Critical Limb Ischemia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

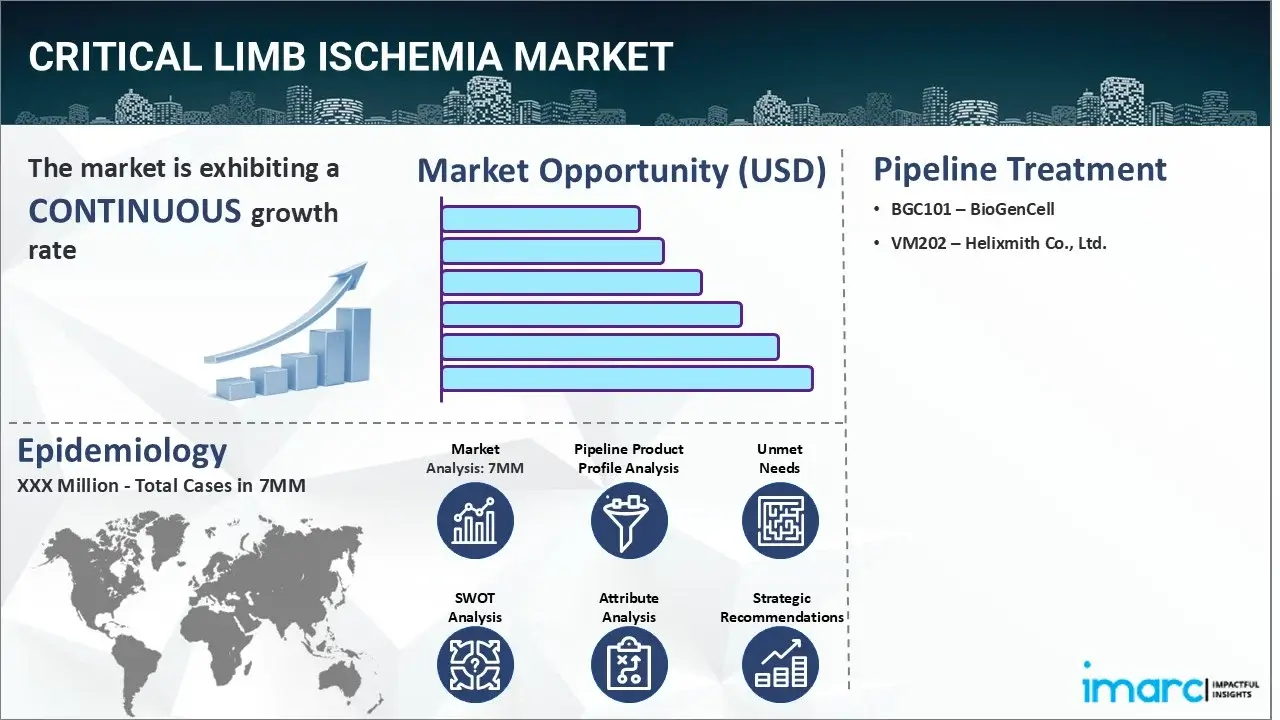

The critical limb ischemia market reached a value of USD 1.4 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 2.7 Billion by 2035, exhibiting a growth rate (CAGR) of 6.37% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year | 2024 |

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 1.4 Billion |

|

Market Forecast in 2035

|

USD 2.7 Billion |

|

Market Growth Rate 2025-2035

|

6.37% |

The critical limb ischemia market has been comprehensively analyzed in IMARC's new report titled "Critical Limb Ischemia Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Critical limb ischemia (CLI) is a severe form of peripheral arterial disease (PAD) that occurs when there is a significant narrowing or blockage of the arteries that carry blood to the legs and feet. It is a progressive condition that can cause tissue damage, chronic pain, and non-healing wounds, as well as lead to amputation of the affected limb. The most typical symptoms of this disorder include intense foot or leg pain, smooth, hairless, shiny, or very dry feet, skin discoloration, discharge from gangrene, thick toenails, slow-healing sores, weak pulse in the legs or feet, etc. Individuals suffering from CLI may also experience cold hands, feet, or legs, skin infections, loss of muscle mass, fainting, and femoral bruit. The diagnosis of this ailment is based on a review of the patient's symptoms and other medical problems. Some of the common investigations to confirm a diagnosis and stage disease severity include computerized tomography scans, magnetic resonance imaging studies, an ankle-brachial index test, angiograms, doppler ultrasounds, etc. The healthcare provider may also perform Buerger's test to assess arterial sufficiency among patients.

To get more information on this market, Request Sample

The rising cases of hyperlipidemia due to high cholesterol levels, which cause narrowed or blocked arteries, are primarily driving the critical limb ischemia market. In addition to this, the elevating incidences of several associated risk factors, including smoking, sedentary lifestyles, high blood pressure, obesity, etc., are further augmenting the market growth. Moreover, the emerging popularity of effective medications, such as beta-blockers, antiplatelet drugs, statins, etc., to prevent clots, control cholesterol levels, decrease blood pressure, and improve blood flow is also creating a positive outlook for the market. Apart from this, the widespread adoption of the pedal-plantar loop technique for percutaneous revascularization of the foot arteries, since it can facilitate better inflow and outflow from both posterior and anterior tibial vessels, is further bolstering the market growth. Additionally, the escalating utilization of intermittent pneumatic compression devices to reduce resting pain, as well as improve healing rates and physical functions in patients unsuitable for amputation, is acting as another significant growth-inducing factor. Besides this, the rising usage of stem cell-based therapy, which prolongs limb survival, decreases the speed of symptom progression, and enhances the quality of life, is expected to drive the critical limb ischemia market in the coming years.

IMARC Group's new report provides an exhaustive analysis of the critical limb ischemia market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for critical limb ischemia and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the critical limb ischemia market in any manner.

Key Highlights:

- Approximately 11% of individuals experience critical limb ischemia, characterized by rest discomfort and tissue loss.

- CLI affects over 2 million individuals in the United States alone.

- CLI prevalence was observed to be slightly higher in women than in males.

- Critical limb ischemia is related to 50% mortality at five years and 40% major amputations at one year.

- The risk of mortality increased with age, while the risk ratio relative to similarly aged nations was higher in younger patients.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the critical limb ischemia market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the critical limb ischemia market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current critical limb ischemia marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| BGC101 | BioGenCell |

| VM202 | Helixmith Co., Ltd. |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the critical limb ischemia market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the critical limb ischemia across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the critical limb ischemia across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of prevalent cases (2019-2035) of critical limb ischemia across the seven major markets?

- What is the number of prevalent cases (2019-2035) of critical limb ischemia by age across the seven major markets?

- What is the number of prevalent cases (2019-2035) of critical limb ischemia by gender across the seven major markets?

- What is the number of prevalent cases (2019-2035) of critical limb ischemia by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with critical limb ischemia across the seven major markets?

- What is the size of the critical limb ischemia patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend critical limb ischemia of?

- What will be the growth rate of patients across the seven major markets?

Critical Limb Ischemia: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for critical limb ischemia drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the critical limb ischemia market?

- What are the key regulatory events related to the critical limb ischemia market?

- What is the structure of clinical trial landscape by status related to the critical limb ischemia market?

- What is the structure of clinical trial landscape by phase related to the critical limb ischemia market?

- What is the structure of clinical trial landscape by route of administration related to the critical limb ischemia market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)