Chronic Idiopathic Constipation Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

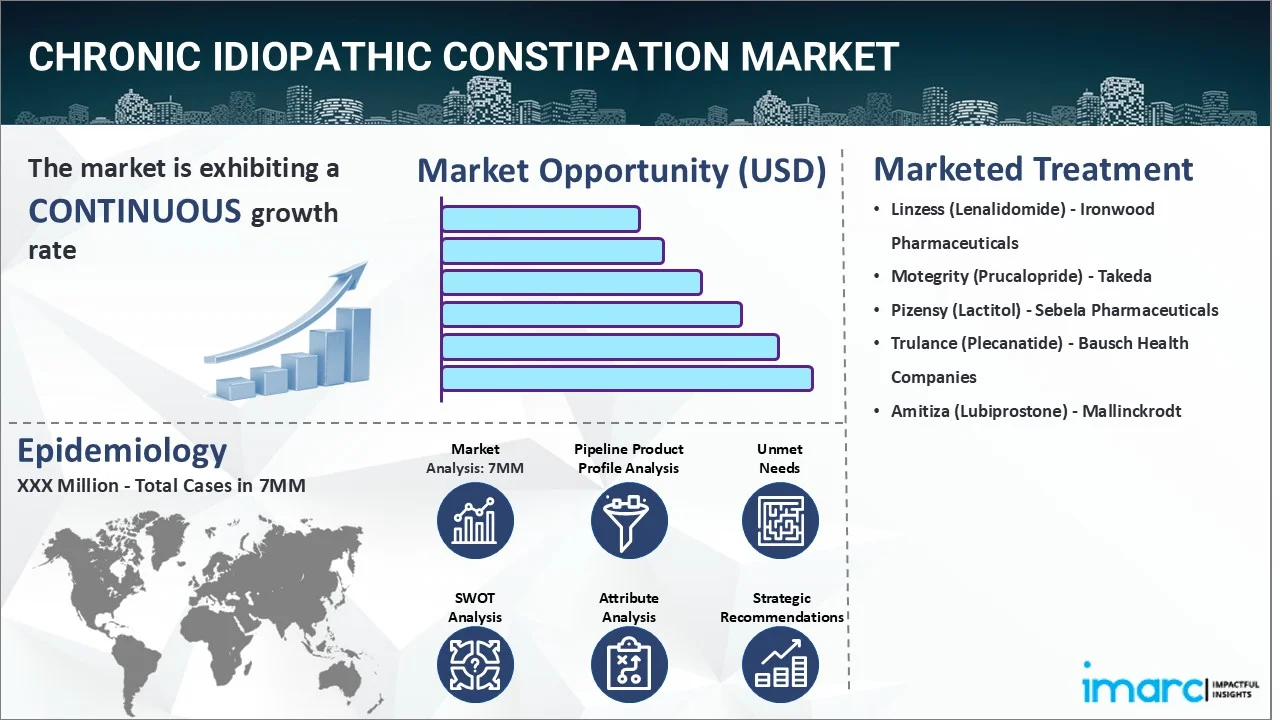

The chronic idiopathic constipation market reached a value of USD 6.6 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 11.0 Billion by 2035, exhibiting a growth rate (CAGR) of 4.71% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 6.6 Billion |

|

Market Forecast in 2035

|

USD 11.0 Billion |

|

Market Growth Rate 2025-2035

|

4.71% |

The chronic idiopathic constipation market has been comprehensively analyzed in IMARC's new report titled "Chronic Idiopathic Constipation Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Chronic idiopathic constipation (CIC) is a type of functional bowel disorder that persists for several months or longer without an apparent underlying cause. This condition is majorly associated with a negative impact on the patient's quality of life, affecting social and professional well-being. The common symptoms of CIC include constipation or difficulty passing stools, straining while defecating, hard and lumpy stools, a feeling of incomplete evacuation following completion, abdominal pain, discomfort, and bloating, excessive flatulence, poorer physical functioning, a decreased perception of health, etc. The diagnosis of this ailment involves a combination of an in-depth medical history, an evaluation of clinical features, and a physical exam. Numerous imaging studies, including magnetic resonance imaging (MRI) scans and anal manometry, are also recommended to confirm a diagnosis. The healthcare provider may perform a colonoscopy, which involves the insertion of a long, flexible tube (colonoscope) into the rectum to visualize the possible cause of the patient's symptoms.

To get more information on this market, Request Sample

The rising prevalence of numerous associated risk factors, such as reduced colon motility, inadequate fluid and fiber intake in the diet, unhealthy lifestyle habits, pelvic floor dysfunction, etc., is primarily driving the chronic idiopathic constipation market. Furthermore, the increasing cases of visceral sensory abnormalities or alterations in the enteric nervous system that decrease rectal sensation and the need to defecate are also augmenting the market growth. In addition to this, the inflating utilization of wireless capsule endoscopy, a non-invasive diagnostic procedure that helps determine gastrointestinal motility, gastric emptying, colonic and small bowel transit, as well as whole gut transit times, is creating a positive outlook for the market. Moreover, the widespread adoption of stimulant laxatives, including bisacodyl and sodium picosulfate, since they decrease water absorption, stimulate intestinal motility directly, and release prostaglandins that aid in the acceleration of intestinal transit is further bolstering the market growth. Apart from this, the emerging popularity of sacral nerve stimulation to stabilize the normal functioning of the bowel and sphincter muscles in patients who are refractory to pharmacotherapy is expected to drive the chronic idiopathic constipation market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the chronic idiopathic constipation market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report the United States has the largest patient pool for chronic idiopathic constipation and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario and unmet medical needs, etc. have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the chronic idiopathic constipation market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the chronic idiopathic constipation market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the chronic idiopathic constipation market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current chronic idiopathic constipation marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Linzess (Lenalidomide) | Ironwood Pharmaceuticals |

| Motegrity (Prucalopride) | Takeda |

| Pizensy (Lactitol) | Sebela Pharmaceuticals |

| Trulance (Plecanatide) | Bausch Health Companies |

| Amitiza (Lubiprostone) | Mallinckrodt |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the chronic idiopathic constipation market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the chronic idiopathic constipation across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the chronic idiopathic constipation across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of chronic idiopathic constipation across the seven major markets?

- What is the number of prevalent cases (2019-2035) of chronic idiopathic constipation by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of chronic idiopathic constipation by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of chronic idiopathic constipation by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with chronic idiopathic constipation across the seven major markets?

- What is the size of the chronic idiopathic constipation patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend chronic idiopathic constipation of?

- What will be the growth rate of patients across the seven major markets?

Chronic Idiopathic Constipation: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for chronic idiopathic constipation drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the chronic idiopathic constipation market?

- What are the key regulatory events related to the chronic idiopathic constipation market?

- What is the structure of clinical trial landscape by status related to the chronic idiopathic constipation market?

- What is the structure of clinical trial landscape by phase related to the chronic idiopathic constipation market?

- What is the structure of clinical trial landscape by route of administration related to the chronic idiopathic constipation market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)