Construction Chemicals Market Size, Share, Trends, and Forecast by Type, Application, and Region 2026-2034

Construction Chemicals Market Size and Share:

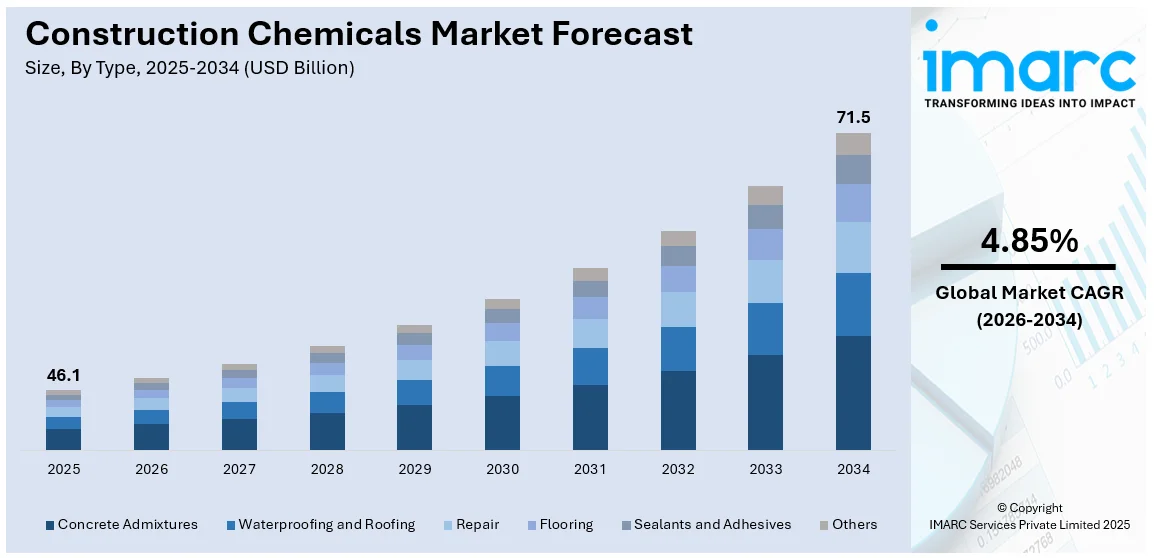

The global construction chemicals market size was valued at USD 46.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 71.5 Billion by 2034, exhibiting a CAGR of 4.85% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 52.0% in 2025. Its dominance is driven by the rising population growth, increasing demand for infrastructure development, rapid urbanization and industrialization, imposition of government initiatives and large-scale investments in smart cities and residential housing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 46.1 Billion |

|

Market Forecast in 2034

|

USD 71.5 Billion |

| Market Growth Rate 2026-2034 | 4.85% |

The increasing urbanization and infrastructure developments across the globe are major factors driving the market for construction chemicals. The transition from rural to urban living is playing a crucial role as this requires significant expenditures for building infrastructure like residential complexes, highways, bridges, and railroads. As per industry studies, the United States' urban population grew by 0.74916% in the year 2023. In order to improve the longevity and functionality of structures, this expansion needs sophisticated construction techniques. Construction chemicals, such as waterproofing agents, sealants, and concrete admixtures, are essential because they enhance the sustainability and quality of these projects.

To get more information on this market Request Sample

United States is among the leading market disrupters due to boosted construction of residential and commercial units, an increased efficiency of technology concerning construction materials, and a rising trend of projects involving retrofitting and renovation in the United States. As reported by the Joint Center for Housing Studies of Harvard University Leading Indicator of Remodeling Activity (LIRA), the two years of 2022 and 2023 in the U.S., home remodeling hit over $400 billion. Homeowners shelled out around $463 billion on renovations in the first quarter of 2024, and more than half (52%) of American homeowners are planning to do some sort of renovation in their homes. These growing renovation activities have led to a rising demand for construction chemicals across the United States.

Construction Chemicals Market Trends:

Growth in Construction Industry

Due to increased urbanization, industrialization, and population growth, the construction sector is majorly impacted on a global scale. The World Bank expects that by 2050, urban populations will be risen by 68%, needing the construction of infrastructure for homes, businesses, and industries. The demand for construction chemicals, which are essential to improve the performance, durability, and efficiency of building materials, is being directly driven by this trend. Large-scale investments in housing and infrastructure improvements in emerging economies like China and India further speed up this rise. For example, China's Belt and Road Initiative and India's Smart Cities Mission are quickening construction activity, which is driving up demand for modern construction chemicals.

Widespread Adoption of Ready-Mix Concrete (RMC)

The adoption of ready-mix concrete (RMC) is transforming construction practices, with contractors increasingly favoring its use for projects such as roads, bridges, tunnels, and dams. This trend is particularly strong in urban centers where time and space constraints demand efficient solutions. Additionally, the versatility of RMC to adapt to various construction conditions ensures its widespread application, driving the demand for related construction chemicals such as admixtures and bonding agents.

Rising Repair and Refurbishment Activities

The need for specialist construction chemicals that are created by rising investments in aged infrastructure repair and refurbishment projects are driving the growth of this market. Through the Federal Highway Administration's (FHWA) Bridge Investment Program, the Biden-Harris Administration has allotted more than USD 5 billion as part of its Investing in America program to finance the rehabilitation, repair, and replacement of 13 nationally significant bridges spread over 16 states. These efforts try to improve freight transport routes, boost economic activity, and increase connectivity. Aside from this, the necessity to update, modernize, and repair outdated infrastructure in order to maintain safety, effectiveness, and resilience in the face of increased urbanization and climatic problems is reflected in this significant expenditure. In a similar vein, European countries are concentrating on renovating ancient structures, which calls for the application of construction chemicals that offer durability while maintaining visual integrity. Products like epoxy adhesives and waterproofing membranes are witnessing heightened demand in these applications, addressing both structural and functional requirements.

Favorable Government Policies

The market for construction chemicals is growing because a significant part of government programs has been devoted to urbanization and infrastructure development. As an example, in India, the government has dedicated 3.3% of GDP to the infrastructure sector in the budget for 2024, where a major focus is placed on logistics and transportation. Roads and highways attract the biggest share of this spend, while railroads and public transportation in cities account for the next. All these expenditure focus on constructing strong, efficient, and eco-friendly infrastructures that result in higher demands for innovative construction chemicals. Legislation supporting green construction practice is also expediting the launch of novel and environmental-friendly chemical solutions. These programs make for a booming industry based on the encouragement of a strong and effective material application. In this respect, these initiatives are creating durable and high-performance material marketplaces, which inculcate stringent environmental and performance characteristics. Such alignment with priorities of the government is imperative because construction chemicals play important roles in modern infrastructure construction.

Construction Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global construction chemicals market, along with forecasts at the global, country and regional levels from 2026-2034. The market has been categorized based on type, application, and region.

Analysis by Type:

- Concrete Admixtures

- Waterproofing and Roofing

- Repair

- Flooring

- Sealants and Adhesives

- Others

Concrete admixtures stand as the largest component in 2025, holding around 49.3% of the market. Due to their extensive use in improving the performance of concrete in a variety of building projects, concrete admixtures account for the biggest market share in the construction chemicals industry. These admixtures, which include retarders, accelerators, plasticizers, and superplasticizers, raise workability, strength, and durability, making them necessary for contemporary infrastructure. Their ability to lower water content, speed up setting, and offer resilience to external factors fits well with the rising need for environmentally friendly and economically viable building solutions. Concrete admixtures are becoming increasingly popular as infrastructure projects and urbanization spread around the world, solidifying their market dominance.

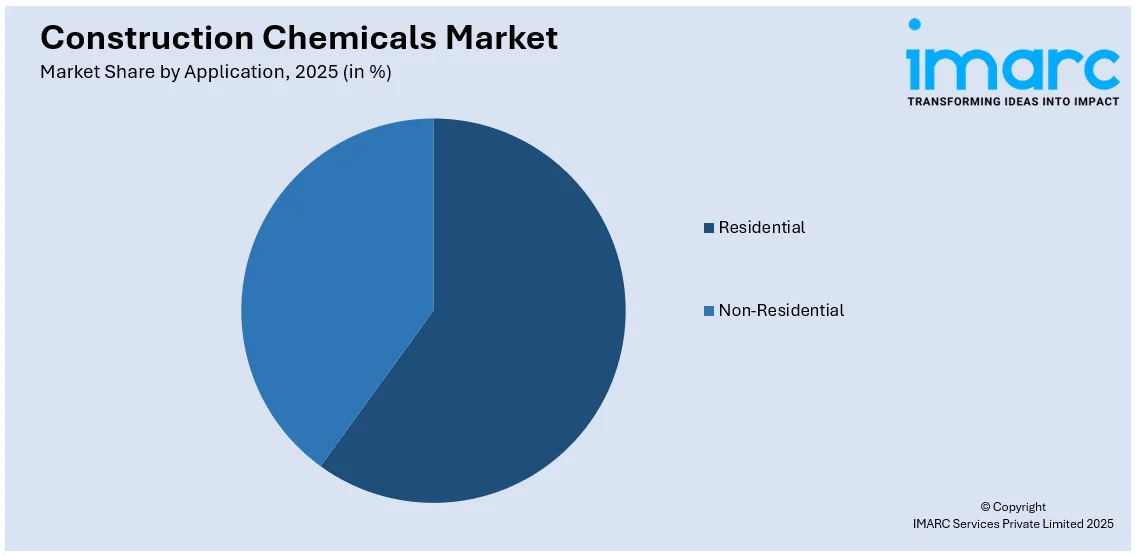

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Residential

- Non-Residential

Non-residential leads the market with around 62.0% of market share in 2025. Commercial, industrial, and institutional buildings, such as offices, factories, schools, hospitals, bridges, and airports are examples of products in the non-residential segment of the construction chemicals market. This segment represents substantial demand for specialty chemicals, including the cement admixtures, sealants, adhesives, protective coatings, and water-proofing chemicals that influence durability, performance, and aesthetic appeal, lowering maintenance costs. The major influences for non-residential construction are urbanization, industrialization, and the governmental investments in the infrastructure developments. The increase in other sectors such as logistics, retail, and healthcare stimulates the demand for more sophisticated construction products.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 52.0%. Due to fast urbanization, population expansion, and considerable infrastructure development in nations like China, India, and Southeast Asia, the Asia Pacific region leads the market for construction chemicals. On top of that, government programs related to industrialization and smart cities have sped up building, increasing demand for cutting-edge chemicals like adhesives, waterproofing agents, and concrete admixtures. Furthermore, the region's cost-effective labor and manufacturing, along with growing expenses in residential and commercial building, are adding to its market leadership.

Key Regional Takeaways:

North America Construction Chemicals Market Analysis

The market for construction chemicals in North America is growing rapidly due to the requirement for upgradation of obsolete infrastructure and renewed focus on sustainable construction methods. Advanced construction chemicals, such as sealants, repair mortars, and coatings, are also in high demand because of the region's robust regulatory framework supporting the use of green and energy-efficient building materials. Market expansion is also supplemented by growing investments in commercial building and renovation projects, especially in the US and Canada.

United States Construction Chemicals Market Analysis

The United States holds 80.30% of the market share. The construction chemicals market in the US is anticipated to increase significantly due to ongoing infrastructure development and a growing demand for durable and eco-friendly building materials. With a focus on important projects including roads, bridges, and public transportation systems, the Infrastructure Investment and Jobs Act (IIJA) has set aside USD 1.2 trillion for infrastructure investments. High-performance construction chemicals, specifically concrete admixtures and waterproofing solutions, increase the longevity and efficiency of infrastructure projects and are hence in demand in such projects. Furthermore, maintenance and repair of old infrastructure have also emerged as a prime reason for the growth in the market. According to the American Society of Civil Engineers (ASCE), the U.S. needs to invest USD 7.4 Trillion by 2033 to address critical infrastructure needs across 11 key areas, including highways, bridges, rail, transit, drinking water, stormwater, wastewater, electricity, airports, seaports, and inland waterways. This made the call for repair chemicals such as epoxy-based resins, bonding agents as critical points in restoring old structures back on track.".

Asia Pacific Construction Chemicals Market Analysis

The Asia-Pacific region alone accounts for the highest market share in the world with the largest revenue for construction chemicals. Among them are roads, airports, bridges, and apartment complexes that are driven by fast-paced urbanization, rapid population growth, and development of economies of nations like China, India, and Southeast Asia. About 4.3 billion people, or 60% of the world's population, live in the Asia-Pacific area, according to the United Nations Population Fund (UNFPA). TThe two most populous countries in the world, China and India, are located in this area, and their combined population significantly increases the need for housing projects, urbanization, and infrastructure development. Aside from extensive requirements for building projects, these population needs drive the growth of this construction chemical market to fill the regional shifts in their demand for building materials that are durable, effective, economical, and most importantly safe to the health of an environment. The growing middle class, along with increasing disposable income, is further driving demand for quality housing and commercial spaces.

Europe Construction Chemicals Market Analysis

Sustainability and regulatory compliance are major factors in the European construction chemicals market. Low-VOC materials, green cement, and energy-efficient chemicals are becoming ever more common due to the European Union's Green Deal and more stringent environmental regulations. The European economy depends heavily on the building industry. With almost 3 million businesses and 18 million direct employees, the construction industry contributes around 9% of the EU's GDP. Investments in urban housing developments and public transit are important market drivers in nations like the UK, France, and Germany. In addition, Europe's pledge to reach net-zero emissions by 2050 encourages more residential, commercial, and industrial projects to use sustainable building chemicals.

Latin America Construction Chemicals Market Analysis

The expansion of residential projects and the construction of infrastructure are majorly impacting the market's strong growth in Latin America. Concrete admixtures, sealants, and flooring solutions are in high demand because of notable countries like Brazil, Mexico, and Chile giving priority to urban housing developments, transportation, and logistics. Additionally, by 2030, the Latin America and the Caribbean (LAC) region would need to invest more than USD 2.2 trillion on vital areas including electricity, transportation, telecommunications, and water and sanitation, according to the Development Bank of Latin America (CAF). This significant investment is necessary to sustain and grow the infrastructure needed to achieve the Sustainable Development Goals (SDGs). In particular, 41% of this sum will go toward repairing and replacing old assets that are reaching the end of their lives, while 59% will go toward building new infrastructure to meet expanding needs. These challenging goals demonstrate the increasing need for refined construction chemicals, which have become essential for improving the sustainability, efficiency, and longevity of both new and old infrastructure projects.

Middle East and Africa Construction Chemicals Market Analysis

The Middle East & Africa (MEA) market is undergoing a transformative construction boom, particularly in the Kingdom of Saudi Arabia (KSA) and the United Arab Emirates (U.A.E.), driven by visionary national agendas and large-scale development projects. Gulf Cooperation Council (GCC) countries, such as the UAE, Saudi Arabia, and Qatar, are investing heavily in modern urban centers, luxury residential projects, and world-class infrastructure, including stadiums and airports. The region’s harsh climate creates a strong demand for waterproofing chemicals, thermal insulation materials, and corrosion inhibitors. In Africa, increasing investments in affordable housing and transportation projects, supported by international funding, are boosting market growth. The MEA region also benefits from its focus on diversification away from oil, with governments prioritizing sustainable urban development and green building certifications.

Competitive Landscape:

Leading companies in the market are actively pursuing strategic initiatives to strengthen their market positions and expand their global footprints. These initiatives include acquiring complementary businesses to enhance product portfolios and entering high-growth regions. Moreover, they are investing in new production facilities and enhancing manufacturing capabilities to cater to diverse construction projects globally. Besides this, companies are also leveraging research and development (R&D) to introduce innovative and sustainable solutions, aligning with the rising focus on green building practices. Apart from this, strategic partnerships and acquisitions are being pursued to strengthen market presence and tap into emerging regions with high growth potential.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- 3M Company

- ACC Limited (Holcim Group)

- Arkema S.A.

- BASF SE

- Conmix Ltd

- Dow Inc.

- Evonik Industries AG (RAG-Stiftung)

- GCP Applied Technologie Inc. (Standard Industries Inc.)

- Mapei S.P.A

- Nouryon Holding B.V.

- Pidilite Industries Limited

- RPM International Inc.

- Sika AG

Latest News and Developments:

- October 2024: Thermax Limited, a leading provider of energy and environment solutions, announced the acquisition of a 100% stake in Buildtech Products India Private Limited. Buildtech specializes in manufacturing admixtures, accelerators, and capsules used in tunnels, infrastructure, and railway projects. This strategic acquisition enhances Thermax's presence in the construction chemicals sector, aligning with its commitment to supporting India's infrastructure development with advanced solutions.

- May 2024: Fosroc India inaugurated a new integrated Construction Chemicals Plant in Hyderabad. This state-of-the-art facility is strategically designed to improve service levels and expand geographical coverage across South and Central India.

- June 2024: Saint-Gobain signed a definitive agreement to acquire FOSROC, a leading global construction chemicals company, for USD 1.025 Billion in cash. This acquisition aims to strengthen Saint-Gobain's presence in construction chemicals, particularly in high-growth markets such as India and the Middle East.

- April 2024: MAPEI S.p.A. launched the Mapeflex MS 55, a hybrid adhesive and sealant with high elasticity. The product is designed for both professional and domestic applications, offering features such as initial solid tack, compatibility with damp surfaces, and low VOC emissions.

- May 2023: Sika AG completed the acquisition of MBCC, enhancing its admixture solutions portfolio. The acquisition integrates MBCC's innovative technologies into Sika's offerings, enabling customers to reduce carbon footprints while strengthening Sika's position in the construction chemicals market.

Construction Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Coverage | Concrete Admixtures, Waterproofing and Roofing, Repair, Flooring, Sealants and Adhesives, Others |

| Applications Coverage | Residential, Non- Residential |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, ACC Limited (Holcim Group), Arkema S.A., BASF SE, Conmix Ltd, Dow Inc., Evonik Industries AG (RAG-Stiftung), GCP Applied Technologie Inc. (Standard Industries Inc.), Mapei S.P.A, Nouryon Holding B.V., Pidilite Industries Limited, RPM International Inc., Sika AG |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the global construction chemicals market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global construction chemicals market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the global construction chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Construction chemicals are specialized products used to enhance the performance, durability, and quality of construction materials and structures. These include concrete admixtures, sealants, waterproofing agents, and adhesives, designed to improve workability, strength, and resistance to environmental factors in both residential and commercial building projects.

The construction chemicals market was valued at USD 46.1 Billion in 2025.

IMARC estimates the global construction chemicals market to exhibit a CAGR of 4.85% during 2026-2034.

The market is driven by rapid urbanization, infrastructure development, and the rising adoption of sustainable building practices. Moreover, technological advancements in construction materials, increasing renovation activities, and growing awareness about enhancing structural durability and safety further boost the demand for these performance-enhancing chemicals.

According to the report, concrete admixtures represented the largest segment by type, as they enhance the strength, workability, and durability of concrete, making them essential for modern construction.

According to the report, non-residential represented the largest segment by application, driven by infrastructure projects, commercial buildings, and industrial developments requiring advanced chemical solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global construction chemicals market include 3M Company, ACC Limited (Holcim Group), Arkema S.A., BASF SE, Conmix Ltd, Dow Inc., Evonik Industries AG (RAG-Stiftung), GCP Applied Technologie Inc. (Standard Industries Inc.), Mapei S.p.A, Nouryon Holding B.V., Pidilite Industries Limited, RPM International Inc., Sika AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)