Cooking Oil Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Cooking Oil Market Size and Share:

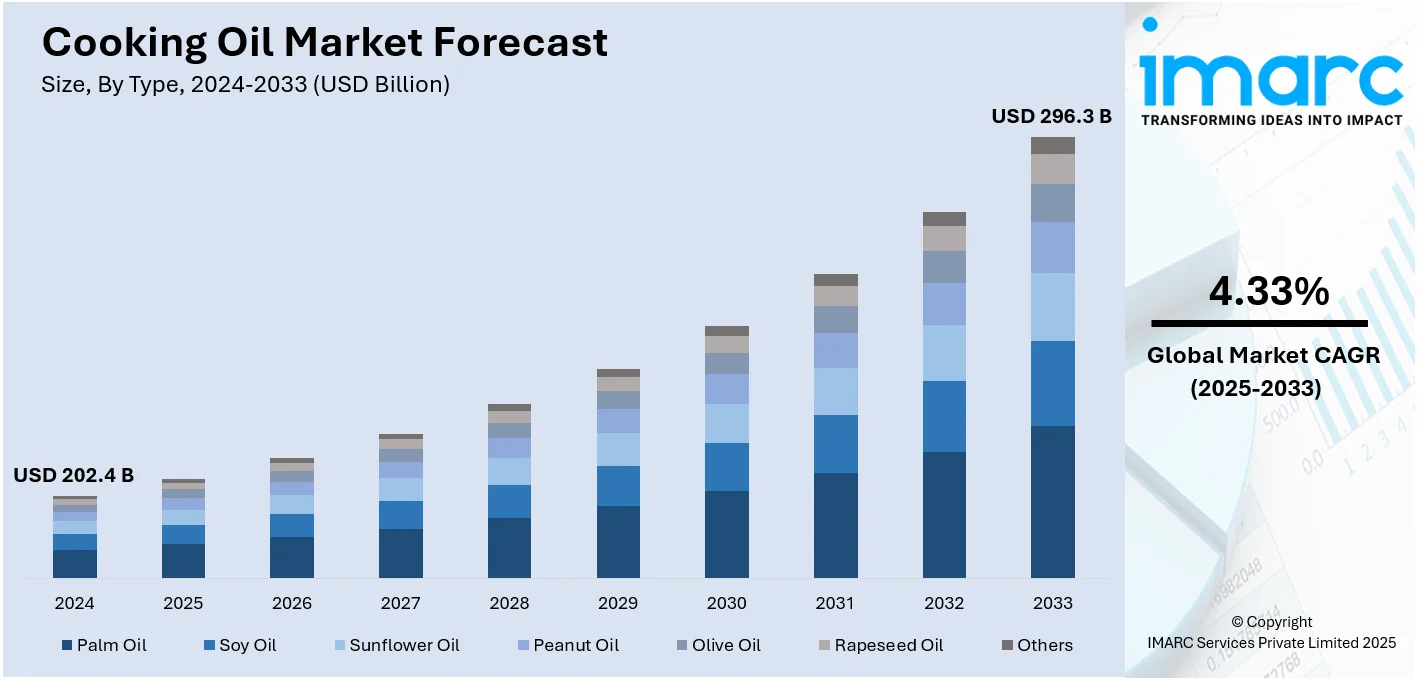

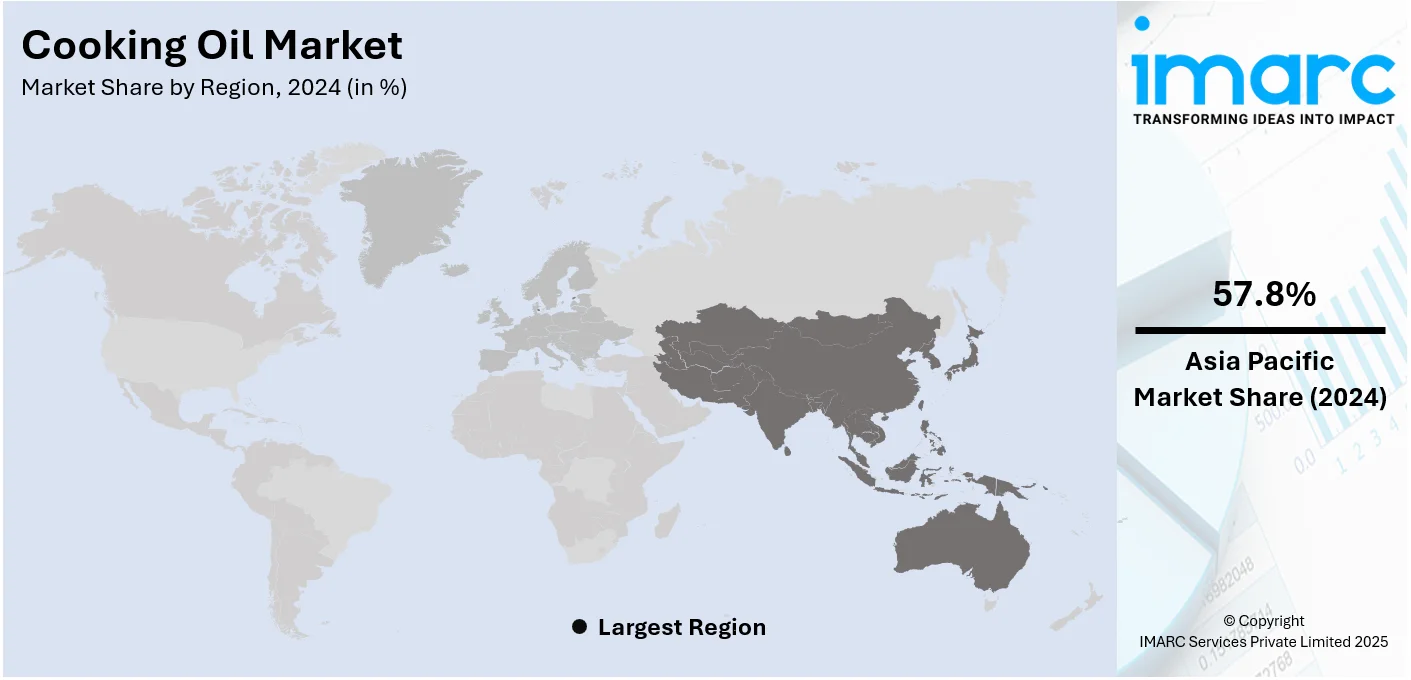

The global cooking oil market size was valued at USD 202.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 296.3 Billion by 2033, exhibiting a CAGR of 4.33% from 2025-2033. Asia Pacific currently dominates the market in 2024. The cooking oil market share is increased by rising awareness about health and wellness, changing individual preferences in dietary requirements, and emphasis on the implementation of sustainability sources and certification related to food.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 202.4 Billion |

|

Market Forecast in 2033

|

USD 296.3 Billion |

| Market Growth Rate 2025-2033 | 4.33% |

The market is growing due to the increasing consumer awareness about health and wellness. The boom in home cooking has significantly propelled the growth in the market. Increased variety in the range of cuisines that consumers try has also added to the need for specialty and premium oils. In addition, plant-based diets have become popular, hence escalating the demand for seed, nut, and vegetable oils, representing another critical cooking oil market trend. Besides, the rapid urbanization and rising disposable incomes, mainly in developing nations, is accelerating market growth with the increase of branded and quality cooking oils purchased by consumers. Innovations in oil processing techniques and the advent of fortified oils enriched with vitamins and minerals also cater to the health-conscious segment. The expanding food service industry and the growing demand for convenience foods contribute to steady growth in the cooking oil market, underlining its essential role in both domestic and commercial kitchens.

The United States has emerged as key regional market for cooking oil, driven by a combination of factors including health trends, convenience, and diverse consumer preferences. Increasing awareness about the health benefits of some oils, such as olive oil, avocado oil, and coconut oil, has led to healthier cooking options. This has been further amplified by increasing concerns over heart health, cholesterol levels, and obesity. The U.S. market is also driven by changes in lifestyle; more consumers are opting for home cooking and trying different cuisines, which has increased demand for a variety of cooking oils. Plant-based diets and vegetarianism also increase the consumption of plant-derived oils. Convenience remains a significant driver, and the rise of pre-packaged oils and ready-to-use products also plays a key role.

Cooking Oil Market Trends:

Rising awareness about health and wellness

According to the report by the IMARC Group, the global health and wellness market reached USD 3,670.4 billion in 2023. There is increasing awareness among consumers of how diet choices impact health. This growing awareness is shifting the trend from saturated oils to healthier alternatives. Oils containing higher amounts of healthful nutrients, such as antioxidants and monounsaturated fats, and having fewer harmful fat components, include olive, avocado, and coconut oil. These oils are gaining popularity based on the different health benefits such as omega-3 which is further creating positive cooking oil market outlook. The consumers enjoy their cooking, which reduces their inflammation and advances their heart wellness. They are also seeking oils that complement dietary guidelines for improving cardiovascular health.

Shift in dietary preference of people

The cooking oil demand is rising due to changes in dietary preferences of people, like ketogenic diets, plant-based diets, and gluten-free diets. Plant-based diets favor oils extracted from plants like avocados or nuts, whereas ketogenic diets might prefer the use of fats like coconut oil and olive oil. Consumers' demand for minimally processed foods with no additives and chemicals is leading to an increased demand for cooking oils. Reports indicate that two in five consumers make healthy food and beverage choices as a way of remaining healthy, and the same percentage aims for a balanced diet. In addition, changing dietary preferences drive innovation in the cooking oil market. Companies in the market are launching new products to meet dietary needs. Some examples are oils that have a high tolerance to temperature without degrading, have a neutral flavor profile, or have special health benefits. For example, on 19 June 2023, the Institute of Natural Sciences and Mathematics scientists came up with vegetable oil blends that exhibit health-benefiting properties. Researchers at SUSU created the ideal oil blend that has a balanced composition of polyunsaturated fatty acids.

Higher emphasis on sustainable sourcing practices and certifications

The increased emphasis on sustainable sourcing practices and certifications is driving the cooking oil market growth. Consumers are more interested in cooking oils that provide clear information about the origin, the source, their production process, and their environmental effects. They prefer products that are labeled clearly and provide information on where the oil comes from, how it was produced, and with what environmental effects. According to IMARC Group, the clean-label ingredients market in 2024 globally reached USD 52.9 Billion. Beyond that, firms focus on complying with consumer needs. On 27 October 2023, KTC Edibles launched Planet Palm, a new portfolio, their biggest brand in the UK within the palm segment, now in supply: sustainable certified and responsibly sourced, certified sustainable and traceable, and sustainably produced, ensuring total clarity from plantations for UK food manufacturers. It is the most recent activity KTC undertakes in its pursuit of a continuous sustainability program where the company wishes to shift perspectives on palm oil and invite more consumers toward such sustainable products.

Cooking Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cooking oil market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, distribution channel, and end user.

Analysis by Type:

- Palm Oil

- Soy Oil

- Sunflower Oil

- Peanut Oil

- Olive Oil

- Rapeseed Oil

- Others

In 2024,palm oil represents the leading segment with a market share of 28.7%, as it is widely used in several food products, such as various cooking oils, margarine, and ready-processed food products. It is much cheaper than many other oils, making it financially appealing to most food companies for use. It is highly productive per hectare of land, which makes it efficient for large-scale production. This high yield contributes to its dominance in the global market, particularly in regions where land availability and agricultural productivity are key considerations. It also has desirable functional properties for food processing, such as a high melting point and stability at high temperatures. Further, major market participants are expanding palm oil manufacturing capability to expand the market share and hence revenue through the cooking oil market. For example, on June 5, 2023, 3F Oil Palm commenced an oil palm plantation in Assam's Lakhimpur district with the government and aspires to expand more than 20,000 hectares in five years in the centrally sponsored scheme.

Analysis by Distribution Channel:

- Hypermarket and Supermarket

- Independent Retail Stores

- Business to Business

- Online Sales Channel

Hypermarkets and supermarkets lead the market with a share of 45.7%, as they play a crucial role in influencing consumer purchasing behavior and furthering the growth of the cooking oil market. These large retail chains cater to a wide spectrum of consumer preferences by offering an extensive selection of cooking oils, ranging from traditional options like vegetable and sunflower oils to premium varieties such as olive, avocado, and specialty oils. Their ability to offer an entire range under one single roof makes the outlets convenient for shoppers who need to buy different things. The hypermarkets and supermarkets facilitate a much better shopping experience by providing them with enough parking space, an extended time of working hours, and an opportunity to easily compare various brands and price comparisons. These stores bring into the market more promotions along with discounts for cooking oils, motivating customers to buy in bulk and achieve higher sales volumes. These types of marketing strategies make cooking oils cheaper and increase brand awareness among customers and build customer loyalty. Through the convenience of shopping, hypermarkets and supermarkets provide a demand-driven supply and actively participate in the increasing trend of global cooking oil consumption.

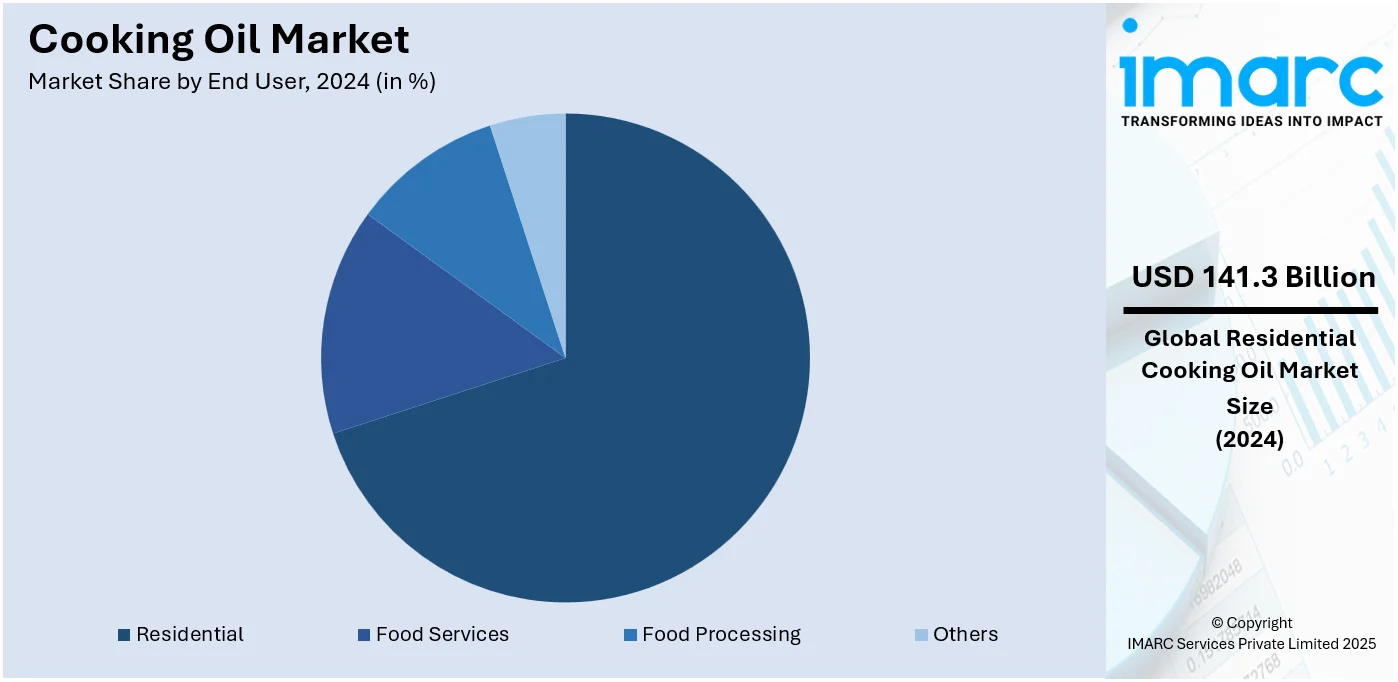

Analysis by End User:

- Residential

- Food Services

- Food Processing

- Others

Residential dominate the market with a share of 69.8%.As a result of the growing diversity in cooking techniques and dietary habits, the demand for residential cooking oils has increased. Consumers prefer maintaining a variety of oils at home to suit their specific culinary requirements, such as traditional staples like vegetable and sunflower oils and healthy options like olive oil, avocado oil, and coconut oil. This reflects the growing interest of consumers in experimenting with flavors and embracing health-conscious choices. This shift toward healthier eating habits further fueled the popularity of oils that are known for their nutritional benefits, such as extra virgin olive oil for cold applications or avocado oil for high-temperature cooking. Households are willing to invest in a diversified oil pantry to accommodate both traditional recipes and modern cooking innovations. These changing trends indicate that cooking oils, being a source of functional and health-related requirements, have led to steady growth in residential consumption and have widened the market globally for cooking oils.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific leads the market. The shifting consumer tastes and preferences in the region are boosting market growth. Cultures and different types of cuisine consumed in this region affect cooking oil consumption patterns. The accelerating pace of urbanization is forcing a rise in the adoption of convenience food items and convenient cooking oils appropriate for different kinds of cooking techniques, thereby accelerating the growth in the region. There are also various major manufacturers in the market that maintain an expansion strategy by opening new farms to produce oil, thus also influencing the market trend of prices for cooking oil. For instance, on 22 May 2024, Dabeeo initiated its newest AI farm monitoring project for palm oil farms in Indonesia, spanning an area bigger than South Korea's capital, Seoul. The company signed a contract with Tunas Sawa Erma Group, one of Indonesia's major palm oil producers, for the project on a total of 765 square kilometers. Dabeeo plans to use AI analysis and ultra-high-resolution satellite imagery to reduce the workload required in the current method of palm oil farm monitoring.

North America's cooking oil market is fueled by an increasing health-conscious consumer base. Increased awareness about the health benefits of oils, particularly olive oil and avocado oil with high levels of monounsaturated fats, results in greater demand for healthier alternatives to cook food. Consumption trends are further fueled by growing plant-based diets, clean-label products, and functional foods. Innovative extraction techniques like cold-pressing, in addition to a growing interest in home cooking, support the upward trend in demand. Further, the growth in demand for non-GMO and organic oil is also due to premium or sustainably sourced products.

Europe-based cooking oil demand is rising amid growing healthier, sustainable, and organic choices. Olive oil remains dominant across Southern Europe. Due to the recognized health benefits of Mediterranean diets. The consumer quest for non-GMO and responsible sourcing is on par with the continued demand for more clean-label products. There is awareness about the nutraceutical contents of various oils, such as sunflower oil, rapeseed oil, and avocado oil, which are considered healthier compared to others. The demand for functional foods, fortified oils enriched with vitamins, and omega-3s acts as a stimulus for market growth.

The driving factors for Latin America's cooking oil market would be increasing disposable income and urbanization, thereby a higher demand for premium oils. Brazil and Mexico are the biggest markets. Their preference for oil is usually for local sources: soybean, palm, and sunflower. As the middle class increases, so does the demand for healthier oils like olive oil and avocado oil. Another thing that impacts consumption is regional diversity in food culture. The increasing demand for processed foods with a focus on healthy items is also fostering market demand.

Growing population and enhanced disposable income within the urban belts are propelling the growth in the cooking oil market in the Middle East and Africa. Increasing usage of processed and fast-food further fuels oil consumption, namely palm, soybean, and sunflower. There is a shift toward healthier, premium oils such as olive and avocado in the GCC countries, mainly due to health awareness. Local oils such as groundnut and palm oil continue to dominate sub-Saharan Africa, although rising middle-class demand for imported, higher-quality oils is also shaping the market.

Key Regional Takeaways:

United States Cooking Oil Market Analysis

In 2024, the United States held 80.0% of cooking oil market in North America due to the growing consciousness among consumers in terms of health and wellness-based lifestyles with better nutrition profiles. Wellness, it has been reported, now accounts for about 50 percent of US consumer's top priority in daily life. From 2020, that rose from 42 percent. Then there is this rich-in-omega-3-fatty-acid, antioxidants, and low-saturated-fat oil. They include olive oil, canola oil, and avocado oil. This would correspond well with the changing consumer preferences relating to natural food items that happen not to be genetically modified organisms (GMOs), as well as items that are either organic or cold-pressed. Studies correlate healthier oil intake with reduced occurrences of cardiovascular and other diseases for which people end up in their hospitals. Second, the great growth of food service operations, such as restaurants, chain operations, and food servicing companies, keeps consuming cooking oils, again in large supplies. Frying oils, especially soybean and palm oils, are widely used in food preparation due to their affordability and functional properties. The growth of convenience food materials and meal delivery services is further catalyzing the need for consistent, high-quality cooking oils, especially in urban areas. Moreover, innovation in oil extraction and refining techniques is improving the quality and shelf life of cooking oils. Premium products can be met by cold pressing, chemical-free extraction, and high packaging solutions, including better sealing and light-resistant containers that ensure the freshness of products to health-conscious consumers.

Europe Cooking Oil Market Analysis

With the growing healthy perception of its cooking oils among European consumers, olive oil, rapeseed oil, and sunflower oil are gaining a lot of interest. The healthful benefits of unsaturated fats, omega-3 fatty acids, and antioxidants support these behaviors. Demand for olive oil alone is increasing. It is core to the well-known Mediterranean diet, which receives much acclaim for protecting against cardiovascular conditions. The growing incidence of cardiovascular diseases is also forcing more people to seek healthy oils. CVDs are the primary cause of disability and premature death in the European Region, causing over 42.5% of all deaths each year, according to WHO. The desire for organic, cold-pressed oils also underlines a tendency toward less processing and higher nutritional value. Another important aspect is sustainability in the cooking oil market in Europe. Consumers and businesses demand oils that are sourced in an environmentally friendly and ethical manner, such as sustainable palm oil certified by the Roundtable on Sustainable Palm Oil (RSPO). Many brands have adopted eco-friendly packaging and traceability measures to meet consumer expectations and comply with stringent EU environmental regulations. In addition, growing interest in Europe toward plant-based and vegan diets is highly impacting the preference for cooking oils. Plant-based oils have become increasingly popular as coconut and avocado oils are highly preferred for versatility in vegan recipes. This trend has gained support by increasing consumers' interest in alternatives to animal-based fats, which meets larger shifts toward ethical and ecological food consumption. European cooking oil manufacturers are investing in innovation to meet changing consumer needs. Blended oils that combine taste, nutrition, and cost-effectiveness are gaining traction. Fortified cooking oils with added vitamins and functional ingredients also cater to health-conscious consumers.

Asia Pacific Cooking Oil Market Analysis

Asia Pacific's fast urbanization and the expansion of the middle class in countries like China, India, Indonesia, and Vietnam drive demand for cooking oil. According to the CIA, in 2023, 36.4% of the total population in India was urban. Higher disposable incomes and changing dietary habits are leading to increasing consumption of fried and processed food items, which rely heavily on cooking oils, such as palm, soybean, and sunflower oil. Urban households increasingly tend to seek packaged and branded oils for quality assurance, further driving market growth. By this trend, consumers in the region are increasingly health conscious and shifting toward perceived health oils. The demand for olive oil and canola oil has especially gained momentum, as they are perceived to be heart-healthy, especially in urban areas, where information and the reach of premium products are higher. Moreover, governments in some countries promote fortified cooking oils containing vitamins A and D to combat malnutrition, which enhances their usage. Apart from this, the easy availability of cheap palm oil in the region has ensured its dominance in both household and industrial use. The versatility and low cost of palm oil have made it a staple in cooking and processed food products, which in turn has driven high consumption in the region.

Latin America Cooking Oil Market Analysis

The Latin America cooking oil market is driven by changing dietary habits, economic factors, and regional agricultural strengths. The increasing urbanization and inflating income levels in countries like Brazil, Mexico, and Argentina are leading to higher consumption of processed and convenience food items. Mexico's urban population was 81.6% of the total population in 2023, according to the CIA. The increasing awareness about maintaining health is encouraging a shift toward oils with better nutritional profiles, such as canola, sunflower, and olive oils. Apart from this, government authorities and health groups are encouraging enriched blending oils for nutritional deficiencies in lower-income groups. Additionally, Latin America is the primary producer of soybeans, sunflowers, and palm, which contributes to cooking oil production. Brazil and Argentina are the largest soybean producers, and in recent times, there has been a steady supply of soybeans for domestic and international markets.

Middle East and Africa Cooking Oil Market Analysis

Traditional cuisines in the region rely heavily on oils like palm, sunflower, and groundnut oil for cooking. Greater population and a rise in income lead to more consumption of these staple oils, especially in urban areas. Increased levels of information about the health values of lower-saturated fats, like olive and canola oil, also account for the demand's increase. The popularity of Mediterranean diets and premium oils is increasing in countries such as the UAE and Saudi Arabia. The region has considerable agricultural production, including palm oil in sub-Saharan Africa and olive oil in North Africa, which provides for local supply and export opportunities. Besides this, rapid growth in the food processing and hospitality sectors drives demand for versatile oils in packaged foods, snacks, and catering services. The UAE hospitality market reached USD 22.7 Billion in 2023, as indicated by the IMARC Group.

Competitive Landscape:

Market players in the cooking oil industry are focusing on innovative products, including a health-oriented theme, like organic, cold-pressed, and fortified varieties of oils. Several companies have begun to innovate new blends, flavors, and oils with added nutrition, like omega-3, and vitamins, among others. In addition, through strategic partnerships and acquisitions, companies can expand their offerings and penetrate further into markets they have not had access to yet. Moreover, the emergence of e-commerce also made market players upgrade their website presence and consider direct-to-consumer models where convenience is made available and even increases brand visibility.

The report provides a comprehensive analysis of the competitive landscape in the cooking oil market with detailed profiles of all major companies, including:

- ACH Food Companies Inc. (Associated British Foods plc)

- American Vegetable Oils Inc.

- Archer-Daniels-Midland Company

- Bunge Limited, Cargill Incorporated

- CJ CheilJedang Corp.

- Fuji oil Holding Inc.

- Indofood Agri Resources Ltd.

- J-Oils Mills Inc.

- Louis Dreyfus Company B.V.

- Marico Limited

- Modi Naturals Ltd.

- Ottogi Co. Ltd.

- Wilmar International Limited.

Latest News and Developments:

- August 2024: The Seed Oil Free Alliance certified a new cooking oil made from algae, produced by Spotlight Foods, which is the first to achieve this certification through fermentation. This oil boasts higher monounsaturated fats than olive oil and a lower environmental impact. It is suitable for high-heat cooking and has a neutral flavor. The certification ensures that products meet rigorous lab testing standards.

- July 2024: Louis Dreyfus Company (LDC) relaunched its consumer edible oil brand, Vibhor, in India, aiming to enhance its market presence in the growing edible oil sector. With over 25 years in India, LDC is leveraging local insights to introduce a refreshed product line, including various oils enriched with vitamins A and D. Targeting both rural and urban consumers, LDC plans significant expansion by 2026, emphasizing quality and health in its offerings.

- May 2024: Adani Wilmar, one of India's largest foods and FMCG companies and a leader in edible oils has unveiled Fortune Pehli Dhaar's first-pressed mustard oil. The new offering will raise the pedestal for the category of mustard oil and present a premium product to serve the segment that can cherish excellent taste, purity, and tradition.

Cooking Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Palm Oil, Soy Oil, Sunflower Oil, Peanut Oil, Olive Oil, Rapeseed Oil, Others |

| Distribution Channels Covered | Hypermarket and Supermarket, Independent Retail Stores, Business to Business, Online Sales Channel |

| End Users Covered | Residential, Food Services, Food Processing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACH Food Companies Inc. (Associated British Foods plc), American Vegetable Oils Inc., Archer-Daniels-Midland Company, Bunge Limited, Cargill Incorporated, CJ CheilJedang Corp., Fuji oil Holding Inc., Indofood Agri Resources Ltd., J-Oils Mills Inc., Louis Dreyfus Company B.V., Marico Limited, Modi Naturals Ltd., Ottogi Co. Ltd., Wilmar International Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cooking oil market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cooking oil market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cooking oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cooking oil market was valued at USD 202.4 Billion in 2024.

IMARC estimates the cooking oil market to exhibit a CAGR of 4.33% during 2025-2033.

The market is driven by rising awareness about health and wellness, changing individual preferences in dietary requirements, and emphasis on the implementation of sustainability sources and certification related to food.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the cooking oil market include ACH Food Companies Inc. (Associated British Foods plc), American Vegetable Oils Inc., Archer-Daniels-Midland Company, Bunge Limited, Cargill Incorporated, CJ CheilJedang Corp., Fuji oil Holding Inc., Indofood Agri Resources Ltd., J-Oils Mills Inc., Louis Dreyfus Company B.V., Marico Limited, Modi Naturals Ltd., Ottogi Co. Ltd., Wilmar International Limited., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)