Cloud Professional Services Market Size, Share, Trends and Forecast by Service, Organization Size, Deployment Model, End Use, and Region, 2025-2033

Cloud Professional Services Market Size and Share:

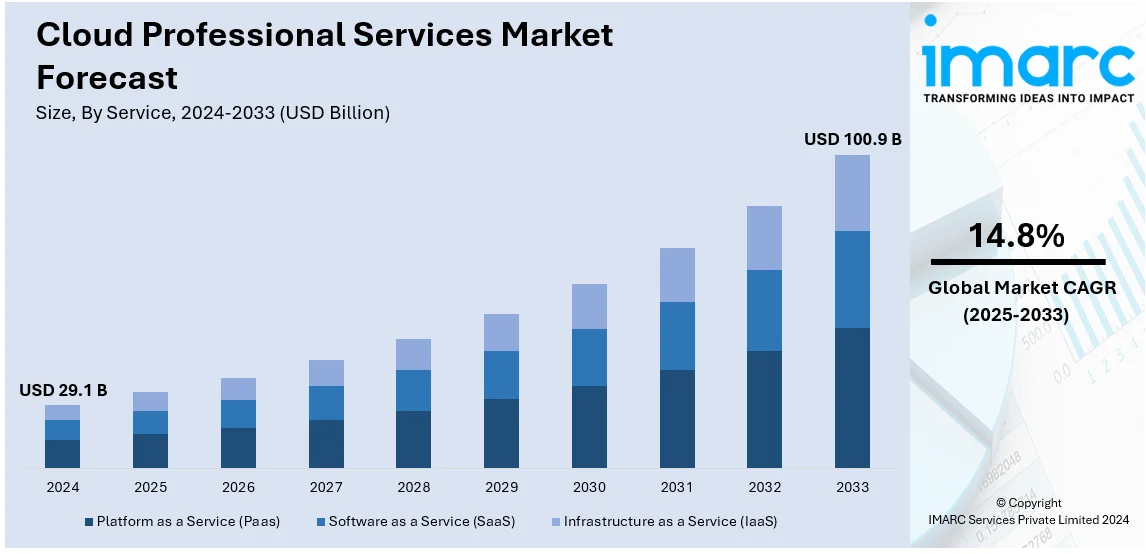

The global cloud professional services market size was valued at USD 29.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 100.9 Billion by 2033, exhibiting a CAGR of 14.8% during 2025-2033. North America currently dominates the market, holding a significant market share of over 48.8% in 2024. The growing focus on digitizing business processes, the escalating importance placed on establishing adaptable information technology (IT) ecosystems along with the advancements in AI, ML and developments and operations (DevOps) practices are some of the major factors contributing positively to the market growth further across the world.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.1 Billion |

| Market Forecast in 2033 | USD 100.9 Billion |

| Market Growth Rate (2025-2033) | 14.8% |

The cloud professional services market is experiencing significant growth mainly driven by the growing adoption of cloud technologies as businesses nowadays seek enhanced flexibility and scalability. Major organizations are undertaking digital transformation initiatives to stay competitive necessitating expert guidance for seamless cloud migration and integration. According to industry reports, the end user expenditure on public cloud services across the world is expected to exceed $ 1 trillion by year 2027. Strict compliance and security requirements compel companies to engage experts to ensure regulatory adherence and data protection. Cost optimization strategies also play a crucial role as businesses nowadays aims to maximize cloud investments while minimizing expenses.

The United States cloud professional market is witnessing significant expansion mainly driven by the growing adoption of cloud technologies as businesses nowadays are pursuing digital transformation in order to enhance their competitiveness and agility. The gradual shift towards hybrid and multi cloud strategies which allows organizations to optimize their performance and cost efficiency is one of the prominent market trends, contributing positively to the market growth across the United States. For instance, in November 2024, Microsoft introduced Azure local a cloud connected infrastructure software for hybrid cloud environment allowing enterprises to run Azure services on-premises. Azure local enables seamless management of resources and includes tools for migrating VMware VMs. Rising concerns over security and regulatory compliance are fueling the demand for specialized cloud security services and expert guidance. In addition to this, the integration of artificial intelligence (AI) and automation is transforming service offerings enabling more efficient and scalable solutions.

Cloud Professional Services Market Trends:

Complex Cloud Environments and Migration Challenges

The diversity of cloud platforms and varying service models such as IaaS, PaaS, SaaS and hybrid cloud setups can make migration a difficult task. Nearly 70% of digital transformation initiatives fail due to complexities in cloud migration underlining the need for professional services to handle the intricacies of moving legacy systems to cloud-native environments. In line with this, cloud professional services support several organizations by evaluating their recent infrastructure and classifying appropriate workloads for cloud migration along with developing effective migration strategies. They manage complex aspects like data transfer, application compatibility and minimizing downtime. Moreover, these services modernize legacy applications through refactoring or rearchitecting to leverage cloud-native features. With their expertise, these services reduce migration risks ensuring a smooth transition and enabling businesses to benefit from the cloud's scalability, agility and cost savings.

Customized Cloud Strategies and Roadmaps

Cloud professional services specialize in understanding an organization's goals and challenges. These services collaborate with stakeholders to create clear objectives like faster time-to-market, cost reduction, enhanced data security or remote work capabilities. In addition to this, they establish a thorough roadmap for application migration, cloud adoption, ongoing management and infrastructure deployment. Around 45% of businesses that customized their cloud migration and strategy had fewer security breaches as compared to those that used a generic approach. This underlines the importance of tailoring cloud roadmaps to include specific security requirements, regulatory compliance needs and risk mitigation strategies. By tailoring strategies to meet the unique needs of each business these services ensure that the cloud acts as a catalyst for growth and innovation rather than a generic solution. This customized approach enables organizations to fully harness the potential of the cloud allowing them to gain a competitive advantage in their respective industries.

Evolving Cloud Technologies and Best Practices

Staying up to date with the latest advancements can be a bit challenging for businesses that are not well versed in intricacies of cloud computing. Cloud professional services bridge this knowledge gap by providing insights into latest trends and helping businesses make informed decisions about adopting new cloud services or optimizing existing ones. These services offer guidance on selecting the most suitable cloud service models thereby ensuring compliance with industry regulations and implementing robust security measures. In line with this, they assist organizations in adopting DevOps practices, containerization, serverless architectures and other cutting-edge techniques that enhance efficiency and agility. The impact of DevOps practices like continuous integration and trunk-based development on organizational performance is greatly enhanced by high-quality documentation. Well-maintained documentation is linked to a 25% boost in team performance compared to cases with poor documentation. By leveraging the expertise of these services, businesses can confidently navigate the dynamic landscape of cloud technologies, ensuring that their cloud environments remain up-to-date, secure, and aligned with industry best practices.

Cloud Professional Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cloud professional services market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on service, organization size, deployment model, end use industry, and region.

Analysis by Service:

- Platform as a Service (Paas)

- Software as a Service (SaaS)

- Infrastructure as a Service (IaaS)

The software as a service (SaaS) segment stands as the largest service in 2024, holding around 51.3% of the market. SaaS applications are hosted and maintained by third-party providers eliminating the need for organizations to manage infrastructure and perform updates or address compatibility issues. This outsourced responsibility allows businesses to focus on utilizing the software to meet their specific needs, streamlining their operations and ultimately enhancing productivity. The subscription-based model of SaaS enables businesses to access software on a pay-as-you-go basis minimizing upfront costs and providing flexibility to scale the usage according to their requirements. This economic advantage along with the seamless user experience facilitated by cloud delivery has also contributed significantly to the widespread adoption of Software as a Service (SaaS) solutions. Furthermore, the diversity of SaaS offerings spans a wide array of applications from customer relationship management (CRM) and enterprise resource planning (ERP) to collaboration tools, human resources management and more.

Analysis by Organization Size:

- Small Enterprises

- Medium Enterprises

- Large Enterprises

Large enterprises lead the market with around 52.0% of market share in 2024. Cloud services offer cost-effective alternatives to traditional IT investments by eliminating the need for extensive on-premises infrastructure, reducing capital expenditures and optimizing operational costs. The pay-as-you-go model of cloud computing allows large enterprises to align their IT expenses with actual usage thereby enhancing financial flexibility and resource allocation. Moreover, the cloud's versatility facilitates the management of diverse business functions within a unified framework. Large enterprises often operate in multiple regions and business verticals, and cloud platforms offer the means to centralize IT management, streamline processes and ensure consistency across the organization. This harmonization is particularly important for fostering collaboration, data sharing and communication across different departments and locations. Additionally, the cloud empowers large enterprises to innovate at a faster pace. The ability to spin up development and testing environments quickly, experiment with new technologies and iterate on ideas accelerates the innovation cycle.

Analysis by Deployment Model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

The demand for public cloud models is growing as they enable organizations to scale operations cost-effectively and rapidly. Its ease of deployment, reduced infrastructure costs, and pay-as-you-go models attract businesses seeking agility. Additionally, the increasing adoption of SaaS applications and demand for remote collaboration tools have further accelerated public cloud adoption across industries.

Private cloud adoption is driven by rising concerns over data security, regulatory compliance, and customization needs. Businesses in sectors such as finance and healthcare are leveraging private cloud for enhanced control over sensitive data. Market growth is fueled by organizations prioritizing secure infrastructure while maintaining scalability and operational efficiency.

Hybrid cloud is a key market segment as organizations seek flexibility to optimize workloads. It supports businesses in maintaining sensitive data on private cloud while leveraging public cloud for scalable operations. The increasing demand for digital transformation and the need to integrate legacy systems with modern cloud solutions are propelling hybrid cloud adoption.

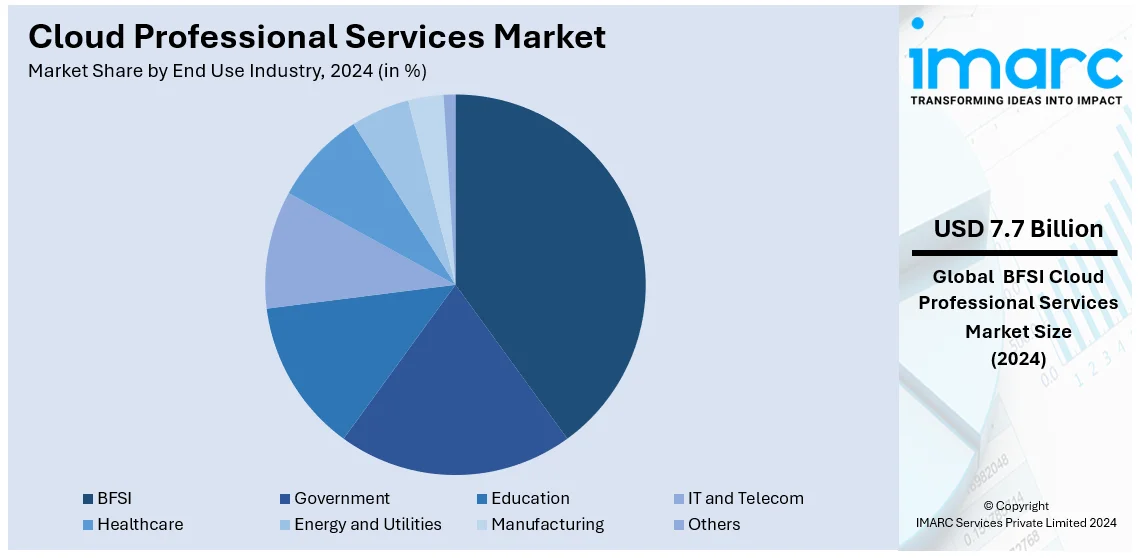

Analysis by End Use Industry:

- BFSI

- Government

- Education

- IT and Telecom

- Healthcare

- Energy and Utilities

- Manufacturing

- Others

BFSI leads the market with around 26.3% of market share in 2024. Cloud computing allows BFSI organizations to optimize their operations by offloading resource-intensive tasks to scalable cloud infrastructure. This is particularly crucial in the BFSI sector where data processing, analytics and risk assessment are essential components. The ability to scale up computational resources during peak demand periods and scale down during off-peak times supports efficient operations and minimizes wastage of resources. Furthermore, data security is paramount in the BFSI industry due to the sensitivity of financial and personal information. Leading cloud service providers invest heavily in robust security measures, compliance certifications and data encryption protocols. This enables BFSI organizations to leverage the advanced security features of cloud platforms often surpassing the security measures achievable through on-premises infrastructure.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for around 48.8% of the total market. North American businesses have been quick to recognize the strategic advantages offered by cloud computing. The scalability, flexibility and cost-efficiency of cloud services align well with the dynamic and competitive nature of industries across the continent. Enterprises of all sizes from startups to multinational corporations have harnessed the cloud's capabilities to optimize their operations, innovate their services and gain a competitive edge. Additionally, regulatory frameworks and security concerns have also driven North American organizations to embrace cloud computing. The stringent compliance requirements and data protection regulations have motivated businesses to partner with reputable cloud service providers that offer robust security measures and adherence to industry standards. Furthermore, North America's proactive approach to research and development has resulted in the emergence of cutting-edge cloud technologies such as artificial intelligence, machine learning and edge computing.

Key Regional Takeaways:

United States Cloud Professional Services Market Analysis

The United States is the most lucrative market in North America, which accounted for around 92.9% market share in 2024. The United States market is largely driven by widespread cloud adoption across industries, advancements in cloud technologies, and an emphasis on digital transformation. Several of the biggest cloud service providers, such as AWS, Microsoft Azure and Google Cloud are based in the United States and work with expert service companies to meet a range of business requirements. Over 90% of businesses worldwide reported using cloud computing services in 2024; the bulk of these businesses are headquartered in the United States and most of them intend to increase their investment in cloud capabilities.

The demand for increased operational efficiency, the growing use of multi-cloud solutions and adherence to strict regulatory frameworks like GDPR and HIPAA are some of the main growth factors. The increasing complexity of hybrid cloud environments is driving up demand for managed, migration and consulting services. Particularly dependent on cloud professional services for scalability, cost efficiency, and improved cybersecurity are sectors including healthcare, finance and retail. Additionally, as companies look to update their IT infrastructure and boost employee productivity the move to remote work following COVID-19 has increased demand for cloud-native apps and expert services.

Europe Cloud Professional Services Market Analysis

The region's strong emphasis on data sovereignty, digital transformation projects and adherence to stringent regulatory frameworks like GDPR are driving the European market for cloud professional services. Organizations are spending more money on expert services to guarantee smooth cloud adoption, migration and integration with current IT systems, with nations like Germany, the UK and France setting the standard.

Significant opportunities are being created for cloud professional service providers by the European Union's push for digitization through initiatives like the Digital Europe Programme and investments in cloud infrastructure. Further driving market expansion is the growing dependence of sectors like manufacturing, BFSI, and the public sector on hybrid cloud solutions. The emergence of European-based cloud providers has also been influenced by the need for industry-specific and locally tailored cloud services, resulting in a competitive but expanding market for professional services.

Asia Pacific Cloud Professional Services Market Analysis

The market for cloud professional services is expanding quickly in Asia-Pacific due to government-led IT infrastructure upgrade projects, the expansion of SMEs, and digital transformation initiatives. Leading the way are nations like China, India, and Japan, where companies are increasingly utilizing cloud services to improve scalability and operational efficiency. Nearly 90% of Asia-Pacific businesses currently have significant workload deployments on several public clouds, as per a new analysis. The trend is most pronounced in India, where 85% of respondents said they have one or more workloads deployed in a true hybrid cloud environment. The majority of Asia/Pacific enterprises have also begun to embrace real hybrid cloud deployments.

Another major factor is the rise in hybrid and multi-cloud setups as companies seek affordable options that provide flexibility and data security. Furthermore, cloud migration, managed services, and consultancy are in high demand due to government initiatives like China's 14th Five-Year Plan and India's Digital India project, which highlight cloud adoption across the public and private sectors.

Latin America Cloud Professional Services Market Analysis

The market for cloud professional services in Latin America is being pushed by initiatives to digitize, the expanding usage of cloud solutions in finance and e-commerce, and the growing acceptance of cloud by SMEs. Brazil and Mexico are the region's top countries, and companies there are looking for expert services for cloud migration and integration to boost their competitiveness. Businesses in Latin America who want to reduce expenses and improve operational effectiveness are also drawn to cloud solutions' affordability and scalability.

Middle East and Africa Cloud Professional Services Market Analysis

Growing investments in cloud infrastructure, increasing use of hybrid cloud models, and government-led digital transformation initiatives are driving the market for cloud professional services in the Middle East and Africa. Enterprises in nations like the United Arab Emirates, Saudi Arabia, and South Africa are setting the standard by implementing cloud services to increase data security and scalability. For instance, Saudi Arabia's Vision 2030 and the United Arab Emirates' Smart Dubai plan focuses on the use of cloud technologies to stimulate economic growth. Furthermore, the need for cloud consulting and managed services has increased due to the region's increased emphasis on cybersecurity and adherence to international standards, especially in the BFSI and healthcare industries.

Competitive Landscape:

Several major companies collaborate with clients to develop tailored cloud strategies aligned with their business objectives. This includes assessing the organization's current IT landscape, determining the optimal cloud deployment model, including public, private, hybrid and outlining a roadmap for successful cloud adoption. Moreover, numerous providers help design cloud architectures that are scalable, secure, and cost-effective. They ensure that the infrastructure is well-architected to meet the organization's performance and availability requirements. Also, cloud professional services firms assist in implementing DevOps practices, automation, and continuous integration/continuous deployment (CI/CD) pipelines. This helps organizations streamline their development processes and enhance agility. Also, providers offer ongoing managed services to handle day-to-day cloud management tasks, such as monitoring, patching, backups, and troubleshooting. This allows organizations to focus on their core business activities.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- Accenture PLC

- Amazon Web Services Inc. (Amazon.com, Inc.)

- Atos SE

- Capgemini SE

- Cisco Systems Inc.

- Dell Technologies Inc.

- Fujitsu Limited

- HCL Technologies Limited

- Hewlett Packard Enterprise Company

- Infosys Limited

- Microsoft Corporation

- NTT DATA Corporation (Nippon Telegraph and Telephone)

- Oracle Corporation

- SAP SE

Latest News and Developments:

- February 2023: Infosys limited collaborated with Microsoft to accelerate Industry adoption of Cloud. These solutions will help businesses uncover value and accelerate enterprise cloud transformation.

- February 2023: IBM planned to acquire NS1, a network automation SaaS provider, to help businesses optimize performance, reliability, security, and cost in delivering content and services to users. Based in New York, NS1 supports enterprises in ensuring easy access to services across the Internet. This acquisition, strengthens its hybrid cloud and AI capabilities, enhancing its network automation portfolio with solutions for managing hybrid multicloud environments and applications from cloud to edge.

- February 2023: Oracle Corporation launched new cloud services to help banks meet customer demands. The Cloud-native, software-as-a-service (SaaS) suite will give corporate and retail banks the agility to modernize their banking applications to meet customer demands.

- December 2022: EY India formed an alliance with Software AG, a provider of enterprise software and technology solutions in business process management, integration, API management, and IoT. The partnership aimed to support organizations in driving digital transformation and growth. The alliance also extended to Germany, where Software AG is headquartered, with plans for further global expansion.

- April 2022: Accenture PLC launched Sovereign Cloud practice to help companies unlock innovation in the cloud. Sovereign cloud is an approach that allows organizations to control the location, access to and processing of their data in a cloud environment in response to new, emerging industry standards and compliance requirements in specific countries or sectors.

Cloud Professional Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Platform as a Service (Paas), Software as a Service (Saas), Infrastructure as a Service (Iaas) |

| Organization Sizes Covered | Small Enterprises, Medium Enterprises, Large Enterprises |

| Deployment Models Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| End Use Industries Covered | BFSI, Government, Education, IT And Telecom, Healthcare, Energy and Utilities, Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture PLC, Amazon Web Services Inc. (Amazon.com, Inc.), Atos SE, Capgemini SE, Cisco Systems Inc., Dell Technologies Inc., Fujitsu Limited, HCL Technologies Limited, Hewlett Packard Enterprise Company, Infosys Limited, Microsoft Corporation, NTT DATA Corporation (Nippon Telegraph and Telephone), Oracle Corporation, SAP SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cloud professional services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cloud professional services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cloud professional services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cloud professional services involve specialized consulting and support to help businesses adopt, implement, and optimize cloud-based solutions. These services address the complexities of migration, architecture design, security, compliance, and performance optimization to enhance scalability, flexibility, and cost-efficiency.

The cloud professional services market was valued at USD 29.1 Billion in 2024.

IMARC estimates the global cloud professional services market to exhibit a CAGR of 14.8% during 2025-2033.

Key drivers include the growing focus on digitizing business processes, integrating AI and ML advancements, adopting DevOps practices, and the need to establish adaptable IT ecosystems to maintain competitive edge.

In 2024, Software as a Service (SaaS) represented the largest segment by service, driven by its ability to minimize infrastructure management and simplify application usage.

Large enterprises lead the market by organization size owing to their need for extensive IT management capabilities and innovation potential.

BFSI leads the market by end use industry owing to the industry's focus on digital transformation, data security, and regulatory compliance requirements.

On a regional level, the market includes North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, with North America currently dominating the global market.

Major players include Accenture PLC, Amazon Web Services Inc. (Amazon.com, Inc.), Atos SE, Capgemini SE, Cisco Systems Inc., Dell Technologies Inc., Fujitsu Limited, HCL Technologies Limited, Hewlett Packard Enterprise Company, Infosys Limited, Microsoft Corporation, NTT DATA Corporation (Nippon Telegraph and Telephone), Oracle Corporation, SAP SE, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)