Cream Market in India: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033

Market Overview:

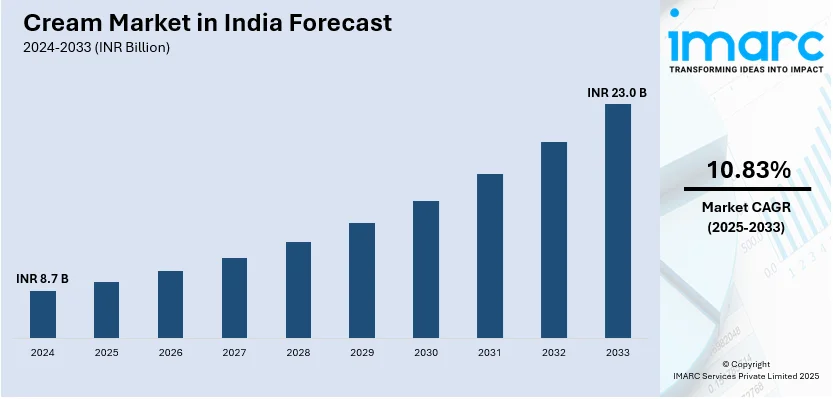

The Indian cream market size reached INR 8.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 23.0 Billion by 2033, exhibiting a growth rate (CAGR) of 10.83% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 8.7 Billion |

|

Market Forecast in 2033

|

INR 23.0 Billion |

| Market Growth Rate 2025-2033 | 10.83% |

Cream is a dairy product which is used to give a smooth texture and consistency to food products. Nowadays, it is widely used in the preparation of various dishes, desserts and beverages such as ice-creams, salads, sweet meals, tea, coffee, etc. The healthy growth of the market can be attributed to numerous forces. Rising population, increasing incomes, expanding application in the food and beverage industry represent some of the major growth driving factors.

To get more information on this market, Request Sample

The report has examined the Indian Cream Market in 15 major states:

- Maharashtra

- Uttar Pradesh

- Andhra Pradesh and Telangana

- Tamil Nadu

- Gujarat

- Rajasthan

- Karnataka

- Madhya Pradesh

- West Bengal

- Bihar

- Delhi

- Kerala

- Punjab

- Orissa

- Haryana

For each of the states, the report provides a thorough analysis of the current and historical value and volume trends, market share of key players and market forecast. Currently, Maharashtra represents the largest market, accounting for majority of the market share. The competitive landscape of the Indian cream market has also been covered in this report. Some of the prominent players operating in the market include GCMMF, Mother Dairy and Parag Milk Foods.

The study gives an in-depth analysis of the cream market landscape in India, covering the current, historical and future trends for cream production along with its prices. The report also offers SWOT, Value Chain and Porter’s Five Forces analysis of the Indian cream market along with breakup by segment, region, and an analysis of the competitive landscape. The study is based on both desk research and multiple waves of qualitative primary research. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Indian cream industry in any manner.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion, Million Kg |

| States Covered | Maharashtra, Uttar Pradesh, Andhra Pradesh and Telangana, Tamil Nadu, Gujarat, Rajasthan, Karnataka, Madhya Pradesh, West Bengal, Bihar, Delhi, Kerala, Punjab, Orissa, Haryana |

| Companies Covered | GCMMF, Mother Dairy and Parag Milk Foods |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The cream market in India was valued at INR 8.7 Billion in 2024.

We expect the cream market in India to exhibit a CAGR of 10.83% during 2025-2033.

The rising demand for cream across the Food and Beverage (F&B) industry to prepare salads, sweet meals, desserts, etc., is primarily driving the cream market in India.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of cream across the nation.

Based on the sector, the cream market in India can be bifurcated into retail sector and institutional sector. Currently, the retail sector holds the largest market share.

On a regional level, the market has been classified into Maharashtra, Uttar Pradesh, Andhra Pradesh, Tamil Nadu, Gujarat, Rajasthan, Karnataka, Madhya Pradesh, West Bengal, Bihar, Delhi, Kerala, Punjab, Orissa, and Haryana, where Maharashtra currently dominates the cream market in India.

Some of the major players in the cream market in India include GCMMF, Mother Dairy, and Parag Milk Foods.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)