Coherent Optical Equipment Market Report by Technology (100G, 200G, 400G+, 400G ZR), Equipment (Wavelength-Division Multiplexer (WDM), Modules/Chips, Test and Measurement Equipment, Optical Amplifiers, Optical Switches, and Others), Application (Networking, Data Center, Original Equipment Manufacturers (OEMs)), End User (Service Provider, Public Sector, Industries), and Region 2025-2033

Coherent Optical Equipment Market Size:

The global coherent optical equipment market size reached USD 29.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 52.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6.8% during 2025-2033. The market is experiencing steady growth driven by the increasing demand for high-speed data transmission, expansion of fifth generation (5G) networks, and the rising adoption of the Internet of Things (IoT) devices among the masses worldwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 29.2 Billion |

|

Market Forecast in 2033

|

USD 52.7 Billion |

| Market Growth Rate (2025-2033) | 6.8% |

Coherent Optical Equipment Market Analysis:

- Major Market Drivers: The market is witnessing moderate growth due to the rising employment of cloud computing, coupled with technological advancements in optical networking.

- Key Market Trends: The market is showcasing rapid growth on account of the increasing adoption of IoT devices, along with the expansion of 5G networks.

- Geographical Trends: North America leads the market, driven by the presence of a well-established telecommunications infrastructure. However, Asia Pacific is emerging as a fast-growing market due to rising focus on adopting advanced technologies.

- Competitive Landscape: Some of the major market players in the coherent optical equipment industry include Acacia Communications Inc. (Cisco Systems Inc), Ciena Corporation, Fujitsu Limited, Huawei Technologies Co. Ltd., Infinera Corporation, NEC Corporation, Nokia Oyj, Ribbon Communications Operating Company Inc., ZTE Corporation, Zygo Corporation (AMETEK Inc), among many others.

- Challenges and Opportunities: While the market faces challenges, such as the higher cost of coherent optics, it also encounters opportunities on account of the escalating demand for energy-efficient solutions.

Coherent Optical Equipment Market Trends:

Rising demand for high-speed data transmission

The increasing focus on high-speed data transmission is propelling the coherent optical equipment market growth. Coherent optics provide the performance and flexibility to transport more information on the same fiber over long distances. They solve the capacity problems faced by network providers. There is a rise in the usage of bandwidth-intensive applications, such as video streaming, cloud computing, and online gaming, among individuals worldwide. People are watching movies, series, and other videos and preferring high-speed internet services for an enhanced experience. As per Statista, the over-the-top (OTT) video revenue reached an estimated 154 billion U.S. dollars in 2022, with the US accounting for the largest share of revenue worldwide.

Expansion of 5G networks

The deployment of 5G networks requires robust infrastructure to support the increased data traffic and low latency needs, thereby catalyzing the coherent optical equipment market demand. This optical equipment provides the necessary bandwidth and reliability for 5G networks. According to 5G Americas, the global 5G wireless connections increased by 76% from the end of 2021 to the end of 2022, reaching up to 1.05 billion. Omdia and 5G Americas also projected that 5G wireless connections will reach 5.9 billion by the end of 2027.

Increasing adoption of IoT devices

The escalating demand for IoT devices among individuals across the globe is offering a positive coherent optical equipment market outlook. Statista claims that the number of IoT devices worldwide is forecast to reach 29 billion in 2030. Coherent optical systems provide high-capacity bandwidth that can accommodate the huge data volumes generated by IoT devices. This enables seamless data transmission across the network without traffic congestion. Coherent optical networks also offer high levels of reliability and resilience to ensure uninterrupted connectivity and data integrity.

Coherent Optical Equipment Market Segmentation:

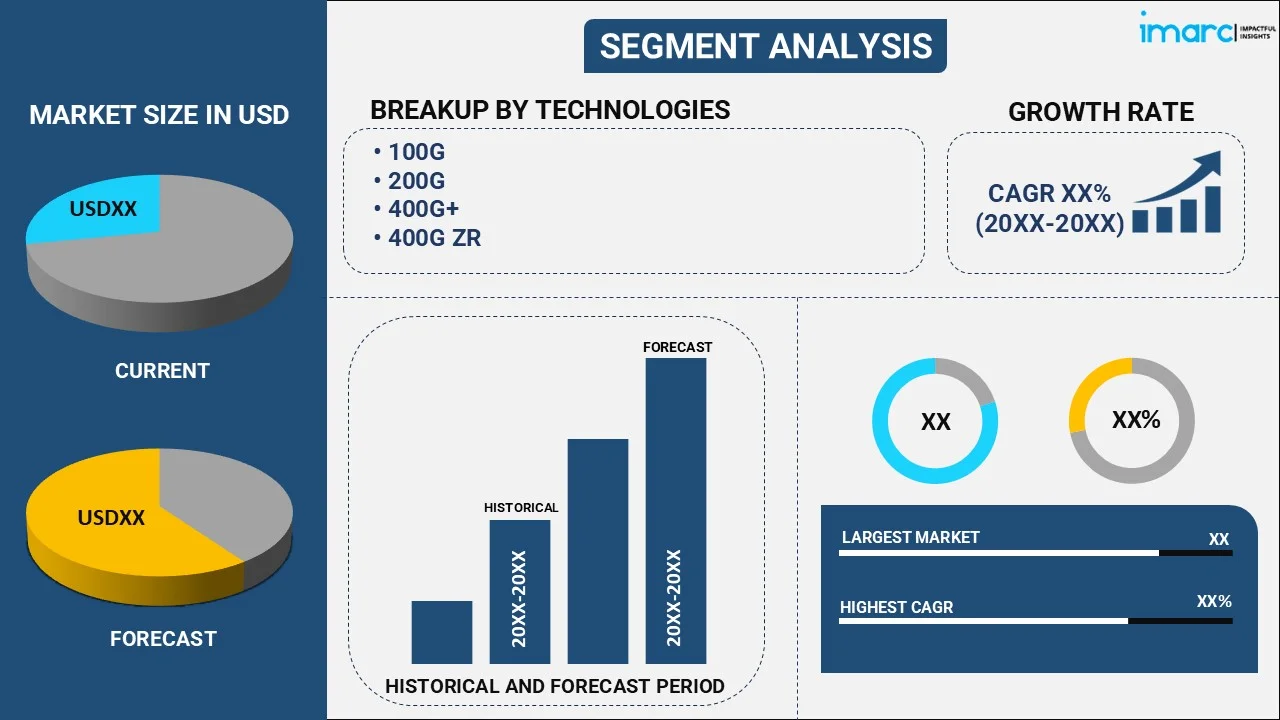

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technology, equipment, application, and end user.

Breakup by Technology:

- 100G

- 200G

- 400G+

- 400G ZR

100G accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the technology. This includes 100G, 200G, 400G+, and 400G ZR. According to the report, 100G represented the largest segment.

100G coherent technology enables the transport of 100G capacity over a single wavelength across long distances. It supports data transmission over distances up to 1000 km. It offers an increase in bandwidth capacity as compared to traditional optical communication systems. Various companies are investing in this technology, such as Coherent Corp., a leading provider of high-performance optical networking solutions, unveiled its versatile I-temp 100G ZR QSFP28 digital coherent optics (DCO) transceiver. The coherent I-temp 100G ZR QSFP28-DCO transceiver is ideal for individuals who need transceivers that support a wider operating temperature range.

Breakup by Equipment:

- Wavelength-Division Multiplexer (WDM)

- Modules/Chips

- Test and Measurement Equipment

- Optical Amplifiers

- Optical Switches

- Others

Wavelength-division multiplexer (WDM) holds the largest share of the industry

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes wavelength-division multiplexer (WDM), modules/chips, test and measurement equipment, optical amplifiers, optical switches, and others. According to the report, wavelength-division multiplexer (WDM) accounted for the largest market share.

Wavelength-division multiplexer (WDM) is a fiber-optic transmission technique that enables multiple light wavelengths to send data over the same medium. It is divided into two categories, such as course wavelength-division multiplexer (CWDM) and dense wavelength-division multiplexer (DWDM). It allows communication in both directions in the fiber cable. It offers enhanced flexibility in managing and allocating bandwidth, as it allows for the addition or removal of wavelengths as needed. WDM also benefits in increasing the capacity of the optical communication system.

Breakup by Application:

- Networking

- Data Center

- Original Equipment Manufacturers (OEMs)

Networking represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes networking, data center, and original equipment manufacturers (OEMs). According to the report, networking represented the largest segment.

Coherent optical equipment involves the deployment of optical communication systems to establish high-speed, reliable, and scalable networking for various purposes. It is widely adopted in long-haul networks to transmit data over extended distances. These networks connect geographically distant locations, such as between cities or across regions, and require high-capacity transmission to support data-intensive applications. Coherent optical equipment is essential for supporting the backhaul and fronthaul segments of mobile networks, particularly in the deployment of 5G technology. The rising adoption of mobile networks is catalyzing the demand for coherent optical equipment. According to Statista, the number of mobile users worldwide recorded 7.1 billion in 2021 and reached 7.26 billion in 2022.

Breakup by End User:

- Service Provider

- Public Sector

- Industries

Service provider exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes service provider, public sector, and industries. According to the report, service provider accounted for the largest market share.

Service provider assists in delivering telecommunications services to businesses and individuals. Telecommunication service providers, including telecommunications carriers and network operators, utilize coherent optical equipment to build and maintain their core network infrastructure and gain trust among clients. Invest India claims that the telecom industry in India has a subscriber base of 1.079 billion, including wireless and wireline subscribers, as of December 2023. The rising focus on providing enhanced services and improving user experience is bolstering the growth of the market. Coherent optical equipment is also used by cloud service providers to interconnect data centers, establish private and hybrid cloud environments, and ensure reliable connectivity for cloud-based services.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest coherent optical equipment market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for coherent optical equipment.

North America has a well-established telecommunications infrastructure, comprising fiber-optic networks, data centers, and network interconnection points. The growing demand for coherent optical equipment due to the rising adoption of edge computing is positively influencing the market in the region. Furthermore, various companies in the region are focusing on mergers and acquisitions (M&A) to provide enhanced optical solutions, thereby increasing coherent optical equipment market revenue. For instance, Cisco acquired Acacia Communications, Inc. following approval of the transaction by a majority of Acacia shareholders on 1 March 2021. The Acacia acquisition reinforces Cisco’s commitment to optics as a building block that will enhance Cisco’s ‘Internet for the Future’ strategy with world class coherent optical solutions.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the coherent optical equipment industry include Acacia Communications Inc. (Cisco Systems Inc), Ciena Corporation, Fujitsu Limited, Huawei Technologies Co. Ltd., Infinera Corporation, NEC Corporation, Nokia Oyj, Ribbon Communications Operating Company Inc., ZTE Corporation, and Zygo Corporation (AMETEK Inc).

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the industry are engaging in collaborations to provide enhanced products services to clients. For instance, Microchip Technology and Acacia partnered on 6 October 2021, to support transition of Data Center Interconnect (DCI) and metro Optical Transport Network (OTN) platforms from 100/200G to 400G pluggable coherent optical modules by introducing solutions like Microchip's DIGI-G5 OT N processor and META-DXI terabit secured-Ethernet PHY and Acacia's 400G pluggable coherent optics. The collaboration between Microchip and Acacia enables the use of 400G coherent pluggables in OTN and Ethernet systems while enhancing coherent optical equipment market price. As a result, these partnerships between companies benefited coherent optical equipment market 2021 positively.

Coherent Optical Equipment Market Recent Developments:

- 16 February 2023, Nokia introduced a sixth-generation super-coherent photonic service engine, the PSE-6s, which is capable of lowering network power consumption by 60%. The product supports a unique chip-to-chip interface that enables them to be deployed in pairs to power the industry’s first 2.4Tb/s coherent transport solution.

- 24 October 2023, ZTE Corporation, a global leading provider of information and communication technology solutions, unveiled the latest Tbit-level deterministic all-optical access platform, the ZXA10 C600E, at the Network X exhibition held in Paris, France. This new platform is poised to drive innovation in Fiber to the X (FTTx) services while contributing to the growth of global optical fiber technology.

Coherent Optical Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | 100G, 200G, 400G+, 400G ZR |

| Equipments Covered | Wavelength-Division Multiplexer (WDM), Modules/Chips, Test and Measurement Equipment, Optical Amplifiers, Optical Switches, Others |

| Applications Covered | Networking, Data Center, Original Equipment Manufacturers (OEMs) |

| End Users Covered | Service Provider, Public Sector, Industries |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acacia Communications Inc. (Cisco Systems Inc), Ciena Corporation, Fujitsu Limited, Huawei Technologies Co. Ltd., Infinera Corporation, NEC Corporation, Nokia Oyj, Ribbon Communications Operating Company Inc., ZTE Corporation, Zygo Corporation (AMETEK Inc)., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How big is the coherent optical equipment market so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global coherent optical equipment market?

- What is the impact of each driver, restraint, and coherent optical equipment market opportunities?

- What are the key regional markets?

- Who is the largest region in coherent optical equipment market?

- What is the breakup of the market based on the technology?

- Which is the most attractive technology in the coherent optical equipment market?

- What is the breakup of the market based on the equipment?

- Which is the most attractive equipment in the coherent optical equipment market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the coherent optical equipment market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the coherent optical equipment market?

- \What is the competitive structure of the market?

- Who are the key players/companies in the global coherent optical equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the coherent optical equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global coherent optical equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the coherent optical equipment industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)