Coffee Roaster Market Report by Type (Drum, Hot Air, Stove Top, and Others), Category (Electric Roaster, Gas Roaster), Distribution Channel (Business to Business, Specialty Stores, Hypermarkets and Supermarkets, Online Sales Channels), End User (Commercial, Residential, Industrial), and Region 2025-2033

Global Coffee Roaster Market:

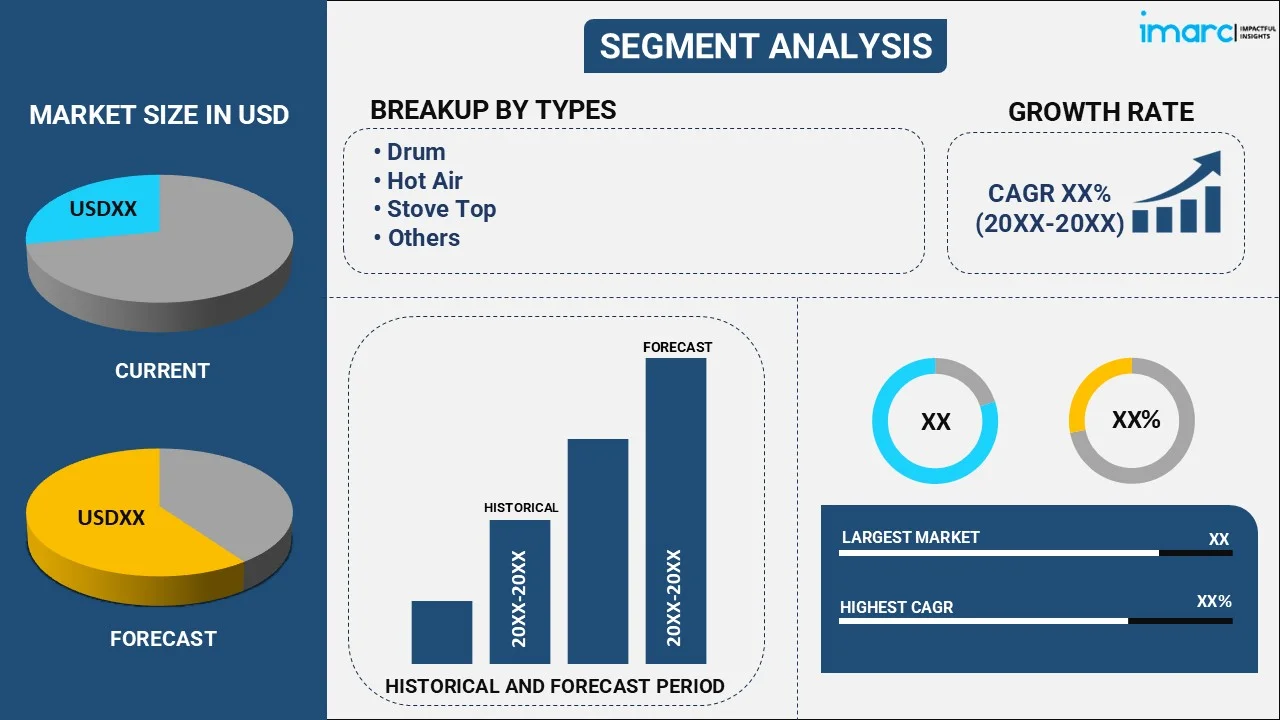

The global coffee roaster market size reached USD 496.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 705.4 Million by 2033, exhibiting a growth rate (CAGR) of 3.97% during 2025-2033. The increasing number of quick-service restaurants, the easy availability of coffee roasters via numerous distributional channels, and the escalating demand for ready-to-drink (RTD) beverages in several flavors represent some of the primary factors stimulating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 496.7 Million |

| Market Forecast in 2033 | USD 705.4 Million |

| Market Growth Rate 2025-2033 |

3.97%

|

Global Coffee Roaster Market Analysis:

- Major Market Drivers: The growing food and beverage (F&B) industry is strengthening the growth of the market. Moreover, the elevating popularity of aromatic and fresh coffee among the millennial population is also propelling the overall market across the globe.

- Key Market Trends: The launch of enhanced coffee roasters for household purposes that have simple functions and require minimal cleanup is one of the key trends positively influencing the market. Additionally, the easy availability of these devices via distribution channels is acting as another significant growth-inducing factor.

- Geographical Trends: Europe exhibits a clear dominance, accounting for the largest share of the market. This can be attributed to the elevating number of coffee outlets. In addition to this, the rising international events held in the region are driving the market forward.

- Competitive Landscape: Some of the primary coffee roaster market companies include Bühler Group, Diedrich Manufacturing Inc., Genio Roasters, Giesen Coffee Roasters, Mill City Roasters LLC, R&R Roaster and Roaster, and Toper Roasters, among many others.

- Challenges and Opportunities: Various factors hampering the growth of the market include political instability in coffee-growing countries and fluctuations in global trade policies that can affect both the availability and price of coffee beans and disrupt supply chains. However, key players are focusing on addressing these challenges effectively, which is expected to propel the market in the coming years.

Global Coffee Roaster Market Trends:

Rising Consumption of Coffee

The widespread adoption of fresh coffee by individuals, as it aids in reducing the chances of several heart diseases, boosting energy levels, lowering the risk of type 2 diabetes among individuals, etc., is positively contributing to the growth of the market. For instance, as per the International Coffee Council, the preference of consumers in Southeast Asia has shifted towards fresh coffee consumption. In line with this, according to the International Coffee Organization, the production of coffee across the globe rose by 6.3% from 2019 to 2020. Moreover, the expanding working population is also bolstering the coffee roaster market demand. For example, according to a survey conducted by the Institute for Scientific Information on Coffee (ISIC), as of 2021, 68% of the respondents stated that they generally consumed coffee while working. This trend is stimulating the adoption of the beverage across countries in Europe, like Germany, as individuals are becoming increasingly conscious about the quality of their coffee.

New Product Launches

The development of enhanced coffee roasters with advanced characteristics by prominent players operating in the market is propelling the growth. Moreover, they are investing in the launch of compact product variants equipped with advanced technologies that cater to the diverse needs of consumers, thereby offering lucrative opportunities to elevate the coffee roaster market revenue. For example, in January 2021, IKAWA Ltd developed a new coffee roaster, IKAWA Pro100. The coffee roaster is consistent, easy to use, and has a capacity of 120 grams. Additionally, U.S. Roasters Corp. introduced Revelation F5, a new solution for heat-circulating. In line with this, in January 2023, PROBAT AG launched the P12e electric coffee roaster with electrical hot air technology, which was an addition to its P series of roasters. The P12e offers consistent and reproducible roasting results and has a roasting capacity of 40kg/h. These new product developments will continue to drive the coffee roaster market outlook over the foreseeable future.

Growing Fast-Food Chains

The easy accessibility of coffee, owing to the increasing number of restaurants, clubs, cafes, pubs, hotels, etc., is acting as another significant growth-inducing factor. For instance, in August 2022, Up Coffee Roasters in Minneapolis was purchased by FairWave, a group of specialty coffee brands based in Kansas City, Missouri, to promote high-quality coffee in local communities. Furthermore, the widespread adoption of easy-to-go and convenient coffee drinks is augmenting the overall growth of the market. As such, in July 2022, Iron & Fire introduced a brand-new website specifically for wholesale customers. Iron & Fire supplies coffee roasters to bar chains, restaurants, garden centers, coffee shops, hotels, and other establishments and has experienced extensive growth since its reopening. In addition to this, in February 2022, Bellwether Coffee, one of the companies that developed a sustainable commercial coffee roaster, the Series 2 Bellwether Automated Roasting System. According to the business, the new roaster was a step towards expanding the coffee industry and making it more accessible to all communities. Moreover, the elevating usage of these devices in fast food chains to provide rich quality coffee to individuals and save time is bolstering the coffee roaster market overview. For instance, in January 2022, Diedrich Manufacturing Inc. introduced a new roaster machine, Diedrich DR-3, replacing the older IR-2.5 and IR-1. The DR-3 has a capacity range of 1-3kg and is specifically designed to fulfill all the functions of the older IR machines.

Global Coffee Roaster Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the type, category, distribution channel, and end user.

Breakup by Type:

- Drum

- Hot Air

- Stove Top

- Others

Hot air represents most popular type

The report has provided a detailed breakup and analysis of the market based on the type. This includes drum, hot air, stove top, and others. According to the report, hot air accounted for the largest market share.

Hot air coffee roasters, also called airflow roasters, generally rely on hot air technology. According to the coffee roaster market statistics, the demand for hot air coffee roasters is increasing, as they do not emit smoke and roast the coffee beans evenly and efficiently while retaining the flavor, thereby propelling the growth of this segmentation. Additionally, the elevating adoption of hot air coffee roasters, as they offer dual functions of cooling and roasting coffee beans, is contributing to the growth of the market. For example, Gravity Automotive's hot air roaster is specifically designed to roast coffee beans or other food products via the circulation of hot air. Additionally, in this process, the coffee beans are in direct contact with a heated surface, and the hot air is circulated around them. This process provides numerous advantages, including even roasting, less smoke, fewer odors, precise temperature control, shorter roasting cycles, etc., which represents one of the coffee roaster market's recent opportunities.

Breakup by Category:

- Electric Roaster

- Gas Roaster

Gas roaster holds the largest market share

The report has provided a detailed breakup and analysis of the market based on the category. This includes electric roaster and gas roaster. According to the report, gas roaster accounted for the largest market share.

Gas roasters usually rely on several fossil fuels for their operation and have manual controls as compared to electric roasters. In addition, the rising adoption of gas roasters among large scale industries to roast coffee beans in bulk quantity easily is further impelling the growth of the market. Apart from this, gas coffee roasters are gaining extensive traction among those who value quick temperature adjustments and precision. Moreover, experienced roasters who use gas roasting can achieve remarkable artistry and exactness in their coffee. This, in turn, is elevating the growth in the segmentation, according to the coffee roaster market statistics.

Breakup by Distribution Channel:

- Business to Business

- Specialty Stores

- Hypermarkets and Supermarkets

- Online Sales Channels

Business to business accounts for the majority of the coffee roaster market share

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes business to business, specialty stores, hypermarkets and supermarkets, and online sales channels. According to the report, business to business accounted for the largest market share.

Business-to-business (B2B) distribution refers to a method of delivering and selling goods to another business. It usually involves buying goods from a manufacturer or supplier and then selling them to wholesalers, retailers, or various manufacturers. It excludes offering of products directly to the end consumers as compared to other distribution channels. For instance, companies, including BlueCart, are gaining traction for these purposes.

Breakup by End User:

- Commercial

- Residential

- Industrial

Industrial exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes commercial, residential, and industrial. According to the report, industrial accounted for the largest market share.

Coffee roasters are widely used in the industrial sector by large coffee production facilities and companies, as they are designed to handle a huge quantity of coffee beans efficiently and minimize wastage. For example, in April 2023, Buhler announced the opening of a new cocoa application center, owing to its focus on reducing greenhouse gas (GHG) emissions. In addition to this, in February 2022, Bellwether Coffee, one of the manufacturers of commercial coffee roasters, launched the Series 2 Bellwether Automated Roasting System. This is among the coffee roaster market's recent developments stimulating the segmentation.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe exhibits a clear dominance, accounting for the largest market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share.

The elevating demand for coffee roasters, on account of the increasing number of coffee outlets, is positively influencing the growth of the market across Europe. Apart from this, the widespread adoption of coffee, owing to the elevating number of international events and shows, is offering a positive market outlook. For example, the World of Coffee, one of Europe's largest specialty trade shows, was organized in Berlin. Over 250 exhibitors from 50 countries participated, displaying the latest products and innovations, including coffee roasters. Moreover, Starbucks Coffee Company offers whole bean coffee in several categories, providing all types of roasts across Europe. It uses only 100% arabica beans. Besides this, these arabica trees thrive at higher altitudes, typically between 3,000 and 6,000 feet. These beans contain approximately 1% caffeine by weight. In addition to this, the elevating need for fresh roasted coffee among consumers is bolstering the coffee roaster market's recent price in the region.

Competitive Landscape:

Key players are launching electric coffee roasters with unique technologies and creating wholesale websites for expanding their product portfolios. Besides this, major players are focusing on introducing coffee roasters that reduce natural gas consumption and carbon footprint in the environment. These roasters have a heat recovery system for pre-heating green coffee beans. This, coupled with the rising consumer demand for green ground coffee, as it has chlorogenic acid content and slows down the absorption of carbohydrates, is offering lucrative growth opportunities for industry players, thereby positively influencing the coffee roaster market growth. Furthermore, key manufacturers are introducing coffee roasters with advanced features, such as drum and heat transfer, cooling, control interface, and chaff management.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Bühler Group

- Diedrich Manufacturing Inc.

- Genio Roasters

- Giesen Coffee Roasters

- Mill City Roasters LLC

- R&R Roaster and Roaster

- Toper Roasters

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Coffee Roaster Market News:

- April 2024: La Colombe Coffee Roasters, a specialty coffee roaster, announces the availability of new 11 fl oz Draft Latte cans with the same creamy texture and smooth taste as the Draft Lattes on-tap in La Colombe cafés.

- March 2024: One of the specialty coffee roaster and café chains in India, Blue Tokai Coffee Roasters, has reached 100 stores with a new outlet in Kolkata.

Coffee Roaster Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Drum, Hot Air, Stove Top, Others |

| Categories Covered | Electric Roaster, Gas Roaster |

| Distribution Channels Covered | Business to Business, Specialty Stores, Hypermarkets and Supermarkets, Online Sales Channels |

| End Users Covered | Commercial, Residential, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bühler Group, Diedrich Manufacturing Inc., Genio Roasters, Giesen Coffee Roasters, Mill City Roasters LLC, R&R Roaster and Roaster, Toper Roasters, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global coffee roaster market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global coffee roaster market?

- What is the impact of each driver, restraint, and opportunity on the global coffee roaster market?

- What are the key regional markets?

- Which countries represent the most attractive coffee roaster market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the coffee roaster market?

- What is the breakup of the market based on the category?

- Which is the most attractive category in the coffee roaster market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the coffee roaster market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the coffee roaster market?

- What is the competitive structure of the global coffee roaster market?

- Who are the key players/companies in the global coffee roaster market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the coffee roaster market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global coffee roaster market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the coffee roaster industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)