Dark Spirits Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region, 2026-2034

Dark Spirits Market Size and Share:

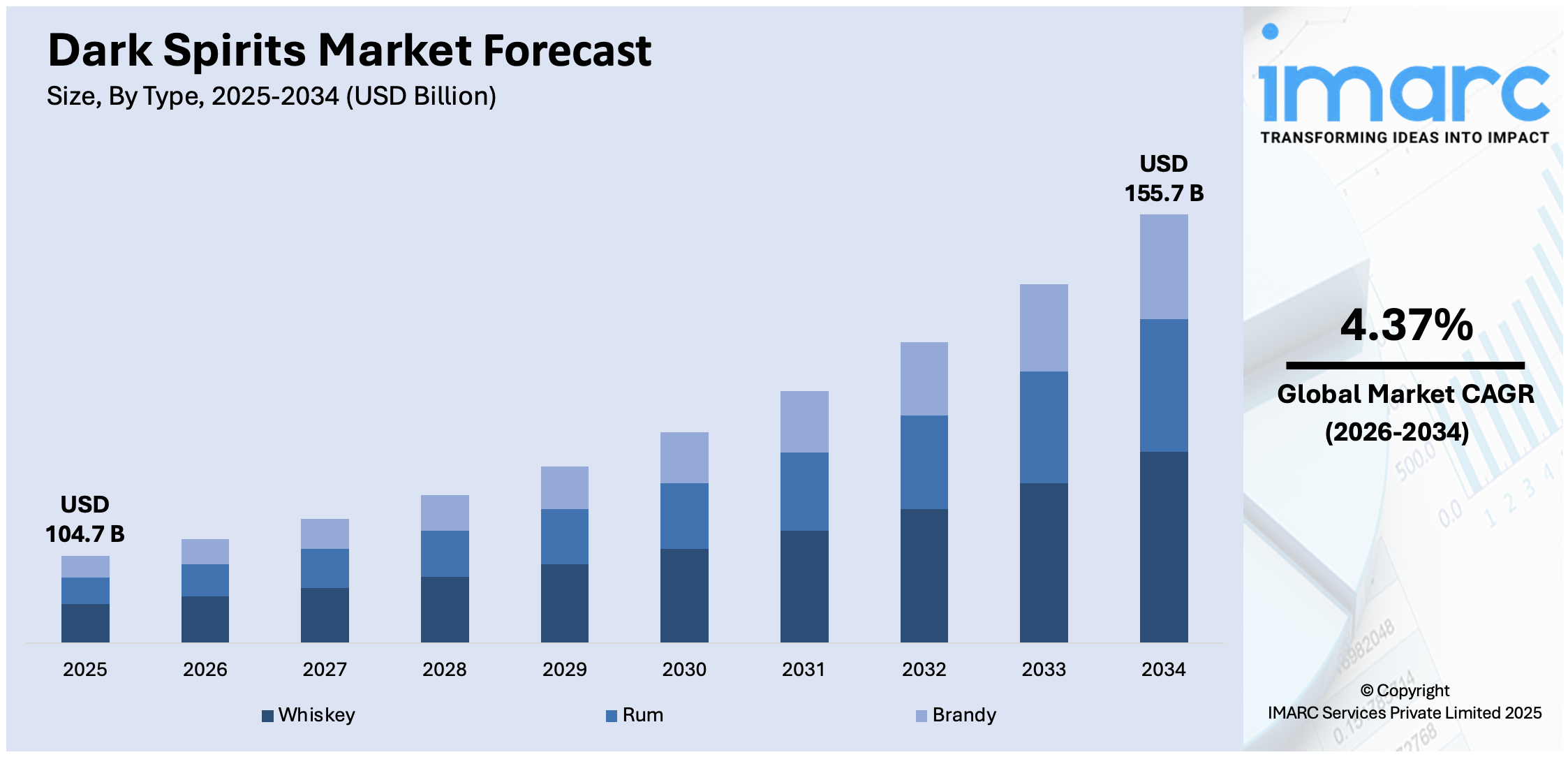

The global dark spirits market size was valued at USD 104.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 155.7 Billion by 2034, exhibiting a CAGR of 4.37% from 2026-2034. Asia Pacific currently dominates the dark spirits market share by holding over 32.8% in 2025. Due to the rising disposable incomes, increasing demand for premium and aged spirits, a strong cocktail culture, expanding urban nightlife, and the growing presence of local and international distilleries catering to evolving consumer preferences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 104.7 Billion |

|

Market Forecast in 2034

|

USD 155.7 Billion |

| Market Growth Rate (2026-2034) | 4.37% |

The global dark spirits market growth is primarily driven by the rising premiumization, that fuels demand for aged whiskey, rum, and brandy as consumers seek high-quality, refined drinking experiences. In addition, the expanding cocktail culture increases consumption in bars, restaurants, and home settings, aiding the market demand. Moreover, the growing disposable incomes, especially in emerging markets, allow consumers to afford premium and craft spirits, providing an impetus to the market. Besides this, the e-commerce expansion enhances accessibility, making premium brands more available worldwide, which is driving the market demand. Also, sustainability trends push distilleries toward eco-friendly packaging and production, attracting conscious consumers and supporting the market growth. Furthermore, heritage and authenticity appeal to drinkers valuing traditional craftsmanship, boosting sales of established brands and craft distilleries, thus impelling the market demand.

To get more information on this market Request Sample

The United States dark spirits market demand is driven by a strong bourbon and whiskey heritage, with a rich distilling history. The market currently holds a total share of 87.40% owing to the increasing continuous innovations in barrel aging, with distilleries experimenting with unique cask finishes and maturation techniques to enhance flavor complexity, contributing to the market expansion. Concurrently, the rise of craft distilleries is driving local and artisanal spirit consumption, appealing to consumers seeking authenticity, which is strengthening the dark spirit market share. However, competition from premium beer remains a factor, as brewers enjoy some immunity to shifting consumer spending habits, premium beer typically costs only around $1 more per drink than mass-market options, making it a more accessible indulgence. Additionally, the shifting consumer demographics, including younger drinkers exploring whiskey and rum, are fueling the market demand. Furthermore, celebrity-backed brands are influencing purchasing trends and boosting brand visibility, which is providing an impetus to the market. Apart from this, direct-to-consumer (D2C) sales growth through online platforms is enhancing accessibility, thereby propelling the market forward.

Dark Spirits Market Trends:

Evolving consumer preferences

The dark spirits market trends are driven by the increased interest of consumers in premium and artisanal spirits. People who have evolved in their drinking habits now choose superior quality spirits with exclusive flavors along with handcrafted production methods. The market also shows a rising preference for heritage-based products alongside premium pricing in exchange for increased production skills. Research shows that despite increasing living costs, customers are willing to invest in sustainable products, as over 80% of buyers support this purchasing trend. Furthermore, the growing demand prompts distilleries to introduce their restricted edition and small-batch products that feature traditional production methods and locally sourced ingredients. With this, dark spirits not only cater to connoisseurs but also appeal to a young generation of drinkers on the quest for new drinking experiences beyond what mainstream brands can offer.

Changing market dynamics

The expansion of cocktail culture is enhancing the dark spirits market outlook. In addition to this, dark spirits such as whiskies, rums, and brandies are cocktail drinks that enjoy widespread popularity with millennials and Gen Z consumers. According to reports, the number of cocktail orders placed at bars, clubs, and restaurants has reached 7.4 Million people since 2020, creating a 13% growth from previous figures. Research also indicates that cocktail drinkers make up 43% of the total population who enjoy their cocktails at least once per week. These particular demographics demonstrate risky alcohol behavior while seeking cocktails which display both sophisticated elements and creative qualities. Bartenders and mixologists also experience continuous innovation through daily experimental work caused by changing flavor trends and mixology methods. Concurrently, the worldwide growth of cocktail bars drives the utilization of dark spirits in upscale and varied drink menus. As a result, dark spirits exceed conventional alcohol consumption patterns as they gain prominence within cultural and social experiences that revolve around night entertainment and culinary arts.

Broader cultural shifts

The increasing globalization of taste and preference is another key factor that contributes to the growth of the global dark spirits market. While dark spirits traditionally enjoyed popularity in developed regions such as North America and Europe, they are rapidly witnessing robust growth in the emerging markets of other regions. The middle-class emergence during a period of economic growth and rapid urbanization brought forth the demand for premium spirits among consumers who had disposable incomes. For instance, the World Bank reports that 56% of humanity lives in cities since 4.4 Billion people inhabit urban areas. Through cultural exchange facilitated by travel, digital platforms, and social media, users now have equal access to information about various spirits thus sparking interest for diverse populations to adopt new spirits. Apart from this, global brands have used their opportunities to create extensive distribution networks while adjusting their marketing approaches to match local preferences thus boosting the dark spirits market share.

Dark Spirits Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dark spirits market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, distribution channel, and application.

Analysis by Type:

- Whiskey

- Rum

- Brandy

Whiskey stands as the largest dark spirit type in 2025, holding around 46.8% of the market. It represents a significant portion of the dark spirits industry, and its demand is fueled by customers' rising inclination towards premiumization and connoisseurship. These consumers place a high value on the skill, aging methods, and geographical uniqueness that distinguish various whiskey varieties. This trend is especially noticeable in developed areas like North America and Europe, where customers are ready to invest in high-quality whiskey as a statement of taste and refinement. Furthermore, due to its emergence as a cultural icon in entertainment and popular media, it is drawing the attention of younger consumers who value authenticity and tradition in their consumption decisions, thus driving the market forward.

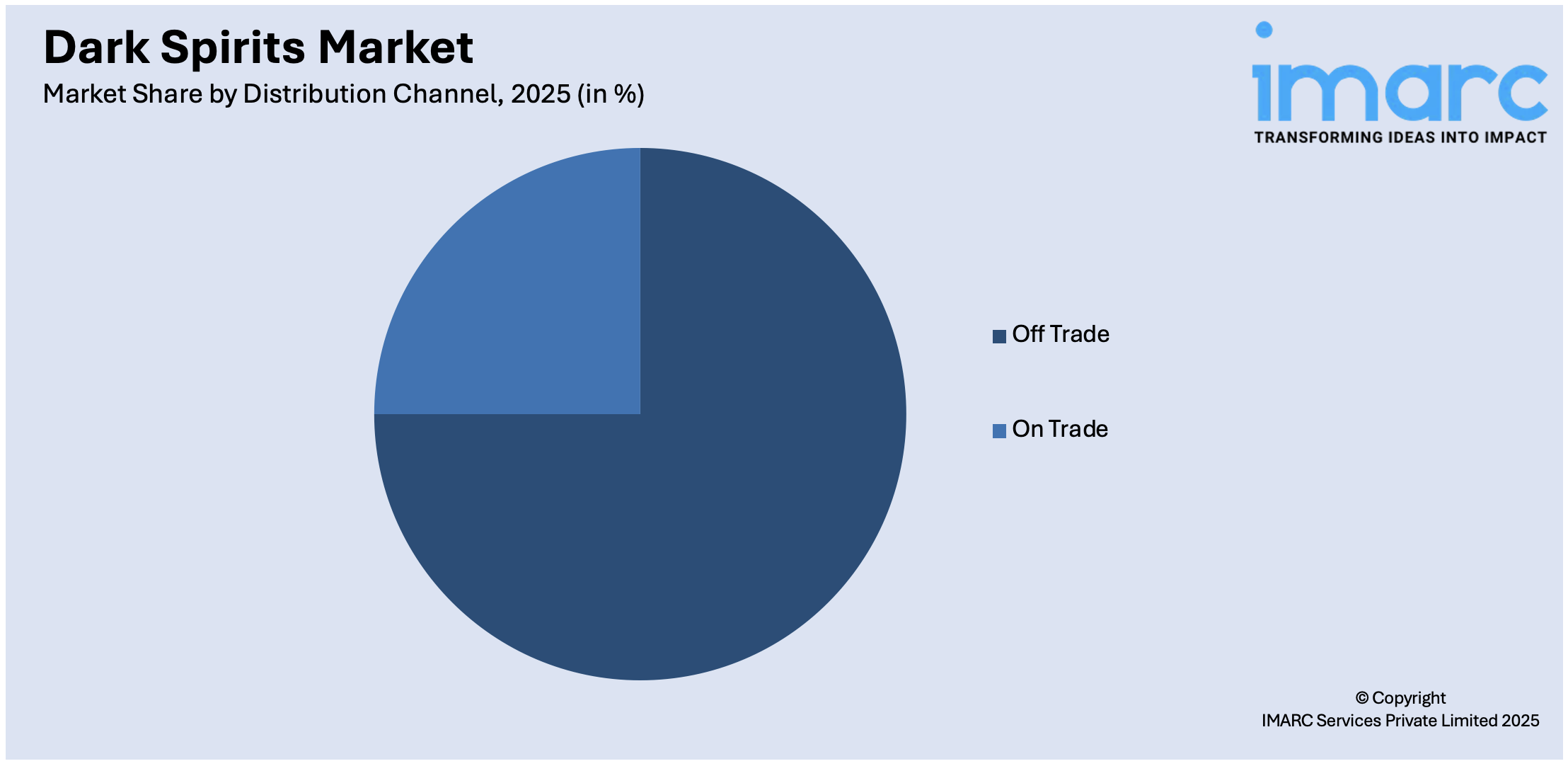

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- On Trade

- Off Trade

Off trade leads the market with around 75.0% of the market share in 2025. This segment is driven by the rising demand for dark spirits through the off-trade distribution channels are accessibility, convenience, and evolving consumer purchasing habits. The term "off-trade" describes sales that take place through retail establishments including supermarkets, liquor shops, and internet platforms, usually outside of pubs and restaurants. Moreover, the growing propensity for at-home consumption, which is fueled by international events that hastened the transition towards home entertainment, is one important reason propelling the dark spirits market size. Furthermore, customers are more likely to buy dark spirits from physical establishments where they can easily compare costs, peruse a large assortment, and shop, thereby impelling the market growth.

Analysis by Application:

- Bars

- Restaurants

- Pubs

- Others

The demand for dark spirits in bars is driven by mixologists creating innovative cocktails, offering unique drinking experiences that attract patrons seeking premium and crafted beverages. This further enhances social gatherings with creative blends, personalized drinks, and high-end selections in trendy, upscale bar settings.

Besides this, dark spirits in restaurants are sought after for their ability to complement gourmet dining experiences, enhancing flavors and offering patrons a sophisticated beverage option that aligns with upscale culinary trends. Moreover, fine dining establishments emphasize aged spirits and curated pairings, appealing to sophisticated palates seeking unique tasting experiences.

Moreover, dark spirits are favored in pubs for their versatility in traditional and contemporary drinks, appealing to patrons seeking both classic whiskey-based drinks and modern interpretations. This further fosters a relaxed and dynamic atmosphere ideal for socializing, casual gatherings, and after-work drinks.

Apart from this, dark spirits are increasingly popular in event settings and catering due to their role in creating memorable experiences, offering diverse options that cater to varied tastes and preferences among attendees.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 32.8%. The demand for dark spirits in the region is significantly propelled by economic growth and rising disposable incomes among the middle class in the region. This trend is leading to an increase in consumer spending on premium alcoholic beverages, including whiskey, brandy, and dark rum. Besides this, as western lifestyles and drinking habits become more integrated into urban Asian cultures, there is a growing appreciation for the sophistication and status associated with dark spirits, particularly among younger demographics. Additionally, cultural celebrations and social gatherings often incorporate dark spirits as a symbol of hospitality and prestige, which is driving the widespread consumption of dark spirits. Apart from this, the increasing influence of global trends, facilitated by digital connectivity and international travel, has broadened awareness and product demand in Asian markets, thereby bolstering the dark spirits market share.

Key Regional Takeaways:

North America Dark Spirits Market Analysis

North America is a key driver of the dark spirits market, fueled by strong consumer demand for premium and craft whiskey, bourbon, and rum. The region experiences market expansion because of its active cocktail scene, growing population income levels, and its preference for mature spirits produced in limited quantities. For example, Diageo reduced the price of its Casamigos Blanco tequila from over $45 to around $40, responding to shifting consumer preferences and increased competition in the premium tequila segment. Additionally, the United States maintains leadership in whiskey manufacturing through its established industry together with expanding craft distilling operations and creative barrel maturation practices. The market further responds to sustainability trends by providing both eco-friendly packaging solutions and sustainable sourcing practices. The accessibility of spirits improves through both e-commerce expansion and direct consumer sales channels. Apart from this, the increasing presence of Hispanics and multicultural groups drives dark rum and various spirits demand, which is providing an impetus to the market.

United States Dark Spirits Market Analysis

The U.S. dark spirits market is experiencing growth because consumers are changing preferences while distilleries produce premium products together with emerging craft distilleries. Research indicates that 62% of U.S. adults drink alcohol yet 38% choose abstinence which demonstrates robust consumer interest in whiskey bourbon and rum products. These generations as well as those after them choose to support brands that make small batches and draw from local histories. The rise of cocktail culture, fueled by mixology trends in bars and restaurants, further accelerates market growth. E-commerce and direct-to-consumer sales enhance accessibility, making premium spirits more available. Whiskey tourism and distillery experiences are also gaining popularity, strengthening consumer engagement. The expansion of craft distilleries receives support from regulatory measures that provide reduced excise duties in specific states. Sustainability initiatives, such as eco-friendly packaging and ethical sourcing, are becoming increasingly important, aligning with shifting consumer values. Social media and digital marketing play a crucial role in boosting brand visibility and consumer education. Macroeconomic stability and rising disposable incomes continue to support premium segment expansion. The competitive marketplace becomes more distinctive due to cask aging innovations as well as distinctive flavor profiles and interesting packaging designs in the beverage industry. As consumers seek authenticity, transparency, and unique tasting experiences, the U.S. dark spirits market remains poised for sustained growth.

Europe Dark Spirits Market Analysis

Europe’s dark spirits market is driven by strong whiskey and rum traditions, premiumization, and evolving consumer preferences. According to UN Tourism, Europe, the world's largest travel destination, welcomed 747 Million international arrivals in 2024, surpassing 2019 levels by 1% and 2023 by 5%. This increase in tourism has fueled demand for whiskey tourism and distillery experiences, particularly in Scotland and Ireland, where heritage brands continue to thrive. Premiumization remains a key trend, with consumers willing to pay more for high-quality, limited-edition releases. Sustainability and transparency, featuring organic ingredients and sustainable packaging, and ethical sourcing, are becoming essential purchasing factors. The on-trade sector, particularly cocktail bars and high-end restaurants, continues to drive demand as mixology trends evolve. Besides this, e-commerce and D2C channels have expanded market accessibility, with digital engagement playing a crucial role in brand visibility. Also, regulatory policies, including taxation and advertising restrictions, influence pricing and market strategies. Furthermore, local distilleries are innovating with unique cask finishes and extended aging techniques to differentiate offerings. Additionally, intraregional demand, supported by strong consumer loyalty and whiskey trails across Europe, further boosts market growth. As consumers seek authenticity and unique tasting experiences, the European dark spirits market is set for continued expansion and innovation.

Asia Pacific Dark Spirits Market Analysis

The dark spirits market in the APAC region grows due to increasing household earnings combined with changing drinking behaviors that adopt Western traditions. Statistical data released between 1995 and 2021 prove that India’s middle class grew by 338 Million at a rate of 6.3% per year thus reaching 31% of the total population. Market analysts expect this segment to expand from its current 38% projection in 2031 to reach 60% by 2047 thus driving the demand for premium whiskey and rum. More consumers now prefer to give and drink aged spirits that are imported into their markets. New Penetration of e-commerce and digital marketing methods speeds up market access, especially among young consumer segments. The growth of cocktail culture across urban areas enhances the consumption of alcoholic beverages in bars and restaurants. The local distillation industry in India and Australia enhances regional distribution capabilities. The market behavior of alcohol products depends on taxation rules together with advertising limits because relaxed restrictions support premium imported products. Worldwide brands when partnered with local players expand their distribution systems. The growth of the Asian dark liquor market continues to be sustained through increased engagement from social media platforms as well as influencer marketing and experiential events.

Latin America Dark Spirits Market Analysis

The Latin America dark spirits market is influenced by economic growth, premiumization, and urban expansion. According to reports, the rising urbanization percentage in the region exceeds around 80%. The increasing number of residents in Mexico City, São Paulo, and Buenos Aires drive whiskey and rum consumption because these cities have become centers of cocktail culture. Besides this, the rising disposable incomes and aspirational consumption drive premium segment growth. E-commerce and digital marketing enhance accessibility and brand awareness. Local distilleries leverage regional aging techniques to offer unique products. Regulatory changes, sustainability initiatives, and heritage-driven branding further shape market trends and long-term expansion.

Middle East and Africa Dark Spirits Market Analysis

The Middle East & Africa dark spirits market is shaped by evolving lifestyles, tourism growth, and premiumization. According to the World Bank, the Middle East and North Africa (MENA) region is already 64% urbanized, supporting increased demand for premium whiskey and rum in cosmopolitan hubs like Dubai and Johannesburg. Expatriate populations and high-end hospitality establishments drive consumption. Moreover, the e-commerce expansion and duty-free retail improve accessibility for the dark spirits in the region. Also, regulatory policies on alcohol taxation and licensing influence the market strategies. Social media and influencer marketing enhance brand engagement. Apart from this, localized offerings and exclusive cask-aged variants attract affluent consumers, while mixology trends further elevate demand in luxury segments.

Competitive Landscape:

The dark spirits market is highly competitive, with key players focusing on product innovation, premiumization, and expanding their global footprint. Leading brands are investing in aged and craft spirits to cater to evolving consumer preferences. Mergers, acquisitions, and strategic partnerships are common, enabling companies to enhance distribution networks and strengthen market presence. Sustainability initiatives, such as eco-friendly packaging and carbon-neutral distillation, are gaining traction among major producers. Additionally, digital marketing and e-commerce strategies are increasingly used to engage consumers and boost online sales. The growing trend of limited-edition releases and unique cask finishes further fuels competition. Emerging players and craft distilleries are also challenging industry giants by offering artisanal, small-batch alternatives with distinct flavor profiles.

The report provides a comprehensive analysis of the competitive landscape in the dark spirits market with detailed profiles of all major companies, including:

- Asahi Group Holdings, Ltd.

- Bacardi Limited

- Brown‑Forman

- Campari Group

- Cointreau Corp.

- Diageo plc

- Edrington

- Halewood Sales

- Pernod Ricard

- Sazerac Company, Inc.

- Suntory Holdings Limited

Latest News and Developments:

- December 2024: Radico Khaitan’s After Dark Whisky surpassed one Million cases in November 2024, joining brands like Magic Moments Vodka and 8 PM Whisky. A blend of imported scotch and Indian grain spirit, the brand grew by 50% in 2022 and is expected to grow by 80% by November FY2025.

- September 2024: Ben Branson, founder of Seedlip, celebrates ten years with a new product, Padauk, from his non-alcoholic distillery, Sylva. Located in Essex, Sylva uses innovative methods like sonic maturation to create luxury dark spirits without alcohol. Branson aims to redefine dark non-alcoholic spirits as the demand for low- and no-alcohol drinks continues to rise.

- September 2024: Diageo India’s McDowell's & Co. has launched the 'X' series, expanding into white spirits and dark rum, targeting the evolving preferences of younger, premium-seeking consumers. This move aligns with India’s broader premiumization trend, driven by rising disposable incomes, urbanization, and a shift in consumer tastes. The white spirits category presents a dynamic opportunity for McDowell’s to assert its presence with innovation.

- June 2024: Casa Lumbre, a Mexican-based global spirits company, unveiled a second wave of their highly sought-after Contraluz 11:11 Mezcal Reposado expression. The limited-edition product, made from 100% Maguey Espadín, has been matured for 11 months and 11 days in American Oak bourbon barrels and Sakura casks.

- May 2024: Pernod Ricard and ecoSPIRITS entered a new stage in their relationship with a five-year global licensing agreement to enable the distribution of Pernod Ricard's spirits brands in ecoSPIRITS' circular packaging technology to on-trade venues worldwide.

Dark Spirits Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Whiskey, Rum, Brandy |

| Distribution Channels Covered | On Trade, Off Trade |

| Applications Covered | Bars, Restaurants, Pubs, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asahi Group Holdings, Ltd., Bacardi Limited, Brown‑Forman, Campari Group, Cointreau Corp., Diageo plc, Edrington, Halewood Sales, Pernod Ricard, Sazerac Company, Inc., Suntory Holdings Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dark spirits market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dark spirits market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dark spirits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dark spirits market was valued at USD 104.7 Billion in 2025.

IMARC estimates the dark spirits market to exhibit a CAGR of 4.37% during 2026-2034, expecting to reach USD 155.7 Billion by 2034.

Key factors driving the dark spirits market include rising demand for premium and aged varieties, expanding cocktail culture, craft distilleries, increasing heritage branding, emerging markets, surging e-commerce growth, and rising consumer interest in natural ingredients and sustainable production.

Asia Pacific currently dominates the market, accounting for a share exceeding 32.8% in 2025. This dominance is fueled by the rising demand for premium whiskey and rum, increasing disposable incomes, expanding urban nightlife, growing cocktail culture, strong local production, and a preference for aged and craft spirits.

Some of the major players in the dark spirits market include Asahi Group Holdings, Ltd., Bacardi Limited, Brown-Forman, Campari Group, Cointreau Corp., Diageo plc, Edrington, Halewood Sales, Pernod Ricard, Sazerac Company, Inc., Suntory Holdings Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)