlorine dioxide industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chlorine dioxide market was valued at USD 1,090.00 Million in 2024.

The chlorine dioxide market is projected to exhibit a CAGR of 3.94% during 2025-2033, reaching a value of USD 1,571.28 Million by 2033.

Key factors propelling the chlorine dioxide market include escalating demand for clean water, stringent environmental regulations, and rapid industrial growth, especially in water treatment, food & beverage, healthcare, pulp & paper, and oil & gas. Advancements in on-site generation technology enhance safety, cost-efficiency, and adoption.

Asia Pacific currently dominates the chlorine dioxide market due to growing demand for clean water, rapid industrial expansion, rising environmental regulations, and increased use in healthcare, food processing, and pulp & paper industries.

Some of the major players in the chlorine dioxide market include Accepta LLC, AquaPulse Systems, CDG Environmental LLC, Ecolab Inc., Evoqua Water Technologies LLC, Grundfos Pumps Corporation, Iotronic Elektrogerätebau GmbH, ProMinent GmbH, Sabre Technologies LLC, Tecme Srl, Vasu Chemicals LLP, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)