Cosmetic Preservatives Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

Cosmetic Preservatives Market Size and Share:

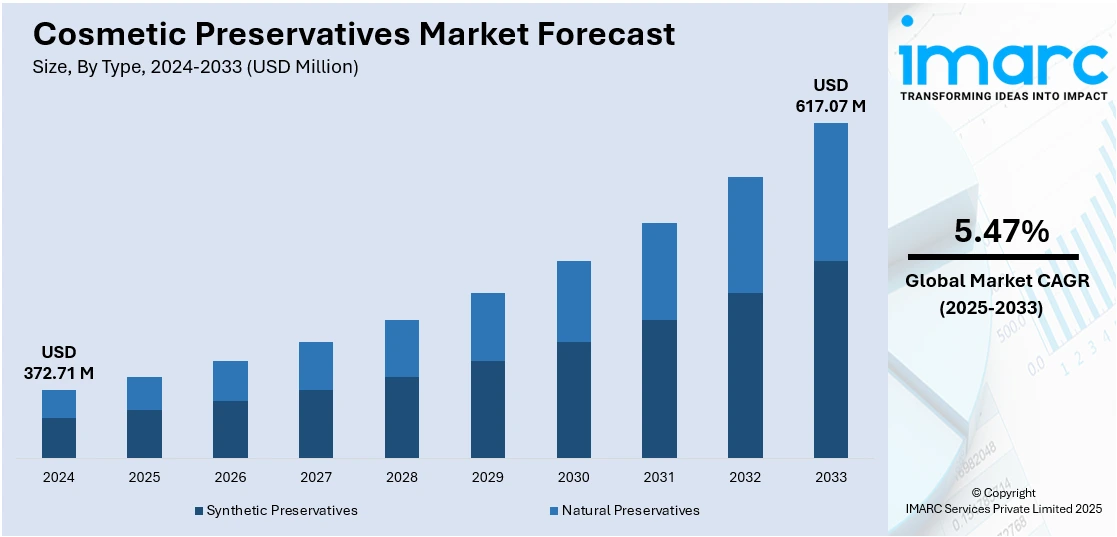

The global cosmetic preservatives market size was valued at USD 372.71 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 617.07 Million by 2033, exhibiting a CAGR of 5.47% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 36.2% in 2024. The dominance of the region is attributed to a strong demand for skincare and beauty products driven by rising awareness about personal care. The preference for both traditional and innovative cosmetic formulations, combined with increasing interest in natural and organic ingredients support the market growth. Furthermore, a broad user base and rapidly evolving beauty trends in countries like China, India, and Japan is contributing to the expansion of the cosmetic preservatives market share in the Asia Pacific region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 372.71 Million |

|

Market Forecast in 2033

|

USD 617.07 Million |

| Market Growth Rate 2025-2033 | 5.47% |

As people gain more knowledge about skincare and hygiene, they seek products that are both effective and safe for use. This recognition is resulting in an increased examination of cosmetic components, especially preservatives. Modern individuals favor items that safeguard their health and contain no harmful substances, which consequently drives the need for safe and effective preservatives. Additionally, the growing inclination towards natural and organic beauty products, motivated by a desire for clean beauty, is positively influencing the market. People are choosing products composed of plant-based ingredients, and preservatives that meet these preferences are becoming more popular. Natural preservatives are viewed as safer and gentler on the skin, positioning them as a vital aspect of this change in user preferences.

The United States plays a vital role in the market, propelled by the enforcement of more stringent regulations to guarantee the safety of cosmetic items. These guidelines guarantee that the preservatives in cosmetics are safe and effective, which creates a demand for high-quality preservatives. Rules regarding product shelf life and ingredient clarity also encourage the use of preservatives by manufacturers that comply with safety standards. Furthermore, according to the US Census Bureau, an increase in the retail e-commerce sales to $300.2 billion during the first quarter of 2025 emphasizes the growing transition towards online purchasing. The rise in e-commerce is catalyzing the demand for cosmetic items to preserve their quality and longevity during long-distance transport, thereby increasing the need for efficient preservatives in beauty and personal care products.

Cosmetic Preservatives Market Trends:

Innovation in Formulation Technologies and Multi-Functional Ingredients

Innovations in cosmetic science are increasing the need for new preservatives that provide multiple functions in addition to microbial defense. Formulators are progressively incorporating ingredients that merge antimicrobial effects with moisturizing, skin conditioning, or antioxidant attributes. Besides this, advancements like nanoencapsulation and slow-release systems improve the effectiveness of preservatives at reduced concentrations, minimizing irritation risks and ensuring product stability. Additionally, preservatives designed for particular product textures, such as emulsions, gels, or wipes, are becoming more popular. Industry participants are partnering with biotech companies to create synthetic bio-identical preservatives that replicate natural compounds while adhering to performance and regulatory requirements. These advancements aid in creating more effective and user-friendly formulations. In 2024, Symrise launched Savelite HB at In-cosmetics Global in Paris, a groundbreaking, single-molecule antimicrobial ingredient made using green chemistry. It offered multifunctional benefits, including moisturization, microbiome-friendliness, and broad pH stability. This new class of preservation was solvent-free, biodegradable, and energy-efficient.

Rising Adoption of Daily Skincare Routines

The increasing incorporation of skincare into daily personal routines, particularly within younger age groups, is fueling the need for stable, long-lasting cosmetic items, which, in turn, is supporting the cosmetic preservatives market growth. As awareness about skincare advantages rises, individuals frequently utilize products like toners, serums, moisturizers, and sunscreens, all of which necessitate efficient microbial defense due to their water content and regular use. A 2023 survey conducted in India revealed that more than 50% of participants aged 18–25 claimed to follow a daily skincare regimen, showcasing a notable change in habits. This trend necessitates preservative systems that uphold product quality during multiple uses while being gentle on delicate skin. With the growth of the skincare sector and an increasing demand for performance, safety, and clean-label aspects in daily products, preservatives that ensure effectiveness while being gentle are crucial for brand success and gaining user confidence.

E-Commerce Growth and Longer Supply Chains

The swift expansion of e-commerce is transforming the distribution, storage, and management of cosmetics, highlighting the importance of preservative performance. Goods are currently transported over extensive distances, held for extended periods, and subjected to varying temperatures and humidity, which include settings without climate control. Under these circumstances, preservatives need to guarantee stability and inhibit microbial growth over prolonged shelf lives. Additionally, online returns, repackaging, and third-party logistics present extra contamination risks, particularly for items that have been opened or partially utilized. As a result, brands are emphasizing preservative systems that are resilient and compatible with different formulations to ensure product quality throughout the entire distribution process. As per the India Brand Equity Foundation (IBEF), India's e-commerce sector was estimated at Rs. 10,82,875 crore (US$ 125 billion) in FY24 and is estimated to attain Rs. 29,88,735 crore (US$ 345 billion) by FY30, expanding at a CAGR of 15%, highlighting the increasing demand for preservative dependability in this sector.

Cosmetic Preservatives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cosmetic preservatives market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, product, and application.

Analysis by Type:

- Synthetic Preservatives

- Natural Preservatives

Natural preservatives dominate the market as individuals favor clean and safe beauty products. With an increasing number of people focusing on health-oriented options, the need for natural components, such as plant-derived preservatives, is growing significantly. These preservatives, including essential oils, plant extracts, and antioxidants, are viewed as safer and more eco-friendly than synthetic options. Moreover, natural preservatives correspond with the rising trend of organic and sustainable cosmetics, as users look for products devoid of harmful chemicals. Regulatory agencies are also endorsing the utilization of natural preservatives, ensuring that products comply with safety regulations. Natural preservatives enhance the longevity of products without degrading the quality of ingredients, providing a significant benefit. The clean beauty movement, along with an increasing awareness about skin sensitivities and allergies, is strengthening the market presence of natural preservatives.

Analysis by Product:

- Paraben Esters

- Formaldehyde Releasers

- Phenol Derivatives

- Alcohols

- Inorganic Chemicals

- Quaternary Compounds

- Organic Acids and their Salts

- Others

Phenol derivatives stand as the largest component in 2024, holding 36.9% of the market. The dominance of the segment is because of their potent antimicrobial characteristics and wide-ranging effectiveness against bacteria, mold, and yeast. Preservatives like phenoxyethanol and ethylhexylglycerin are commonly utilized in cosmetic products to inhibit microbial growth and prolong shelf stability. Their efficiency at minimal concentrations renders them an economical option for producers. Moreover, phenol derivatives are reliable and adaptable, appropriate for various cosmetic items, such as lotions, shampoos, and cosmetics. Their capacity to operate in various pH conditions further increases their appeal. Regulatory agencies also authorize numerous phenol derivatives, bolstering their common application in cosmetics. The increasing need for items with extended shelf life and improved safety is catalyzing the demand for phenol derivatives. Moreover, phenol derivatives are frequently regarded as safer options compared to conventional preservatives, such as parabens, leading to their growing popularity in the clean beauty trend.

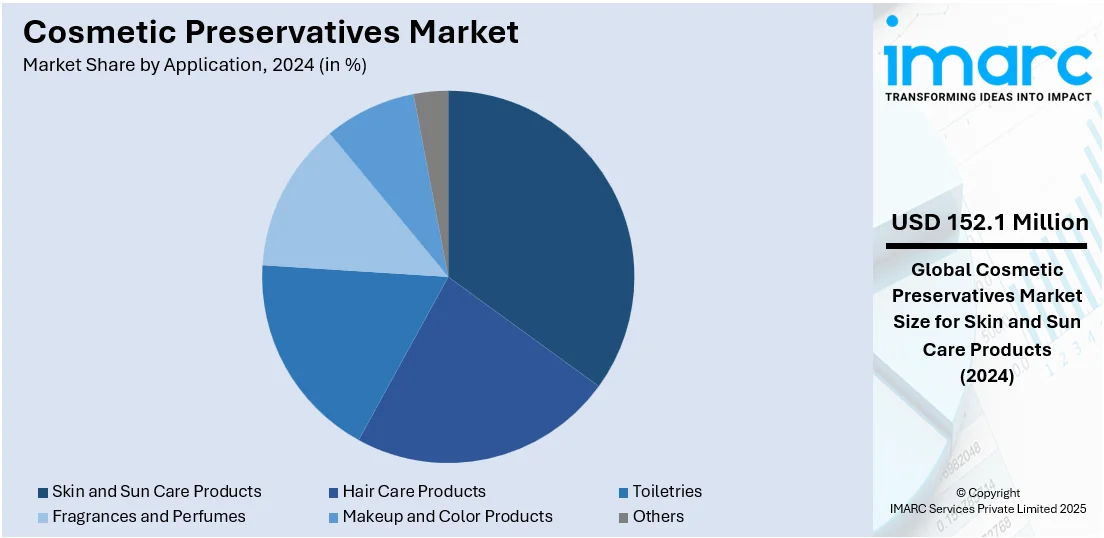

Analysis by Application:

- Skin and Sun Care Products

- Hair Care Products

- Toiletries

- Fragrances and Perfumes

- Makeup and Color Products

- Others

Skin and sun care products lead the market with 40.8% of market share in 2024, as awareness about skincare rises and the demand for products that safeguard and enhance the skin expands. Products, such as sunscreens, moisturizers, anti-aging creams, and serums, are very vulnerable to microbial contamination, necessitating the use of effective preservatives to ensure their safety and prolong shelf life. The increasing occurrence of skin concerns, including pigmentation, acne, and aging, is catalyzing the demand for specialized skin care items, thereby increasing the requirement for preservatives. Sun care products, specifically, need preservatives to maintain their stability and effectiveness in different conditions, like being exposed to heat and sunlight. Moreover, the growing popularity of outdoor activities, particularly in areas with significant sun exposure, boosts the need for sunscreen and sunblock products. The cosmetic preservatives market forecast indicates continued growth, driven by the rising demand for skin and sun care products and the rising focus on product safety and efficacy.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 36.2% because of its extensive and varied user base, quickly expanding beauty and personal care sector, and a rising inclination towards skincare and cosmetic products. For instance, the beauty and personal care market in India was valued at USD 28 billion in 2024 and is projects the market to attain USD 48.3 Billion by 2033, as per the IMARC Group. Besides this, the area's preference for natural and organic beauty products further increases the need for effective preservatives that ensure safety without sacrificing ingredient quality. Moreover, the Asia Pacific region is emerging as a center for the production and utilization of personal care items, creating a robust market for preservatives. The growing emphasis on skin health, beauty, and cleanliness, along with the rise of e-commerce platforms and retail distribution, further offers a favorable cosmetic preservatives market outlook.

Key Regional Takeaways:

United States Cosmetic Preservatives Market Analysis

In North America, the market portion held by the United States was 84.30%, mainly propelled by an increasing need for extended shelf life and stability in personal care and beauty products. With the growing preference among individuals for multifunctional skincare and cosmetic products, manufacturers are dependent on preservatives to guarantee microbiological safety and sustain product effectiveness over time. The expansion of natural and organic products is influencing the market growth, leading to the creation and use of naturally sourced or gentle preservatives that satisfy clean-label requirements while maintaining effectiveness. Moreover, the growing men's grooming and anti-aging markets are leading to increased production volumes of creams, lotions, and serums, which necessitate efficient preservation because of their high-water content. As per a report from the IMARC Group, the market for men's grooming products in the United States attained USD 18,292.3 Million in 2024 and is expected to expand at a CAGR of 4.81% from 2025 to 2033. Regulatory supervision by the U.S. FDA and user ingredient scrutiny are also encouraging companies to invest in safer, compliant preservative systems. In addition, individual awareness regarding specific conventional preservatives like parabens and formaldehyde donors is fostering the development of alternative mixtures, such as phenoxyethanol, ethylhexylglycerin, and potassium sorbate.

Europe Cosmetic Preservatives Market Analysis

The European cosmetic preservatives market is witnessing growth, driven by the rising demand for multifunctional, durable formulations that need advanced preservation methods. The growing popularity of multi-step skincare routines and products that integrate cleansing, moisturizing, and protective functions is catalyzing the demand for preservatives that guarantee stability and effectiveness during the entire shelf life of intricate formulations. A survey carried out in Poland with 412 participants aged 18-29 indicated that 58% of those surveyed have begun to emphasize their facial skincare routines more, especially following the COVID-19 pandemic, according to the National Institutes of Health. Moreover, the growth of the e-commerce industry in Europe results in products being subjected to different shipping and storage conditions, highlighting the necessity for preservatives that maintain quality throughout transit and over time. A Eurostat survey conducted in 2024 revealed that 77% of individuals aged 16-74 in the European Union reported buying services or goods online in the past twelve months. Primarily, the 25-34 and 35-44 age brackets were the key drivers of e-commerce expansion in the EU in 2024. In addition to this, the rising preference for personalized beauty and skincare products, where users choose items designed for their individual skin issues, is driving the demand for effective but safe preservatives.

Asia Pacific Cosmetic Preservatives Market Analysis

The cosmetic preservatives market in the Asia Pacific is progressively expanding as the beauty and personal care industry flourishes in the area, especially in nations like China, India, and Japan, where swift urbanization and rising disposable income are elevating the demand for cosmetic goods. With increasing user awareness about skincare and hygiene, there is a rise in the demand for safe and efficient preservatives to avert microbial contamination in items like lotions, creams, and shampoos. Moreover, the growing demand for natural and organic products is leading to the creation of plant-derived and gentle preservatives that satisfy clean-label requirements. For example, a 2024 survey indicated that 71% of individuals in India favored natural beauty products instead of synthetic ones. In addition to this, the increasing trend of K-beauty and J-beauty products is greatly influencing the market, emphasizing high-performance skincare formulations that demand sophisticated preservation methods.

Latin America Cosmetic Preservatives Market Analysis

The market for cosmetic preservatives in Latin America is strongly driven by the rising demand for personal care and cosmetic items, along with heightened user awareness regarding product safety and hygiene. For example, the market for beauty and personal care products in Brazil attained USD 29.9 Billion in 2024 and is projected to expand at a CAGR of 4.11% from 2025 to 2033. With the growth of the beauty and skincare sector in the area, producers are concentrating on creating products that are safe and effective for users, resulting in an increase in the utilization of preservatives. Regulatory bodies in Latin America, like the Brazilian Health Regulatory Agency (ANVISA), are advocating for stricter safety regulations, guaranteeing the application of safe and effective preservatives in cosmetic products.

Middle East and Africa Cosmetic Preservatives Market Analysis

The cosmetic preservatives market in the Middle East and Africa is shaped by swift urban growth, an expanding middle class, and a rising need for premium beauty products. As people become more aware about skincare and personal hygiene, the demand for efficient preservatives to maintain product safety and durability is increasing. Moreover, the demand for both high-end and affordable cosmetics is growing, especially in nations like the UAE, Saudi Arabia, and South Africa, where shoppers are spending on premium beauty items. According to IMARC Group, the luxury cosmetics market in Saudi Arabia attained USD 491.8 Million in 2024 and is expected to expand at a CAGR of 3.48% from 2025 to 2033. Regulatory demands for upholding elevated safety standards in cosmetics are significantly driving the use of dependable preservative systems.

Competitive Landscape:

Major participants in the market are concentrating on innovation, placing significant importance on natural and organic solutions to satisfy user demand for clean and sustainable products. They are allocating resources to research activities to design preservative systems that are effective and safe, addressing the growing worries about harmful substances. For instance, in September 2024, Dermegen Inc. introduced Dermacare NP, the company’s natural synergistic preservative cosmetic blend that can be used as a substitute for phenoxyethanol. The ingredient, which was obtained by fermentation, offered unparalleled broad antibacterial protection over an extensive pH range and provides synergistic activity via its peptide complex and esters. Moreover, market leaders are increasing their international footprint by forming strategic alliances, making acquisitions, and broadening distribution channels to access emerging markets.

The report provides a comprehensive analysis of the competitive landscape in the cosmetic preservatives market with detailed profiles of all major companies, including:

- Akema Fine Chemicals

- Ashland Global Holdings Inc.

- BASF SE

- Chemipol

- Clariant AG

- Lonza Group AG

- Salicylates and Chemicals Pvt. Ltd.

- Symrise AG

- Dow Inc.

Latest News and Developments:

- March 2025: Alfa Chemistry announced intentions to expand its line of cosmetic components to include cosmetic preservatives, additional antioxidants, emulsifiers, and UV absorbers, in an effort to strengthen its presence in the beauty sector. The initiative will provide cosmetic enterprises with the high-quality raw materials they require to make skincare and cosmetic products that are both safe and effective.

- March 2025: Clariant introduced Nipaguard SCE Vita, a naturally generated preservative solution for cosmetic compositions without problematic preservatives. Nipaguard SCE Vita provides a strong, contemporary solution that will improve product protection and satisfy consumer demands for sustainability and safety.

- January 2025: Seqens unveiled the AdvensProtect 8 Green, a 100% biobased caprylyl glycol that acts as an emollient and preservative enhancer for cosmetics. This solution, which was created and produced at Seqens' UK facility, provides a multipurpose method of improving formulations for a variety of personal care products.

Cosmetic Preservatives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Synthetic Preservatives, Natural Preservatives |

| Products Covered | Paraben Esters, Formaldehyde Releasers, Phenol Derivatives, Alcohols, Inorganic Chemicals, Quaternary Compounds, Organic Acids and their Salts, Others |

| Applications Covered | Skin and Sun Care Products, Hair Care Products, Toiletries, Fragrances and Perfumes, Makeup and Color Products, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akema Fine Chemicals, Ashland Global Holdings Inc., BASF SE, Chemipol, Clariant AG, Lonza Group AG, Salicylates and Chemicals Pvt. Ltd., Symrise AG and Dow Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cosmetic preservatives market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cosmetic preservatives market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cosmetic preservatives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market

Key Questions Answered in This Report

The cosmetic preservatives market was valued at USD 372.71 Million in 2024.

The cosmetic preservatives market is projected to exhibit a CAGR of 5.47% during 2025-2033, reaching a value of USD 617.07 Million by 2033.

The cosmetic preservatives market is growing because of the rising demand for long-lasting, safe, and effective cosmetic products. Increasing user awareness about skin health, rising product innovations, and the shift towards natural and organic ingredients are also key factors bolstering the market growth.

Asia Pacific currently dominates the cosmetic preservatives market, accounting for a share of 36.2%. The dominance of the region is attributed to its large user base and the growing demand for personal care products. The increasing middle-class population, rising disposable incomes, and evolving beauty trends also contribute the market growth. Additionally, the presence of major manufacturing hubs and expanding retail sectors further boost market dominance.

Some of the major players in the cosmetic preservatives market include Akema Fine Chemicals, Ashland Global Holdings Inc., BASF SE, Chemipol, Clariant AG, Lonza Group AG, Salicylates and Chemicals Pvt. Ltd., Symrise AG, Dow Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)