Cut and Bend Equipment Market Size, Share, Trends and Forecast by Type, Operation Mode, End User, and Region, 2025-2033

Cut and Bend Equipment Market Size and Share:

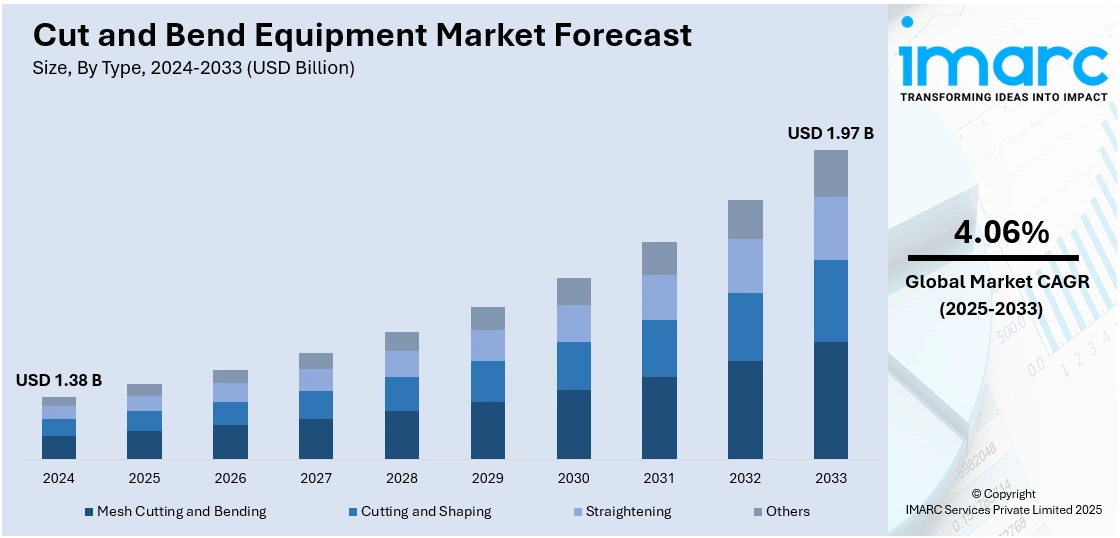

The global cut and bend equipment market size was valued at USD 1.38 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.97 Billion by 2033, exhibiting a CAGR of 4.06% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 35.8% in 2024. The dominance of the region is attributed to rapid urbanization, strong infrastructure investment, and sustained growth in construction activities across the region. Government initiatives supporting housing and industrial development, along with a growing focus on project efficiency and automation, are encouraging widespread adoption of advanced equipment for faster and more accurate steel processing and contributing in the expansion of cut and bend equipment market share in the Asia Pacific region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.38 Billion |

| Market Forecast in 2033 | USD 1.97 Billion |

| Market Growth Rate (2025-2033) | 4.06% |

Construction companies are progressively depending on automated solutions to enhance operational efficiency. Cutting and bending rebar by hand is labor-intensive and susceptible to variations. Automated machines provide enhanced precision, consistency in results, and rapid performance. This enhances project schedules and decreases the chances of mistakes, making automation a favored option for contemporary contractors. Additionally, in several nations, it is becoming challenging to locate skilled workers for repetitive and physically intensive jobs, such as rebar bending. Even when accessible, this type of labor frequently comes with a high cost. Cutting and bending equipment alleviates this by decreasing reliance on manual labor, allowing for uninterrupted functioning with limited human involvement. This enables businesses to manage labor expenses and enhance efficiency.

The United States plays a vital role in the market, as the construction sector encounters a shortage of skilled labor, especially in trades related to manual rebar tasks. Automated and semi-automated machines provide a dependable option, decreasing reliance on labor while sustaining productivity. Moreover, the increasing interest in modular construction is driving the need for sophisticated cut and bend equipment. Modular construction techniques demand highly accurate, pre-fabricated parts that can be rapidly assembled on-site, which makes automation and precision in cutting and bending processes crucial. This trend improves project efficiency, decreases reliance on labor, and shortens construction periods, encouraging broader use of advanced technology in machinery to satisfy these changing production demands. In 2024, Greystar revealed it is approaching the launch of its initial modular multifamily housing project in the US. Constructed with components from its factory in Pennsylvania, the initiative seeks to lower development expenses. The program promotes the availability of more reasonably priced rental homes.

Cut and Bend Equipment Market Trends:

Rise in Construction and Infrastructure Development Activities

The growth in construction and infrastructure projects is greatly influencing the global market. This expansion is mainly driven by swift urbanization, turning rural areas into vibrant urban hubs, along with significant government funding for various infrastructures, such as buildings, bridges, roads, and tunnels. The United Nations estimates that by 2050, 68% of the global population will live in cities. Addressing the distinct requirements of these intricate projects necessitates specialized equipment tailored for forming and altering construction materials like steel and rebar. These tools are essential for ensuring the structural stability and effectiveness of extensive infrastructure initiatives, requiring exactness and precision. Additionally, as urban areas expand and communities advance, the demand for updates and enhancements increases, requiring careful modification of current buildings to meet modern requirements and criteria. Whether it's updating an existing structure or designing new architectural marvels, the need for advanced tools facilitating precise automation is emerging as a key factor. It leads to upholding superior quality standards, boosting productivity, and guaranteeing that the constructed environment can endure the challenges. Consequently, the cut and bend equipment market value is expected to witness substantial growth, supported by the rising demand for precision-driven tools essential for executing complex and large-scale infrastructure projects efficiently.

Technological Advancements

The incorporation of automation, robotics, and computer numerical control (CNC) technologies into manufacturing methods is not only updating the processes but also resulting in the development of machines that are highly precise, efficient, and dependable. For example, in 2024, the International Federation of Robotics reported that there were 4,281,585 robotic units utilized in factories worldwide, marking a 10% rise. These devices can perform intricate tasks with a degree of precision that was once impossible, minimizing human mistakes, and enhancing the overall quality of the product. These advancements are catalyzing the demand for these tools and promoted ongoing research and development (R&D). Moreover, the integration of digital systems with custom software solutions enables a greater level of personalization to accommodate diverse client requirements, resulting in more effective and efficient outcomes. Enhanced operational efficiency, along with flexibility, fosters an environment rich with possibilities for market growth. The cooperation among various technological fields, integration within industries, solutions centered on customers, and the continuous drive for excellence are fostering an optimistic cut and bend equipment market growth.

Implementation of Stringent Regulations

A heightened emphasis on quality, safety, and compliance with regulations is encouraging the use of cut and bend equipment by workers in the construction sector. The International Trade Union Confederation reports that around 220 million people were working in the construction sector in 2023. The rising need for tools that can execute precise functions on construction materials, providing accuracy and meeting strict standards is contributing to the market growth. Global government authorities implement regulations that address key aspects of construction, such as building methods, structural strength, and earthquake resistance. These regulations aim to safeguard not just the integrity of the structures but also the welfare of the individuals who reside in them. Thus, the significance of precision tools in forming construction components is essential. These tools allow construction firms to meet regulatory standards, improving the overall structural integrity, safety, and sustainability of buildings and infrastructure projects. As communities become more aware about environmental issues and human safety, these regulations will probably tighten further. As a result, the emphasis on regulations is fostering not only the wider use of specialized tools but also highlighting the importance of responsible construction practices.

Cut and Bend Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cut and bend equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, operation mode, and end user.

Analysis by Type:

- Mesh Cutting and Bending

- Cutting and Shaping

- Straightening

- Others

Cutting and shaping stand as the largest component in 2024, holding 39.8% of the market. The dominance of the segment is attributed to their crucial function in improving construction efficiency and material usage. These procedures are essential for the production of reinforced steel, which is vital for maintaining structural integrity in numerous construction initiatives. The precision and accuracy offered by cutting and shaping tools guarantee that the materials conform to the precise specifications needed for various designs and structures. Furthermore, these methods contribute to minimizing material waste and enhancing cost-effectiveness, making them greatly appreciated in the construction sector. The growing demand for quicker project finishes and enhanced quality management in construction is catalyzing the demand for sophisticated cutting and shaping equipment. Cut and bend equipment market forecast indicates that this segment will continue to lead the market in the coming years, driven by ongoing advancements in technology and an increasing need for high-quality, time-efficient construction solutions.

Analysis by Operation Mode:

- Semi-Automatic

- Automatic

Automatic leads the market with 65.2% of market share in 2024 because it greatly improves efficiency, accuracy, and reliability in construction projects. Automatic system minimizes human mistakes and provide more precise cuts and bends, which are essential for preserving the structural integrity of buildings and other infrastructures. Automation enhances productivity by minimizing manual work and speeding up production schedules, resulting in quicker project finishes. The simplicity of merging with cutting-edge technologies, such as artificial intelligence (AI) and robotics, enhances the attractiveness of automated systems. It is especially preferred for its capacity to manage intricate tasks with little supervision, lessening the need for skilled workers and lowering operational expenses. Furthermore, automated machinery can be set up for uniform output, guaranteeing top-notch results throughout extensive projects. The increasing need for fast, top-quality construction materials is making automatic operation modes the favored option in the market.

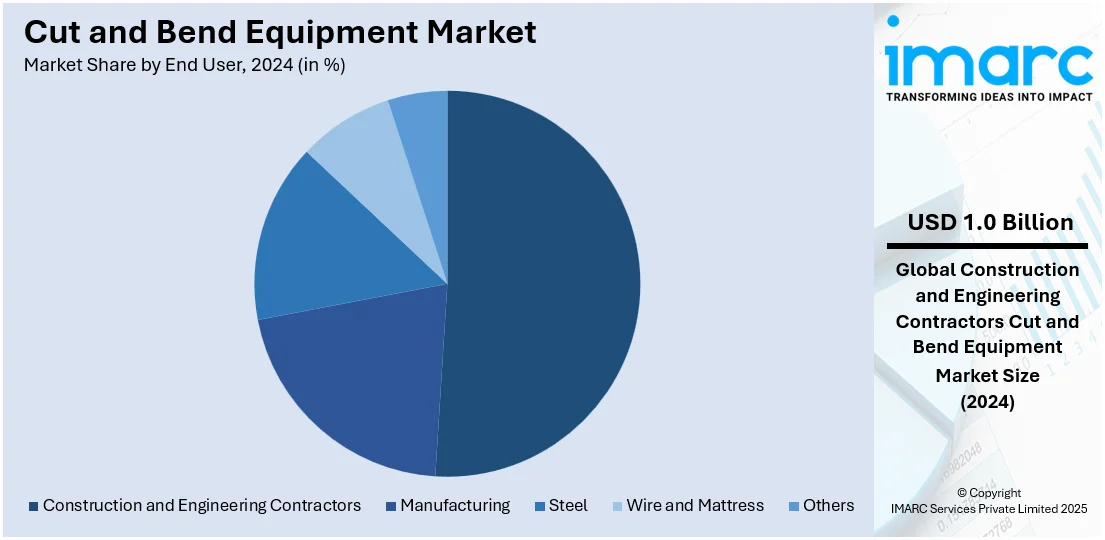

Analysis by End User:

- Construction and Engineering Contractors

- Manufacturing

- Steel

- Wire and Mattress

- Others

Construction and engineering contractors represent the largest segment, accounting 51.2% market share because of their key role in carrying out substantial infrastructure and construction ventures. These contractors need accurate and effective cutting and bending tools to guarantee that materials adhere to rigid standards for structural integrity and safety. The requirement for high-quality, long-lasting materials that are swiftly processed to precise dimensions renders this equipment crucial for their operations. Additionally, contractors gain from the efficiency and time-saving features of contemporary cut and bend machines, enabling them to optimize their processes and minimize manual effort. With the growing demand for quicker project timelines and improved productivity, contractors depend on advanced machinery to remain competitive and fulfill client requirements. The adaptability of cut and bend machinery, which can manage numerous materials and designs, reinforces its necessity among construction and engineering contractors. According to the cut and bend equipment market research report, this segment is expected to dominate the industry, as contractors invest in advanced machinery to enhance operational efficiency and meet the evolving demands of modern construction projects.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific held the biggest market share of 35.8% owing to its leadership in construction and infrastructure development initiatives. The area sees significant demand for cut and bend equipment due to widespread construction and infrastructure projects in both emerging and developed nations. For instance, in 2024, it was announced that 75 infrastructure projects, constructed by the Border Roads Organisation (BRO) at a cost of Rs 2,236 crore, were set to be inaugurated on October 12. The projects were spread across 11 border states/UTs, including Jammu and Kashmir, Ladakh, and Arunachal Pradesh. The rising emphasis on extensive residential, commercial, and industrial developments is catalyzing the demand for effective and accurate equipment to manage intricate reinforcement activities. Furthermore, numerous nations in the area are embracing innovative construction technologies to enhance efficiency and lower labor expenses, resulting in a high demand for automated machinery. The existence of major producers and a competitive marketplace further enhances the dominance of Asia Pacific, as local firms offer affordable solutions customized to meet regional demands.

Key Regional Takeaways:

United States Cut and Bend Equipment Market Analysis

In North America, the market portion held by the United States was 80.80%, propelled by the continuous movement toward automation in various sectors as businesses aim to enhance efficiency, accuracy, and output. Cutting and bending equipment is vital for optimizing steel rebar processing in the construction sector, where both speed and precision are necessary to satisfy the requirements of major infrastructure initiatives like bridges and skyscrapers. As reported by the United States Census Bureau, in January and February 2025, spending on construction endeavors hit USD 311.1 billion, showing a 2.1% increase compared to the equivalent timeframe in 2024. Moreover, with the manufacturing industry continuing to grow, there is an increase in demand for sophisticated machinery that can manage large quantities and offer customization options for various metals and sizes. The growing emphasis on safety and minimizing labor expenses is offering a favorable cut and bend equipment market outlook. Automated cutting and bending equipment aids in decreasing human mistakes, improving worker safety, and reducing material waste, making it very appealing in budget-minded sectors. Besides this, the rising trend of prefabrication and modular building is driving the need for effective steel processing machinery to guarantee quicker production schedules and enhanced quality management.

Europe Cut and Bend Equipment Market Analysis

The market for cut and bend equipment in Europe is seeing growth, driven by the rising trend of digitalization in manufacturing, a move towards lean construction methods, and a growing demand for customized solutions. Reports indicate that the European Union intends to achieve a foundational level of digital transformation for 90% of SMEs in the area by 2030. By 2030, it is anticipated that 75% of firms in the EU will reach a greater degree of digital intensity, leveraging advanced technologies like AI and cloud computing. As European industries increasingly emphasize digital transformation, the integration of automated control systems and advanced software with cut and bend machinery is becoming more common. These technologies enable enhanced accuracy, adaptability, and instantaneous monitoring, increasing efficiency and minimizing mistakes in rebar processing. In addition, the shift towards lean construction techniques, focusing on minimizing waste and streamlining processes, is driving the need for automated machinery that can boost production rates and reduce material usage. The rise of customization is another significant factor driving growth, as an increasing number of construction projects demand specific rebar specifications to fulfill distinct structural needs. This is catalyzing the demand for cut and bend machinery that can manage various sizes, shapes, and bending angles, facilitating industry growth.

Asia Pacific Cut and Bend Equipment Market Analysis

The market for cut and bend equipment in the Asia Pacific region is growing due to swift urbanization, rising construction activities, and the demand for enhanced automation in manufacturing processes. According to projections, 53.6% of Asia's population is anticipated to reside in urban regions by 2025. With urban areas in the region growing, substantial infrastructure initiatives like housing developments, business establishments, and transit systems are driving the need for effective steel reinforcement processing. As a result, there is a heightened need for sophisticated cutting and bending machinery to manage large quantities of rebar accurately and quickly. Moreover, the increasing use of automation in the construction and manufacturing industries is enhancing productivity, lowering labor expenses, and reducing mistakes in steel processing. Additionally, the transition to more sustainable building methods and waste minimization further propels the market, as automated machinery enables better material utilization.

Latin America Cut and Bend Equipment Market Analysis

The market for cut and bend equipment in Latin America is mainly influenced by the rising demand for infrastructure upgrades, urban development, and the need for quicker project completion. With the increase in construction activities in the region, especially in developing nations, there is a heightened demand for effective steel reinforcement methods. Moreover, the growth of prefabrication and modular building in Latin America is significantly aiding industry growth, as these techniques demand more efficient and uniform steel processing. For example, the modular building market in Brazil attained USD 2.00 Billion in 2024 and is expected to expand at a CAGR of 4.80% from 2025 to 2033, according to the IMARC Group. In addition to this, the growing emphasis on superior construction quality, along with an increasing focus on minimizing human error and enhancing safety standards, is encouraging the use of automated cut and bend machinery.

Middle East and Africa Cut and Bend Equipment Market Analysis

The market for cut and bend equipment in the Middle East and Africa is driven by the rising demand for construction quality and efficiency, supported by a flourishing real estate industry and significant infrastructure developments. For example, in 2021, Dubai's real estate sector documented over 84,196 transactions, totaling close to AED 300 Billion and achieving a growth of 66.3% compared to the prior year, as reported by the Government of Dubai. As the construction sector emphasizes enhancing project schedules, there is a rise in the demand for automated machinery that boosts productivity while guaranteeing accuracy in rebar processing. The increase in tailored construction projects is also catalyzing the demand for adaptable tools that can handle various rebar dimensions and configurations.

Competitive Landscape:

Major participants in the market are concentrating on innovation, automation, and efficiency to address changing industry needs. They are putting significant resources into research operations to improve product efficiency, longevity, and accuracy. There is a focus on creating systems that are user-friendly and have enhanced control and safety features. Businesses are also optimizing production methods and increasing manufacturing capabilities to satisfy rising demand. Strategic partnerships, mergers, and international growth strategies are being implemented to enhance market presence and secure competitive edges. For instance, in 2025, Sigma successfully acquired the 100% electric eMOB 150 tube bending machine from AMOB to help improve the accuracy and effectiveness of their manufacturing procedures. The eMOB 150 uses state-of-the-art technologies to execute intricate bends with the highest level of quality and repeatability.

The report provides a comprehensive analysis of the competitive landscape in the cut and bend equipment market with detailed profiles of all major companies, including:

- Consolidated Machines

- Emg S.r.l.

- Eurobend S.A.

- Jayem Manufacturing Co.

- KRB Machinery

- M.E.P. Macchine Elettroniche Piegatrici S.p.A

- Progress Maschinen & Automation AG

- Retecon (Pty) Ltd.

- Schnell Spa

- SweBend AB

- TJK Machinery (Tianjin) Company Limited

- Toyo Kensetsu Kohki Co. Ltd.

- Unicorn Equipment

Latest News and Developments:

- April 2025: Komaspec opened a new custom metal components production plant in Mexico, reaching a significant milestone in the company’s expansion plans. The facility, which spans 20,000 square feet, is equipped with advanced cut and bend equipment, including laser cutting and sheet metal bending, and other cutting-edge manufacturing technologies such as laser engraving.

- March 2025: Bystronic launched the ByTube Star 330, an advanced tube laser cutter with a power of 6-10 kilowatts. The tube laser provides an exceptionally high processing rate for components above 0.82 feet and 88.18 pounds per foot. Its completely automated feeding and sorting greatly reduces labor costs while increasing output.

- February 2025: Damen Naval secured two tube bending machines from AMOB, the CH 80 AND CH 170 hydraulic models. This acquisition is a significant step forward in the company’s plans to upgrade its manufacturing procedures, boost operational effectiveness, and guarantee the best possible quality in the construction of its ships and vessels.

- August 2024: Jaypee Construction Equipment Solutions launched the new Winget Bending & Cutting Machine to improve the efficiency and accuracy of manufacturing and construction operations. By incorporating state-of-the-art technological advancements that adhere to industry standards, this edition considerably improves upon previous models.

Cut and Bend Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mesh Cutting and Bending, Cutting and Shaping, Straightening, Others |

| Operation Modes Covered | Semi-Automatic, Automatic |

| End Users Covered | Construction and Engineering Contractors, Manufacturing, Steel, Wire and Mattress, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Consolidated Machines, Emg S.r.l., Eurobend S.A., Jayem Manufacturing Co., KRB Machinery, M.E.P. Macchine Elettroniche Piegatrici S.p.A, Progress Maschinen & Automation AG, Retecon (Pty) Ltd., Schnell Spa, SweBend AB, TJK Machinery (Tianjin) Company Limited, Toyo Kensetsu Kohki Co. Ltd., Unicorn Equipment, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cut and bend equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cut and bend equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cut and bend equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cut and bend equipment market was valued at USD 1.38 Billion in 2024.

The cut and bend equipment market is projected to exhibit a CAGR of 4.06% during 2025-2033, reaching a value of USD 1.97 Billion by 2033.

The market is driven by rapid urbanization, growing infrastructure projects, and increased demand for prefabricated construction components. Advancements in automation, labor cost optimization, and the need for faster, accurate rebar processing also support the market growth. Additionally, government investments in smart cities and housing projects fuel equipment adoption in emerging economies.

Asia Pacific currently dominates the cut and bend equipment market, accounting for a share of 35.8%. The dominance of the region is attributed to large-scale infrastructure development, rapid urbanization, and strong growth in the construction sector across countries. Supportive government initiatives, rising labor costs encouraging automation, and expanding industrialization further catalyze the demand for cut and bend equipment in the region.

Some of the major players in the cut and bend equipment market include Consolidated Machines, Emg S.r.l., Eurobend S.A., Jayem Manufacturing Co., KRB Machinery, M.E.P. Macchine Elettroniche Piegatrici S.p.A, Progress Maschinen & Automation AG, Retecon (Pty) Ltd., Schnell Spa, SweBend AB, TJK Machinery (Tianjin) Company Limited, Toyo Kensetsu Kohki Co. Ltd., Unicorn Equipment, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)