Data Center Rack Market Size, Share, Trends and Forecast by Type, Rack Units, Rack Size, Frame Size, Frame Design, Service, Application, End-User, and Region, 2025-2033

Data Center Rack Market Size and Share:

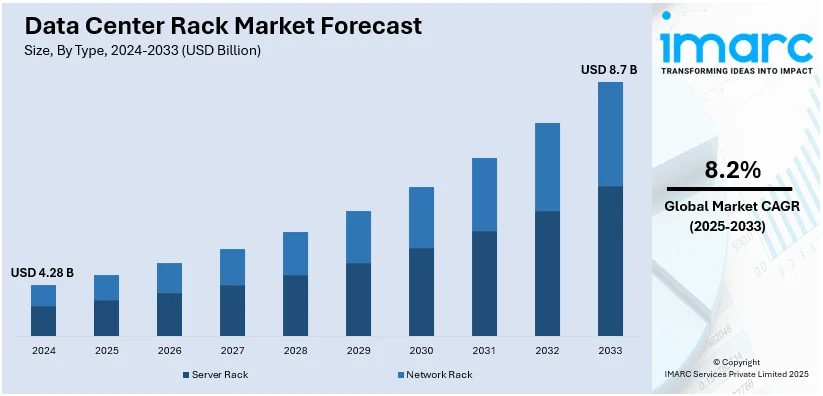

The global data center rack market size was valued at USD 4.28 Billion in 2024. Looking forward, the market is projected to reach USD 8.7 Billion by 2033, exhibiting a CAGR of 8.2% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.3% in 2024. The market is driven by the exponential growth in global data traffic, compelling enterprises to deploy scalable, high-density infrastructure solutions. Rising adoption of modular and enclosed racks enhances cooling efficiency, space optimization, and security. The strategic shift toward edge infrastructure for improved latency and user experience positions data center racks as essential components in decentralized digital ecosystems, further augmenting the data center rack market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.28 Billion |

|

Market Forecast in 2033

|

USD 8.7 Billion |

| Market Growth Rate 2025-2033 | 8.2% |

The increasing acceptance of cloud computing and data-intensive technologies is significantly driving the demand for the data center rack market. As organizations begin to migrate increasing workloads to cloud-based platforms and adapt to artificial intelligence, machine learning, and big data analytics, the need for scalable and high-performance infrastructure accelerates. Optimal space use and efficient cooling of equipment is critical in achieving this support requirement, and hence, data center racks play an important role in this regard. Moreover, rapid proliferation of edge computing and 5G networks puts an added imperative to the evolution of advanced data center racks as the industries require high-availability solutions for higher processing and storage. For instance, in 2024, Belden Inc. introduced advanced network products, including Cat6A Ethernet cables, Hirschmann’s EAGLE40-6M firewall, OpEdge™-4D gateway, and ProSoft’s Wi-Fi 6 radio, that are often used in data center environments, ensuring secure, high-performance solutions for critical applications.

The United States plays a pivotal role in serving the data center rack market by being a hub for technological innovation, advanced manufacturing, and a strong demand base. Home to leading technology companies and cloud service providers, the US drives the adoption of cutting-edge data center solutions, including high-density and modular racks. For instance, in 2024, Chatsworth Products introduced over 100 high-power eConnect PDU configurations, ranging from 28.8 kW to 57.5 kW, to support GPU/AI applications, showcasing innovation in ICT power solutions. Strategic investments in hyperscale data centers and the rapid deployment of 5G networks further strengthen its position. Additionally, the US boasts a robust supply chain and skilled workforce, enabling the production and customization of racks to meet diverse customer needs, fostering growth and global competitiveness in the sector.

Data Center Rack Market Trends:

Increasing Data Traffic and Storage Needs

The exponential growth of data traffic and storage needs is a primary driver of the global data center rack market. According to Ericsson, global mobile data traffic increased by 4.34% in Q2 2024 compared to Q1 2024, as per their mobility visualizer tool. Today, businesses, governments, and individuals generate and consume huge amounts of data. Streaming services and social media, e-commerce and IoT devices are always generating data. Because of this, data centers have to expand their capacity to include this rise of data, and thereby data center racks become a center for optimizing space and organization in such facilities. These support the efficient piling and cooling of servers, networking equipment, and storage devices. The importance of storing data in a highly secure and efficient manner compels organizations to upgrade their data centers with advanced solutions for racks.

Technological Advancements and Rack Innovation

Technological advancements and innovation within the data center rack industry are driving market growth. As data centers strive for higher efficiency, better cooling, and space optimization, rack manufacturers have responded with cutting-edge solutions. High-density racks are a prime instance of technological advancement. These racks are designed to accommodate more equipment in a smaller space while maintaining efficient cooling. For instance, in 2024, HPE and Danfoss launched IT Sustainability Services – Data Center Heat Recovery, featuring Modular Data Centers reducing energy use by 20% and heat reuse modules providing renewable heating, boosting cooling efficiency by 30%. Blade servers and other compact hardware configurations have become increasingly popular, making high-density racks a necessity. Furthermore, data center operators are investing in rack-level cooling solutions, which enhance energy efficiency by directly cooling the equipment within the rack. This reduces the overall cooling load on the data center and lowers operational costs.

Rise in Edge Computing

The rise of edge computing is a pivotal factor driving the global data center rack market. According to reports, the spending on edge computing in the world is expected to reach USD 228 Billion in 2024, reflecting a 14% growth from 2023. Edge computing involves processing data closer to the source, reducing latency and improving real-time decision-making. As organizations embrace IoT devices, autonomous systems, and applications with low-latency requirements, the demand for edge data centers is incresing. Edge data centers are often smaller and more distributed compared to traditional centralized data centers. They require compact and efficient rack solutions to fit into constrained spaces. Data center racks designed for edge deployments are typically ruggedized and capable of withstanding harsh environmental conditions, making them suitable for deployment in a variety of remote locations.

Increasing Adoption of Cloud Services

The increasing adoption of cloud services is a significant driver of the global data center rack market. For instance, by 2025, it is estimated that the world will store 200 Zettabytes (2 Billion Terabytes) in the cloud, highlighting the rapid growth of cloud services. computing is fast becoming the mainstay of IT infrastructure in organizations and companies around the globe. Its main strengths include flexibility, scalability, and cost effectiveness. Thus, cloud computing compels the transition of the operation from local or premises-based infrastructures to cloud. It houses vast amounts of servers, storage, and networking equipment on large data centers managed by the cloud service providers (CSPs). These racks are specifically made to meet the specific needs of CSPs, such as high-density configurations and powerful cooling solutions. Also, hybrid cloud strategies, where enterprises use data centers both on-premises and in the cloud, are increasingly becoming popular. Such a hybrid approach requires adaptable data center racks with the ability to effortlessly integrate into both on-premises and cloud-based infrastructure.

Rising Focus on Energy Efficiency and Sustainability

Energy efficiency and sustainability have become paramount in the data center industry, and data center racks play a crucial role in achieving these goals. The environmental impact of data centers, including their energy consumption and carbon footprint, has garnered increased attention from stakeholders, including governments and consumers. According to McKinsey, global data center capacity demand is projected to grow annually by 19-22%, reaching 171-219 Gigawatts (GW) between 2023 and 2030. To address these issues, energy-efficient rack designs are being developed by data center operators. Such racks are designed to minimize airflow and enhance cooling, thereby reducing the power needed to achieve proper operating temperatures. Cold aisle containment and hot aisle containment systems, installed with racks, further enhance the efficiency of cooling. Many data centers are now also looking for renewable sources of energy and adopting advanced strategies for power distribution to reduce the environmental impact of their operations. Such designs for data center racks are supporting the changes through modular power distribution units that have the ability to manage power more efficiently.

Shift Toward Modular, High-Density, and Enclosed Rack Solutions

The data center rack market is witnessing accelerated innovation in response to surging data generation across industries. To handle the increasing data load, there is a marked shift toward modular and high-density rack systems that maximize capacity while optimizing space, power, and thermal management. Cabinets and enclosed racks are gaining prominence for offering enhanced equipment security, cable management, and airflow control, especially in high-density computing and mission-critical environments. These advanced solutions are crucial in edge computing scenarios, where space constraints and operational efficiency demand compact, resilient, and scalable rack architectures.

Data Center Rack Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global data center rack market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on type, rack units, rack size, frame size, frame design, service, application, and end-user.

Analysis by Type:

- Server Rack

- Network Rack

Server rack stand as the largest component in 2024, holding around 55.6% of the market. The server rack segment is the backbone of the global data center rack market, holding a significant share in the industry. Server racks are designed to accommodate servers, storage devices, and other equipment within data centers. These racks are engineered to provide optimal organization, cooling, and accessibility for servers, ensuring efficient and reliable data processing. The ever-increasing demand for computing power and storage capacity is one of the key drivers for the server rack segment. As businesses and organizations generate vast amounts of data, the need for powerful servers to process and store this information is paramount. Server racks are essential in accommodating these servers while maximizing space utilization.

Analysis by Rack Units:

- Small

- Medium

- Large

Small leads the market with around 43.6% of the market share in 2024. Small rack units measure between 1U and 10U; they are specifically designed for those businesses and organizations that have fewer space requirements or equipment. In general, compact and space-saving racks are considered ideal for use in small and medium-sized enterprises, branch offices, and other edge computing setups. Small rack units are predominantly used to house equipment such as small servers, routers, and switches. They are designed to maximize vertical space while ensuring efficient cable management and airflow. This compact form factor helps SMEs optimize their available space without compromising on performance.

Analysis by Rack Size:

- 36U

- 42U

- 45U

- 47U

- 48U

- 51U

- Others

42U leads the market with around 52.1% of the market share in 2024. 42U racks are among the most commonly used rack sizes in data centers worldwide. Standing at around 7 feet tall, they offer ample vertical space for a wide range of servers, switches, and other hardware. These racks are favored by medium to large enterprises and cloud service providers due to their versatility and capacity. The market for 42U racks is robust and constantly growing. This size provides the ideal balance between scalability and efficiency. Data centers of various scales find them suitable, from corporate data facilities to hosting providers.

Analysis by Frame Size:

- 19 Inch

- Others

19 inch stand as the largest component in 2024, holding around 93.6% of the market. The 19-inch data center racks segment is a fundamental and widely recognized category in the market. These racks adhere to the EIA-310 standard, which specifies the width of 19 inches (or 482.6 mm) as the industry norm for mounting servers, networking equipment, and other IT hardware. They are commonly used across various industries and have a long-standing history of reliability and versatility. The 19-inch racks come in various heights and configurations, making them suitable for different data center needs. They are known for their compatibility with standard server equipment and ease of installation. These racks provide efficient airflow management, ensuring that equipment remains cool, which is crucial for optimal performance and longevity.

Analysis by Frame Design:

- Open Frame

- Enclosed

- Customized

Open frame leads the market with around 51.8% of market share in 2024. Open frame racks are a popular and versatile choice in the data center rack market. They are characterized by their minimalist design, typically consisting of a framework without fully enclosed sides and doors. Open frame racks offer several advantages that make them a preferred option for various applications. One of the key advantages of open frame racks is their excellent airflow and heat dissipation properties. Since they lack fully enclosed sides and doors, they facilitate efficient cooling, preventing equipment from overheating. This is particularly crucial in high-density data center environments where heat management is paramount. Open frame racks are also known for their flexibility. They can accommodate a wide range of equipment sizes and form factors, making them suitable for businesses with diverse hardware requirements.

Analysis by Service:

- Consulting Services

- Installation and Support Services

- Professional Services

Installation and support services leads the market with around 43.5% of market share in 2024. Installation and support services are part of the data center rack market, concerning the correct deployment and maintenance of rack infrastructure. These services include the physical installations of racks with the securing and anchoring of such racks together with their configuring according to specific requirements. Installation services providers have experience regarding those technical aspects of rack settings, for example, cable management, power distribution, or even cooling systems integration. They make sure that racks are aligned to the best in industries and safety standards. Support services extend beyond just installation. This includes maintenance, troubleshooting, inspections, equipment upgrade, and possible issues that can occur during data centers' operation life. Effective support services ensure reduced risks for downtime and rack life.

Analysis by Application:

- Small and Medium Size Organization

- Large Size Organization

Large size organization leads the market with around 67.7% of market share in 2024. Large-sized organizations, including enterprises, multinational corporations, and hyperscale data centers, represent a substantial portion of the data center rack market. These entities operate extensive IT infrastructure to support their complex operations, global reach, and high-volume data processing requirements. For large-sized organizations, data center racks are fundamental building blocks of their data centers. These racks are often customized to meet specific performance, density, and scalability demands. High-density racks, capable of accommodating a vast number of servers and storage units, are particularly favored by large enterprises and hyperscale data centers.

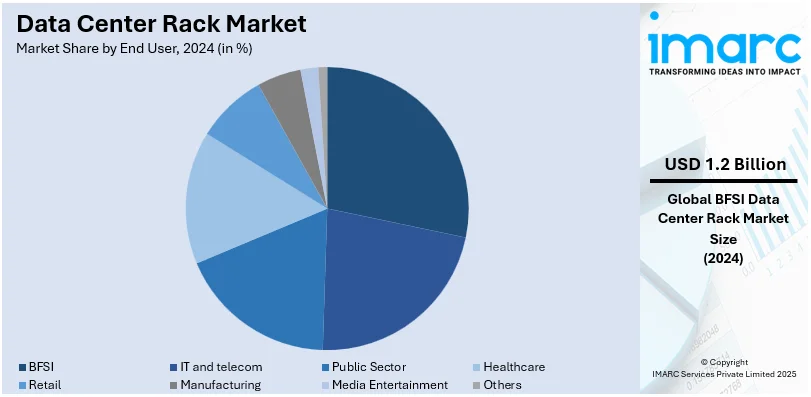

Analysis by End User:

- IT and telecom

- BFSI

- Public Sector

- Healthcare

- Retail

- Manufacturing

- Media Entertainment

- Others

BFSI leads the market with around 27.5% of market share in 2024. Data centers in the BFSI sector provide racks to deal with enormous amounts of financial data and transactions with maximum security. In this BFSI industry, data centers have a requirement for racks with extreme security features and redundancy to have uninterrupted operations. Financial institutions, stock exchanges, and insurance companies rely on such racks to maintain critical servers and network equipment. Additionally, as the BFSI sector continues to adopt advanced technologies such as blockchain and AI for fraud detection and risk analysis, the demand for high-performance data center racks remains strong.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 35.3%. North America is very robust in its IT infrastructure with high technological adaptation. The North American region hosts a mature ecosystem of data centers that cater to multiple industries with various data centers. The adoption of data-driven applications, cloud computing, and growth of IoT is fueling demand for data center racks in the North American market. The need for effective data storage and management has created a constant market for high-density racks and high-end cooling systems in North America. The commitment to sustainability and energy efficiency by the region is also accelerating the demand for green rack designs.

Key Regional Takeaways:

United States Data Center Rack Market Analysis

US accounts for 87.8% of the market share in North America. The demand for data center racks in the United States is witnessing a substantial increase as the IT and telecom sectors expand rapidly. According to CompTIA, the U.S. is home to over 557,000 software and IT services companies, with approximately 13,400 tech startups. This booming IT sector is driving demand for data center racks as businesses expand their digital infrastructure. This expansion is fueled by the increasing reliance on cloud computing, data analytics, and the growing need for network infrastructure. With telecom companies upgrading their networks to 5G and enhancing their data services, the requirement for more robust data centers becomes evident. As a result, data center racks play a vital role in supporting the infrastructure growth, with organizations seeking efficient and scalable solutions to house their servers and networking equipment. This surge in data center adoption is driving the demand for racks capable of supporting high-performance and dense hardware configurations. The increasing need for secure and reliable data storage and processing systems further supports the widespread use of data center racks to ensure system uptime, scalability, and efficient space management in this competitive market.

Asia Pacific Data Center Rack Market Analysis

Small and medium-sized organizations in the Asia-Pacific region are embracing the adoption of data center racks due to their increasing reliance on digital transformation. According to India Brand Equity Foundation, the number of MSMEs in India is expected to grow from 63 Million to approximately 75 Million, driving demand for data center racks as small businesses expand. This growth presents significant opportunities for data infrastructure providers. These organizations are prioritizing the establishment of reliable IT infrastructures to support growing workloads, enhanced communication tools, and cloud-based services. As a result, data center racks are becoming integral to their operations, helping these businesses scale their IT infrastructure efficiently. With the rise of e-commerce and digital platforms, the need for efficient, cost-effective data management systems is paramount, leading to increased demand for racks that provide flexible, modular solutions. Data centers are increasingly seen as essential for enhancing the productivity and competitiveness of smaller organizations, enabling them to store and manage vast amounts of data securely.

Europe Data Center Rack Market Analysis

The growing banking, financial services, and insurance (BFSI) sector in Europe is driving a notable rise in data center rack adoption. For instance, the number of foreign bank branches in the EU reached 784 in 2021, with 619 from other EU states and 165 from third countries. This growing presence of banks supports the demand for data center racks, benefiting infrastructure expansion. As financial institutions, insurers, and investment firms continue to digitize their operations and expand their online services, there is an increasing demand for data centers that can manage sensitive financial data securely and efficiently. With compliance regulations demanding stringent data protection measures, organizations are investing in reliable data storage and processing capabilities, making data center racks crucial for meeting these needs. Furthermore, the trend of adopting cloud-based services for better scalability and flexibility among BFSI companies accelerates the need for advanced data infrastructure. The continuous adoption of financial technology (fintech) solutions and online banking also increases the demand for highly efficient, secure, and scalable data centers to support a growing range of digital financial services.

Latin America Data Center Rack Market Analysis

Latin America is witnessing a rise in data center rack adoption driven by the growth of the retail and manufacturing sectors. For instance, Brazil's retail sales grew 5.1% YoY in October 2024, surpassing the 4.5% increase in the previous month. This growth is driving demand for data centers and data center racks, as retailers expand their digital infrastructure. The retail sector's expansion creates significant opportunities for data center providers to support increased data storage and processing needs. As businesses in these industries increasingly rely on digital solutions for inventory management, customer transactions, and supply chain operations, the need for robust data infrastructure has intensified. Retailers are investing heavily in e-commerce platforms, data analytics, and customer management systems, all of which require scalable data storage solutions. Similarly, the manufacturing sector’s adoption of automation, real-time data analytics, and Internet of Things (IoT) technologies has necessitated the expansion of data centers and the adoption of efficient rack systems to handle growing data workloads.

Middle East and Africa Data Center Rack Market Analysis

Growing healthcare facilities in the Middle East and Africa are contributing to the increased adoption of data center racks. According to Dubai Healthcare City Authority report, by 2022, Dubai had 4,482 private medical facilities, including 55,208 licensed medical professionals and over 56 hospitals. The Dubai Health Authority forecasts a 10-15% growth in medical professionals and a 3-6% increase in facilities from 2023 onward. This expansion boosts demand for data center racks to support growing healthcare infrastructure and digital needs. With an expanding healthcare infrastructure, there is a rising demand for efficient data management solutions to support electronic health records (EHR) systems, patient management software, and telemedicine services. Data centers are playing a crucial role in ensuring that these systems run smoothly, supporting hospitals and clinics in managing large volumes of sensitive patient data. The rapid growth of healthcare services and the increasing focus on modernizing medical facilities further drive the need for data center racks capable of securely housing the required IT infrastructure to manage healthcare data efficiently.

Competitive Landscape:

The competitive landscape of the market is characterized by the presence of global and regional players offering a diverse range of solutions. Established data center rack manufacturers focus on innovation, integrating features like enhanced cooling, power management, and modularity to meet evolving customer demands. Strategic partnerships, mergers, and acquisitions are common as businesses aim to expand their market share and strengthen their product portfolios. The market also sees competition from emerging players introducing cost-effective and customized solutions. Additionally, the shift toward sustainable practices drives investments in energy-efficient designs, creating further differentiation among competitors in this rapidly growing and technologically driven sector. For instance, in May 2024, Black Box inaugurated its Hyperscale Data Center of Excellence in Inver Grove Heights, Minnesota, highlighting decades of innovation and excellence in data center services and technology solutions.

The report provides a comprehensive analysis of the competitive landscape in the data center rack market with detailed profiles of all major companies, including:

- Belden Inc.

- Black Box Corporation

- Chatsworth Products

- Cisco Systems, Inc.

- Dell Inc.

- Eaton Corporation plc

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- Legrand S.A.

- Martin International Enclosures

- nVent Electric

- Panduit Corp.

- Schneider Electric SE

- Vertiv Group Corp.

Latest News and Developments:

- May 2025: Infineon Technologies, in collaboration with NVIDIA, announced a pioneering 800-volt high-voltage direct current (HVDC) power delivery architecture designed specifically for future AI server racks. This centralized power system is set to replace current decentralized models, enabling more energy-efficient power distribution directly to GPUs and supporting anticipated rack power demands exceeding 1 megawatt per rack by decade’s end. As AI data centers scale beyond 100,000 GPUs, this development is expected to establish new industry standards in the data center rack market.

- May 2025: RackBank Datacenters Pvt. Ltd. unveiled an AI-focused data center park in Nava Raipur, Chhattisgarh, beginning with an 80MW capacity in Phase 1 and scalable to 160MW over four phases. The project spans 13.5 acres with an investment of INR 1,000 Crores (USD 120 Million), scalable to INR 3,000 Crores (USD 360 Million), and will house up to 100,000 GPUs with rack densities ranging from 80kW to 200kW. Featuring advanced cooling technologies and designated SEZ status, the facility is positioned to significantly enhance India’s AI and high-density data center ecosystem while creating up to 2,000 direct and indirect jobs.

- May 2025: Refroid Technologies has launched the SentraFlo Series, India’s first indigenously developed liquid-to-liquid Coolant Distribution Units (CDUs), designed specifically to support direct-to-chip cooling in high-density data center racks. With cooling capacities ranging from 200 kW to 2 MW, these CDUs enable AI and HPC workloads by allowing racks to operate at 80–200 kW densities, far beyond the limits of traditional air cooling. This innovation enhances thermal efficiency, reliability, and scalability for modern data centers deploying next-gen liquid-cooled rack infrastructures.

- December 2024: Equinix has agreed to acquire BT Group's Irish data center business for USD 61.3 Million, including two operational data centers in Dublin. The transaction, expected to close in H1 2025, includes the 10MW CityWest facility and another in Ballycoolin. This move supports BT's strategy to focus on cloud, networking, and security services while partnering with global data center providers.

- December 2024: At AWS re:Invent, Amazon Web Services (AWS) unveiled new data center components aimed at advancing AI innovation. The flexible components will provide 12% more compute power, enhancing energy efficiency and availability. These upgrades integrate innovations in power, cooling, and hardware design, supporting the next generation of generative AI. The improvements are being implemented globally, with many already deployed in AWS's existing data centers.

- October 2024: Vertiv has launched the EnergyCore battery cabinets, designed for high-density computing in HPC data centers. These cabinets are factory-assembled with LFP battery modules and an integrated battery management system. They save space and are compatible with most Vertiv UPS systems, including the Trinergy and Liebert APM2.

- October 2024: Eaton launched Heavy-Duty SmartRack enclosures that are designed to support the increasing demands of generative AI computing in data centers. These enclosures cater to larger, heavier AI servers and critical IT infrastructure, enabling future-proofing for enterprise, colocation, and hyperscale data centers. The product aims to assist data center operators and IT managers in accommodating the surge in AI technology. Various specifications are available to meet diverse operational needs.

- March 2024: Eaton has launched its SmartRack modular data center solution, combining racks, cooling, and service enclosures to support up to 150kW of equipment load. The system is designed for edge computing, AI, and machine learning needs, offering fast deployment in just days for enterprises, colos, and manufacturing facilities. The modular data center addresses the growing demand for small, cost-effective, and scalable solutions.

Data Center Rack Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Savor Rack, Network Rack |

| Rack Units Covered | Small, Medium, Large |

| Rack Sizes Covered | 36U, 42U, 45U, 47U, 48U, 51U, others |

| Frame Sizes Covered | 19 Inch, Others |

| Frame Designs Covered | Open Frame, Enclosed, Customized |

| Services Covered | Consulting Services, Installation and Support Services, Professional Services |

| Applications Covered | Small and Medium Size Organization, Large Size Organization |

| End Users Covered | IT and Telecom, BFSI, Public Sector, Healthcare, Retail, Manufacturing, Media Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Belden Inc., Black Box Corporation, Chatsworth Products, Cisco Systems, Inc., Dell Inc., Eaton Corporation plc, Fujitsu Limited, Hewlett Packard Enterprise Development LP, Legrand S.A., Martin International Enclosures, nVent Electric, Panduit Corp., Schneider Electric SE, Vertiv Group Corp., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the data center rack market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global data center rack market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the data center rack industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global data center rack market was valued at USD 4.28 Billion in 2024.

IMARC Group estimates the market to reach USD 8.7 Billion by 2033, exhibiting a CAGR of 8.2% during 2025-2033.

Key factors driving the global data center rack market include the growing adoption of cloud computing, increased deployment of hyperscale data centers, and the expansion of edge computing and 5G networks. Demand for energy-efficient, scalable, and modular solutions further accelerates market growth as businesses prioritize performance optimization and cost-effectiveness.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global data center rack market include Belden Inc., Black Box Corporation, Chatsworth Products, Cisco Systems, Inc., Dell Inc., Eaton Corporation plc, Fujitsu Limited, Hewlett Packard Enterprise Development LP, Legrand S.A., Martin International Enclosures, nVent Electric, Panduit Corp., Schneider Electric SE, Vertiv Group Corp., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)