DevOps Market Size, Share, Trends and Forecast by Type, Deployment Model, Organization Size, Tools, Industry Vertical, and Region, 2025-2033

DevOps Market Size and Share Analysis:

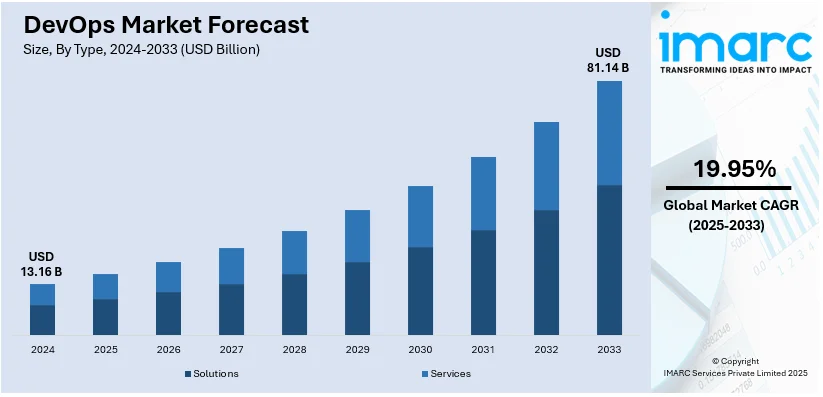

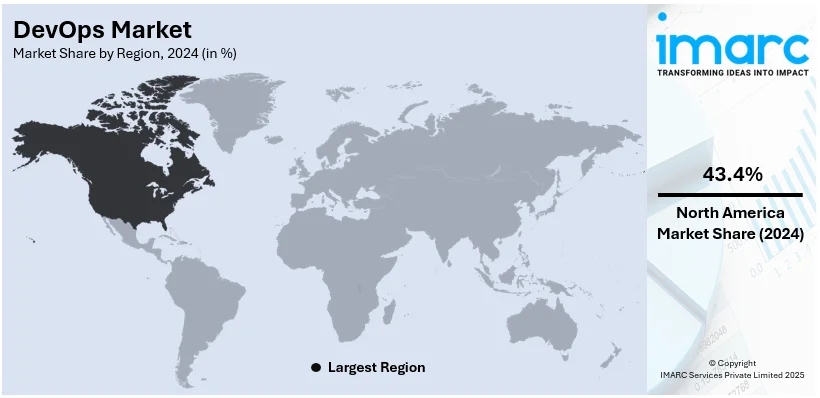

The global DevOps market size was valued at USD 13.16 Billion in 2024. Looking forward, the market is projected to reach USD 81.14 Billion by 2033, growing at a CAGR of 19.95% from 2025-2033. North America currently dominates the market, holding a market share of over 37% in 2024. The shifting preferences from traditional data centres to hybrid systems, the increasing focus on automating business processes across various industries, and the rising demand for serverless computing represent some of the major determinants fueling the DevOps market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.16 Billion |

|

Market Forecast in 2033

|

USD 81.14 Billion |

| Market Growth Rate (2025-2033) | 19.95% |

The global market is witnessing remarkable growth, driven by the need for agile software development and seamless collaboration between development and operations teams. Organizations are increasingly adopting DevOps to accelerate delivery cycles, improve software quality, and streamline processes. Key drivers include the expansion of cloud computing, widespread use of CI/CD frameworks, and advancements in automation technologies. Additionally, the integration of AI and ML into DevOps processes enhances predictive capabilities and operational efficiency, aligning with businesses’ digital transformation goals. This trend is supported by the demand for faster innovation, as companies strive to maintain a competitive edge in emerging markets.

To get more information on this market, Request Sample

In the United States, the DevOps market stands out due to the dominance of technology-driven enterprises and their early adoption of cloud-native strategies. Companies are leveraging DevOps to reduce time-to-market, optimize workflows, and strengthen customer satisfaction. High demand for skilled professionals reflects the critical role DevOps plays in enhancing scalability and operational resilience. For instance, in September 2024, System Initiative launched its innovative DevOps Automation technology, offering a collaborative SaaS platform that replaces Infrastructure as Code, featuring a free tier and a commitment to open-source principles. Furthermore, U.S. businesses are increasingly focused on security and compliance, reinforcing the adoption of DevOps as a strategic approach to meet evolving regulatory and cybersecurity requirements.

DevOps Market Trends:

Rising Transformation of Traditional Data Centers to Hybrid Systems

Rising adoption of hybrid systems is significantly driving the DevOps market size. For instance, according to an article published by Cloud Zero in December 2023, most of the organizations (39%) deployed a hybrid cloud in 2022. Hybrid systems introduce complexity with the combination of on-premises infrastructure and cloud services. DevOps practices such as infrastructure as code (IaC), configuration management, and automated provisioning help manage this complexity by enabling consistent, repeatable infrastructure deployments across hybrid environments. For instance, as per an article published by Appvia, IaC helps in enabling the businesses to work the hybrid cloud infrastructure in the same way as the code, where the different of the provisioning, configuration, and management can be automated. Besides this, hybrid systems offer scalability and flexibility to meet fluctuating demand and accommodate diverse workloads. Practices such as auto-scaling, containerization, and orchestration enable organizations to scale resources up or down dynamically based on demand, optimizing performance, security, control and resource utilization in hybrid environments. For instance, in May 2023, IBM launched IBM Hybrid Cloud Mesh today, a SaaS product meant to help organizations manage their hybrid multi-cloud architecture. IBM Hybrid Cloud Mesh was designed to automate the process, management, and observability of application connectivity in and between public and private clouds, allowing modern enterprises to operate their infrastructure across hybrid multi-cloud and heterogeneous environments. It is driven by "Application-Centric Connectivity". IBM Hybrid Cloud Mesh is intended to enable information technology (IT) teams to achieve network control while also offering DevOps teams with a single experience and toolkit for addressing application performance, visibility, control, and security challenges. These factors are further positively influencing the DevOps market forecast.

High Adoption of Automated Software

The high adoption of automated software owing to repetitive tasks is significantly boosting the DevOps market size. Automated software can perform repetitive tasks quickly and accurately, leading to increased efficiency and productivity. This in turn permits the employees to concentrate on more creative and challenging tasks of their work. For instance, according to an article published by Kiss Flow in April 2024, 94% of firms carry out repetitive, time-consuming operations. Also, 83% of IT leaders agreed that workflow automation is required for digital transformation. 48% of firms are implementing automation solutions to replace manual tasks. However, 36% of businesses had already implemented business process management tools to automate workflows. While 50% of corporate leaders intend to automate more monotonous jobs in their firms. Automated software deployment, configuration management, testing, and monitoring streamline development and operations workflows, reducing manual effort and improving productivity. DevOps practices emphasize automation to eliminate repetitive tasks and manual errors, accelerate delivery, and enable teams to focus on higher-value activities, driving efficiency across the software development lifecycle. For instance, in February 2024, ISmile Technologies, an IT solutions provider known for its creativity and competence, launched Cloud DevOps and Automation Services. This complete offering enables enterprises of all sizes to dramatically improve deployment speed, agility, and overall software delivery efficiency. CI/CD pipelines reduce manual errors and speed up software delivery by automating code testing, integration, and deployment. These factors are significantly boosting the DevOps market revenue.

Escalating Integration of AI

Integration of AI is one of the prominent DevOps market trends. AI-powered analytics and decision-making capabilities are increasingly integrated into DevOps processes. AI enables predictive analytics in DevOps, forecasting potential issues, bottlenecks, and failures in software development and operations. By analyzing historical data and identifying trends, AI algorithms can anticipate problems, allowing organizations to take proactive measures to prevent downtime, reduce errors, and improve system reliability. For instance, in June 2023, Harness Inc., the Modern Software Delivery Platform company, launched an AI assistant, AIDA (AI Development Assistant). This comprehensive AI solution is free of charge for all Harness clients and would be seamlessly integrated into all Harness platform processes and capabilities, including Continuous Integration (CI), Continuous Deployment (CD), Cloud Cost Management, and Feature Flags. AIDA can examine log files and associate error messages with known problems. This functionality allows developers to quickly troubleshoot and resolve deployment errors, without having to trawl through millions of log lines. AIDA also proposes fixes and predicts probable issues in the code before the build starts. Apart from this, AI is integrated into automated testing processes in DevOps to improve test coverage, accuracy, and efficiency. AI-powered testing tools use machine learning algorithms to generate test cases, prioritize test execution, and identify areas of the codebase that require additional testing, reducing manual effort and improving test effectiveness. For instance, in April 2024, Copado, the AI-powered DevOps and testing provider for enterprise SaaS, launched Test Copilot, an AI-powered test creation assistant. Test Copilot, powered by CopadoGPT, is an easy way for users of all skill levels to quickly create exact Salesforce tests. When combined with Copado Explorer, it is an effective method for delivering high-quality releases on an enterprise scale. These factors are driving the adoption of DevOps.

DevOps Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global DevOps market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on type, deployment model, organization size, tools, and industry vertical.

Analysis by Type:

- Solutions

- Services

Solution leads the market with around 68.4% of market share in 2024. DevOps solutions encompass a wide range of practices, tools, and processes that work together to streamline the entire software development lifecycle. As a result, organizations often opt for comprehensive DevOps solutions that can address multiple aspects of their DevOps needs. Besides, DevOps involves the integration of various tools for continuous integration, automation, monitoring, and more. DevOps solutions often provide a unified platform or framework that integrates these tools seamlessly, making it easier for organizations to implement and manage their DevOps practices.

Analysis by Deployment Model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Public cloud leads the market with around 47.6% of market share in 2024. According to the report, public cloud accounted for the largest DevOps market share. According to the DevOps market outlook, public cloud providers offer virtually unlimited scalability. This aligns well with DevOps principles, which emphasize the ability to scale infrastructure and resources on-demand to accommodate varying workloads. Organizations can easily add or reduce computing power, storage, and networking resources as needed, making it ideal for continuous integration and continuous delivery (CI/CD) pipelines and agile development practices. Moreover, public cloud platforms provide a wide range of services and tools that cater to the diverse needs of DevOps teams. From infrastructure as code (IaC) to container orchestration and serverless computing, the flexibility of the public cloud allows DevOps teams to select and configure the resources and services that best suit their requirements. For instance, in June 2021, Neptune Software introduced Neptune DXP Cloud, a managed public-cloud version of the company's flagship low-code app development platform. With Neptune DXP Cloud, customers can transform their IT teams into innovation powerhouses that rapidly produce predictable business outcomes.

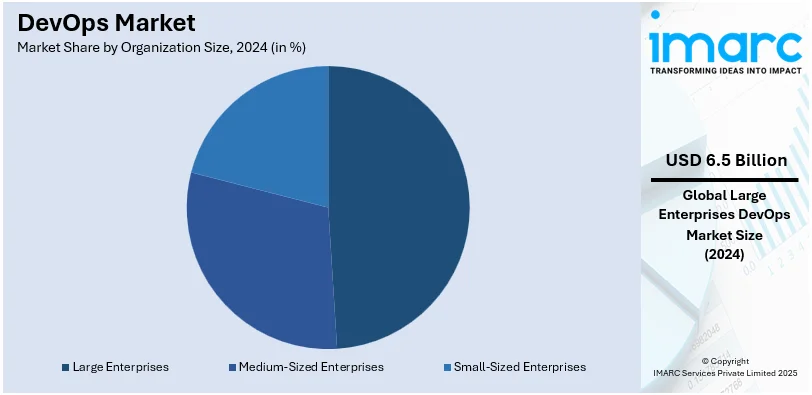

Analysis by Organization Size:

- Large Enterprises

- Medium-Sized Enterprises

- Small-Sized Enterprises

Large enterprises lead the market with around 49.4% of market share in 2024. According to the DevOps market overview, large enterprises often have a strong focus on DevOps to streamline their processes, enhance collaboration between teams, and ensure the rapid and efficient delivery of software products. They are willing to invest in DevOps tools, platforms, and services to achieve these goals. Large enterprises also tend to have dedicated DevOps teams or specialists responsible for implementing and maintaining DevOps practices throughout the organization. While medium-sized enterprises (SMEs) are organizations that fall between small businesses and large enterprises in terms of size and resources. They typically have a moderate number of employees and a less complex IT infrastructure compared to large enterprises. However, many medium-sized enterprises recognize the benefits of DevOps in terms of improving software development and deployment efficiency. Moreover, small-sized enterprises (SMEs) are typically characterized by a relatively small workforce and a more limited IT infrastructure. They leverage DevOps to streamline their development processes, reduce manual tasks, and improve the quality and reliability of their software products. Small-sized enterprises opt for simplified and cost-effective DevOps solutions that align with their budget and requirements.

Analysis by Tools:

- Development Tools

- Testing Tools

- Operation Tools

Development tools lead the market with around 45% of market share in 2024. Development tools in the DevOps ecosystem are designed to facilitate and streamline the software development phase. They help developers write, collaborate on, and manage code efficiently. Tools like GitHub, GitLab, and Bitbucket facilitate code review, code collaboration, and project management. Moreover, testing tools are essential for quality assurance and ensuring that software is free from defects and issues. DevOps emphasizes automated testing to catch issues early in the development cycle. For instance, tools like Docker Compose and Kubernetes help test containerized applications for compatibility and performance. Furthermore, operation tools in DevOps are focused on the deployment, management, and monitoring of applications and infrastructure in production. These tools ensure that software runs smoothly in a live environment.

Analysis by Industry Vertical:

- Telecommunications and Information Technology Enabled Services (ITES)

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- Manufacturing

- Healthcare

- Government and Public Sector

- Others

Telecommunications and information technology enabled services (ITES) leads the market with around 35.7% of market share in 2024. Telecommunications and ITES companies are at the forefront of digital transformation efforts. They are continually seeking ways to enhance their services, improve customer experiences, and stay competitive in a rapidly evolving landscape. DevOps practices align with these objectives by enabling faster software development, deployment, and updates, which are essential in delivering innovative digital services. Moreover, these industries operate complex IT infrastructures that include a wide range of applications, from customer-facing mobile apps to back-end systems. Managing and maintaining these diverse systems efficiently is a significant challenge. DevOps practices help streamline IT operations, reduce errors, and enhance the reliability of these systems.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 37%. According to the report, North America accounted for the largest DevOps market share. North America was an early adopter of DevOps practices and principles. Many pioneering technology companies and startups in the United States, especially in Silicon Valley, embraced DevOps to accelerate software development, improve collaboration between teams, and achieve faster time-to-market. This early adoption created a strong foundation for DevOps market growth in the region. Besides, North America is home to a significant number of large enterprises and multinational corporations across various industries, including technology, finance, healthcare, and manufacturing. These organizations often have complex IT environments and face the challenges of managing extensive software applications and infrastructure. DevOps offers them solutions to streamline operations, reduce costs, and stay competitive in rapidly changing markets. For instance, in March 2023, OpenText, a Canadian provider of information management software, launched the recent edition of ValueEdge, a cloud-based DevOps and value stream management (VSM) platform. This announcement follows OpenText's acquisition of UK software firm Micro Focus, which included ValueEdge, in an all-cash transaction of USD 6 Billion earlier this year. Powered by ValueEdge Strategy and ValueEdge Agile, this will enable the continuous planning process required by today's agile development enterprises.

DevOps Market Regional Takeaways:

United States DevOps Market Analysis

In 2024, United States accounted for 81.70% of the market share in North America. The main drivers of the U.S. DevOps market are growing popularity in microservices architecture, increased adoption of cloud computing, and the rising need for faster application delivery. According to industry reports, over 90% of American organizations use cloud services in one form or another, and the adoption of hybrid clouds is increasing by 20% per annum. DevOps approaches are now gaining prominence in large businesses as well as SMEs in order to increase operational efficiency and reduce application time-to-market. A recent survey showed that 80% of the organizations that are using DevOps had seen a reduction of up to 50% in software development and deployment timelines. To support the growing 5G infrastructure, the IT and telecom industry, which is contributing to more than 30% of the market demand, has embraced DevOps. Furthermore, the need for DevOps-integrated security (DevSecOps) solutions is being driven by adherence to strict cybersecurity laws like the CCPA and HIPAA. Nearly 30% of workers now work remotely, which has further pushed businesses to use DevOps solutions like Jenkins, Docker, and Kubernetes to optimize distributed development. Moreover, the venture capital for DevOps startups in the year 2023 had been very high, that indicated that the investors already had immense trust in such a prospect of growth for the industry.

Europe DevOps Market Analysis

The European region is dominated by the influence of initiatives for digital transformation along with an increasing use of agile approaches and automation focuses. DevOps adoption has been highly influenced by the European Union's Digital Decade program, which aims to digitalize 75% of EU enterprises by 2030, according to data by European Commission. About 70% of European organizations have adopted or are likely to adopt DevOps principles in order to enhance operational efficiency and reduce delivery times. DevOps is utilized by the financial industry, which is a large portion of market demand, to support quick innovation in fintech products and ensure regulatory compliance. With more than 60% of the demand in the regional market, nations like Germany, the UK, and France are leading the way. Another factor driving development is the extensive use of containerization tools like Docker and Kubernetes in cloud-native apps. Furthermore, businesses are being forced to include DevOps tools in green IT initiatives by Europe's focus on sustainability and energy-efficient IT processes.

Asia Pacific DevOps Market Analysis

The market for DevOps in Asia-Pacific is growing rapidly due to the increasing demand for agile software development, further digitization, and cloud usage. Reports say that over 60% of the firms in nations like China, India, and Australia are adopting more than this percentage of firms for their cloud-based infrastructures with the need for smooth transition and application administration. The growing IT industry, especially in India and Southeast Asia, is making huge investments in DevOps solutions for supporting large-scale projects and start-up ecosystems. Government programs, such as China's push for IT self-sufficiency and India's Digital India initiative, are also promoting the adoption of DevOps. DevOps is highly used in Japan's industrial sector to improve productivity due to Industry 4.0 initiatives. E-commerce, which grew over 30% in the region in 2023 (as per an industry report), also boosts the need for DevOps to ensure fast feature upgrades and safe apps.

Latin America DevOps Market Analysis

The Latin American DevOps market is now driven by increased use of cloud technology and efforts made in digital transformation. Major contributors to the regional supply are Brazil and Mexico; they supply more than 50% of this demand, while Brazil presents the highest number of developers of software. Reports suggest that the region's banking and e-commerce industries are growing as online sales increase by 20% every year, which requires the use of dependable and agile software development techniques. The government in countries like Chile and Colombia is promoting cloud-first policies, which are compelling companies to use DevOps tools for digital modernization. Further driving market expansion is the IT outsourcing sector in the region using DevOps to ensure better project effectiveness and increase customer satisfaction.

Middle East and Africa DevOps Market Analysis

The DevOps market in the Middle East and Africa is driven by high-speed cloud usage, the adoption of digital government initiatives, and an increased emphasis on automation. The Kingdom of Saudi Arabia (KSA) mirrors the global cloud adoption trend. IDC report showed that yearly spending on public cloud services is expected to increase to USD 3.9 Billion in 2027, with the compounded annual growth rate, (CAGR), forecasted at 23.4%. Digitization within government initiatives such as Saudi Vision 2030 boosts both public and private sector DevOps needs. More and more finance and telecom sectors in the region depend on DevOps tools for the improvement of user experience and smooth running of their operations. Additionally, it is the necessity of cybersecurity in cloud-native applications that is helping the adaptation of DevOps in the MEA region.

Leading DevOps Companies:

The competitive landscape is highly fragmented, with existing brands, new entrant startups, and niche industry players driving innovative production strategies. Presently, leading companies are continuously expanding their product portfolios to offer a comprehensive range of tools and services. This includes offerings for continuous integration (CI), continuous delivery (CD), container orchestration, infrastructure as code (IaC), monitoring, and more. For instance, in March 2024, CircleCI unveiled CircleCI releases, allowing developers to automate the CI/CD release process directly from the UI, enhancing deployment visibility, rollback options, and overall efficiency in software delivery. They are also acquiring and merging with complementary companies to enhance their capabilities. These acquisitions include technology companies specializing in areas such as security, monitoring, or containerization. Moreover, key players are providing training, documentation, and resources to help their customers maximize the value of their DevOps solutions. Superior customer support fosters loyalty and encourages customers to expand their usage.

The report provides a comprehensive analysis of the competitive landscape in the DevOps market with detailed profiles of all major companies, including:

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- CA Technologies

- Google LLC

- Cisco Systems

- Amazon Web Services

- Cigniti Technologies Ltd.

- Hewlett Packard Enterprise Company

- EMC Corporation

- VersionOne, Inc.

- Micro Focus International PLC

- Puppet, Inc.

- Red Hat, Inc.

- GitLab, Inc.

- Progress Chef Software Corporation

- Docker Inc.

- Atlassian Corporation PLC

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- October 2025: Qovery secures $13 million to transform DevOps automation and boost expansion in the U.S. The round was spearheaded by IRIS, along with Speedinvest, Crane Venture Partners, Techstars, Irregular Expressions, and individual investors. VC investors comprise IRIS, Crane Venture Partners, Speedinvest, Irregular Expressions, and Techstars.

- September 2025: Copado, the front-runner in AI-driven DevOps for business applications, today revealed the inaugural CopadoCon India, a single-day event featuring over 1,000 participants from the Salesforce developer community. The completely booked event is the biggest DevOps conference in India for Salesforce developers, prompting Copado to expand its agenda and acquire one of Bangalore’s top venues, the Sheraton Grand Whitefield, Bangalore.

- July 2025: IBM and DBmaestro, a top-tier enterprise-grade database DevOps platform, today revealed the establishment of a significant OEM partnership agreement. This growth will make DBmaestro's sophisticated database DevSecOps and observability tools accessible via IBM's solutions portfolio, enabling clients to attain comprehensive DevOps automation, instant database visibility, and unparalleled agility, security, and innovation.

- July 2025: BlueOptima, a prominent global provider of software engineering performance insights, has announced today that it has reached an agreement to acquire the DevOps solutions segment from Cirata, an AIM-listed provider of data and analytics migration services. The purchase comprises essential DevOps tools that support Subversion, Gerrit, and Git, including Subversion MultiSite Plus, Git MultiSite, Gerrit MultiSite, and Access Control Plus. These solutions allow software development teams distributed globally to work together securely and effectively with low latency, relied upon by major enterprise clients around the globe.

- June 2025: Opsera, the top AI-driven DevOps platform relied upon by Fortune 1000 firms, today revealed the growth of its collaboration with Databricks, the Data and AI organization. By introducing its DevOps for DataOps feature, a Built on Databricks (www.databricks.com/company/partners/built-on-partner-program) offering, Opsera enables customers to enhance and protect data processes via automation, governance, and intelligence, fostering innovation and guaranteeing enterprise-level compliance.

- May 2024: GitLab Duo unveiled an enterprise edition of its artificial intelligence (AI) add-on for its CI/CD platform in order to enable DevOps teams to proactively detect and fix security vulnerabilities, summarize issue discussions and merge requests, eliminate bottlenecks and enhance team collaboration.

- April 2024: Copado, the AI-powered DevOps and testing provider for enterprise SaaS, launched Test Copilot, an AI-powered test creation assistant.

- February 2024: ISmile Technologies, an IT solutions provider, launched Cloud DevOps and Automation Services. This complete offering enables enterprises of all sizes to dramatically improve deployment speed, agility, and overall software delivery efficiency.

DevOps Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solutions, Services |

| Deployment Models Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Organization Sizes Covered | Large Enterprises, Medium-Sized Enterprises, Small-Sized Enterprises |

| Tools Covered | Development Tools, Testing Tools, Operation Tools |

| Industrial Verticals Covered | Telecommunications and Information Technology Enabled Services (ITES), Banking, Financial Services, and Insurance (BFSI), Retail, Manufacturing, Healthcare, Government and Public Sector, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | IBM Corporation, Microsoft Corporation, Oracle Corporation, CA Technologies, Google LLC, Cisco Systems, Amazon Web Services, Cigniti Technologies Ltd., Hewlett Packard Enterprise Company, EMC Corporation, VersionOne, Inc., Micro Focus International PLC, Puppet, Inc., Red Hat, Inc., GitLab, Inc., Progress Chef Software Corporation, Docker Inc., Atlassian Corporation PLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the DevOps market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global DevOps market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the DevOps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The devOps market was valued at USD 13.16 Billion in 2024.

The devOps market is projected to exhibit a CAGR of 19.95% during 2025-2033, reaching a value of USD 81.14 Billion by 2033.

The market is driven by the growing demand for accelerated software delivery, increasing adoption of cloud technologies, rising need for improved operational efficiency, and the surge in demand for automated development and testing tools. Additionally, the integration of artificial intelligence (AI) in DevOps workflows and the shift toward microservices architecture further contribute to market growth.

North America currently dominates the devOps market, accounting for a share of 37% in 2024. The dominance is fueled by a strong technological infrastructure, early adoption of advanced IT solutions, a high concentration of key industry players, and significant investments in digital transformation initiatives.

Some of the major players in the devOps market include IBM Corporation, Microsoft Corporation, Oracle Corporation, CA Technologies, Google LLC, Cisco Systems, Amazon Web Services, Cigniti Technologies Ltd., Hewlett Packard Enterprise Company, EMC Corporation, VersionOne, Inc., Micro Focus International PLC, Puppet, Inc., Red Hat, Inc., GitLab, Inc., Progress Chef Software Corporation, Docker Inc., and Atlassian Corporation PLC, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)