Diammonium Hydrogen Phosphate Market Report by Application (Fertilizer, Food and Beverages, Fire Retardant, and Others), and Region 2025-2033

Market Overview:

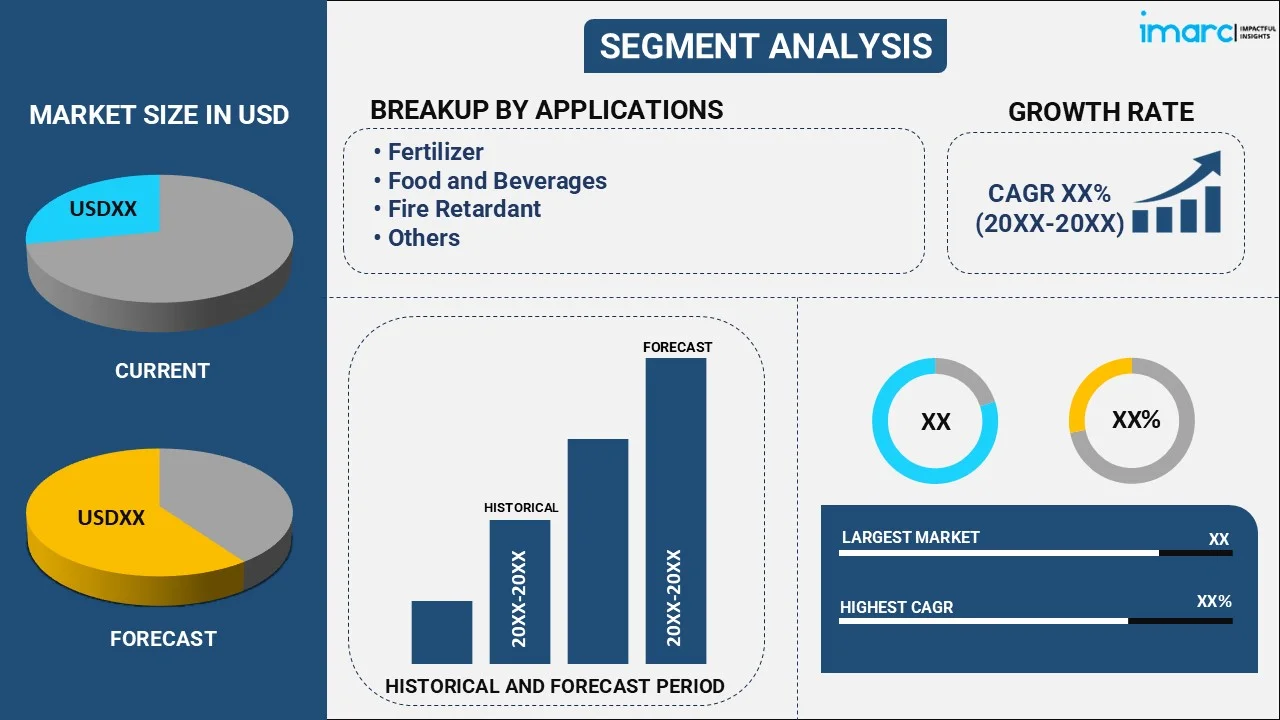

The global diammonium hydrogen phosphate market size reached USD 985.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,294.7 Million by 2033, exhibiting a growth rate (CAGR) of 9.85% during 2025-2033. Asia-Pacific dominates the market, driven by the expansion of the agrochemical industry and rising adoption of advanced farming practices. The increasing demand for fertilizers to enhance agricultural productivity and address food security and heightened emphasis on sustainable agriculture are fueling the market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 985.2 Million |

| Market Forecast in 2033 | USD 2,294.7 Million |

| Market Growth Rate (2025-2033) | 9.85% |

Diammonium hydrogen phosphate (DAP), (NH4)2HPO4, is a highly soluble salt commonly used in agriculture as a source of both nitrogen and phosphorus nutrients for plants. It is produced through the reaction of ammonia and phosphoric acid, resulting in white crystalline granules or powder. Its popularity stems from its dual nutrient composition, as nitrogen supports vigorous vegetative growth, while phosphorus aids in root development and flowering. DAP offers several advantages, such as its water-soluble nature, ensuring quick absorption by plants and promoting rapid growth. Moreover, its balanced nitrogen-phosphorus ratio is suitable for various crops and soil types. Additionally, DAP is convenient to handle and can be applied directly to soil or in a liquid form through irrigation systems. Two primary types of DAP are available: granular and liquid. Granular DAP is commonly used for direct soil application, while liquid DAP is preferred for foliar feeding or fertigation.

To get more information on this market, Request Sample

The global diammonium hydrogen phosphate market is influenced by the increasing demand for fertilizers in agriculture to enhance crop yields, the expansion of the agrochemical industry, and adoption of advanced farming practices. Additionally, the rising global population necessitates improved food production, supporting the demand for fertilizers, which, in turn, is augmenting the market growth. Furthermore, ongoing research and development (R&D) activities to enhance the product's efficiency and effectiveness contribute to market expansion. Moreover, the growing awareness about balanced nutrition in plants fuels the utilization of diammonium hydrogen phosphate in various crops, which is supporting the market growth. The mining industry's reliance on diammonium hydrogen phosphate as a flotation agent for ore separation is also another significant driver. In line with this, the expansion of greenhouses and indoor farming amplifies the need for controlled-release fertilizers, such as diammonium hydrogen phosphate, thereby propelling market expansion.

Diammonium Hydrogen Phosphate Market Trends:

Rising Demand for Phosphate Fertilizers in Agriculture

DAP is one of the most widely used phosphate fertilizers, providing essential nitrogen and phosphorus for crop growth. With the global population increasing, the demand for food production is expanding, driving higher fertilizer utilization. DAP is particularly valued for its high nutrient content and ability to support strong root development, improved yields, and better crop quality. It is employed in fruits, vegetables, and cash crops, making it indispensable in modern farming. Farmers prefer DAP because it dissolves quickly in soil and provides immediate nutrition to plants. As agricultural intensification is growing to meet evolving food security needs, the rising use of phosphate fertilizers, especially DAP, remains a primary driver of the market growth. As per the IMARC Group, the India phosphatic fertilizer market is set to attain USD 3.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6.24% during 2025-2033.

Expansion of Cereal and Grain Production

Cereals and grains, such as wheat, rice, maize, and barley, are staple foods for much of the global population. According to the Third Advance Estimates of major agricultural crop production for the agricultural year 2024–25, issued by the Ministry of Agriculture & Farmers’ Welfare, India attained a historic foodgrain output of 3539.59 LMT, exceeding the previous production of 3322.98 LMT in 2023-24 by 216.61 LMT. These crops require significant amounts of phosphorus and nitrogen during early growth stages, making DAP fertilizer a preferred choice among farmers. Countries with large-scale cereal cultivation, including India, China, and the US, are heavily reliant on DAP to maintain high productivity. As the demand for staple food items is increasing with population growth and changing dietary needs, farmers are adopting efficient fertilizers to enhance output. Government subsidies and agricultural support programs for cereal production are further boosting DAP utilization.

Increasing Demand from Horticulture and Cash Crops

Beyond staple cereals, rising demand for high-value crops, such as fruits, vegetables, cotton, sugarcane, and tobacco, is creating the need for DAP fertilizers. As per the USDA, crop cash receipts totaled USD 242.7 Billion in 2024. These crops require balanced nutrition to ensure quality, size, and taste, making phosphorus-rich fertilizers essential. Farmers cultivating cash crops are willing to invest in nutrient-rich inputs like DAP to maximize returns, particularly in regions with export-oriented agriculture. Rising demand for fruits and vegetables due to health-conscious lifestyles is further expanding the market share. Horticultural producers also prefer DAP for its role in early plant growth and root development. As diversification in farming practices continues and cash crop cultivation is increasing, the requirement for fertilizers tailored to high-value crops is steadily catalyzing the demand for DAP.

Key Growth Drivers of Diammonium Hydrogen Phosphate Market:

Supportive Government Policies and Subsidies

Government agencies worldwide play a critical role in supporting fertilizer use through subsidies, price controls, and distribution schemes. In many developing countries, DAP is offered at subsidized rates to encourage farmers to adopt balanced nutrient practices. These policies ensure the affordability and accessibility of fertilizers, boosting large-scale consumption. For instance, agricultural support programs often prioritize phosphorus-based fertilizers to improve soil fertility and crop yields. Additionally, government agencies are promoting fertilizer usage as part of rural development and food security initiatives. Such supportive frameworks provide stability to the DAP market. As more nations are implementing agricultural policies to ensure food self-sufficiency, the subsidized and regulated distribution of DAP is becoming a strong market growth driver.

Expanding Global Trade and Distribution Networks

The DAP market benefits from strong international trade flows, with major producers exporting to regions dependent on fertilizer imports. Countries with limited domestic production rely heavily on imports to meet agricultural demand, creating a robust global distribution system. International companies and cooperatives play a key role in ensuring steady availability across different regions. The expansion of logistics, warehousing, and bulk transportation facilities has improved accessibility of DAP, even in remote farming areas. Additionally, partnerships between governments and fertilizer companies aid in supporting smooth supply chains. As global trade liberalization is progressing and infrastructure is strengthening, DAP distribution is becoming more efficient, driving wider adoption. This globalized supply chain ensures steady demand and availability, fueling consistent growth of the market.

Rising Focus on Food Security and Agricultural Productivity

With global food demand rising, ensuring agricultural productivity has become a top priority for governments and organizations worldwide. Fertilizers like DAP are central to achieving higher crop yields, improving nutritional value, and meeting growing consumption needs. Food security concerns are particularly pressing in regions with rapidly growing populations and limited arable land. By enhancing plant growth and increasing per-hectare yields, DAP helps bridge the gap between demand and supply. International agencies and governments are emphasizing the use of modern fertilizers as part of agricultural development strategies. As food security remains a global challenge, the role of fertilizers like DAP in boosting productivity and ensuring sustainable farming is increasingly critical, propelling continuous market growth.

Diammonium Hydrogen Phosphate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global diammonium hydrogen phosphate market report, along with forecasts at the global, regional and country levels for 2025-2033. Our report has categorized the market based on application.

Breakup by Application:

- Fertilizer

- Food and Beverages

- Fire Retardant

- Others

Fertilizer dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes fertilizer, food and beverages, fire retardant, and others. According to the report, fertilizer accounted for the largest market share.

The dominance of fertilizer as the largest application in the global diammonium hydrogen phosphate market is attributed to its pivotal role in enhancing agricultural productivity. Diammonium hydrogen phosphate, with its nitrogen and phosphorus content, serves as a potent source of essential nutrients for plants. This nutrient-rich composition contributes to improved soil fertility and increased crop yields, aligning with the ever-growing global demand for enhanced agricultural output. As the global population continues to expand, the need for efficient and effective fertilizers becomes paramount to ensure food security. The versatility of diammonium hydrogen phosphate in promoting robust plant growth and crop development makes it a crucial component in modern agricultural practices. Its role in bolstering soil nutrient levels and driving higher agricultural yields cements fertilizer as the dominant application, addressing the world's pressing need for sustainable and productive farming methods.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest diammonium hydrogen phosphate market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific's leadership in the global diammonium hydrogen phosphate market can be attributed to several key factors. The region's substantial agricultural sector, driven by a large population and growing food demand, fosters significant demand for fertilizers containing diammonium hydrogen phosphate. Moreover, Asia Pacific's robust industrial growth fuels the need for fire retardants, where diammonium hydrogen phosphate finds application due to its fire-suppressing properties. Additionally, the region's expanding food and beverage industry benefits from the compound's multifaceted role as a pH regulator and texture enhancer. Diammonium hydrogen phosphate's diverse applications in water treatment, mining, and controlled-release fertilizers also contribute to its prevalence. Furthermore, proactive government initiatives to enhance agricultural productivity and industrial safety is bolstering the adoption of diammonium hydrogen phosphate-based products across Asia Pacific.

Competitive Landscape:

In the global diammonium hydrogen phosphate market, competition is characterized by key players focusing on innovation and differentiation. Leading manufacturers invest in research and development to enhance their formulations for modern agriculture, including conventional and specialized crop cultivation. Distribution network expansion ensures wider market reach and timely availability, while collaborations with research institutions position companies as industry thought leaders, contributing to advanced farming practices. Sustainability is highlighted as a differentiator, aligning with greener agricultural solutions. Strategic partnerships and acquisitions drive portfolio diversification and geographical expansion. This dynamic landscape promotes innovation, quality, and customer-centric solutions, ensuring the diammonium hydrogen phosphate market remains responsive to evolving agricultural demands.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Airedale Group

- Bunge Limited

- China BlueChemical Ltd.

- Gujarat Narmada Valley Fertilizers and Chemicals Limited

- Koch Fertilizer, LLC

- Mosaic India (The Mosaic Company)

- PhosAgro Group of Companies

- Sinofert Holdings Limited

- Wego Chemical Group

Diammonium Hydrogen Phosphate Market News:

- August 2025: India signed a five-year deal with Saudi Arabia for the provision of DAP, a vital fertilizer for the initial growth of staple crops like wheat and rice. It represented an important move to decrease reliance on a single foreign supplier, primarily China.

- May 2025: Indian Farmers Fertiliser Cooperative (IFFCO) started the commercial production of nano DAP liquid at two newly built nano fertilizer facilities in Aonla, Bareilly district, and Phulpur, Prayagraj district. Every plant had a daily output capacity of two lakh bottles, significantly enhancing the distribution of this innovative liquid fertilizer throughout India.

- January 2025: During the initial cabinet meeting of 2025, the Indian government sanctioned a unique package for DAP fertilizer producers, offering monetary aid in conjunction with subsidies. A new crop insurance plan for farmers was also launched. These efforts focused on increasing agricultural output, aiding farmers, and guaranteeing economical access to vital fertilizers.

Diammonium Hydrogen Phosphate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Fertilizer, Food and Beverages, Fire Retardant, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Airedale Group, Bunge Limited, China BlueChemical Ltd., Gujarat Narmada Valley Fertilizers and Chemicals Limited, Koch Fertilizer, LLC, Mosaic India (The Mosaic Company), PhosAgro Group of Companies, Sinofert Holdings Limited, Wego Chemical Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global diammonium hydrogen phosphate market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global diammonium hydrogen phosphate market?

- What is the impact of each driver, restraint, and opportunity on the global diammonium hydrogen phosphate market?

- What are the key regional markets?

- Which countries represent the most attractive diammonium hydrogen phosphate market?

- What is the breakup of the market based on application?

- Which is the most attractive application in the diammonium hydrogen phosphate market?

- What is the competitive structure of the global diammonium hydrogen phosphate market?

- Who are the key players/companies in the global diammonium hydrogen phosphate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the diammonium hydrogen phosphate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global diammonium hydrogen phosphate market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the diammonium hydrogen phosphate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)