Colombia Dairy Market Report by Product Type (Milk, Ice-cream, Butter, Cream, Yogurt, Cheese, and Others), Packaging Type (Pouches, Tetra-Packs, Bottles, Cans, and Others), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Retailers, Online Retail Stores, and Others), and Region 2025-2033

Market Overview:

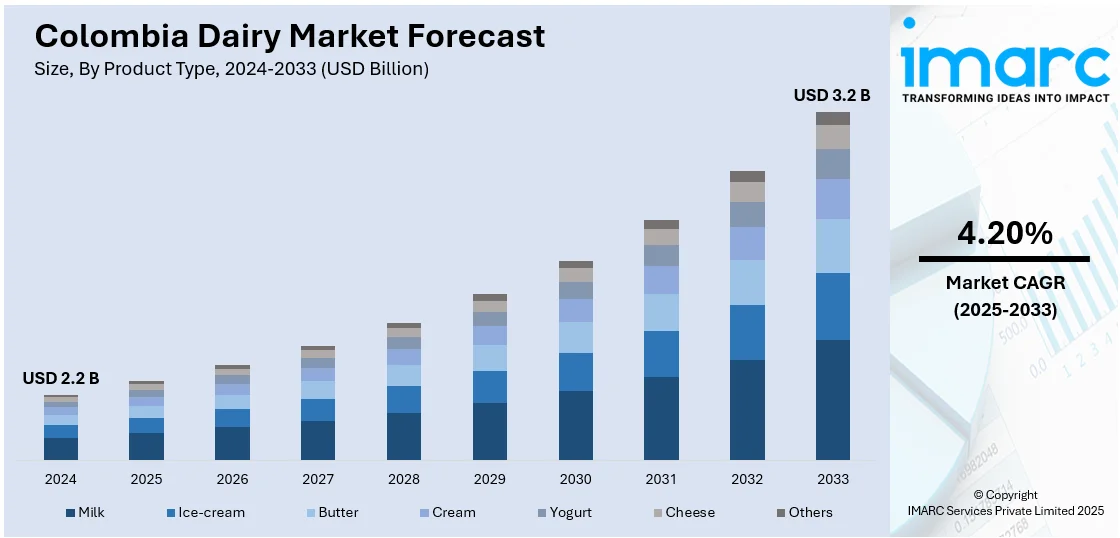

The Colombia dairy market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.2 Billion by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The growing health consciousness among consumers, increasing consumption of protein-rich diets, and rising awareness about the benefits of incorporating milk into daily diets represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.2 Billion |

|

Market Forecast in 2033

|

USD 3.2 Billion |

| Market Growth Rate 2025-2033 | 4.20% |

Dairy refers to the processing and harvesting of milk from cows, goats, camels, and buffaloes for human consumption. It comprises a wide variety of food products, such as powdered milk, cheese, yogurt, condensed milk, cottage cheese, cream, butter, cream cheese, sour cream, and ice cream. It also produces whey and casein, which are widely consumed as workout supplements to increase muscle growth, maintain muscle mass, and gain energy. Dairy is a rich source of various essential nutrients, such as vitamin D, A, and B12, potassium, phosphorus, magnesium, iodine, zinc, and calcium, which are important for the proper development of bones and improving skeletal calcium retention during growth. It also contains various preservatives, such as benzoate, sorbate, and natamycin, to inhibit the contamination caused by microorganisms and milk spoilage. It provides a wide range of probiotics which are essential for maintaining digestive health and boosting immunity. It also prevents the occurrence of various bone-related complications, such as osteoporosis and arthritis, in adults and prevents dental diseases in children. Furthermore, as dairy possesses numerous health-benefiting properties, its consumption is increasing in Colombia.

Colombia Dairy Market Trends:

At present, the increasing demand for dairy products due to the rising health consciousness among consumers represents one of the primary factors influencing the market positively in Colombia. Besides this, the growing awareness about the benefits of incorporating milk into the daily diets of pregnant women and children is offering a favorable market outlook. In addition, the increasing consumption of protein-rich diets to prevent the occurrence of various lifestyle disorders, such as obesity, diabetes, arthritis, and thyroiditis, is propelling the growth of the market in the country. Apart from this, the transformation of the dairy industry in Colombia from an unorganized sector to an organized one is contributing to the market growth. Additionally, governing agencies of Colombia are introducing several innovative schemes, including genetic programs, nutrition improvement practices to enhance the quality of milk, intensive pasture management by adopting rotational grazing and forage seeding, and production increment programs to increase the manufacturing of dairy products. Moreover, the rising popularity of whey and casein protein powders among gymgoers, athletes, and fitness enthusiasts is supporting the growth of the market. Furthermore, the increasing availability of clean-label dairy products that are free from artificial preservatives and additives is bolstering the market growth in Colombia.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Colombia dairy market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, packaging type and distribution channel.

Product Type Insights:

- Milk

- Ice-cream

- Butter

- Cream

- Yogurt

- Cheese

- Others

The report has provided a detailed breakup and analysis of the Colombia dairy market based on the product type. This includes milk, ice-cream, butter, cream, yogurt, cheese, and others. According to the report, milk represented the largest segment.

Packaging Type Insights:

- Pouches

- Tetra-Packs

- Bottles

- Cans

- Others

A detailed breakup and analysis of the Colombia dairy market based on the packaging type has also been provided in the report. This includes pouches, tetra-packs, bottles, cans, and others. According to the report, tetra-packs accounted for the largest market share.

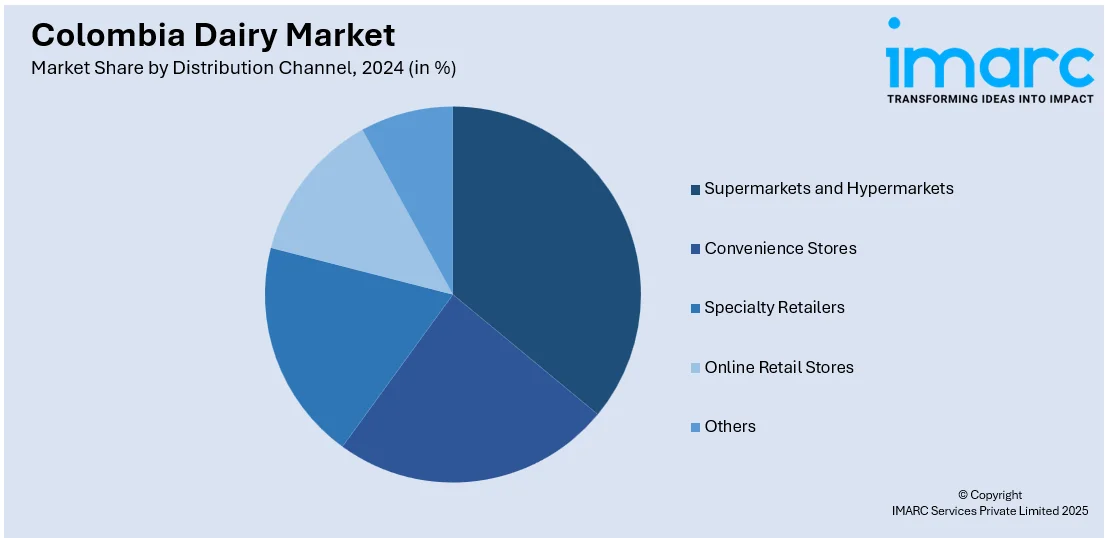

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Retailers

- Online Retail Stores

- Others

A detailed breakup and analysis of the Colombia dairy market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty retailers, online retail stores, and others. According to the report, supermarkets and hypermarkets accounted for the largest market share.

Regional Insights:

- Andean Region

- Caribbean Region

- Pacific Region

- Orinoquía Region

- Amazon Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Andean Region, Caribbean Region, Pacific Region, Orinoquia Region, and Amazon Region. According to the report, Andean Region was the largest market for Colombia dairy. Some of the factors driving the Andean Region dairy market included the growing technological advancements, rising consumption of protein-rich items, increasing health-consciousness among the masses, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the Colombia dairy market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered Alpina Productos Alimenticios, Alquería, Coolechera, Colanta, Nestlé, Lactalis Colombia Ltda, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Packaging Type, Distribution Channel, Region |

| Region Covered | Andean Region, Caribbean Region, Pacific Region, Orinoquía Region, Amazon Region, Others |

| Companies Covered | Alpina Productos Alimenticios, Alquería, Coolechera, Colanta, Nestlé and Lactalis Colombia Ltda |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Colombia dairy market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the Colombia dairy market?

- What is the impact of each driver, restraint, and opportunity on the Colombia dairy market?

- What are the key regional markets?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the Colombia dairy market?

- What is the breakup of the market based on the packaging type?

- Which is the most attractive packaging type in the Colombia dairy market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the Colombia dairy market?

- What is the competitive structure of the Colombia dairy market?

- Who are the key players/companies in the Colombia dairy market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Colombia dairy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Colombia dairy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Colombia dairy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)