Clinical Diagnostics Market Size, Share, Trends and Forecast by Test, Product, End User, and Region, 2026-2034

Clinical Diagnostics Market Size and Share:

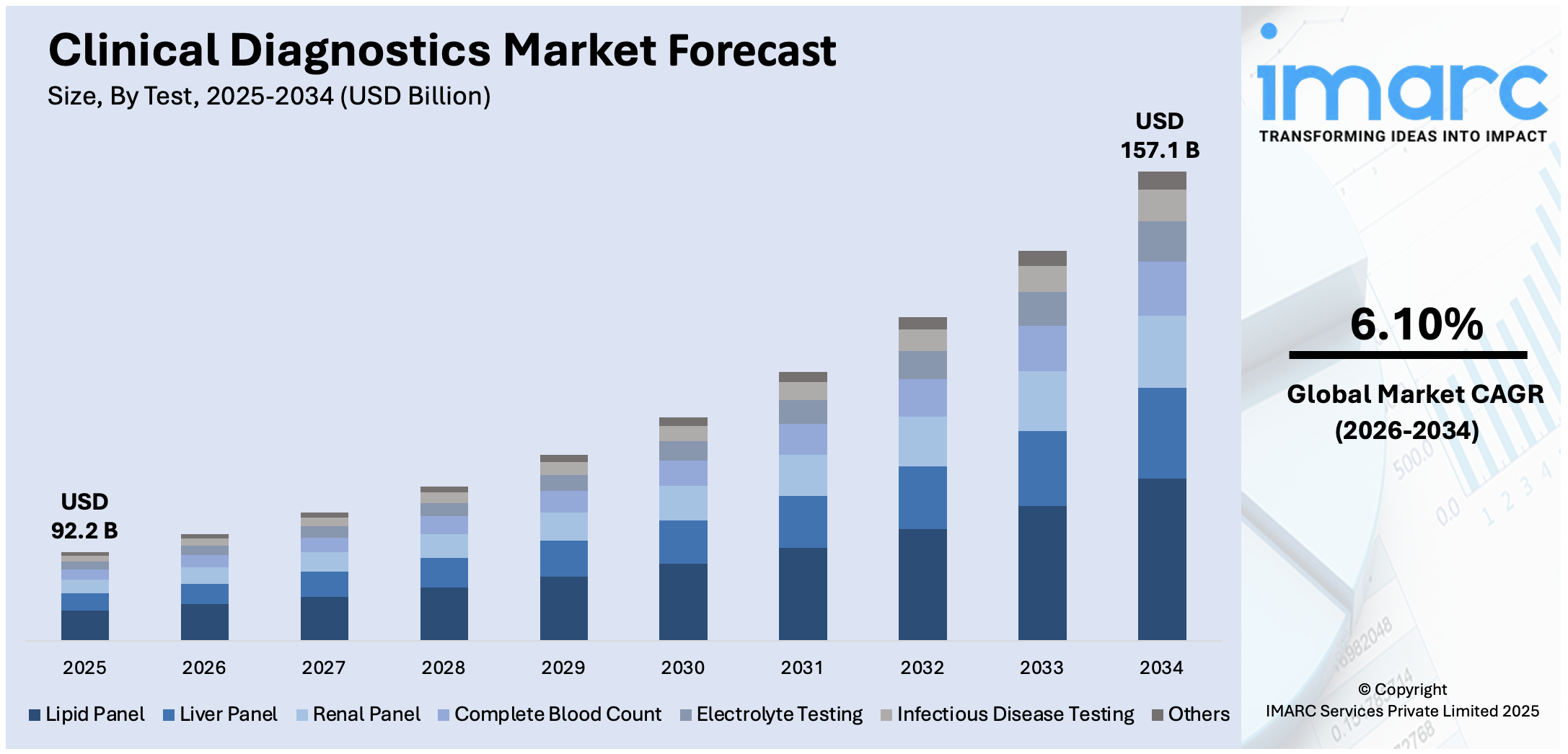

The global clinical diagnostics market size was valued at USD 92.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 157.1 Billion by 2026-2034, exhibiting a CAGR of 6.10% from 2026-2034. North America currently dominates the market in 2025. The increasing number of autoimmune disorders, rising trend of medical tourism, particularly in countries with advanced healthcare systems, and the growing inclination towards personalized medicine and diagnostics are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 92.2 Billion |

| Market Forecast in 2034 | USD 157.1 Billion |

| Market Growth Rate (2026-2034) | 6.10% |

The increasing prevalence of chronic and infectious diseases including diabetes, cancer and cardiovascular conditions is resultant in an increased demand for diagnostic tool being used to help in the early detection and treatment of these diseases. Some of the recent technological advancements and clinical diagnostics market research, such as artificial intelligence integration, automation, and point-of-care diagnostics have boosted the efficacy, efficiency, and accessibility of medical diagnostics, thereby creating a better impetus for clinical diagnostics market growth. This demand was further exacerbated by the ongoing COVID pandemic as diagnostic solutions have proven most beneficial for disease management. Furthermore, government-imposed initiatives, growing healthcare infrastructure investments, and the increasing emergence of diagnostic laboratories in developing economies makes clinical diagnostics the backbone of any healthcare system.

To get more information on this market Request Sample

The United States has emerged as a critical region for the clinical diagnostics market stemming from the rising burden of chronic and infectious diseases such as diabetes, cancer, and cardiovascular conditions, which ultimately escalated the demand for precise tools in diagnosis. Along with advancing technologies results in improvements of diagnostic methods such as molecular diagnostics, next-generation sequencing, and point-of-care testing, the speed and precision in disease detection further lead to market growth. Other factors for the increasing demand for diagnostics are the aging population crowding the preventive healthcare programs. Additional increased expenditures in healthcare services with the government policies meant for the early detection of diseases also contribute to the overall market expansion, thereby driving clinical diagnostics market investment.

Clinical Diagnostics Market Trends:

Increasing lifestyle diseases

There has been an alarming increase in the incidence of non-communicable lifestyle-related illnesses, such as obesity, hypertension, and diabetes, around the world. According to the PAHO/WHO, there are approximately 41 Million deaths globally caused by non-communicable diseases (NCDs), 71% of total mortality worldwide. Sedentary lifestyles and poor quality of diets are highly contributive to such conditions. They can be easily diagnosed clinically and can, therefore, be effectively prevented and treated in individual patients. Timely diagnosis save lives and reduce health care system expenses. These rising lifestyle diseases further raise the importance of clinical diagnostics in the management and control of non-communicable diseases.

Rising Health Awareness

There has been increased awareness in the public arena and into households about the necessity of healthcare along with preventive actions. This is due to the increase in the availability of information through the internet and national public health campaigns. Consequently, reports indicate that 40% or more favor preventive health checks and screening tests. Such actions drive demand for clinical diagnostic services both by individuals who seek to know their health indicators and to diagnose problems early. Among the many demographical categories ages of interested individuals, the older group shows the number of people willing and actively seeking preventive healthcare.

Increasing transformative impact of artificial intelligence (AI)

The clinical diagnostics industry has been drastically affected by the revolutionary impacts of AI-based diagnostic technologies, especially in medical imaging and tailored treatment plans. AI technologies are improving the accuracy and speed of the diagnostic process so that healthcare providers can deliver more accurate assessments. A significant development is HarmonyCVI, an AI-based platform aimed at enhancing cardiovascular assessments and introduced in 2024. Utilizing machine learning algorithms, HarmonyCVI examines imaging data to identify initial indicators of cardiovascular issues, facilitating timely interventions and customized treatment strategies. These AI-driven tools enhance workflow efficiency while also presenting opportunities to minimize human error, optimize resource distribution, and elevate patient outcomes, establishing them as essential to the future of clinical diagnostics.

Growing government initiatives and policies

Governments have been spending huge amounts of money on health infrastructures and providing medical screening policies access to the general public. They have introduced subsidized health insurance, public health campaigns for early disease detection, and massive funding for medical research, thus influencing clinical diagnostics demand. According to Hudson's Global Residence Index, all 43 countries worldwide provide free or universal healthcare to at least 90% of their citizens. These programs allow more people to avail themselves of diagnostic services, thus increasing utilization.

Clinical Diagnostics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global clinical diagnostics market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on test, product, and end user.

Analysis by Test:

- Lipid Panel

- Liver Panel

- Renal Panel

- Complete Blood Count

- Electrolyte Testing

- Infectious Disease Testing

- Others

Lipid panels stand as the largest segment in 2025. A lipid panel is a blood test that measures different types of fats and cholesterol levels in the blood, notably low-density lipoprotein (LDL), high-density lipoprotein (HDL), and triglycerides. The test provides valuable information about the risk for heart disease of an individual and helps guide decisions about what treatment can be best if there is borderline or high risk.

A liver panel is a group of blood tests that evaluate the function of the liver and check for signs of liver damage or inflammation. The panel can include tests like alanine aminotransferase (ALT), aspartate aminotransferase (AST), alkaline phosphatase (ALP), and bilirubin, among others. These results can aid in diagnosing liver diseases such as hepatitis or cirrhosis, and can also monitor the effects of certain medications on the liver.

The renal panel, also commonly known as a kidney panel, consists of various tests aimed at assessing kidney function. It often includes measurements of elements such as creatinine, blood urea nitrogen (BUN), and electrolytes like sodium, potassium, and chloride. The test is critical for diagnosing kidney diseases and for monitoring individuals who are at risk for kidney complications due to conditions like diabetes or high blood pressure.

Analysis by Product:

- Instruments

- Reagents

- Others

Instruments leads the market in 2025. Instruments in clinical diagnostics refer to the specialized machinery and devices used to carry out various tests. These range from simple equipment like centrifuges, which separate different components of blood, to more complex machines like polymerase chain reaction (PCR) devices, which are used for DNA testing. Other instruments can include hematology analyzers for blood cell counts, biochemistry analyzers for measuring chemical substances in the blood, and imaging devices like X-rays or MRIs. These instruments are designed to be highly accurate and efficient, allowing for quick and reliable diagnoses.

Reagents are the chemical substances or compounds used in conjunction with diagnostic instruments to conduct tests. They interact with the samples of blood, urine, or tissue to produce measurable outcomes. Reagents can include antibodies used in immunoassays, chemical indicators, and enzymes. They are typically produced under strict quality control measures to ensure their efficacy and reliability.

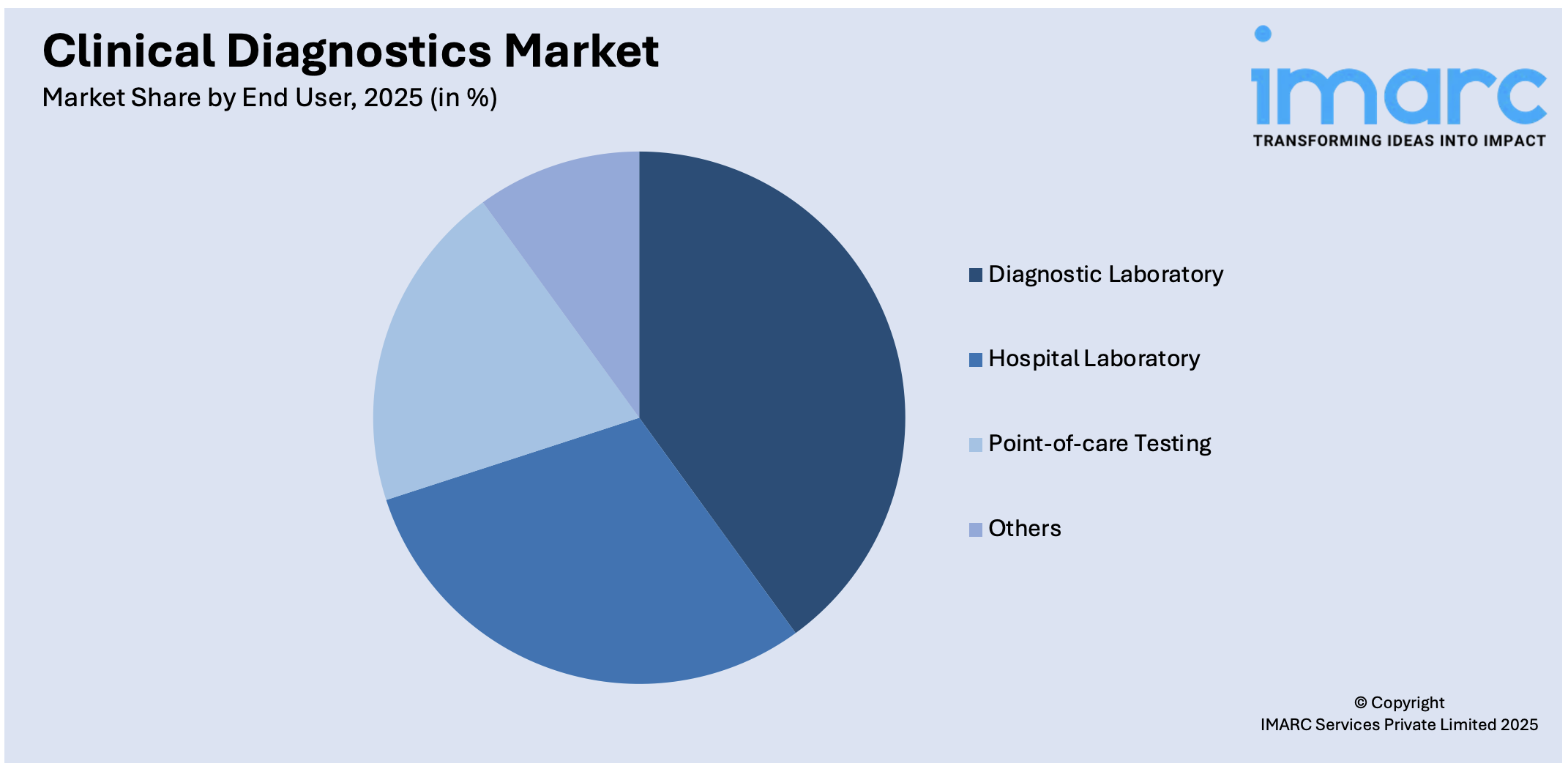

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Hospital Laboratory

- Diagnostic Laboratory

- Point-of-care Testing

- Others

Diagnostic laboratory leads the market. Diagnostic laboratories are specialized facilities that focus solely on conducting diagnostic tests. They often serve multiple healthcare providers and may even accept samples from across different regions. These labs typically offer a wide array of tests, including specialized ones that a hospital lab might not provide. Diagnostic laboratories are crucial for outpatient care and ongoing monitoring of chronic conditions.

Point-of-care testing (POCT) is defined as all those diagnostic tests that are performed in or around the place where health care is being given. These tests are made simpler, more rapid, and timely in relation to results that enable actions to be taken and assisted by other facilities in the same environment. Examples include glucose monitoring for diabetic people and quick strep tests offered in a primary care setting. POCT is really useful in situations where fast decisions are required and immediate treatment is necessary.

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the clinical diagnostics market share in 2025. Increased public awareness about clinical diagnostics has stimulated the market growth in North America. North America's adoption of automation in medical testing is another contributor to the market growth in the region. Another driver of the market is increasing mobile utilization with m-health applications. The affluent economic base of North America allows high expenditure towards health care to support the adoption of advanced diagnostics, such as molecular diagnostics, next-generation sequences, and point-of-care testing. R&D will also be propelled by healthy collaborations between academic institutions, biotechnology firms, and even diagnostics companies.

Key Regional Takeaways:

United States Clinical Diagnostics Market Analysis

The clinical diagnostics market in the United States is driven by advancements in healthcare infrastructure, increasing healthcare spending, and the adoption of cutting-edge technologies. An estimated 129 Million people in the U.S. live with at least one major chronic disease, including heart disease, cancer, diabetes, obesity, and hypertension, according to the U.S. Department of Health and Human Services. This growing burden of chronic conditions has spurred demand for diagnostic tools that aid in early disease detection and personalized medicine. The aging population also plays a critical role in this trend, as older adults are more likely to develop chronic health issues. Government initiatives, such as the Affordable Care Act, aim to improve healthcare access, fueling the demand for diagnostic services. Moreover, advancements in genomics, molecular diagnostics, and AI technology continue to drive innovation in the sector. The increasing popularity of home diagnostics and telemedicine is also enhancing the accessibility of diagnostic tests, particularly in underserved areas. The U.S. is a leader in the global market due to its highly developed healthcare system and technological advancements, with a strong regulatory framework that ensures the safety and efficacy of diagnostic products.

Asia Pacific Clinical Diagnostics Market Analysis

The clinical diagnostics market in the Asia-Pacific (APAC) region is driven by rising healthcare investments, expanding healthcare infrastructure, and a growing burden of chronic diseases. Respiratory infections, such as pneumonia, are prevalent, affecting approximately 475,000 people and accounting for 16.8% of disease cases, according to PubMed Central. Rapid economic growth and urbanization in countries like China and India are increasing demand for advanced diagnostic technologies. Additionally, the region’s aging population, which is projected to double from 630 Million in 2020 to about 1.3 Billion by 2050, according to ESCAP, is driving the need for age-related health diagnostics. Governments across APAC are implementing healthcare reforms and expanding insurance coverage to enhance access to diagnostics. Rising awareness of preventive healthcare and the growing demand for early disease detection also contribute to the market’s growth. Technological innovations, particularly in molecular diagnostics and AI-based solutions, are improving the efficiency and accessibility of diagnostic services, while home healthcare is also gaining traction due to rising disposable incomes.

Europe Clinical Diagnostics Market Analysis

The clinical diagnostics market in Europe is primarily driven by an aging population, growing prevalence of chronic diseases, and continuous advancements in diagnostic technologies. As of January 1, 2023, the European Union's population was estimated at 448.8 Million, with more than one-fifth (21.3%) aged 65 years and over, according to reports. This demographic shift is leading to an increased demand for diagnostic services, particularly for the early detection of conditions such as cancer, cardiovascular diseases, and diabetes. Additionally, Europe's strong emphasis on preventive healthcare is encouraging the adoption of diagnostic tests to manage and detect diseases at earlier stages. Government investments in healthcare infrastructure, as well as favorable reimbursement policies in many European countries, further support market growth. The regulatory environment, including the European Union’s In Vitro Diagnostic Regulation (IVDR), ensures high standards of quality and safety, fostering market confidence. The demand for personalized medicine and molecular diagnostics is driving the adoption of advanced technologies like next-generation sequencing and biomarker testing. Additionally, the region’s well-established healthcare system, coupled with rising healthcare awareness, contributes to the growth of the clinical diagnostics market. Home diagnostics and digital health solutions are also gaining momentum, providing new opportunities for expansion.

Latin America Clinical Diagnostics Market Analysis

The clinical diagnostics market in Latin America is driven by increasing healthcare access, a growing middle-class population, and rising awareness of preventive healthcare. According to PubMed Central, Brazil alone sees an estimated 928,000 deaths annually due to chronic diseases, emphasizing the need for effective diagnostic solutions. Governments across the region, particularly in Brazil and Mexico, are investing in healthcare infrastructure, improving the availability of diagnostic services. The rising incidence of chronic diseases such as diabetes, hypertension, and infectious diseases further fuels demand for diagnostic testing. Technological advancements in molecular diagnostics, portable testing devices, and telemedicine also enhance accessibility in underserved areas.

Middle East and Africa Clinical Diagnostics Market Analysis

The clinical diagnostics market in the Middle East and Africa is propelled by improving healthcare infrastructure and a rising burden of chronic diseases. In the UAE, for example, the prevalence of self-reported chronic diseases stands at 23%, with obesity (12.5%), diabetes (4.2%), and asthma/allergies (3.2%) being the most common, according to PubMed Central. As the region’s healthcare system modernizes, there is an increasing demand for diagnostic solutions. Additionally, the growing prevalence of chronic conditions and the need for early detection are driving market growth. Public health initiatives focusing on disease prevention and early diagnosis further support the expansion of the market.

Competitive Landscape:

Companies are investing heavily in R&D to develop advanced diagnostic tools such as molecular diagnostics, next-generation sequencing, and AI-powered platforms. These innovations enhance accuracy, speed, and reliability in disease detection. Besides, collaborations with academic institutions, hospitals, and research organizations help companies accelerate product development and broaden their reach. Partnerships with telemedicine providers are also enabling integration of diagnostics with remote healthcare services. Moreover, leading players are acquiring smaller firms or merging with competitors to expand their portfolios and strengthen their market presence. These moves allow access to new technologies and markets.

The clinical diagnostics market report provides a comprehensive analysis of the competitive landscape in the clinical diagnostics market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Becton Dickinson and Company

- bioMérieux SA

- Bio-Rad Laboratories Inc.

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Qiagen N.V.

- Quest Diagnostics Incorporated

- Siemens AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc

Latest News and Developments:

- December 2024: Roche received CE mark approval for its cobas® Mass Spec solution, which includes the cobas® i 601 analyzer and Ionify® reagent pack for steroid hormone testing. This marks the start of its global launch, offering over 60 analytes for clinical diagnostics. The solution aims to enhance diagnostic accuracy and patient care by enabling earlier detection and treatment adjustments.

- December 2024: BD and Babson Diagnostics expanded their fingertip blood collection and testing technologies for U.S. clinical diagnostics, integrating BD’s MiniDraw™ system with Babson’s BetterWay technology. This method enables capillary blood collection using just six drops, offering a less invasive, accessible alternative for diagnostic testing in urgent care, doctor’s offices, and other clinical settings.

- September 2023: Abbott completed the acquisition of Bigfoot Biomedical, a leader in smart insulin management systems for diabetes. The transaction enhanced Abbott's position in diabetes care, complementing its FreeStyle Libre® continuous glucose monitoring technology. Bigfoot became a wholly owned subsidiary of Abbott, following the acquisition.

- December 2024: Roche declared that it has accepted CE mark approval for its cobas® Mass Spec solution containing the cobas® i 601 analyser and the first Ionify® reagent pack of four assays for steroid hormones2.

- August 2024: MP Biomedicals expands its portfolio of in vitro diagnostic tests for infectious diseases with innovative immunochromatographic-based qualitative rapid tests. These new diagnostic kits utilize advanced technology to provide accurate results, allowing healthcare professionals to quickly and precisely detect Helicobacter pylori, Salmonella typhi, and Vibrio cholerae serogroups O1 and O139.

- September 2024: QIAGEN N.V. launched the QIAcuityDx Digital PCR System, a crucial enhancement to its digital PCR collection now progressing into clinical diagnostics. The device and its components are exempt from 510(k) requirements in the U.S. and are certified under IVDR for diagnostic purposes in Europe.

Clinical Diagnostics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Tests Covered | Lipid Panel, Liver Panel, Renal Panel, Complete Blood Count, Electrolyte Testing, Infectious Disease Testing, Others |

| Products Covered | Instruments, Reagents, Others |

| End Users Covered | Hospital Laboratory, Diagnostic Laboratory, Point-Of-Care Testing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Becton Dickinson and Company, bioMérieux SA, Bio-Rad Laboratories Inc., Danaher Corporation, F. Hoffmann-La Roche AG, Qiagen N.V., Quest Diagnostics Incorporated, Siemens AG, Sysmex Corporation, Thermo Fisher Scientific Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the clinical diagnostics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global clinical diagnostics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the clinical diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Clinical diagnostics refers to the process of identifying diseases, conditions, or health abnormalities through laboratory tests and assessments. These tests are conducted on patient samples such as blood, urine, tissues, or other bodily fluids to detect and monitor diseases, evaluate organ function, and determine treatment effectiveness. Clinical diagnostics plays a crucial role in healthcare, enabling early detection, accurate diagnosis, and informed decision-making for patient care.

The clinical diagnostics market was valued at USD 92.2 Billion in 2025.

IMARC estimates the global clinical diagnostics market to exhibit a CAGR of 6.10% during 2026-2034.

The increasing number of autoimmune disorders, rising trend of medical tourism, particularly in countries with advanced healthcare systems, and the growing inclination toward personalized medicine and diagnostics are some of the major factors propelling the market.

In 2025, lipid panel represented the largest segment as it evaluates the function of the liver and check for signs of liver damage or inflammation.

Instruments lead the market as they are designed to be highly accurate and efficient, allowing for quick and reliable diagnoses.

The diagnostic laboratory is the leading segment as they are specialized facilities that focus solely on conducting diagnostic tests.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global clinical diagnostics market include Abbott Laboratories, Becton Dickinson and Company, bioMérieux SA, Bio-Rad Laboratories Inc., Danaher Corporation, F. Hoffmann-La Roche AG, Qiagen N.V., Quest Diagnostics Incorporated, Siemens AG, Sysmex Corporation, Thermo Fisher Scientific Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)