Diabetic Retinopathy Market Size, Share, Trends and Forecast by Type, Treatment Type, End-User, and Region, 2025-2033

Diabetic Retinopathy Market Size and Share:

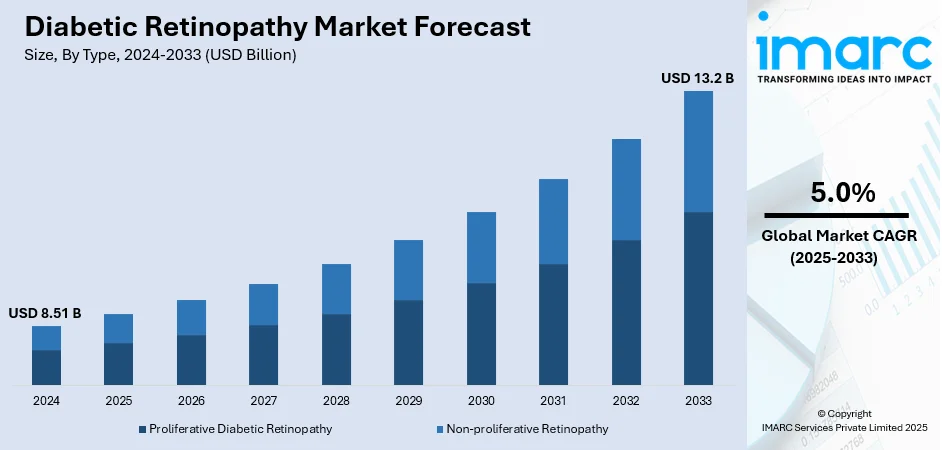

The global diabetic retinopathy market size was valued at USD 8.51 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.2 Billion by 2033, exhibiting a CAGR of 5.0% during 2025-2033. North America currently dominates the market, holding a significant market share of over 43.8% in 2024, owing to its high diabetes prevalence, advanced healthcare infrastructure, and early adoption of innovative diagnostics and anti-VEGF therapies. Supportive reimbursement policies and strong R&D investment further strengthen the region’s dominance in the diabetic retinopathy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.51 Billion |

|

Market Forecast in 2033

|

USD 13.2 Billion |

| Market Growth Rate 2025-2033 | 5.0% |

The market is being propelled by the rising global prevalence of diabetes, which continues to increase due to sedentary lifestyles, obesity, and aging populations. Industry reports states that in 2023 there were 589 million adults (age 20-79) living with diabetes globally. That number is projected to rise to 853 million by 2050. Greater awareness of diabetes-related complications is leading to earlier screening and diagnosis of retinal disorders, supporting timely interventions. Technological advancements in imaging devices, such as optical coherence tomography (OCT) and fundus cameras, are enabling accurate detection and monitoring of disease progression. Furthermore, the introduction of innovative treatment modalities, including gene therapy and sustained drug delivery systems, is enhancing therapeutic outcomes. Increased healthcare spending and supportive government initiatives for diabetes management are also strengthening market growth.

To get more information on this market, Request Sample

In the United States, the diabetic retinopathy market growth is expanding due to a rising burden of diabetes, which affects over 38 million Americans, coupled with increasing cases of obesity that elevate risks of vision complications. Widespread screening programs and insurance coverage for retinal examinations are facilitating early identification and treatment. The strong presence of advanced healthcare infrastructure and access to cutting-edge diagnostic tools contributes to better disease management. Additionally, a robust pipeline of innovative biologics and biosimilars is reshaping treatment practices, supported by ongoing FDA approvals. High research investments, coupled with proactive public health campaigns promoting regular eye check-ups, are further accelerating market growth.

Diabetic Retinopathy Market Trends:

Rising Diabetes Burden and Aging Population

The global diabetic retinopathy market is being fueled by the sharp increase in diabetes prevalence and the expanding geriatric demographic. According to the International Diabetes Federation (IDF), by 2050, 1 in 8 adults, nearly 853 million people, will be living with diabetes, representing a 46% increase compared to current figures. This surge significantly raises the risk pool for diabetic retinopathy, particularly among older adults who face compounded vulnerabilities due to aging eyes and comorbid conditions. Consequently, healthcare systems are under growing pressure to expand screening, diagnosis, and treatment services. This demographic shift not only expands the patient base but also intensifies demand for advanced therapies, diagnostics, and long-term management strategies.

Innovation in Therapeutics and Drug Delivery

Therapeutic innovation continues to be a one of the most critical diabetic retinopathy market trends. The development of anti-VEGF agents and sustained-release implants has revolutionized diabetic retinopathy treatment, offering improved visual outcomes and reducing the frequency of interventions. Major pharmaceutical companies are investing heavily in pipelines targeting novel biologics and next-generation delivery systems that extend drug efficacy. These innovations are particularly important as adherence to frequent injections remains a challenge for many patients. The combination of efficacy, safety, and reduced treatment burden is boosting uptake globally. Additionally, supportive reimbursement policies in key markets are accelerating adoption, ensuring that cutting-edge therapies reach a wider patient population, reinforcing long-term market growth potential.

Integration of AI, Telemedicine, and Screening Programs

Technological integration is reshaping diabetic retinopathy management by improving accessibility and efficiency of care. The adoption of AI-powered screening tools and telemedicine platforms is enabling earlier detection, particularly in underserved regions. For example, NHS England’s initiative to offer advanced eye scans closer to home could save up to 120,000 hospital appointments annually, highlighting the benefits of decentralized screening. AI algorithms assist ophthalmologists in rapidly identifying retinopathy signs, reducing diagnostic delays. This trend aligns with the rising demand for early intervention as awareness of vision-threatening complications grows. Coupled with government programs and healthcare spending, these digital innovations are expanding screening coverage, transforming patient engagement worldwide, and creating a positive diabetic retinopathy market outlook.

Diabetic Retinopathy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global diabetic retinopathy market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, treatment type, and end-user.

Analysis by Type:

- Proliferative Diabetic Retinopathy

- Non-proliferative Retinopathy

Non-proliferative retinopathy stands as the largest type in 2024, holding around 70.5% of the market. This dominance is attributed to the high prevalence of early-stage diabetic eye complications, as most patients are initially diagnosed at this stage before progressing to more severe forms. The non-proliferative type is commonly detected during routine retinal examinations, and advancements in imaging technologies have improved its identification. Increased patient education and awareness about regular ophthalmic check-ups have further strengthened this segment’s share. Its dominance reflects both the frequency of early diagnosis and the greater population base in earlier disease stages.

Analysis by Treatment Type:

- Anti VEGF Drugs

- Steroid Implants

- Laser Surgeries

- Vitrectomy

Anti VEGF drugs leads the market with around 56.86% of market share in 2024. Their dominance stems from their proven efficacy in reducing macular edema, improving vision, and delaying disease progression. Anti-VEGF therapies, such as ranibizumab, aflibercept, and bevacizumab, are widely adopted as first-line treatments due to their targeted mechanism of action. Frequent clinical endorsements and inclusion in treatment guidelines have reinforced their position. Additionally, the growing patient preference for minimally invasive pharmacological options over surgical interventions has supported their widespread use. The expanding availability of biosimilars is also expected to strengthen the adoption of anti-VEGF therapies in coming years.

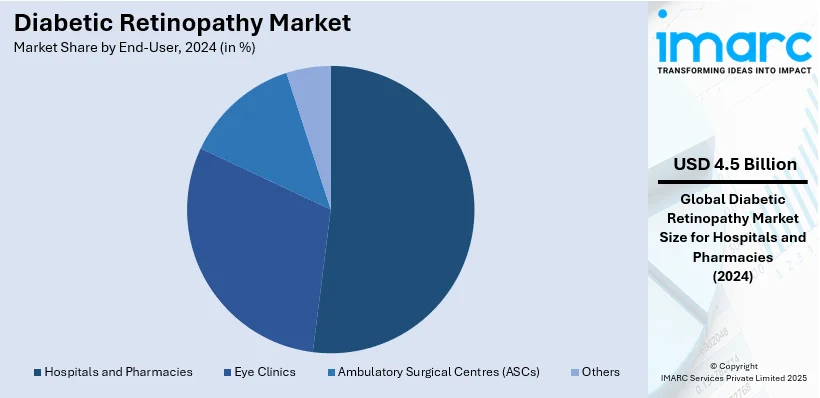

Analysis by End-User:

- Hospitals and Pharmacies

- Eye Clinics

- Ambulatory Surgical Centres (ASCs)

- Others

Hospitals and pharmacies leads the market with around 52.3% of market share in 2024. Their dominance is supported by the availability of advanced ophthalmology departments within hospitals, which provide integrated diagnostic and treatment services under one roof. Pharmacies play a crucial role in ensuring the consistent supply of anti-VEGF drugs and other ophthalmic medications, especially through retail and hospital-based outlets. The strong network of pharmacies across both urban and rural areas increases accessibility to treatment. Moreover, insurance reimbursements and patient reliance on hospital-led care pathways for retinal disease management further contribute to this segment’s leading share.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 43.8%. The region’s leadership is supported by the high prevalence of diabetes, well-established healthcare infrastructure, and advanced diagnostic capabilities. The U.S. spearheads regional growth due to substantial research funding, widespread adoption of anti-VEGF therapies, and access to innovative treatment modalities. Favorable reimbursement policies further encourage early screening and treatment adherence among patients. Canada also contributes significantly, with government-led initiatives focused on diabetic eye health. The presence of leading pharmaceutical companies and ongoing clinical trials in the region reinforce North America’s dominant position globally.

Key Regional Takeaways:

United States Diabetic Retinopathy Market Analysis

In 2024, the United States held a market share of 88.25% in North America. The United States diabetic retinopathy market is experiencing robust growth, driven by increased adoption of AI-integrated diagnostic imaging tools and a rising focus on early disease detection in ophthalmology. The growing geriatric population and the rising prevalence of long-standing diabetes cases are further amplifying the demand for specialized retinal care services. According to the Centers for Disease Control and Prevention (CDC), diabetic retinopathy, caused by damage to small blood vessels in the back of the eye, is projected to affect 14.7 Million Americans with diabetes by 2050, underscoring the urgent need for scalable diagnostic and treatment strategies. Additionally, favorable reimbursement structures for diagnostic tests and laser treatments are making diabetic retinopathy management more accessible. The expansion of teleophthalmology services in rural and underserved areas is also significantly enhancing patient outreach. Ongoing collaborations between academic research centers and healthcare providers are fostering the development of advanced screening platforms. The availability of wearable glucose monitoring technologies that support early intervention is indirectly supporting the diabetic retinopathy care ecosystem. Collectively, these dynamics are positioning the U.S. market for sustained expansion over the coming years.

Europe Diabetic Retinopathy Market Analysis

The Europe diabetic retinopathy market is witnessing steady growth due to the widespread implementation of national screening programs targeting early detection of retinal complications. Increased funding for retinal imaging infrastructure and mobile screening units is enhancing accessibility across both urban and remote regions. Approximately 25% of diabetic patients in Europe are estimated to have some form of diabetic retinopathy, according to regional health authorities. The integration of deep learning algorithms in ophthalmic diagnostics is improving accuracy and reducing turnaround times for diagnosis. A growing emphasis on preventive healthcare and patient-centric care models is encouraging timely intervention and monitoring of diabetic eye diseases. The market is also benefiting from rising adoption of intraocular pharmacotherapies aimed at controlling disease progression. Multisector partnerships between healthcare institutions and technology innovators are promoting the development of portable diagnostic devices. Moreover, structured training programs for primary care providers in retinal disease management are streamlining referrals to specialists. Regulatory support for digital health initiatives is enabling the integration of remote screening tools within national healthcare frameworks. Collectively, these factors are fostering a comprehensive approach to diabetic retinopathy detection and care across the region.

Asia Pacific Diabetic Retinopathy Market Analysis

The Asia Pacific diabetic retinopathy market is expanding due to the rapid digitization of healthcare and the growing deployment of mobile eye screening solutions. Rising health consciousness and periodic vision health campaigns are contributing to early-stage identification of diabetic eye disorders. According to the World Health Organization (WHO), an initiative supported by the Ministry of Health and Family Welfare in India aims to screen and place 75 Million people with hypertension or diabetes on standard care by 2025, indicating a strong focus on early detection of comorbid conditions such as diabetic retinopathy. Academic institutions across the region are launching specialized programs to train retinal imaging technicians and ophthalmic assistants, thus addressing screening gaps. The adoption of cloud-based diagnostic tools is streamlining data sharing between primary and tertiary care facilities. Regional healthcare authorities are actively promoting affordable diagnostic camps in semi-urban zones, helping to bridge accessibility gaps. These developments are collectively boosting the early diagnosis and clinical management of diabetic retinopathy across diverse population groups.

Latin America Diabetic Retinopathy Market Analysis

The Latin America diabetic retinopathy market is growing due to expanded outreach programs that provide eye health services at the community level. Mobile vision clinics and traveling ophthalmic units are increasing access to remote and underserved populations. According to the American Academy of Ophthalmology (AAO), about 17% of patients with diabetic retinopathy in Latin America require treatment, highlighting the importance of early detection and targeted therapeutic delivery. Enhanced collaboration between public health agencies and non-governmental organizations is improving awareness of vision care among diabetic patients. Efforts to integrate diabetic retinopathy screening into routine primary care visits are facilitating earlier detection and timely referrals. Additionally, academic institutions in the region are offering continuing education programs for healthcare professionals to improve diagnostic capabilities. These initiatives are collectively strengthening the region’s capacity for early intervention and long-term management of diabetic retinal conditions.

Middle East and Africa Diabetic Retinopathy Market Analysis

The Middle East and Africa diabetic retinopathy market is witnessing moderate growth, supported by the increasing availability of point-of-care diagnostic devices. Government-backed health awareness campaigns are encouraging routine retinal checkups among high-risk populations. According to the U.S.-Saudi Business Council (USSBC), by 2030, the region aims to raise the private sector’s share in healthcare delivery to 65% of total services, up from the current public sector dominance, indicating a substantial shift in infrastructure and investment in specialized care, including ophthalmology. Investments in community health worker training are enhancing the identification and referral of diabetic eye conditions at the grassroots level. The adoption of compact retinal imaging systems is facilitating diagnostics in primary care settings, reducing the dependence on urban specialist centers.

Competitive Landscape:

The diabetic retinopathy market is characterized by strong competition among global pharmaceutical companies, device manufacturers, and biotech firms focused on ophthalmic care. Leading players such as Novartis, Roche, Regeneron, Bayer, and AbbVie dominate through their established portfolios of anti-VEGF drugs, biosimilars, and emerging therapies. For instance, in May 2025, the FDA approved Roche’s Susvimo for diabetic retinopathy (DR), offering a breakthrough treatment that maintains vision with just one refill every nine months. This marks the third US approval for Susvimo, already used for age-related macular degeneration and diabetic macular edema. Delivered via a refillable eye implant, Susvimo provides a more durable, less frequent alternative to monthly eye injections. Backed by positive Phase III trial results, it could significantly improve outcomes for the nearly 10 million Americans with DR. Startups and mid-tier firms are actively exploring gene therapy, sustained-release implants, and AI-driven diagnostic tools, creating opportunities for innovation. Strategic partnerships, acquisitions, and licensing agreements remain key approaches to broaden treatment access and accelerate product pipelines. With increasing demand for effective solutions, the diabetic retinopathy market forecast predicts steady growth, supported by technological advances and expanding screening programs worldwide.

The report provides a comprehensive analysis of the competitive landscape in the diabetic retinopathy market with detailed profiles of all major companies, including:

- Alimera Sciences

- Allergan PLC

- Ampio Pharmaceuticals

- Bayer Healthcare

- BCN Peptides

- Genentech

- Kowa Group

- Novartis AG

- Regeneron Pharmaceuticals Inc.

- Sirnaomics Inc.

Latest News and Developments:

- July 2025: ASG Eye Hospital partnered with Bihar’s health department to establish 200 Vision Centres under a PPP model, offering early diagnosis and referrals for conditions like diabetic retinopathy. Equipped with telemedicine and modern diagnostics, the centres enabled timely intervention for underserved populations, helping prevent avoidable blindness in over 40 lakh patients.

- April 2025: Dr. Mohan’s Diabetes Specialities Centre introduced an AI-driven diabetic retinopathy screening system at its Pondicherry and Thanjavur clinics. This innovation utilised high-resolution imaging and algorithmic analysis to detect early-stage retinal damage, enabling doctors to gain real-time insights and facilitate quicker, more accurate diagnosis and treatment decisions for diabetes patients nationwide.

- February 2025: The Cleveland Clinic opened the Jeffrey and Patricia Cole Pavilion, doubling the Cole Eye Institute's capacity to manage the growing number of ophthalmic cases, including diabetic retinopathy. With 60 new exam rooms, advanced imaging, and research facilities, the expansion enhanced early detection, surgical care, and access to specialised eye treatment for thousands annually.

- January 2025: CheckEye launched a diabetic retinopathy screening initiative in Chernihiv, Ukraine, offering accessible early detection at the “Family Clinic.” Amid rising diabetes prevalence, the AI-powered program aimed to reduce vision loss through rapid, accurate diagnostics. WHO data highlighted the urgency, with diabetic retinopathy causing 2.6% of global blindness cases.

Diabetic Retinopathy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Proliferative Diabetic Retinopathy, Non-proliferative Retinopathy |

| Treatment Types Covered | Anti VEGF Drugs, Steroid Implants , Laser Surgeries, Vitrectomy |

| End-Users Covered | Hospitals and Pharmacies, Eye Clinics, Ambulatory Surgical Centres (ASCs), Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alimera Sciences, Allergan PLC, Ampio Pharmaceuticals, Bayer Healthcare, BCN Peptides, Genentech, Kowa Group, Novartis AG, Regeneron Pharmaceuticals Inc. and Sirnaomics Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the diabetic retinopathy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global diabetic retinopathy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the diabetic retinopathy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diabetic retinopathy market size was valued at USD 8.51 Billion in 2024.

The diabetic retinopathy market is projected to exhibit a CAGR of 5.0% during 2025-2033, reaching a value of USD 13.2 Billion by 2033.

The market is driven by the rising prevalence of diabetes worldwide, an expanding geriatric population, and growing awareness of diabetes-related eye complications. Technological advancements in imaging and diagnostic tools, coupled with the availability of innovative therapies such as anti-VEGF drugs and sustained-release implants, are further boosting growth. Increasing healthcare expenditure, supportive reimbursement frameworks, and government-led awareness campaigns aimed at early screening and treatment are also key growth enablers.

North America currently dominates the diabetic retinopathy market, accounting for a share of over 43.8% in 2024. The region’s leadership is attributed to high diabetes prevalence, advanced healthcare infrastructure, early adoption of innovative ophthalmic technologies, and favorable reimbursement policies. Strong R&D activities and strategic collaborations among leading pharmaceutical players further reinforce its dominance.

Some of the major players in the diabetic retinopathy market include Alimera Sciences, Allergan PLC, Ampio Pharmaceuticals, Bayer Healthcare, BCN Peptides, Genentech, Kowa Group, Novartis AG, Regeneron Pharmaceuticals Inc., Sirnaomics Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)