Diabetes Care Devices Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Diabetes Care Devices Market Size and Share:

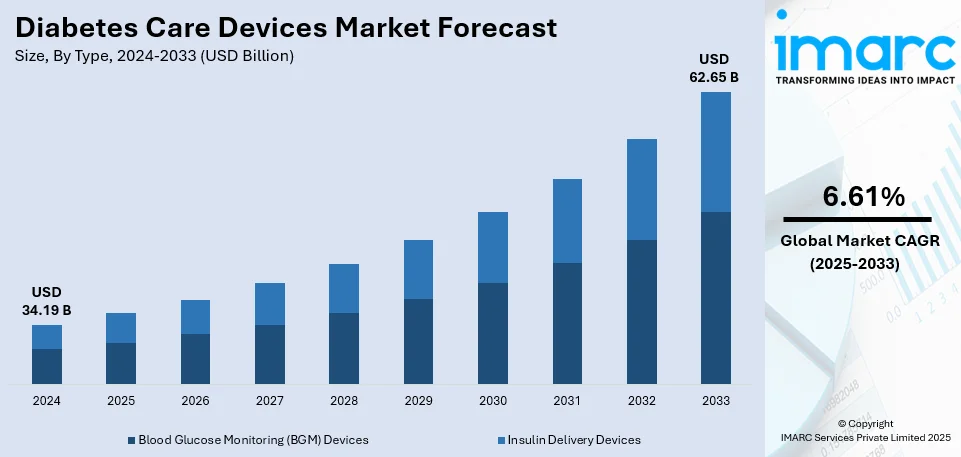

The global diabetes care devices market size was valued at USD 34.19 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 62.65 Billion by 2033, exhibiting a CAGR of 6.61% from 2025-2033. North America currently dominates the market, holding a market share of over 38.6% in 2024. The rising incidences of diabetes, rapid technological advancements, imposition of favorable government initiatives, increasing disposable incomes, integration of big data and analytics, and escalating geriatric population are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34.19 Billion |

| Market Forecast in 2033 | USD 62.65 Billion |

| Market Growth Rate (2025-2033) | 6.61% |

The growing global market for diabetes care devices is triggered by a geriatric population, increasingly sedentary lifestyle, and poor diets leading to higher levels of diabetes cases. The urbanization pace continues to rise in conjunction with higher rates of obesity. Advanced technology in continuous glucose monitoring (CGM) systems, smart insulin pens, and closed-loop insulin delivery contributes to greater compliance and outcomes from the patients' end. Government efforts toward escalating diabetes awareness and early diagnosis also spur the market, especially in emerging economies with an improving healthcare infrastructure. For instance, in August 2024, Medtronic received FDA approval for its Simplera™ CGM, a disposable, all-in-one device, and announced a global partnership with Abbott to expand continuous glucose monitoring (CGM) solutions. Moreover, diabetes management solutions are surged by artificial intelligence (AI) and cloud-based data analytics for better remote monitoring capabilities. Rising disposable income and health care spending in developing economies enhance the adoption of advanced diabetes care devices. Reimbursement policies and regulatory approvals also speed up innovation and commercialization. The advancements in telehealth and in digital diabetes management platforms hold new growth opportunities, especially with remote patient monitoring becoming more critical in the management of chronic diseases.

The U.S. diabetes care devices market share is 89.5% owing to the accelerating demand from patients preferring home-based diabetes management solutions which will reduce their hospital visits. For example, in August 2024, Dexcom launched Stelo, the first over-the-counter glucose biosensor in the U.S., providing 24/7 glucose insights without prescriptions or fingersticks for individuals with Type 2 diabetes and prediabetes. Furthermore, well-developed healthcare infrastructure, research facilities, and established reimbursement policies support the use of novel diabetes management devices and solutions. The demand for CGM devices is high in the country, especially in the case of insulin-dependent patients, since Medicare as well as private insurances cover such devices. The presence of key industry players, combined with regular product approvals by the U.S. FDA, favors fast-paced technological development. Heightened consumer awareness and preference for devices that are minimally invasive, user-friendly, and support therapeutic benefits drive market growth. Greater adoption of digital health solution-based solutions, such as mobile apps and AI-based diabetes management tools, enhance patient engagement. The rising prevalence of gestational diabetes and prediabetes further amplifies the volume of demand. Public-private partnerships and research grants fuel continuous innovation, strengthening the market's competitive landscape.

Diabetes Care Devices Market Trends:

The Rising Incidence of Diabetes

The increasing prevalence of diabetes is a dominant factor fueling the diabetes care devices market growth. This escalation is primarily caused by various lifestyle changes, including sedentary habits and increasing consumption of high-sugar and high-fat diets. Furthermore, as the number of diabetes cases multiplies, the need for efficient management and monitoring tools becomes more critical than ever. In 2021, around 537 million adults worldwide have diabetes, a number that the International Diabetes Federation estimates will continue to rise and reach 783 million by 2045. In line with this, diabetes care devices are widely used to improve glucose management, minimize the risks of complications, reduce emergency healthcare visits, increase patient outcomes, and provide real-time data for quick decision-making. Moreover, the high incidence rates lead to greater awareness and urgency, thereby encouraging more investments in research and innovation efforts to accelerate the pace of technological advancements, making the market even more attractive to potential buyers.

The Rapid Technological Advancements

The diabetes care devices market is being shaped by rapid technological advancements that offer improved precision, ease of use, and convenience. Continuous glucose monitoring systems are introducing CGMs, which observe the continuous glucose profile of a patient and provide real-time glucose monitoring, enhancing treatment customization and lifestyle adjustments that are positively influencing the growth in this market. According to an industry report, the CGM market is expected to capture sales of USD 20 Billion by 2028. Additionally, in smart insulin pens having dose calculators, which are nothing but the incorporation of high sophistication by eliminating all the guesswork in the actual dosing of insulin, is contributing toward this market growth as well. Additionally, the development of innovative devices that are equipped with connectivity features, enabling seamless data sharing between healthcare professionals and patients, is favoring the market growth.

The Imposition of Favorable Government Initiatives

Public health policies and government initiatives play a significant role in the growth of the diabetes care devices market. Several governments are recognizing the burden that diabetes imposes on healthcare systems and are taking proactive measures to address it. According to WHO, in 2021, "over 422 million people across the world were suffering from this disease, which is estimated at around USD 1.3 trillion in its economic burden throughout the world globally." In continuation of this point, the marketing growth is contributed by organizations that organize information campaigns to advise the public in relation to a risk of encountering diabetes and various ways of disease management. Moreover, the increasing allocation of funds by several governments to subsidize the cost of diabetes care devices, making them more accessible to a broader population, is contributing to the market growth. Besides this, the introduction of various reimbursement schemes to cover the cost of advanced devices, such as continuous glucose monitoring (CGMs) is contributing to the market growth.

Diabetes Care Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global diabetes care devices market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type, distribution channel, and end user.

Analysis by Type:

- Blood Glucose Monitoring (BGM) Devices

- Self-Monitoring Devices

- Continuous Glucose Monitoring Devices

- Insulin Delivery Devices

- Pumps

- Pens

- Syringes

- Jet Injectors

Blood Glucose Monitoring (BGM) leads the market with around 65.8%% of market share in 2024. These devices are dominating the market as they are highly affordable, making them accessible to a broader range of consumers. Furthermore, they are designed for user-friendliness, often requiring just a small drop of blood for accurate glucose readings. Additionally, BGM devices offer near-instantaneous results, enabling immediate action if needed, such as adjusting insulin dosage or food intake. Besides this, they are compact and easy to carry, making them convenient for people who are always on the go. This portability ensures that monitoring can happen anytime, anywhere. Moreover, BGM devices are being used for a longer period and enjoy broad acceptance among healthcare providers. In addition, they require minimal upkeep, usually replacement of test strips and occasional calibration, which makes them convenient for long-term use.

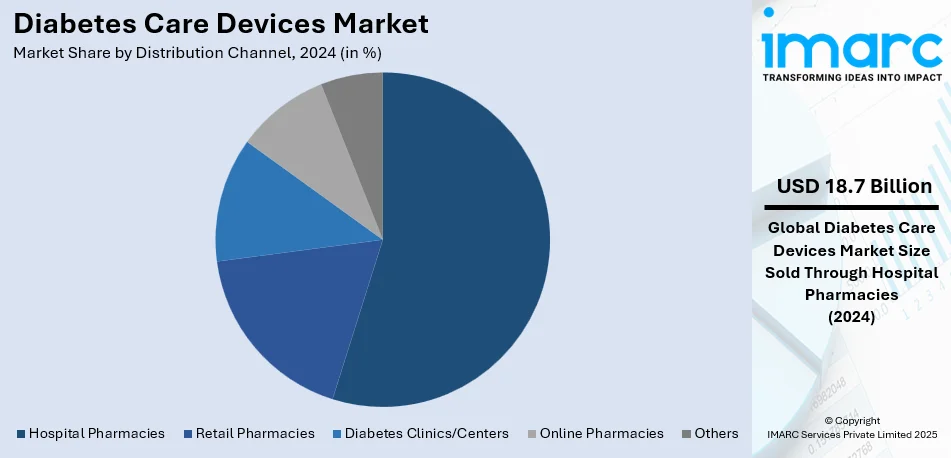

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Diabetes Clinics/Centers

- Online Pharmacies

- Others

Hospital pharmacies lead the market with around 54.7% of market share in 2024. These are dominating the market as they are considered reliable and trustworthy sources for medical devices, including those for diabetes care. Furthermore, patients admitted for diabetes complications or those visiting for a routine check-up can quickly and conveniently purchase the required devices and supplies from the hospital pharmacy. In addition, they employ well-trained pharmacists who can provide expert advice on device usage, thereby adding an extra layer of reassurance for patients. Besides this, products sold in hospital pharmacies are generally subject to rigorous quality checks, ensuring that patients receive authentic and effective devices. Moreover, they offer a streamlined process for insurance claims and reimbursements, making it easier for patients to offset the costs of their diabetes care devices. Along with this, hospital pharmacies offer a comprehensive range of diabetes care devices, giving patients various options to choose from.

Analysis by End User:

- Hospitals

- Homecare

- Diagnostic Centers

- Ambulatory Surgery Centers

Hospitals leads the market with around 40.5% of market share in 2024, as they offer a one-stop solution for all medical needs, making it easier for patients to get all their diabetes-related services, including consultations, treatments, and devices. Furthermore, they employ specialists in endocrinology and diabetes care, ensuring that patients receive expert advice and treatment. In addition, hospitals have the resources to handle diabetes-related emergencies, such as diabetic ketoacidosis, which standalone clinics may not be equipped for. Apart from this, hospital-based care is often covered by insurance plans, making it a more accessible option for many patients. Moreover, the sheer number of patients that hospitals serve ensures that they purchase diabetes care devices in bulk, thus contributing to their large share of the market. Along with this, they are subjected to strict quality control standards, which provide assurance of the efficacy and safety of the diabetes care devices used.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.6%. The region has one of the highest rates of diabetes in the world, which leads to increased demand for diabetes care devices. Furthermore, the region boasts a well-developed healthcare system with widespread availability of advanced medical technologies, including diabetes care devices. Additionally, the presence of comprehensive insurance plans, which cover diabetes treatment and devices, making it convenient for patients to access the care they need, is positively influencing the market growth. Besides this, North America hosts some of the leading companies in medical device manufacturing that are continuously updating and advancing diabetes care technology. In addition, the escalating awareness about diabetes and its management among regional consumers is acting as another growth-inducing factor. Moreover, the imposition of supportive policies and initiatives by regional governments to combat diabetes and provide access to high-quality treatment is favoring the market growth.

Key Regional Takeaways:

United States Diabetes Care Devices Market Analysis

The U.S. diabetes care devices market is increasing steadily due to the prevalence of diabetes and high healthcare expenditures. According to the CDC, around 37.3 million people in America suffer from diabetes, and this makes 11.3% of the total population in the United States. This raised number is raising the demand for diabetes management products. In 2023, an estimated amount of USD 327 billion were spent on U.S. healthcare on diabetes care, most of which goes into medical devices, including CGMs and insulin pumps. Leading players in this market are Medtronic, Abbott, and Dexcom, which are moving the technologies along to include the integrated insulin delivery systems. The continued efforts towards accessibility and affordability of diabetes devices will further drive the market growth. As the country continues to push for integration of digital health, telemedicine for diabetes care is expected to augment device adoption, ensuring continued momentum in the market.

Europe Diabetes Care Devices Market Analysis

The market for diabetes care devices is increasing in Europe with increasing prevalence of diabetes and increased investment in health. IDF states that 2023 was the year when more than 60 million people were living with diabetes in Europe. Germany and UK are well ahead in using advanced diabetes care devices. These include insulin pens, CGMs, and insulin pumps. Further, cost-effective health care seems to be creating growth opportunities for the European as well as EU-wide markets. There is a wide effort to curb chronic diseases that is also working for the industry's growth. Smart insulin pens, wireless glucose monitoring systems are other innovative products coming from leaders such as Roche and Bayer. The regulation framework in Europe about diabetes care products, safety and effectiveness in treatment, facilitates the innovation in market growth.

Asia Pacific Diabetes Care Devices Market Analysis

Asia Pacific diabetes care devices market is highly growing due to the increasing diabetes rates and geriatric population. IDF reports that more than 170 million people are suffering from diabetes, and the population of China and India is leading in this segment. An industrial report suggests that China's diabetes care market was at USD 4.7 billion in 2023, and considerable investments have been made into the advanced medical devices, which include CGMs and insulin delivery systems. In India, the diabetes care device markets also grow as more emphasis is being put upon cost-effective and affordable solutions. Healthcare infrastructure growth and adoption of digital health solutions have spurred the demand for diabetes devices in this region. Innovation and access to products is also driven through partnerships between international and local players, such as Abbott and Medtronic collaborating in India. Government-backed programs for increasing the accessibility of better diabetes care in the region continue to fuel the growth of this market.

Latin America Diabetes Care Devices Market Analysis

In terms of the high prevalence of diabetes in Latin America, Brazil accounts for over 15.7 million adults who are already affected, a figure provided by the International Diabetes Federation (IDF) of 2021. This explains why the high prevalence of the disease has driven up healthcare costs in the country. As per industrial reports, in 2021, a total of 42.93 billion USD had been allocated toward diabetes care within Brazil. Given the trend this amount is believed to increase profoundly in the forthcoming years, surging to a total of about 48.31 billion in 2030 and 51.44 billion in 2045. In other words, it is directly proportional to increasing disease burden. Moreover, the Brazilian government tries to expand the use of advanced technologies in the treatment of very high medical specialties like insulin pumps, continuous glucose monitors (CGMs), and insulin pens, along with expanding the public knowledge and patient's perception. The overall approach to that is driven by Novo Nordisk, Sanofi, and other key market players with very critical treatment options and increasingly adequate technologies for satisfying the present demand.

Middle East and Africa Diabetes Care Devices Market Analysis

The International Diabetes Federation (IDF) estimates around 73 million adults in the Middle East and North Africa, also known as the MENA region. The statistics show that the prevalence among adults in Saudi Arabia is nearly 17.7%, and about 4.27 million people are diagnosed with diabetes in the country, while South Africa is also the region's 'hot spot'. This boosting trend is due to the growing diabetes care market in the country. Current government action, such as healthcare initiatives that offer cheap access to diabetes care equipment, has been proved to impact the aspect comprehensively. Saudi Arabia has also accentuated the healthcare infrastructure, and campaigns to educate the people about diabetes management. Therefore, the diabetes care market in Saudi Arabia is growing, as demand for insulin pumps and continuous glucose monitoring (CGM) devices is increasing along with other advanced solutions for efficient management of the disease.

Competitive Landscape:

Leadership companies are moving towards bringing next-generation products in the pipeline to market, such as smart insulin pens, CGM integrated devices and much accurate meters for checking the blood sugar. Additionally, major companies are developing partnership arrangements with health-care organisations, IT organizations and sometimes, competitors for designing new devices jointly. Moreover, key companies have developed differentiated product lines which suit emerging geographies where the risk of developing the disease is escalating. They are also integrating digital technologies, such as data analytics and telehealth, into their devices to allow real-time monitoring and data collection, which can be crucial for effective diabetes management. Several companies are investing in education programs and materials to help users understand how to manage diabetes effectively. Along with this, they are leveraging online platforms for direct sales and customer engagement.

The report provides a comprehensive analysis of the competitive landscape in the diabetes care devices market with detailed profiles of all major companies, including:

- Abbott Laboratories

- ACON Laboratories Inc.

- Ascensia Diabetes Care Holdings AG (PHC Holdings Corporation)

- Becton Dickinson and Company

- Bionime Corporation

- Dexcom Inc.

- F. Hoffmann-La Roche AG

- Johnson & Johnson

- Medtronic plc

- Novo Nordisk A/S

- Sinocare Inc.

- Terumo Corporation

Latest News and Developments:

- September 2024: the FDA has cleared the Eversense 365 system for people with diabetes, a long-term continuous glucose monitoring solution with a one-year sensor lifespan that minimizes disturbances compared to shorter-term CGMs. Launch in early Q4 2024 will further advance diabetes management, with greater accuracy and comfort.

- August 2024: Abbott launched a global partnership with Medtronic to combine Abbott's FreeStyle Libre continuous glucose monitoring (CGM) system with Medtronic's automated insulin delivery (AID), as well as smart insulin pen systems, for the purpose of bettering health outcomes and easing decision-making for all those with Type 1 and Type 2 diabetes.

- March 2024: Roche made a presentation on its Accu-Chek SmartGuide CGM solution at the 17th International Conference on Advanced Technologies and Treatments for Diabetes. This device provides real-time glucose monitoring, predictive insights, and alerts on the risk of hypoglycemia with high accuracy (MARD 9.2%) and promising user feedback to address the unmet needs in diabetes management.

- March 2024: The FDA has approved Stelo from Dexcom-the first glucose biosensor available without a prescription. Designed for patients aged 18+ with Type 2 diabetes who do not take insulin, it provides glucose insights via smartphone. Stelo will be launched in summer 2024 and will further extend access to continuous glucose monitoring.

- March 2023: Becton Dickinson has developed the BD ™ Diabetes Care App to help people with diabetes, caregivers, and healthcare providers. It provides self-management tools, expert health content, personal goal setting, tracking, and educational resources on insulin techniques, diet, and lifestyle designed to better manage diabetes.

Diabetes Care Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Diabetes Clinics/Centers, Online Pharmacies, Others |

| End Users Covered | Hospitals, Homecare, Diagnostic Centers, Ambulatory Surgery Centers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, ACON Laboratories Inc., Ascensia Diabetes Care Holdings AG (PHC Holdings Corporation), Becton Dickinson and Company, Bionime Corporation, Dexcom Inc., F. Hoffmann-La Roche AG, Johnson & Johnson, Medtronic plc, Novo Nordisk A/S, Sinocare Inc., Terumo Corporation etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the diabetes care devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global diabetes care devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the diabetes care devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diabetes care devices market was valued at USD 34.19 Billion in 2024.

The diabetes care devices market is projected to exhibit a CAGR of 6.61% during 2025-2033, reaching a value of USD 62.65 Billion by 2033.

The diabetes care devices market is expanding due to the rising prevalence of diabetes, technological advancements in glucose monitoring and insulin delivery, increasing awareness, government initiatives, and growing adoption of minimally invasive solutions. Demand for continuous glucose monitoring (CGM) and smart insulin pens further accelerates market growth.

North America currently dominates the diabetes care devices market, accounting for a share of 38.6%. The market is expanding due to a high prevalence of diabetes, advanced healthcare infrastructure, significant R&D investments, and increasing adoption of continuous glucose monitoring and insulin delivery technologies.

Some of the major players in the diabetes care devices market include Abbott Laboratories, ACON Laboratories Inc., Ascensia Diabetes Care Holdings AG (PHC Holdings Corporation), Becton Dickinson and Company, Bionime Corporation, Dexcom Inc., F. Hoffmann-La Roche AG, Johnson & Johnson, Medtronic plc, Novo Nordisk A/S, Sinocare Inc., Terumo Corporation etc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)