Curd Market in India Size, Share, Trends and Forecast by Type, Sales Channel, and Region, 2025-2033

Curd Market in India Size, Share:

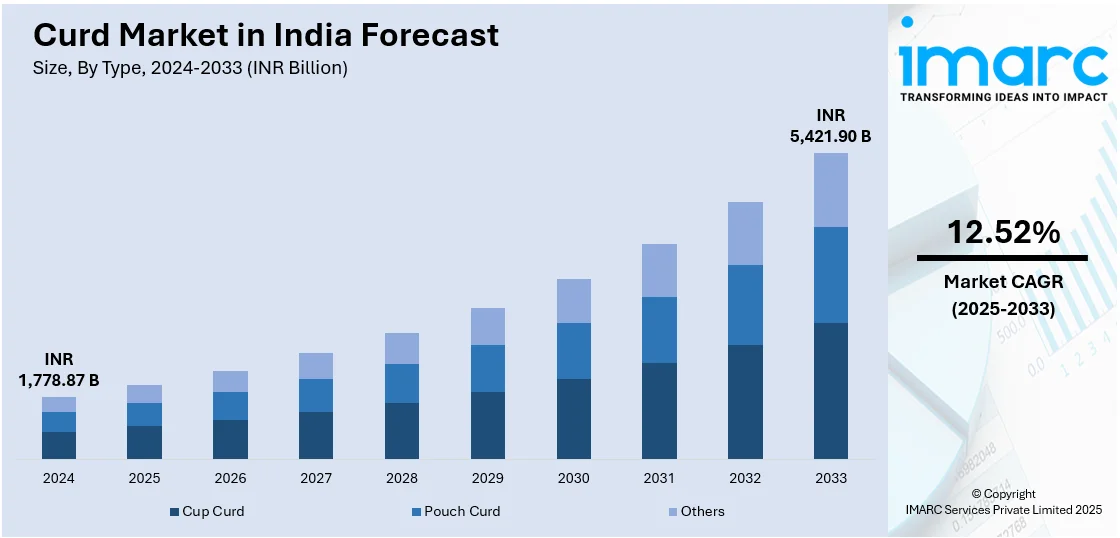

The curd market in India size was valued at INR 1,778.87 Billion in 2024. Looking forward, IMARC Group estimates the market to reach INR 5,421.90 Billion by 2033, exhibiting a CAGR of 12.52% from 2025-2033. The market is witnessing steady growth driven by rising health awareness, increasing dairy consumption, and the popularity of probiotic-rich foods. Growth is further supported by innovations in flavored curd and fortified variants catering to evolving consumer preferences and dietary trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 1,778.87 Billion |

|

Market Forecast in 2033

|

INR 5,421.90 Billion |

| Market Growth Rate (2025-2033) | 12.52% |

India's curd market is growing because of rising health awareness, increasing disposable income, and the need for probiotic-enriched dairy products. Urbanization and shifting eating habits are fueling packaged curd consumption with companies providing easy-to-use, hygienic and fortified products. The organized dairy industry is witnessing significant investment with leading players introducing value-added variants such as flavored, Greek and lactose-free curd. Government policies favoring dairy farming, enhanced cold chain infrastructure and e-commerce growth are also propelling market expansion. For instance, in September 2024, Union Minister of India announced the launch of 'White Revolution 2.0', aimed at transforming India's dairy cooperative sector. The initiative focuses on empowering women farmers, enhancing milk production, strengthening infrastructure and boosting exports. It includes RuPay Kisan Credit Cards, micro-ATMs for farmers and the computerization of Primary Agriculture Credit Societies.

To get more information on this market, Request Sample

Regional and cultural differences influence curd consumption with thicker types preferred in North India and curd as a staple being consumed in South India. The growth in quick-service restaurants and ready-to-consume food is driving consumption of curd-based food items such as raita and smoothies. Expansion in modern retail and online grocery shopping is increasing accessibility. Moreover, technology developments in fermentation and sustainable dairy farming practices are increasing the efficiency of production bringing in consistent supply and quality. For instance, in November 2024, dairy farmers from Rajasthan and Assam received their first carbon credit payments as part of India's manure management initiative. This was celebrated at the National Dairy Development Board's Diamond Jubilee event. The program supports sustainable practices by providing clean fuel and organic fertilizers while also enhancing farmers' incomes. It underscores a strong commitment to ecofriendly dairy farming.

Curd Market in India Trends:

Expansion of Flavored and Greek Curd

The demand for flavored and Greek curd is rising as consumers seek variety and health benefits in their diets. Flavored curd infused with fruits, honey or natural sweeteners appeals to those looking for taste and convenience. Greek curd known for its thicker texture and higher protein content is gaining popularity among fitness enthusiasts and weight-conscious consumers. Brands are introducing innovative variants including lactose-free and low-fat options catering to diverse dietary needs and expanding market opportunities in the premium dairy segment. For instance, in February 2024, Epigamia announced the launch of a new Greek yogurt variant combining oats and a seed mix that includes chia, flax and amaranth seeds sweetened with honey and date syrup. This high-protein and healthy snack caters to consumer demand for nutritious and convenient options.

Enhanced Focus on Sustainability

Indian dairy firms are embracing sustainable and ethical methods to respond to increasing consumer demand for environmentally friendly products. Brands are changing to biodegradable or recyclable packaging to minimize plastic usage. For instance, in August 2024, Khyber Agro Pvt Ltd announced the launch of eco-friendly 1 kg curd packaging in biodegradable buckets in Srinagar. The event, attended by the Food Commissioner, highlighted the company's commitment to sustainability and food safety. With a strong distribution network, the product aims to enhance access to high-quality dairy in Kashmir. Organic milk production free from antibiotic and synthetic hormones is becoming popular among health-conscious consumers. Ethical dairy farming practices, including better cattle welfare, water conservation, and the use of renewable energy, are becoming a focus. These initiatives not only reinforce brand trustworthiness but also fit with changing consumer demands for sustainability.

Increasing E-commerce and Modern Retail Sales

Online grocery platforms and supermarkets are expanding the availability and accessibility of packaged curd. According to the data published by the India Brand Equity Foundation, the Indian online grocery market is projected to reach US$ 26.93 billion by 2027 expanding from US$ 3.95 billion in FY21. The ecommerce industry could grow to US$ 325 billion by 2030 with a GMV of US$ 60 billion in FY23 and a 31% CAGR in social commerce by 2025. Ecommerce platforms provide doorstep delivery offering convenience and a wider selection of curd variants. Supermarkets and hypermarkets are dedicating more shelf space to dairy products promoting branded and value-added curd options. Digital payments, discounts and subscription models further drive online sales. This shift towards organized retail and digital commerce is transforming consumer buying habits and enhancing market penetration in both urban and semi-urban areas.

Curd Market in India Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the curd market in India, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and retail vs institutional.

Analysis by Type:

- Cup Curd

- Pouch Curd

- Others

The cup curd segment holds the largest curd market share in India on account of its convenience, longer shelf life, and increasing consumer preference for packaged dairy. Urbanization, increasing disposable income, and rising awareness about health have contributed towards the demand for hygienically packed curd. Top dairy companies are augmenting their offerings with fortified and flavored variants to appeal to consumers. Also, innovation in cold chain logistics and penetration of retail fuels the growth of the segment and makes cup curd a sought-after option over loose curd.

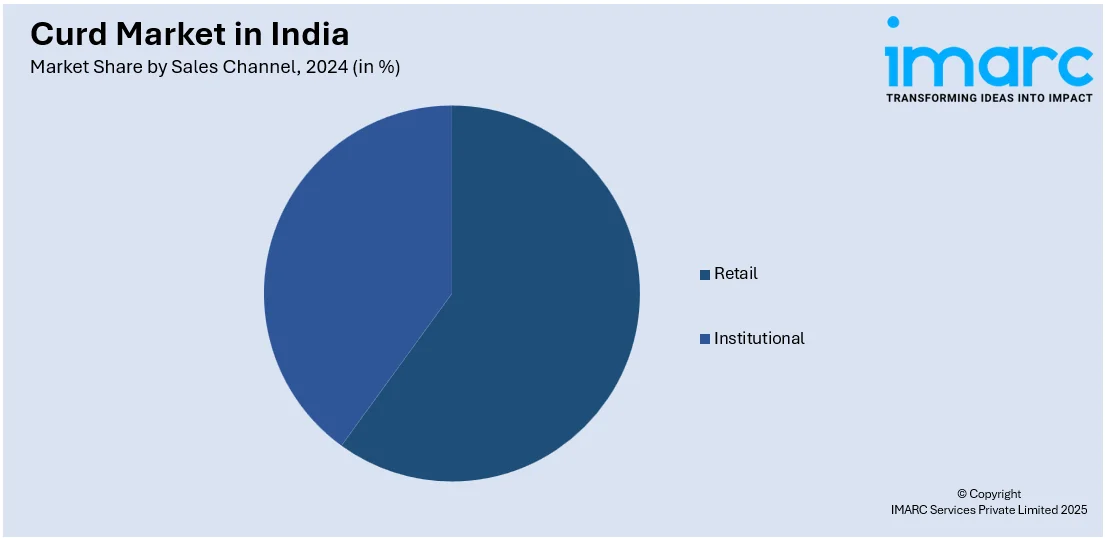

Analysis by Sales Channel:

- Retail

- Institutional

The retail sector dominates the Indian curd market driven by expanding supermarket chains, hypermarkets and online grocery platforms. Consumers increasingly prefer branded packaged curd for its quality assurance, hygiene and convenience. Organized retail offers a wide variety of curd products including flavored, probiotic and low-fat options catering to diverse preferences. Aggressive marketing, attractive packaging and promotional discounts boost retail sales. The rise of e-commerce and quick commerce platforms further accelerates market growth making retail the primary distribution channel.

Regional Analysis:

- Maharashtra

- Uttar Pradesh

- Andhra Pradesh and Telangana

- Tamil Nadu

- Gujarat

- Rajasthan

- Karnataka

- Madhya Pradesh

- West Bengal

- Bihar

- Delhi

- Kerala

- Punjab

- Orissa

- Haryana

Maharashtra dominates the Indian market for curd with its massive urban population, high demand for dairy consumption and strong retail infrastructure. State metro cities like Mumbai and Pune dominate the demand for packaged curd supported by busy lifestyles and rising health consciousness. Leading dairy players are well entrenched offering different types of curd including probiotic and low-fat curd. Maharashtra's sophisticated cold chain logistics and wide coverage of supermarket chains further propel the sale of curd and it is the biggest driver of the nation's market for curd.

Competitive Landscape:

The Indian curd market is highly competitive with both national and regional dairy brands vying for market share. Established players leverage strong distribution networks, advanced packaging and brand loyalty to maintain dominance. Regional dairies compete by offering fresh and locally sourced curd at competitive prices. The rise of private-label brands in modern retail further intensifies competition. Companies focus on innovation introducing probiotic, flavored and low-fat curd variants to cater to evolving consumer preferences. Ecommerce and quick-commerce platforms are also reshaping the competitive landscape enabling wider reach and faster delivery. Marketing strategies including celebrity endorsements and promotional discounts play a crucial role in brand positioning. The market remains dynamic driven by changing consumer habits and expanding retail infrastructure.

The report provides a comprehensive analysis of the competitive landscape in the curd market in India with detailed profiles of all major companies, including:

- KMF

- GCMMF

- Mother Dairy

- Sri Vijaya Visakha Milk Producers

- Heritage

Latest News and Developments:

- In February 2025, Amul announced its plans to invest Rs 600 crore to establish the world's largest curd manufacturing plant in Kolkata. The facility, with a capacity of 10 lakh kg per day, aims to meet rising local demand for dairy products and bolster the dairy cooperative movement in West Bengal.

- In November 2024, Karnataka Milk Federation (KMF) announced its plans to launch Nandini milk and curd products in Delhi, aiming to compete with Amul in the North Indian dairy market. KMF has successfully conducted trial runs for supply logistics and also plans to introduce idli and dosa batter in Bengaluru.

- In January 2023, Heritage Foods announced the launch of 'GlucoShakti', a whey-based orange energy drink, fortified with glucose and essential minerals, priced at ₹10. Alongside, they introduced 'Creamilicious Curd', known for its creaminess and taste, available in various pack sizes. The products are now available across multiple states in India.

Curd Market in India Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion INR, Million Litres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cup Curd, Pouch Curd, Others |

| Sales Channels Covered | Retail, Institutional |

| Regions Covered | Maharashtra, Uttar Pradesh, Andhra Pradesh and Telangana, Tamil Nadu, Gujarat, Rajasthan, Karnataka, Madhya Pradesh, West Bengal, Bihar, Delhi, Kerala, Punjab, Orissa, Haryana |

| Companies Covered | KMF, GCMMF, Mother Dairy, Sri Vijaya Visakha Milk Producers, Heritage |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the curd market in India from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the curd market in India.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the curd market in India and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The curd market was valued at INR 1,778.87 Billion in 2024.

The market is expanding due to rising health consciousness, increased disposable income, and demand for probiotic-rich dairy products. Urbanization, organized retail, and e-commerce growth are fueling demand. Companies are introducing flavored, Greek, and fortified curd variants to cater to changing dietary preferences. Government support for dairy farming and cold chain infrastructure also contributes to expansion.

IMARC estimates that the curd market will reach INR 5,421.90 Billion by 2033, growing at a CAGR of 12.52% from 2025-2033.

The cup curd segment leads the market due to its convenience, extended shelf life, and increasing preference for packaged dairy. Urban consumers are shifting from loose curd to hygienically packed alternatives.

Some of the major key players in market include, KMF, GCMMF, Mother Dairy, Sri Vijaya Visakha Milk Producers, Heritage, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)