Cookies Market Size, Share, Trends and Forecast by Ingredient, Product, Packaging, Sales Channel, and Region, 2025-2033

Cookies Market Size and Share:

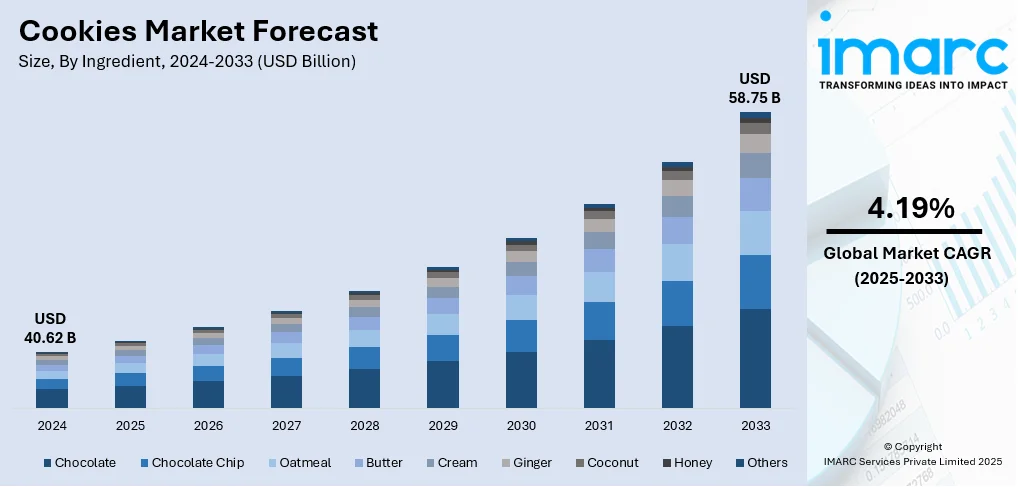

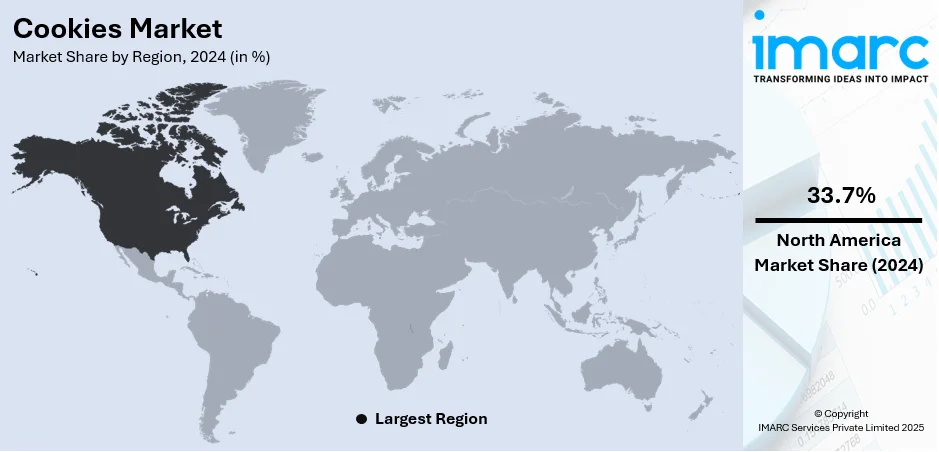

The global cookies market size was valued at USD 40.62 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 58.75 Billion by 2033, exhibiting a CAGR of 4.19% from 2025-2033. North America currently dominates the market, holding a market share of 33.7% in 2024. The dominance of the market is attributed to strong consumer demand, high disposable incomes, and a well-established retail infrastructure. The region benefits from a large variety of product offerings, effective marketing strategies, and an increasing preference for convenient, ready-to-eat snacks, contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 40.62 Billion |

| Market Forecast in 2033 | USD 58.75 Billion |

| Market Growth Rate 2025-2033 | 4.19% |

Ongoing advancements in flavors, textures, and components are among the primary factors propelling the global cookies market growth. Businesses are launching distinctive and novel tastes, high-end choices, and functional cookies that accommodate different dietary needs. This variety maintains the market's vibrancy and attractiveness to diverse consumers. Furthermore, the rise of e-commerce is influencing the cookies market by allowing consumers easier access to a diverse range of cookie brands and flavors. E-commerce sites provide the ease of home delivery, along with special offers and discounts, which further contribute to the market growth. Besides this, many people are favoring brands that implement environment-friendly methods, like utilizing recyclable packaging and sourcing ingredients in a sustainable manner. In response, cookie producers are placing greater emphasis on eco-friendly practices to appeal to these mindful buyers.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by the constant product innovation. Producers are launching innovative flavors, high-end variants, and unique formulations, including keto, paleo, or allergy-conscious choices. For example, in 2025, the Japanese food technology firm Base Food, Inc. revealed its plan to enter the US market with Base cookies. These cookies utilize exclusive technology and are abundant in protein, fiber, vitamins, and minerals, featuring components such as whole wheat, soy, kelp, and rice bran. Apart from this, the growing number of e-commerce platforms are offering convenient access to an extensive selection of cookies, spanning from well-known brands to specialty and unique varieties. Additionally, the ease of home delivery, along with promotional deals and subscriptions, is driving cookie sales.

Cookies Market Trends:

Sustainability and Ethical Sourcing

With rising environmental concerns and sustainability becoming more significant to consumers, the market is progressively embracing eco-friendly practices. Producers are concentrating on ingredients obtained sustainably, including fair-trade-certified chocolate, to appeal to environment conscious individuals. Packaging is vital, as brands are transitioning towards recyclable, biodegradable, or minimized plastic materials to satisfy consumer demand for eco-friendly products. As indicated, a Nielsen survey found that 66% of worldwide consumers are prepared to spend extra on sustainable products, increasing to 73% among Millennials. Furthermore, in 2024, Mondelēz International and Saica launched environment-friendly single-paper packaging for LU cookies, including "Véritable Petit Beurre," cutting down virgin plastic usage by 63%. The FSC®-certified paper packaging was entirely recyclable and supported Mondelēz's sustainability objectives, aiming for 98% of packaging to be recyclable by 2025 under its Vision 2030 plan. Such dedication not only aids in safeguarding the environment but also fosters brand loyalty among consumers who value ethical buying, influencing their purchasing choices.

Expansion of Distribution Channels

The cookies market is growing as a result of broader and varied distribution channels, improving availability for consumers. Cookies can now be found in convenience stores, online grocery services, and dedicated e-commerce websites, enabling brands to access a broader range of consumers. Additionally, collaborations with external delivery services, such as food delivery applications, are enhancing convenience, especially for shoppers in urban areas. In 2024, Tiff’s Treats launched a delivery-exclusive location in Aurora, Colorado, becoming its third site in the state. Renowned for delivering warm cookies, the brand intended to broaden its reach and make gifting easier during the holiday season. Shoppers enjoyed an assortment of traditional cookie flavors and catering services via different delivery. This growth across various touchpoints guarantees that cookies stay easily available and attractive to diverse consumer tastes.

Premiumization and Artisanal Offerings

As consumers increasingly seek premium options, there is a rise in the demand for artisanal, high-quality, and gourmet varieties. According to the IMARC Group, India gourmet foods market size was valued at USD 4.55 Billion in 2024. This shift is driven by a desire for unique, opulent experiences, highlighting quality over quantity. Premium cookies often feature exceptional ingredients, such as organic flour, fine chocolate, and distinctive flavors, appealing to consumers willing to pay extra for superior taste. Key players are responding by introducing unique flavors made with high-quality ingredients to cater to the changing demands of consumers. Besides this, the segment benefits from a growing interest in small-batch, locally sourced, and handcrafted products, offering an authentic, personalized touch. With rising disposable incomes in many markets, consumers are more inclined to purchase premium items, including cookies.

Cookies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cookies market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on ingredient, product, packaging, and sales channel.

Analysis by Ingredient:

- Chocolate

- Chocolate Chip

- Oatmeal

- Butter

- Cream

- Ginger

- Coconut

- Honey

- Others

The chocolate segment is one of the most popular in the cookies market, driven by consumer preference for rich, indulgent flavors. Cookies made with chocolate as a key ingredient cater to a wide range of tastes, from dark to milk chocolate, and even include options like white chocolate. The segment appeals to those seeking a sweet, satisfying treat and is often associated with premium and comfort food offerings.

Chocolate chip cookies are a classic favorite and dominate the cookies market due to their iconic status and broad appeal. This segment benefits from the combination of rich cookie dough and the melt-in-the-mouth quality of chocolate chips. The popularity of chocolate chip cookies is supported by their versatility, as they can be found in various forms, including soft-baked, crunchy, or thick.

Oatmeal cookie provides a nutritious option for those wanting to enjoy flavor without compromise. Incorporating oats into cookies provides a chewy consistency, and these cookies are frequently viewed as healthier because of the presence of whole grains, fiber, and additional wholesome components, such as dried fruits and nuts.

Butter cookies are highly valued for their rich, creamy texture and delicate flavor. The use of butter gives these cookies a smooth and indulgent mouthfeel, making them a preferred choice for those who enjoy traditional, classic baked goods. This segment is popular across various demographics, particularly among consumers seeking a premium, flavorful treat.

Cream-filled cookie caters to those seeking a more luxurious and multi-layered treat. The silky, rich filling contrasts with the frequently crunchy or tender cookie exterior, resulting in a harmonious texture and taste sensation. This segment is greatly preferred by customers looking for a more decadent, sweeter choice with an indulgent texture.

Ginger cookie attracts individuals who appreciate a zesty, comforting taste experience. It is frequently linked to comfort and seasonal enjoyment, especially during the holiday season. The ginger segment appeals to those looking for a strong, fragrant flavor, and its popularity is enhanced by the believed health advantages of ginger, including its digestive and anti-inflammatory effects.

Coconut cookie is favored by those who like tropical and exotic tastes. The addition of coconut contributes a distinctive flavor and texture, as the chewiness of shredded coconut enhances the sweetness of the cookie dough. This segment attracts individuals looking for a unique, tasty cookie experience and is especially well-liked in areas where coconut is a preferred component.

Honey cookie is becoming more popular because of the natural sweetness and richness that honey offers. This segment caters individuals looking for a healthier and more natural substitute for refined sugars. The distinct taste of honey complements a range of other components, enabling a variety of flavor combinations, ranging from straightforward honey-sweetened cookies to those featuring fruits, nuts, and spices.

Others include cookies made with a wide range of unique and innovative ingredients that do not fall into the standard categories. This segment allows manufacturers to experiment with novel flavors, including combinations of superfoods, spices, fruits, nuts, and seeds. It appeals to adventurous consumers looking for new, bold cookie experiences.

Analysis by Product:

- Drop Cookies

- Bar Cookies

- Molded Cookies

- No-bake Cookies

- Ice Box Cookies

- Rolled Cookies

- Sandwich Cookies

- Others

Bar cookies stand as the largest component in 2024, holding 33.7% of the market attributed to their convenience, portability, and capacity to meet diverse consumer tastes. The small and portable design of bar cookies makes them a suitable snack for those on the move, attracting busy individuals looking for quick, fulfilling choices. Moreover, bar cookies are frequently viewed as a healthier option than conventional cookies as they can be made with various nutritious components, attracting health-conscious consumers. The adaptability of bar cookies permits a wide array of flavor creativity, allowing producers to cater to various consumer preferences and dietary requirements. Their uniform dimensions and form guarantee reliable quality, making them a favored option for both consumers and producers. This trend aligns with the cookies market forecast, which predicts continued growth in demand for portable, health-oriented snacks like bar cookies.

Analysis by Packaging:

- Rigid

- Flexible

- Others

Rigid holds the biggest market share, as it offers excellent protection, maintaining the freshness and quality of cookies for longer durations. This type of packaging guarantees that items stay whole while being transported, minimizing the chance of harm and preserving their visual attractiveness on retail shelves. The strong and durable nature of rigid packaging also enhances consumer confidence, as it conveys a sense of premium quality and reliability. Additionally, rigid packaging allows for intricate designs, offering companies the opportunity to create attractive, branded packaging that stands out in competitive retail environments. The durability of rigid packaging enhances shelf life and provides improved defense against environmental elements like moisture and air. These features enhance consumer favor for rigid packaging, especially for premium and high-quality cookie items, establishing it as the favored option for producers in the industry.

Analysis by Sales Channel:

- Online Channels

- Offline Channels

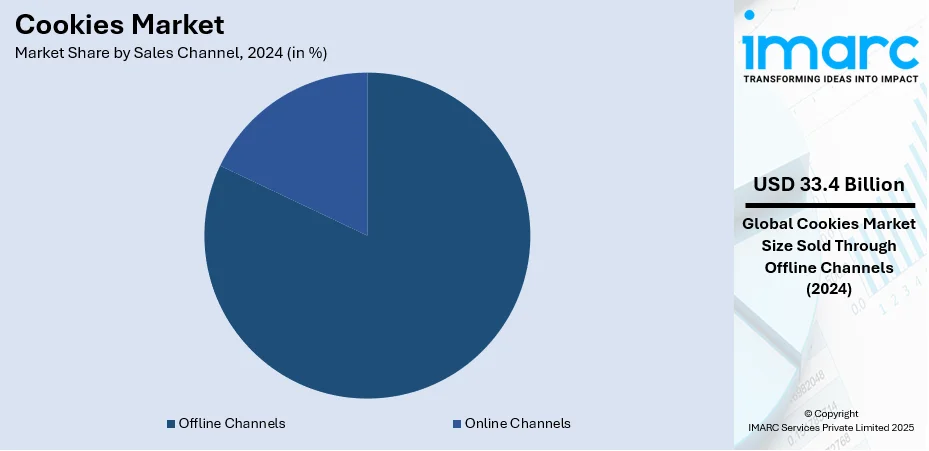

Offline channels represent the largest segment, accounting 82.3%, owing to their extensive and well-established presence, guaranteeing wide consumer accessibility. Physical retail establishments like supermarkets, hypermarkets, and convenience stores enable consumers to directly evaluate product quality and make instant purchasing choices. These platforms provide numerous choices and deals, improving the shopping experience and encouraging spontaneous purchases. Moreover, brick-and-mortar shops frequently offer personalized shopping experiences via in-store displays and tastings, fostering brand loyalty. Additionally, offline retail stores gain from established consumer confidence, as many shoppers favor the immediacy and physical experience that in-person shopping provides. These channels guarantee reliable product availability and visibility, supported by a robust physical infrastructure. These factors align with current cookies market trends, highlighting the continued dominance of offline channels in driving consumer engagement and sales.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 33.7% because of robust consumer demand, significant disposable incomes, and a well-developed retail system. The area gains from a well-established market featuring a variety of products that meet a broad spectrum of consumer tastes, encompassing both healthier and indulgent choices. The rising demand for portable snacks and the convenience provided by cookies is supporting the market growth. Moreover, the emphasis on quality, unique flavors, and high-end products among consumers in the region are encouraging manufacturers to regularly launch new options. For example, in 2024, Coca-Cola and Oreo announced a limited-edition collaboration in Canada, launching two products, including the Oreo x Coca-Cola Sandwich Cookie and Coca-Cola x Oreo Zero Sugar. The sandwich cookie combined Coca-Cola-flavored Oreo wafers with a creamy filling and popping candy. Besides this, the area features strong distribution networks, comprising supermarkets, convenience stores, and online shopping platforms, guaranteeing wide accessibility.

Key Regional Takeaways:

United States Cookies Market Analysis

In North America, the market portion held by the United States was 87.60%, supported by the swift rise of online platforms. For example, in 2025, it is projected that there will be between 2.7 and 3.5 million online shops in the US. Shoppers are increasingly choosing to buy cookies via digital platforms because of convenience, custom offers, and home delivery. Online platforms offer a larger variety of products, accommodating different dietary needs, tastes, and packaging options, enhancing the cookie's attractiveness to a more extensive audience. Due to improved logistics systems and immediate order monitoring, internet platforms are turning into an essential element of cookie distribution. Influencer marketing and focused digital ads enhance the visibility of cookie brands to consumers. The ease of subscription services and same-day shipping further contributes to increasing consumption. As shoppers adopt digital buying habits, online platforms are enhancing cookie visibility, availability, and accessibility, solidifying their robust market presence among various demographics.

Europe Cookies Market Analysis

Europe experiences a rise in cookie adoption as food processing companies actively engage in improving production capacity, diversifying flavors, and innovating packaging. In 2025, Europe has 3,731 food processing startups, including Novozymes, Butternut Box, Bella and Duke, Lesaffre, and Greencore. Among them, 998 startups have received funding, with 645 obtaining Series A+ investment. These businesses emphasize health-oriented formulas, natural components, and transparent labeling to align with changing consumer tastes. Investing in automated baking solutions and eco-friendly processing methods enhances cost-effectiveness and uniform product quality, promoting increased production. Food processing firms partner with suppliers to optimize ingredient procurement and maintain freshness. Manufacturers create buzz around cookies by launching limited-edition flavors and seasonal products. These efforts contribute significantly to the overall cookies market growth, as companies continue to meet evolving consumer demands while increasing their market share and expanding production capabilities.

Asia Pacific Cookies Market Analysis

The Asia-Pacific region is witnessing increasing cookie adoption attributed to the growing presence of supermarkets, hypermarkets, and convenience stores. As of May 5, 2025, India has 66,225 Supermarkets, marking a 3.88% rise since 2023. These retail formats provide more shelf space and better positioning, enhancing product visibility and encouraging impulse purchases. As consumer lifestyles evolve and urban areas become more fast-paced, supermarkets and hypermarkets offer convenient shopping options that promote regular cookie purchases. Convenience stores especially address the demands of on-the-go snacking by providing readily available cookie packs in city areas. Ongoing store growth in emerging regions places cookies nearer to consumers looking for convenient snack choices. Retailers' investment in product variety, promotional discounts, and in-store displays further boosts interest. This expanding retail footprint and the increasing focus on convenience are offering a positive cookies market outlook across the region.

Latin America Cookies Market Analysis

Latin America is witnessing increased cookie consumption because of the growing disposable income among different demographic groups. By 2025, the typical yearly salary in Brazil is about BRL 40,200, equating to roughly USD 7,025.63 annually. As consumer purchasing power rises, people are more drawn to indulgent snack options, including cookies. This change also enables more regular buying of premium cookie options and multi-pack sizes. The affordability paired with increased income levels makes cookies a standard item in household pantries and snacking habits.

Middle East and Africa Cookies Market Analysis

The cookies market in the Middle East and Africa (MEA) is witnessing consistent growth, driven by urban development, increasing disposable incomes, and changing consumer tastes. From 2020 to 2030, the urban populace in the Gulf Cooperation Council (GCC) area is projected to increase by 30%. In the Middle East, cookies frequently include traditional components like dates, nuts, and spices like cardamom and cinnamon, matching regional flavors and cultural traditions. In contrast, African cookies often incorporate local ingredients, such as coconut, cocoa, and indigenous grains, showcasing the continent's rich culinary traditions. This variation in regional flavors meets the unique tastes of consumers throughout the MEA region.

Competitive Landscape:

Major market players are concentrating on product development, launching new flavors, and addressing various consumer tastes, including healthier choices. For example, in 2024, Sunfeast Baked Creations launched its Global Gourmet Cookie range in India for the festive season, inspired by international cafés. The premium line included Rich Choco Chip, Oats and Hazelnut, and Walnut and Choco Chip cookies with globally sourced ingredients. Numerous businesses are putting money into sustainable sourcing and packaging to attract eco-aware individuals. Businesses are also broadening their distribution methods, utilizing both conventional retail and online platforms, to target a wider audience. Strategic alliances, purchases, and joint efforts with other food brands are becoming more prevalent to boost market presence. Moreover, leading companies are applying sophisticated marketing tactics, exploiting social media and focused advertising, to enhance brand loyalty and sustain a competitive edge in a progressively fragmented market.

The report provides a comprehensive analysis of the competitive landscape in the cookies market with detailed profiles of all major companies, including:

- Ben's Cookies

- Britannia Industries Limited (Wadia Group)

- General Mills Inc.

- Great American Cookies

- Grupo Bimbo S.A.B. de C.V.

- Lotus Bakeries

- Mondelez International Inc.

- Nairns Oatcakes Ltd.

- Pacific Cookie Company

- Parle Products

- UNIBIC Foods India Pvt. Ltd.

- Voortman Cookies.

Latest News and Developments:

- July 2025: Mondelez International, Inc. launched the CHIPS AHOY! x Stranger Things Limited-Edition Cookie, blending fudge chips, a chocolatey base, and red strawberry filling inspired by the show's Upside Down. The cookies, along with retro-style packs and an AR game, celebrated cookies through nostalgic branding and fan engagement.

- May 2025: ITC launched Sunfeast Mom’s Magic SHINES, a shiny butter cookie with delicate sugar glazing and eight crunchy layers that delivered a rich, flaky melt-in-mouth experience. Featuring actress Nadhiya Moidu in its new TVC, the cookie celebrated everyday indulgence and added sparkle to butter cookie moments.

- May 2025: Pillsbury launched its new BIG COOKIES refrigerated cookie dough in three indulgent flavors—S’mores, Chocolate Chunk Salted Caramel, and Double Chocolate Cherry—offering oversized, bakery-style cookies baked at home. The cookies, safe to eat raw, marked a flavorful expansion in the refrigerated cookies segment.

- May 2025: Ferrero North America partnered with Warner Bros. to launch limited-edition Keebler fudge stripe cookies featuring Superman-themed designs and red, mixed berry fudge, celebrating the upcoming film and enhancing family cookie moments.

- January 2025: Mother’s® Cookies introduced its first-ever chocolatey cookies, Dynamite Dinosaurs, inspired by Jurassic World, featuring four dinosaur-shaped frosted treats. These cookies marked the brand’s first portfolio addition in four years and delighted families with chocolate bases, blue and green vanilla frosting, and colorful sprinkles.

Cookies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ingredients Covered | Chocolate, Chocolate Chip, Oatmeal, Butter, Cream, Ginger, Coconut, Honey, Others |

| Products Covered | Drop Cookies, Bar Cookies, Molded Cookies, No-Bake Cookies, Ice Box Cookies, Rolled Cookies, Sandwich Cookies, Others |

| Packagings Covered | Rigid, Flexible, Others |

| Sales Channels Covered | Online Channels, Offline Channels |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ben's Cookies, Britannia Industries Limited (Wadia Group), General Mills Inc., Great American Cookies, Grupo Bimbo S.A.B. de C.V., Lotus Bakeries, Mondelez International Inc., Nairns Oatcakes Ltd., Pacific Cookie Company, Parle Products, UNIBIC Foods India Pvt. Ltd. and Voortman Cookies., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cookies market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cookies market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cookies industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cookies market was valued at USD 40.62 Billion in 2024.

The cookies market is projected to exhibit a CAGR of 4.19% during 2025-2033, reaching a value of USD 58.75 Billion by 2033.

The cookies market is primarily driven by consumer demand for convenient, indulgent snacks, growing preferences for healthier options, and innovations in flavor and packaging. Additionally, factors such as increased disposable income, online retail growth, and seasonal demand contribute to the market's expansion, along with evolving dietary trends and shifting consumer behaviors.

North America currently dominates the cookies market, accounting for a share of 33.7%. The dominance of the market is attributed to strong consumer demand, high disposable incomes, and a well-established retail infrastructure. The region benefits from a large variety of product offerings, effective marketing strategies, and an increasing preference for convenient, ready-to-eat snacks, contributing to the market growth.

Some of the major players in the cookies market include Ben's Cookies, Britannia Industries Limited (Wadia Group), General Mills Inc., Great American Cookies, Grupo Bimbo S.A.B. de C.V., Lotus Bakeries, Mondelez International Inc., Nairns Oatcakes Ltd., Pacific Cookie Company, Parle Products, UNIBIC Foods India Pvt. Ltd., Voortman Cookies., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)