Data Loss Prevention Market Size, Share, Trends and Forecast by Type, Services, Size, Deployment Type, Application, Industry, and Region, 2026-2034

Data Loss Prevention Market Size and Share:

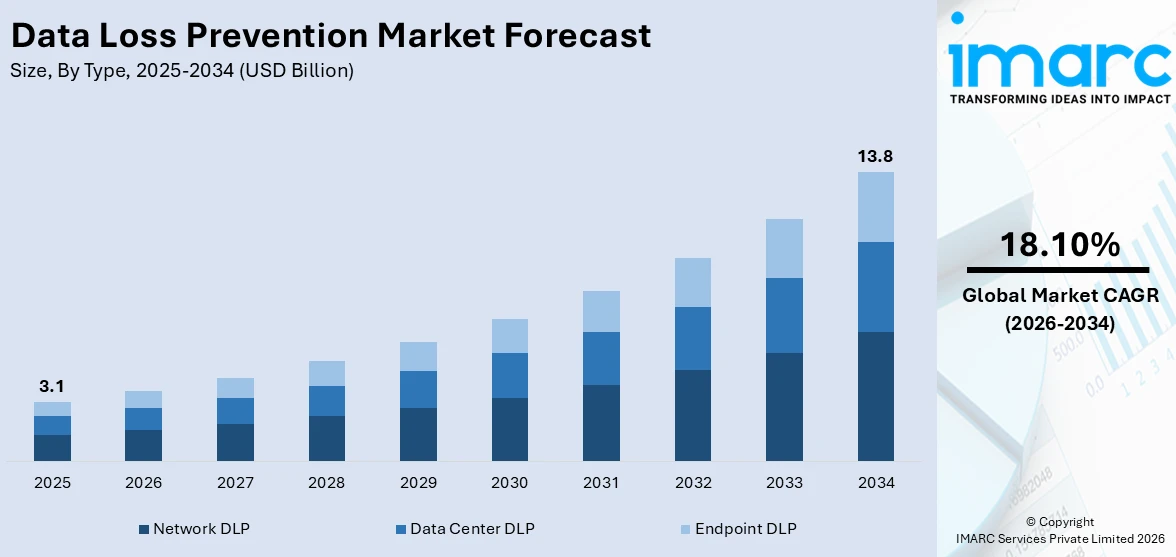

The global data loss prevention market size was valued at USD 3.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 13.8 Billion by 2034, exhibiting a CAGR of 18.10% during 2026-2034. North America currently dominates the market, holding a significant market share of over 29.8% in 2025. The growing focus of organizations on securing and protecting their data and complying with regulations, coupled with the rising adoption of DLP software to secure data and mobile workforce on remote cloud systems, is propelling the data loss prevention market demand. At present, North America holds the largest market share, driven by stringent data privacy regulations and advanced cybersecurity ecosystem.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.1 Billion |

|

Market Forecast in 2034

|

USD 13.8 Billion |

| Market Growth Rate 2026-2034 | 18.10% |

The data loss prevention (DLP) market is driven by the rising adoption of cloud computing, increased regulatory compliance requirements, and growing concerns over data breaches and insider threats. Industry reports indicate that the global average cost of a data breach has reached USD 4.88 million in 2024. Organizations that implement security AI and automation can save, on average, USD 2.22 million. This emphasizes the growing importance of proactive cyber defense strategies. Organizations are prioritizing data security to protect sensitive information, driven by stricter data protection laws such as GDPR and CCPA. The shift to remote work has further highlighted the need for robust DLP solutions to secure endpoints and cloud environments. Advancements in AI and machine learning are enhancing DLP capabilities, offering real-time threat detection and automated responses. Additionally, the increasing value of intellectual property and customer data fuels demand for advanced DLP technologies.

To get more information on this market Request Sample

The United States data loss prevention (DLP) market is driven by stringent data protection regulations like CCPA and HIPAA, emphasizing the need for secure handling of sensitive information. The rise in cyberattacks targeting critical industries such as healthcare, finance, and technology has heightened the demand for DLP solutions. For instance, in 2024, 386 health care cyberattacks have been reported maintaining 2023’s high breach rate. New HHS Cybersecurity Performance Goals aim to strengthen defenses against common cyber threats. Increased adoption of cloud-based platforms and remote work has further accelerated the need for endpoint and network security. Organizations are leveraging AI and machine learning in DLP tools for real-time threat detection and automated response. Additionally, the growing focus on protecting intellectual property and personal data continues to push investments in advanced DLP technologies.

Data Loss Prevention Market Trends

Rising Risk of Unauthorized Access

The growing prevalence of cyberattacks can have adverse impacts on businesses, such as reputational harm, monetary losses, and potential legal consequences. This is encouraging them to adopt data loss prevention systems to minimize the possibility of unauthorized access, accidental data leaks, and data breaches by implementing favorable safety policies. For example, in April 2023, Microsoft introduced a purview data loss prevention policy for Power BI, which was commonly available to the general public preview. In line with this, large and mid-size enterprises are developing appropriate security controls with a well-defined classification framework, including access controls, specifically tailored to each data classification level. Furthermore, jurisdictions and regulatory bodies are aiming at elevating data protection, thereby bolstering the data loss prevention market value. For example, government bodies in Canada are launching new privacy laws to improve control and transparency of individuals over how companies handle their personal data. Similarly, legislative initiatives, such as the Digital Charter Implementation Act, 2020 (Bill C-11), also called as the Consumer Privacy Protection Act (CPPA), and Quebec's Bill 64 are leading the way. In addition, the GDPR, implemented by the European Union (EU), is one of the most important data protection legislation globally. It aims to protect EU data and implements stringent standards on organizations regarding privacy rights, data breach reporting, data protection, and consent. The GDPR has driven organizations to deploy novel DLP solutions to secure personal data and maintain compliance.

The Rising Applications of the IoT

The inflating usage of the Internet of Things is primarily augmenting the data loss prevention market revenue. According to IoT Analytics' State of IoT Summer 2024 report, global IoT-connected devices reached 16.6 Billion by the end of 2023, marking a 15% increase from 2022. This surge highlights the rapid adoption of IoT technologies worldwide. For example, according to Ericsson, the number of Internet of Things (IoT) connections is expected to be six Billion by 2028. Besides this, the elevating concerns among organizations over data privacy and the implementation of strict regulations by government bodies are increasing the integration of artificial intelligence (AI) with cybersecurity solutions. Moreover, enterprises are prioritizing next-generation identity and access communication, management, and network security, thereby reflecting significant investments in these cybersecurity domains. These trends are poised to catalyze the growth of the data loss prevention market in the coming years.

Continuous Technological Advancements

The rising complexities of data, owing to the emergence of advanced technologies, including robotics, big data, Artificial Intelligence (AI), cloud computing, etc., are creating significant opportunities for data loss prevention solutions that can effectively classify, discover, and monitor sensitive data across diverse platforms. Consequently, small and medium-sized businesses with limited funds are extensively investing in DLP programs. For instance, in October 2022, Nightfall introduced a DLP solution in partnership with the Asana Partner Program as a technology partner. Through this collaboration, Asana aimed to build data protection capabilities into the Asana app. As such, organizations are also developing platforms to prevent data loss prevention. For instance, in September 2023, Proofpoint Inc. developed Aegis Threat Protection, Identity Threat Defense, and Sigma Information Protection platforms to address risks of organizations, such as business email compromise (BEC), ransomware, and data exfiltration. Proofpoint Sigma, the information protection platform, merges content classification, threat telemetry, and user behavior across channels for data loss prevention. In addition to this, Proofpoint's Misdirected Email solution prevents users from accidentally sending emails to the wrong recipient, thereby preventing data loss.

Data Loss Prevention Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global data loss prevention market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, services, size, deployment type, application and industry.

Analysis by Type:

- Data Center DLP

- Endpoint DLP

- Network DLP

Network DLP systems usually enable session-level network traffic analysis. As most of the human-readable data in organizations is not plain text, network DLP decisions need insights beyond individual packets. Additionally, these systems offer visibility into network channels, protocols, and applications. Network data loss prevention systems enforce security standards by blocking, flagging, allowing, auditing, encrypting, or quarantining suspicious activities that violate information security regulations.

Analysis by Services:

- Managed Security Services

- Training and Education

- Consulting

- System Integration and Installation

- Threat and Risk Assessment

Managed security services in the DLP market provide continuous monitoring, management, and protection of sensitive data. These services are essential for organizations lacking in-house expertise or resources to handle complex security challenges. Providers deliver customized solutions, ensuring compliance with data protection regulations while addressing specific business needs. The focus is on real-time threat detection, response, and reporting. This outsourcing approach helps businesses reduce operational costs while maintaining robust security postures, making it a critical component of the DLP ecosystem.

Training and education services are vital in equipping employees with the knowledge to prevent data loss through human errors or negligence. These programs focus on building awareness about data security policies, regulatory requirements, and proper handling of sensitive information. By offering hands-on workshops and e-learning modules, organizations can mitigate insider threats and foster a security-conscious culture. Regular training sessions ensure employees remain updated on emerging threats, contributing to a comprehensive approach to data protection.

Consulting services in the DLP market help organizations design and implement tailored data protection strategies. Experts analyze the specific needs and risks of businesses, identifying vulnerabilities and recommending appropriate tools and policies. These services include guidance on regulatory compliance, risk management, and technology selection. By partnering with experienced consultants, companies can develop scalable and effective DLP frameworks that align with their goals, ensuring robust defenses against data breaches and unauthorized access.

System integration and installation services focus on seamlessly deploying DLP solutions within an organization’s existing IT infrastructure. These services ensure compatibility across networks, endpoints, and cloud environments, optimizing performance and efficiency. Providers manage the end-to-end process, including configuring policies, testing, and training staff on new systems. Proper integration reduces implementation challenges, minimizes downtime, and ensures the organization benefits from comprehensive, real-time data protection.

Threat and risk assessment services identify vulnerabilities in an organization’s IT ecosystem, enabling proactive measures to prevent data breaches. Experts evaluate potential risks, including external cyber threats and internal vulnerabilities, and prioritize them based on their impact. Comprehensive assessments provide actionable insights to strengthen security measures, refine DLP strategies, and ensure compliance. These services are critical for organizations aiming to maintain a resilient data security framework in an evolving threat landscape.

Analysis by Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises leads the market with around 56.7% of data loss prevention market share in 2025. Large enterprises often deal with complicated data ecosystems, including unstructured and structured data distributed across numerous systems and platforms. DLP assists these enterprises in setting up data governance frameworks by categorizing, detecting, and managing sensitive material. Moreover, large enterprises utilize data loss prevention solutions to monitor data transfers to third parties and enforce data protection policies. DLP solutions minimize the chances of mismanagement, third-party data breaches, or non-compliance with security regulations.

Analysis by Deployment Type:

- On-premises

- Cloud Data Loss Protection

On-premises stand as the largest deployment type in 2025, holding around 56.0% of the market. On-premises data loss prevention provides organizations with more control over sensitive data. It also enables users to maintain information within personal infrastructure, thereby facilitating direct monitoring and management. This level of control is essential for organizations dealing with highly sensitive, as it minimizes reliance on third-party entities. On-premises DLP solutions provide more integration options and customization with updated security and infrastructure systems. Moreover, they are gaining traction, as these solutions offer lower latency and faster responses when compared to cloud-based solutions.

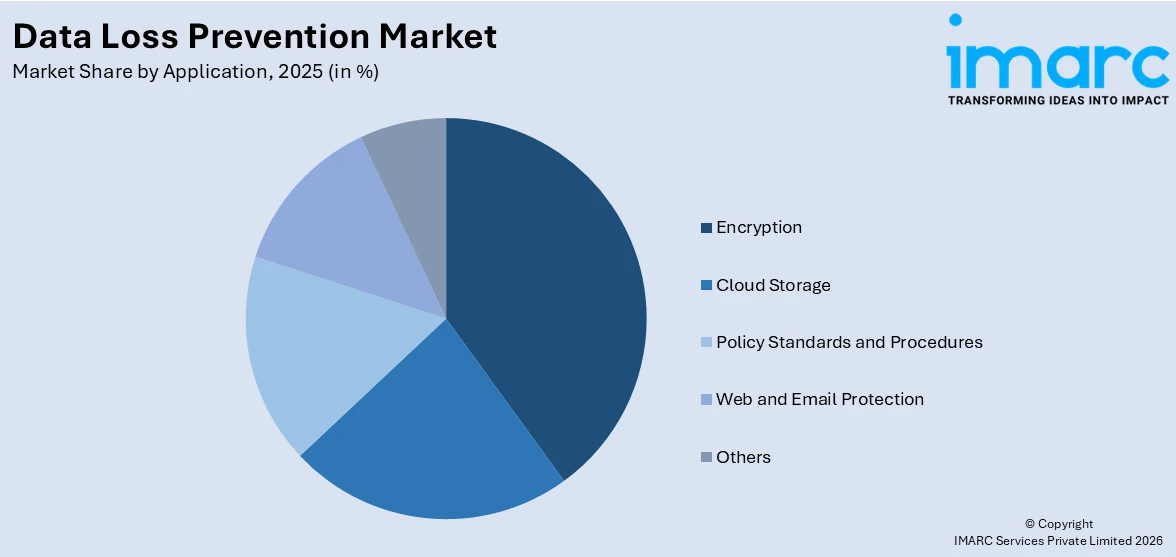

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Cloud Storage

- Encryption

- Policy Standards and Procedures

- Web and Email Protection

- Others

Encryption leads the market with around 20.6% of market share in 2025. Encryption applications in the DLP market provide essential tools for safeguarding data by converting it into unreadable formats accessible only through authorized decryption keys. These solutions protect data at rest, in transit, and during processing, ensuring its confidentiality and integrity. Encryption prevents unauthorized access in cases of breaches or accidental exposure. Organizations use encryption to comply with regulatory requirements and secure intellectual property, customer information, and financial data, making it a cornerstone of comprehensive DLP strategies.

Analysis by Industry:

- Healthcare

- Retail and Logistics

- Defense and Intelligence

- Public Utilities and Government Bodies

- BFSI

- IT and Telecom

- Others

IT and telecom leads the market with around 19.5% of market share in 2025. The rising incidences of data breaches in the IT and telecom industry are primarily driving the market growth in this segmentation. For instance, according to cybersecurity firm, EfficientIP, 43% of telecom operators went through Domain Name System (DNS)-based malware attacks in 2018. The same report stated that the telecommunications industry has the most sensitive data stolen across all sectors. Furthermore, Cloudflare, a security company, reported that the telecommunications industry was the most targeted by distributed denial of service (DDoS) attacks in the first quarter of 2021, a major increase from the previous year. Consequently, data loss prevention technology is widely used by the IT and telecom industry, as it helps in selecting predefined profiles for sensitive information, including PII and credit card information, and compliance-oriented profiles for laws and standards, such as PCI DSS and GDPR.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 29.8%. Businesses across the region are extensively adopting cloud computing and leveraging cloud services for several purposes, such as collaboration, data storage, and business operations. This shift is encouraging the demand for cloud-based DLP solutions to secure sensitive data in cloud environments. For example, in November 2023, Nightfall AI, a prominent provider of cloud data loss prevention (Cloud DLP), developed an innovative DLP solution tailored for Microsoft Teams. Given the platform's elevating usage in highly regulated industries, businesses enabled DLP tools that align with frameworks like PCI DSS, SOC 2, HIPAA, etc. Besides this, government bodies in countries, including Canada, are proposing new policies to enhance transparency over how companies handle their personal data, which is propelling the regional market.

Key Regional Takeaways:

United States Data Loss Prevention Market Analysis

In 2025, the United States captured 86.80% of the North American market. Adoption of advanced measures is increasingly influenced by heightened investments in sensitive domains like defense and intelligence. According to reports, the United States allocated USD 916 Billion to military spending in 2023, marking a 2.3% rise from 2022 and a 9.9% increase compared to 2014. This surge underscores the prioritization of national security and advanced technologies. Enhanced budgets benefit data loss prevention by enabling robust cybersecurity measures. These investments safeguard critical defense infrastructure against evolving digital threats. The rise of initiatives focusing on operational resilience and secure communications has fuelled the demand for protective solutions. The need to safeguard classified information, prevent unauthorized access, and mitigate insider threats has led organizations in this sector to integrate tailored approaches. Advanced analytics, coupled with detection mechanisms, provide robust tools to monitor and control critical data flows. With increasing collaborations between public and private entities, the demand for adaptable and scalable technologies is rising. Enhanced scrutiny of infrastructure vulnerabilities and the growing complexity of digital operations necessitate proactive systems that prioritize information integrity and confidentiality.

Asia Pacific Data Loss Prevention Market Analysis

Small and Medium-Sized Enterprises are witnessing a transformative shift in operational dynamics, leading to increased interest in protective frameworks. According to India Brand Equity Foundation, the number of Micro, Small, and Medium Enterprises (MSMEs) in the country is projected to grow from 6.3 crore 2023 to approximately 7.5 crore in 2024, at a CAGR of 2.5%. This expansion highlights the sector's increasing role in adopting robust Data Loss Prevention (DLP) strategies, safeguarding sensitive information as digitalization accelerates. Strengthened DLP measures can foster trust and resilience in growing MSMEs. Rapid digitalization and cloud-based workflows in this sector have amplified concerns over data breaches and intellectual property theft. Organizations are now adopting scalable and cost-efficient solutions customized to various business models. Increasing reliance on external service providers and inter-organizational collaborations necessitate stringent security protocols to mitigate exposure risks. The focus has shifted to solutions that integrate real-time threat analysis, content filtering, and automated responses to enhance compliance and operational efficiency. Furthermore, the expansion of remote working trends has emphasized the importance of protecting sensitive business data across distributed networks.

Europe Data Loss Prevention Market Analysis

Expanding digital infrastructures within Banking, Financial Services, and Insurance have amplified the need for robust frameworks to ensure compliance with stringent regulatory standards. According to reports, the foreign bank branches across the EU, reaching 784 in 2021, highlights a shift favoring branches over subsidiaries. This trend, driven by 619 branches from EU states and 165 from non-EU countries, strengthens regional banking integration. It also enhances data loss prevention by centralizing regulatory compliance and cybersecurity protocols. This consolidation supports robust risk management across borders. Financial transactions and client data must be protected from emerging cyber threats and fraud attempts. The proliferation of cashless payment systems, blockchain implementations, and AI-driven credit assessments require proactive risk mitigation strategies. Comprehensive visibility across endpoints, automated classification, and advanced encryption are now integral to maintaining trust and operational continuity. Institutions are increasingly focusing on safeguarding not just transactional data but also predictive analytics models and internal communications.

Latin America Data Loss Prevention Market Analysis

The healthcare sector's growing reliance on digital systems for patient records, telemedicine, and diagnostic tools has intensified the need for effective measures. According to International Trade Administration, Brazil's booming healthcare sector, the largest in Latin America, allocates 9.47% of its GDP approximately USD 161 Billion to health services in 2023. With 62% of its 7,191 hospitals privately owned, robust investment enhances data loss prevention systems. The private sector's dominance drives advanced digital solutions for safeguarding sensitive medical information. This growth ensures greater security and efficiency in managing healthcare data. Securing sensitive medical data and ensuring privacy compliance are central priorities. Proactive measures prevent breaches that could compromise patient confidentiality or disrupt critical operations. With the integration of connected devices and electronic health records, demand is rising for adaptable frameworks that address evolving challenges.

Middle East and Africa Data Loss Prevention Market Analysis

The rapid digitization of retail and logistics operations has propelled the adoption of enhanced measures to safeguard transactional data, inventory details, and supply chain communications. According to Ministry of Media - Saudi Arabia, the logistics sector has emerged as a key growth area, ranking among the top ten promising industries in Q2 2024. Active commercial registrations surged to 11,928, a 76% increase from 6,742 in Q2 2023. This expansion supports enhanced data loss prevention through improved supply chain transparency and secure handling practices. The sector's rapid growth underscores its role in bolstering operational efficiency and data security. Ensuring secure customer interactions and preventing unauthorized access to sensitive systems are key drivers. Retailers and logistics operators are leveraging automated monitoring tools and secure file-sharing protocols to address vulnerabilities. Real-time visibility across operations and protection against unauthorized data exposure have become essential components of the evolving digital landscape.

Competitive Landscape:

The Data Loss Prevention (DLP) market is highly competitive, driven by rapid technological advancements and increasing demand for robust security solutions. Market participants focus on innovation, offering features like AI-powered threat detection, cloud integration, and real-time analytics to differentiate their offerings. The rise of remote work and cloud adoption has intensified competition, with solutions targeting diverse industries such as healthcare, finance, and technology. For instance, in November 2024, Absolute Security launched its Enterprise Edition, featuring the Safe Connect and Comply modules for enhanced Security Service Edge (SSE). This platform ensures secure, compliant access for remote workers, utilizing dynamic zero trust access, continuous device monitoring, and firmware-based protection, all backed by its Absolute Resilience Platform. Players compete on factors like scalability, ease of deployment, and compliance capabilities to address specific regulatory requirements. Partnerships with cloud service providers and advancements in endpoint protection further enhance competitiveness. Customization and managed services are key areas where providers aim to gain an edge, appealing to organizations seeking tailored, cost-effective approaches to safeguard sensitive data.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Absolute Software Corporation

- Broadcom, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc

- CrowdStrike

- Forcepoint

- GTB Technologies, Inc

- Netskope, Inc

- Proofpoint

- Thales Group

- Varonis

- Zscaler, Inc.

Latest News and Developments:

- December 2024: Wald.ai has launched a data loss protection platform for AI platforms, utilizing contextual redaction to safeguard sensitive business information. The Wald Context Intelligence platform enables secure interactions with AI assistants like ChatGPT and Gemini while ensuring compliance. It sanitizes proprietary data, replacing it with intelligent substitutions for optimal AI responses. Sensitive details are restored outside the AI before reaching users.

- December 2024: Versa has launched Versa Endpoint DLP, an advanced endpoint data loss prevention feature within its VersaONE™ Universal SASE Platform. This lightweight solution blocks copy/paste, screenshots, and USB data transfers to prevent exfiltration. Delivered via the Versa SASE Client, it offers robust Zero Trust-based protection. The innovation enhances data security for organizations using SASE frameworks.

- November 2024: Fortinet, Inc. has unveiled an AI-driven data loss prevention solution utilizing Next DLP technology. This innovation aligns with Fortinet’s position among top AI stocks trending in financial media. Meanwhile, AI’s growth highlights the critical role of memory chips like Kioxia’s, poised for a USD 5 Billion IPO. Such advancements reflect the growing integration of AI across tech sectors.

- April 2024: Proofpoint, a cybersecurity and compliance leader, launched Adaptive Email Data Loss Prevention in April 2024. The solution is designed to mitigate accidental data loss through advanced email detection capabilities. It uses AI-powered tools to identify and prevent potential leaks during email exchanges. This innovation reflects the growing emphasis on securing sensitive data in corporate communications.

Data Loss Prevention Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Data Center DLP, Endpoint DLP, Network DLP |

| Services Covered | Managed Security Services, Training and Education, Consulting, System Integration and Installation, Threat and Risk Assessment |

| Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Deployment Types Covered | On-premises, Cloud Data Loss Protection |

| Applications Covered | Cloud Storage, Encryption, Policy Standards and Procedures, Web and Email Protection, and Others |

| Industries Covered | Healthcare, Retail and Logistics, Defense and Intelligence, Public Utilities and Government Bodies, BFSI, IT and Telecom, and Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Absolute Software Corporation, Broadcom, Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc, CrowdStrike, Forcepoint, GTB Technologies, Inc, Netskope, Inc, Proofpoint, Thales Group, Varonis, Zscaler, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the data loss prevention market from 2020-2034.

- The data loss prevention market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the data loss prevention industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Data loss prevention (DLP) refers to strategies, processes, and tools used to protect sensitive information from being lost, misused, or accessed by unauthorized individuals. DLP solutions monitor and control data transfer to ensure compliance with security policies and prevent data breaches.

The global data loss prevention market was valued at USD 3.1 Billion in 2025.

IMARC estimates the global data loss prevention market to exhibit a CAGR of 18.10% during 2026-2034.

Drivers include the increasing adoption of cloud computing, stringent regulatory requirements like GDPR and CCPA, the rise in cyberattacks, and growing reliance on remote work, all emphasizing the need for advanced data protection measures.

In 2024, Network DLP represented the largest segment by type, driven by its ability to monitor and secure network traffic comprehensively.

In 2024, large enterprises represented the largest segment by size driven by their complex data ecosystems requiring robust DLP solutions.

On-premises is the leading segment by deployment type, driven by organizations seeking greater control over sensitive data.

In 2024, IT and telecom represented the largest segment by industry, driven by the increasing need to secure sensitive data, prevent cyberattacks, and ensure compliance with regulations like GDPR and PCI DSS.

In 2024, encryption represented the largest segment by application, driven by the increasing need to protect sensitive data from unauthorized access and cyber threats.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global data loss prevention market include Absolute Software Corporation, Broadcom, Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc, CrowdStrike, Forcepoint, GTB Technologies, Inc, Netskope, Inc, Proofpoint, Thales Group, Varonis, Zscaler, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)