Dental Practice Management Software Market Size, Share, Trends and Forecast by Deployment Type, Application, End User, and Region 2025-2033

Dental Practice Management Software Market Size and Share:

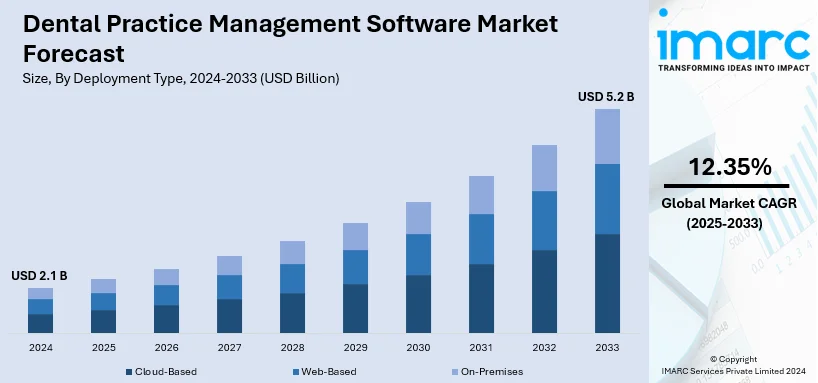

The global dental practice management software market size was valued at USD 2.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.2 Billion by 2033, exhibiting a CAGR of 12.35% during 2025-2033. North America currently dominates the market, holding a significant market share of over 39.6% in 2024. The growing occurrence of various dental diseases, increasing adoption of dental imaging and diagnostic devices, and rising emphasis on paperless practices in the healthcare industry are some of the major factors propelling the dental practice management software market across North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.1 Billion |

|

Market Forecast in 2033

|

USD 5.2 Billion |

|

Market Growth Rate 2025-2033

|

12.35% |

Digital solutions are increasingly being deployed in the healthcare sector, and that is driving the global dental practice management software market. The dental clinics have also been motivated to invest in billing, appointments, and record-keeping software solutions. This is on account of a strong need for efficient patient management and productive administrative processes due to the growing requirement in this area. This increases awareness toward oral health which, along with an added number of patients consulting dental experts is further contributing to a good market prospect. More advanced technologies like AI and analytics in data are also gradually integrated into dental operation, therefore developing efficiency in its operations, and making the process up-to-date.

The United States becomes critical among the most significant regional markets for dental practice management software. The growing demands for successful workflows associated with its governance, such as scheduling patient appointments, patient records and billing, are the added drivers for the United States market. Other than this, the fast-growing number of individuals reported to possess oral diseases enhances the number of dental visitors therefore boosting the market growth more. According to Medline Plus, over more than 42% in all adults above the age of 30 have somehow obtained gum disease and about 8% have severe cases on periodontal diseases. Apart from this, a growing number of group dental practices and dental service organizations, is making an increasing demand for the use of a central management system which would make it possible for multiple locations to be used. In addition, on-the-rise cloud-based software is gaining in terms of its efficiency, economic nature, and availability.

Dental Practice Management Software Market Trends:

Rising occurrence of dental diseases

The rise in the occurrence of dental diseases is primarily attributed to dietary patterns. Besides this, the consumption of foods high in sugar and calories is impacting the oral health. The consumption of acidic foods and beverages is increasing, leading to a higher risk of tooth decay and erosion. According to the Centres for Disease Control and Prevention, the overall prevalence of tooth decay in primary or permanent teeth among individuals aged 2–19 years was 45.8%. Poor dietary habits, including frequent snacking and the excessive intake of processed foods, are contributing to the proliferation of dental diseases. Apart from this, lifestyle factors, such as tobacco use and alcohol consumption, have a detrimental effect on oral health. Smoking and chewing tobacco cause gum disease, tooth discoloration, and oral cancer. Excessive alcohol consumption is associated with dry mouth, plaque buildup, and a high risk of oral infections. Furthermore, the increasing occurrence of dental diseases caused by inadequate oral hygiene maintenance is bolstering the utilization of dental practice management software.

Increasing adoption of dental imaging and diagnostic devices

The application of dental imaging and diagnostic technologies is moving upward, mainly as dental practice management software is being increasingly used. Such software is continually upgraded by the integration of various imaging and diagnostic devices, including X-ray sensors, panoramic systems, and intraoral cameras. This makes it possible to capture, store, and analyze dental images within the framework of the software. The integration of clinical data with imaging outcomes will enable dental practitioners to advance their treatment decision-making process, thereby enhancing patient care and optimizing workflow efficiency. Additionally, increased awareness about the importance of early diagnosis and preventive care among dental professionals and patients is encouraging increased use of dental imaging and diagnostic equipment integrated with dental practice management software. For instance, a study on oral cancer awareness perception indicated that there was a significant difference in the perception of the role of early detection on survival between dentists and students. The study results indicated that 90.7% of the dentists believed that early diagnosis of oral cancer greatly improves survival.

Growing emphasis on paperless practices

Traditional paper-based record-keeping systems are giving way to digital alternatives in the dental sector. By digitizing patient data, treatment plans, and other crucial documents, dental practice management software helps clinics make the shift to a paperless environment. The need for effective information management, less physical storage space, and easier access to patient data are the main forces behind this movement. In addition, being paperless minimizes the carbon footprint and the amount of trees that are cut down to make paper. Additionally, the demand for dental practice management software is rising globally as it removes the burden of organizing numerous printed copies of records.

Dental Practice Management Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global dental practice management software market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on deployment type, application, and end user.

Analysis by Deployment Type:

- Cloud-Based

- Web-Based

- On-Premises

Web-based dental practice management software is a software system that can be accessed and used via a web browser. It enables dental offices to manage patient data, scheduling, invoicing, and communication centrally and digitally, among other areas of their business operations. It removes the necessity for conventional on-premises infrastructure and offers dentists a safe and practical platform to improve office management by streamlining administrative duties. Among its functions are scheduling appointments, patient registration, maintenance of electronic health records (EHR), treatment planning, billing and invoicing, processing insurance claims, and reporting. By enabling dental staff and professionals to view and amend patient data, treatment plans, and financial records from any location with an internet connection, it fosters accessibility and flexibility.

Analysis by Application:

- Patient Communication Software

- Billing Software

- Payment Processing Software

- Insurance Management

- Others

The largest market share is held by patient communications. Digital platforms and solutions created to promote efficient communication between dental offices and their patients are referred to as IT patient communication software. It makes use of technology to increase patient involvement, boost communication effectiveness, and offer easy access to data and services. Sending appointment reminders by email, SMS text message, or automated phone call can all be automated with it. These reminders increase appointment adherence, decrease no-shows, and boost scheduling effectiveness in general. Additionally, it makes two-way communication between dental offices and patients safe and easy. It promotes effective and direct contact by enabling patients to submit information directly through the platform, ask questions, or request explanations.

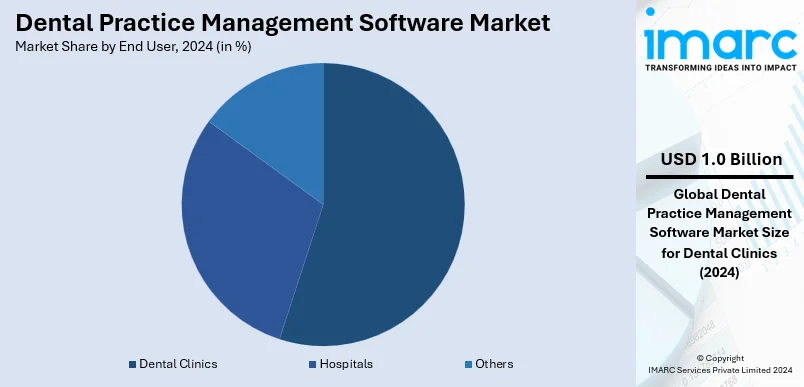

Analysis by End User:

- Dental Clinics

- Hospitals

- Others

Dental clinics lead the market with around 47.5% of market share in 2024. Dental clinics employ dental practice management software to improve overall practice management, increase efficiency, and streamline and optimize operations. It offers a consolidated platform for tracking availability, managing appointments, and preventing scheduling conflicts. By automatically reminding patients of their appointments, it can minimize no-shows and streamline the clinic's schedule. Additionally, it makes it possible for dental offices to have thorough and well-organized electronic patient records. Features include things like scan data, treatment plans, progress notes, medical histories, and patient demographics. By combining treatment alternatives, resources, and related expenses, it makes treatment planning easier. Additionally, it makes it possible to monitor progress, guaranteeing that treatment plans are efficiently overseen and modified as needed.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.6%. North America held the biggest market share due to the rising focus on streamlining operations and improving efficiency. The rising adoption of technologically advanced solutions to digitize processes in healthcare is contributing to the growth of the market in the region.

Another contributing aspect is the growing demand for convenience, transparency, and seamless communication among patients. Besides this, the rising healthcare expenditure among the masses is impelling the growth of the market.

Asia Pacific is estimated to expand further in this domain due to the rising adoption of smoking habits and consumption of alcohol among the masses. Apart from this, the increasing utilization of advanced digital imaging and diagnostic devices in the dental industry is propelling the market growth.

Key Regional Takeaways:

United States Dental Practice Management Software Market Analysis

In 2024, the United States accounts for over 81.9% of dental practice management software in North America. The DPMS market in the United States is driven by several key factors, including the rising adoption of electronic health records (EHR) systems, the need for operational efficiency, and the demand for integrated solutions to enhance patient care. According to the Office of the National Coordinator for Health Information Technology, as of 2021, nearly 4 in 5 office-based physicians (78%) and almost all non-federal acute care hospitals (96%) had adopted a certified EHR, reflecting a broader trend toward digital solutions in healthcare. As the number of dental practices grows, both independent and group practices are turning to DPMS to streamline administrative tasks, improve billing, and ensure regulatory compliance. The increasing adoption of cloud-based solutions offers flexibility and remote data access, especially for multi-location practices. Furthermore, the growing focus on patient engagement and the need for robust data security and privacy protections have made DPMS vital for improving patient experiences. Government initiatives, such as the Health Information Technology for Economic and Clinical Health (HITECH) Act, are also promoting the digitalization of healthcare, further contributing to market growth. As a result, dental practices are increasingly adopting advanced software solutions to stay competitive in the evolving, digital-first healthcare landscape.

Asia Pacific Dental Practice Management Software Market Analysis

The dental practice management software (DPMS) market in the Asia-Pacific region is gaining momentum due to rapid digital transformation in healthcare and the increasing adoption of technology by dental professionals for operational efficiency. In 2021, 64% of China’s population and 37% of India’s population lived in urban areas. This urbanization trend is driving the rise of private dental practices and increasing demand for integrated solutions for patient management, scheduling, and billing. The growing urban population in countries like China and India is expected to further fuel demand for advanced dental services, leading to greater reliance on DPMS. Additionally, government support for digital healthcare initiatives and expanding healthcare infrastructure are creating favorable conditions for market growth. The shift toward cloud-based systems and mobile solutions is also contributing to the adoption of DPMS, offering scalability, accessibility, and cost-efficiency across the region.

Europe Dental Practice Management Software Market Analysis

The Dental Practice Management Software (DPMS) market in Europe is expanding due to rising demand for efficient administrative management and the increasing adoption of digital technologies in healthcare. In 2023, the European MedTech market was valued at approximately USD 167 Billion, reflecting the region's strong growth in healthcare technologies, according to MedTech Europe. The integration of software for scheduling, billing, and patient records has become crucial for dental practices to ensure smooth operations, reduce administrative overhead, and enhance patient care. Additionally, the increasing focus on patient-centric services, including appointment reminders, treatment history tracking, and personalized care, is boosting the adoption of DPMS in the region. The growing trend of dental group practices and multi-location operations is also contributing to the market’s growth, as centralized management systems help streamline operations across multiple sites. Furthermore, regulatory pressure for data security and compliance with GDPR has driven the use of secure, cloud-based software solutions to protect sensitive patient data. The demand for mobile-friendly applications and investment in advanced technologies like artificial intelligence and analytics is shaping the future of the market, making it a competitive and dynamic space.

Latin America Dental Practice Management Software Market Analysis

The expanding use of digital healthcare technology and an emphasis on enhancing patient care are driving growth in the Dental Practice Management Software (DPMS) market in Latin America. The need for DPMS solutions that provide integrated patient management, scheduling, and billing is growing as dental offices look to optimize their operations. Together with the proliferation of private dental clinics in nations like Mexico, Brazil, which has 374 dental schools (307 private and 67 public), is a major contributor to market expansion. The adoption of DPMS is also being accelerated by the demand for safe, cloud-based systems to comply with legal requirements and safeguard patient data. The need for creative, effective, and compliant software solutions is growing throughout the region as the industry develops.

Middle East and Africa Dental Practice Management Software Market Analysis

In the Middle East and Africa, the Dental Practice Management Software (DPMS) market is expanding due to increasing healthcare infrastructure investments and a rising demand for advanced dental care services. As the region modernizes its healthcare system, there is a growing need for integrated solutions to streamline patient management, scheduling, and billing. Government initiatives promoting digital health technologies are also driving DPMS adoption. Additionally, the rising number of private dental clinics and the push for improved patient care are contributing to market growth. According to the EMEA Cloud Business Survey 2023, 68% of Middle East companies plan to migrate most of their operations to the cloud within the next two years, further accelerating the adoption of cloud-based DPMS solutions offering scalability and flexibility.

Competitive Landscape:

Key players in the United States dental practice management software market are implementing strategic steps in order to hold a strong position in the market, while catering to evolving consumer demands. They are also working on innovations by including advanced technologies (AI), machine learning (ML), and cloud computing into their solutions, so as to improve usability and efficiency. Besides this, a majority of these companies are also getting into calculated partnerships and collaborations with dental service organizations (DSOs) and healthcare providers, which eventually lead to larger consumer bases and customized solutions. Moreover, creative marketing efforts, such as targeted campaigns and consumer education programs, are further allowing them to build a brand loyalty.

The report provides a comprehensive analysis of the competitive landscape in the dental practice management software market with detailed profiles of all major companies, including:

- ABELSoft Inc.

- Allscripts Healthcare Solutions

- Carestream Dental LLC

- Curve Dental Inc.

- Datacon Dental Systems

- DentiMax LLC

- Epic Systems Corporation

- Henry Schein Inc.

- Patterson Companies Inc.

- Practice-Web Inc.

Latest News and Developments:

- November 2024: Dentimax has launched DentiMax Flow, a browser-based practice management software designed to meet the needs of modern dental offices. The new software allows dental professionals to access appointments, patient records, reports, billing, SMS, documents, and more from any device with an internet connection.

- October 2024: Planet DDS has launched DentalOS, the first dental operating system designed to enhance the integration of advanced technology within Dental Support Organizations (DSOs) and group practices. The platform offers an open API ecosystem, ensuring seamless data flow and full interoperability between applications to support growth and operational efficiency.

- October 2024: MaxiDent Software Systems has rebranded to Mint Ops, marking its shift from a software provider to a broader ecosystem supporting dental clinics across Canada. The Mint Ops brand will encompass a suite of integrated solutions aimed at improving clinic operations, marketing, staffing, and patient communication.

- March 2023: Carestream Dental has launched IO Scanner Link, enabling CS Imaging version 8 software to integrate with third-party intraoral scanners. This solution centralizes imaging data, simplifying workflows by storing and managing images in a single software and patient database, thereby enhancing operational efficiency in digital dental practices.

- November 2022: Pearl, a leader in dental AI solutions, and Curve Dental, a cloud-based dental software provider, announced plans to integrate Pearl's Second Opinion® disease detection technology into Curve Dental's SuperHero practice management system. This partnership brought FDA-cleared clinical AI capabilities to Curve’s 70,000 users across the United States and Canada.

Dental Practice Management Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | Cloud-Based, Web-Based, On-Premises |

| Applications Covered | Patient Communication Software, Billing Software, Payment Processing Software, Insurance Management, Others |

| End Users Covered | Dental Clinics, Hospitals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABELSoft Inc., Allscripts Healthcare Solutions, Carestream Dental LLC, Curve Dental Inc., Datacon Dental Systems, DentiMax LLC, Epic Systems Corporation, Henry Schein Inc., Patterson Companies Inc. and Practice-Web Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the dental practice management software market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global dental practice management software market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the dental practice management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Dental practice management software is a digital tool designed to streamline the operations of dental clinics. It manages administrative tasks like scheduling, billing, patient records, and insurance claims.

The dental practice management software market was valued at USD 2.1 Billion in 2024.

IMARC estimates the global dental practice management software market to exhibit a CAGR of 12.35% during 2025-2033.

The increasing adoption of digital solutions in dental practices, rising demand for efficient patient record and appointment management, integration of advanced technologies such as artificial intelligences (AI) and cloud computing are the major factors driving dental practice management software market.

According to the report, web based represented the largest segment by deployment type, driven by its accessibility, cost-effectiveness, and scalability, enabling users to manage operations remotely without the need for complex on-premise infrastructure.

Patient communication software leads the market by application as it enhances patient engagement, streamlines appointment scheduling, and improves communication efficiency, addressing critical needs in modern dental practices.

According to the report, dental clinics represented the largest segment by end user, driven by their widespread adoption of practice management software to streamline operations, enhance patient care, and manage high patient volumes efficiently.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Dental Practice Management Software market include ABELSoft Inc., Allscripts Healthcare Solutions, Carestream Dental LLC, Curve Dental Inc., Datacon Dental Systems, DentiMax LLC, Epic Systems Corporation, Henry Schein Inc., Patterson Companies Inc., and Practice-Web Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)