Diethyl Carbonate Production Cost Analysis Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue

Report Overview:

IMARC Group’s report, titled “Diethyl Carbonate Production Cost Analysis Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue,” provides a complete roadmap for setting up a diethyl carbonate production plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc. The diethyl carbonate project report provides detailed insights into project economics, including capital investments, project funding, operating expenses, income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI and net present value (NPV), profit and loss account, financial analysis, etc.

Diethyl Carbonate Market Analysis:

The market is primarily driven by the increased demand for diethyl carbonate in the pharmaceutical and agrochemical industries due to its effectiveness as a solvent to dissolve substances. Moreover, the fact that diethyl carbonate can be present in liquid or solid form makes it possible to have several applications, from a solvent in industrial processes to an intermediate in a battery electrolyte, thus opening its expansive use in various industries. For example, Sigma Aldrich is a chemical production and supply company that provides diethyl carbonate in the form of anhydrous liquids and solids of varying purity grades. The higher demand for lithium-ion battery manufacture, as the chemical is broadly used as a solvent for preparing the electrolyte for high-performance applications, has been a primary growth driver for the diethyl carbonate manufacturing market.

In addition to this, its versatility in the synthesis of fine chemicals and its role in the formulation of perfumes and flavoring agents also support market growth. Furthermore, research and development (R&D) activities on DEC's role in electrolyte solvent oxidation and DEC’s use in advanced electrolyte formulations are supporting the market. For instance, in 2024, a study examined the oxidation mechanism of diethyl carbonate (DEC) and oxygen in the thermal runaway process of lithium-ion batteries. The research, using synchrotron vacuum ultraviolet radiation photoionization mass spectrometry, identified key oxidation products, such as alcohols and carboxylic acids, formed during the reaction. This investigation enhances understanding of electrolyte solvent oxidation and its contribution to battery safety concerns. Moreover, the solvent's favorable environmental characteristics coupled with low evaporation rates during application in producing coatings and paints is a significant factor that supports the market expansion. The ongoing industrialization and urbanization in emerging economies, especially in Asia-Pacific, further stimulate diethyl carbonate manufacturing market demand.

Diethyl Carbonate Market Trends:

Sustainability and Eco-friendly Alternatives

The growing demand for alternatives of sustainable and environmentally friendly solvents to the more classical solvents is also increasingly becoming a trend in the DEC manufacturing market outlook. Since chemicals and coatings companies are also facing immense pressure to reduce their environmental footprint, DEC's properties of low toxicity and biodegradable nature have thus provided it with a popular niche as an alternative compared to others. DEC is less harmful as compared to the extremely harmful chemicals methylene chloride and toluene. Its application in paints, coatings, and adhesives also addresses regulatory imperatives for low-emission and low-VOC solutions. On January 17, 2025, the US Environmental Protection Agency published an action that amended the National Volatile Organic Compound (VOC) Emission Standards for Aerosol Coatings. The amendments set more stringent VOC limits for certain aerosol coatings, thereby reducing air pollution and improving air quality. With the increase in government regulation towards the control of industrial product environmental impacts, the need for DEC keeps on rising as the product is highly environmentally friendly.

Growing Demand in the Electric Vehicle Industry

Another significant factor propelling the market for diethyl carbonate production is the exapnsion of the electric vehicle (EV) industry. Diethyl carbonate is utilized as a solvent in lithium-ion battery electrolytes, which form an integral part of EV batteries. The growing investments are further facilitating the market. For instance, on March 25, 2024, on the US Gulf Coast, Dow declared its intention to invest in a brand-new, global carbonate solvents factory. This facility will support growing demand in electric vehicle and energy storage sectors and capture over 90% of CO2 emissions from its production process. As the world shifts towards electric mobility and becomes increasingly stringent about environmental regulations, lithium-ion batteries are in great demand. Consequently, the requirement for high-quality solvents like DEC, which enhance the battery's performance, stability, and longevity, is also on the rise. The escalation in the usage of electric vehicles, coupled with governmental incentives and the pursuit of greener transport solutions, guarantees a continued demand for diethyl carbonate as a precursor in battery manufacturing, thus an important market trend.

Latest Industry News:

The market is also being driven by increasing investments and capacity expansions:

- March 5, 2024: UBE Corporation is planning the first US factory in Jefferson Parish, Louisiana, in a USD 500 Million investment. The plant will produce key lithium-ion battery components, including ethyl methyl carbonate (EMC) and dimethyl carbonate (DMC), crucial for electric vehicles. Construction is set to begin later this year, with operations commencing in 2026.

- December 6, 2024: Jiangsu Sailboat Petrochemical inaugurated a carbonates facility in Lianyungang, Jiangsu Province, China, utilizing Asahi Kasei's technology to produce high-purity dimethyl carbonate (DMC) and ethylene carbonate (EC) from carbon dioxide. The facility is designed to consume up to 54,000 Tonnes of CO₂ annually, contributing to sustainable manufacturing practices.

The following aspects have been covered in the diethyl carbonate production plant report:

To gain detailed insights into the report, Request Sample

- Market Analysis:

- Market Trends

- Market Breakup by Segment

- Market Breakup by Region

- Price Analysis

- Impact of COVID-19

- Market Forecast

The report provides insights into the landscape of the diethyl carbonate industry at the global level. The report also provides a segment-wise and region-wise breakup of the global diethyl carbonate industry. Additionally, it also provides the price analysis of feedstocks used in the manufacturing of diethyl carbonate, along with the industry profit margins.

- Detailed Process Flow:

- Product Overview

- Unit Operations Involved

- Mass Balance and Raw Material Requirements

- Quality Assurance Criteria

- Technical Tests

The report also provides detailed information related to the diethyl carbonate manufacturing process flow and various unit operations involved in a production plant. Furthermore, information related to mass balance and raw material requirements has also been provided in the report with a list of necessary quality assurance criteria and technical tests.

- Project Details, Requirements and Costs Involved:

- Land, Location and Site Development

- Plant Layout

- Machinery Requirements and Costs

- Raw Material Requirements and Costs

- Packaging Requirements and Costs

- Transportation Requirements and Costs

- Utility Requirements and Costs

- Human Resource Requirements and Costs

The report provides a detailed location analysis covering insights into the land location, selection criteria, location significance, environmental impact, expenditure, and other diethyl carbonate production plant costs. Additionally, the report provides information related to plant layout and factors influencing the same. Furthermore, other requirements and expenditures related to machinery, raw materials, packaging, transportation, utilities, and human resources have also been covered in the report.

- Project Economics:

- Capital Investments

- Operating Costs

- Expenditure Projections

- Revenue Projections

- Taxation and Depreciation

- Profit Projections

- Financial Analysis

The report also covers a detailed analysis of the project economics for setting up a diethyl carbonate production plant. This includes the analysis and detailed understanding of diethyl carbonate production plant costs, including capital expenditure (CapEx), operating expenditure (OpEx), income projections, taxation, depreciation, liquidity analysis, profitability analysis, payback period, NPV, uncertainty analysis, and sensitivity analysis. Furthermore, the report also provides a detailed analysis of the regulatory procedures and approvals, information related to financial assistance, along with a comprehensive list of certifications required for setting up a diethyl carbonate production plant.

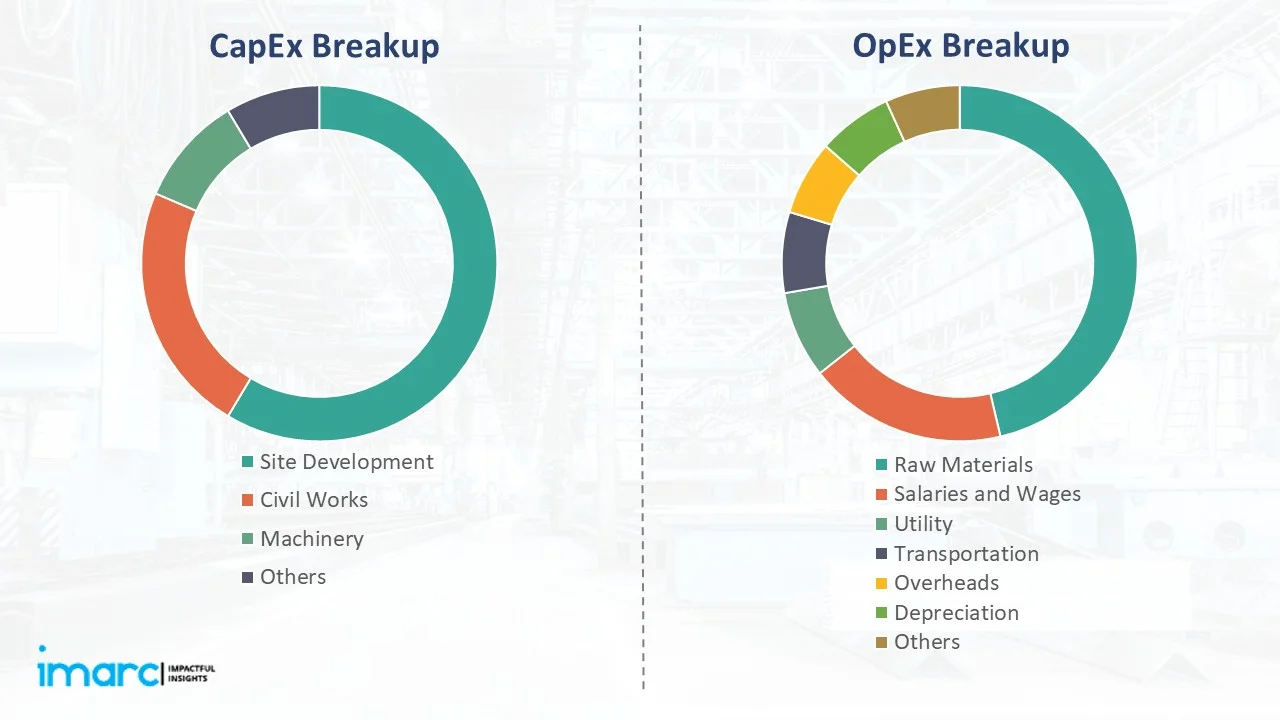

Capital Expenditure Breakdown:

| Particulars | Cost (in US$) |

|---|---|

| Land and Site Development Costs | XX |

| Civil Works Costs | XX |

| Machinery Costs | XX |

| Other Capital Costs | XX |

Operational Expenditure Breakdown:

| Particulars | In % |

|---|---|

| Raw Material Cost | XX |

| Utility Cost | XX |

| Transportation Cost | XX |

| Packaging Cost | XX |

| Salaries and Wages | XX |

| Depreciation | XX |

| Other Expenses | XX |

Profitability Analysis:

| Particulars | Unit | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|---|

| Total Income | US$ | XX | XX | XX | XX | XX |

| Total Expenditure | US$ | XX | XX | XX | XX | XX |

| Gross Profit | US$ | XX | XX | XX | XX | XX |

| Gross Margin | % | XX | XX | XX | XX | XX |

| Net Profit | US$ | XX | XX | XX | XX | XX |

| Net Margin | % | XX | XX | XX | XX | XX |

Report Coverage:

| Report Features | Details |

|---|---|

| Product Name | Diethyl Carbonate |

| Report Coverage | Detailed Process Flow: Unit Operations Involved, Quality Assurance Criteria, Technical Tests, Mass Balance, and Raw Material Requirements Land, Location and Site Development: Selection Criteria and Significance, Location Analysis, Project Planning and Phasing of Development, Environmental Impact, Land Requirement and Costs Plant Layout: Importance and Essentials, Layout, Factors Influencing Layout Plant Machinery: Machinery Requirements, Machinery Costs, Machinery Suppliers (Provided on Request) Raw Materials: Raw Material Requirements, Raw Material Details and Procurement, Raw Material Costs, Raw Material Suppliers (Provided on Request) Packaging: Packaging Requirements, Packaging Material Details and Procurement, Packaging Costs, Packaging Material Suppliers (Provided on Request) Other Requirements and Costs: Transportation Requirements and Costs, Utility Requirements and Costs, Energy Requirements and Costs, Water Requirements and Costs, Human Resource Requirements and Costs Project Economics: Capital Costs, Techno-Economic Parameters, Income Projections, Expenditure Projections, Product Pricing and Margins, Taxation, Depreciation Financial Analysis: Liquidity Analysis, Profitability Analysis, Payback Period, Net Present Value, Internal Rate of Return, Profit and Loss Account, Uncertainty Analysis, Sensitivity Analysis, Economic Analysis Other Analysis Covered in The Report: Market Trends and Analysis, Market Segmentation, Market Breakup by Region, Price Trends, Competitive Landscape, Regulatory Landscape, Strategic Recommendations, Case Study of a Successful Venture |

| Currency | US$ (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customized based on the requirement of the customer |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Report Customization

While we have aimed to create an all-encompassing diethyl carbonate production plant project report, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include:

- The report can be customized based on the location (country/region) of your plant.

- The plant’s capacity can be customized based on your requirements.

- Plant machinery and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why Buy IMARC Reports?

- The insights provided in our reports enable stakeholders to make informed business decisions by assessing the feasibility of a business venture.

- Our extensive network of consultants, raw material suppliers, machinery suppliers and subject matter experts spans over 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our cost modeling team can assist you in understanding the most complex materials. With domain experts across numerous categories, we can assist you in determining how sensitive each component of the cost model is and how it can affect the final cost and prices.

- We keep a constant track of land costs, construction costs, utility costs, and labor costs across 100+ countries and update them regularly.

- Our client base consists of over 3000 organizations, including prominent corporations, governments, and institutions, who rely on us as their trusted business partners. Our clientele varies from small and start-up businesses to Fortune 500 companies.

- Our strong in-house team of engineers, statisticians, modeling experts, chartered accountants, architects, etc. has played a crucial role in constructing, expanding, and optimizing sustainable production plants worldwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Frequently Asked Questions

Capital requirements generally include land acquisition, construction, equipment procurement, installation, pre-operative expenses, and initial working capital. The total amount varies with capacity, technology, and location.

To start a diethyl carbonate production business, one needs to conduct a market feasibility study, secure required licenses, arrange funding, select suitable land, procure equipment, recruit skilled labor, and establish a supply chain and distribution network.

Diethyl carbonate production requires ethanol, carbon dioxide or phosgene (depending on process route), and catalysts. Additional inputs include energy (electricity, heat), water, and possibly solvents or other chemicals for purification.

The diethyl carbonate factory requires reactors or transesterification units, distillation columns, separation and purification systems, storage tanks, mixing vessels, filtration units, and packaging machinery. Utility systems such as cooling water systems, heat exchangers, and waste treatment facilities are also necessary.

The main steps generally include:

-

Feedstock preparation and handling

-

Chemical reaction (e.g., transesterification of DMC with ethanol or direct synthesis from ethanol and CO2)

-

Reaction catalysis and heat management

-

Distillation and purification of product

-

Packaging and quality control

-

Storage, logistics, and distribution

Usually, the timeline can range from 18 to 36 months to start a diethyl carbonate production plant, depending on factors like the scale, environmental approvals, plant capacity, regulatory requirements (especially if phosgene is used), and equipment lead time. Construction, utility setup, safety compliance, and pilot testing are critical steps before full operations.

Challenges may include high capital requirements, securing regulatory approvals, ensuring raw material supply, competition, skilled manpower availability, and managing operational risks.

Typical requirements include business registration, environmental clearances, factory licenses, fire safety certifications, and industry-specific permits. Local/state/national regulations may apply depending on the location.

The top diethyl carbonate producers are:

-

UBE Corporation

-

Kowa American Corporation

-

Sandong Shida Shenghua Chemical Group Co.,ltd

-

Shandong Lixing Chemical Co., Ltd.

-

Chongqing ChangFeng Chemical Co.,Ltd.

Profitability depends on several factors including market demand, production efficiency, pricing strategy, raw material cost management, and operational scale. Profit margins usually improve with capacity expansion and increased capacity utilization rates.

Cost components typically include:

-

Land and Infrastructure

-

Machinery and Equipment

-

Building and Civil Construction

-

Utilities and Installation

-

Working Capital

Break even in a diethyl carbonate production business typically range from 4 to 7 years, depending on raw material prices, production scale, market demand (especially in batteries and solvents), demand from battery, solvent, or pharmaceutical sectors, and safety management costs. Advanced production methods may offer faster ROI through cleaner processes and higher margins.

Governments may offer incentives such as capital subsidies, tax exemptions, reduced utility tariffs, export benefits, or interest subsidies to promote manufacturing under various national or regional industrial policies.

Financing can be arranged through term loans, government-backed schemes, private equity, venture capital, equipment leasing, or strategic partnerships. Financial viability assessments help identify optimal funding routes.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization