Cross-border B2C E-commerce Market Size, Share, Trends and Forecast by Category, Offering, Payment Method, End User, and Region, 2025-2033

Cross-border B2C E-commerce Market Size and Share:

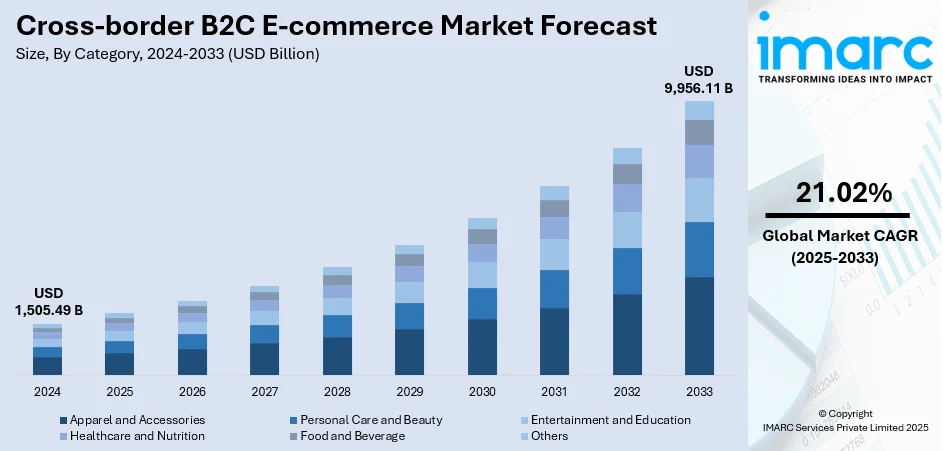

The global cross-border B2C e-commerce market size was valued at USD 1,505.49 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9,956.11 Billion by 2033, exhibiting a CAGR of 21.02% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 30% in 2024. At present, the heightened number of people preferring to shop online is bolstering the market growth. Moreover, the rising influence of social media platforms is offering a favorable market outlook. Apart from this, the favorable trade agreements and tariff reductions implemented are expanding the cross-border B2C e-commerce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,505.49 Billion |

| Market Forecast in 2033 | USD 9,956.11 Billion |

| Market Growth Rate (2025-2033) | 21.02% |

The cross-border B2C e-commerce business is growing at a fast rate as shoppers are becoming interested in accessing foreign products. Business houses are increasing global penetration using digital platforms, while the online platforms are providing more comprehensive product offerings and localized shopping experiences. Retailers are streamlining logistics and supply chains to accelerate delivery, and businesses are embracing advanced technology like artificial intelligence (AI) and machine learning (ML) to enhance shopping experiences. Consumers are expecting competitive prices and varied product offerings, pushing retailers to adopt global competitiveness strategies. Payment processing companies are creating safe and smooth cross-border payment systems, and regulatory authorities are adopting new frameworks to enable secure and transparent trade, thereby supporting the cross-border B2C e-commerce market growth. Mobile commerce is on the rise, with people increasingly using mobiles to make purchases from foreign suppliers.

To get more information on this market, Request Sample

The United States cross-border B2C online retailing market is growing with individuals buying goods from overseas retailers. People are looking for access to distinctive and affordable products not easily found locally, and online channels are making such purchases easier. Retailers are streamlining digital storefronts to serve US shoppers, and marketplaces are providing wide product offerings and competitive prices. Payment processors are bringing secure and hassle-free solutions to the table so that cross-border transactions are moving ahead without significant impediments. Companies are also building logistics capabilities, as buyers demand faster shipping and tracking transparency. Technology adoption is speeding up, and AI and data analytics are being utilized to enhance cross-border shopping experiences on an individual basis. IMARC Group predicts that the United States artificial intelligence market is projected to attain USD 1,09,514.9 Million by 2033.

Cross-border B2C E-commerce Market Trends:

Increasing trend of mobile shopping

The increasing trend of mobile shopping is bolstering the market. With the widespread adoption of smartphones and mobile devices, consumers can now browse, compare, and purchase products from anywhere, at any time. Mobile shopping apps and optimized mobile websites offer seamless user experiences, making cross-border shopping more accessible and appealing. For instance, approximately 7.21 Billion people use smartphones globally, representing about 90% of the world’s population, which is around 8 Billion. The convenience of mobile shopping aligns well with the fast-paced lifestyles of modern consumers. They can explore international products, read reviews, and complete transactions with just a few taps. Moreover, the integration of mobile wallets and secure payment systems enhances trust in cross-border transactions. The trend influences buying behavior and shapes how businesses approach their online presence. E-commerce platforms and companies are investing in responsive design, user-friendly interfaces, and mobile payment options to cater to this growing mobile-centric market. As the mobile shopping trend continues to rise, it is poised to drive cross-border e-commerce growth further, reshaping how consumers connect with global products and brands.

The rising influence of social media platforms

The rising influence of social media platforms is offering a favorable cross-border B2C e-commerce market outlook. Social media has evolved from a means of communication to a dynamic marketplace where consumers discover and engage with international products. For instance, as of January 2025, there are over 5.24 Billion people using social media worldwide, and the average user accesses 6.83 social media platforms monthly. Visual platforms like Instagram, Pinterest, and TikTok allow brands to showcase products creatively, capturing consumer attention and sparking interest in unique cross-border offerings. Influencer marketing, a pivotal social media component, is vital in promoting international products to a global audience. Influencers share their experiences with products, bridging the gap between sellers and buyers across borders. Social media's interactive nature also encourages real-time engagement, enabling consumers to seek information, reviews, and recommendations before making cross-border purchases. The seamless integration of shopping features on social platforms further streamlines the cross-border purchasing process, converting consumer interest into transactions. The rising influence of social media platforms is thus reshaping the market landscape, connecting consumers with global products and cultures in previously unimaginable ways.

Favorable trade agreements and tariff reductions

One of the major cross-border B2C e-commerce market trends include favorable trade agreements and tariff reductions, which are creating a positive outlook for the market. These agreements facilitate smoother international trade by reducing or eliminating tariffs, taxes, and trade barriers between countries. These agreements create a more economically viable environment for cross-border transactions by reducing the cost of importing and exporting goods. These favorable trade conditions mean increased profitability for businesses, enabling competitive pricing and wider profit margins. Consumers also benefit by accessing a broader array of international products at more affordable prices. Moreover, tariff reductions encourage businesses to explore new markets, expanding their customer base beyond borders. As countries recognize the economic benefits of cross-border e-commerce and the potential for global trade growth, they actively negotiate and implement trade agreements that foster a conducive environment for cross-border transactions. For instance, with over 33% of the world’s population shopping online, e-commerce is now a USD 6.8 Trillion industry and will reach the USD 8 Trillion mark by 2027. These agreements play a pivotal role in shaping the landscape of international online commerce, driving market growth, and promoting global economic integration.

Cross-border B2C E-commerce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cross-border B2C e-commerce market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on category, offering, payment method, and end user.

Analysis by Category:

- Apparel and Accessories

- Personal Care and Beauty

- Entertainment and Education

- Healthcare and Nutrition

- Food and Beverage

- Others

Apparel and accessories stand as the largest component in 2024, holding 35.6% of the market. This category is becoming one of the most robust categories in cross-border B2C e-commerce, fueled by growing demand from consumers for global fashion trends and more varied product options. Global consumers are continually looking for access to high-end brands, exclusive designs, and bargain versions that are not being offered in their home countries. This demand is driving the expansion of global fashion marketplaces and brand-owned online stores that are extending their reach beyond domestic markets. The category is gaining from intense digital activity, with social media platforms and influencer marketing driving consumer behavior and inducing cross-border shopping. Apparel and accessories are best suited for online commerce because of standardized sizing charts, effective return policies, and visually focused product promotion. Additionally, developments in logistics and fulfillment services are improving cross-border delivery of fashion products, thus enhancing customer confidence and driving repeat buying in this category.

Analysis by Offering:

- Assorted Brand

- In-House Brands

Assorted brands lead the market with 84.6% of market share in 2024. The multi-brand segment in cross-border B2C e-commerce is picking up pace as shoppers are looking for greater variety, convenience, and value out of their online shopping experience. Marketplaces and multi-brand sites are taking center stage by providing a broad blend of global and local brands, enabling consumers to shop across price points, fashion directions, and quality levels. This breadth is drawing a wide range of consumers, from value shoppers to searchers of premium or niche brands. The presence of various brands is also boosting customer loyalty, with consumers appreciating the convenience of being able to access several options from one platform. Competitive pricing strategies, bundled packages, and regular price cuts are also contributing to purchases, making multi-brand assortment a popular choice. Data analysis is also being used by retailers to package brand choices based on customer preferences for a highly personalized shopping experience. Such diversity-based strategy is reinforcing the position of diverse brands for cross-border e-commerce expansion.

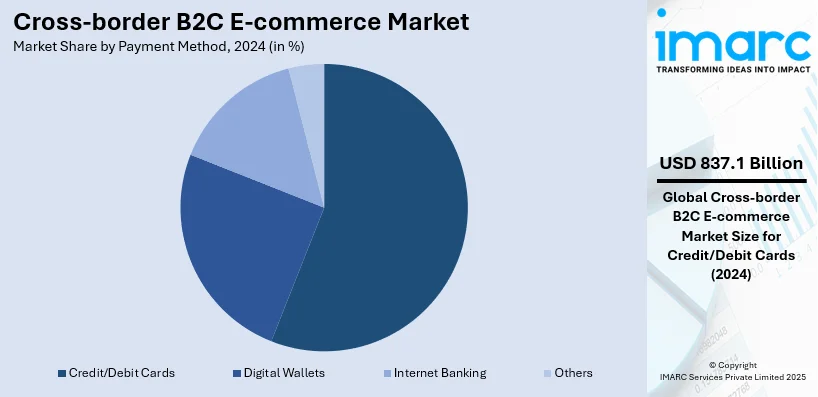

Analysis by Payment Method:

- Digital Wallets

- Internet Banking

- Credit/Debit Cards

- Others

Credit/debit cards lead the market with 55.6% of market share in 2024. They continue to reign as a favored payment mode in cross-border B2C e-commerce, backed by their extensive acceptability and familiarity among consumers. People are using these modes for safe and easy international transactions, while merchants are increasingly joining hands with international payment processors to ease cross-border buys. The card network-based trust is raising the confidence level among consumers, making them one of the strong promoters of international online shopping. Usage of the credit and debit cards is also being enhanced by features like fraud protection, chargeback facilities, and currency conversion, which are rectifying issues of concern in cross-border transactions. There is also encouragement of repeat usage due to loyalty schemes and reward points, enhancing the popularity of the mode of payment. Even with increasing adoption of substitute digital wallets and pay-later options, credit and debit cards are holding firm because they are dependable, global, and remain pertinent to enabling frictionless e-commerce payments.

Analysis by End User:

- Adults

- Teenagers/Millennial

- Senior Citizens

- Others

Adults are accounting for the largest proportion of cross-border B2C e-commerce consumption since they are actively buying products across categories like apparel, electronics, and lifestyle products. With increased disposable incomes and established purchasing power, adults are driving consistent growth while in pursuit of value as well as premium international brands.

Millennials and teenagers are redefining market patterns in the wake of trend-driven consumption and intense interaction with internet platforms. Social media, celebrity sponsorship, and international fashion trends play a significant influence on them. They are major drivers of fast-moving categories like apparel, accessories, and cosmetics. Their mobile shopping focus and effortless digital experience are driving electronic commerce platform innovation.

Senior citizens are increasingly taking part in cross-border e-commerce, especially in areas like healthcare products, wellness products, and customized goods. Adoption is slower than among younger generations, yet this demographic is progressively growing online engagement as digital literacy and confidence in online buying grow.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 30%. The market in Asia-Pacific is growing at a fast pace as international products are being increasingly bought by consumers to gain access to better quality, variety, and competitive prices. Regional customers are adopting global platforms to get fashion, electronics, beauty, and lifestyle products, and businesses are enhancing their web presence to tap into increasing demand. Businesses are making investments in digital technologies to improve user experience, and marketplaces are providing localized language, currency, and payment facilities to reach a broader population. Mobile commerce is taking center stage, with the use of smartphones by consumers for effortless browsing and shopping. Social media sites are also dictating purchasing decisions, with brands pushing products proactively through strategic campaigns and influencer partnerships. Logistics companies are enhancing cross-border delivery performance, facilitating quicker and more consistent fulfilment to please consumers.

Key Regional Takeaways:

North America Cross-border B2C E-commerce Market Analysis

The cross-border B2C e-commerce sector in North America is growing with high speed, fueled by growing interest in a wider variety of foreign products. People are looking for distinctive, high-value products not found domestically, and businesses feel compelled to meet these needs. E-commerce sites are merging with evolving technologies, such as AI and ML, to improve user experience and tailor shopping. Businesses are also widening their payment options to provide greater security and convenience, allowing for smoother transactions across borders. Shipping and logistics capabilities are also becoming better, with businesses providing quicker and cheaper options for delivery. The increased use of mobile commerce is also changing the way that consumers shop overseas. Cross-border trade regulations are adapting to accommodate these changes, making the experience smoother for both consumers and business. In consequence, increasing brands are leveraging global markets, hence fueling the continued growth of cross-border B2C e-commerce in North America.

United States Cross-border B2C E-commerce Market Analysis

The United States holds 88.70% share in North America. The country is experiencing increased cross-border B2C e-commerce adoption due to the expansion of B2C e-commerce platforms that offer a wide range of international products. For instance, in 2025, there are an estimated 2.7 to 3.5 Million online stores in the U.S. Consumers are increasingly drawn to global offerings because of improved delivery logistics, streamlined payment options, and user-friendly shopping interfaces. The rapid development of B2C e-commerce platforms is enabling better access to cross-border products, driving higher purchasing volumes. Enhanced digital infrastructure and increased consumer familiarity with global online transactions are making cross-border purchases more appealing. Additionally, local platforms collaborating with international sellers are supporting this momentum. With seamless user experiences and growing confidence in product quality and return policies, consumers are more inclined toward shopping from international vendors.

Asia Pacific Cross-border B2C E-commerce Market Analysis

Asia-Pacific is witnessing rising cross-border B2C e-commerce adoption driven by growing internet penetration across urban and rural regions. For instance, there were 806 Million individuals using the internet in India at the start of 2025, when online penetration stood at 55.3 percent. As more users gain access to the internet, especially via mobile networks, online shopping behaviors are evolving rapidly. Increasing digital literacy and accessible data plans are encouraging consumers to explore international marketplaces. The expansion of digital payment options and multi-lingual platforms further facilitates smoother cross-border transactions. With improved logistics networks and tracking services, the reliability of deliveries from international sellers is gaining trust. Social media integration is also enhancing product visibility and promoting foreign brands.

Europe Cross-border B2C E-commerce Market Analysis

Europe is advancing in cross-border B2C e-commerce adoption as digital wallets and internet banking become mainstream. For instance, 52% of Germans aged 18 to 34 are more likely to shop with an online retailer that offers buy-now-pay-later options. Secure and swift payment technologies have simplified online transactions, making international purchases more accessible and reliable. Users are increasingly confident in using digital wallets for currency conversion and fraud protection, which strengthens trust in cross-border transactions. Internet banking integration with e-commerce platforms streamlines checkout processes, improving the overall consumer journey. Financial institutions across Europe are supporting cross-border purchases through multicurrency support and real-time payment validation. As these digital payment systems evolve, they enhance buyer convenience and reduce friction in transactions.

Latin America Cross-border B2C E-commerce Market Analysis

Latin America is witnessing an increase in cross-border B2C e-commerce adoption as growing disposable income empowers more consumers to explore international shopping options. For instance, as of 2025, the average annual salary in Brazil is approximately BRL 40,200, which translates to around USD 7,025.63 per year. Improved financial access and economic growth are enabling higher spending on foreign brands and premium products. Consumers are using digital platforms to seek unique or cost-effective goods unavailable locally.

Middle East and Africa Cross-border B2C E-commerce Market Analysis

Middle East and Africa are witnessing higher cross-border B2C e-commerce adoption due to the growing social media user base. For instance, the UAE was home to 11.3 Million social media user identities in January 2025, equating to 100 percent of the total population. Platforms such as Instagram and Facebook are influencing purchase decisions and connecting users with international brands. Social commerce features, combined with targeted ads, are promoting awareness of global products.

Competitive Landscape:

Players in cross-border B2C e-commerce are aggressively increasing their international presence by improving digital platforms, consolidating logistics networks, and providing localized shopping experiences. Firms are investing in technology such as artificial intelligence, big data, and machine learning to make recommendations personalized and enhance customer interactions. Top marketplaces are expanding product offerings and collaborating with global brands to engage a broader customer base. Payment solution companies are launching secure and frictionless platforms to facilitate seamless cross-border transactions, while logistics companies are streamlining last-mile delivery to provide quicker fulfillment. Furthermore, as per the cross-border B2C e-commerce market forecasts, companies are expected to embrace sustainability efforts, including green packaging and sustainable procurement, to resonate with changing needs and build strong long-term brand loyalty.

The report provides a comprehensive analysis of the competitive landscape in the cross-border B2C e-commerce market with detailed profiles of all major companies, including:

- Alibaba Group

- Amazon.com Inc.

- Anchanto Pte. Ltd.

- BoxMe

- eBay Inc.

- JD.com, Inc.

- Rakuten Group, Inc.

- SHEIN

- SIA Joom (Latvia)

- Wish Inc.

- Zalando SE

Latest News and Developments:

- July 2025: LT Foods expanded into cross-border B2C e-commerce by launching organic operations in Europe through a new Rotterdam facility, aiming to replicate its India model and strengthen traceable supply chains; the move marked its entry into direct-to-consumer retail across European markets with sustainably sourced food products.

- June 2025: JINGDONG Logistics launched JoyExpress, its cross-border B2C express delivery service in Saudi Arabia, offering same-day or next-day delivery. The move aligned with JD.com’s global expansion efforts during the 618 Grand Promotion, where its cross-border e-commerce businesses, including JD Worldwide, saw significant growth in international sales, notably gaming consoles, and strengthened its global supply chain network.

- April 2025: Unilever expanded its cloud-based B2B and B2C ecommerce platform across emerging markets, aiming to reach 1.5 Million micro-retailers and enable over USD 4.28 Billion in annual turnover through mobile and AI tools, including support for cross-border B2C ecommerce; its rollout reached five Asian countries by April 2025, excluding the U.S. due to its focus on high-growth traditional retail markets.

- April 2025: JD.com piloted its self-operated retail platform Joybuy in London, signaling its re-entry into cross-border B2C e-commerce and aiming to challenge Amazon in the UK’s USD 163 Billion market; the move marked JD’s broader push to globalize via logistics, brand onboarding, and localized services like fast delivery and high discounts.

- February 2025: Amazon and DGFT extended their collaboration to strengthen cross-border B2C e-commerce exports from India by integrating Amazon’s Export Navigator tool into the DGFT Trade Connect portal and launching training in 47 districts, aiming to support India’s USD 200–300 Billion export vision by 2030.

Cross-border B2C E-commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered | Apparel and Accessories, Personal Care and Beauty, Entertainment and Education, Healthcare and Nutrition, Food and Beverage, Others |

| Offerings Covered | Assorted Brands, In-House Brands |

| Payment Methods Covered | Digital Wallets, Internet Banking, Credit/Debit Cards, Others |

| End Users Covered | Adults, Teenagers/Millennial, Senior Citizens, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alibaba Group, Amazon.com Inc., Anchanto Pte. Ltd., BoxMe, eBay Inc., JD.com, Inc., Rakuten Group, Inc., SHEIN, SIA Joom (Latvia), Wish Inc., Zalando SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cross-border B2C E-commerce market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the cross-border B2C E-commerce market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the global cross-border B2C E-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cross-border B2C e-commerce market was valued at USD 1,505.49 Billion in 2024.

The cross-border B2C e-commerce market is projected to exhibit a CAGR of 21.02% during 2025-2033, reaching a value of USD 9,956.11 Billion by 2033.

The market is being driven by increasing mobile commerce adoption, the growing influence of social media, favorable trade agreements, enhanced payment systems, and rising demand for international products.

Asia Pacific currently dominates the cross-border B2C e-commerce market, accounting for a share of 30% in 2024, driven by mobile commerce, digital platform expansion, and high consumer demand for global products.

Some of the major players in the cross-border B2C e-commerce market include Alibaba Group, Amazon.com Inc., Anchanto Pte. Ltd., BoxMe, eBay Inc., JD.com, Inc., Rakuten Group, Inc., SHEIN, SIA Joom (Latvia), Wish Inc., Zalando SE, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)