Clean Hydrogen Market Size, Share, Trends and Forecast by Technology, End User, and Region, 2025-2033

Clean Hydrogen Market Size:

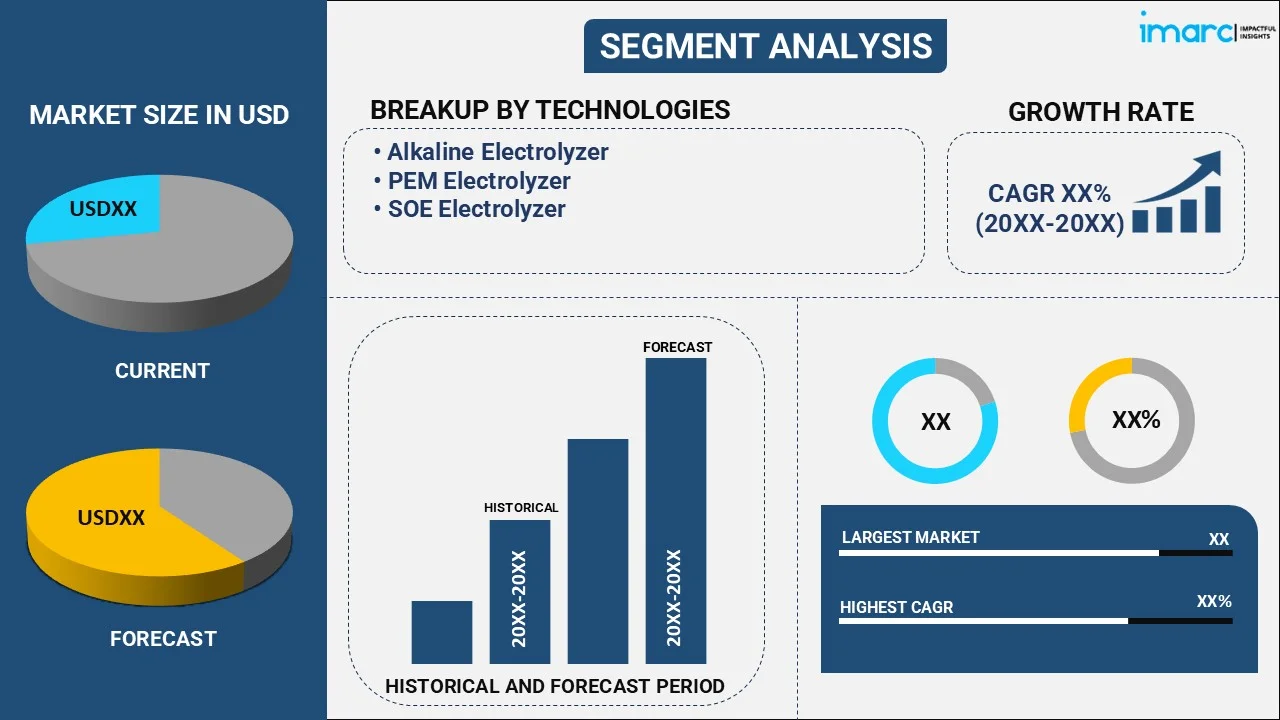

The global clean hydrogen market size was valued at USD 1.92 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.10 Billion by 2033, exhibiting a CAGR of 13.01% during 2025-2033. Europe dominated the market in 2024. Stringent government policies, advancements in electrolysis technology, and increasing private sector investments, positioning hydrogen as a key component in achieving global net-zero emissions and transforming energy, transportation, and industrial sectors, represent some of the factors contributing to the clean hydrogen market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.92 Billion |

|

Market Forecast in 2033

|

USD 6.10 Billion |

| Market Growth Rate 2025-2033 | 13.01% |

Clean Hydrogen Market Analysis:

- Major Market Drivers: Government policies and international agreements focused on climate change are major drivers, pushing for reductions in greenhouse gas emissions and encouraging the adoption of clean hydrogen.

- Key Market Trends: There is a noticeable trend towards integrating hydrogen in sectors such as transportation, power generation, and industrial processes, driven by the advancements in fuel cell technologies.

- Geographical Trends: Europe dominates the clean hydrogen sector as a result of strict environmental legislation and improved investment in hydrogen production and delivery. Aside from Asia-Pacific and North American regions that are also growing their hydrogen markets, substantial investments in technology and new projects are made.

- Competitive Landscape: Some of the major market players in the clean hydrogen industry include Air Liquide S.A., Air Products and Chemicals Inc., Cummins Inc., Enapter S.r.l., Engie SA, Green Hydrogen Systems, Linde plc, Nel ASA, Plug Power Inc., SG H2 Energy Global LLC, Siemens Energy AG, SunGreenH2. Etc among many others.

- Challenges and Opportunities: One major challenge is the high initial cost and economic viability of hydrogen production and infrastructure development. Nevertheless, this also offers the chance for new ways of cost-cutting and international standardization and regulations to help in the growth of the market.

The market is primarily driven by the need to decarbonize industries and reduce greenhouse gas emissions. Growing government support, through policies, subsidies, and incentives, encourages investment in hydrogen technologies and infrastructure. Technological advancements in green hydrogen production, such as electrolysis powered by renewable energy, are making clean hydrogen more cost-competitive. Rising concerns about climate change and the urgency to meet global emission reduction targets are prompting industries to adopt hydrogen as a clean alternative to fossil fuels. Additionally, sectors like transport, heavy industry, and power generation are increasingly relying on hydrogen to lower their carbon footprints. Investment in infrastructure, including refueling stations and pipelines, is vital for market growth, facilitating hydrogen distribution and usage. As these factors align, clean hydrogen is emerging as a critical component of the global energy transition.

Machine learning and artificial intelligence are accelerating the scalability, efficiency, and affordability of clean hydrogen production. A US-based hydrogen manufacturer is set to integrate advanced AI technologies into its operations, aiming to revolutionize clean energy generation at a key hydrogen hub on the East Coast. For instance, in April 2025, Honeywell announced the release of Honeywell Protonium, a suite of technologies driven by machine learning (ML) and artificial intelligence (AI) that was developed to increase the scalability, efficiency, and affordability of clean hydrogen generation. Aternium, a manufacturer of clean hydrogen based in the United States, will be the first to implement the technology suite, utilizing the novel innovations throughout its proposed Mid-Atlantic Clean Hydrogen Hub (MACH2).

Clean Hydrogen Market Trends:

Government Policies and Regulations

According to the clean hydrogen market outlook, governments all over the world are putting out comprehensive and embracing rules to cut emissions, and this pressure is driven by clean hydrogen as a sustainable energy source. For instance, in July 2025, the European Commission recommended an amendment to the EU Climate Law in order to achieve the EU climate target of a 90% decrease in net greenhouse gas (GHG) emissions by 2040 in comparison to 1990 levels. This proposal expands on the EU's legally binding objective of lowering net greenhouse gas emissions by at least 55% by 2030 and presents a more adaptable and realistic plan to achieve the goal. Many countries have hydrogen in their energy plans and policies and incentives such as rewards for the development and incorporation of hydrogen technology are being enacted. For example, the European Union has created the European Hydrogen Strategy, which aims to run the hydrogen economy in full operation by 2050. These programs consequently reduce the number of fossil fuels that are used in industry and transportation, and according to the clean hydrogen market forecast, are leading to the higher adoption of cleaner fuels.

Technological Advancements in Electrolysis

The efficiency and cost-effectiveness of the technology known as electrolysis, which is used for producing hydrogen from water by utilizing electricity, is increasing. The development of PEM (proton exchange membranes) and alkaline electrolyzers has made large-scale hydrogen production more economical. With the increasing popularity and affordability of renewable energy sources like solar and wind, the utilization of these energies in the electrolysis processes has resulted in a significant cost reduction of green hydrogen production. This makes clean hydrogen an improved way of energy storage and as a fuel for transportation, the power sector, and industrial processing, which in turn enhances the clean hydrogen market value. Clean hydrogen market trends reflect that 35% of European vehicles will be hydrogen-powered by 2040. Globally, there are 401 hydrogen fuel stations, with 159 more planned, and 46 in the USA.

Increasing Investment from Private Sector

Private sector companies are currently looking actively and investing in clean hydrogen. For instance, in March 2025, Invenergy, a renowned private developer and operator of clean energy technologies, disclosed that its first clean hydrogen energy project, the 5-acre Sauk Valley Hydrogen plant in Illinois, officially started operating commercially. The Sauk Valley facility can generate nearly 40 Metric Tons of clean hydrogen per year using power from Invenergy's co-located solar plant and Ohmium International's electrolyzer technologies. It can also store approximately 400 Kilograms of clean hydrogen at its location. Major energy companies, automobile manufacturers, and start-ups pay much to build up hydrogen infrastructure, which incorporates production stations, storage systems, and fuel cells. This investment rise is brought about by the capability of hydrogen to greatly assist in the delivery of net-zero emissions goals, as well as its applicability in numerous applications and the chances of forming economic prospects. These investments help in not just accelerating technological innovations but also manufacturing at a large scale, which in turn reduces costs and stimulates clean hydrogen market growth.

Clean Hydrogen Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global clean hydrogen market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology and end user.

Analysis by Technology:

- Alkaline Electrolyzer

- PEM Electrolyzer

- SOE Electrolyzer

Alkaline electrolyzer stood as the largest technology in 2024. The conventional technology for hydrogen production, known as alkaline electrolysis, uses water electrolysis with an alkaline solution as an electrolyte. This is because being in the market for so long and having a large number of operational experiences have led to the widespread use of it. Alkaline-type electrolyzers have a reputation for being reliable, durable, and scalable. They are therefore particularly ideal for industrial applications where large quantities of hydrogen are needed. They may demonstrate lower efficiencies compared to PEM electrolyzers, but their simple design and lower cost of materials mean they are a desirable option for many projects. Moreover, continuous progression in technology with regards to enhancing its efficiency and reducing operational costs are the other factors that underpin this segment as the largest in the clean hydrogen market.

Analysis by End User:

- Transport

- Power Generation

- Industrial

- Others

Transport led the market in 2024. According to the clean hydrogen market segmentation, transport is the largest segment, followed by the growing application of hydrogen gas-powered vehicles (HGVs). The carbon emissions and hydrocarbon consumption reduction actions undertaken by governments, as well as manufacturers, are promoting the development of hydrogen infrastructure with the installation of refueling stations. Hydrogen vehicles, such as buses, trucks, and passenger cars, have the advantage of fast refueling time and longer ranges; thus, they are very suitable for heavy-duty and long-haul trips as compared to electric vehicles, which require charging. Both large automobile producers and start-ups invest in the generation of hydrogen vehicles, and some countries have even started including hydrogen trains and maritime vessels in this diversity. This push towards hydrogen as a fuel in transport is fueled by policy incentives, public-private collaborations, and international cooperation toward formulating a sustainable hydrogen economy; thus, the transport sector becomes a key driver of the hydrogen market development.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share. According to the clean hydrogen market overview, the largest segment of the market in Europe plays a crucial role since the European Union has adopted extensive and ambitious energy and climate policies to combat air pollution and climate change. The EU's hydrogen strategy is a great part of the European Green Deal and very promising. The goal here is to introduce clean hydrogen into the transport, industry, and energy production sectors by 2050. This policy is backed up by many financially significant instruments, such as the Clean Hydrogen Partnership, which allocates billions for different hydrogen projects, paying special attention to the development of green hydrogen through electrolysis powered by renewables. In addition, the partnerships among European countries for cross-border hydrogen infrastructure as well as the presence of high-technology providers in the region keep the development of the market. These joint initiatives not only mark Europe as a leader in the green hydrogen sector but also as a sizeable market that provides a platform for global improvements and applications in hydrogen energy solutions.

Key Regional Takeaways:

United States Clean Hydrogen Market Analysis

The United States clean hydrogen market is primarily driven by regulatory support, corporate investment, technological advancements, and evolving energy needs. The government is increasingly offering tax credits and grants to manufacturers and developers of electrolyzers, hydrogen hubs, and renewable electricity infrastructure. For instance, in June 2025, the New York State Energy Research and Development Authority (NYSERDA) issued a USD 3.7 Million funding to boost New York's clean hydrogen-based fuel cell resources. With the help of this funding, cutting-edge fuel cell solutions will be developed in New York and presented as a viable dispatchable option to preserve grid resilience and dependability, decarbonize industrial operations, and integrate more renewable energy sources such as solar and wind. These incentives have sparked a rise in planned hydrogen production facilities in regions with strong renewable energy potential. Leading industrial companies in steel, ammonia production, and heavy transportation are also increasingly incorporating hydrogen as a decarbonization tool, driven by sustainability commitments and customer demand. Additionally, technological breakthroughs in electrolyzer efficiency and scale have substantially lowered production costs, making hydrogen a more competitive alternative to traditional fossil-derived sources. Public–private partnerships, university research, and pilot projects are also fostering innovation in advanced catalysts, carbon capture integration, and next-generation fuel cell applications, which are collectively validating market potential and attracting capital.

Asia Pacific Clean Hydrogen Market Analysis

The Asia Pacific clean hydrogen market is expanding due to increasing corporate decarbonization commitments and the rising emphasis on low-emission manufacturing to meet global supply chain standards. Multinational companies operating in the region are demanding cleaner energy sources to align with environmental, social, and governance (ESG) criteria, driving the adoption of clean hydrogen in industrial processes. Increasing governmental and private investments are also supporting the development and deployment of large-scale production facilities. For instance, in June 2025, Adani New Industries Limited (ANIL), a division of Adani Enterprises, launched the first off-grid clean hydrogen pilot facility with a 5 MW capacity in India. Located in Kutch, Gujarat, the facility is powered by solar energy and aligns with India's National Green Hydrogen Mission, marking a significant milestone in the development of clean hydrogen technologies in the region. Besides this, the integration of hydrogen with digital technologies, such as AI-based energy management and blockchain for supply chain tracking, is opening up new efficiencies and transparency in hydrogen operations, strengthening its role in future energy ecosystems.

Europe Clean Hydrogen Market Analysis

The growth of the Europe clean hydrogen market is largely fueled by policy frameworks, private investment, and industrial transformation. Initiatives such as the European Green Deal and REPowerEU have created a robust regulatory backbone, offering subsidies, grants, and hydrogen-specific auctions that lower project risk and attract capital. National strategies in countries such as Germany, France, Spain, and the Netherlands have designated hydrogen valleys and corridors, fostering regional clusters and cross-border synergies. Moreover, in November 2021, the European Commission launched the Clean Hydrogen Partnership to expedite the development implementation of a clean hydrogen technology value chain throughout Europe. Through its 2024 call for proposals, the initiative has so far granted EUR 154.6 Million in funding to 26 innovative projects that will significantly advance the development and adoption of hydrogen technology throughout Europe. Additionally, major utilities and energy firms are investing heavily in large-scale electrolyzer projects linked to offshore wind and solar capacity, ensuring a steady supply of renewable electricity for green hydrogen production. Transportation sectors, such as heavy-duty trucking, maritime shipping, and rail, are also piloting hydrogen fuel cell applications and refueling infrastructure, supporting market growth. Other than this, strategic partnerships between energy companies, equipment manufacturers, and governments are also accelerating deployment, reinforcing momentum across the continent’s hydrogen ecosystem.

Latin America Clean Hydrogen Market Analysis

The Latin America clean hydrogen market is experiencing robust growth due to rising regional interest in energy diversification and long-term economic resilience. Numerous countries across the region are seeking to reduce reliance on fossil fuels and hydro-based power by integrating hydrogen into their broader energy mix. Local demand is also rising as transportation and power sectors explore hydrogen-based solutions to improve energy security and reduce emissions. For instance, in June 2025, Neoenergia SA, a utility firm based in Rio de Janeiro, Brazil, officially started the construction of the country’s first clean hydrogen production facility. A photovoltaic (PV) plant power the facility. It will be a supply point for both light and heavy vehicles. Innovations in hydrogen storage and conversion technologies are also gaining traction to facilitate easier transport and commercialization.

Middle East and Africa Clean Hydrogen Market Analysis

The Middle East and Africa clean hydrogen market is significantly influenced by the presence of abundant natural resources and a strategic focus on the diversification of energy economies. Countries rich in solar energy, such as Saudi Arabia, UAE, and Morocco, are investing in large-scale green hydrogen projects supported by sovereign wealth funds and public–private partnerships. Ambitious nation-wide strategies are also strengthening export capabilities and securing foreign investment tied to hydrogen hubs and gigaprojects. For instance, in February 2025, Saudi Arabia-based ACWA Power signed a Memorandum of Understanding (MoU) with SEFE, an international energy firm, for the production and provision of green hydrogen to Europe. As part of the agreement, SEFE and ACWA Power will create a hydrogen bridge between Saudi Arabia and Germany with an initial goal of supplying 200,000 tons of green hydrogen annually by 2030. ACWA Power will be the primary developer, financier, and operator of the green hydrogen production facilities.

Competitive Landscape:

The key players in the clean hydrogen market are strengthening their market position through collaborative strategies, technological innovations, and scaling up their production capacity to match the growing clean hydrogen demand. These companies such as Air Liquide, Siemens Energy, and Linde are leading in the development of cutting-edge electrolysis technology that increases efficiency and reduces the cost of hydrogen generation. They are also investing in the development of an elaborate infrastructure, which includes hydrogen refueling stations and aspects of large-scale transport, to promote the wide use of hydrogen as an energy source. Besides that, collaborations between energy companies and governments is a key factor in developing legal regimes of legislation and financial incentives, leading to the foundation of more clean hydrogen projects and enhancing the clean hydrogen market revenue.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Air Liquide S.A.

- Air Products and Chemicals Inc.

- Cummins Inc.

- Enapter S.r.l.

- Engie SA

- Green Hydrogen Systems

- Linde plc

- Nel ASA

- Plug Power Inc.

- SG H2 Energy Global LLC

- Siemens Energy AG

- SunGreenH2

Latest News and Developments:

- July 2025: The World Bank authorized a new initiative to assist the clean hydrogen program of Companhia de Desenvolvimento do Complexo Industrial e Portuário do Pecém (Pecém Industrial and Port Complex Company – CIPP) and the Government of Ceará. This initiative aims to facilitate the production of clean hydrogen at the Complex of Pecém, supporting jobs, inclusivity, and long-term climate resilience.

- July 2025: Utility Global selected Rockwell Automation to supply the automation and control platform for its patented H2Gen systems, which utilize Utility's exclusive technologies for producing clean hydrogen with no electricity. With this partnership, Utility will leverage Rockwell’s automation technologies to expedite the commercial launch of its clean hydrogen solutions for industrial applications.

- July 2025: Utility Global established a cooperative project development agreement with Kunhwa E&C to introduce clean hydrogen projects in South Korea. As part of this agreement, the companies will collaborate for the construction and implementation of numerous hydrogen production facilities that utilize Utility's innovative H2Gen technology to transform biogas into inexpensive, clean, carbon-negative hydrogen.

- June 2025: NuScale Power Corporation reported the launch of research initiatives to develop an integrated energy system that can produce clean hydrogen and clean water with little energy use. At its headquarters in Corvallis, Oregon, NuScale also created an Integrated Energy System simulator for the production of hydrogen using high-temperature steam electrolysis mode, hydrogen storage, and hydrogen power generation fuel cell mode.

Clean Hydrogen Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Alkaline Electrolyzer, PEM Electrolyzer, SOE Electrolyzer |

| End Users Covered | Transport, Power Generation, Industrial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Liquide S.A., Air Products and Chemicals Inc., Cummins Inc., Enapter S.r.l., Engie SA, Green Hydrogen Systems, Linde plc, Nel ASA, Plug Power Inc., SG H2 Energy Global LLC, Siemens Energy AG, SunGreenH2, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the clean hydrogen market from 2019-2033.

- The clean hydrogen market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the clean hydrogen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The clean hydrogen market was valued at USD 1.92 Billion in 2024.

The clean hydrogen market is projected to exhibit a CAGR of 13.01% during 2025-2033, reaching a value of USD 6.10 Billion by 2033.

Key factors driving the clean hydrogen market include advancements in hydrogen production technologies, growing demand for renewable energy, decarbonization goals, government policies and incentives, and the push for sustainable industrial applications. Increased investments in infrastructure, such as refueling stations and pipelines, also support market expansion.

Europe dominated the clean hydrogen market in 2024 through strong government policies, significant investments, and advanced infrastructure, aiming for carbon-neutral goals, supported by strategic partnerships and innovation in hydrogen production and technology.

Some of the major players in the clean hydrogen market include Air Liquide S.A., Air Products and Chemicals Inc., Cummins Inc., Enapter S.r.l., Engie SA, Green Hydrogen Systems, Linde plc, Nel ASA, Plug Power Inc., SG H2 Energy Global LLC, Siemens Energy AG, SunGreenH2, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)