Cold Chain Tracking and Monitoring Market Size, Share, Trends and Forecast by System, Solution, End User, and Region, 2025-2033

Cold Chain Tracking and Monitoring Market Size and Share:

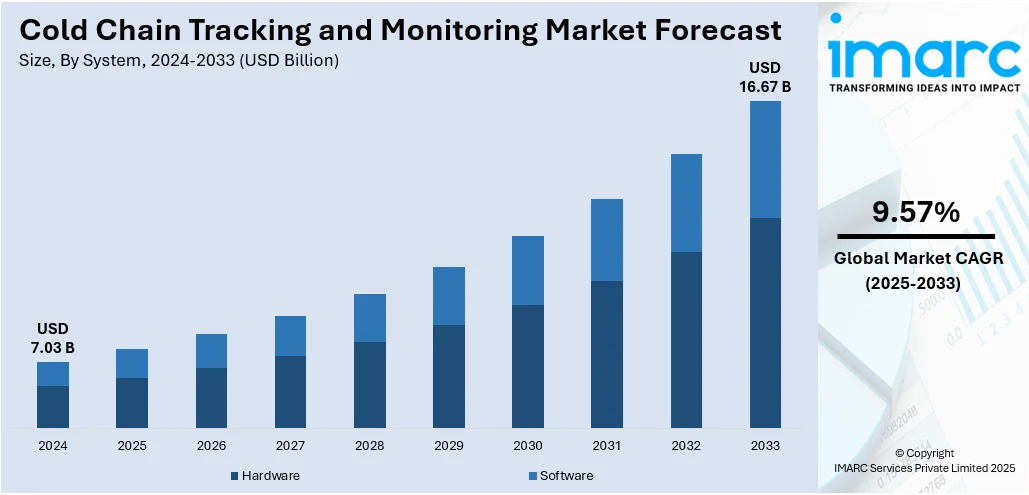

The global cold chain tracking and monitoring market size was valued at USD 7.03 Billion in 2024. The market is projected to reach USD 16.67 Billion by 2033, exhibiting a CAGR of 9.57% from 2025-2033. North America currently dominates the market, holding a market share of 33.0% in 2024. The market is driven by the growing demand from the pharmaceutical and healthcare industries. In addition, the integration of analytics and artificial intelligence (AI) with tracking systems helps optimize routes and storage conditions. Besides this, the broadening of e-commerce portals is propelling the cold chain tracking and monitoring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.03 Billion |

|

Market Forecast in 2033

|

USD 16.67 Billion |

| Market Growth Rate 2025-2033 | 9.57% |

At present, the market is driven by the growing demand for temperature-sensitive items in numerous industries, including chemical, food and beverage (F&B), and pharmaceutical. Because maintaining product integrity during storage and transit is becoming important, real-time monitoring systems are in high demand. In addition, technologies like radio frequency identification (RFID), global positioning system (GPS), and the Internet of Things (IoT) are being adopted to improve visibility and lower spoilage. Businesses are being encouraged to employ smart cold chain systems, especially due to the growth of international trade and e-commerce, particularly in perishable goods. Apart from this, stringent government regulations and quality standards are motivating businesses to implement advanced systems that can guarantee precise temperature control, thereby impelling the cold chain tracking and monitoring market growth.

To get more information on this market, Request Sample

The United States has emerged as a major region in the cold chain tracking and monitoring market owing to many factors. The market is driven by the growing demand for secure and effective delivery of temperature-sensitive items, such as vaccines, biologics, perishable food products, and specialty chemicals. The rise in pharmaceutical innovations, particularly in biologics and messenger ribonucleic acid (mRNA)-based therapies, is promoting the utilization of precise temperature control throughout the supply chain. The rapid broadening of e-commerce and online grocery platforms is further creating the need for reliable cold chain infrastructure. As per IMARC Group, the United States e-commerce market size reached USD 1,161.5 Billion in 2024. Additionally, technological advancements in IoT, cloud analytics, and wireless communication, which aid in enhancing the accuracy and responsiveness of tracking systems, are offering a favorable cold chain tracking and monitoring market outlook.

Cold Chain Tracking and Monitoring Market Trends:

Growing demand from pharmaceutical and healthcare industries

Increasing demand for cold chain tracking and monitoring solutions across the thriving pharmaceutical and healthcare industries is significantly fueling the market growth. From FY 2018 to FY 2023, the Indian pharmaceutical sector saw consistent broadening, attaining a compound annual growth rate of 6%–8%. Many medical products, including biologics, insulin, and other temperature-sensitive drugs, require strict temperature control throughout storage and transportation to maintain their efficacy and safety. With increasing production and worldwide distribution of such medicines, there is a rising need for real-time temperature monitoring and advanced tracking systems. These solutions help ensure regulatory compliance, reduce the risk of spoilage, and improve operational efficiency. As per the cold chain tracking and monitoring market forecast, the broadening of pharmaceutical logistics, especially in developing regions, and the growing emphasis on patient safety will continue to support the industry expansion.

Rising utilization of advanced cold chain tracking technologies

With the growing need to ensure the quality and safety of temperature-sensitive goods like pharmaceuticals, vaccines, and perishable foods, companies are adopting IoT-enabled sensors, RFID, GPS, and cloud-based systems for real-time monitoring. As per the World Health Organization (WHO), nearly 50% of vaccines were lost in 2024, frequently because of temperature changes during transportation, stressing the importance of dependable cold chain monitoring technologies. These technologies provide continuous visibility into location, temperature, and humidity, allowing stakeholders to detect anomalies and take corrective actions before product quality is compromised. The ability to automate data logging, generate alerts, and support regulatory compliance further enhances operational efficiency and minimizes losses. Moreover, the integration of analytics and AI with tracking systems helps optimize routes and storage conditions.

Broadening of e-commerce portals

The expansion of e-commerce portals is among the major cold chain tracking and monitoring market trends. As online shopping platforms increasingly cater to temperature-sensitive products like fresh items, frozen foods, and pharmaceuticals, there is growing demand for reliable and efficient cold chain logistics. Rising online grocery sales are significantly increasing the volume of perishable items requiring real-time monitoring and temperature control during transit. According to a recent industry report, worldwide online grocery sales are expected to increase by USD 164 Billion, totaling USD 646 Billion by 2029. E-commerce firms and delivery partners rely heavily on advanced tracking systems equipped with IoT sensors, GPS, and cloud platforms to ensure product integrity from warehouse to doorstep. These technologies help maintain quality, reduce spoilage, and enhance customer satisfaction. Furthermore, the need for faster delivery and transparent order tracking is leading to high investments in smart cold chain infrastructure.

Cold Chain Tracking and Monitoring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cold chain tracking and monitoring market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on system, solution, and end user.

Analysis by System:

- Hardware

- Software

Hardware held 78.1% of the market share in 2024. It forms the foundation for capturing and transmitting real-time data throughout the supply chain. Devices, such as sensors, data loggers, RFID tags, GPS trackers, and telemetry systems, are essential for continuously monitoring temperature, humidity, location, and shock conditions during storage and transit. These hardware components are physically deployed on assets and shipments, enabling accurate data collection and immediate alerts in case of deviations. The growing demand for end-to-end visibility and the need to meet stringent regulatory standards have increased the reliance on advanced hardware systems. Additionally, the rise in international trade of perishable goods and biologics, which require constant environmental control, has accelerated hardware adoption. Hardware systems also offer scalability and compatibility with various types of cold chain goods, making them indispensable. Their robust performance, long lifespan, and ability to function in diverse environments contribute to their dominance in the market.

Analysis by Solution:

- Storage

- Transportation

Transportation represents the largest market share. The transportation phase is most prone to fluctuations in temperature, delays, and external impacts, which can compromise product quality and safety. Hence, the demand for advanced GPS tracking, temperature logging, and telematics solutions is highest during transit. Cold chain tracking and monitoring solutions play a critical role in maintaining product integrity across long distances and varying environmental conditions. As temperature-sensitive goods, such as vaccines, biologics, dairy, meat, and fresh items, are moved from production sites to end-users, ensuring consistent and real-time monitoring is becoming vital. Moreover, increasing international trade of perishable and pharmaceutical products has amplified the need for reliable transportation monitoring systems. Regulatory requirements mandating temperature-controlled logistics and strict reporting are further encouraging businesses to adopt innovative tracking technologies. As a result, transportation remains the most critical and investment-heavy segment in cold chain tracking solutions.

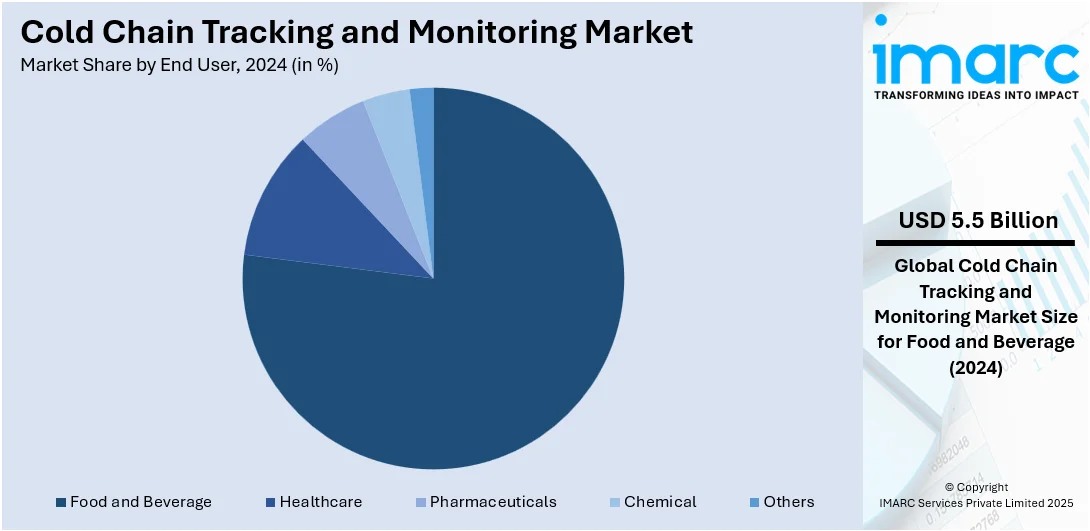

Analysis by End User:

- Healthcare

- Pharmaceuticals

- Food and Beverage

- Chemical

- Others

Food and beverage account for 77.5% of the market share. The food and beverage industry is employing cold chain tracking and monitoring solutions to maintain product freshness, safety, and compliance with stringent food safety standards. Perishable food items, such as dairy, meat, seafood, fruits, and vegetables, require consistent temperature control throughout storage and transportation to prevent spoilage and contamination. Any deviation in temperature can compromise item quality, lead to financial losses, and risk public health. As a result, food producers, distributors, and retailers continue to rely on real-time monitoring technologies to ensure product integrity across the supply chain. Moreover, rising international food trade, the growth of e-commerce grocery delivery services, and increasing demand for fresh and packaged food items have intensified the need for reliable cold chain systems. Regulatory frameworks also mandate temperature monitoring, further driving adoption.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for a share of 33.0%, enjoys the leading position in the market. The region’s advanced transportation networks and widespread adoption of digital technologies, such as IoT, cloud computing, and AI, allow real-time monitoring and efficient management of perishable goods. As per industry reports, by 2025, in the United States, AI is expected to produce between USD 350 Billion and USD 410 Billion each year for the pharmaceutical industry. The demand for high-quality temperature-sensitive products, especially in the pharmaceutical and biotechnology industries, is creating the need for reliable cold chain solutions. Additionally, rising expectations for fresh and safe food items in the retail and e-commerce industries are driving investments in sophisticated monitoring systems. The presence of key market players and proactive government initiatives to maintain product integrity during storage and transportation is further contributing to North America’s dominance. Moreover, collaborations between logistics companies and tech firms are supporting innovations and the seamless integration of cold chain systems.

Key Regional Takeaways:

United States Cold Chain Tracking and Monitoring Market Analysis

The United States holds 83.20% of the market share in North America. The market is witnessing significant growth due to the increased focus on reducing food wastage and ensuring pharmaceutical product integrity. The country’s strong regulatory framework is driving the adoption of advanced monitoring solutions that enable real-time temperature, humidity, and location tracking across supply chains. Feeding America reported that in 2024, the United States discarded more food than any other country, wasting nearly 60 Million tons annually, which represented about 40% of the national food supply or 325 pounds per person. This massive waste volume is propelling investments in cold chain systems that enhance transparency and reduce spoilage. The integration of IoT technologies with cloud platforms is streamlining cold chain logistics, offering improved visibility and predictive analytics. Additionally, increasing demand for fresh and organic items is leading to high expenditure on cold storage infrastructure. The availability of 5G networks is accelerating the implementation of smart monitoring systems, refining end-to-end traceability. The growing emphasis on sustainability and energy-efficient logistics is also contributing to the modernization of cold chain processes.

Europe Cold Chain Tracking and Monitoring Market Analysis

In Europe, the cold chain tracking and monitoring market is growing steadily, supported by stringent environmental regulations and a rising emphasis on food safety standards. The implementation of digital technologies across the logistics sector enhances traceability and regulatory compliance, especially in the transportation of dairy, seafood, and specialty pharmaceuticals. A recent report showed that France recorded logistics investments of approximately USD 3.68 Billion in Q1 2025, reflecting a 67% rise from 2024, while Italy experienced over USD 650 Million in transactions, adding to a greater total of USD 2.93 Billion. These capital flows indicate growing momentum towards cold chain modernization and smart monitoring adoption across the continent. Increasing urbanization and user awareness are encouraging stakeholders to maintain high-quality standards in perishable goods distribution. Furthermore, the shift towards automated storage systems and energy-efficient refrigeration solutions is catalyzing the demand for integrated monitoring platforms. Regional cross-border trade collaborations are standardizing cold chain protocols, while AI-oriented analytics streamline operations and enhance sustainability goals through real-time data interpretation and predictive maintenance.

Asia-Pacific Cold Chain Tracking and Monitoring Market Analysis

The Asia-Pacific cold chain tracking and monitoring market is expanding rapidly, driven by rising disposable incomes and increasing demand for temperature-sensitive healthcare and food products. Rapid urbanization and the growing middle-class population are contributing to the expansion of organized retail and quick commerce channels. This growth highlights the region’s increasing reliance on cold chain infrastructure to support its pharmaceutical and healthcare systems. The Indian pharmaceutical industry is set to grow at a CAGR of over 10% to attain a size of USD 130 billion by 2030. Regional government agencies are also investing in infrastructure modernization, which supports the adoption of smart monitoring tools in storage and transport facilities. Innovations in wireless monitoring and mobile-enabled control systems are making cold chain logistics more adaptable, especially in semi-urban areas. The integration of AI and machine learning (ML) in supply chains is enhancing responsiveness and minimizing spoilage.

Latin America Cold Chain Tracking and Monitoring Market Analysis

In Latin America, the cold chain tracking and monitoring market is witnessing steady development due to the growing demand for export-quality agricultural products and temperature-sensitive medical supplies. Expansion in agribusiness and the increasing adoption of traceability standards across logistics operations are supporting the use of cold chain tracking solutions. According to an industrial report, Brazil’s agricultural shipments reached a historic USD 164.4 Billion in 2024, reinforcing the country’s leadership in agri-export and driving the demand for efficient cold chain systems to maintain quality and compliance across international markets. Technological advancements, such as GPS-enabled monitoring, wireless sensors, and mobile applications, facilitate real-time oversight of perishable shipments across diverse terrains. Investments in climate-controlled transportation and cloud-based platforms for data analytics are helping reduce operational losses.

Middle East and Africa Cold Chain Tracking and Monitoring Market Analysis

The Middle East and Africa cold chain tracking and monitoring market is gaining momentum, fueled by increased reliance on temperature-controlled imports and the growing demand for high-value perishable goods. According to industry data, Saudi Arabia’s logistics market size reached a value of USD 136.3 Billion in 2024 and is set to attain USD 198.9 Billion by 2030, illustrating a strong national drive towards logistics leadership in the region. This shift is spurring advancements in cold chain infrastructure and technology adoption. The expansion of healthcare logistics, particularly in remote areas, is creating the need for monitoring solutions that ensure the safe delivery of pharmaceuticals and vaccines. The region is enhancing food security by deploying intelligent cold storage systems, improving visibility, and leveraging IoT and automation for temperature-controlled logistics.

Competitive Landscape:

Key players are continuously investing in advanced technologies and innovative solutions. These companies develop smart sensors, GPS-enabled devices, and real-time monitoring systems that ensure accurate tracking of temperature, humidity, and location throughout the supply chain. Their efforts in integrating IoT, AI, and blockchain technologies improve data transparency, predictive maintenance, and compliance with safety regulations. Major players also offer end-to-end solutions, including cloud-based platforms for remote access and analytics, enabling logistics providers and manufacturers to make informed decisions. Strategic partnerships, mergers, and acquisitions by these players expand market reach and enhance service capabilities. By offering scalable and customizable solutions, key companies aid industries, such as pharmaceuticals and chemicals, in ensuring item integrity, thereby propelling the market growth. For instance, in January 2025, SmartSense by Digi introduced VOYAGE™, an IoT solution for tracking assets in real-time. Employing small, GPS-equipped T1 sensors, it provided ongoing oversight of location and environmental factors. The platform assisted the healthcare, food, and retail industries in achieving regulatory compliance while protecting cold chain integrity and enhancing the distribution of sensitive or perishable products.

The report provides a comprehensive analysis of the competitive landscape in the cold chain tracking and monitoring market with detailed profiles of all major companies, including:

- Berlinger & Co. AG

- Carrier Global Corporation

- Cold Chain Technologies

- Controlant

- Ellab A/S

- Elpro Buchs AG

- Infratab, Inc

- Monnit Corporation

- Orbcomm

- Rotronic AG

- Smarter Technologies Group

Latest News and Developments:

- May 2025: Kulr introduced a blockchain-driven supply chain platform to monitor battery cell metadata utilizing NFTs on Coinbase’s Base L2 network. Engineered for secure validation, the system featured NASA-quality batteries, providing tamper-resistant transparency and immediate traceability. This advancement facilitated decentralized inventory management and enhanced cold chain oversight of sensitive battery parts.

- April 2025: Identiv collaborated with Tag-N-Trac to provide real-time IoT tracking for cold chain pharmaceuticals. The system integrated BLE smart labels with the RELATIVITY™ SaaS platform, providing item-level visibility, monitoring of temperature and humidity, and assurance of compliance. This integration provided complete transparency for vaccines and temperature-sensitive medical products across international supply chains.

- April 2025: FedEx launched its Surround® monitoring system in Indonesia, providing AI-oriented, real-time tracking and intervention for sensitive deliveries. Fitted with SenseAware ID sensors, the system guaranteed accurate cold chain management, anticipatory logistics, and continuous expert assistance. It offered customized insights for healthcare and high-value industries requiring strict temperature and handling regulations.

- January 2025: Tive created disposable sensors along with a cloud platform to enable real-time tracking of cold chain logistics for sectors, such as F&B and pharmaceuticals. The system tracked location, temperature, humidity, and impact, providing notifications and insights. Tive expanded its global operations with more than 900 clients and raised USD 40 Million to improve product development and sustainability.

Cold Chain Tracking and Monitoring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Systems Covered | Hardware, Software |

| Solutions Covered | Storage, Transportation |

| End Users Covered | Healthcare, Pharmaceuticals, Food and Beverage, Chemical, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Berlinger & Co. AG, Carrier Global Corporation, Cold Chain Technologies, Controlant, Ellab A/S, Elpro Buchs AG, Infratab, Inc, Monnit Corporation, Orbcomm, Rotronic AG, Smarter Technologies Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cold chain tracking and monitoring market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cold chain tracking and monitoring market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cold chain tracking and monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold chain tracking and monitoring market was valued at USD 7.03 Billion in 2024.

The cold chain tracking and monitoring market is projected to exhibit a CAGR of 9.57% during 2025-2033, reaching a value of USD 16.67 Billion by 2033.

As the demand for perishable goods and biologics is rising, there is a stronger emphasis on maintaining strict temperature control throughout transportation and storage. Real-time visibility, enabled by technologies like IoT, GPS, RFID, and cloud platforms, is becoming vital for minimizing losses and ensuring regulatory compliance. The surge in e-commerce and international trade is further creating the need for robust cold chain monitoring solutions to manage complex, multi-location supply chains.

North America currently dominates the cold chain tracking and monitoring market, accounting for a share of 33.0% in 2024, due to its robust technological adoption, strong presence of pharmaceutical and F&B industries, and stringent regulatory frameworks ensuring quality control. High demand for fresh and safe products is further driving the region's dominance in cold chain infrastructure and smart monitoring solutions.

Some of the major players in the cold chain tracking and monitoring market include Berlinger & Co. AG, Carrier Global Corporation, Cold Chain Technologies, Controlant, Ellab A/S, Elpro Buchs AG, Infratab, Inc, Monnit Corporation, Orbcomm, Rotronic AG, Smarter Technologies Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)