Deodorants Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2026-2034

Deodorants Market Size and Share:

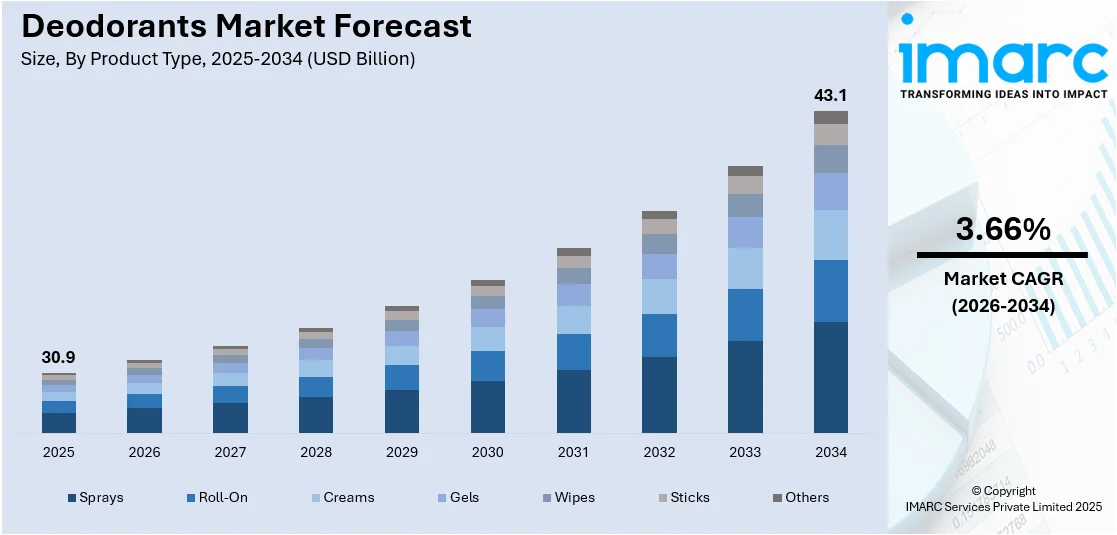

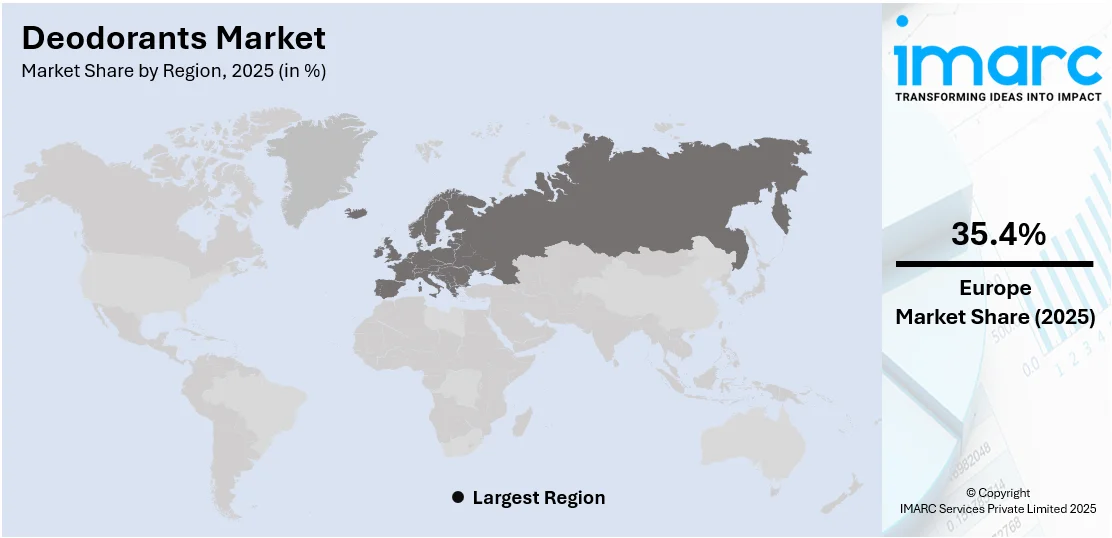

The global deodorants market size was valued at USD 30.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 43.1 Billion by 2034, exhibiting a CAGR of 3.66% from 2026-2034. Europe currently dominates the market, holding a market share of 35.4% in 2025. Growing awareness of personal grooming is driving demand for deodorants as individuals prioritize hygiene and self-care. The expanding popularity of natural and organic products reflects consumer concerns about health and the environment, prompting a shift toward clean-label formulations. Additionally, the overview of gender-neutral scents and sustainable packaging appeals to modern values of inclusivity and eco-consciousness. These trends are reshaping consumer preferences and encouraging innovation, collectively contributing to the steady deodorants market share across various regions and demographics.

Market Size & Forecasts:

- Deodorants market was valued at USD 30.9 Billion in 2025.

- The market is projected to reach USD 43.1 Billion by 2034, at a CAGR of 3.66% from 2026-2034.

Dominant Segments:

- Product Type: Sprays dominate the deodorants market with a 48.7% share, driven by their rapid-drying, non-sticky nature and wide appeal to users.

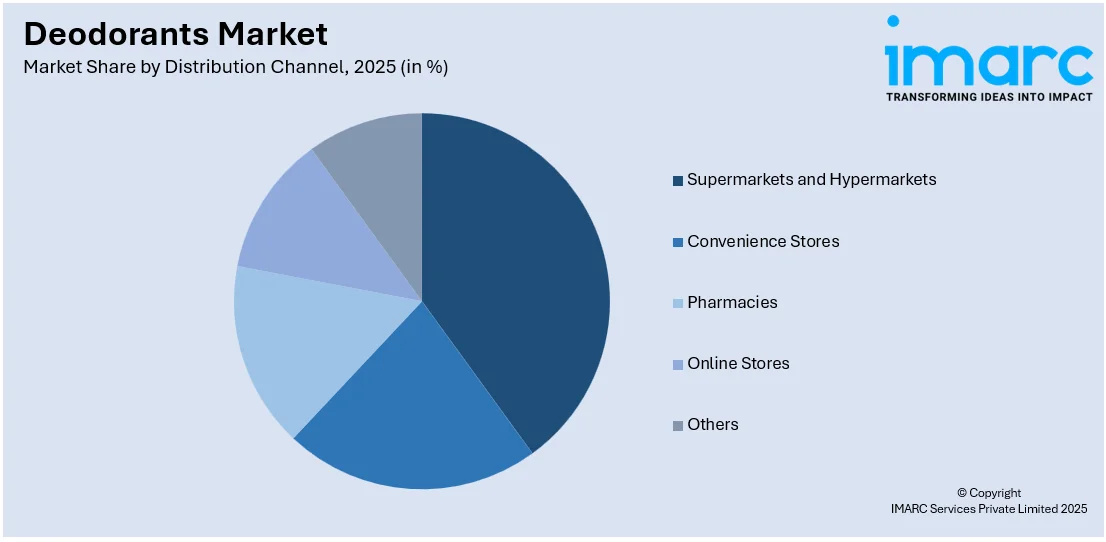

- Distribution Channel: Supermarkets and hypermarkets hold the largest share of deodorant sales, accounting for 35.6%, because of their universal availability, product range, and ease of access.

- Packaging Type: Plastic holds the largest market share in the deodorants market because it is economical, long-lasting, and can be applied in diversified packaging design.

- Region: Europe leads the deodorants market with a 35.4% share due to high awareness of personal hygiene, high purchasing power, and a penchant for premium, eco-friendly products.

Key Players:

- The leading companies in the market include Adidas AG, Avon Products Inc. (Natura & Co.), Beiersdorf AG (maxingvest ag), Cavinkare Private Limited, Church & Dwight Co. Inc., Colgate-Palmolive Company, Estée Lauder Companies, Godrej Consumer Products Limited, Henkel AG & Co. KGaA, Lion Corporation, L'Oréal, The Procter & Gamble Company, Unilever Plc, etc.

Key Market Growth Drivers:

- Environmental Awareness: Increased awareness about the environmental effects of chemicals used in personal care products is driving the move towards natural and green deodorants.

- User Health Awareness: People are becoming more inclined towards products with less synthetic content, resulting in greater demand for natural or organic ingredient-based deodorants.

- Product Innovation: Ongoing advancements in deodorant formulation, such as long-lasting, non-irritating, and fragrance-free varieties, are increasing product attractiveness to people.

- Sustainability Trends: The increasing shift towards sustainable packaging, like recyclable or biodegradable packaging, is encouraging deodorant producers to employ greener processes.

- Increasing Disposable Incomes: As disposable incomes rise in emerging economies, people are increasingly choosing premium, luxury, and specialized deodorant products, supporting the market growth.

Future Outlook:

- Consistent Market Expansion: The market for deodorants is growing steadily, boosted by innovations, the growing need for natural products, and environmental and health concerns.

- Market Diversification: The industry is shifting away from the conventional stick and spray form to more diversified products, including creams, gels, and roll-ons, increasing its reach across various consumer groups and geographies.

One major driver in the deodorants market is the growing awareness of personal hygiene, especially among younger consumers. As lifestyles become more active and urbanized, people are increasingly conscious of body odor and overall grooming. This awareness is further fueled by social media, celebrity endorsements, and health campaigns promoting cleanliness. Additionally, the rising disposable incomes in emerging economies enable consumers to spend more on personal care products. Innovative product formats such as roll-ons, sprays, and natural deodorants also attract diverse customer segments. The trend toward natural and organic ingredients is gaining traction, as consumers seek skin-friendly and eco-conscious options. This shift in consumer behavior continues to push manufacturers toward developing effective, sustainable deodorant solutions.

To get more information on this market Request Sample

The U.S. deodorants market, holding a dominant 82.38% share, is driven by strong consumer demand for personal hygiene and grooming. Americans prioritize cleanliness and body odor control, making deodorants a daily essential. EPA data shows that aerosol products like deodorant sprays are typically used 1–2 times daily among adults aged 18–64, reinforcing consistent usage habits. Market growth is further fueled by interest in natural, aluminum-free, and sensitive-skin-friendly products amid rising health and environmental awareness. Consumers increasingly seek cruelty-free, sustainable options with clean ingredients. Innovation in formats and gender-neutral branding, alongside digital marketing and e-commerce, continues to shape evolving preferences and competitive dynamics across the U.S. market.

Deodorants Market Trends:

Increased Demand for Environment Friendly Products

There is a rising preference for environment friendly and green products among the masses. This is driven by greater environmental consciousness, with people becoming more aware about the environmental cost of their purchases. They are choosing deodorants whose packaging is recyclable, biodegradable, or minimalist. Brands are also employing eco friendly ingredients that will not pollute the environment, including plant oils and waxes. Because of this, companies that sell deodorants are getting creative in fulfilling these needs by providing packaging that will minimize plastic waste, ensuring sustainability throughout their product lines. Most deodorant producers are also emphasizing cruelty-free testing and the ethical sourcing of materials so that their products meet the demands of environmental-friendly end user. In 2025, Hyléance Beauté, the beauty sector of the Hyléance Group located in Ceyzériat, France, has teamed up with the Parisian start-up 900.care to introduce a novel refillable roll-on deodorant container. The new Pure Roll-on container, tailored for a 50 mL size, focuses on durability and minimal plastic consumption, responding to the increasing consumer desire for eco-friendly personal care options.

Rising Health and Wellness Consciousness

People are becoming increasingly health-aware and are giving priority to products that are in line with their well-being aspirations. This trend is driving the need for natural, organic, and skin-friendly deodorants. Most individuals are consciously shunning synthetic chemicals, parabens, and artificial perfumes, which are traditionally linked to health hazards. Consequently, deodorant manufacturers are meeting this trend by creating products using safer, plant-based ingredients, appealing to people who care more about what they put on their skin. This increasing popularity of healthier personal care products is largely contributing to the rise of the natural and organic deodorant market, as consumers remain increasingly looking for alternatives to traditional products that contain potentially harmful substances. To this, brands are investing into research and development (R&D) to enhance product formulations so they can keep pace with the increased demand for clean beauty and skincare products. In 2024, Dove launched its latest niacinamide-enriched deodorant with an aluminum free formulation to provide 72 hour odor protection.

Enhanced Use of Deodorants among Men in Grooming

Male grooming is rising, and deodorants are at the center of this growth. With grooming practices becoming more mainstream with men, men are now looking for deodorants that provide long-lasting protection, fresh fragrances, and skin-friendly qualities. Male-targeted deodorants are in greater demand, with more men choosing specialty products that suit their taste. These include deodorants with men's fragrances, as well as products that have been specifically designed to address problems like excessive sweating, skin irritation, or body odor due to active lifestyles. Brands are meeting this challenge by introducing deodorants made just for men as critical components of contemporary grooming regimens. IMARC Group predicts that the global male grooming products market is projected to attain USD 153.6 Billion by 2033.

Deodorants Market Growth Drivers:

Product Formulation and Convenience Innovations

Continuous product formulation innovations are strengthening the market growth. Manufacturers are constantly devising ways to enhance the performance, texture, and duration of deodorants. Deodorants with new formulations that provide 24-hour protection, soothing ingredients for the skin, and non-irritating qualities are being increasingly adopted. The convenience aspect is also an important factor in the market's growth. Customers are increasingly seeking deodorant products that blend into their hectic lives, prompting the trend of convenient and portable formats such as wipes, sprays, and roll-ons. Deodorants are also being offered in various fragrances and forms specific to individual skin types and tastes, further increasing their popularity. With deodorant companies further focusing on innovation, they are providing more diversified and functional products based on changing demands for performance, convenience, and customization.

Impact of Social Media and Celebrity Endorsements

Social media sites and celebrity endorsements are showing a greater impact on consumer buying behavior in the deodorants market. Inflencers, beauty vloggers, and celebrities are promoting particular deodorant brands and products, influencing public perception and increasing product awareness. With the availability of deodorants through online channels, buyers are exposed to multiple alternatives, usually based on reviews, tutorials, and recommendations. This is instilling confidence in brands backed by popular names or supported by social media communities. As such, buyers are likely to experiment with new deodorants that match trends online. Social media also allows brands to communicate with their target market directly, creating brand loyalty and nurturing closer customer relationships.

Growing Disposable Incomes and Premium Product Demand

With rising disposable incomes, particularly in emerging markets, people are more open to spending money on premium deodorant products that are superior in quality, have novel fragrances, or provide other benefits such as skin care or extended protection. The high-end, luxury deodorant category is growing as people look for products that provide more than the bare essentials. Such high-quality products usually possess superior formulation, natural ingredients, and upscale packaging, targeting people who perceive personal care products as part of their lifestyle and self-care regimen. In addition, with rising numbers of individuals becoming middle-class in emerging economies, the capacity to buy high-quality personal care products rises, fueling the market growth.

Deodorants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Deodorants market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, distribution channel, and packaging type.

Analysis by Product Type:

- Sprays

- Roll-On

- Creams

- Gels

- Wipes

- Sticks

- Others

Sprays dominate the deodorants market with a 48.7% share, driven by their quick-drying, non-sticky application and broad consumer appeal. They offer instant freshness and even coverage, making them ideal for active lifestyles and on-the-go use. Sprays are perceived as more hygienic since they don’t require direct skin contact, which appeals to many users. Additionally, they are available in a wide range of scents and sizes, catering to varied preferences. Their popularity is also fueled by effective marketing, especially targeting younger demographics. The convenience of aerosol delivery, along with advancements in environmentally friendly propellants and recyclable packaging, supports sustained demand. This format's blend of practicality, performance, and sensory appeal makes it a leading choice in the global deodorant market.

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies

- Online Stores

- Others

Based on the deodorants market forecast, the supermarkets and hypermarkets hold the largest share of deodorant sales, accounting for 35.6%, due to their widespread accessibility, product variety, and convenience. These retail outlets offer consumers a one-stop shopping experience, allowing them to compare multiple brands, formats, and price points in a single location. Promotions, discounts, and in-store displays further encourage impulse buying and brand switching. The physical presence of products allows customers to assess packaging, scents, and ingredients directly, which enhances buying confidence. Moreover, supermarkets and hypermarkets cater to both mass-market and premium segments, making them appealing to a broad consumer base. Their established distribution networks and consistent foot traffic ensure high product visibility, reinforcing their role as a dominant sales channel in the deodorants market.

Analysis by Packaging Type:

- Metal

- Plastic

- Others

Plastic holds the largest market share in the deodorants market due to its cost-effectiveness, durability, and versatility in packaging design. Manufacturers prefer plastic because it is lightweight, easy to mold, and supports various formats like roll-ons, sticks, and sprays. Its resilience reduces the risk of breakage during transport and handling, ensuring product safety and shelf stability. Additionally, plastic allows for customizable shapes and colors, enhancing brand appeal and consumer convenience. Despite growing environmental concerns, plastic remains dominant due to its widespread availability and low production costs. However, sustainability efforts are prompting innovations such as recyclable plastics, bio-based materials, and refillable packaging, which aim to address ecological issues without compromising the functional advantages of plastic.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the deodorants market with a 35.4% share due to high consumer awareness of personal hygiene, strong purchasing power, and a preference for premium, sustainable products. European consumers are increasingly focused on natural, aluminum-free, and eco-friendly formulations, driving demand for clean-label deodorants. The region's strict regulations on cosmetic ingredients also push brands to innovate with safer, high-quality products. A well-established retail infrastructure, including supermarkets, pharmacies, and online platforms, ensures widespread availability and easy access. Additionally, growing environmental consciousness supports the adoption of sustainable packaging and refillable formats. Lifestyle trends promoting wellness, grooming, and daily freshness further reinforce consistent deodorant use, while regional cultural norms emphasize cleanliness, fueling continued market growth across diverse demographics.

Key Regional Takeaways:

North America Deodorants Market Analysis

The North America deodorants market is growing steadily, driven by rising hygiene awareness, fitness-oriented lifestyles, and demand for clean-label products. Consumers increasingly prefer natural, aluminum-free, and dermatologically tested formulations, aligning with wellness and sustainability trends. Gender-neutral and all-over body deodorants are gaining traction, reflecting evolving preferences. Innovative product formats like gels and wipes cater to convenience-driven users. Social media influence and digital marketing significantly shape purchasing behavior, particularly among younger demographics. Retail expansion across supermarkets, specialty stores, and online platforms enhances accessibility. Overall, the market benefits from evolving consumer values, product innovation, and a shift toward inclusive, performance-driven solutions.

United States Deodorants Market Analysis

The deodorant market in the United States is experiencing robust growth, driven by evolving consumer preferences toward personal hygiene and self-care routines. Increasing awareness about body odor management, particularly among younger demographics, is contributing significantly to the rising product demand. The trend of daily grooming as part of wellness routines is also gaining momentum. Furthermore, growing participation in fitness and outdoor activities is fueling the demand for long-lasting and performance-oriented deodorants. Interestingly, according to a recent report, men are now spending more than women on beauty and grooming products, with an average monthly spend of approximately USD 90 on personal care and grooming compared to USD 80 for women. This shift is reshaping product development and marketing strategies to cater to a broader and more diverse consumer base. The market is also benefiting from increased interest in gender-neutral and dermatologically tested formulations. Innovations in product formats, such as sprays, gels, and wipes, are enhancing consumer engagement. Additionally, the rising influence of digital marketing and social media campaigns is shaping purchasing behavior, especially among urban consumers. Retail expansion across supermarkets, hypermarkets, and online platforms is facilitating wider product accessibility.

Europe Deodorants Market Analysis

In Europe, the deodorant market is expanding steadily, fueled by the region’s strong emphasis on grooming culture and aesthetic appeal. Consumers are increasingly opting for products that offer a balance between efficacy and skin-friendliness, reflecting a shift toward clean-label preferences. The market is witnessing a surge in demand for hypoallergenic and alcohol-free formulations to address sensitive skin needs. Moreover, the cultural importance of fragrance in personal identity is influencing product selection, with deodorants becoming an extension of personal style. According to the CBI Ministry of Foreign Affairs, European imports of natural ingredients for cosmetics amounted to 470,561 Tons, which is about USD 2.4 Billion, underscoring the growing reliance on naturally derived components in personal care products. The region's mature retail infrastructure, growing preference for pharmacy and organic stores, and rising awareness about ingredients are driving demand for deodorants free from synthetic preservatives and artificial scents. Seasonal shifts and lifestyle patterns also contribute to fluctuating demand, particularly during summer.

Asia Pacific Deodorants Market Analysis

Urbanization, global lifestyle changes, rising disposable incomes, and growing awareness of personal hygiene are all contributing to the Asia Pacific deodorants market's explosive expansion. A notable trend is the adoption of compact and travel-friendly packaging formats suited to busy, on-the-go lifestyles. Additionally, rising demand for products that cater to different climatic needs, particularly in humid and tropical regions, is influencing product formulations. The younger population, particularly millennials and Generation Z, is highly influenced by international beauty trends and is increasingly adopting deodorant as part of their daily grooming routines. As reported, eighty-three percent of the world's growing population of millennials are in Asia. Cultural shifts toward modern grooming habits, especially in emerging economies, are accelerating market penetration. Promotional strategies through e-commerce and influencer marketing are playing a critical role in building brand visibility and consumer engagement across the region.

Latin America Deodorants Market Analysis

In Latin America, the deodorant market is largely influenced by the increasing consumer demand for personal care products that provide long-lasting freshness and protection. Rising temperatures in tropical regions have also intensified the need for effective deodorants that help manage body odor throughout the day. The region is seeing a shift toward more sophisticated deodorant formulations, such as antiperspirants with skin-care benefits. Social media has played a significant role in this shift, with influencers and beauty experts promoting new, premium deodorant brands and natural ingredients. Given that 40.5% of Latin Americans get their news from social media, sites like Instagram and TikTok are crucial in influencing how people buy. Furthermore, the growth of the middle-class population and greater exposure to international beauty trends are driving the adoption of high-quality deodorant products. Consumers are increasingly turning to social platforms for product reviews, recommendations, and the latest trends, fueling the demand for long-lasting, premium deodorants that align with their personal care routines.

Middle East and Africa Deodorants Market Analysis

The Middle East and Africa's deodorant market is expanding due to rising hygiene awareness, evolving beauty standards, modern retail formats, and religious and cultural preferences. A notable market indicator is the growing demand for grooming and personal care products in the region. The market is also witnessing a shift toward personal grooming among male consumers, with dedicated products gaining popularity. As such, Saudi Arabia Male Grooming Products Market size reached USD 841.78 Million in 2024 to reach USD 1429.44 Million by 2033. Longevity in high-temperature climates is a critical purchase driver. Digital outreach and promotional campaigns through localized content are helping brands connect with diverse audiences.

Competitive Landscape:

The deodorants market is highly competitive, driven by evolving consumer preferences, innovation, and branding strategies. Companies compete on factors such as product efficacy, natural ingredients, skin-friendliness, and sustainability. The shift toward organic, aluminum-free, and gender-neutral formulations has intensified innovation. Packaging also plays a critical role, with demand growing for eco-friendly and refillable options. Market players differentiate through unique scents, long-lasting protection, and multifunctional benefits like skin care or anti-bacterial features. Aggressive marketing, social media engagement, and influencer partnerships are key tactics to capture consumer attention, especially among Gen Z and millennials. Both mass-market and premium segments are expanding, making pricing strategy crucial. The rise of e-commerce and direct-to-consumer models is further shaping the competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the Deodorants market with detailed profiles of all major companies, including:

- Adidas AG

- Avon Products Inc. (Natura & Co.)

- Beiersdorf AG (maxingvest ag)

- Cavinkare Private Limited

- Church & Dwight Co. Inc.

- Colgate-Palmolive Company

- Estée Lauder Companies

- Godrej Consumer Products Limited

- Henkel AG & Co. KGaA

- Lion Corporation

- L'Oréal

- The Procter & Gamble Company

- Unilever Plc

Latest News and Developments:

- July 205: Juicy Chemistry has introduced an innovation in natural personal care with the debut of its 5% AHA + 2% BHA Underarm Roll-On Deodorant. Combining active exfoliation with plant-based nourishment, this clean beauty breakthrough seeks to revolutionize our approach to caring for one of the most neglected parts of the body like the underarms.

- June 2025: CodeSteri Inc., a technology-focused startup situated at Hanyang University College of Medicine in Seoul, has unveiled PlaDeo, the globe's first electronic deodorant device utilizing bio-plasma. PlaDeo is engineered to safely and effectively eradicate underarm odor, providing an innovative solution for handling axillary bromhidrosis, an ailment marked by persistent underarm odor, while avoiding chemicals, pore-clogging agents, and aluminum salts.

- March 2025: Luna Daily launched its aluminum-free All-Over Deodorant, offering multi-zone odor protection using SYMDEO technology. Designed for underarms, inner thighs, and neck, the pH-balanced gel stick features DEO-PLEX, hyaluronic acid, and probiotics to hydrate skin, support microbiome health, and effectively neutralize odor across the body.

- March 2025: Dove launched its Whole-Body Deodorant, promoting all-over odor protection and skin comfort through a Toronto-based interactive dance installation with influencer Spencer Barbosa. The aluminum-free range offers pH-balanced cream, anti-friction stick, and cooling spray formats, targeting odor, chafing, and moisture with dermatologist- and gynecologist-tested, skin-friendly formulas.

- February 2025: Each & Every expanded into Ulta Beauty stores, launching a deodorant collection designed as a foundational fragrance. Made with six ingredients and natural scents, the brand emphasizes sensory self-expression. It also appointed Alison Zimmermann as head of marketing to drive growth through storytelling and brand activations.

- February 2025: Rexona launched its Whole-Body Deodorant range with a bold campaign highlighting that only 1% of body odor originates from armpits. Developed with adaptive odor technology, the campaign featured playful ads across TV, social, and cinema, aiming to normalize all-over odor care and boost confidence through humor and inclusivity.

- January 2025: Unilever launched Sure Whole-Body Deodorant and Lynx Lower Body Spray in the UK, introducing odor-adapt technology for multi-area freshness. Backed by rising demand and a strong ATL campaign, the products addressed odor beyond underarms, aiming to reshape personal care routines and unlock significant incremental growth in the deodorant category.

Deodorants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sprays, Roll-On, Creams, Gels, Wipes, Sticks, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies, Online Stores, Others |

| Packaging Types Covered | Metal, Plastic, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adidas AG, Avon Products Inc. (Natura & Co.), Beiersdorf AG (maxingvest ag), Cavinkare Private Limited, Church & Dwight Co. Inc., Colgate-Palmolive Company, Estée Lauder Companies, Godrej Consumer Products Limited, Henkel AG & Co. KGaA, Lion Corporation, L'Oréal, The Procter & Gamble Company and Unilever Plc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, deodorants market forecast, and dynamics of the market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global deodorants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the deodorants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The deodorants market was valued at USD 30.9 Billion in 2025.

The deodorants market is projected to exhibit a CAGR of 3.66% during 2026-2034, reaching a value of USD 43.1 Billion by 2034.

Deodorants are personal care products designed to prevent or mask body odor caused by bacterial growth, especially in the underarms. They come in various forms like sprays, roll-ons, sticks, and creams. Many also include antiperspirant ingredients to reduce sweating, offering freshness, hygiene, and confidence throughout the day.

Europe currently dominates the deodorants market, accounting for a share of 35.4% due to high awareness of personal hygiene, strong demand for natural and eco-friendly products, and strict regulatory standards. Consumers prioritize sustainable packaging, clean ingredients, and premium quality, driving innovation and consistent product use across diverse age and gender groups.

Some of the major players in the deodorants market include Adidas AG, Avon Products Inc. (Natura & Co.), Beiersdorf AG (maxingvest ag), Cavinkare Private Limited, Church & Dwight Co. Inc., Colgate-Palmolive Company, Estée Lauder Companies, Godrej Consumer Products Limited, Henkel AG & Co. KGaA, Lion Corporation, L'Oréal, The Procter & Gamble Company and Unilever Plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)