Communication Platform as a Service (CPaaS) Market Size, Share, Trends and Forecast by Component, Enterprise Size, Industry, and Region, 2025-2033

Communication Platform as a Service (CPaaS) Market Size and Share:

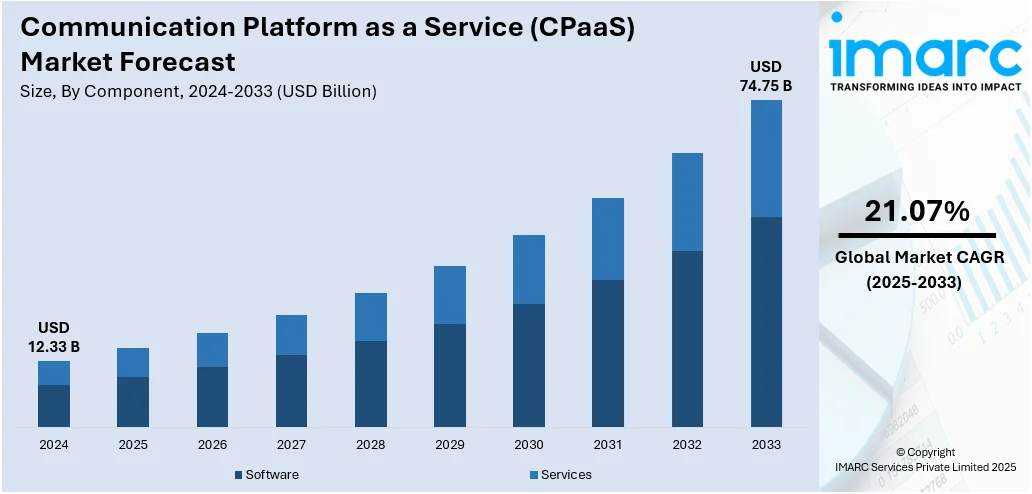

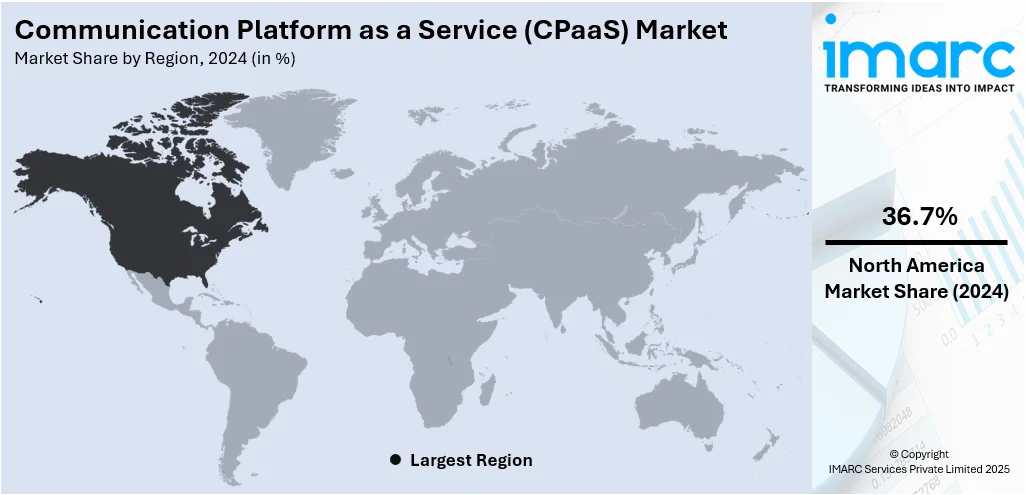

The global communication platform as a service (CPaaS) market size was valued at USD 12.33 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 74.75 Billion by 2033, exhibiting a CAGR of 21.07% from 2025-2033. North America currently dominates the market, holding a market share of 36.7% in 2024. The growth of the market is attributed to its advanced tech infrastructure, significant uptake of cloud services, and robust need for effective communication solutions. The robust business environment, along with continuous digital transformation in various sectors, fosters the development and innovation of CPaaS platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.33 Billion |

|

Market Forecast in 2033

|

USD 74.75 Billion |

| Market Growth Rate 2025-2033 | 21.07% |

Companies are progressively aiming for smooth communication across multiple platforms, such as voice, messaging, and video. CPaaS platforms enable companies to unify these channels, enhancing client engagement and satisfaction while boosting operational efficiency. In addition, CPaaS provides economical solutions by removing the necessity for substantial infrastructure expenditures. Companies can adjust communication services according to demand, offering flexibility and decreasing operational expenses, making it appealing for organizations of any size. Apart from this, the incorporation of artificial intelligence (AI) and automation into CPaaS platforms enhances client service, allowing for instantaneous responses and tailored communication. This improves user satisfaction, catalyzing the demand for more sophisticated CPaaS solutions in industries like retail, healthcare, and finance.

To get more information on this market, Request Sample

The United States plays a crucial role in the market, driven by the expansion of remote and hybrid work arrangements that necessitate efficient communication tools. CPaaS platforms enable immediate collaboration and online interaction, helping businesses adapt to new work models and promote market expansion. Besides this, the growing need for affordable communication options and adaptable platforms is catalyzing the demand for CPaaS. Organizations are implementing CPaaS to enhance productivity, improve user engagement, and lower infrastructure expenses. The transition towards cloud-driven communication solutions is anticipated to greatly enhance the market expansion, with the CPaaS sector in the United States predicted to show a strong growth rate (CAGR) of 10.55% from 2025 to 2033.

Communication Platform as a Service (CPaaS) Market Trends:

Growing Demand for Digital Communication in Education

The increasing dependence on technology in education is a crucial factor bolstering the CPaaS market growth. A 2023 UNESCO report indicates that over 90% of nations have adopted digital education strategies, highlighting the transition to online learning and virtual classrooms. CPaaS solutions play a vital role in enabling real-time communication among students, educators, and administrative personnel, ensuring effective and seamless learning experiences. These platforms provide multi-channel features like video calls, messaging, and alerts, improving the quality of online education while promoting accessibility and involvement. Incorporating CPaaS in educational settings enables automated administrative functions, optimizing processes, such as enrollment, student assistance, and resource allocation. With the worldwide education system increasingly focusing on digitalization for ongoing learning, the need for CPaaS platforms that facilitate remote education, collaboration, and communication is growing, greatly aiding the market development.

Adoption of Cloud Infrastructure in Healthcare

The widespread adoption of cloud infrastructure within the healthcare sector significantly contributes to the growth of the CPaaS market. A recent industry report indicated that 83% of healthcare organizations have implemented cloud-based solutions, greatly enhancing operational efficiency. The shift to cloud infrastructure has led to a 35% reduction in patient wait times, a 45% increase in diagnostic accuracy, and a 30% decrease in IT costs. CPaaS platforms are crucial in this transformation by enabling secure, real-time communications between healthcare providers, patients, and administrative staff. CPaaS improves healthcare delivery by integrating voice, messaging, and video solutions for telemedicine, appointment scheduling, and remote patient monitoring. Additionally, these platforms are critical in streamlining workflows, improving collaboration, and ensuring data protection while complying with regulations, such as HIPAA. As healthcare organizations place greater emphasis on digital transformation, the demand for CPaaS solutions to enhance patient engagement and operational efficiency is escalating.

Integration of AI and machine learning (ML)

The integration of AI and machine learning (ML) is significantly improving communication skills and automating a variety of processes. AI and ML are employed in speech recognition, automation, agent improvement, emotion detection, and call analysis, enabling companies to provide smarter and personalized user experiences. These technologies help companies enhance efficiency, reduce costs, and increase client satisfaction by automating everyday tasks, delivering immediate insights, and refining decision-making processes. Industry research shows that 58% of nonprofits and 47% of B2C firms in the private sector are integrating AI into their CPaaS services, reflecting a growing reliance on these technologies. With the progression of AI and ML, CPaaS platforms gain significant advantages, improving efficiency, elevating user experiences, and allowing companies to create more personalized and flexible communication services.

Communication Platform as a Service (CPaaS) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global communication platform as a service (CPaaS) market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, enterprise size, and industry.

Analysis by Component:

- Software

- Services

Software leads the market owing to the increasing need for adaptable and scalable communication options. Software allows companies to merge different communication channels, including voice, messaging, and video, into their current systems, facilitating smooth and adaptable communication across various touchpoints. The growing dependence on cloud platforms and the demand for real-time communication tools are turning software into an essential element for businesses. Moreover, software allows companies to seamlessly expand their communication infrastructure as their requirements change, without large initial expenditures on physical infrastructure. As sectors persist in emphasizing client engagement enhancement, operational efficiency improvement, and digital transformation facilitation, software-driven CPaaS solutions deliver the essential tools to realize these objectives. The capability to tailor software solution to address particular business needs, enhances its role as the leading segment in the market.

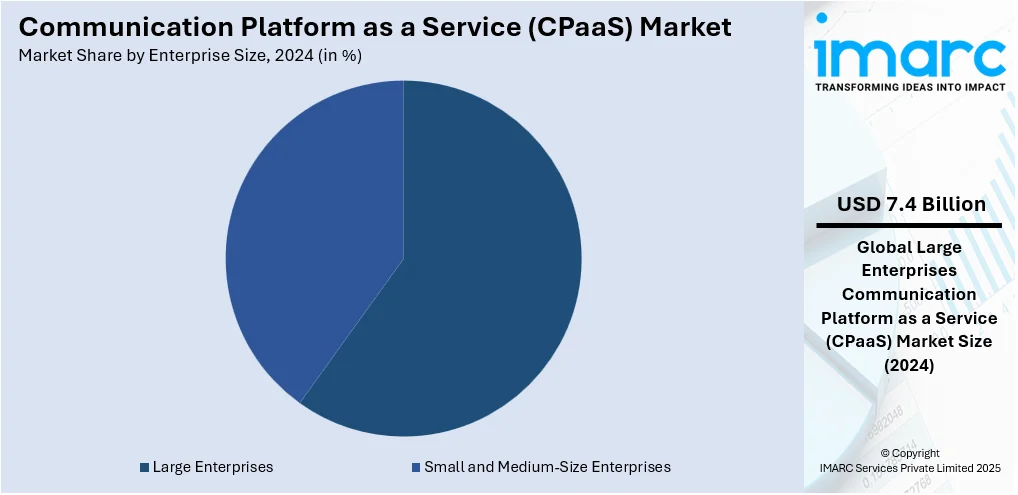

Analysis by Enterprise Size:

- Small and Medium-Size Enterprises

- Large Enterprises

Large enterprises stand as the largest component in 2024, holding 59.8% of the market. The dominance of the segment is attributed to their demand for scalable, adaptable, and effective communication solutions. These organizations typically possess intricate communication needs across various regions, divisions, and client interactions, rendering CPaaS an ideal solution for enhancing operations. The increasing trend of digital transformation and the use of cloud-based technologies in large enterprises boosts the need for CPaaS platforms. These companies gain advantages from the capability to merge different communication methods, including voice, messaging, and video, into one cohesive system, improving customer interaction and workflow efficiency. Additionally, large enterprises frequently possess more resources to allocate towards cutting-edge technologies such as AI, automation, and ML, which are provided by CPaaS vendors. The necessity to sustain competitive edges and improve client satisfaction encourages large enterprises to utilize CPaaS.

Analysis by Industry:

- BFSI

- Government

- IT and Telecom

- Healthcare and Life Sciences

- Retail

- Education

- Others

IT and telecom represent the largest segment, owing to the growing demand for effective communication solutions and the rising need for smooth, multi-channel interactions. The swift digital evolution in these sectors is catalyzing the demand for cloud-based solutions to facilitate scalable, adaptable, and economical communication. Telecom providers are utilizing CPaaS to upgrade their service options and enhance client satisfaction while lowering infrastructure expenses. In addition, IT companies depend on CPaaS to facilitate numerous communication applications, such as client support, automated alerts, and real-time teamwork, which are crucial for contemporary business functions. As the two sectors progress, fueled by a growing dependence on digital tools and remote work frameworks, CPaaS allows them to provide more cohesive, efficient, and creative communication services.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 36.7%, influenced by various factors. The area features cutting-edge technological infrastructure and a significant adoption of cloud services, creating a suitable setting for the expansion of CPaaS solutions. Moreover, North America's strong presence of tech giants and startups cultivates a competitive market that encourages ongoing innovation. The extensive implementation of digital transformation strategies in different sectors, coupled with the growing demand for multi-channel communication, guarantees that CPaaS providers can successfully address a variety of client requirements. Additionally, supportive government policies that endorse technological progress and the development of digital infrastructure are sustaining the region's dominance in the market. For instance, in 2024, the Government of Canada announced an investment of up to $51.2 million for 19 digital infrastructure projects under the National Trade Corridors Fund. Such projects ensure continued leadership of North America in the CPaaS market.

Key Regional Takeaways:

United States Communication Platform as a Service (CPaaS) Market Analysis

In North America, the market portion held by the United States was 85.00%, mainly fueled by the rising need for smooth client interaction solutions. The ongoing transition towards cloud-based infrastructure, which enables scalability and adaptability for businesses, is supporting the communication platform as a service (CPaaS) market growth. In January 2025, AWS intended to invest USD 11 billion in Georgia by enhancing its infrastructure to bolster AI and cloud technologies. This investment will generate 550 skilled positions, improve Georgia’s technology ecosystem, and foster community development through education and sustainability programs. The increase in mobile-centric communication approaches is also greatly aiding the market's growth, enabling companies to engage with clients through smartphones and applications. Besides this, the swift incorporation of cutting-edge technologies, including AI and ML, is elevating client experiences and boosting operational efficiency. The rising demand for secure communication channels, propelled by rigorous data security and privacy regulations, is another significant factor influencing the market. Furthermore, the increasing focus on omnichannel communication strategies is leading to CPaaS adoption, enabling organizations to interact with clients through various platforms.

Europe Communication Platform as a Service (CPaaS) Market Analysis

The European market is growing because of the area's increased emphasis on digital transformation, with companies embracing cloud-based solutions to enhance their operations. Moreover, the rising need for omnichannel communication to improve client experience is driving this expansion. The increase in mobile usage and the embrace of mobile-first communication approaches are accelerating the adoption of CPaaS. According to GSMA, by the end of 2024, 88% of the population in Europe, equivalent to 520 million individuals, will have subscribed to mobile services, while 79% (471 million users) will have embraced mobile internet, representing a rise of more than 150 million users over the last ten years. Additionally, the continuous enforcement of strict data protection regulations, like GDPR, is catalyzing the demand for secure and compliant platforms. The swift incorporation of AI and automation into client engagements is another crucial factor impelling the market growth. Besides this, the growing demand for CPaaS in SMEs for adaptability and growth is a key market motivator. In addition, the extensive implementation of cloud solutions in different industries, which is enabling smooth integration of CPaaS platforms, is broadening the market reach.

Asia Pacific Communication Platform as a Service (CPaaS) Market Analysis

The CPaaS market in the Asia Pacific is propelled by the swift digital transformation of companies throughout the region. Furthermore, the rise of 5G networks, improving mobile connectivity, is facilitating more effortless communication experiences. South Korea emerged as a leader in 5G technology by being the first nation to launch 5G services commercially on April 3, 2019. According to an industry report, the total number of 5G connections in the country had hit 36.11 million by the third quarter of 2024. Apart from this, the growth of e-commerce and digital payment solutions is also boosting the adoption of CPaaS for enhanced user interaction. Additionally, increasing government funding for digital infrastructure is leading to the expansion of cloud-based services, which enable scalable communication options. The growing popularity of mobile messaging apps like WhatsApp and WeChat is encouraging the adoption of CPaaS for effective user engagement.

Latin America Communication Platform as a Service (CPaaS) Market Analysis

In Latin America, the CPaaS market is expanding due to rising demand for affordable communication solutions, enabling companies to lower operational costs. The broad use of cloud technologies is enhancing the scalability and adaptability of CPaaS implementations. In September 2024, Microsoft allocated USD 2.7 Billion in Brazil over three years to improve cloud and AI infrastructure, train 5 million individuals in AI, and assist the nation’s digital transformation, promoting economic growth and competitiveness. The increasing implementation of mobile-first approaches in different sectors, especially in retail and finance, is propelling the market growth. Additionally, the heightened emphasis on digital client interaction, spurred by the growth of social media platforms, is encouraging the adoption of CPaaS solutions to improve individual service and communication effectiveness.

Middle East and Africa Communication Platform as a Service (CPaaS) Market Analysis

The rapid adoption of digital transformation strategies across various industries is inlfuencing the market in the Middle East and Africa. Moreover, heightened investments in telecom infrastructure and the growth of 4G and 5G networks are enhancing market accessibility. In the first half of 2024, e& Emirates and du allocated around Dh2.1 billion to UAE telecom infrastructure, emphasizing 5G development, fiber optic improvements, and digital transformation, which driving growth in subscribers, services, and fintech solutions. Additionally, the growing need for localized client support services is catalyzing the demand for regional CPaaS solutions. Besides this, the growth of mobile banking and digital payment solutions is encouraging the use of CPaaS for secure and effective communications in the financial services industry, fostering a favorable market outlook.

Competitive Landscape:

Main participants in the CPaaS market are broadening their product offerings to provide more tailored APIs, enhanced integration with AI technologies, and greater support across voice, messaging, video, and email platforms. They are concentrating on solutions tailored to specific industries and aiming at enterprise clients who seek greater control over their communication processes without starting from the scratch. Collaborations with cloud providers and mobile operators are prevalent to enhance accessibility and dependability. Numerous individuals are also putting money into low-code platforms to facilitate the adoption of their services by non-developers. Leading companies are consistently evolving to deliver multi-channel assistance, enhance security, and create tailored communication experiences. For instance, in 2025, Infobip partnered with NTT Com Online to launch a localised CPaaS platform in Japan, combining NTT's reliable SMS and Voice services with Infobip's omnichannel technology. The collaboration offers businesses an advanced, no-code solution for customer engagement with new channels like WebRTC and live chat. The platform aims to enhance communication experiences in the Japanese market.

The report provides a comprehensive analysis of the competitive landscape in the communication platform as a service (CPaaS) market with detailed profiles of all major companies, including:

- 8x8 Inc.

- Avaya Inc.

- Bandwidth Inc.

- Infobip

- Intelepeer Cloud Communications LLC

- Mavenir Systems Inc. (Mavenir plc)

- MessageBird B.V.

- Plivo Inc.

- Ringcentral Inc.

- Telnyx LLC

- Twilio Inc.

- Vonage Holdings Corp. (Telefonaktiebolaget LM Ericsson)

- Voxvalley Technologies Pvt. Ltd.

Latest News and Developments:

- June 2025: JT Global collaborated with Aduna to upgrade its CPaaS platform with secure network APIs, enhancing authentication, identity verification, and fraud deterrence. The partnership seeks to deliver safe, real-time solutions for international businesses, assisting them in combating fraud and maintaining compliance in digital communications within regulated sectors.

- June 2025: Vodafone and Three UK finalized their GBP 16.5 billion merger, creating VodafoneThree, the largest mobile network in the UK. The merged organization intends to boost 5G implementation and UC features, providing unified CPaaS solutions, enhanced mobile-centric services, and quicker deployment for companies, while encountering regulatory and competitive hurdles.

- June 2025: MTN Nigeria revealed plans to launch its Communication Platform as a Service (CPaaS) in the third quarter of 2025. The solution will enhance business processes by providing unified messaging, voice, video, and chat functionalities, boosting customer interaction and response rates, concentrating on digital communication platforms.

- June 2025: Aduna revealed a collaboration with JT Global to incorporate high-trust network APIs into JT's CPaaS platform. This partnership improves authentication, identity verification, and fraud prevention abilities, assisting global companies in combating fraud and securing transactions, while fostering compliance and trust in digital interactions.

- February 2025: Infobip collaborated with White Label Communications to improve CPaaS and SaaS offerings for medium and large businesses. This partnership connects Infobip's platform with White Label's APIs, enhancing communication features and customer experiences, while maintaining compliance and providing round-the-clock support for partners.

- January 2025: Proximus combined its subsidiaries BICS, Telesign, and Route Mobile into Proximus Global, a consolidated CPaaS powerhouse. The merger integrates IoT connectivity, digital identity solutions, and cloud communications, setting Proximus Global up for expansion in major international markets such as the US, Europe, and India.

Communication Platform as a Service (CPaaS) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Enterprise Sizes Covered | Small and Medium-Size Enterprises, Large Enterprises |

| Industries Covered | BFSI, Government, IT and Telecom, Healthcare and Life Sciences, Retail, Education, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 8x8 Inc., Avaya Inc., Bandwidth Inc., Infobip, Intelepeer Cloud Communications LLC, Mavenir Systems Inc. (Mavenir plc), MessageBird B.V., Plivo Inc., Ringcentral Inc., Telnyx LLC, Twilio Inc., Vonage Holdings Corp. (Telefonaktiebolaget LM Ericsson), Voxvalley Technologies Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the communication platform as a service (CPaaS) market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global communication platform as a service (CPaaS) market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the communication platform as a service (CPaaS) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The communication platform as a service (CPaaS) market was valued at USD 12.33 Billion in 2024.

The communication platform as a service (CPaaS) market is projected to exhibit a CAGR of 21.07% during 2025-2033, reaching a value of USD 74.75 Billion by 2033.

The CPaaS market is driven by the increasing demand for seamless communication across different channels, cost-effective solutions, and the rise of cloud-based services. Businesses seek enhanced client engagement, operational efficiency, and scalability. Additionally, the growing adoption of IoT, AI, and automation in communication technologies further supports the market growth and innovation.

North America currently dominates the communication platform as a service (CPaaS) market, accounting for a share of 36.7%. The dominance of the region is attributed to its robust technological infrastructure, high uptake of cloud services, and strong demand for efficient communication solutions. The region's robust business environment, coupled with ongoing digital transformation across industries, supports the growth and innovation of CPaaS platforms.

Some of the major players in the communication platform as a service (CPaaS) market include 8x8 Inc., Avaya Inc., Bandwidth Inc., Infobip, Intelepeer Cloud Communications LLC, Mavenir Systems Inc. (Mavenir plc), MessageBird B.V., Plivo Inc., Ringcentral Inc., Telnyx LLC, Twilio Inc., Vonage Holdings Corp. (Telefonaktiebolaget LM Ericsson), Voxvalley Technologies Pvt. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)