Circuit Breaker Market Size, Share, Trends and Forecast by Product Type, Voltage, Technology, End Use, and Region, 2025-2033

Circuit Breaker Market Size and Share:

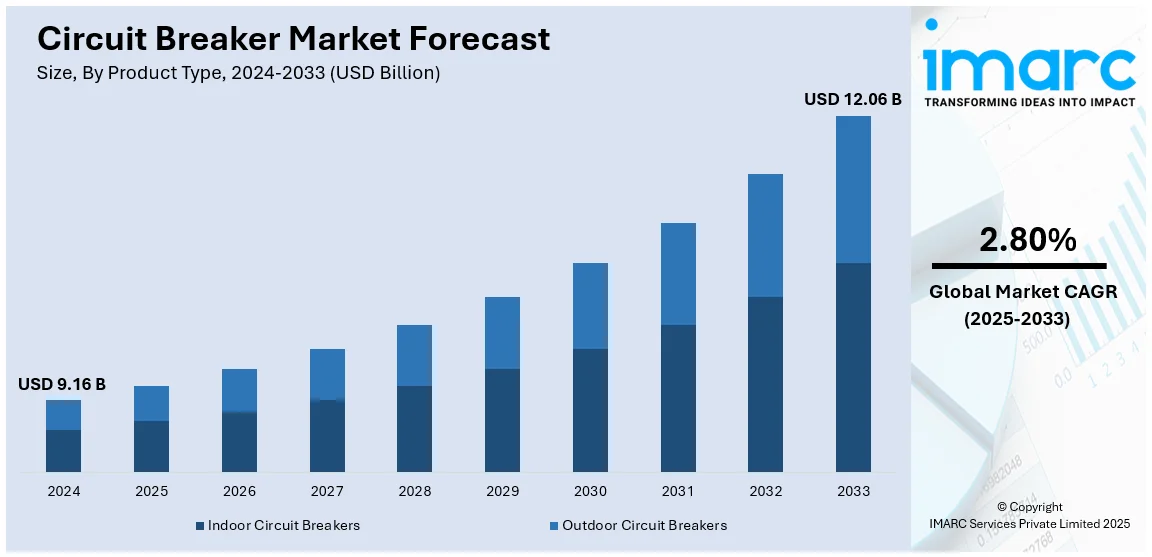

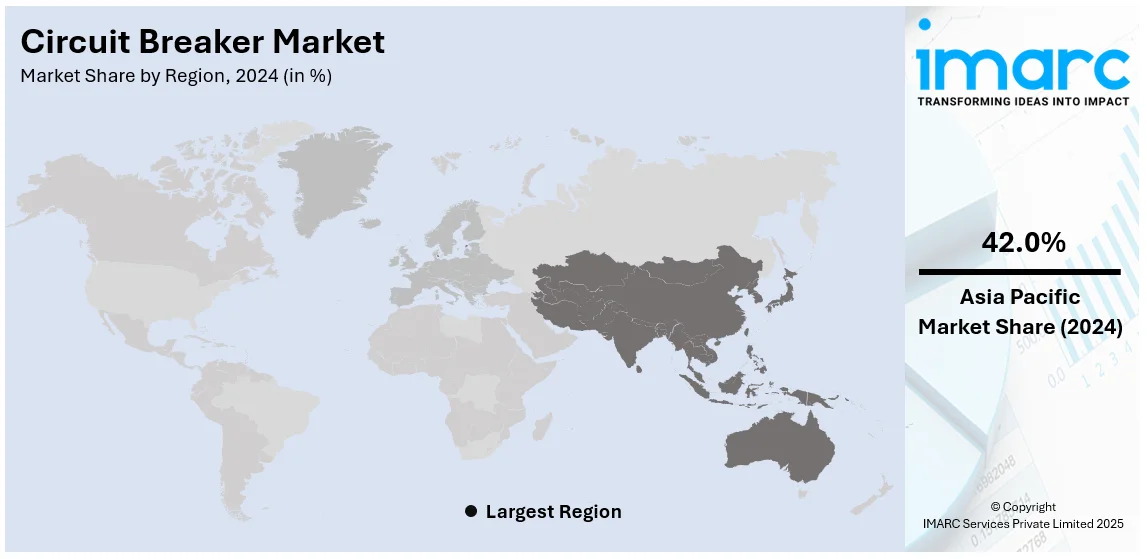

The global circuit breaker market size was valued at USD 9.16 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.06 Billion by 2033, exhibiting a CAGR of 2.80% from 2025-2033. Asia-Pacific currently dominates the market. The market is driven by rapid urbanization and industrial growth, which is increasing the demand for advanced electrical protection systems to ensure the safety and efficiency of infrastructure. More stringent safety regulations and heightened investments in smart grid technologies are hastening the implementation of intelligent circuit breakers equipped with predictive maintenance features. Moreover, the rise in renewable energy initiatives and the integration of IoT in power systems improve the functionality of circuit breakers, thereby further augmenting the circuit breaker market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.16 Billion |

|

Market Forecast in 2033

|

USD 12.06 Billion |

| Market Growth Rate (2025-2033) | 2.80% |

The global market is primarily driven by the rapid urbanization and industrial infrastructure. In line with this, the growing demand for enhanced electrical protection systems rises is strengthening the market demand. Furthermore, continual technological advancements, particularly in smart grid systems, are also contributing to the integration of more sophisticated circuit breakers, ensuring better control and protection. For instance, on 18 April 2024, Schaltbau launched its Smart Circuit Breaker product line, designed to provide ultra-fast protection for DC applications like microgrids, energy storage, and EV charging. These intelligent breakers, which include Smart, Hybrid, and Solid-State variants, enhance grid safety, reliability, and longevity. They also support predictive maintenance and root cause analysis. Besides this, stricter government regulations and growing investments in renewable energy projects further accelerate the adoption of advanced circuit breakers across various sectors.

To get more information on this market, Request Sample

The United States stands out a key regional market and is influenced by the growth of renewable energy sources, such as solar and wind, demanding advanced circuit protection for complex energy systems. Additionally, the ongoing modernization of the aging electrical infrastructure requiring the replacement of outdated devices with more efficient circuit breakers, is impelling the market. Notably, on September 30, 2024, Siemens announced its SDV7 medium-voltage outdoor distribution circuit breakers, verified by UL Solutions to meet IEEE standards for safety and performance, ensuring compliance, reducing legal liabilities, and stimulating customer confidence. Moreover, the rising demand for electric vehicles (EVs), expanded EV charging networks, and the focus on industrial automation and safety in sectors like healthcare and manufacturing is providing an impetus to the market.

Circuit Breaker Market Trends:

Rising investment in the industrial sector

Increased investments in the industrial sector, as well as increased investment to leverage industrial infrastructure, drive up global demand for electrical switching devices. These devices are mostly utilized in industrial and commercial settings. According to the World Investment Report 2021, Asia-Pacific received USD 535 Billion in foreign direct investment (FDI) in 2020, primarily from China and Singapore. As a result, increased industrial investment necessitates the deployment of these devices in a variety of end-use and manufacturing industries. This, in turn, is resulting in an increasing circuit breaker market share.

Rapid infrastructure development

The growing global building of infrastructure, including residential, commercial, government, and industrial infrastructures, as a result of rising population, urbanization, and industrialization, is necessitating the use of circuit breaker systems. For example, the World Bank estimates that the value added to the industrial sector, including construction, will increase from USD 23.47 Trillion in 2019 to USD 27.76 Trillion in 2022, having a significant impact on infrastructure expansion. Circuit breakers are required in infrastructure to maintain operational safety and efficiency by disconnecting electrical circuits in the event of overloads or faults, preventing equipment damage, and reducing the risk of electrical fires. Also, the integration of smart technology and the Internet of Things (IoT) into infrastructure projects enhances the requirement for the installation of advanced circuit protection solutions, thereby bolstering the circuit breaker market growth.

Increasing adoption of electrical safety regulations

Circuit breakers are now essential components of electrical systems in homes, businesses, factories, and large-scale power grids. Due to the rapid growth of urban areas and modernization, electrical switches are installed in every residential, commercial, and other building to keep up with the changing times, making them a crucial component of all structures. The United Nations (UN) states that the 68% of the world population is projected to live in urban areas by 2050. Regular revisions involve closely following test procedure compliance for circuit breakers and switchgear in electrical power distribution systems. Certain heavy load equipment necessitates the use of separate circuit breakers to ensure safe and dependable functioning. This regulatory situation has had a positive impact on the circuit breaker demand.

Circuit Breaker Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global circuit breaker market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, voltage, technology, and end use.

Analysis by Product Type:

- Indoor Circuit Breakers

- Outdoor Circuit Breakers

Outdoor circuit breakers stand as the largest component of the market in 2024. They are playing an important role in creating a positive circuit breaker market outlook. The majority of the installed breakers are electrical switches that function automatically outdoors. Outdoor breakers are utilized in switchgear assemblies, which are primarily utilized outside for large-scale utility applications. Due to their vital roles in outside electrical distribution networks, outdoor circuit breakers are driving the circuit breaker market. These breakers are made especially to survive hard climatic factors including high humidity, low temperatures, and exposure to components like dust and rain. This, in turn, is expected to contribute to the market growth in the circuit breaker market forecast period.

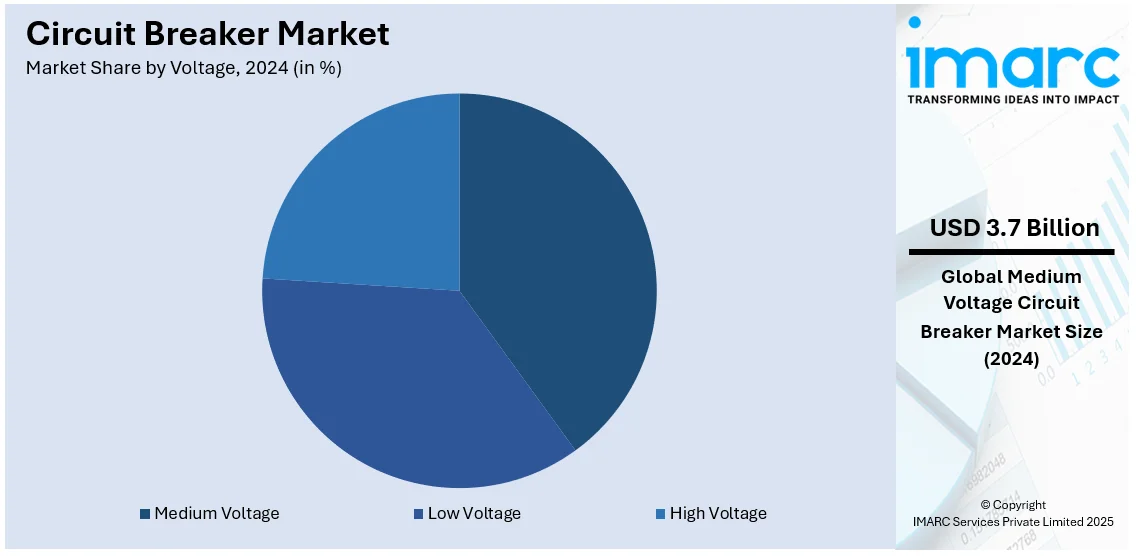

Analysis by Voltage:

- Low Voltage

- Medium Voltage

- High Voltage

High voltage leads the market share in 2024. High-voltage automatically operated electrical switches are primarily found in utility-scale applications. The increasing development of electrical technology led to the growing popularity of these breakers, thereby expanding the circuit breaker industry. The introduction of high voltage DC cables is fostering an increase in the market size for high voltage breakers. The continuous improvements in infrastructure and global power generation and distribution network expansions are favorable to the market for these breakers. Advanced high voltage circuit breakers are expected to remain in high demand as utilities and industry work to find more sustainable and efficient energy solutions.

Analysis by Technology:

- Air

- Vacuum

- Oil

- SF6

According to the circuit breaker market research report, air circuit is dominating the market. Innovations in air technology has greatly impacted the circuit breaker market, by improving safety and efficiency in electrical systems. Barometric breakers have recently demonstrated increased reliability and enhanced capacity to manage higher loads, thus being essential for industrial use as well as for urban infrastructure. These are essential gadgets that help to protect electric circuits from over-voltage or short-circuits which could cause potential disruption of power flow without endangering human beings’ lives. Having a strong build, they can be used when different industries produce goods and services in almost all areas like commerce among others. As demand increases for sustainable and efficient energy solutions, air technology continues to be the force behind innovative approaches in the circuit breaker field.

Analysis by End Use:

- Transmission and Distribution

- Renewable

- Power Generation

- Railways

The transmission and distribution sector are leading the circuit breaker market due to increasing global electrification and infrastructure upgrades. As nations expand their power grids and integrate renewable energy sources, the demand for reliable circuit protection grows. Circuit breakers play a crucial role in safeguarding equipment and managing power flow, thereby ensuring uninterrupted electricity supply to homes, industries, and commercial establishments. Additionally, advancements in smart grid technologies and the need for enhanced grid resilience further propel the adoption of advanced circuit breakers capable of handling higher voltages and frequencies.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share. The expansion in population in growing economies like as India and China is increasing the electrical demand, resulting in a higher requirement for circuit breakers in the Asia-Pacific area. Furthermore, the replacement of aging grid infrastructure is driving growth in the circuit breaker industry. According to the International Renewable Energy Agency, China and India are among the top five renewable energy producers in the world, which fuels industry growth. Furthermore, the increased connectivity of renewable energy with grid infrastructure drives the expansion of the market.

Key Regional Takeaways:

United States Circuit Breaker Market Analysis

A key driver is the growing demand for reliable and uninterrupted power supply across residential, commercial, and industrial sectors. As electricity consumption increases, the requirement for effective protection against overloads and short circuits becomes crucial, fostering the acceptance of circuit breakers. U.S. power consumption is expected to reach record highs in 2024 and 2025, as reported by the U.S. Energy Information Administration (EIA). Furthermore, the U.S. Energy Information Administration (EIA) has forecasted that power demand will increase to 4,099 billion kilowatt-hours (kWh) in 2024 and further to 4,128 billion kWh in 2025. Another contributing factor is the expansion of renewable energy installations. Integrating renewable sources like solar and wind into the power grid requires advanced circuit breakers capable of handling variable power inputs and ensuring grid stability. This shift towards sustainable energy solutions propels the demand for modern circuit breakers designed for such applications. Apart from this, the development of smart circuit breakers equipped with real-time monitoring and remote control features enhance energy efficiency and system reliability. These innovations cater to the changing needs of smart grids and modern electrical infrastructure, further driving market expansion. Additionally, stringent safety regulations and standards necessitate the use of circuit breakers to protect electrical systems and prevent hazards. Compliance with these regulations ensures the safety of both infrastructure and individuals, thereby encouraging the widespread adoption of circuit breakers across various sectors.

Europe Circuit Breaker Market Analysis

The European circuit breaker market is expanding due to several key factors. One significant driver is the modernization of aging electrical infrastructure. As older systems become less reliable, there's a pressing need to upgrade to advanced and energy-efficient circuit breakers to ensure consistent power distribution and enhance safety. Moreover, the integration of renewable energy sources, such as wind and solar power, into the grid is catalyzing the demand for specialized circuit breakers. These devices are essential for managing the variable power inputs from renewables, maintaining grid stability, and preventing potential overloads. Besides this, technological advancements are leading to the development of smart circuit breakers equipped with Internet of Things (IoT) capabilities. These breakers offer real time monitoring, predictive maintenance, and improved fault detection, aligning with Europe's focus on smart grid initiatives and enhancing overall energy efficiency. Furthermore, the rising number of electric vehicles (EVs) are necessitating robust charging infrastructure, which relies heavily on advanced circuit breakers for safety and operational efficiency. As reported by the IEA, new electric car registrations in Europe totaled nearly 3.2 million in 2023, marking an increase of almost 20% compared to 2022. High-performance breakers are crucial in EV charging stations to handle increased power loads and ensure user safety. Government regulations and mandates emphasizing safety and environmental standards further propel the market.

Asia Pacific Circuit Breaker Market Analysis

Rapid urbanization and industrialization in countries like China, India, and Japan are leading to increased electricity demand, necessitating reliable electrical infrastructure and driving the adoption of circuit breakers. According to the Ministry of Statistics and Programme Implementation (MoSPI), India's industrial production increased to 3.8% in December 2023 as against 2.4% in November 2023. In addition, the region's focus on renewable energy sources, such as solar and wind, requires advanced circuit breakers to manage variable power inputs and ensure grid stability. This shift towards sustainable energy solutions is catalyzing the demand for modern circuit breakers designed for these applications. Besides this, technological advancements are leading to the development of smart circuit breakers. These innovations enhance energy efficiency and system reliability, catering to the changing needs of smart grids and modern electrical infrastructure. In line with this, favorable government initiatives promoting grid modernization and infrastructure development in countries like China and India are providing lucrative opportunities in the market. In summary, the Asia Pacific circuit breaker market is driven by rapid urbanization and industrialization, expansion of renewable energy installations, technological advancements, and government initiatives promoting grid modernization. These factors collectively contribute to the rising adoption of circuit breakers, ensuring the protection and efficiency of electrical systems across the region.

Latin America Circuit Breaker Market Analysis

The Latin American circuit breaker market is expanding due to several key factors. Rapid urbanization and infrastructure development is increasing electricity demand, thereby necessitating reliable electrical systems, and driving the adoption of circuit breakers. In addition, the region's focus on renewable energy sources, such as solar and wind, requires advanced circuit breakers to manage variable power inputs and ensure grid stability. In 2023, the Brazilian government announced a new “growth acceleration” plan that included USD 12.5 Billion to finance new renewable energy projects. This shift towards sustainable energy solutions is catalyzing the demand for modern circuit breakers designed for these applications. Moreover, governing agencies in the region are promoting grid modernization and infrastructure development in countries like Brazil and Mexico, which is supporting the market growth.

Middle East and Africa Circuit Breaker Market Analysis

Rapid urbanization and industrialization in the region are contributing to the market growth. According to the CIA, urban population in Iraq was 71.6% of total population in 2023. Government initiatives aimed at modernizing power grids and expanding renewable energy sources are further propelling the market growth. Investments in smart grid technologies and renewable energy projects require advanced circuit breakers to manage variable power inputs and ensure grid stability. These innovations enhance energy efficiency and system reliability, catering to the changing needs of modern electrical infrastructure. In summary, the MEA circuit breaker market is driven by rapid urbanization and industrialization, government initiatives promoting grid modernization and renewable energy integration, and technological advancements in smart circuit breakers. These factors collectively contribute to the rising adoption of circuit breakers, ensuring the protection and efficiency of electrical systems across the region.

Competitive Landscape:

The circuit breaker market is highly competitive, led by global players, along with regional manufacturers. Companies focus on innovation, offering energy-efficient and smart circuit breakers for industrial, residential, and utility applications. Regional players emphasize cost-effective solutions, particularly in emerging economies like India and China, where infrastructure growth drives demand. Key strategies include adopting IoT-enabled technologies, expanding product portfolios, and forming strategic partnerships. Highlighting sustainability, Siemens and BASF introduced the SIRIUS 3RV2 circuit breaker on June 10, 2024, featuring biomethane-based plastics that reduce CO₂ emissions by ~270 tons annually. Compact, durable, and affordable designs dominate cost-sensitive regions, while advanced, sustainable features attract premium markets, driving the industry's shifting dynamics.

The report provides a comprehensive analysis of the competitive landscape in the circuit breaker market with detailed profiles of all major companies, including:

- ABB Ltd

- Camsco Electric Co. Ltd

- Eaton Corporation plc

- Kirloskar Electric Company

- LS Electric Co., Ltd

- Mitsubishi Electric Corporation

- Powell Industries

- Salzer Electronics Limited

- Schneider Electric SE

- SCHURTER Group

- Sensata Technologies, Inc.

- Siemens AG

- Toshiba Corporation

Latest News and Developments:

- October 2024: Schneider Electric introduced its newest circuit breaker, the MasterPacT MTZ Active, designed to enhance real-time monitoring and safety in power-reliant industries. This advanced breaker allows users to monitor and control energy consumption in real time, tackling challenges such as continuous uptime demands, increasing energy costs, and the need for sustainability.

- August 2024: Mitsubishi Electric Corporation signed an agreement with Siemens Energy Global GmbH & Co. KG, based in Munich, Germany, has partnered to co-develop specifications for Direct Current (DC) Switching Stations and DC Circuit Breakers. The goal of the collaboration is to develop Multi-terminal High Voltage DC (HVDC) systems that will improve the efficient operation of large-scale renewable energy resources.

- October 2023: ABB introduced the SACE Infinitus solid-state circuit breaker, which premiered at the CEATEC 2023 sustainable technology exhibition in Makuhari, Chiba City, Japan. It is the world’s first IEC60947-2 compliant solid-state circuit breaker and plays a crucial role in enabling the development of next-generation sustainable energy networks.

- October 2023: RTX demonstrated a solid-state circuit breaker to support hybrid-electric propulsion in future aircraft, advancing the aviation industry's sustainability initiatives focused on achieving net-zero carbon emissions by 2050.

- March 2022: GE Renewable Energy’s Grid Solutions introduced the world’s first 420 kV, 63 kA g3 gas-insulated substation (GIS) circuit breaker prototype. During a recent virtual roundtable, leading transmission utilities from across Europe were introduced to the g3 circuit breaker.

Circuit Breaker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Indoor Circuit Breakers, Outdoor Circuit Breakers |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| Technologies Covered | Air, Vacuum, Oil, SF6 |

| End Uses Covered | Transmission and Distribution, Renewable, Power Generation, Railways |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ABB Ltd, Camsco Electric Co. Ltd, Eaton Corporation plc, Kirloskar Electric Company, LS Electric Co., Ltd, Mitsubishi Electric Corporation, Powell Industries, Salzer Electronics Limited, Schneider Electric SE, SCHURTER Group, Sensata Technologies, Inc., Siemens AG, Toshiba Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the circuit breaker market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global circuit breaker market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the circuit breaker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global circuit breaker market was valued at USD 9.16 Billion in 2024.

IMARC estimates the global circuit breaker market to exhibit a CAGR of 2.80% during 2025-2033.

The global market is majorly driven by rapid urbanization, industrial infrastructure growth, the adoption of renewable energy sources, and technological advancements, such as the development of smart grid systems. Additionally, increasing electricity consumption and stricter safety regulations also contribute to the market expansion.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global circuit breaker market include ABB Ltd, Camsco Electric Co. Ltd, Eaton Corporation plc, Kirloskar Electric Company, LS Electric Co., Ltd, Mitsubishi Electric Corporation, Powell Industries, Salzer Electronics Limited, Schneider Electric SE, SCHURTER Group, Sensata Technologies, Inc., Siemens AG, and Toshiba Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)