Cotton Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Cotton Price Trend, Index and Forecast

Track real-time and historical cotton prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Cotton Prices October 2025

| Region | Price (Pricing Index) | Latest Movement |

|---|---|---|

| Global | 0.98 | -1.7% ↓ Down |

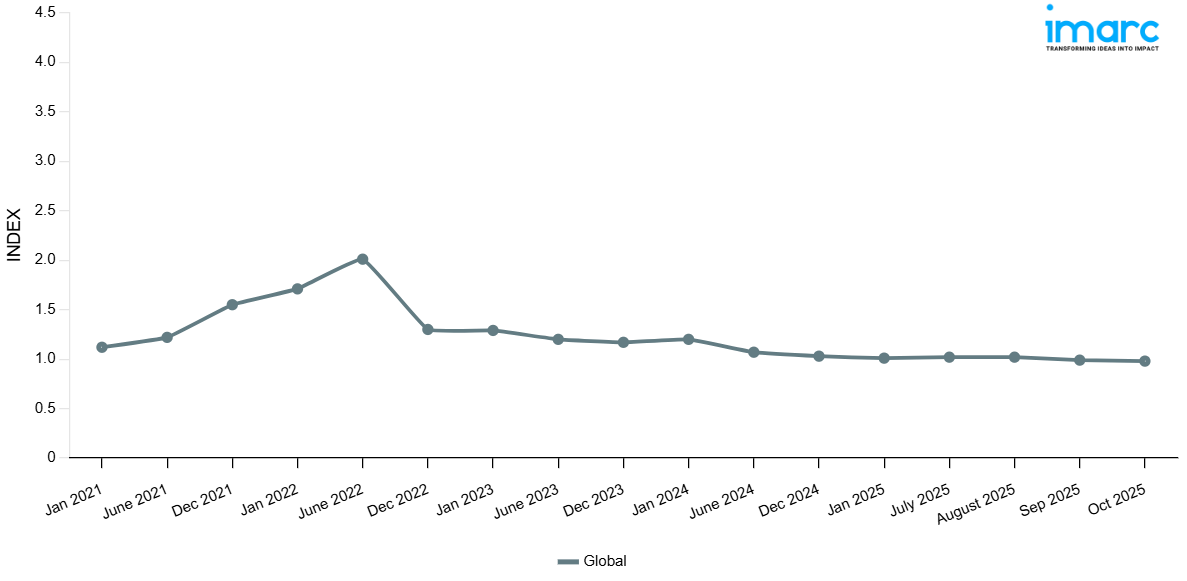

Cotton Price Index (INDEX):

The chart below highlights monthly cotton prices across different regions.

Get Access to Monthly/Quaterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Global: Globally, the price of cotton decreased. A combination of factors led to this downward movement, including lower demand from key markets like China and economic slowdowns in emerging markets, reducing global cotton consumption. Additionally, fluctuating weather patterns impacted yields in major cotton-producing countries, such as India, the US, and Brazil. Rising freight and shipping costs, especially in regions like North America and South America, further added to the cost of cotton, making the product less competitive in global markets. The decrease in price was also attributed to the growing preference for synthetic fibers, as global textile industries began to diversify away from natural fibers. The price drop across all regions reflected the global balancing of supply and demand, with consumers opting for cheaper alternatives and traders anticipating a weaker global economy in the coming quarters.

Cotton Price Trend, Market Analysis, and News

IMARC's latest publication, “Cotton Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the cotton market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of cotton at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed cotton prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting cotton pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Cotton Industry Analysis

The global cotton industry size reached 25.1 Million Tons in 2024. By 2033, IMARC Group expects the market to reach 28.2 Million Tons, at a projected CAGR of 1.24% during 2025-2033. The market is driven by the rising demand for textile fibers, the growth of sustainable fashion trends, and technological advancements in cotton cultivation methods. Furthermore, the expansion of cotton production in developing countries and a stable global demand for cotton from the textile industry play a crucial role in shaping the market’s growth trajectory.

Latest developments in the Cotton Industry:

- August 2025: The Government of India extended its import duty exemption on cotton until December 31, 2025, to support the domestic textile industry amid 50% US tariffs. Initially introduced by the Finance Ministry for the period from August 19 to September 30, 2025, the exemption aimed to enhance raw cotton availability and alleviate pressure on exporters. This extension reflected ongoing efforts to stabilize the sector and ensure smoother operations for textile manufacturers facing heightened trade challenges.

- June 2024: The Organic Cotton Accelerator (OCA) announced its launch in Türkiye, marking a significant step in uniting players across the organic cotton value chain in this key production country. OCA will deliver its transformative program designed to support local organic cotton farmers and those interested in transitioning, thereby scaling the global supply of organic cotton. To highlight the launch, OCA is hosting a stakeholder event in Istanbul this week, bringing together key players to discuss the future of organic cotton in the country.

- April 2024: The Union textiles ministry planned to launch a revamped Cotton Technology Mission aimed at improving the quality and output of India's "white gold" by adopting best practices that could position India as a prime destination for textile sourcing and foreign investment.

Product Description

Cotton refers to a natural fiber obtained from the seeds of the cotton plant, belonging to the genus Gossypium. This fiber is one of the most extensively utilized fibers in the textile industry owing to its softness, breathability, and durability. The cotton plant thrives in warm climates and requires a long frost-free period, plenty of sunshine, and moderate rainfall. The fibers are harvested from the seed pods, or bolls, after the plant blooms. The cotton fibers are separated from the seeds through a process called ginning once harvested. They are then spun into yarn and woven or knitted to create fabric. Cotton is highly versatile and employed in a variety of products such as bed linens, clothing, industrial materials, and towels. Its natural properties make it hypoallergenic and comfortable, suitable for sensitive skin.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Cotton |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Cotton Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of cotton pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting cotton price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The cotton price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The cotton price in October 2025 was 0.98 Pricing Index in the global market.

The cotton pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for cotton prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)