Cosmetic Implants Market Size, Share, Trends and Forecast by Product, Raw Material, End User, and Region 2025-2033

Cosmetic Implants Market Size and Trends:

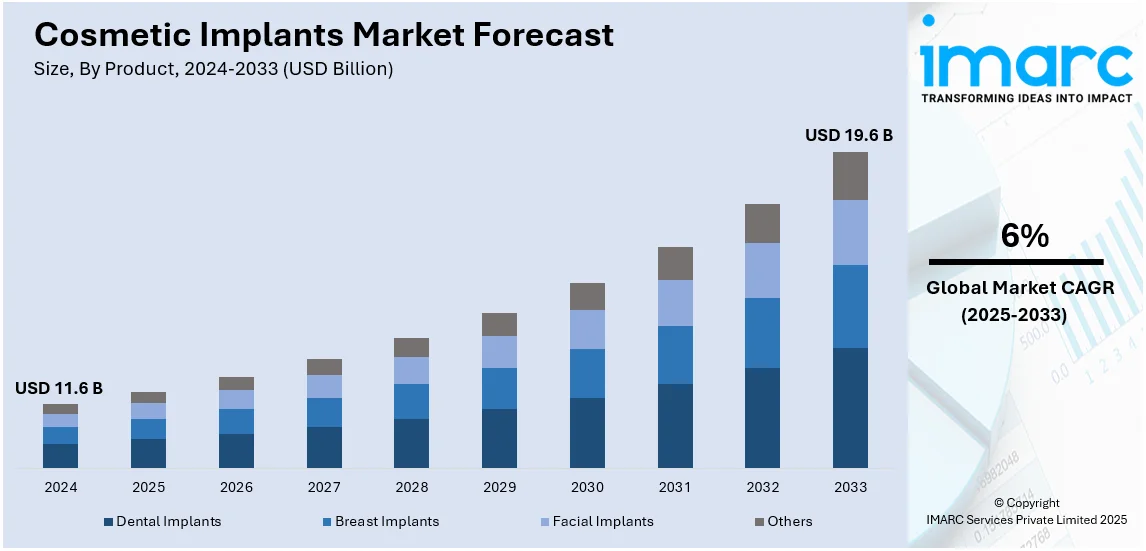

The global cosmetic implants market size reached USD 11.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.6 Billion by 2033, exhibiting a growth rate CAGR of 6% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.5% in 2024. The market is driven by rapid economic development, improved healthcare infrastructure, and rising incidences of congenital disorders, along with increasing social media influence, advancements in minimally invasive surgeries, and technological innovations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.6 Billion |

|

Market Forecast in 2033

|

USD 19.6 Billion |

| Market Growth Rate 2025-2033 | 6% |

Cosmetic implants are devices or tissues that are surgically placed inside or on the surface of the body. They are manufactured from skin, bone, tissues, metal, plastic, ceramic and other materials. They are widely used in surgical procedures to improve appearance or rectify deformities caused due to accidents and congenital disorders. According to the cosmetic implants market insights, the industry is gaining popularity worldwide on account of the growing influence of social media and the rising awareness among individuals about physical appearance.

The global market for cosmetic implants is steadily expanding worldwide. High levels of consumer awareness and acceptance of aesthetic procedures are driving market growth. Technological developments that provide safer and more natural outcomes are also shifting the views of consumers, thereby propelling the adoption of these procedures. Apart from this, increasing disposable incomes and a heightened focus on of body aesthetics are also encouraging many to opt for cosmetic transformations. Some of these consist of breast, facial and dental implants. Technological innovations are also enhancing customization and patient outcomes, further fueling demand. These include 3D printing innovations and improved biocompatible materials. Other factors contributing to industry expansion include the increasing number of trained professionals performing these procedures and suitable healthcare infrastructure. This is particularly evident in developing economies where aesthetic trends are gaining popularity.

The United States has emerged as a key regional market for cosmetic implants. It is driven by a strong demand for aesthetic enhancements on account of cultural emphasis on appearance and body positivity trends. Advancements in implant materials and other innovations are also attracting a broader consumer base. These include silicone and saline options for implants and developments in 3D printing that enable personalized procedures. According to the IMARC Group, the United States 3D printing market size is expected to reach US$ 31.0 Billion by 2032, with a projected CAGR of 21.17% during 2024-2032. Besides this, rising disposable incomes and increased awareness through social media and celebrity influence are encouraging more individuals to opt for various procedures. A well-established healthcare infrastructure and a high concentration of skilled cosmetic surgeons further support overall market growth.

Cosmetic Implants Market Trends:

Growing Popularity of Aesthetic Procedures

The need for cosmetic implants is being primarily driven by the emphasis on physical attractiveness in a society that fosters and endorses such values. This explains the rise in the number of people seeking cosmetic surgeries, for instance, breast or facial implants. In 2023 the International Society of Aesthetic Plastic Surgery reports that more than 15,813,353 surgical cosmetic procedures were performed, of which a substantial number were breast augmentations. Liposuctions and injections of botulinum toxin were the most practiced cosmetic procedures on patients from ages 35-50 years (47.9% and 43.3%, respectively). The age group of 18-34 years registered the highest number of breast augmentations at 54.6% of the total, followed closely by rhinoplasty which accounted for 66.7%. This again reflects the rising demand for cosmetic surgeries and the growing cultural acceptance of the practice.

Advancements in Implant Technology

The market for cosmetic implants is also expanding due to advancements in implant technology, which provide enhanced safety, customisation, and aesthetic results. The European Union’s Scientific Committee on Emerging and Newly Identified Health Risks has released an opinion that supports this claim. Furthermore, 3D printing technology makes it possible to create personalised implants that fit each patient's anatomy, improving procedural precision, and increasing patient satisfaction. Additionally, advancements in nanotechnology and biocompatible materials are improving implant integration and reducing recovery times by as much as 30%. As a result, these technical developments and the increasing demand for minimally invasive procedures are driving patient confidence and the global market's projected growth to over US$ 7 billion by 2030.

Growing Disposable Income and Medical Tourism

The global market for cosmetic implants is significantly influenced by rising medical tourism and growing disposable incomes. As consumers are increasingly able to afford elective cosmetic operations due to higher disposable incomes, there is a growing demand for such procedures. At the same time, medical tourism for cosmetic procedures is expanding, drawing people to nations such as Brazil, Thailand, and India because of their affordable medical care. For instance, a significant percentage of patients seek cosmetic surgery in India, which specialises in orthopaedic, cardiac, and organ transplant surgery, and offers procedures that are up to 50% to 80% less expensive than those in Western countries. As a result, the global cosmetic implants market is steadily expanding as a result of affordability and growing wages.

Cosmetic Implants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global cosmetic implants market report, along with forecasts at the global, regional, and country level from 2025-2033. Our report has categorized the market based on product, raw material, and end user.

Analysis by Product:

- Dental Implants

- Breast Implants

- Facial Implants

- Others

Dental implants lead the market with around 42.8% of the market share in 2024. Due to its strong demand for restoring functionality and aesthetics with missing or damaged teeth, dental implants are a major segment of the cosmetic implants market. The category is growing significantly due to improvements in implant materials, minimally invasive treatments, and increasing awareness about oral health.

Breast implants are a key segment, driven by their popularity in both cosmetic enhancements and reconstructive surgeries post-mastectomy. Advancements in silicone and saline implants, alongside improved surgical techniques, ensure safety and natural results, boosting demand. Cultural trends and rising acceptance of body aesthetics further support growth in this category.

Facial implants cater to individuals seeking enhancements or reconstructive solutions for facial contours. These include chin, cheek, and jawline implants made from biocompatible materials. The rising demand for youthful appearances, combined with innovations in implant design, is driving growth in this specialized market segment.

The others category focuses on niche cosmetic requirements such as pectoral, gluteal, and calf implants. The growth factors in this segment are driven by the popularity of body contouring procedures and advancements in customized implant designs. Increased awareness among body-building enthusiasts and body-enhanced individuals to avail of these solutions enhances growth in this segment.

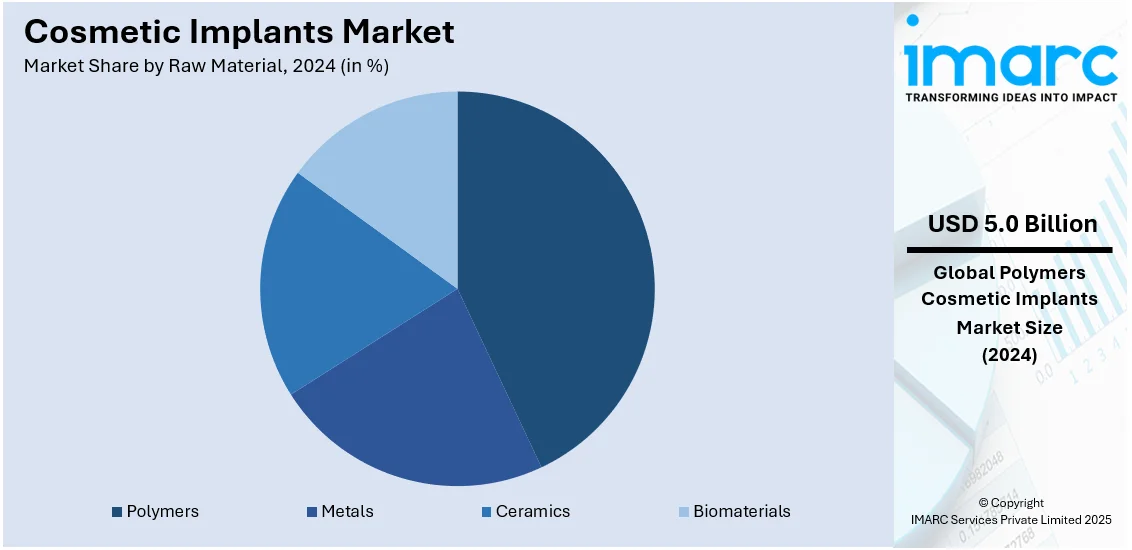

Analysis by Raw Material:

- Metals

- Polymers

- Ceramics

- Biomaterials

Polymers dominate the market with around 43.0% of the market share in 2024. Polymers, such as silicone and polyethylene, are key materials in breast and facial implants. These materials offer flexibility, durability, and biocompatibility. Their ability to mimic natural tissue textures and adapt to various applications drives their demand. Ongoing innovations in polymer formulations improve safety and aesthetic outcomes, expanding their use in cosmetic procedures.

Metals, including titanium and its alloys, are widely used in dental and facial implants due to their strength, durability, and biocompatibility. Their corrosion resistance and ability to integrate with bone make them ideal for long-term applications. Continuous advancements in metal processing techniques enhance their appeal in the cosmetic implants market.

Ceramic materials have particular values in dental implants such that they present with the finest natural appearance, high bio-inertness, and significant high strength. These are well-known to develop an excellent resistance against wear and stain thus best for long-term usage. Advancements in ceramic manufacturing techniques, such as zirconia-based products, are driving growth in this segment.

Biomaterials, including collagen and hyaluronic acid-based substances, are gaining popularity for their biocompatibility and minimal risk of immune rejection. These materials are extensively used in soft tissue augmentation and reconstructive surgeries. Natural integration with the body and rising demand in minimal invasive procedures increase their market share.

Analysis by End User:

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

Due to its infrastructure and qualified practitioners, the hospital segment dominates a huge market share in the cosmetic implants market. In a position to conduct challenging operations, hospitals attract patients with good services that assure quality service provision. Tie-ups with implant manufacturing firms and easy access to recent technological innovations have further enhanced the hospitals' role in this market.

Ambulatory surgical centers are gaining popularity as cost-effective and convenient options for cosmetic implant procedures. Outpatient surgeries combined with quick recovery periods attract patients toward these ambulatory surgical centers. With modern facilities, they offer specialized services which make them a preferred destination for straightforward cosmetic enhancements including dental and facial implants.

Specialty clinics cater to niche markets, offering personalized care for procedures such as breast and facial implants. Their dedicated focus on aesthetic and reconstructive surgeries, combined with expert practitioners, drives their appeal. Clinics often provide a more private and tailored experience, attracting clients seeking specialized cosmetic solutions.

The others category includes home-care settings and independent practitioners who cater to specific cosmetic needs. These settings appeal to patients requiring follow-up care or minimally invasive procedures. Growth in this segment is supported by increasing awareness, accessibility of cosmetic treatments, and demand for personalized, patient-centered solutions.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America is a leading segment with 35.5% of the market share. North America dominates the cosmetic implants market due to high consumer spending on aesthetic procedures, advanced healthcare infrastructure, and widespread adoption of cutting-edge technologies. The presence of leading market players ensures the region remains a key contributor to market growth.

Europe holds a significant market share, driven by increasing awareness about aesthetic procedures and favorable regulatory frameworks. High demand for dental and breast implants and advancements in biomaterials and surgical techniques support industry growth.

Asia Pacific is witnessing rapid growth in the cosmetic implants market due to rising disposable incomes, urbanization, and growing acceptance of aesthetic procedures. Countries such as China, India, and South Korea lead the region, driven by medical tourism, technological advancements, and an expanding middle-class population seeking affordable cosmetic treatments.

Latin America is emerging as a lucrative market, driven by increasing awareness about cosmetic implants and the availability of cost-effective procedures. Brazil and Mexico are key markets, benefiting from skilled professionals, advanced medical facilities, and a rising preference for aesthetic and reconstructive surgeries among the population.

The Middle East and Africa market is growing steadily, supported by rising medical tourism and improving healthcare infrastructure. Countries such as the UAE and South Africa are leading the region, driven by an increasing focus on personal aesthetics and a growing number of high-net-worth individuals seeking premium cosmetic treatments.

Key Regional Takeaways:

United States Cosmetic Implants Market Analysis

The market for cosmetic implants in the United States is fueled by technological advancements, the rising cultural acceptance of cosmetic modifications, and a high demand for aesthetic procedures. Members of the American Society of Plastic Surgery (ASPS) reported 5% more cosmetic procedures in 2023. The number of cosmetic plastic surgery treatments recorded rose from 1,498,361 in 2022 to 1,575,244 in 2023. Furthermore, rising disposable incomes as well as an emphasis on beauty and self-worth are also driving overall industry expansion.

The adoption rates have skyrocketed due to technological development, including minimally invasive treatments and 3D printing, capable of manufacturing custom-made implants. Furthermore, the United States healthcare system provides qualified personnel and world-class surgical facilities, favoring this market. Along with social media, rising awareness and demand have gained momentum due to the constant need for aesthetic enhancements inspired by influencers and celebrities.

Reconstructive procedures are also being backed by insurance coverage, particularly in cases involving breast reconstructions post-cancer. With improvements in materials such as silicone and biocompatible polymers and with changes in customer preference, the industry is poised to expand.

Europe Cosmetic Implants Market Analysis

Rising disposable incomes, sophisticated healthcare infrastructure, and cultural trends are contributing substantially to the growth of the cosmetic implants industry in Europe. Countries such as Germany, the UK, and France have the highest volume of procedures due to their established networks of cosmetic clinics. For instance, Germany is a major market in the region, accounting for over 1,244,466, aesthetic operations in 2023, followed by France with 883,700 procedures and Italy with 757,442 procedures. Due to customer preferences for cosmetic dentistry and body improvements, breast and dental implants are particularly well-liked.

Another significant factor propelling industry expansion is the increasing geriatric population in the region. More and more individuals over 40 are opting for face implants and other rejuvenating treatments to combat the effects of ageing. Bioengineered implants and less invasive procedures are examples of technological developments in implant materials that have greatly improved safety and results, increasing patient confidence. Furthermore, the EU Medical Device Regulation (MDR) and other European regulations guarantee high levels of quality and safety, which draws in customers. In addition to this, the market for cosmetic implants is also expanding due to increased medical tourism, particularly in nations such as Turkey and Poland, which provide procedures at affordable costs. Consequently, Europe has become a steady market for cosmetic implants due to the rise in societal acceptance of cosmetic operations in recent years.

Asia Pacific Cosmetic Implants Market Analysis

Growing economic prosperity, rising desire for aesthetic operations, and cultural changes are driving the Asia-Pacific cosmetic implants industry. The market is dominated by nations such as China, Japan, and South Korea; the latter is referred to as the "global capital of plastic surgery," with over a million surgeries carried out there each year. Cultural demands for perfection and beauty are reflected in the use of implants for breast and face improvements.

Cosmetic implants are also more widely available due to rising middle-class disposable money in developing nations such as Thailand and India. Additionally, government campaigns to support medical tourism have strengthened the market by providing overseas patients with high-quality, reasonably priced procedures, particularly in Thailand and Malaysia.

Latin America Cosmetic Implants Market Analysis

The cosmetic implants market in Latin America is driven by cultural considerations, procedure affordability, and a significant emphasis on physical appearance. With over 2.3 Million treatments performed annually, including a sizable portion of implant surgeries, Brazil leads the world in cosmetic surgery. Both domestic and foreign consumers are drawn to the nation by its highly skilled surgeons and sophisticated infrastructure for cosmetic surgery. Consequently, Latin America has become a popular destination for medical tourism due to the lower cost of cosmetic operations in comparison to North America and Europe. Nations such as Mexico and Colombia also provide excellent services at affordable costs. The region's cultural preferences for body improvements are reflected in the high popularity of breast and buttock implants.

Middle East and Africa Cosmetic Implants Market Analysis

Growing disposable incomes, rising awareness about aesthetic procedures, and the impact of western beauty standards are the main factors propelling the Middle East and Africa (MEA) cosmetic implants market. The region's biggest markets are the United Arab Emirates and Saudi Arabia, where cutting-edge cosmetic operations are available through a growing medical tourism industry. Another important factor is the rising incidence of reconstructive procedures such as mastectomies that are performed after accidents or illnesses. Due to restricted access to modern healthcare facilities, market growth is sluggish in Africa; nonetheless, chances for expansion are being created by growing urbanisation and middle-class populations.

Competitive Landscape:

Key players in the global cosmetic implants market are taking strategic actions to drive growth and meet increasing consumer demand. Companies are investing in research and development (R&D) to create innovative products, such as more natural-looking and durable implants using advanced biocompatible materials. Many are adopting 3D printing technology to offer customized solutions tailored to individual needs. Collaborations with healthcare providers and training programs for surgeons are further enhancing the quality and accessibility of procedures. In addition, marketing strategies focused on raising awareness about the safety and benefits of cosmetic implants are expanding the customer base. Partnerships with e-commerce platforms are also improving product availability, while targeted efforts in emerging markets are tapping into growing opportunities. Regulatory approvals and certifications for new products are also being prioritized to ensure compliance and build consumer trust. Collectively, these actions are fostering market expansion and improving patient outcomes in the cosmetic implants industry.

The report provides a comprehensive analysis of the competitive landscape in the global cosmetic implants market with detailed profiles of all major companies, including:

- 3M Company

- Allergan plc (AbbVie Inc.)

- Danaher Corporation

- Dentsply Sirona

- Implantech Associates Inc.

- Institut Straumann AG

- Johnson & Johnson

- POLYTECH Health & Aesthetics GmbH

- Sientra Inc.

- Zimmer Biomet Holdings Inc.

Latest News and Developments:

- September 2024: Motiva breast implants are a cutting-edge choice for breast augmentation, and Morales Plastic Surgery, a pioneer in sophisticated cosmetic operations, is thrilled to introduce them. Motiva implants, created by Establishment Labs and just authorized by the FDA, combine cutting-edge technology and creative design to give patients outcomes that seem natural and are of excellent quality.

- July 2024: The first dental implant line from BioHorizons with a deep conical connection, Tapered Pro Conical implants, was just introduced. With their proprietary CONELONG connection, which is said to be appropriate for quick surgical procedures for immediate implant cases ranging from single tooth replacements to full arch restorations, the new implants are based on the macro design of the Tapered Pro implant line.

- February 2023: At MD&M West, Maxon unveiled several new motors, including a line of frameless DT motors with internal rotor technology and a series appropriate for implants and surgical robots. Because of their space-saving design, the ECX SPEED 8 motors also include pin connections.

Cosmetic Implants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Dental Implants, Breast Implants, Facial Implants, Others |

| Raw Materials Covered | Metals, Polymers, Ceramics, Biomaterials |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Allergan plc (AbbVie Inc.), Danaher Corporation, Dentsply Sirona, Implantech Associates Inc., Institut Straumann AG, Johnson & Johnson, POLYTECH Health & Aesthetics GmbH, Sientra Inc., Zimmer Biomet Holdings Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cosmetic implants market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cosmetic implants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cosmetic implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cosmetic implants are medical devices surgically placed to enhance physical appearance or restore body structures. These include breast, facial, and dental implants, made from biocompatible materials such as silicone or saline. Cosmetic implants improve aesthetics, address deformities, or restore functionality, catering to personal preferences and reconstructive needs in medical and aesthetic fields.

The cosmetic implants market was valued at USD 11.6 Billion in 2024.

IMARC estimates the global cosmetic implants market to exhibit a CAGR of 6% during 2025-2033.

The rising demand for aesthetic and reconstructive procedures, advancements in implant materials and technology, increasing disposable incomes and consumer spending on cosmetic enhancements, growing awareness and acceptance of cosmetic procedures, and expansion of healthcare infrastructure in emerging economies are primarily driving the global cosmetic implants market.

According to the report, dental implants represented the largest segment by product due to their ability to restore both function and aesthetics, offering a permanent solution for missing teeth.

Polymers lead the market by raw material due to their versatility, lightweight nature, and biocompatibility, making them ideal for various implant applications.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Cosmetic Implants market include 3M Company, Allergan plc (AbbVie Inc.), Danaher Corporation, Dentsply Sirona, Implantech Associates Inc., Institut Straumann AG, Johnson & Johnson, POLYTECH Health & Aesthetics GmbH, Sientra Inc., Zimmer Biomet Holdings Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)