Customs Audit Market Size, Share, Trends and Forecast by Type, and Region, 2025-2033

Customs Audit Market Size and Share:

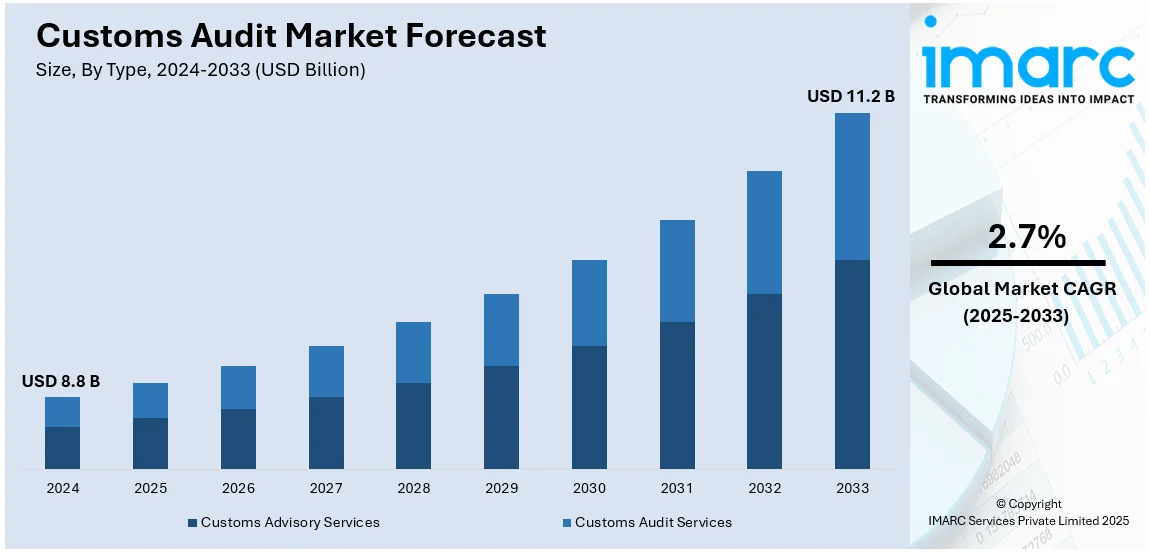

The global customs audit market size was valued at USD 8.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.2 Billion by 2033, exhibiting a CAGR of 2.7% from 2025-2033. North America currently dominates the market, holding a market share of over 40.0% in 2024. The customs audit market share is expanding, driven by the increasing demand for auditing services, the introduction of virtual audits, and the implementation of various government initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.8 Billion |

|

Market Forecast in 2033

|

USD 11.2 Billion |

| Market Growth Rate (2025-2033) | 2.7% |

Stricter trade regulations are impelling the market growth. Government agencies are focusing more on preventing fraud, misdeclarations, and tax evasion, leading to increased audits. Businesses must comply with changing customs laws, making regular audits essential to avoid penalties. Digitalization in customs procedures also plays a big role, as automated systems make audits more efficient and widespread. With more free trade agreements (FTAs) in place, companies need audits to ensure they pay the right duties and follow trade rules. Supply chain transparency is another factor, as businesses must prove ethical sourcing and accurate reporting. Additionally, risk-based auditing helps authorities to target danger-prone shipments, ensuring adherence while protecting customs revenue.

The United States has emerged as a major region in the customs audit market owing to many factors. Higher trade volumes, with authorities ensuring proper classification and valuation, are propelling the customs audit market growth. Besides this, businesses must navigate complex and ever-changing laws to avoid penalties, creating the need for audit services. The rising cases of trade fraud, misdeclarations, and undervaluation, with customs authorities working to safeguard government revenue, are further fueling the market growth. Digitalization of customs processes makes audits more efficient, increasing their frequency and effectiveness. FTAs and their compliance requirements further promote the adoption of audits to ensure that the right duties are paid. As per the information given on the official website of the United States government, the US Customs and Border Protection (CBP) revealed a notice of ‘Proposed Rulemaking (NPRM)’ policy intended to strengthen the de minimis duty exemption concerning specific low-value shipments arriving in the US.

Customs Audit Market Trends:

Stringent Regulatory Compliance Requirements

Government agencies around the world are implementing stricter customs regulations in a bid to curb fraud, ensure proper duty collection, and promote transparent trade. Accords, such as the World Trade Organization (WTO) Trade Facilitation Agreement, the EU Union Customs Code, and the US Customs Modernization Act are encouraging businesses to wager on sound customs audit solutions to avoid breaches and penalties. The TFA also provides enormous benefits. According to the WTO, its full implementation is estimated to minimize trade costs by an average of 14.3% and increase international trade by USD 1 Trillion annually. Its greatest benefits are expected, especially in developing and least-developed countries where better customs efficiency can improve trade flows and economic growth.

Rising Global Trade and Supply Chain Complexities

The growing international trade complexity is offering a favorable customs audit market outlook. With an increase in cross-border trade, businesses need to understand intricate tariff structures, trade agreements, and classification rules for compliance. An increase in FTAs, changes in geopolitical status like Brexit, and the development of import/export controls make customs audits more essential. As of 2024, the WTO documented more than 350 active trade agreements around the world. This is an indication of the evolving regulatory landscape that businesses have to adhere to. Such complexities require frequent and detailed customs audits to mitigate financial risks, avoid penalties, and maintain seamless international trade operations. With the ongoing deviations in international trade dynamics, effective compliance strategies, strong internal audit systems, and knowledgeable trade advisory services are critical for companies looking to maneuver through the intricate customs environment successfully.

Advancements in Digital Solutions and Automation

One of the primary growth factors of the customs audit market is advanced digital integration. With technologies like blockchain, artificial intelligence (AI), and big data analytics, customs audit processes have streamlined compliance and minimized human errors for efficient and smoother audit processing. Real-time tracking of transactions and the discovery of discrepancies by employing automated tools facilitate strict adherence to international trade laws and increase the demand for digital solutions. In January 2023, PwC unveiled ‘Customs Radar,’ an online platform that helps businesses to manage their customs compliance. The use of analytics and automation has become enhanced and transparent so as to ensure accuracy in customs processes. With the rise in worldwide trade complexity, effective regulatory compliance requires AI-driven customs audit solutions.

Customs Audit Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global customs audit market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type.

Analysis by Type:

- Customs Advisory Services

- Customs Audit Services

Customs audit services lead the market with 82.8% of the market share in 2024. They help businesses to navigate complex regulations and ensure compliance with customs laws. As worldwide trade grows, businesses need professional services to manage the high number of regulations and avoid costly penalties for misdeclarations or non-compliance. Customs audit services also assist companies in identifying potential risks in their import and export processes, such as incorrect tariff classifications, undervaluation, or improper documentation. These services offer a thorough review of a company’s practices, ensuring that all duties and taxes are paid correctly and that businesses adhere to both local and international trade laws. They also aid in finding opportunities for tax recovery and enabling proper reporting of goods and customs valuations. With customs regulations becoming more stringent, businesses depend heavily on these services to avoid legal issues, improve trade efficiency, and maintain a strong reputation. As a result, customs audit services remain essential for companies involved in international trade.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 40.0%, enjoys the leading position in the market. The region is noted for its significant role in worldwide trade and its complex regulatory environment. The United States and Canada have robust customs systems that enforce strict compliance with import and export regulations. With increasing trade activities, businesses in North America face the challenge of adhering to evolving laws, making customs audits crucial. According to the data published on the official website of the Bureau of Economic Analysis (BEA), the total US export revenue, including goods and services, amounted to USD 266,507 Million in December 2024. As a result, customs authorities in this region focus on preventing fraud, misdeclarations, and tax evasion, which drives the need for audits. Additionally, North American businesses, especially those in sectors like manufacturing, retail, and technology, depend on customs audit services to ensure their shipments meet legal requirements. Digitalization and automation of customs procedures also make audits more efficient and widespread in the area.

Key Regional Takeaways:

United States Customs Audit Market Analysis

The United States hold 86.80% of the market share in North America. The market is driven by increased expenditure on border security and compliance measures. The Department of Homeland Security (DHS) reported that the FY 2024 Budget inculcated more than USD 1 Billion in new investments in modern border security technology to facilitate operational needs and improve US Customs and Border Protection (CBP) functions. All these fundings will work to enhance the oversight of trade, customs enforcement, and the accurate collection of duties. Heightened security measures in customs enable companies to adhere to regulations in the collection of duties in order not to face penalties or delays. Border operations that implement the usage of advanced technology are bound to make customs audits more frequent and more detailed. It means businesses need to maintain clear trade records and documentation. This market is likely to grow, as the government agencies continue to spend resources on border security infrastructure in the US, driven by the requirement for regulatory adherence and keen trade monitoring.

Europe Customs Audit Market Analysis

The Europe customs audit market is experiencing growth, as the number of trade activities being covered under extensive trade agreements within the European Union is increasing day by day. According to the annual report on the Implementation and Enforcement of EU Trade Policy, 2024, the trade value covered under 42 agreements with 74 partners was over Euro 2.3 Trillion (USD 2.38 Trillion) for the year 2023. This was 30% up from five years ago. This has increased the demand for customs oversight and regulatory compliance, which has led to a rise in the requirement for customs audit solutions. Additionally, as trade agreements ease cross-border transactions between businesses, trade duty calculations must be accurate and proper tariff classification must be followed, with customs rules being complied with to minimize the risk of non-adherence. The growing complexity of trade rules between different jurisdictions creates the need for detailed customs audits in such a scenario.

Asia-Pacific Customs Audit Market Analysis

The market is witnessing growth because the area is gaining share in the world economy. As per industry reports, the region’s share of the world economy rose from 21% in 1990 to 39% in 2023, marking rapid economic expansion and rising trade activities. As international trade volumes increase, governments are enforcing stronger customs regulations to ensure the proper collection of duties, reduce fraud, and increase trade transparency, thereby increasing demand for customs audit solutions. With the growing cross-border trade, businesses must adhere to the complex tariff structures, trade agreements, and changing import/export regulations to avoid financial penalties and disruptions. The increased integration of Asia-Pacific countries into worldwide supply chains also requires detailed customs audits to ensure compliance with international trade laws.

Latin America Customs Audit Market Analysis

The Latin America market is growing owing to the increasing volume of exports from the region. Latin American exports increased by 1.8% in 2023, after a 5.5% rise in 2022, according to the Inter-American Development Bank. This steady expansion of trade activities is creating the need for stronger customs oversight and regulatory compliance, driving the demand for customs audit solutions. With increasing exports in various businesses, these businesses must go thoroughly for accurate tariff classification, proper duty payment, and other customs regulations to avoid risks of non-compliance in such transactions. Expanding trade agreements and import/export controls are also making detailed customs audits a necessity for transparent and efficient cross-border transactions.

Middle East and Africa Customs Audit Market Analysis

The market is growing because the potential for Arab-African trade is on the upswing. The International Trade Administration (ITA) forecasts that Arab-African trade is set to surpass USD 37.6 Billion by 2027, marking a 31 percent increase from its value in 2021. This great surge in the activities of trade has given an impetus to the demand for upgraded customs compliance, precise tariff evaluation, and effective duty collection, which has created the need for customs audit solutions. As trade between Arab and African nations continues to grow, businesses have to navigate intricate trade agreements, changing import/export controls, and stricter customs regulations to avoid penalties and ensure the smoothness of cross-border transactions. The regional government agencies are also working on the simplification of customs procedures and enhancing trade transparency, making the importance of customs audits even greater.

Competitive Landscape:

Key players in the market work to ensure that businesses comply with ever-evolving regulations. Audit firms, consulting companies, and technology providers help businesses to navigate complex customs laws and lower the risk of penalties. They offer specialized services that include strict adherence and identifying potential issues like misdeclarations or undervaluation of goods to meet the customs audit market demand. By providing expertise in tariff classifications, duty payments, and international trade laws, they assist companies in avoiding costly mistakes. Technology providers also contribute by developing automated tools that streamline the audit process, making it more efficient and accurate. As global trade expands, these key players are essential in maintaining transparency, preventing fraud, and guaranteeing that businesses adhere to both local and worldwide customs requirements. Their expertise is vital for companies seeking to protect their operations and stay competitive in the market. For instance, in May 2023, the Royal Malaysian Customs Department planned for AViP in July of 2023. Through the initiative, self-compliance was expected to be fostered, with this being paired with voluntary disclosures to enhance complete transparency in conducting customs-related activities.

The report provides a comprehensive analysis of the competitive landscape in the customs audit market with detailed profiles of all major companies, including:

- Baker Tilly International Ltd.

- BDO International Ltd.

- Deloitte Touche Tohmatsu Ltd.

- Ernst & Young Global Ltd.

- Grant Thornton International Ltd

- KPMG International Ltd.

- Larkin Trade International

- PricewaterhouseCoopers LLP

- Ryan LLC

- Schenker AG

- World Wide Customs Brokers Ltd

Latest News and Developments:

- December 2024: The Federal Board of Revenue's Directorate of Customs Post-Clearance Audit South uncovered a fraud of INR 2.4 Billion (USD 27.56 Million) affecting the exchequer. In this instance, the duty and tax have been avoided in the Manufacturing Bond, Duty and Tax Remission for Exports (DTRE), and Temporary Import and Export Facilitation Scheme.

- February 2024: The Spanish Tax Administration Agency issued a resolution published in the Official Gazette of Spain, outlining the key guidelines of the Annual Tax and Customs Audit Plan for 2024, known as the Spanish Tax Audit Plan 2024.

Customs Audit Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Customs Advisory Services, Customs Audit Services |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Baker Tilly International Ltd., BDO International Ltd., Deloitte Touche Tohmatsu Ltd., Ernst & Young Global Ltd., Grant Thornton International Ltd, KPMG International Ltd., Larkin Trade International, PricewaterhouseCoopers LLP, Ryan LLC, Schenker AG, World Wide Customs Brokers Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the customs audit market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global customs audit market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the customs audit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The customs audit market was valued at USD 8.8 Billion in 2024.

The customs audit market is projected to exhibit a CAGR of 2.7% during 2025-2033, reaching a value of USD 11.2 Billion by 2033.

As international trade is growing, the need for stricter customs regulations and audits is rising to ensure compliance and prevent fraud. Besides this, the evolving nature of trade laws requires businesses to stay updated and conduct regular audits to avoid penalties. Moreover, the increasing cases of misdeclarations, undervaluation, and smuggling are encouraging authorities to enforce more audits to protect customs revenue.

North America currently dominates the customs audit market, accounting for a share of 40.0% in 2024, driven by due to its high volume of trade, complex regulations, and strict enforcement by authorities. With advanced technologies and a focus on compliance, businesses in this region rely heavily on audits to ensure legal operations.

Some of the major players in the customs audit market include Baker Tilly International Ltd., BDO International Ltd., Deloitte Touche Tohmatsu Ltd., Ernst & Young Global Ltd., Grant Thornton International Ltd, KPMG International Ltd., Larkin Trade International, PricewaterhouseCoopers LLP, Ryan LLC, Schenker AG, World Wide Customs Brokers Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)