Coagulation Analyzer Market Size, Share, Trends and Forecast by Testing Type, Product Type, Technology Type, End User, and Region, 2025-2033

Coagulation Analyzer Market Size and Share:

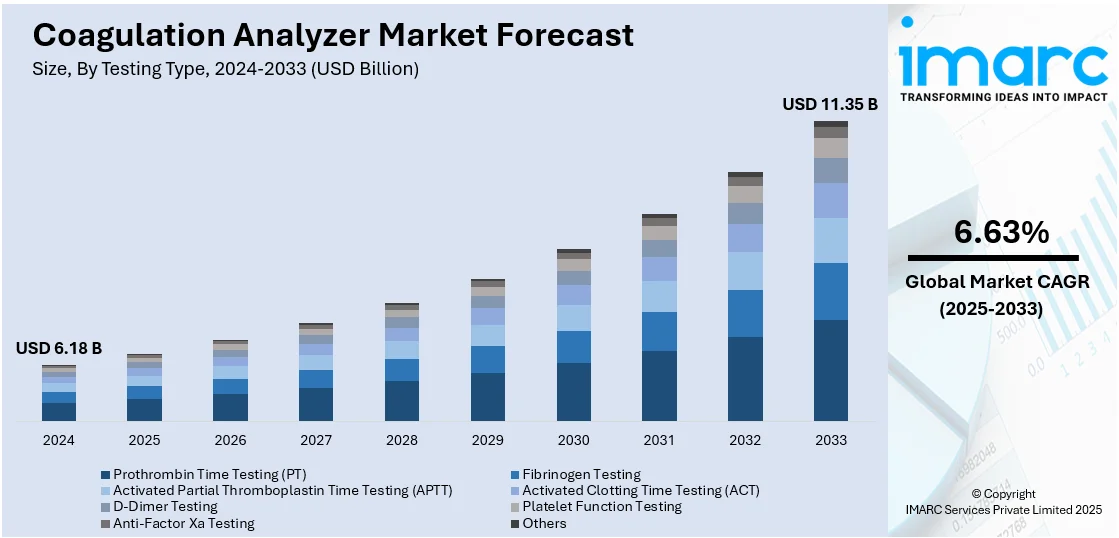

The global coagulation analyzer market size was valued at USD 6.18 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.35 Billion by 2033, exhibiting a CAGR of 6.63% from 2025-2033. North America currently dominates the market, holding a market share of 42.7% in 2024. The increasing incidence of blood disorders such hemophilia, thrombosis, and cardiovascular diseases (CVD), which require constant monitoring, is driving the market's expansion. Technological innovations, including artificial intelligence (AI) integration, automation, and point-of-care (POC) testing, improve diagnostic speed and accuracy. Increasing demand for quick, on-site testing, particularly in emergency and remote locations, also drives coagulation analyzer market share. Furthermore, increased awareness of the value of early diagnosis and of the personalized therapeutic approaches also aids in fueling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.18 Billion |

|

Market Forecast in 2033

|

USD 11.35 Billion |

| Market Growth Rate 2025-2033 | 6.63% |

One major driver in the coagulation analyzer market is the increasing prevalence of CVDs and blood clotting disorders. Globally, CVDs are the leading cause of death, responsible for an estimated 17.9 million deaths annually. Accurate and effective coagulation testing is becoming more and more necessary to monitor blood health as CVDs increase. Coagulation analyzers play a crucial role in diagnosing conditions such as deep vein thrombosis, stroke, and hemophilia. The growing demand for quick, reliable diagnostic solutions in hospitals and clinics further fuels coagulation analyzer market growth. Furthermore, technological developments like automation and POC care testing are greatly increasing the use and efficacy of coagulation analyzers.

The U.S. coagulation analyzer market is experiencing significant growth along with a share of 87.80%, driven by the rising prevalence of blood disorders such as hemophilia, with approximately 33,000 males affected in the country, and thrombosis, both of which require consistent monitoring. Technological advancements like POC devices and automated systems are improving the precision and efficiency of coagulation testing. The aging population and increased awareness about the importance of early detection and management of coagulation disorders further contribute to market expansion. Additionally, the growing demand for reliable diagnostic tools in hospitals and clinics is driving the adoption of coagulation analyzers, solidifying their essential role in U.S. coagulation analyzer market outlook.

Coagulation Analyzer Market Trends:

Integration of Artificial Intelligence and Machine Learning

The incorporation of Artificial Intelligence (AI) and Machine Learning (ML) into coagulation analyzers is changing the market by enhancing diagnostic accuracy and operational performance. AI and ML technologies allow devices to process complex data, identify patterns, and predict outcomes, which increases the speed and accuracy of test results. These innovations minimize human error, automate routine tasks, and deliver consistent results in laboratories, resulting in more accurate outcomes. Moreover, AI and ML's capacity to process vast amounts of data at high speeds automates processes, saving time and resources. This enables healthcare professionals to make better decisions, treat blood disorders more efficiently, and enhance patient care by delivering timely and accurate diagnostic reports with greater accuracy.

Advancements in Point-of-Care Testing (POCT)

Point-of-Care Testing (POCT) is emerging as a major trend in the market for coagulation analyzers as it can deliver rapid, convenient, and accurate diagnostic results. POCT devices, being portable and user-friendly, enable healthcare professionals to receive instant results of tests, thus facilitating timely decision-making in urgent environments such as emergency rooms and intensive care units. This minimizes waiting times and ensures that treatment can be initiated quickly, enhancing patient outcomes. POCT is particularly useful in rural or remote locations where centralized laboratory access may be restricted, allowing for easier monitoring of blood disorders on site. By making coagulation testing more accessible to the patient, POCT increases the overall efficiency and convenience of healthcare provision, particularly in urgent care situations.

Miniaturization and Portability of Analyzers

Miniaturization is one of the leading coagulation analyzer market trends, and it is propelling the creation of portable, compact, and easy-to-use machines. These small analyzers are designed to perform accurate coagulation testing outside normal laboratory environments and are suited for mobile clinics, rural areas, and home healthcare settings. Their mobility makes it easier for healthcare professionals to provide convenient, on-site testing, enhancing patient access to diagnostic care in those who might not have access to hospitals or labs easily. This is very useful for patients who require constant monitoring since it minimizes the necessity for repeat visits to laboratories without losing diagnostic reliability. Miniaturized analyzers enable prompt detection and management of blood disorders, optimizing patient care through making routine testing convenient and available across various healthcare environments.

Coagulation Analyzer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global coagulation analyzer market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based testing type, product type, technology type, and end user.

Analysis by Testing Type:

- Prothrombin Time Testing (PT)

- Fibrinogen Testing

- Activated Partial Thromboplastin Time Testing (APTT)

- Activated Clotting Time Testing (ACT)

- D-Dimer Testing

- Platelet Function Testing

- Anti-Factor Xa Testing

- Others

Based on the coagulation analyzer market forecast, the prothrombin Time (PT) testing has the largest shares of 25.4% because of its critical function in assessing blood clotting ability and following anticoagulant treatment, particularly among patients taking warfarin. It is among the most frequently utilized coagulation tests, performed extensively in clinics, hospitals, and laboratories for diagnosing bleeding disorders, liver disease, and vitamin K deficiency. PT testing is critical in preoperative assessments and current management of CVDs and thus an obligatory routine procedure. Its accuracy, simplicity, and extensive clinical use create high demand. Additionally, the progressive worldwide chronic disease burden and the aging population, which is more susceptible to clotting disorders, continues to propel the frequency of PT monitoring.

Analysis by Product Type:

- Instruments/Analyzers

- Automated Analyzers

- Semi-Automated Analyzers

- Manual Analyzers

- Reagents

- Consumables

- Others

Instruments/analyzers represent the majority share in the coagulation analyzer market because of their key position in performing accurate and efficient diagnostic testing. These instruments are indispensable in the clinical as well as research environments for the identification of clotting disorders, monitoring anticoagulant therapy, and in directing treatment strategy. Demand is fueled by a requirement for high-performance, automated systems that are capable of processing large sample volumes with speed and accuracy. Technological improvements, including compatibility with digital platforms and AI-driven analysis, also improve their utility and popularity. Moreover, the increasing incidence of chronic and lifestyle diseases that need frequent coagulation monitoring drives the use of these devices. Their ruggedness, scalability, and capacity for routine as well as specialty testing make them a staple of coagulation diagnostics.

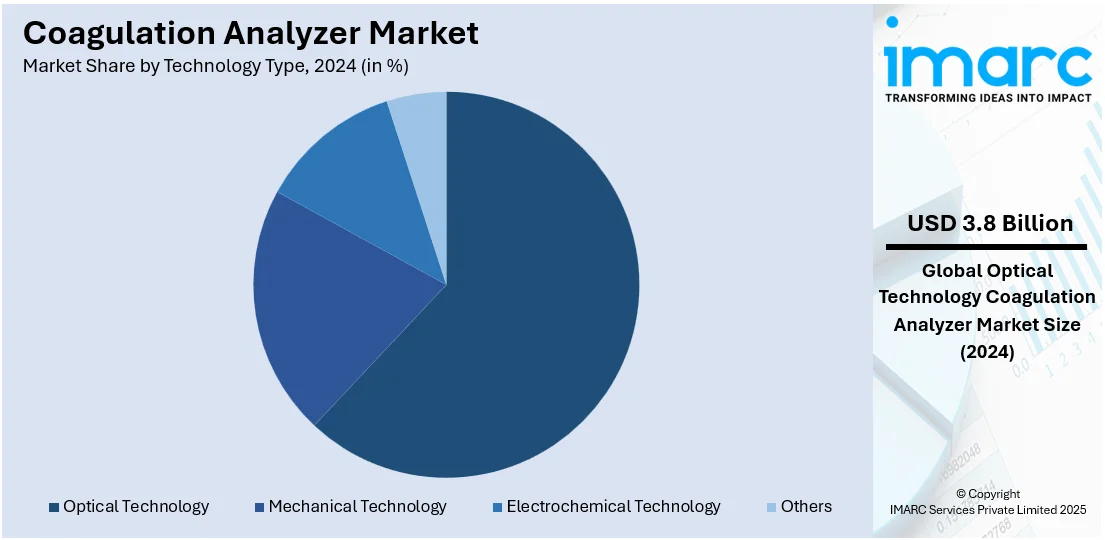

Analysis by Technology Type:

- Optical Technology

- Mechanical Technology

- Electrochemical Technology

- Others

Optical technology leads the market for coagulation analyzers with a share of 61.8% because of its high reliability, accuracy, and capacity for producing quick results. Optical technology employs light transmission or absorbance to measure clot formation in plasma and is very sensitive and applicable to a broad spectrum of tests. Optical analyzers are used in clinical environments because they minimize contamination and human error risk, optimizing workflow efficiency. They also facilitate integration and automation with laboratory information systems, as needed in high-throughput testing laboratories. The technology's ability to be used with different types of tests and reagents makes it more versatile, and ongoing innovation enhances ease of use and accuracy. With these benefits, optical coagulation analyzers are the top choice for hospitals, laboratories, and diagnostic facilities worldwide.

Analysis by End User:

- Clinical Laboratories

- Diagnostic Centers

- Hospitals

- Others

Clinical laboratories are major users of coagulation analyzers, conducting large volumes of routine and specialized blood tests. These facilities rely on high-throughput, automated systems for efficient and accurate diagnostics. Their demand is driven by the need for reliable, cost-effective solutions for managing blood disorder diagnostics and monitoring treatments.

Additionally, the diagnostic centers use coagulation analyzers to provide quick and accessible testing services to outpatients. These centers often focus on delivering rapid results using compact, automated devices. The growing emphasis on preventive healthcare and early disease detection supports their role, especially in urban and semi-urban areas with high patient turnover.

Moreover, the hospitals are key end users due to the need for continuous monitoring of patients with coagulation issues, especially in intensive care and surgical units. They utilize both laboratory-based and POC analyzers for real-time decision-making. Their demand is driven by emergency care, complex procedures, and inpatient testing requirements.

Also, the others category includes research institutes, academic centers, and home healthcare providers. These users focus on specialized applications such as clinical studies, personalized treatment research, and patient self-monitoring. Growing interest in home-based testing and chronic disease management is expanding the use of portable coagulation analyzers in these settings.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

North America is the most prominent market for coagulation analyzers with a share of 42.7% because the region has an established healthcare infrastructure and considerable healthcare spending, making it easy to adopt newer diagnostic technologies at an early stage. The prevalence of chronic blood-related disorders like thrombosis, hemophilia, and CVDs is high in the region, which supports frequent coagulation testing demands. The availability of qualified healthcare professionals and extensive awareness regarding early disease detection also adds to market growth. Moreover, robust research and development efforts, along with favorable regulatory environments, foster innovation and new product launches. The growing adoption of POC testing and home-based diagnostics also adds to the region's leadership, as does the growing population of elderly people, which needs continuous monitoring for clotting disorders.

Key Regional Takeaways:

United States Coagulation Analyzer Market Analysis

The United States coagulation analyzer market is dominated by the increasing rate of cardiovascular disease, diabetes, and blood disorders in the nation, which require frequent monitoring of blood clotting parameters. As per the American Heart Association, in 2024, about 48.6% of the population in the United States had a cardiovascular disease, including stroke, heart failure, coronary heart disease, and high blood pressure. Additionally, as the elderly population base in the country continues to increase, the occurrence of diseases such as deep vein thrombosis, pulmonary embolism, and hemophilia is on the rise, consequently increasing demand for trustworthy coagulation testing. In addition to this, expanding utilization of anticoagulant therapies necessitates continuous monitoring through coagulation analyzers for the purpose of ensuring therapeutic response and reducing potential side effects. Advances in coagulation testing technology, such as fully automated and POC systems, are also improving diagnostic precision and operational efficiency, leading to increased adoption in clinical laboratories and hospitals. Increased emphasis on personalized medicine and early disease detection also supports market growth as clinicians require detailed and timely coagulation profiles to inform treatment decisions. In addition, higher healthcare spending and better access to diagnostic services are creating a more conducive climate for the uptake of advanced laboratory equipment. The focus on laboratory automation to minimize human error and maximize throughput in high-volume environments is also driving the uptake of advanced coagulation analyzers.

Asia Pacific Coagulation Analyzer Market Analysis

The Asia Pacific coagulation analyzer market is expanding due to the region's rapidly aging population, particularly in countries such as Japan and India, which is leading to an increased prevalence of age-related vascular diseases, thereby elevating the demand for coagulation testing. In 2023, 44,483 individuals in Japan were aged 60 years and over, accounting for 36.1% of the population of the country, as per industry reports. Additionally, economic development in countries such as China and India has significantly improved healthcare infrastructure, enhancing access to advanced diagnostic services and fostering industry expansion. The growing adoption of POC testing devices is also contributing substantially to market growth by providing rapid and convenient diagnostic solutions. Moreover, the increasing focus on laboratory automation is driving the demand for advanced coagulation analyzers that offer high throughput and efficiency. Collectively, these factors are positioning the Asia Pacific region as a dynamic and rapidly expanding market for coagulation analyzers.

Europe Coagulation Analyzer Market Analysis

The European coagulation analyzer market is witnessing strong growth, driven by changing clinical practices that increasingly emphasize precision diagnostics and evidence-based medicine. The increasing need for full coagulation profiling in surgical interventions, especially in orthopedics, cardiology, and transplant surgery, has resulted in increased dependence on high-performance analyzers that can provide quick, real-time results. Aside from this, growth in outpatient facilities and ambulatory surgery centers throughout Europe is promoting the demand for small, intuitive POC testing systems offering rapid turnaround times and enabling more rapid clinical decision-making. Growth in cancer patients, especially with thrombotic complications, is another significant consideration requiring routine coagulation testing as part of oncology protocols. In addition, the rising prevalence of lifestyle-related risk factors like obesity, smoking, and lack of physical activity has indirectly fueled the increased incidence of clotting disorders, requiring increased diagnostic vigilance. The growing geriatric population in Europe is also leading to an increased incidence of coagulation-related disorders, further driving the demand for diagnostic solutions. As per industry reports, in January 2024, 21.6% of the population in the European Union was over 65 years old. Aside from this, the growing focus on quality control, accreditation, and standardization in European laboratories is driving the use of analyzers that provide better accuracy, international benchmark compliance, and effective data management functionality, enabling industry growth.

Latin America Coagulation Analyzer Market Analysis

The Latin America coagulation analyzer market is significantly driven by economic development in countries such as Brazil and Mexico, which has improved healthcare infrastructure and enhanced access to advanced diagnostic services. For instance, Brazil spends 9.47% of its GDP on healthcare, equating to USD 161 Billion and making it the largest healthcare market in Latin America, as per the International Trade Administration (ITA). An increase in surgical procedures across urban hospitals is also fueling the need for accurate and rapid coagulation testing to manage intraoperative and postoperative bleeding risks. Rising awareness among healthcare professionals regarding the importance of coagulation testing in clinical decision-making is further fostering industry expansion. As diagnostic practices evolve, there is a greater demand for analyzers that can deliver comprehensive panels, supporting market growth in Latin America.

Middle East and Africa Coagulation Analyzer Market Analysis

Middle East and Africa (MEA) coagulation analyzer market is increasingly being driven by the growing number of blood disorders like hemophilia, sickle cell disease, and thalassemia, especially in areas like Sub-Saharan Africa, fueling demand for precise and effective coagulation testing. Increasing incidence of CVDs, including coronary heart disease and stroke, is also fueling the demand for continuous coagulation monitoring. Furthermore, advancements in healthcare infrastructure and higher healthcare expenditure in nations like Saudi Arabia, the UAE, and South Africa are improving access to sophisticated diagnostic services, thus fueling market growth. For example, Saudi Arabia contributes 60% of the total healthcare spending among the Gulf Cooperation Council (GCC) nations, as reported by the International Trade Administration (ITA). Additionally, under the Vision 2030 initiative, Saudi Arabia intends to spend over USD 65 Billion in developing the nation's healthcare infrastructure.

Competitive Landscape:

Competitive landscape of the market includes established participants as well as nascent innovation leaders. Companies are, of late, trying to target product differentiation using developments like automation, POC, and the incorporation of AI. The incorporation of analysis-based design development and miniaturization along with portable instruments is getting vital for serving on-site as well as at-home test needs. Market participants are also investing in improving the accuracy and speed of coagulation testing to enhance patient outcomes. Partnerships, collaborations with healthcare institutions, and strategic acquisitions are typical methods employed to increase market reach. With increasing focus on personalized medicine and diagnostics, competition is growing, as firms try to meet the varied needs of healthcare providers and patients in various regions.

The report provides a comprehensive analysis of the competitive landscape in the coagulation analyzer market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Roche Diagnostics (F. Hoffmann-La Roche Ltd.)

- Nihon Kohden

- Sysmex Corporation

- Siemens Healthineers Company

- Thermo Fisher Scientific Inc.

- Helena Laboratories Corporation

- DIAGNOSTICA STAGO

- Instrumentation Laboratory Company

Latest News and Developments:

- April 2025: Sysmex Corporation announced the commencement of operations at its new production facility in India, which is the Group’s first base that can manufacture both diagnostic reagents and instruments. Sysmex has already started producing the XQ™-Series Automated Hematology (Coagulation) Analyzer (XQ-320) for the Indian market at this facility to support the ‘Make in India’ initiative.

- March 2025: Sysmex America Inc. announced the addition of the XQ-320TM to its 3-part differential automatic coagulation analyzer range in an attempt to provide more accurate and dependable CBC testing solutions. The XQ-320, the first 3-part differential analyzer with BeyondCare Quality Monitor, is ideal for stat labs, physician office labs, or any other setting where quick diagnostic analysis is needed.

- January 2025: Erba Transasia Group launched the Erba H7100, the company’s novel coagulation analyzer, at a Clinical Symposium in Bengaluru. The Erba H7100, which is outfitted with fluorescence flow cytometry technologies, provides a 70-parameter spectrum that includes reticulocytes, immature granulocytes (IG), and immature platelet fraction (IPF). These parameters are crucial for the diagnosis and treatment of diseases such as anemia, thrombocytopenia, infections, inflammation, and blood malignancies.

- September 2024: Sysmex Corporation introduced the HISCLTM HIT IgG Assay Kit in the Japanese market in order to measure IgG antibodies against the complexes of platelet factor 4 and heparin. The assay kit is intended for Sysmex's Automated Blood Coagulation Analyzers CN-6500/CN-3500, which use the HISCL-Series technology. By achieving the high sensitivity and high specificity needed for serological testing for heparin-induced thrombocytopenia, the kit minimizes false positives, which are detrimental when identifying the side effects of heparin therapies.

- June 2024: HORIBA introduced new models of its advanced compact coagulation analyzers, expanding the company’s range of product offerings. The new devices, namely Yumizen H550E (autoloader), H500E CT (closed tube), and Yumizen H500E OT (open tube) provide 60-second combined analysis for CBC/DIFF and ESR values from whole blood, which adds a thorough profile for inflammatory disease screening in addition to their existing broad range of capabilities.

Coagulation Analyzer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Testing Types Covered | Prothrombin Time Testing (PT), Fibrinogen Testing, Activated Partial Thromboplastin Time Testing (APTT), Activated Clotting Time Testing (ACT), D-Dimer Testing, Platelet Function Testing, Anti-Factor Xa Testing, Others |

| Product Types Covered |

|

| Technology Types Covered | Optical Technology, Mechanical Technology, Electrochemical Technology, Others |

| End Users Covered | Clinical Laboratories, Diagnostic Centers, Hospitals, Others |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

| Companies Covered | Abbott Laboratories, Roche Diagnostics (F. Hoffmann-La Roche Ltd.), Nihon Kohden, Sysmex Corporation, Siemens Healthineers Company, Thermo Fisher Scientific Inc., Helena Laboratories Corporation, DIAGNOSTICA STAGO and Instrumentation Laboratory Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the coagulation analyzer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global coagulation analyzer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Coagulation Analyzer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The coagulation analyzer market was valued at USD 6.18 Billion in 2024.

The coagulation analyzer market is projected to exhibit a CAGR of 6.63% during 2025-2033, reaching a value of USD 11.35 Billion by 2033.

Key factors driving the coagulation analyzer market include the rising prevalence of blood disorders, technological advancements in automation and POC testing, and increasing demand for rapid, accurate diagnostics. Additionally, the aging population, growing awareness about coagulation disorders, and the shift towards personalized healthcare further propel market growth.

North America currently dominates the coagulation analyzer market with a share of 42.7% due to its advanced healthcare infrastructure, high healthcare expenditure, and early adoption of innovative technologies. The region’s well-established hospitals and diagnostic centers drive demand for accurate and efficient coagulation testing, while the growing prevalence of blood disorders further fuels market growth.

Some of the major players in the Coagulation Analyzer market include Abbott Laboratories, Roche Diagnostics (F. Hoffmann-La Roche Ltd.), Nihon Kohden, Sysmex Corporation, Siemens Healthineers Company, Thermo Fisher Scientific Inc., Helena Laboratories Corporation, DIAGNOSTICA STAGO, Instrumentation Laboratory Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)