Contact Center Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, End Use, and Region, 2025–2033

Contact Center Software Market 2024, Size and Trends:

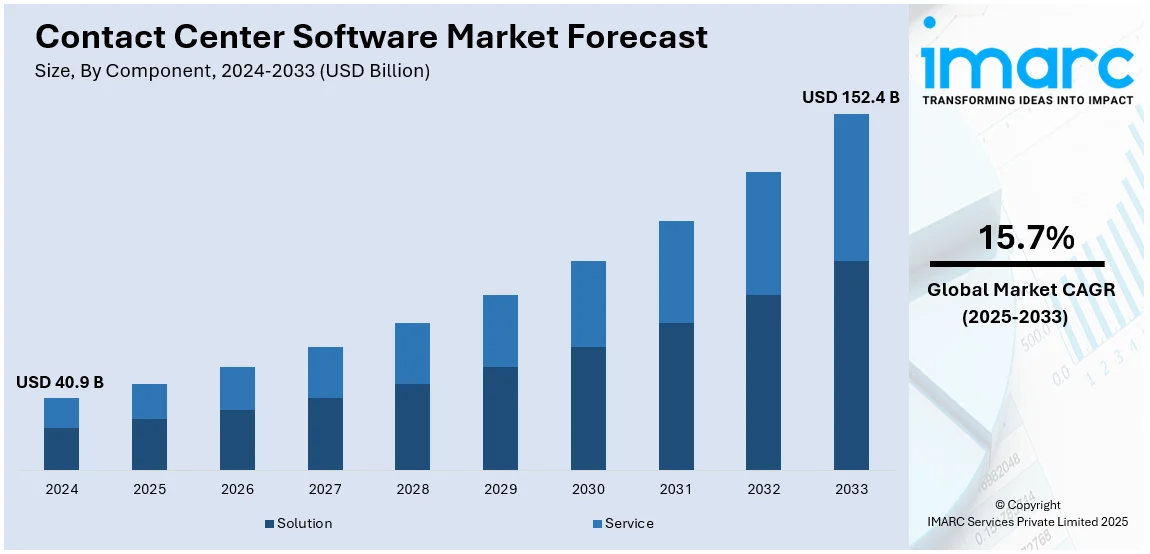

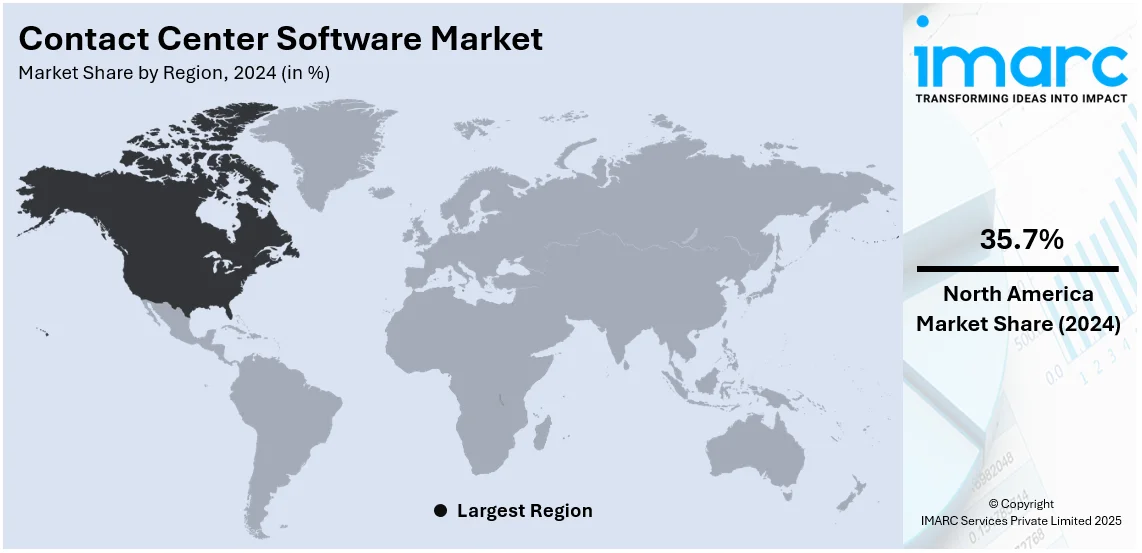

The global contact center software market size was valued at USD 40.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 152.4 Billion by 2033, exhibiting a CAGR of 15.7% from 2025-2033. North America currently dominates the market, holding a market share of over 35.7% in 2024. The growing consumer demand for seamless and personalized interactions with businesses, rising adoption of cloud-based solutions that offer enhanced flexibility, and integration of advanced technologies to improve user experience are some of the major factors propelling the contact center software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 40.9 Billion |

|

Market Forecast in 2033

|

USD 152.4 Billion |

| Market Growth Rate 2025-2033 | 15.7% |

The global contact center software market growth is primarily fueled by increasing demand for efficient customer service solutions across industries. Omnichannel strategies integrating voice, email, chat, and social media enhance engagement and satisfaction. Businesses leverage AI and ML technologies for predictive analytics, chatbots, and sentiment analysis, providing a boost to the efficiency and personalization. On November 12, 2024, Dialpad launched Dialpad Support, an AI-powered solution utilizing DialpadGPT to streamline workflows, reduce burnout, and provide actionable insights. Cloud-based solutions are gaining traction with rising remote work trends, offering scalability and flexibility. Regulatory requirements for data protection and compliance drive investments in secure software. The focus on customer retention and operational cost reduction further supports market growth.

The United States stands out as a key market disruptor, primarily driven by the growing need for seamless customer interactions and superior service delivery. Rapid digital transformation is accelerating the adoption of AI-powered solutions for real-time analytics, intelligent routing, and automation, enhancing customer experiences. The rise of hybrid and remote work models is significantly strengthening demand for cloud-based platforms offering scalability and flexibility. Owl Labs' 2024 State of Hybrid Work Report reveals that 38% of the workforce is now hybrid or remote, a 15% increase from last year, including 27% hybrid workers, up by 4%. Meanwhile, full-time office workers have dropped to 62%, a 6% decline. Expanding e-commerce and personalized, omnichannel support is further driving market growth.

Contact Center Software Market Trends:

Rising Consumer Demand for Seamless and Personalized Interactions

The rising consumer demand for seamless and personalized interactions with businesses is contributing to the contact center software market share. As per to a 2023 report by Salesforce, 76% of consumers anticipate organizations to understand their needs and provide customized experiences. In line with this, contact center software offers various features, such as intelligent call routing, integrated customer relationship management (CRM) data, and real-time customer feedback analysis that assist in enhancing customer satisfaction. These tools enable agents to provide quick and tailored solutions that aid in enhancing the overall customer experience. Apart from this, these tools benefit in stimulating customer loyalty and maintaining the reputation of a business, which is bolstering the growth of the market. As a result, businesses are investing in solutions to remain competitive and ensure that their customer service meets the highest standards.

Growing Adoption of Cloud-based Solutions providing Flexibility

The contact center software market demand is expanding as a result of people's growing use of cloud-based solutions as a result of the global remote work culture. In line with this, organizations increasingly require cloud-based contact center solutions that enable their agents to work from anywhere. Apart from this, cloud-based solutions offer the flexibility needed to maintain operations during disruptions and ensure business continuity, which is propelling the growth of the market. Cloud-based contact centers offer substantial cost savings by reducing reliance on physical infrastructure, with businesses saving up to 40% on operating costs through cloud migration, as reported by International Data Corporation. Furthermore, they reduce the reliance on physical infrastructure, which benefits in saving costs in a business. In addition, there is a rise in the demand for flexible and agile solutions among the masses around the world.

Integration of Advanced Technologies

The rapid integration of advanced technologies, such as data analytics and artificial intelligence (AI), in the contact center software is impelling the growth of the market. Besides this, advanced analytics tools analyze customer interactions to extract valuable insights that can be further used to optimize operational efficiency, improve agent performance, and identify trends in customer behavior. In addition to this, AI-powered chatbots and virtual assistants enhance self-service options and provide immediate responses to common queries that reduce the workload on human agents. For example, 79% of companies report that AI-powered analytics have led to improved customer service, according to a recent study by Salesforce. Moreover, this improves efficiency as well as ensures consistent service quality. Furthermore, AI-driven analysis helps in identifying customer emotions during interactions and allows companies to offer tailored support.

Contact Center Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global contact center software market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, enterprise size, and end use.

Analysis by Component:

- Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Others

- Service

- Integration and Deployment

- Support and Maintenance

- Training and Consulting

- Managed Services

As per the latest contact center software market forecast, solution (IVR) leads the market with around 22.3% of market share in 2024. Incoming client calls are managed and automated by solution Interactive Voice Response (IVR). IVR systems use voice recognition and touch-tone keypad inputs to interact with callers and allow them to navigate through a series of pre-recorded prompts and menus to access the information or services they require. In addition, IVR solutions serve multiple purposes within contact centers. They efficiently route calls to the appropriate agents or departments, aid in reducing wait times, and ensure customers are connected to the right resources. IVR can also handle routine inquiries and transactions, such as checking account balances, making payments, or providing order status updates, without the need for agent intervention.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

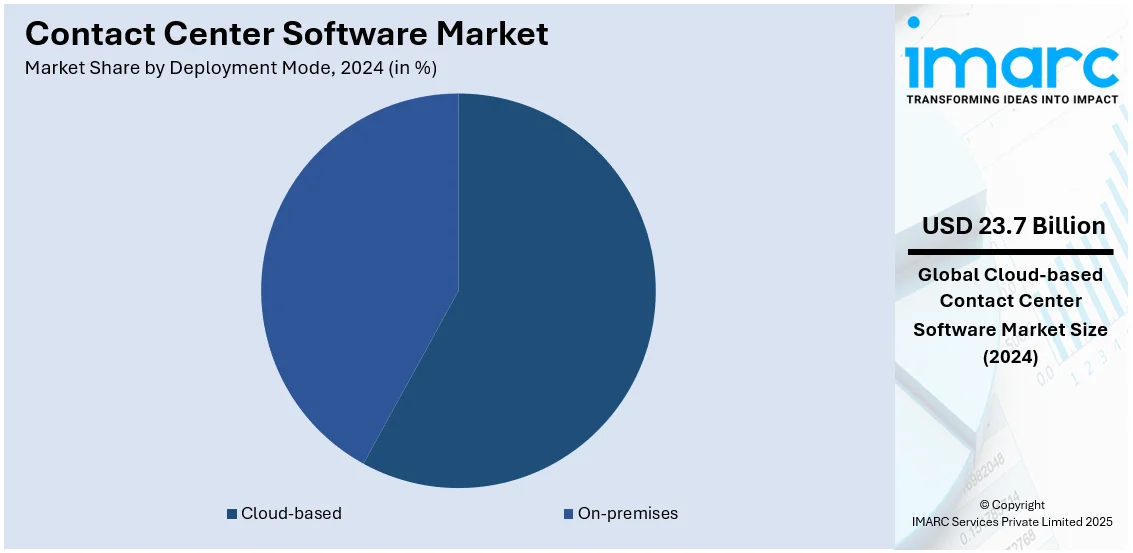

According to the recent contact center software market outlook, cloud-based leads the market with around 57.8% of market share in 2024. Cloud-based refers to solutions that are hosted and operated in the cloud. Furthermore, it provides scalability that allows businesses to easily adjust their contact center capacity to meet fluctuating demand. This flexibility is particularly valuable during peak periods or when expanding operations. Additionally, the cloud eliminates the need for significant upfront hardware and infrastructure investments. Companies can subscribe to cloud-based services to reduce capital expenditures and enable quicker deployment. It also offers geographic flexibility that enables agents to work from anywhere with an internet connection.

Analysis by Enterprise Size:

- Large Enterprise

- Small and Medium Enterprise

Large enterprise leads the market with around 57.6% of market share in 2024. Large enterprises are characterized by their extensive customer bases that often require advanced and highly customizable solutions to effectively manage their customer interactions. Contact center software for large enterprises can handle a high volume of customer inquiries, often across multiple communication channels, without compromising performance or customer experience. It allows for easy expansion as the business grows or experiences seasonal fluctuations in customer demand. In line with this, large enterprises often require advanced features, such as AI-driven analytics, to obtain more meaningful insights into consumer trends and behavior. These insights aid in making data-driven decisions and improving overall customer satisfaction.

Analysis by End Use:

- BFSI

- Consumer Goods and Retail

- Government

- Healthcare

- IT and Telecom

- Travel and Hospitality

- Others

According to the report, consumer goods and retail represented the largest segment. The consumer goods and retail sector comprise a wide range of businesses, such as supermarkets, e-commerce platforms, apparel retailers, and consumer electronics stores. The contact center software plays a vital role in enhancing customer experience and serves as the primary point of interaction between the brand and its customers. It helps in managing inquiries related to product information, order tracking, returns, and general customer support. In addition to this, it assists in facilitating omnichannel customer engagement. It enables businesses to provide consistent and personalized support across these channels.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.7%. North America held the biggest market share due to the increasing focus on enhanced customer service and satisfaction. Apart from this, the rising preference for data privacy and security is contributing to the growth of the market in the region. In line with this, stringent compliance with security is propelling the growth of the market. Besides this, the rising awareness about the importance of effective customer engagement and support is bolstering the growth of the market in the North America region.

Key Regional Takeaways:

United States Contact Center Software Market Analysis

In 2024, the United States represent 80.20% of the North America contact center software market. The U.S. contact center software market is escalating with digital transformation in customer service across industries. Industries such as retail, healthcare, and finance are investing in such technologies with increased demand for omnichannel support solutions and AI-driven tools. According to an industrial report, the U.S. had about 3 million contact center agents in 2022, with a high growth of remote and hybrid models. Key industry players, such as Genesys, Five9, and Cisco, are front-runners in implementing AI, automation, and cloud-based services to improve operations. It is also being influenced by the regulatory policies, like Telephone Consumer Protection Act (TCPA), driving the market to change into new, advanced customer-centric technologies.

Europe Contact Center Software Market Analysis

The demand for the contact center software market of Europe is growing as people prefer automated and cloud-based services. This market is highly dominated by three European countries: Germany, UK, and France. According to an industrial report, contact center agents in the UK were approximately 800,000 in 2022. The growth is driven in the region by the necessity of businesses to improve customer experience and reduce operational complexity by leveraging AI, analytics, and cloud contact center platforms. Moreover, European companies are compelled to adopt more secure and compliant solutions due to very stringent GDPR regulations. Companies such as Atos and Sitel Group innovate in AI-powered chatbots and voice recognition technologies, placing Europe in the center of advanced contact center solutions. For instance, the global provider Altitude Software serves more than 300,000 users through 1,100 customers across 80 countries using its omnichannel platform, Altitude Xperience.

Asia Pacific Contact Center Software Market Analysis

Asia Pacific is growing rapidly in the contact center software market due to technological advancements, increased outsourcing, and digital adoption. Outsourcing continues to lead the market in countries like India, the Philippines, and China. According to an industrial report, as of last year, India hosts approximately 1.3 million agents for contact centers. Markets such as Japan and South Korea are experiencing a high uptake of AI and cloud-based solutions, thus fast-tracking the demand for sophisticated software for contact centers. For instance, hundreds of industry leaders in China are using LCall, an intelligent call center solution, that supports up to 200 agents on a single PC with advanced features such as predictive dialers, IVR, and CRM systems. This is evidence of the increasing demand for high-capacity, flexible, and low-cost solutions across Asia Pacific, which contributes to the market growth.

Latin America Contact Center Software Market Analysis

The contact center software market in Latin America is witnessing rapid growth on account of cloud adoption and high demand for experience enhancement. In Brazil, for instance, companies like Edenred Brazil have transformed the nature of their operations. This is done by abandoning obsolete, on-premises systems to adopt omnichannel platforms from the cloud. For example, in such operations, agent productivity went up by 28% while customer satisfaction reached as high as 97.95%. Edenred, for instance, saved some USD 10,000 a month in maintenance costs from replacing its data center infrastructure with much more efficient cloud solutions. The move also reduced claims on services by 12.64%, which translated to efficiency in operations. The use of AI-powered tools like the EVA chatbot and CRM systems improves customer interactions, reducing the average handle time by 30 seconds. The penetration of cloud solutions in the region is certainly contributing to the strong upward trend registered by Latin American businesses optimizing their contact center operations.

Middle East and Africa Contact Center Software Market Analysis

The Middle East and Africa contact center software market is experiencing an upward trend. Increasing business digitization, government-backed initiatives, and growing demand for contact center services are the primary drivers for the growth of this market. According to an industrial report, in 2022, UAE had approximately 70,000 contact center agents. Saudi Arabia followed closely after that. Demand for AI-driven solutions and automation tools is growing in all the sectors, especially in telecommunication, retail, and banking. Contact centers employ more than 250,000 agents in South Africa alone, thus significantly contributing to the growth of this market region. Dimension Data, the local player, and global players like Avaya innovate for enhancing customer engagement tools. Additionally, smart city initiatives in countries such as Dubai are encouraging the use of more sophisticated customer service technologies, thereby fueling more market growth.

Competitive Landscape:

As per the emerging contact center software market trends, key players are integrating advanced technologies, such as artificial intelligence (AI), machine learning (ML), and natural language processing (NLP), to enhance automation, improve self-service options, and provide more personalized customer interactions. In addition, many companies are expanding their cloud-based offerings that allow businesses to easily adapt to changing customer demands and to support remote workforces. Apart from this, major manufacturers are focusing on omnichannel capabilities. They are enabling businesses to engage with customers seamlessly across various channels, such as voice, email, chat, social media, and short message service (SMS), to ensure a consistent and integrated customer experience. Moreover, companies are focusing on enhancing their analytics and reporting capabilities.

The report provides a comprehensive analysis of the competitive landscape in the contact center software market with detailed profiles of all major companies, including:

- Aspect Software

- Avaya Inc.

- Cisco Systems Inc.

- Enghouse Interactive Inc.

- Five9 Inc.

- Genesys

- International Business Machines Corporation

- NEC Corporation

- Oracle Corporation

- SAP SE

- Unify Inc. (Atos SE)

Latest News and Developments:

- December 2024: Alvaria announced that it reintroduced Aspect as a subsidiary and showcased its WorkforceOS platform, powered by predictive analytics. This relaunch under CEO Darryl Kelly has placed great emphasis on agile workforce solutions.

- October 2024: Cisco launched a series of AI-driven innovations through WebexOne, consisting of the AI Agent Studio, Cisco AI Assistant, and Webex AI Agent. These tools improve interactions with customers, automate inquiries, and increase satisfaction, allowing companies to deliver faster and more empathetic support.

- August 2024: ASAPP introduced its contact center AI software on the Genesys AppFoundry, enhancing customer and employee experiences. The platform addresses issues in the contact center, including balancing superior customer service with cost management.

- March 2024: Avaya expanded its unified Avaya Experience Platform™ to enhance customer and employee experiences. A single platform allows simplification of solutions related to CX, supports cloud flexibility, and integrates the newest advanced AI-driven innovations.

- February 2024: Enghouse Interactive, a subsidiary of Enghouse Systems Limited, has introduced next-generation AI products that are designed to enhance the productivity of contact center agents and deliver transformative insights into customer interactions for better CX capabilities.

Contact Center Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium Enterprise |

| End Uses Covered | BFSI, Consumer Goods and Retail, Government, Healthcare, IT and Telecom, Travel and Hospitality, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aspect Software, Avaya Inc., Cisco Systems Inc., Enghouse Interactive Inc., Five9 Inc., Genesys, International Business Machines Corporation, NEC Corporation, Oracle Corporation, SAP SE, Unify Inc. (Atos SE), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the contact center software market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global contact center software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the contact center software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The contact center software market was valued at USD 40.9 Billion in 2024.

IMARC estimates the contact center software market to exhibit a CAGR of 15.7% during 2025-2033.

The market is majorly driven by rising demand for seamless, personalized customer interactions, increasing adoption of cloud-based solutions offering flexibility, integration of AI for predictive analytics, and growing e-commerce activities that emphasize omnichannel engagement and improved customer service efficiency.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the contact center software market include Aspect Software, Avaya Inc., Cisco Systems Inc., Enghouse Interactive Inc., Five9 Inc., Genesys, International Business Machines Corporation, NEC Corporation, Oracle Corporation, SAP SE, and Unify Inc. (Atos SE), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)