Diamond Wire Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

Diamond Wire Market Size and Share:

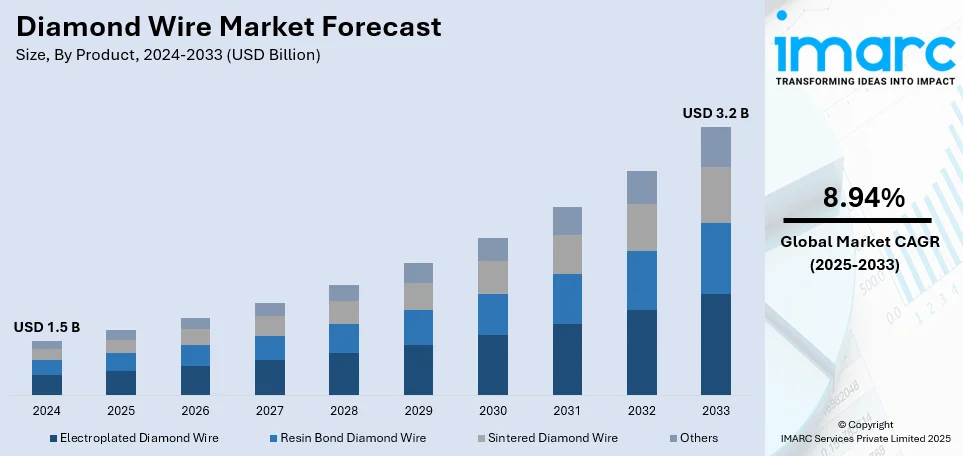

The global diamond wire market size was valued at USD 1.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.2 Billion by 2033, exhibiting a CAGR of 8.94% from 2025-2033. Asia Pacific currently dominates the market, holding a significant market share in 2024. The diamond wire market share is rising increasing use of diamond wire for construction applications, the bolstering growth of the mining industry, and the expanding product applications across the automotive, aerospace, and electronic sectors are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Market Growth Rate (2025-2033) | 8.94% |

The growing need for precision cutting in industries similar as semiconductors, photovoltaics, and electronics is a crucial driver of the diamond wire market demand. Manufacturers gradually prefer diamond wire over traditional cutting styles due to its superior delicacy, reduced material waste, and advanced effectiveness. Expansion in solar energy output is another major factor propelling market growth. Diamond wire is considerably used for slicing silicon wafers in solar panel manufacturing, and with rising global investments in renewable energy, the demand for high- quality cutting solutions is surging. Also, advancements in diamond wire technology have enhanced continuity, cutting speed, and cost- effectiveness, making it a captivating choice for industries like construction and stone processing. The demand is also serving from sustainability trends, as diamond wire cutting generates lower waste and requires lower energy consumption.

The United States has emerged as a key regional market for diamond wire driven by advancements in semiconductor manufacturing, compounding embracement of solar energy, and rising demand for precision cutting in various industries. The semiconductor sector, a crucial driver, relies on diamond wire for wafer slicing due to its superior perfection, reduced material destruction, and cost effectiveness. As the U.S. strengthens its domestic semiconductor production, the need for high- performance cutting tools continues to rise. also, the growing emphasis on renewable energy has boosted solar panel product, where diamond wire is considerably used for cutting silicon wafers. Government incitements and investments in solar energy systems further contribute to market expansion. The aerospace, automotive, and medical industries are also fueling demand, as they necessitate high- precision cutting for advanced materials. With nonstop inventions in manufacturing processes and the adding embracement of automation, the U.S. Diamond Wire market is anticipated to witness sustained growth in the coming times.

Diamond Wire Market Trends:

Upsurge in demand from sapphire and PV silicon wafers industries

In the sapphire sector, diamond wire plays a crucial part in the slicing and dicing of sapphire crystals, widely used in applications like as light-emitting diode (LED) manufacture, optical components, and smartphone screens. By 2024, for example, there will be over 4.88 billion smartphone users worldwide, or roughly 60.42% of the world's population. The growing demand for sapphire-based products, notably in the electronics and semiconductor industries, is creating lucrative opportunities for the diamond wire market growth. Furthermore, the photovoltaic (PV) industry significantly relies on diamond wire to produce silicon wafers used in solar cells, which helps to drive market growth. Furthermore, diamond wire technology provides excellent cutting precision while minimizing material loss, making it a popular choice in the PV industry. As a result, the increased acceptance of solar energy and installation of solar photovoltaic systems around the world are helping to drive market growth.

Increasing demand for diamond wire across the construction industry

Diamond wire is extensively used in the construction industry for cutting and shaping various materials such as concrete, natural stone, and glass. As a result, the bolstering growth of the construction sector, driven by increasing infrastructure development projects, such as bridges, roads, tunnels, and residential and commercial construction, and urbanization, is positively impacting the market growth. Industry studies state that construction projects worldwide accounted for $13 Trillion of gross yearly output in 2023. Besides this, diamond wire offers several advantages, such as high cutting precision, efficiency, reduced material waste, and intricate shaping and sizing of materials, which is further propelling their adoption in the construction sector. Moreover, the growing focus on sustainable construction practices to minimize environmental impact and reduce waste is contributing to the market growth.

Advancements in Manufacturing Technologies

Rapid advancements in manufacturing technologies play a pivotal role in driving the growth of the diamond wire market. Ongoing innovations in diamond wire manufacturing techniques have led to the development of improved products with enhanced cutting efficiency, durability, and flexibility, thus presenting remunerative opportunities for market growth. In addition to this, the employment of advanced machinery and equipment in diamond wire-cutting processes has resulted in increased productivity and cost-effectiveness, which, in turn, is fueling their demand. Furthermore, the advent of high-performance wire saw machines equipped with advanced automation and control systems that enable faster cutting speeds, greater accuracy, and improved process control are strengthening the market growth.

Diamond Wire Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global diamond wire market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and end user.

Analysis by Product:

- Electroplated Diamond Wire

- Resin Bond Diamond Wire

- Sintered Diamond Wire

- Others

Electroplated diamond wire stands as the largest segment in 2024. The growing demand for electroplated diamond wire in the semiconductor industry for precise cutting, slicing, and dicing of silicon wafers is propelling the market growth. Besides this, it is also used in manufacturing cutting photovoltaic (PV) cells, silicon ingots, and electronic units, such as printed circuit boards (PCBs), further creating a favorable outlook for market expansion. In addition to this, the expanding establishment of residential and commercial buildings and infrastructural development of roads and bridges are propelling the demand for resin bond diamond wire. Moreover, the increasing use of sintered diamond wire in mining applications, such as dimensional stone extraction, granite and marble quarrying, and mining of precious gemstones, are positively impacting the market growth.

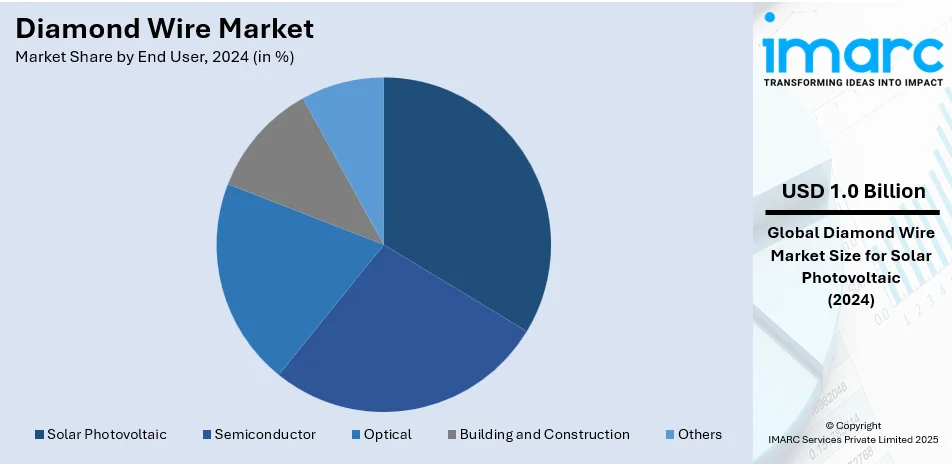

Analysis by End User:

- Solar Photovoltaic

- Semiconductor

- Optical

- Building and Construction

- Others

Solar photovoltaic leads the market. The significant expansion of the solar energy sector has increased the need for diamond wires to efficiently slice and dice silicon wafers, enabling the manufacturing of high-quality PV cells. Besides this, continuous advancements in technology and the demand for smaller, more powerful electronic devices are bolstering the market growth. Moreover, the increasing demand for lenses, prisms, and other optical components in the telecommunications, healthcare, and consumer electronics industries is impelling the adoption of diamond wires. Apart from this, the surge in the production of airplanes and automobiles has further enhanced the product demand, strengthening the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share due to its strong presence in semiconductor manufacturing, solar energy production, and industrial cutting applications. Countries like China, Japan, South Korea, and Taiwan are global leaders in semiconductor fabrication, where diamond wire is crucial for slicing silicon wafers with high precision and minimal material loss. With rising government investments in chip production, the demand for advanced cutting technologies continues to surge.

North America is known for its technological advancements and innovations in industries, such as aerospace, automotive, and electronics, which is propelling the need for diamond wire in high-precision manufacturing processes. In addition to this, extensive investments in renewable energy, particularly in the solar energy sector, have generated a largescale demand for solar photovoltaic cells, further creating a positive outlook for the market in the region.

Apart from this, there is rising demand for lightweight and fuel-efficient vehicles in Europe due to the expanding shift towards a sustainable lifestyle, supported by the introduction of favorable government regulations regarding carbon emissions. This, in turn, is fueling the need for diamond wire to precisely cut materials like composites, metals, and advanced alloys in the automotive industry.

Key Regional Takeaways:

United States Diamond Wire Market Analysis

The increasing demand for advanced cutting tools in the aerospace and automotive sectors is driving the adoption of diamond wire technology. For example, since the beginning of 2021, automakers have declared plans to invest over USD 75 billion in the United States. Precision and efficiency are critical in manufacturing components for aircraft and vehicles, making diamond wire an ideal solution for achieving high-quality finishes and intricate designs. The surge in lightweight material usage, such as composites and aluminum alloys, further boosts the need for superior cutting tools that minimize material waste and enhance productivity. As manufacturers push for improved sustainability and cost-effectiveness, diamond wire's long lifespan and reduced material loss appeal to production processes. Another diamond wire market trend is the growing demand of electric vehicles also demands specialized cutting solutions for battery and motor components, where diamond wire excels due to its high accuracy. These advancements are reinforcing the reliance on diamond wire in industrial applications.

Asia Pacific Diamond Wire Market Analysis

The rapid development of consumer electronics and advanced devices is fuelling the utilization of diamond wire for precise material processing. India, a well-known manufacturing powerhouse, increased its domestic electronics production from USD 29 billion in 2014–15 to USD 101 billion in 2022–23, according to the India Brand Equity Foundation. The electronics sector's demand for smaller, more efficient components with exceptional surface quality has necessitated high precision cutting tools. Diamond wire is gaining prominence for slicing delicate materials like silicon wafers and sapphire substrates used in semiconductors, displays, and LED production. Rising investments in manufacturing facilities and increasing production of smartphones, tablets, and wearables contribute to the demand for high-performance cutting technologies. Diamond wire's ability to produce thin cuts with minimal kerf loss aligns with the industry's focus on resource efficiency. The shift toward miniaturized components and advanced chips further emphasizes the role of diamond wire in achieving unparalleled precision in electronics manufacturing.

Europe Diamond Wire Market Analysis

The accelerating deployment of solar photovoltaic systems is driving the adoption of diamond wire for wafer slicing in the renewable energy industry. For example, the EU-27 Member States' total installed solar PV capacity reached 269 GW by 2023, indicating a notable increase in solar energy investments throughout the region. The need for cost-effective and energy-efficient production processes has led manufacturers to adopt diamond wire technology, which ensures minimal material loss during the slicing of silicon wafers. As demand for solar panels grows, the push for high-output production lines necessitates reliable cutting solutions. Diamond wire offers smooth, precise cuts, reducing the need for post-processing and enabling faster assembly. The transition toward thinner wafers to improve efficiency and lower costs further underscores the importance of advanced cutting technologies. The renewable energy sector's emphasis on reducing carbon footprints aligns with the environmentally friendly features of diamond wire, reinforcing its adoption in photovoltaic manufacturing.

Latin America Diamond Wire Market Analysis

The rising production of semiconductor devices is driving demand for diamond wire in the precision slicing of wafers and substrates. For example, the US is anticipated to increase semiconductor ATP capabilities by investing USD 500 Million in the Latin American semiconductor business over a five-year period. The semiconductor industry requires cutting tools capable of handling materials like silicon and gallium arsenide with high accuracy and minimal waste. Diamond wire is preferred for its ability to produce consistent results, supporting the efficient manufacturing of chips and microelectronics. The expansion of regional facilities dedicated to semiconductors amplifies the need for advanced cutting solutions, making diamond wire a crucial component in the supply chain. Moreover, its role in achieving fine cuts and maintaining product integrity contributes significantly to its widespread adoption.

Middle East and Africa Diamond Wire Market Analysis

The increasing infrastructure development and construction activities are boosting the demand for diamond wire in material cutting applications. Saudi Arabia's building industry is reportedly expanding quickly, with more than 5,200 projects totaling USD 819 billion already under way. The construction sector requires advanced tools to process hard materials like marble, granite, and reinforced concrete with precision and speed. Diamond wire is valued for its ability to deliver smooth cuts and reduce material waste, making it an essential tool for large-scale projects. As the sector emphasizes sustainable practices, diamond wire's durability and efficiency align with the goals of reducing energy consumption and material wastage. This technology plays a crucial role in meeting the growing construction needs, enhancing project timelines and outcomes.

Competitive Landscape:

Companies are investing in R&D to enhance the durability and efficiency of diamond wire. Innovations in wire coatings and bonding techniques improve cutting precision, reduce material waste, and extend product lifespan, catering to the growing demands of the semiconductor and solar industries. Leading manufacturers are scaling up production facilities, particularly in Asia-Pacific and North America, to meet the rising demand from semiconductor and photovoltaic industries. Automation in manufacturing processes is also being adopted to enhance efficiency and cost-effectiveness. Besides, companies are forming alliances with semiconductor and solar panel manufacturers to secure long-term contracts. Moreover, partnerships with raw material suppliers ensure a constant supply chain, reducing dependency on volatile markets. These efforts are creating a favorable diamond market outlook.

The report provides a comprehensive analysis of the competitive landscape in the diamond wire market with detailed profiles of all major companies, including:

- Asahi Diamond Industrial Co. Ltd.

- CO.FI.PLAST SRL

- Dellas SPA

- Diamond Pauber S.R.L.

- Diamond WireTec GmbH & Co. KG

- Henan Yicheng New Energy Co. Ltd.

- Iljin Diamond Co. Ltd.

- Nakamura Choukou Co. Ltd.

- Nanjing Sanchao Advanced Materials Co. Ltd.

- Noritake Co. Limited

- Pulitor

- Solga Diamant SL

- Zhengzhou Sino-Crystal Diamond Co. Ltd.

Latest News and Developments:

- January 2025: Chennai Metco has introduced the first diamond wire saw in India, a state-of-the-art device for precisely cutting materials such as glass tubes, PCBs, and electronic components. In applications ranging from electronics to atomic research and space exploration, this multipurpose tool ensures outstanding results by minimizing cutting damage. It was created in collaboration with AMTDC and IIT Madras and exemplifies advanced manufacturing innovation.

- January 2025: By expanding its service team to major international markets, the diamond wire production company, Skystone Group, improved its capacity to provide expert and effective services. The goal of this expansion is to improve customer service. Skystone's action demonstrates its dedication to enhancing service delivery and satisfying the increasing demand from around the world. The business is ready to provide premium solutions in a variety of markets.

- September 2024: At the Asia Optoelectronics Expo 2024, Zhengzhou Shine Smart Equipment displayed their cutting-edge Endless Diamond Wire Saw, which includes the SH60-R, SG20, and SGI 20 models. Industry experts paid close attention to the state-of-the-art saws, which were made to precisely cut optical crystals. These saws have the potential to completely transform manufacturing in the semiconductor and optoelectronics industries due to their capacity to work with hard materials like silicon and sapphire.

- July 2024: In order to improve cutting accuracy and efficiency, Shenyang Kejing introduced a new generation diamond wire saw that can cut materials up to 150mm. The business, which is renowned for having excellent R&D skills, has spent years developing automation equipment. With its ability to swiftly and neatly cut boulders, this innovative tool offers substantial advancements in material processing. Shenyang Kejing is still at the forefront of cutting, polishing, and grinding technology innovation.

- July 2024: The diamond wire spool, Ensoll Worldwide's newest invention, was introduced in July. It is intended to cut extremely hard materials, including as semiconductors and ceramics. With its unique coating process, it lasts two to three times as long as traditional wires, guaranteeing increased production. The spool promises breakthrough cutting performance and is perfect for advanced manufacturing, electronics, and aerospace.

Diamond Wire Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electroplated Diamond Wire, Resin Bond Diamond Wire, Sintered Diamond Wire, Others |

| End Users Covered | Solar Photovoltaic, Semiconductor, Optical, Building and Construction, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asahi Diamond Industrial Co. Ltd., CO.FI.PLAST SRL, Dellas SPA, Diamond Pauber S.R.L., Diamond WireTec GmbH & Co. KG, Henan Yicheng New Energy Co. Ltd., Iljin Diamond Co. Ltd., Nakamura Choukou Co. Ltd., Nanjing Sanchao Advanced Materials Co. Ltd., Noritake Co. Limited, Pulitor, Solga Diamant SL, Zhengzhou Sino-Crystal Diamond Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the diamond wire market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global diamond wire market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the diamond wire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diamond wire market was valued at USD 1.5 Billion in 2024.

IMARC estimates the diamond wire market to exhibit a CAGR of 8.94% during 2025-2033.

The increasing use of diamond wire for construction applications, the bolstering growth of the mining industry, and the expanding product applications across the automotive, aerospace, and electronic sectors are some of the major factors propelling the market.

Asia Pacific currently dominates the market due to its strong presence in semiconductor manufacturing, solar energy production, and industrial cutting applications.

Some of the major players in the diamond wire market include Asahi Diamond Industrial Co. Ltd., CO.FI.PLAST SRL, Dellas SPA, Diamond Pauber S.R.L., Diamond WireTec GmbH & Co. KG, Henan Yicheng New Energy Co. Ltd., Iljin Diamond Co. Ltd., Nakamura Choukou Co. Ltd., Nanjing Sanchao Advanced Materials Co. Ltd., Noritake Co. Limited, Pulitor, Solga Diamant SL, Zhengzhou Sino-Crystal Diamond Co. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)