Commercial Avionics Systems Market Size, Share, Trends and Forecast by Sub System, Aircraft Type, Fit, and Region, 2025-2033

Commercial Avionics Systems Market Size and Share:

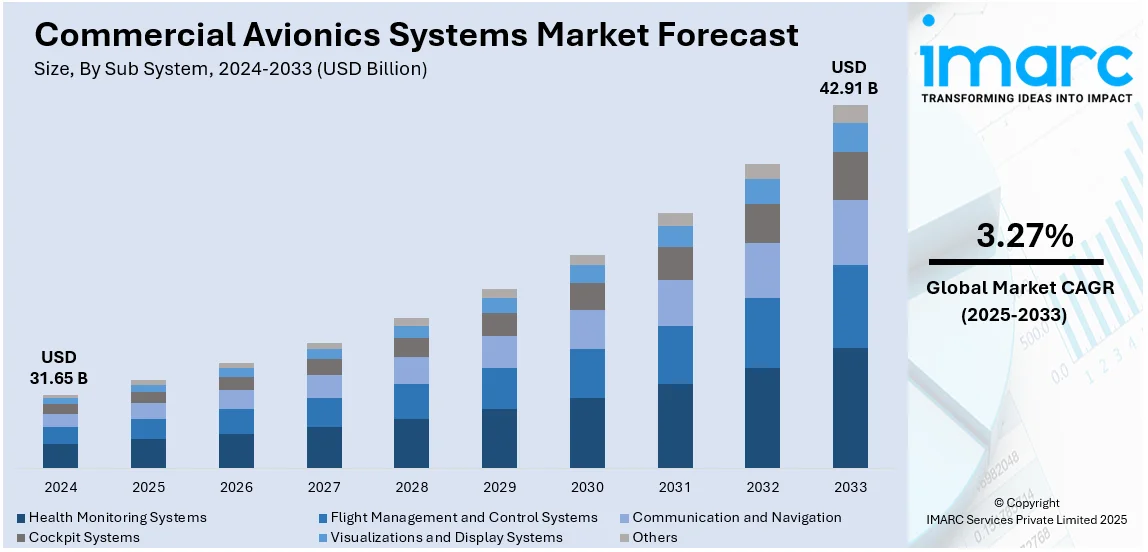

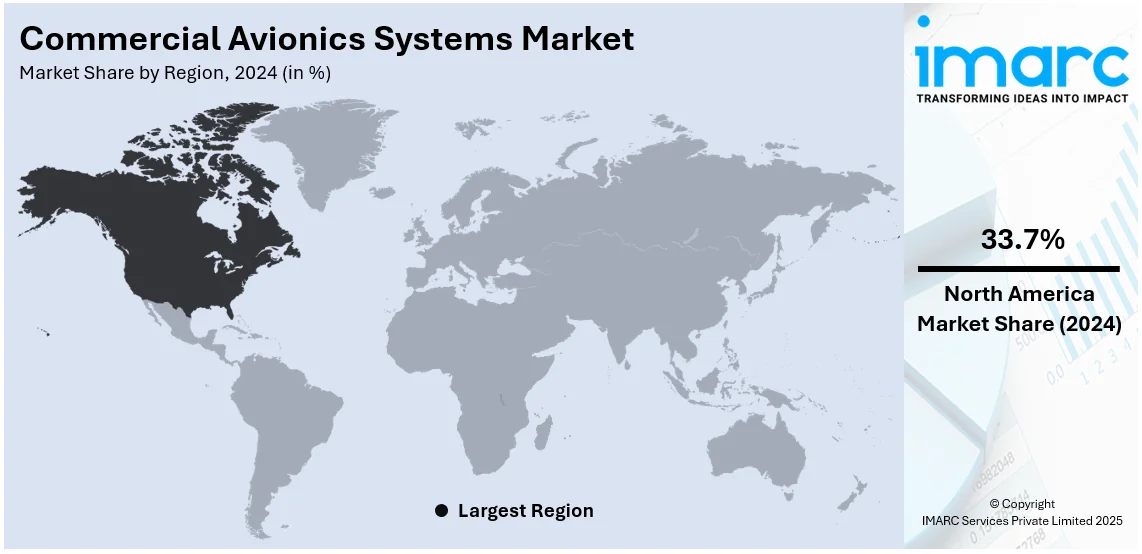

The global commercial avionics systems market size was valued at USD 31.65 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 42.91 Billion by 2033, exhibiting a CAGR of 3.27% from 2025-2033. North America currently dominates the market, holding a market share of over 33.7% in 2024. The commercial avionics systems market share is expanding, driven by the heightened issue of excessive air traffic, increasing air travel activities among the masses, and rising technological advancements in the aviation industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 31.65 Billion |

|

Market Forecast in 2033

|

USD 42.91 Billion |

| Market Growth Rate (2025-2033) | 3.27% |

Commercial avionics systems are gaining popularity due to the growing need for advanced avionics systems to enhance the safety, performance, and operating efficiency of aircraft. As aviation is developing rapidly in developing countries and air traffic is increasing, highly reliable and complex avionics systems have become much more crucial. Newer avionics systems improve flight safety by providing real-time data on aircraft health, weather conditions, and air traffic. In addition, newer avionics enhance the efficiency of flight crews with better cockpit management tools and automation. Advances in avionics technology have become a significant driver for the market. The introduction of newer technologies like synthetic vision systems, satellite based navigation systems, and integrated avionics suites along with the emergence of digital avionics are increasing the capabilities of modern aircraft known as mother, and this is driving the commercial avionics systems market demand.

The United States has come up as a major region in the commercial avionics market due to various factors. Aircraft fleets age, and new technologies emerge; thus, operators invest in upgrading avionics to ensure that their aircraft meet contemporary operational needs, safety regulations, and passenger expectations. Many of the older aircraft still in the US fleet are having newer avionics systems added to improve the performance of such aircraft, achieve regulatory compliance, and to enhance safety. The modernization of air traffic control systems and the requirement for better integration of commercial airliners into the National Airspace System (NAS) also highlights the necessity of advanced avionics to accommodate these developments. In 2024, Airlines for America called on the Department of Transportation and the Federal Aviation Administration to address the shortage of air traffic controller in the US. The company launched a campaign called "Staff the Towers" to raise the issues of air traffic control.

Commercial Avionics Systems Market Trends:

Technological Advancements and Innovation

Technological advancements are the most significant drivers for this market. The continuous advancements in avionics technology, including artificial intelligence (AI), machine learning (ML), and the internet of things (IoT), is immensely refining the performance capabilities of avionics systems. Better flight management, predictive maintenance, and real-time data analysis offer savings in operation costs for airlines due to these innovations. For example, AI and ML technologies are continually enhancing flight optimization through the processing of large data from aircraft systems for more precise flight planning, reduction in fuel consumption, and enhancement of operational safety and performance by seamless communication of various aircraft components. New systems in the likes of advanced flight control systems, synthetic vision, as well as in real-time information on weather further enhance cockpit automation, helping to enable pilots' better and safer management of the flight even if it involves such complex airspace and adverse weather conditions. In 2024, Skyryse® publicly announced the initiation of the very first entirely autonomous hover at swipe of a finger in a totally conforming aircraft production.

Regulatory Compliance and Safety Standards

Regulatory requirements and safety standards are supporting the commercial avionics systems market growth. Since the regulations concerning aviation safety become more stringent, airlines and aircraft manufacturers have to implement advanced avionics technologies to abide by these regulations. For instance, the introduction of automatic dependent surveillance-broadcast mandates that aircraft are equipped with real-time tracking systems for accurate position reporting, thereby improving air traffic control and preventing collisions. Moreover, cockpit technologies, FMS, and navigation equipment are to be used in strict accordance with rules and regulations laid by authorities such as the. As commercial aircraft fly more often and in increasingly crowded airspace, there is more pressure to reduce flight delays and enhance situational awareness. This has resulted in the adoption of various systems, like electronic flight instrument systems (EFIS) and synthetic vision systems (SVS), that offer pilots clearer and more reliable information, reducing human error and improving safety. In 2024, Lilium N.V. announced that it achieved the first set of its standby flight instruments from Garmin, a known provider of avionics solutions.

Increased Demand for Air Travel and Aircraft Fleet Expansion

Requirement for air travel is rising, particularly from emerging economies. With the increasing air traffic, airlines are integrating highly efficient technologies to their fleets to cater to the increasing passenger numbers. New aircraft, mainly from manufacturers, come with next-generation avionics systems, which enhance operational performance and save more fuel. Old aircraft are also upgraded with modern avionics technology to improve safety, comply with new regulations, and enhance capabilities. This trend is most observable in regions that have a growing middle class, creating an increased need for air travel. Fleet modernization is also being experienced by the US aviation industry, whereby airlines are aiming to increase utilization of their fleet by introducing modern avionics that will better manage flights, reduce fuel consumption, and offer automation, allowing operators to take on more passengers while remaining cost-effective and safe. Moreover, Financial Express stated in an article, the Indian aviation sector experienced massive growth during 2024 by introducing over 100 new air routes, further increasing the demand for the aircraft fleet.

Commercial Avionics Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial avionics systems market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on sub system, aircraft type, and fit.

Analysis by Sub System:

- Health Monitoring Systems

- Flight Management and Control Systems

- Communication and Navigation

- Cockpit Systems

- Visualizations and Display Systems

- Others

Communication and navigation hold the biggest market share, thereby offering a favorable commercial avionics systems market outlook. Improvement in communication systems is the prime factor that pushes the market forward. The rise in air traffic across the world and increased complexities in flight operations require effective communication for safe and seamless operations. Digital communications, such as Data Link Communication or DLC, ensure that aircraft continuously communicate real-time information with both air traffic control and other flying aircraft. Thereby, reducing radio congestion improves the reliability and accuracy of communicating data, in which crowded spaces require this facility. Increasing integration of communication, navigation, and avionics into a seamless avionics system is driving growth in the industry. More integration of aircraft systems, especially as related to the combination of communication, navigation, and surveillance into a single platform, provides more operational benefits in terms of aircraft operations. In an integrated system, there is smoother communication with the ATC, more efficient routing, and more situational awareness for the pilot. The reduction of weight and cockpit complexity and improvements in reliability and performance for each function are achievable through consolidation of these systems.

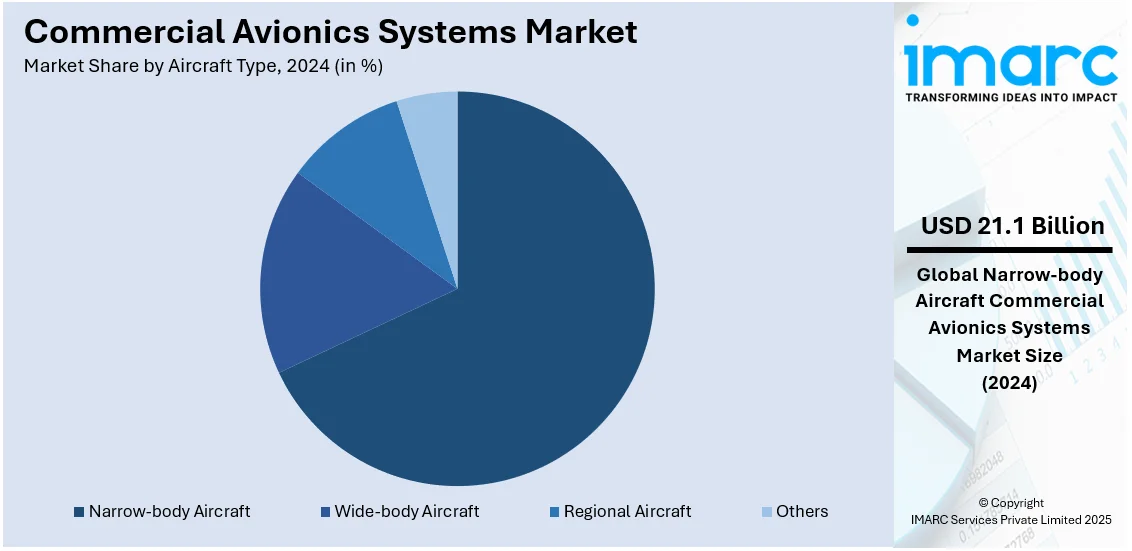

Analysis by Aircraft Type:

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Aircraft

- Others

Narrow-body aircraft holds 66.7% of the market share. Narrow-body aircraft are economical, but that is one reason why airlines operating in regional markets or shorter routes prefer them. Probably the key attribute that gives narrow-body aircraft their advantage against wide-body aircraft is its relatively much lower costs of operation. These aircraft consume lesser fuel because they are smaller and lighter, in addition to efficient engines, therefore consuming less per seat. As such, the aircraft are ideal for airlines that value cost-effective operation, especially in market areas where the profitability is attributed to high frequencies of short hauls. The lower capital cost of narrow-body aircraft compared to wide-body models also makes them more accessible to airlines, especially budget carriers or emerging markets. A combination of both lower fuel consumption and lower upfront costs allows the airlines to offer competitive ticket prices, and thus narrow-body aircraft are more popular among both full-service and low-cost carriers. All these factors facilitate better operational margins for airlines by making travel even more affordable to the passengers.

Analysis by Fit:

- Linefit

- Retrofit

The linefit segment of the market refers to the installation of avionics systems in new aircraft during the manufacturing process. In this segment, avionics systems are integrated directly into the aircraft during the production line assembly, ensuring that the systems are customized and optimized for the specific aircraft model from the outset. Linefit installations are generally driven by the demand from aircraft manufacturers, airlines, and leasing companies that require advanced avionics systems for newly manufactured commercial aircraft.

The retrofit segment refers to the process of upgrading or replacing avionics systems in existing aircraft. This typically occurs when airlines or operators decide to update their older fleets with the latest technologies to meet new regulatory requirements, improve operational efficiency, or enhance safety and performance. Retrofit installations are becoming increasingly common as older aircraft need to comply with new mandates, such as automatic dependent surveillance-broadcast (ADS-B) or performance-based navigation (PBN) systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 33.7%. The North American market is poised for significant growth, driven by a combination of evolving technological innovations, stringent regulatory requirements, increasing air traffic, and the ongoing modernization of fleets. Innovations in avionics technology are significantly transforming the way aircraft operate, making them more efficient, safer, and easier to manage. The integration of technologies such as AI, ML, the IoT, and satellite-based navigation systems is increasingly influencing the development of avionics systems in North America. As the fleet of commercial aircraft continues to grow, the demand for modernized avionics systems in both new and existing aircraft is a driving force in the North American market. North American airlines are increasingly looking to replace outdated avionics in their fleets with the latest systems to improve safety, compliance with new regulations, and operational efficiency. The growth in air traffic, combined with the rising need for fleet modernization, has created a robust demand for avionics upgrades and retrofitting. According to an article published on the website of the United States Department of Transportation, U.S. airlines carried 89.7 million systemwide scheduled service passengers throughout June 2024.

Key Regional Takeaways:

United States Commercial Avionics Systems Market Analysis

The United States holds 87.00% share in North America. The market in the United States is propelled by advancements in technology, growing air traffic, and regulatory requirements for flight safety. According to the Bureau of Transportation Statistics (BTS), airline traffic data up 1.6% in September from the same month previous year. In addition, the Federal Aviation Administration's (FAA) NextGen initiative, aimed at modernizing the National Airspace System, drives significant investment in avionics upgrades. This incorporates better communication, navigation, and surveillance systems that guarantee safety and efficiency in increasingly crowded airspace. Besides this, the robust domestic aviation sector, with a high volume of passenger and cargo flights, fuels demand for reliable avionics systems. Airlines are adopting advanced avionics for fuel efficiency and route optimization, responding to rising fuel costs and environmental concerns. The adoption of satellite-based navigation systems and autopilot technology is further supporting this trend. In line with this, military-to-commercial technology transfer plays a role in innovation. Systems developed for defense purposes often find applications in commercial aviation, boosting market growth. For example, enhanced radar and sensor technologies are being integrated into commercial fleets to improve situational awareness. Furthermore, the push for sustainability and the development of electric and hybrid aircraft by U.S.-based manufacturers is contributing to the need for cutting-edge avionics systems tailored to these new platforms.

Europe Commercial Avionics Systems Market Analysis

Europe’s market benefits from stringent regulatory frameworks, sustainability initiatives, and technological innovation. The European Union Aviation Safety Agency (EASA) administers rigorous safety and environmental standards, requiring the adoption of advanced avionics systems. These regulations push airlines and aircraft manufacturers to integrate cutting-edge navigation, communication, and monitoring technologies. In addition, there is a rise in the focus on sustainability as the aviation sector in the region emits high amounts of pollutants in the environment. The aviation sector created approximately 172 Million tons of CO2 in Europe, parallel to 4% of the total CO2 generated on the continent, according to the European Union’s estimates. The Clean Aviation Joint Undertaking under Horizon Europe supports the development of green technologies, including avionics tailored for hybrid and electric aircraft. This associates with the region's dedication to reducing the environmental impact of aviation. Furthermore, the region’s well-established aerospace industry, featuring key players like Airbus, provides a robust ecosystem for avionics development and adoption. Collaborative projects across countries strengthen technological advancements and enable the integration of systems such as ADS-B, flight management systems (FMS), and synthetic vision systems. Moreover, digital transformation is another factor influencing market growth. Airlines in Europe are increasingly relying on avionics to enable predictive maintenance, optimize air traffic management, and enhance passenger connectivity.

Asia Pacific Commercial Avionics Systems Market Analysis

The Asia Pacific region’s market is driven by government investments in aviation infrastructure and the expansion of low-cost carriers (LCCs). With countries, such as China and India, experiencing double-digit growth in passenger numbers, airlines are investing heavily in modernizing their fleets with advanced avionics to meet demand and ensure operational efficiency. Additionally, governing agencies in the region are prioritizing aviation modernization through policies, such as China's Civil Aviation Development Fund and India's Regional Connectivity Scheme (RCS). These programs promote fleet growth, increasing the need for avionics systems that improve navigation, communication, and safety features. Reports indicate that the Indian Government intends to invest USD 1.83 Billion in airport infrastructure development and aviation navigation services by the year 2026. Apart from this, the adoption of next-generation technologies, including automatic dependent surveillance-broadcast (ADS-B) and satellite-based navigation, is becoming widespread. These systems ensure compliance with global airspace regulations and improve flight efficiency. Additionally, the region’s increasing focus on sustainability, coupled with investments in electric and hybrid aviation, creates a burgeoning need for avionics tailored to innovative aircraft designs. Furthermore, collaboration with regional manufacturing giants and international OEMs aid in enhancing the market growth. Their initiatives to build modern aircraft emphasize the integration of advanced avionics, catering to both domestic and export markets.

Latin America Commercial Avionics Systems Market Analysis

The market in Latin America is primarily driven by fleet modernization and infrastructure development. Governments and airlines are focusing on improving aviation safety and efficiency to meet the demands of growing passenger numbers. According to the CEIC, passenger traffic data was reported at 112,698,015 persons in 2023 in Brazil. Compliance with International Civil Aviation Organization (ICAO) mandates, such as ADS-B implementation, is a key factor encouraging avionics upgrades. Economic growth in countries like Brazil and Mexico further supports investments in aviation, while regional airline expansions drive demand for cost-effective avionics solutions. The rise of low-cost carriers also plays a role, with these airlines adopting advanced systems for operational efficiency. Additionally, sustainability efforts are gaining traction, with a focus on reducing emissions and adopting green technologies. This aligns with a gradual shift toward fuel-efficient aircraft, necessitating state-of-the-art avionics for enhanced performance and environmental compliance.

Middle East and Africa Commercial Avionics Systems Market Analysis

The Gulf region, in particular, serves as a global aviation hub, with countries like the UAE and Qatar investing heavily in modernizing their fleets and airports. These investments include cutting-edge avionics to ensure efficiency and competitiveness in long-haul operations. In addition, the rise of regional and low-cost airlines across Africa is catalyzing the demand for avionics systems tailored to diverse operational needs. Safety compliance with ICAO regulations and improving air navigation services are critical drivers in this market. Governing agencies in both regions are supporting industry growth through policies aimed at enhancing connectivity and integrating next-generation technologies, ensuring a steady trajectory for avionics systems demand. Furthermore, with the rise of data-driven solutions, avionics manufacturers are focusing on integrating IoT and AI capabilities into their products. Additionally, high passenger traffic in the region is impelling the market growth. Hamad International Airport (DOH) maintains impressive performance in 2023, showing a significant 26.84% rise in passenger traffic for Q3 compared to the same timeframe last year.

Competitive Landscape:

One of the key strategies that leading players in the market are employing is investing heavily in research and development (R&D). R&D allows companies to stay at the forefront of technological advancements and ensure that their products meet the ever-evolving demands of the aviation industry. Companies are not only providing individual avionics systems but are increasingly offering integrated avionics suites, which combine various systems, such as navigation, communication, flight management, and flight control into one cohesive unit. Strategic partnerships and alliances are also a crucial avenue for growth in the market. As the industry becomes more interconnected and complex, collaboration with other aerospace manufacturers, technology companies, and even airlines has become essential. By partnering with other stakeholders, avionics companies can access new technologies, expand their customer base, and improve the efficiency of their operations.

The report provides a comprehensive analysis of the competitive landscape in the commercial avionics systems market with detailed profiles of all major companies, including:

- Cobham Limited

- Garmin Ltd.

- General Electric Company

- Honeywell International Inc.

- L3Harris Technologies Inc.

- Panasonic Corporation

- Raytheon Technologies Corporation

- Safran SA

- Teledyne Technologies Inc.

- Thales Group

- Universal Avionics Systems Corporation (Elbit Systems Ltd.).

Latest News and Developments:

- August 2024: United Airlines selected Honeywell to provide avionics on new 737 Max. Honeywell will provide technology including 3D weather radar, new 25-hour flight data recorders, and advanced traffic avoidance systems.

- July 2024: Panasonic Avionics Corporation, a global leader in in-flight engagement and connectivity (IFEC) solutions, inaugurated a new software design and development center in Pune, India. A variety of software will be created, evaluated, and maintained in cutting-edge labs across the facility to provide passenger experiences for narrowbody and widebody planes that align with airlines’ requirements. These encompass the X Series in-flight entertainment system and digital solutions such as airline interactives, allowing airlines to design distinctive seatback passenger experiences, IFEC development assistance through SDKs, and mobile companion applications, among others.

- April 2024: L3Harris Technologies revealed a significant deal with Air India to be the primary provider of the advanced SRVIVR25™ Voice and Data Recorders for the airline’s B737-8 fleet. This agreement marks the initial avionics collaboration between L3Harris and Air India since the latter was acquired by the Tata Group, enhancing their relationship, as L3Harris will also deliver pilot training for Air India’s existing and upcoming pilots.

- February 2024: Malaysia Airlines Berhad (MAB) entered into an avionics hardware and support contract for its 737-8 fleet with Collins Aerospace, a business unit of RTX, during the 2024 Singapore Air Show. Collins' Dispatchsm solution will supply and maintain critical communications, navigation, surveillance systems, and air data sensors.

Commercial Avionics Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sub Systems Covered | Health Monitoring Systems, Flight Management and Control Systems, Communication and Navigation, Cockpit Systems, Visualizations and Display Systems, Others |

| Aircrafts Types Covered | Narrow-body Aircraft, Wide-body Aircraft, Regional Aircraft, Others |

| Fits Covered | Linefit, Retrofit |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cobham Limited, Garmin Ltd., General Electric Company, Honeywell International Inc., L3Harris Technologies Inc., Panasonic Corporation, Raytheon Technologies Corporation, Safran SA, Teledyne Technologies Inc., Thales Group, Universal Avionics Systems Corporation (Elbit Systems Ltd.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial avionics systems market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global commercial avionics systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial avionics systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial avionics systems market was valued at USD 31.65 Billion in 2024.

The commercial avionics systems market is projected to exhibit a CAGR of 3.27% during 2025-2033, reaching a value of USD 42.91 Billion by 2033.

Key factors driving the commercial avionics systems market include the rising air traffic, increasing air travel demand, technological advancements in avionics, regulatory compliance, and the need for enhanced safety, performance, and efficiency in aircraft operations.

North America currently dominates the commercial avionics systems market, accounting for a share of 33.7%, driven by technological innovations, stringent regulatory requirements, increasing air traffic, fleet modernization, and demand for advanced avionics in both new and retrofitted aircraft.

Some of the major players in the commercial avionics systems market include Cobham Limited, Garmin Ltd., General Electric Company, Honeywell International Inc., L3Harris Technologies Inc., Panasonic Corporation, Raytheon Technologies Corporation, Safran SA, Teledyne Technologies Inc., Thales Group, and Universal Avionics Systems Corporation (Elbit Systems Ltd.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)