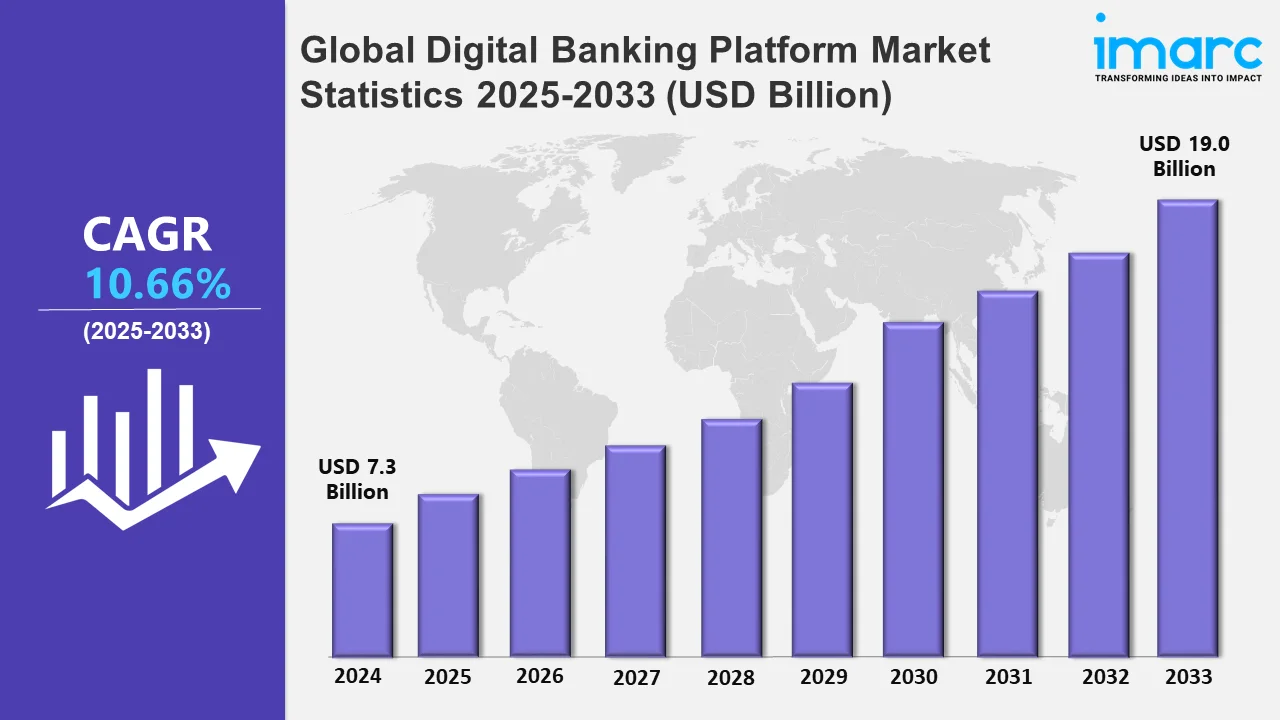

Global Digital Banking Platform Market Expected to Reach USD 19.0 Billion by 2033 – IMARC Group

Global Digital Banking Platform Market Statistics, Outlook, and Regional Analysis 2025-2033

The global digital banking platform market size was valued at USD 7.3 Billion in 2024, and it is expected to reach USD 19.0 Billion by 2033, exhibiting a growth rate (CAGR) of 10.66% from 2025 to 2033.

To get more information on this market, Request Sample

In June 2024, Mashreq Bank revealed plans to extend its international presence by incorporating Oracle’s digital banking technologies. These developments seek to optimize processes, improve customer support, and deliver quicker and more effective financial services. This action emphasizes the increasing dependence on technological advancements to remain competitive in the constantly changing banking sector, enhancing user experience and operational scalability. Technologies, such as AI and ML, are revolutionizing banking, offering customized and predictive financial services. Cloud computing enables banks to expand their operations while reducing costs, keeping data availability and continuity. Sophisticated data analysis offers understandings of customer behavior, allowing banks to customize services and enhance customer satisfaction. Mobile and web technologies are transforming user experiences, providing intuitive interfaces and smooth functionality across devices. Automation tools optimize everyday tasks like account oversight and loan authorization, minimizing time and operational expenses. Improved cybersecurity protocols, such as biometric verification and encryption, are fostering customer confidence in digital platforms.

Digital banking services provide functionalities, such as mobile applications and web portals, ensuring smooth access to financial solutions. The capability to conduct transactions, verify balances, and oversee accounts from a distance greatly improves customer satisfaction. Hectic schedules and limited time are prompting individuals to opt for effective and immediate banking options. Digital platforms enable instant payments, quick loan approvals, and hassle-free account setups, meeting modern customer expectations. Personalized services, such as tailored financial advice and transaction alerts, further attract individuals to digital banking platforms. The rising preferences for contactless and cashless payments is heightening the dependence on digital banking services. Younger, tech-oriented customers demand cutting-edge features like AI-powered chatbots, virtual cards, and blockchain-based security in banking. Digital banking platforms offer inclusive and accessible financial services, especially in underserved economies. In December 2024, TCS Limited ties up with the Bank of Bhutan to digitize its digital banking system for improved services that leverage cutting-edge technologies to achieve higher accessibility, security, and scalability. A smooth, hassle-free experience, a precursor to meeting increasingly evolving customer demands in creating a financially inclusive Bhutan, is envisioned in this collaboration.

Global Digital Banking Platform Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounts for the largest market share due to its advanced technological infrastructure, high internet penetration, and strong adoption of digital banking services by both individuals and financial institutions.

North America Digital Banking Platform Market Trends:

North America holds the highest market share because of its developed infrastructure. The area is witnessing swift digital uptake in both personal and commercial banking sectors. Financial institutions in the United States and Canada are utilizing advanced technologies to provide novel banking services. Individuals in North America are progressively seeking uninterrupted and instantaneous access to financial services. Consequently, banks are putting money into AI and blockchain to provide tailored and secure solutions. The increasing demand for mobile banking options, especially in the US, is presenting a positive market perspective. In October 2024, Santander introduced Openbank in the US, broadening its banking services across the country with digital options. The platform provides attractive savings options and strives to deliver uniform and safe banking experiences for its clients. The emergence of neobanks and fintech companies is heightening competition, prompting conventional banks to adopt digital solutions. Supportive government policies in North America are promoting the digital transformation of financial services. Widespread internet access and a technologically proficient populace accelerates the transition to digital banking services.

Asia-Pacific Digital Banking Platform Market Trends:

The Asia Pacific region is among the fastest-growing markets, fueled by rising internet access, especially in developing markets like India and China. The adoption of mobile banking is significant in the area, with people favoring digital options for their financial requirements. Governing agencies are actively encouraging digital payments and financial inclusion, which encourages the use of digital platforms. Fintech startups are increasingly emerging in the region, providing innovative solutions that attract younger, technology-oriented demographics. Regional banks are making significant investments in technologies like AI, ML, and blockchain to improve customer experiences.

Europe Digital Banking Platform Market Trends:

The market for digital banking platforms in Europe is known for its high regulatory frameworks and financial stability. The European Union's commitment towards digitalization and financial innovation is bolstering the growth of the market. Adoption of digital banking solutions is high in countries like the UK, Germany, and France, attributed to high internet usage. European customers are demanding more efficient, secure, and user-friendly digital banking experiences, which is prompting banks to invest in technological solutions. The region's regulatory landscape including the GDPR and PSD2, is encouraging secure digital transformation and financial transparency. Banks are increasingly adopting AI, cloud computing, and blockchain technologies to enhance customer engagement and improve service delivery. Fintech companies in Europe are disrupting traditional banking models, especially through the provision of digital-first banking solutions for younger demographics.

Latin America Digital Banking Platform Market Trends:

Latin America is experiencing rapid adoption of digital banking platform, with countries like Brazil and Mexico leading the way. Economic instability in the region is driving the need for more efficient and secure financial services. The unbanked population in Latin America is a major factor, with digital banking providing improved access to financial services. Governments in the region are increasingly encouraging digital payments, which drives the market for digital platforms. High smartphone penetration and growing internet access are contributing to the usage of mobile banking services across the region.

Middle East and Africa Digital Banking Platform Market Trends:

The Middle East and Africa region is emerging as an important market, supported by its growing tech-savvy population. The region is undergoing rapid digital transformation, driven by government initiatives and investments in infrastructure. Countries like the UAE and Saudi Arabia are spearheading digital banking adoption in the Middle East, with many fintech startups gaining traction. The increasing demand for secure, efficient financial services is motivating banks in the region to adopt digital solutions. Mobile banking adoption is growing in both urban and rural areas, as smartphones become more accessible to individuals.

Top Companies Leading in the Digital Banking Platform Industry

Some of the leading digital banking platform market companies include Appway AG (FNZ (UK) Ltd.), Fidelity Information Services (FIS), Finastra Limited, Fiserv Inc., Infosys Limited, nCino, NCR Corporation, Oracle Corporation, SAP SE, Sopra Steria, Tata Consultancy Services Limited, Temenos AG, The Bank of New York Mellon Corporation, and Worldline, among many others. In November 2024, Temenos AG has partnered with Reem Finance to launch a new digital community bank in the UAE. This collaboration utilizes Temenos’ cloud-based solutions to enhance flexibility and scalability. The initiative is expected to improve financial inclusion by offering diverse services to individuals and businesses. It also aims to reduce operational costs through digital transformation.

Global Digital Banking Platform Market Segmentation Coverage

- On the basis of the component, the market has been categorized into solutions and services, wherein solutions represent the leading segment. Solutions integrate services like payments, risk management, and customer interaction into one platform. Banks are increasingly putting money into solutions to meet rising customer expectations for seamless and personalized experiences. Advanced technologies like AI, blockchain, and analytics embedded in solutions offer safe and scalable banking options. The rising necessity to automate processes and reduce operational costs heightens the demand for solutions. Regulatory compliance requirements prompt banks to seek cohesive solutions that ensure data protection and clarity, strengthening the market growth.

- Based on the type, the market has been classified into retail banking and corporate banking, amongst which retail banking dominates the market.Retail banking dominates the market because of its extensive customer base and expanding demand for digital services. Customers are progressively favoring online and mobile banking solutions for their convenience, effectiveness, and accessibility. Digital platforms in retail banking provide customized services, including personalized financial guidance and account oversight. Retail banks emphasize customer interaction by utilizing sophisticated tools like chatbots, payment gateways, and real-time transactions. The swift embrace of smartphones and internet access additionally enhances the digital transformation of retail banking.

- On the basis of the deployment mode, the market has been divided into on-premises and cloud-based. Among these, on-premises accounts for the majority of the market share.Banks emphasize security and adherence to stringent regulations, preferring on-premises solutions to safeguard data. These implementations enable financial organizations to tailor systems to address particular operational and client requirements. On-premises systems also allow smooth integration with current infrastructure, reducing interruptions during digital transformations. Financial institutions appreciate the decreased dependence on external providers and the capacity to handle resources in-house. The demand for immediate processing and safe transactions leads to a preference for on-premises solutions, even as cloud-based options gain momentum in the market.

- Based on the banking mode, the market is segregated into online banking and mobile banking. Amongst which online banking holds the largest market share. Online banking prevails because it provides convenient, round-the-clock financial services to clients. The widespread use of the internet and smartphones has sped up the global adoption of online banking platforms. These platforms allow users to conduct transactions, pay bills, and manage accounts without having to visit branches. Banks are progressively prioritizing the improvement of online services by incorporating features like instant payments, chatbots, and enhanced security. Internet banking additionally fosters financial inclusion by offering access to services in neglected regions.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.3 Billion |

| Market Forecast in 2033 | USD 19.0 Billion |

| Market Growth Rate 2025-2033 | 10.66% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Solutions, Services |

| Types Covered | Retail Banking, Corporate Banking |

| Deployment Modes Covered | On-premises, Cloud-based |

| Banking Modes Covered | Online Banking, Mobile Banking |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Appway AG (FNZ (UK) Ltd.), Fidelity Information Services (FIS), Finastra Limited, Fiserv Inc., Infosys Limited, nCino, NCR Corporation, Oracle Corporation, SAP SE, Sopra Steria, Tata Consultancy Services Limited, Temenos AG, The Bank of New York Mellon Corporation, Worldline, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)