Data Converter Market Size, Share, Trends and Forecast by Type, Sampling Rate, Application, and Region 2025-2033

Data Converter Market Size and Share:

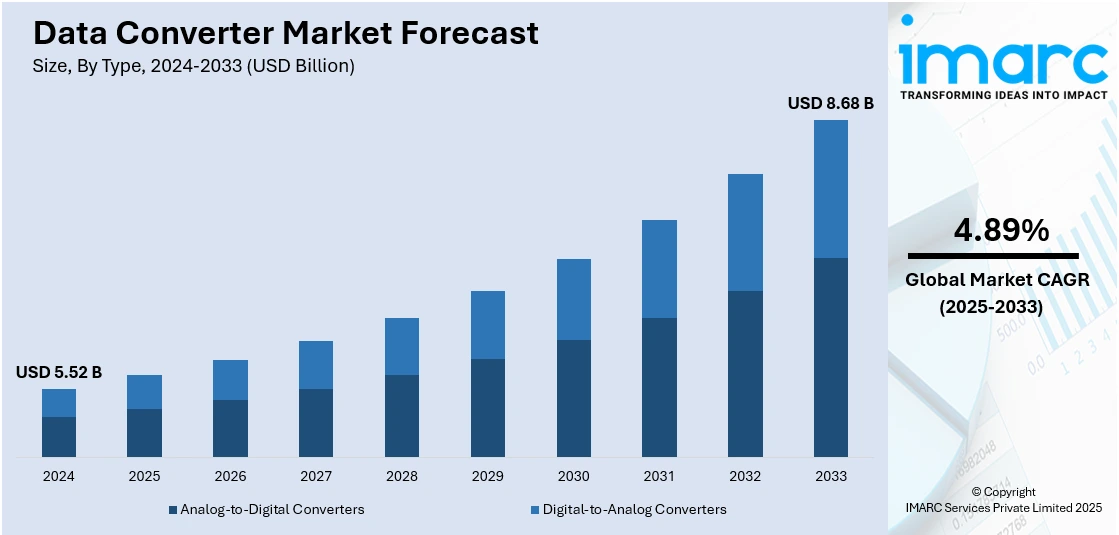

The global data converter market size was valued at USD 5.52 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.68 Billion by 2033, exhibiting a CAGR of 4.89% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 38.7% in 2024. This is driven by increasing demand for advanced electronics, rapid technological adoption, and significant investments in infrastructure. Besides this, expanding sectors such as telecommunications, automotive, and consumer electronics are contributing to the region's notable data converter market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.52 Billion |

|

Market Forecast in 2033

|

USD 8.68 Billion |

| Market Growth Rate (2025-2033) | 4.89% |

The global market is experiencing robust growth due to increasing integration of artificial intelligence and machine learning technologies in advanced systems, which require high-resolution and high-speed data conversion for optimal performance. Rising demand for sophisticated instrumentation in aerospace and defense sectors is also propelling market expansion. Additionally, the emergence of smart infrastructure and digital twins in industrial environments necessitates efficient analog-to-digital and digital-to-analog conversion. The adoption of edge computing solutions, along with increasing deployment of smart energy systems and precision agriculture technologies, further supports market demand. Moreover, innovations in mixed-signal integrated circuits are enabling compact, power-efficient converters that enhance performance across a wide range of applications.

The United States data converter market growth is primarily driven by substantial investments in defense modernization programs, which demand advanced signal processing capabilities. The country's strong focus on research and development fosters continuous innovation in semiconductor technologies, including high-speed converters. Increasing deployment of autonomous systems and electric vehicles is accelerating demand for precise data conversion solutions. Additionally, the presence of major technology firms and design houses contributes to early adoption of next-generation converter architectures. Growth in satellite communication and space exploration initiatives further stimulates market expansion. Furthermore, the integration of data converters in advanced medical imaging and diagnostic equipment underscores their critical role in the evolving U.S. healthcare technology landscape. For example, in October 2023, U.S.-based startup Wavr LLC introduced a wave energy converter (WEC) that can be used for low-power marine applications.

Data Converter Market Trends:

Proliferation of Smart Devices

The widespread adoption of the Internet of Things (IoT) is positively impacting the market. For instance, there will be 152,200 IoT devices connecting to the internet every minute in 2025. As IoT devices generate massive amounts of data that need to be analyzed and processed, the demand for efficient and high-speed data converters is increasing. For example, in November 2023, Renesas Electronics Corporation, one of the suppliers of advanced semiconductor solutions, expanded its 32-bit microcontroller (MCU) offering with a 24-bit Delta-Sigma A/D converter for systems that demand accurate and fast analog signal measurements. Besides this, the rising popularity of these electronic components, as they play a crucial role in translating analog signals from sensors into digital data that IoT systems can process, is also strengthening the market. For instance, in March 2023, Socionext developed a high-speed direct RF data converter PHY solution for Wi-Fi network infrastructure and 3GPP 5GNR/LTE in the FR1 and FR2 (mmWave with external mixers) bands. Moreover, in the same month, Aruba, a Hewlett Packard Enterprise company, and reelyActive introduced an open-source data converter for Microsoft Azure that enables IoT device data that is securely streamed from Aruba Wi-Fi access points (APs) to be utilized by other Azure applications.

Growing 5G Deployment

The increasing number of 5G networks is inflating the need for high-speed data conversion to handle the increased data rates and bandwidth demand. For instance, as of April 2025, 5G has reached a global inflection point. With more than 2.25 Billion connections worldwide, adoption is accelerating at a rate four times faster than 4G during its corresponding growth phase. This, in turn, is expanding the data converter market share. For example, in February 2024, one of the Paris-based startups, Scalinx, introduced ultra-high–speed data converters for applications in 5G and 6G networks. Apart from this, the elevating focus among key players on ensuring the smooth reception and transmission of signals in high-frequency environments is also contributing to the market growth. For instance, in February 2024, Bharat Sanchar Nigam Limited (BSNL) launched the "BSNL Mission Mode Fiberization" project in Tamil Nadu, India, with the aim of transitioning all copper-based landline and broadband connections to high-speed fiber connections. Furthermore, the emerging trend of using advanced data converters that can support faster data rates and higher frequencies is projected to bolster the global market in the coming years. In June 2024, Infineon Technologies unveiled a power modeling solution for applications, including ACDC rectifiers, DCDC converters, IBC modules, etc.

Advancements in Automotive Electronics

The inflating popularity of advanced driver-assistance systems (ADAS) and autonomous vehicles is creating a positive data converter market outlook. For instance, with nearly 100,000,000 ADAS-equipped vehicles on U.S. roads and adoption rates exceeding 90% for key safety systems, shops that master calibration will define the future of automotive repair. For example, in June 2024, the Asahi Kasei Microdevices introduced a CQ36 series integrated circuit with a built-in Delta-Sigma (ΔΣ) modulator, enabling the IC to replace traditional shunt resistors and isolated analog-to-digital converters (ADCs) in a single package. Additionally, these systems rely heavily on sensors and data processing capabilities, thereby making data converters vital components. For instance, in April 2024, DigiKey expanded its product portfolio after signing a strategic global distribution partnership with 3PEAK, a high-performance analog IC specialist. Apart from this, the increasing inclination among consumers towards electric and hybrid vehicles is propelling the adoption of data converters to manage power conversion and energy efficiency. For example, in April 2024, indie Semiconductor, Inc. developed new high-performance video converters and retimers to enable in-cabin connectivity applications, including audio and video transport and device interfacing. Moreover, they are specifically designed to deliver best-in-class in-vehicle experience to automakers.

Data Converter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global data converter market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, sampling rate, and application.

Analysis by Type:

- Analog-to-Digital Converters

- Digital-to-Analog Converters

Analog to digital converters stand as the largest type in 2024, holding around 56.9% of the market. The analog to digital converters (ADCs) segment dominates the data converter market due to their critical role in bridging the gap between analog signals and digital systems. ADCs are essential in a wide range of applications, including communication systems, consumer electronics, automotive, industrial, and medical devices, where they enable the processing and analysis of real-world analog signals. As the demand for high-performance, data-driven applications grows, ADCs' ability to facilitate accurate signal conversion and support high-speed, high-resolution performance has made them indispensable. The increasing need for digital technologies in IoT, AI, and 5G networks further boosts ADC adoption, solidifying their market leadership.

Analysis by Sampling Rate:

- High-Speed Data Converters

- General-Purpose Data Converters

High-speed data converters lead the market with around 64.3% of market share in 2024. The high-speed data converters segment dominates the data converter market due to their ability to efficiently handle high-frequency signals and provide superior performance in demanding applications. These converters enable faster data processing, making them essential for industries like telecommunications, automotive, aerospace, and consumer electronics. With the increasing demand for high-definition video, 5G connectivity, and real-time data processing, high-speed converters are crucial in ensuring high throughput, minimal latency, and accurate signal conversion. Their ability to deliver precise, high-speed conversions in real-time applications allows businesses to meet evolving technological requirements, driving their dominance in the market.

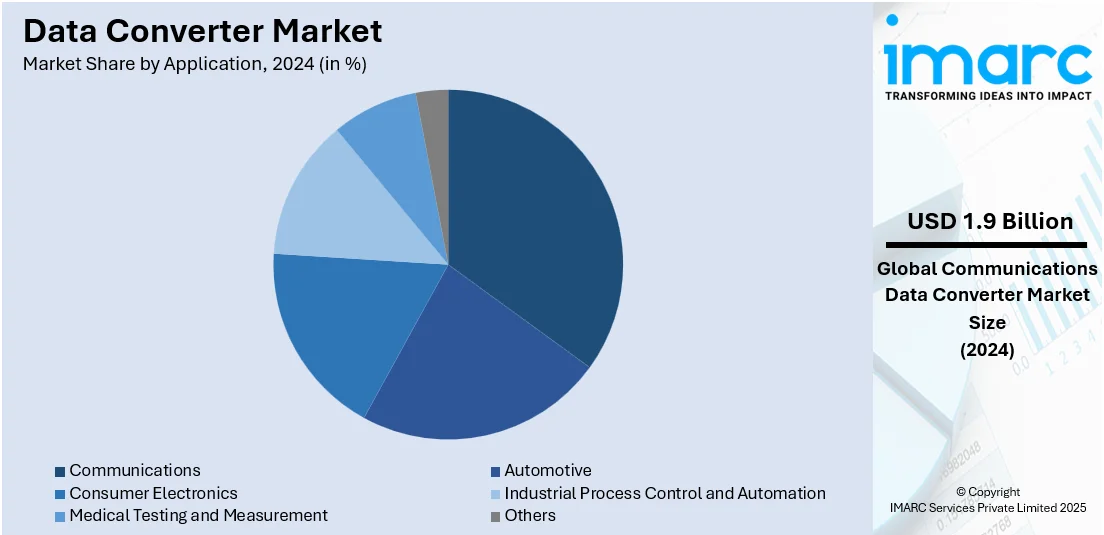

Analysis by Application:

- Communications

- Automotive

- Consumer Electronics

- Industrial Process Control and Automation

- Medical Testing and Measurement

- Others

Communications lead the market with around 35.0% of market share in 2024. The communications segment dominates the data converter market due to the increasing demand for high-speed data transmission and efficient signal processing in telecommunications systems. With the rapid growth of 5G networks, IoT devices, and data centers, there is a rising need for advanced data converters to support higher frequencies, faster data rates, and improved accuracy. These converters play a critical role in converting analog signals into digital formats and vice versa, essential for seamless communication. Additionally, the growing trend of digital transformation in the telecommunications industry drives the continuous adoption of innovative data conversion technologies.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 38.7%. Asia-Pacific dominates the data converter market due to its strong presence in semiconductor manufacturing and electronics industries, particularly in countries like China, Japan, and South Korea. These nations lead in the production of consumer electronics, automotive, and industrial devices that require high-performance data converters. Additionally, the rapid adoption of emerging technologies such as 5G, IoT, and AI has driven the demand for advanced data conversion solutions. The region also benefits from significant investments in research and development, robust supply chains, and cost-effective production, making it a global hub for data converter manufacturing, thereby commanding a substantial market share. For instance, in April 2024, Japan's Fuji Electric developed a high-power module in its next-core series based on its latest insulated-gate bipolar transistor (IGBT) platform with diodes that feature a free-wheeling diode (FWD) function.

Key Regional Takeaways:

United States Data Converter Market Analysis

In 2024, the United States held a market share of around 88.80% in North America. The United States is witnessing robust demand for data converters driven by the widespread adoption of the Internet of Things (IoT). For instance, 57% of all households in the United States are anticipated to have at least one smart home device by the end of 2025. As more devices become interconnected across residential, commercial, and industrial sectors, the requirement for efficient analog-to-digital and digital-to-analog conversion intensifies. IoT applications such as smart home systems, industrial automation, and health monitoring heavily depend on real-time data processing, further propelling the integration of data converters. The continuous expansion of smart infrastructure and sensor-based systems amplifies this need. In parallel, sectors like manufacturing and logistics are embracing IoT to optimize operations, which boosts the demand for accurate and high-speed signal conversion. Data converters are essential to bridge analog environments and digital control systems, enabling reliable communication between devices. As IoT ecosystems become more complex, the precision and performance of data converters become increasingly critical, driving manufacturers to innovate and cater to this evolving technological landscape across various application areas.

Asia Pacific Data Converter Market Analysis

Asia-Pacific is experiencing a significant increase in data converter usage fueled by accelerating 5G deployment across urban and industrial networks. According to the Department of Telecommunications, the total number of deployed 5G BTS stands at 4,78,459 as of the end of April 2025, up from 4,74,234 as of the end of March 2025. The roll-out of 5G infrastructure demands high-speed, high-resolution signal conversion to support enhanced mobile broadband, ultra-reliable low-latency communications, and massive machine-type communications. Data converters serve a crucial role in managing high-frequency signals and maintaining performance across base stations, small cells, and edge computing units. The need for reliable and energy-efficient signal processing capabilities is intensifying as telecom operators scale their networks to meet rising bandwidth demands. In addition, the 5G ecosystem’s reliance on millimeter wave technology and advanced RF front-end modules necessitates the adoption of high-performance digital and analog conversion technologies.

Europe Data Converter Market Analysis

Europe is demonstrating an increasing demand for data converters due to rapid advancements in automotive electronics. According to a comprehensive study by the Autopromotec Observatory, nearly 70% of cars on European roads will be connected by 2025. As modern vehicles evolve with sophisticated electronic control units, advanced driver assistance systems, and infotainment technologies, data converters become integral for seamless signal processing between analog sensors and digital platforms. The transition toward electric and hybrid vehicles is also prompting innovations in battery management systems, inverters, and motor control, all of which require accurate data conversion. Enhanced in-vehicle connectivity and safety features rely heavily on reliable data acquisition and conversion to facilitate communication across multiple components. Automotive manufacturers are integrating a wide range of analog input devices, such as cameras, ultrasonic sensors, and radars, which necessitate fast and accurate signal conversion to support autonomous functionalities.

Latin America Data Converter Market Analysis

Latin America is experiencing rising data converter usage supported by rapid digitalization and growing internet connectivity. For instance, Venezuela’s internet penetration rate stood at 61%, with Panama at 74%. Overall, the internet penetration rate in Latin America is approximately 75% in 2024. As more sectors adopt digital infrastructure and cloud services, the demand for reliable analog and digital signal conversion has expanded. Increased mobile device penetration and broadband access are enhancing communication networks, prompting greater integration of data converters in networking hardware and consumer electronics. Expanding tech-based service adoption is reinforcing the relevance of efficient signal processing tools.

Middle East and Africa Data Converter Market Analysis

The Middle East and Africa are witnessing increased demand for data converters driven by investments in telecommunications, smart city projects, and the oil and gas sector's digitization efforts. For instance, the Middle East expects to invest nearly USD 50 Billion in smart city projects through 2025. Upgraded telecom infrastructure requires precise signal conversion for enhanced data handling in modern communication systems. Smart urban developments are relying on real-time monitoring technologies, where data converters ensure seamless data processing.

Competitive Landscape:

The data converter market forecast projects intense competition, driven by the continuous demand for higher precision, speed, and integration in applications such as communications, automotive, industrial, and consumer electronics. Companies in the market are focusing on innovation, offering a wide range of analog-to-digital (ADC) and digital-to-analog (DAC) converters to meet diverse customer needs. Key competitive factors include performance, power consumption, cost-effectiveness, and customization options. Strategic partnerships, mergers, and acquisitions are common as companies look to enhance their product portfolios and expand into new markets. The growing trend of miniaturization and integration of data converters into smaller devices has led to increasing competition for offering compact yet high-performance solutions. Additionally, advancements in digital technologies and the need for real-time data processing further intensify competition. For instance, in June 2024, Astronics Corporation launched the Ballard NG1 Series Avionics I/O Converter, designed for rugged military use in aircraft environments. This ultra-compact device simplifies avionics data conversion to Ethernet for real-time distributed control or remote I/O applications. It meets military requirements for durability and has been pre-validated for rapid deployment, offering flexibility and low size, weight, and power (SWaP). The NG1 features a powerful 64-bit computing platform, supports various avionics protocols, and includes cybersecurity features for secure operation.

The report provides a comprehensive analysis of the competitive landscape in the data converter market with detailed profiles of all major companies, including

- Analog Devices Inc.

- Asahi Kasei Microdevices Corporation

- Datel Inc. (Murata Manufacturing)

- Fujitsu Ltd.

- IQ-Analog Corporation

- Maxim Integrated

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- ON Semiconductor

- Renesas Electronics Corporation

- STMicroelectronics

- Synopsys Inc.

- Texas Instruments Incorporated

Latest News and Developments:

- May 2025: Silanna Semiconductor launched the Plural Data Converter Series, offering over 150 factory-configurable ADCs. The data converter lineup features 10-, 12-, 14-, and 16-bit chips with sample rates ranging from 20 to 250 Msps, delivering enhanced affordability and shorter lead times.

- April 2025: Navitas Semiconductor and Great Wall Power launched a 2.5 kW GaN-based DC-DC data converter that achieved record power density and efficiency. Designed for AI data centers, the module uses the GaNSense NV6169 IC and supports 400 V DC cabinet architectures to optimize space and energy.

- March 2025: Amber Semiconductor (AmberSemi) announced that it would soon launch a 50V-to-0.8V DC-DC converter designed for AI data centers. This vertical power delivery solution enhances efficiency from 81% to over 90%, potentially saving USD 4 billion annually and reducing CO₂ emissions by 15 million tons in the U.S. By delivering power directly to high-density AI chips, it addresses the escalating power demands of modern AI servers.

- March 2025: Omni Design Technologies extended its Swift data converter solutions for FR1 and FR2 5G subsystems through a partnership with Metanoia. The collaboration deploys advanced multi-gigahertz Swift analog front-end technologies, including data converters, in Metanoia’s programmable baseband solutions for next-generation wireless communication.

- June 2024: The Asahi Kasei Microdevices developed a CQ36 series integrated circuit with a built-in Delta-Sigma (ΔΣ) modulator, enabling the IC to replace traditional shunt resistors and isolated analog-to-digital converters (ADCs) in a single package.

- May 2024: Microchip Technology (MCHP) introduced the SAMD21RT, a radiation-tolerant 32-bit microcontroller (MCU) integrated with multiple analog functions, including a 20-channel analog-to-digital converter (ADC), a digital-to-analog converter (DAC), and analog comparators.

- February 2024: Scalinx launched an ultra-high–speed data converter for applications in 5G and 6G networks.

Data Converter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog-to-Digital Converters, Digital-to-Analog Converters |

| Sampling Rates Covered | High-Speed Data Converters, General-Purpose Data Converters |

| Applications Covered | Communications, Automotive, Consumer Electronics, Industrial Process Control and Automation, Medical, Testing and Measurement, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Analog Devices Inc., Asahi Kasei Microdevices Corporation, Datel Inc. (Murata Manufacturing), Fujitsu Ltd., IQ-Analog Corporation, Maxim Integrated, Microchip Technology Inc., NXP Semiconductors N.V., ON Semiconductor, Renesas Electronics Corporation, STMicroelectronics, Synopsys Inc., Texas Instruments Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the data converter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global data converter market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the data converter industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data converter market was valued at USD 5.52 Billion in 2024.

The data converter market is projected to exhibit a CAGR of 4.89% during 2025-2033, reaching a value of USD 8.68 Billion by 2033.

The data converter market is driven by rising demand for high-speed data transmission, increasing adoption of consumer electronics, growth in industrial automation, and advancements in wireless communication technologies. Additionally, the proliferation of IoT devices and the need for efficient signal processing in automotive and healthcare sectors further fuel market expansion.

In 2024, Asia Pacific dominated the data converter market, holding a market share of 38.7%. This dominance is driven by rapid industrialization, expanding electronics manufacturing, strong presence of semiconductor companies, growing adoption of 5G technology, and increasing demand for consumer electronics and automotive applications across countries like China, Japan, and South Korea.

Some of the major players in the data converter market include Analog Devices Inc., Asahi Kasei Microdevices Corporation, Datel Inc. (Murata Manufacturing), Fujitsu Ltd., IQ-Analog Corporation, Maxim Integrated, Microchip Technology Inc., NXP Semiconductors N.V., ON Semiconductor, Renesas Electronics Corporation, STMicroelectronics, Synopsys Inc., Texas Instruments Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)