Connected Drug Delivery Devices Market Size, Share, Trends, and Forecast by Product, End User, Technology, and Region, 2025-2033

Connected Drug Delivery Devices Market, 2024 Size and Share:

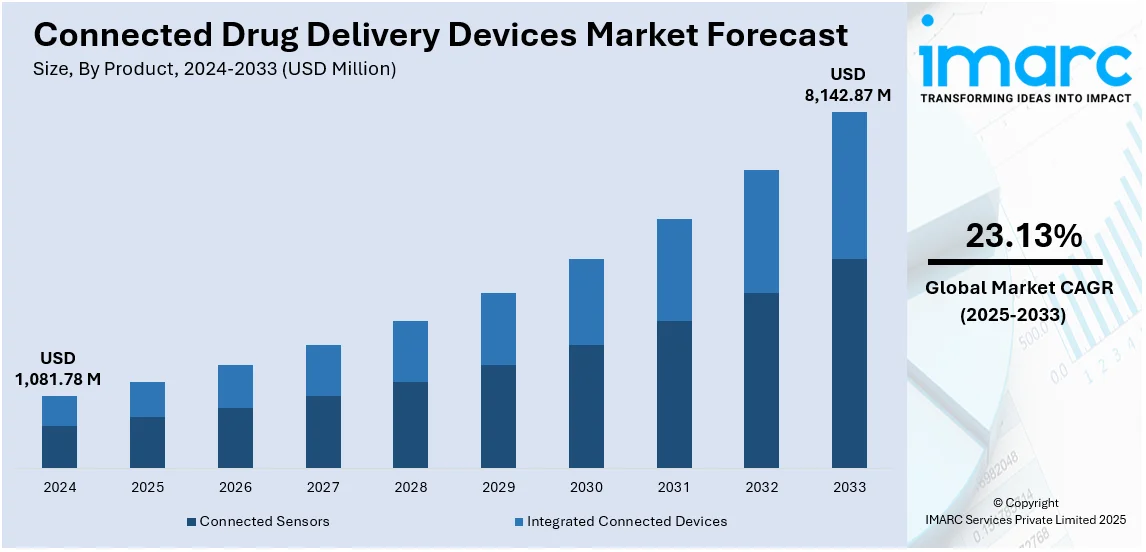

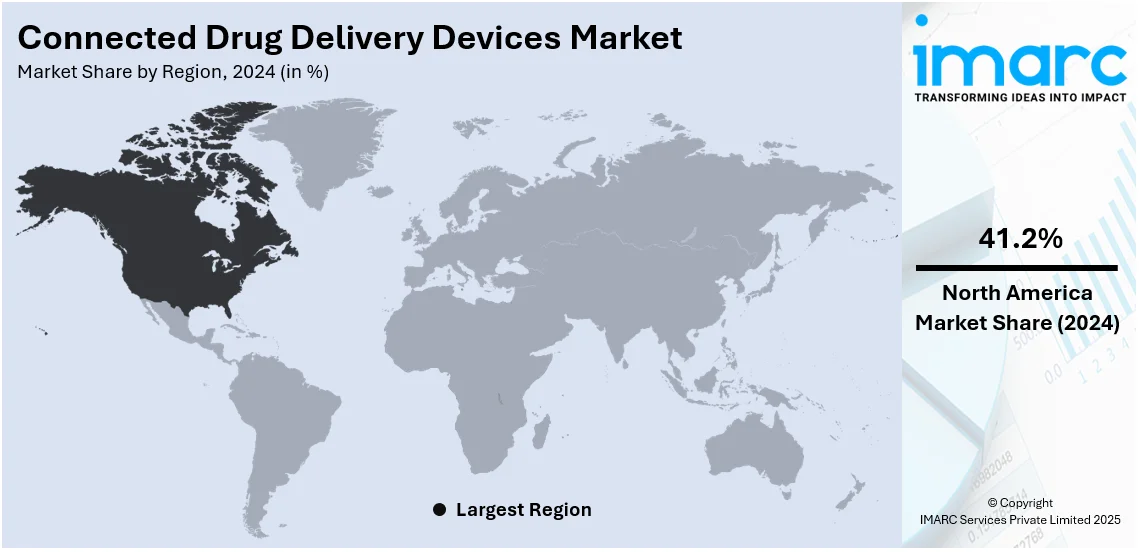

The global connected drug delivery devices market size was valued at USD 1,081.78 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,142.87 Million by 2033, exhibiting a CAGR of 23.13% from 2025-2033. North America currently dominates the connected drug delivery devices market share, holding a market share of over 41.2% in 2024. The region’s connected drug delivery devices market share is driven by advancements in healthcare technology, high adoption of connected devices, increasing chronic disease prevalence, and supportive regulatory frameworks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,081.78 Million |

|

Market Forecast in 2033

|

USD 8,142.87 Million |

| Market Growth Rate (2025-2033) | 23.13% |

The COVID-19 pandemic accelerated the adoption of remote healthcare solutions within the connected drug delivery devices market outlook. Due to this, the number of patient visitations in healthcare facilities was also very low. There was intense demand for devices that could be used for self-monitoring and self-management of medications at home. This placed emphasis on ensuring medication adherence and efficient treatment management in the home care setting. The pandemic boosted innovation in digital health technologies further, and growth in reimbursement policies for telehealth supported the expansion of connected drug delivery devices.

The prevalence of chronic conditions, which include asthma, diabetes, and cardiovascular diseases is driving the demand for more efficient and accurate medication delivery methods. Connected drug delivery devices offer a solution by ensuring proper dosing and improving overall treatment outcomes, making them essential for managing long-term health conditions. in addition, connected devices help address the growing challenge of medication non-adherence by offering features like reminders, dosage tracking, and notifications. They ensure that patients take their medications on time and follow prescribed regimens, which is crucial for the effectiveness of treatments. Moreover, innovation in sensor technology, wireless communication, and integration with mobile applications and healthcare platforms is enhancing the functionality of connected drug delivery devices. These advancements allow devices to provide more accurate tracking, monitoring, and real-time feedback, making them highly effective in both clinical and home settings.

The United States plays a crucial role in the connected drug delivery devices market share, driven by the rising prevalence of chronic diseases like diabetes, asthma, and cardiovascular conditions, which require efficient and reliable medication delivery solutions. Connected drug delivery devices help improve disease management by ensuring accurate dosing and enhancing medication adherence. Furthermore, the U.S. Food and Drug Administration (FDA) is establishing clear regulatory frameworks for connected medical devices, encouraging innovation and the adoption of digital health solutions. Additionally, expanding reimbursement policies for telehealth and connected devices are helping make these technologies more accessible to patients and healthcare providers. In 2024, BIOCORP revealed it obtained FDA 510(k) approval for SoloSmart®, an intelligent sensor created for Sanofi's SoloStar insulin pens. The device tracks insulin units, injection date, and time, sending information to a digital app, improving diabetes management. This represents the second approval from the FDA for BIOCORP's Mallya platform.

Connected Drug Delivery Devices Market Trends:

Growing aging population

As people are aging, they are encountering greater risk of continual ailments like diabetes, high blood pressure, and cardiovascular diseases. Connected drug delivery devices play an important role in handling those situations effectively by ensuring precise medicinal drug dosing and monitoring. Moreover, these devices can simplify those regimens through reminders, tracking dosages, and transmitting records mechanically to healthcare companies. Connected drug delivery devices allow remote tracking of medicine adherence and fitness parameters. This allows healthcare companies to intervene the issues early, thus supporting aging in place. An article published on the website of the World Health Organization (WHO) shows that individuals aged over 60 are expected to double by 2050, reaching nearly 2.1 Billion worldwide. This is projected to positively impact the product demand while significantly boosting the connected drug delivery devices market growth.

Rising prevalence of chronic obstructive pulmonary disease (COPD)

As per the content updated in 2023 on the website of the World Health Organization (WHO), nearly 90% of COPD deaths in those under 70 years of age occur in low- and middle-income countries. COPD patients require precise and managed delivery of medicinal drugs which include bronchodilators and corticosteroids. Connected drug delivery devices ensure correct dosing and timely administration, which is vital for coping with COPD signs effectively. In addition, connected devices can monitor inhalation strategies and provide feedback to patients in actual time. This allows COPD sufferers optimize their inhalation approach, making sure that they obtain the maximum benefits from their medicines. In line with this, COPD is a revolutionary disease that requires continuous monitoring of symptoms and lung function. Connected devices permit for remote monitoring of COPD patients' fitness fame, consisting of lung feature tests and symptom monitoring, facilitating early detection of exacerbations and timely adjustments to treatment plans.

Thriving telemedicine sector

The IMARC Group’s report shows that the global telemedicine market reached USD 74.7 Billion in 2023. Telemedicine platforms facilitate remote consultations between healthcare providers and patients, offering greater accessibility and convenience for individuals seeking healthcare. Connected drug delivery devices supplement telemedicine by enabling real-time tracking of patients' medication adherence, treatment response, and overall health status. These devices provide vital data on drug intake, dosage timing, and patient condition, which is especially beneficial for managing chronic conditions such as diabetes, hypertension, and respiratory illnesses. Additionally, the integration of connected drug delivery devices with telehealth platforms allows healthcare providers to remotely adjust medication dosages, fine-tune treatment plans, and monitor patient progress continuously. This synergy not only ensures more accurate and personalized care but also enhances the effectiveness of telemedicine consultations by offering actionable insights directly from the patient’s environment. Such integration supports proactive management and improves patient outcomes, reducing the need for frequent in-person visits.

Connected Drug Delivery Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global connected drug delivery devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, end user, and technology.

Analysis by Product:

- Connected Sensors

- Connected Inhaler Sensors

- Connectable Injection Sensors

- Integrated Connected Devices

- Connected Inhalation Devices

- Connected Injection Devices

Integrated connected devices hold the biggest market share, accounting 56.8% in 2024. Integrated connected devices (connected inhalation devices and connected injection devices) represent the largest segment attributed to their ability to combine medication delivery with advanced monitoring features, significantly enhancing patient care. These devices provide real-time tracking of medication usage, helping patients adhere to prescribed regimens and improving overall treatment outcomes. For instance, connected inhalers monitor usage frequency, technique, and dosage, while connected injection devices track injection sites, doses, and timing, offering valuable data for both patients and healthcare providers. The integration of sensors and connectivity allows for immediate feedback, helping to identify and address issues like missed doses, improper techniques, or potential side effects. Furthermore, these devices enable remote monitoring by healthcare professionals, facilitating personalized treatment adjustments. As a result, integrated connected devices offer a comprehensive solution that enhances convenience, precision, and patient engagement, driving their dominance in the market.

Analysis by End User:

- Hospitals and Healthcare Providers

- Homecare

Hospitals and healthcare providers stand as the largest component in 2024, holding 59.3% of the market share. Hospitals and healthcare providers lead the market because of their critical need for efficient patient care, improved medication adherence, and better treatment outcomes. These institutions rely on connected devices to streamline medication management, monitor patient progress, and enable more personalized treatments. With the growing prevalence of chronic diseases such as diabetes, asthma, and cardiovascular conditions, healthcare providers are adopting connected drug delivery systems to ensure accurate dosing and track medication usage in real time. The integration of connected devices into healthcare settings also supports remote monitoring, reducing the need for frequent hospital visits, and providing a more convenient and cost-effective solution for both patients and providers. Moreover, hospitals benefit from the real-time data provided by connected devices, which enhances decision-making and patient safety. As healthcare systems move toward more digital and data-driven approaches, hospitals and healthcare providers continue to drive demand for connected drug delivery technologies.

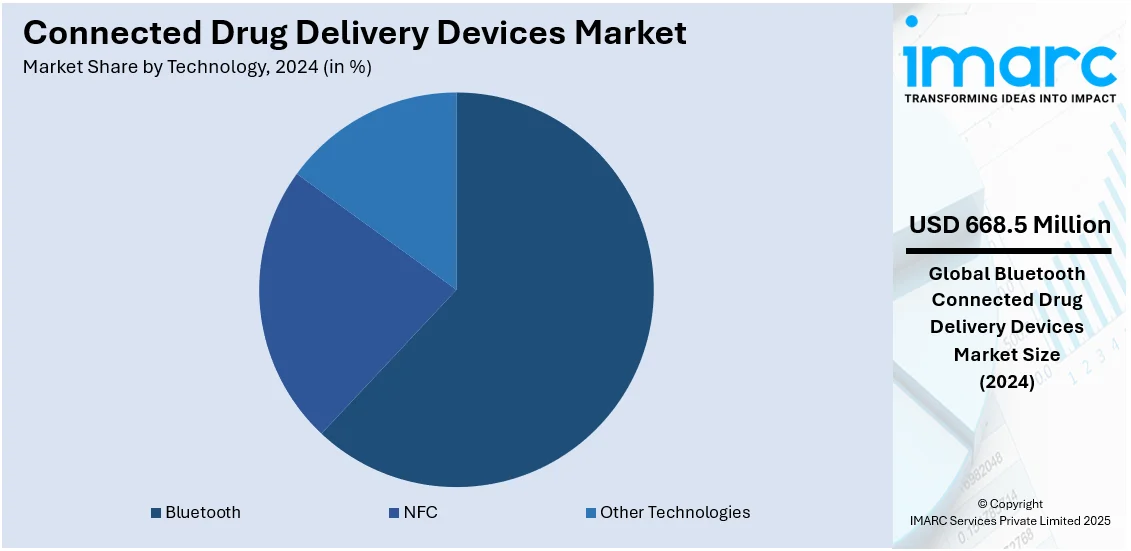

Analysis by Technology:

- Bluetooth

- NFC

- Other Technologies

In 2024, Bluetooth represented the largest segment, accounting 61.8% of the market share. Bluetooth leads the market due to its numerous advantages in healthcare applications. Its low power usage is a critical factor, allowing devices such as insulin pens, inhalers, and wearable injectors to operate efficiently for long periods without frequent battery replacements, enhancing patient compliance and reducing operational costs. Bluetooth’s wireless communication capabilities enable seamless data transmission between drug delivery devices and mobile applications or healthcare platforms, providing real-time insights into medication usage, dosage, and adherence. This capability is vital for remote monitoring, allowing healthcare providers to track patient progress and adjust treatment plans as needed. Additionally, Bluetooth is widely compatible with a range of devices, including smartphones, tablets, and other medical equipment, ensuring ease of integration into existing healthcare systems. The technology’s reliability, security, and cost-effectiveness make Bluetooth a natural fit for the connected drug delivery device market, driving its widespread adoption globally.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share at 41.2%. North America dominates the market owing to the increasing healthcare expenditure. According to the information revised in 2023 on the Centers for Medicare & Medicaid Services website, U.S. health care expenditures increased by 4.1 percent in 2022, totaling USD 4.5 trillion or USD 13,493 for each individual. The rising healthcare spending indicates a stronger focus on enhancing patient results and lowering total healthcare expenses via innovative technologies. Besides this, the region has a strong presence of pharmaceutical companies and medical device manufacturers that are investing heavily in research and development (R&D) activities of connected drug delivery devices. These companies are leveraging advancements in IoT and digital connectivity to develop innovative devices that enhance medication adherence, patient monitoring, and overall treatment outcomes. Additionally, beneficial reimbursement policies and encouraging regulatory frameworks in the area aid in the swift expansion of this market segment.

Key Regional Takeaways:

United States Connected Drug Delivery Devices Market Analysis

In North America, the market share for the United States was 81.80% of the total. The adoption of connected drug delivery devices has surged, driven by increasing investments aimed at enhancing the healthcare infrastructure. For instance, U.S. healthcare companies securing venture capital deals of USD 15 Million plus are driving robust investment growth, focusing on innovation in medical technology to meet rising market demands. These devices enable real-time monitoring and improved medication adherence, appealing to both providers and patients. With more resources allocated to integrating advanced technologies, healthcare systems are better equipped to offer personalized treatment solutions. Such investments pave the way for the incorporation of connected solutions into clinical workflows, simplifying chronic disease management and reducing hospital readmissions. Patients benefit from timely alerts and dosage tracking, while healthcare providers gain access to valuable data that improves decision-making. Advanced connectivity features, combined with the demand for efficient patient care, are driving this shift. The growing focus on reducing long-term treatment costs and improving outcomes favoring the connected drug delivery devices market forecast.

Europe Connected Drug Delivery Devices Market Analysis

An aging population has significantly influenced the adoption of connected drug delivery devices, as these systems address the unique healthcare challenges of older adults. For instance, Europe's ageing population is on the rise, with one in five Europeans now aged 65 or older, projected to approach 30% by 2050. With age-related conditions requiring consistent and precise medication, such devices help ensure adherence to prescribed regimens. They simplify the administration process for individuals with limited mobility or cognitive decline by providing automated reminders and easy-to-use interfaces. Additionally, caregivers can remotely monitor medication schedules and adjust treatments as needed, enhancing the quality of care. This focus on supporting aging individuals fosters increased interest in technologies that improve independence and safety. Furthermore, healthcare providers benefit from access to detailed medication data, enabling them to identify trends and tailor therapies effectively. As the population continues to age, the demand for solutions that enhance patient care and reduce hospitalizations is driving the widespread adoption of these devices in managing chronic conditions.

Asia Pacific Connected Drug Delivery Devices Market Analysis

The rise of digitalization and telemedicine has fuelled the connected drug delivery devices market demand. For instance, Indian digital healthcare segment is estimated to grow 10x from USD 2.7 Billion in 2022 to USD 37 Billion by 2030. These devices seamlessly integrate with digital platforms, facilitating remote patient monitoring and enhanced medication adherence. As healthcare providers are continuously relying on telehealth solutions, the requirement for connected systems that bridge the gap between patients and caregivers has become more pronounced. Digital ecosystems now include features that allow users to share medication data with professionals in real-time, streamlining treatment processes. Patients benefit from reminders and data tracking, while caregivers can monitor compliance remotely. This digital evolution has transformed the way chronic diseases are managed, emphasizing convenience and accessibility. With the growing emphasis on telemedicine, connected devices are becoming indispensable tools in ensuring continuity of care and improving therapeutic outcomes, particularly in areas that rely heavily on virtual healthcare models.

Latin America Connected Drug Delivery Devices Market Analysis

Chronic obstructive pulmonary disease is a significant factor driving the use of connected drug delivery devices. For instance, among the 22,663,091 deaths that occurred from 2000 to 2019 in Brazil, 1,132,968 had COPD mentioned as a cause of death. These devices provide patients with real-time feedback and reminders, ensuring consistent use of prescribed treatments. By monitoring inhaler usage and patterns, the devices help optimize medication adherence, leading to improved outcomes. For healthcare providers, the ability to track usage remotely offers insights into disease progression and effectiveness of treatments. This connectivity facilitates timely interventions, reducing exacerbations and hospital visits. The increased awareness of managing respiratory conditions with precision and ease makes these devices a preferred choice for long-term care, aligning with the growing focus on effective management of chronic diseases.

Middle East and Africa Connected Drug Delivery Devices Market Analysis

The expansion of healthcare facilities has bolstered the adoption of connected drug delivery devices, addressing the need for advanced patient-centric solutions. According to Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022, projected to expand further by 3-6% in facilities and 10-15% in professionals in 2023. These devices integrate seamlessly into hospital and clinic settings, providing real-time data to enhance treatment accuracy. Their ability to simplify medication management while reducing errors aligns with the objectives of modern healthcare environments. Patients benefit from enhanced compliance tools, while professionals utilize the collected data for informed decision-making. As healthcare systems evolve, incorporating connected devices ensures streamlined operations and improved patient experiences. This growth reflects the increasing emphasis on leveraging technology to optimize care delivery in expanding medical infrastructures.

Competitive Landscape:

Major participants in the market are concentrating on technological advancement and strategic collaborations to enhance their product range. Organizations are putting substantial resources into creating sophisticated features, including real-time tracking, data analysis, and compatibility with mobile apps, to boost patient involvement and enhance treatment results. They are prioritizing obtaining regulatory approvals to ensure their devices comply with industry standards and achieve wider market acceptance. Moreover, numerous stakeholders are partnering with healthcare providers, technology firms, and regulatory agencies to facilitate the integration of connected devices in diverse healthcare environments. In 2024, Medtronic revealed that its Simplera™ continuous glucose monitor (CGM) received FDA approval, offering a compact, integrated device. Medtronic announced a worldwide collaboration with Abbott to combine Abbott's CGM technology with Medtronic's intelligent insulin delivery systems. This partnership seeks to improve access to sophisticated diabetes management resources.

The report provides a comprehensive analysis of the competitive landscape in the connected drug delivery devices market with detailed profiles of all major companies, including:

- Adherium Ltd.

- BioCorp Production

- Cohero Health Inc. (AptarGroup Inc.)

- Elcam Medical ACS. Ltd

- Findair Sp. z o. o.

- Merck KGaA

- Phillips Medisize (Molex LLC)

- Propeller Health (Resmed Inc.)

- Teva Pharmaceutical Industries Ltd.

- West Pharmaceutical Services Inc.

Latest News and Developments:

- October 2024: Modivcare Inc., a leader in tech-driven healthcare services, partnered with Tenovi to introduce Adherium’s Hailie Smart inhalers through its subsidiaries, VRI and Higi Care. This collaboration aims to improve care for patients with chronic respiratory conditions by leveraging connected drug delivery technology.

- September 2024: SHL Medical, a leader in self-injection solutions, launched the Elexy device, an electromechanical drug delivery system. Featuring cellular and Bluetooth connectivity, Elexy enhances digital therapeutics by enabling comprehensive data collection on drug usage, device performance, and container details.

- June 2024: Aptar Digital Health teamed up with SHL Medical to enhance connected drug delivery systems. The collaboration combines Aptar’s software expertise with SHL’s autoinjectors and pen injectors to offer better solutions for managing injectable therapies.

- May 2024: Adherium Limited, a leader in respiratory eHealth, remote monitoring and data management solutions, announced that AstraZeneca has selected its Hailie® Smartinhaler® platform for a clinical trial. This contract is valued at USD 1.1M over the course of three years.

Connected Drug Delivery Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Users Covered | Hospitals and Healthcare Providers, Homecare |

| Technologies Covered | Bluetooth, NFC, Other Technologies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adherium Ltd., BioCorp Production, Cohero Health Inc. (AptarGroup Inc.), Elcam Medical ACS. Ltd, Findair Sp. z o. o., Merck KGaA, Phillips Medisize (Molex LLC), Propeller Health (Resmed Inc.), Teva Pharmaceutical Industries Ltd., West Pharmaceutical Services Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the connected drug delivery devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global connected drug delivery devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the connected drug delivery devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The connected drug delivery devices market was valued at USD 1,081.78 Million in 2024.

IMARC estimates the global connected drug delivery devices market to exhibit a CAGR of 23.13% during 2025-2033.

The global connected drug delivery devices market is driven by increasing chronic disease prevalence, rising demand for personalized healthcare, advancements in digital health technologies, and the need for improved medication adherence. Additionally, healthcare cost reduction, remote patient monitoring, and regulatory support for innovative medical devices are supporting the market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global connected drug delivery devices market include Adherium Ltd., BioCorp Production, Cohero Health Inc. (AptarGroup Inc.), Elcam Medical ACS. Ltd, Findair Sp. z o. o., Merck KGaA, Phillips Medisize (Molex LLC), Propeller Health (Resmed Inc.), Teva Pharmaceutical Industries Ltd., West Pharmaceutical Services Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)