Digital Camera Market Size, Share, Trends and Forecast by Product Type and Region, 2025-2033

Digital Camera Market Size and Share:

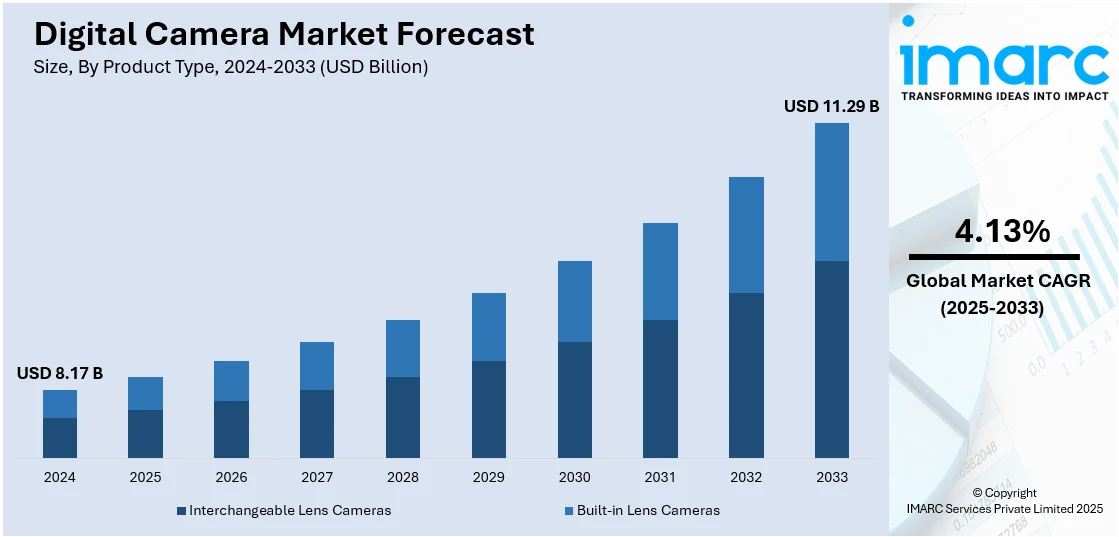

The global digital camera market size was valued at USD 8.17 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.29 Billion by 2033, exhibiting a CAGR of 4.13% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of around 39.8% in 2024. The market is driven by increasing consumer demand for high-quality images, with growth supported by advancements in image processing and sensor technologies. The emergence of social media and influencer-type content creation culture are further enhancing digital camera sales among enthusiasts and professional users. Moreover, technological advancements in mirrorless systems, AI-assisted functionality, and slimmer designs enhancing usability further augment digital camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.17 Billion |

|

Market Forecast in 2033

|

USD 11.29 Billion |

| Market Growth Rate 2025-2033 | 4.13% |

The market is primarily driven by advancements in imaging technology, including higher megapixels, improved sensors, and enhanced low-light performance, which collectively improve overall photo quality. Increased content creation, especially on social media and video-sharing platforms, has induced more demand for quality cameras. The worldwide surge in travel photography driven by increased travel and tourism has continued to accelerate the digital camera market. As more consumers prioritize capturing memorable moments, especially during vacations and excursions, there is a rising need for portable yet powerful cameras. For instance, France recorded 100 million international travelers in 2024, highlighting the expanding demand for high-quality cameras to capture travel experiences. Competitive pricing and affordable options across different segments have also played a key role in market development.

In the United States, the market is driven by the country’s robust infrastructure for media and entertainment, which supports continuous investment in high-end imaging equipment. The U.S. Media and Entertainment (M&E) industry, the largest in the world, stands at USD 649 Billion and is anticipated to increase to USD 808 Billion by 2028, at an average annual growth rate of 4.3%, according to industry reports. This rapid expansion of the M&E sector directly contributes to the demand for advanced cameras, as high-quality imaging is essential for professional content creation across film, television, and digital media platforms. In addition, improvements in camera technology, such as optical zooming and AI-driven image improvements, play a crucial role in generating interest among consumers. The expanding e-commerce sector in the U.S. has simplified purchasing processes, making digital cameras more accessible.

Digital Camera Market Trends:

Expanding Creator Economy

The rise of the creator economy is significantly influencing the market as more individuals monetize their content across various platforms. According to an industry report, the creator economy comprises approximately 207 million creators globally and is projected to grow at a 22.5% annual rate to reach USD 528.39 billion by 2030. This growth has generated immense demand for high-quality, portable, and easy-to-use cameras that can handle both photo and video capture. Content creators appreciate the quality, such as 4K video recording, fast autofocus, image stabilization, and wireless connectivity, which make sharing and editing easy. Given their sole nature of operation, compact mirrorless cameras and vlogging kits with flip screens, and built-in microphones have become particularly favored. Additionally, the need for a professional look has given rise to interest in interchangeable lens systems, which allow creators to switch lenses based on different environments. Camera manufacturers are responding by launching creator-focused models and accessories that cater to this segment.

Growing Interest in Photography as a Hobby and Profession

Photography has evolved from a niche interest into a widely embraced hobby and profession, contributing to digital camera market growth. According to an industry report, the global photography market is projected to grow at a steady rate of 4.4% annually, potentially reaching USD 161.8 Billion by 2030. The growth is driven by an increased demand from consumers for professional and amateur photography, as well as a faster demand for high-resolution images in various sectors, including media, advertising, travel, and retail commerce. The market is also being supported by the proliferation of online photo learning websites and photo forums, which are fostering a new generation of capable photographers. Amateur photographers are spending more money on professional-standard cameras to try out genres like landscape, wildlife, street, and portrait photography. For professionals, full-frame and medium-format sensors, dynamic range, and color accuracy are essential, leading to a demand for full-frame and medium-format cameras. Therefore, there is a need for camera companies to expand their product range to accommodate various levels of expertise, from entry-level cameras to professional systems.

Integration of AI and Computational Photography

Artificial intelligence (AI) and computational photography are transforming the capability of digital cameras, enhancing image quality and also improving user experience. AI capabilities, such as subject detection, scene adjustment, real-time tracking, and autofocus accuracy, enhance the digital camera market outlook. Notably, on May 26, 2025, Fujifilm released the GFX100RF, its first fixed-lens medium-format digital camera in the GFX series. The camera comes with a 102MP CMOS II sensor, X-Processor 5 processor, AI-driven subject detection autofocus, and can record 4K/30P 10-bit video with F-Log2. It also features a newly created 35mm F4 lens, an aluminum body machined to precision, and a new Aspect Ratio Dial, making it a high-performance, compact option for professional creators. Computational improvements, including HDR processing, noise reduction, and depth mapping, also help deliver better results in difficult lighting conditions. These technologies enable users to capture sharp, properly exposed images with minimal manual effort, making advanced photography accessible to a wider audience.

Digital Camera Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global digital camera market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on product type.

Analysis by Product Type:

- Interchangeable Lens Cameras

- Digital Single Lens Reflex (SLR) Cameras

- Digital Rangefinders

- Line-Scan Camera Systems

- Built-in Lens Cameras

- Integration Camera

- Bridge Cameras

- Compact Digital Cameras

Interchangeable lens cameras lead the market with around 89.2% of market share in 2024 due to their versatility, higher image quality, and ability to cope with different shooting conditions. Both DSLR and mirrorless systems qualify as ILCs, which enable changing the lenses according to specific requirements, ranging from wide landscapes to high-level macro shots, making them suitable for professionals and heavy users. Their high-end features, including larger sensors, manual settings, and compatibility with a wide array of accessories, contribute to their robust popularity. ILCs also include high-resolution video recording, which responds to the increasing popularity among vloggers and content creators. As photography and videography flourish with digital storytelling and social media, the role of ILCs becomes more significant, providing users with both technical accuracy and creative freedom. Their position of spearheading innovation and establishing performance levels maintains their strong position in the market.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of over 39.8% driven by its expansive consumer market, increased urbanization, and increasing passion for photography and content creation. China, Japan, South Korea, and India are key contributors to both the production and consumption of digital cameras. The area is also home to several important manufacturing centers and is supported by a robust technology infrastructure and innovation capacity. Increasing disposable incomes, growing middle classes, and the popularity of social media sites have all contributed further to the demand for high-quality imaging devices. The growing population of professional photographers, vloggers, and influencers within the areas further supports advanced camera segments, such as mirrorless and interchangeable lens models. With a vibrant combination of mature and emerging markets, the Asia Pacific remains an important strategic priority for market players seeking to strengthen their global presence and cater to shifting digital imaging consumer demands.

Key Regional Takeaways:

United States Digital Camera Market Analysis

In 2024, the United States holds a substantial share of around 77.90% of the market share in North America. The market is thriving due to increased interest in content creation, vlogging, and professional photography. Consumers are seeking high-resolution, mirrorless, and full-frame cameras for better image quality and portability. AI-powered features and enhanced low-light capabilities are boosting demand, while short-form video platforms encourage creators to invest in advanced digital imaging tools. The photography culture among hobbyists and professionals alike supports consistent sales. Innovation in optical zoom, real-time editing, and wireless connectivity is reshaping the user experience. Educational institutions and online learning platforms are also contributing to demand by promoting digital photography courses. For instance, the number of photographer jobs is expected to increase by 4% between 2023 and 2033, which aligns with the average growth rate for all occupations. On average, there will be around 13,700 job openings for photographers annually throughout the decade. Moreover, the expanding application of digital cameras in scientific research and law enforcement has created niche opportunities. Retailers and e-commerce platforms are enhancing product visibility through online campaigns and tech-focused user reviews, fostering greater consumer engagement. Seasonal promotions and bundling with accessories further stimulate purchases.

Europe Digital Camera Market Analysis

The market in Europe is thriving due to a strong photography culture and a growing number of content creators. The market demand is driven by digital archiving, wildlife documentation, and architectural photography. Eco-conscious consumers are interested in modular camera systems, while the filmmaking and visual arts industries are expanding into the market. In addition to this, travel and tourism drive interest in high-performance cameras, while emerging trends include smart home ecosystem integration and AR/VR compatibility. Youth are also adopting visual storytelling and vlogging. Online retail and digital marketing efforts are helping brands tap into diverse audience segments. Moreover, the number of films starting principal photography during the first quarter of 2025, 37 films began principal photography, marking an increase of 15 compared to the initial figures for the first quarter of 2024. These productions had a total expenditure of £632 Million (approximately USD 850.8 Million). Enhanced durability and weatherproof designs are seeing increased traction in Northern and Central Europe. With a balanced blend of innovation and tradition, the market in Europe is positioned for long-term growth.

Asia Pacific Digital Camera Market Analysis

The market in Asia Pacific is gaining momentum due to rapid urbanization and rising disposable incomes. Consumers are increasingly embracing photography as a lifestyle activity and personal expression. Visual-based platforms and e-commerce photography needs are driving investment in upgraded devices. Furthermore, technological convergence, including real-time image processing and smart device integration, is enhancing the user experience. The expansion of creative industries, particularly fashion and advertising, is further catalyzing market demand. Additionally, local online influencers and digital tutorials drive product awareness, which supports market expansion. As Akashvani states, the Union Information and Broadcasting Minister announced a USD 1 Billion fund for the creator’s economy as part of the World Audio-Visual and Entertainment Summit (WAVES) 2025 in India, which is expected to boost the demand for advanced digital cameras tailored to content creators.

Latin America Digital Camera Market Analysis

The market in Latin America is witnessing significant growth as interest in visual storytelling, social documentation, and digital marketing surges across the region. According to an industry report, the creator economy in Brazil alone has seen a 30% growth in direct and indirect job creation, driving a higher demand for cameras in content creation. Apart from this, consumers are increasingly engaging with image-based platforms, leading to greater demand for compact, user-friendly cameras with professional-grade outputs. The region’s expanding creative economy, encompassing online content creation and small-scale media production, is broadening the digital imaging customer base. Also, digital photography is gaining prominence in local events, arts, and education due to intuitive interfaces, wireless sharing, affordability, and accessibility. Moreover, exhibitions and contests encourage new users to explore camera technology, which facilitates market expansion.

Middle East and Africa Digital Camera Market Analysis

In the Middle East and Africa, the market is gradually expanding, supported by a growing appreciation for digital art and media production. Increasing use of cameras for documenting cultural heritage, tourism experiences, and local storytelling is fueling market engagement. For instance, Saudi Arabia’s creator economy surged by 32% in Q1 2025. This shift is likely to enhance demand for digital cameras as more consumers seek advanced photography tools for both personal and professional use. In addition to this, digital literacy programs, increased photography demand, professional growth in visual journalism, and mobile integration are driving sustained growth in the market. Additionally, the expansion of e-commerce and digital marketing in the region has increased the requirement for professional-grade imaging equipment among businesses and content creators, which is positively impacting the market.

Competitive Landscape:

The market competition is extremely strong, with a wide range of players offering products at all levels, from small point-and-shoot cameras to professional models at the higher end. The key drivers of competition are product innovation, image quality, features, and price. Companies are pining for innovations like higher resolution sensors, better low-light performance, quicker autofocus, and improved video capabilities to distinguish themselves within the market. Apart from this, consumer behavior is also shifting towards onboard connectivity-enabled cameras that can easily be shared and integrated into mobile phones. Apart from this, the introduction of mirrorless cameras, which offer the ease of use of DSLRs in compact form factors, adds another layer of competition. Social networking and online media have created the demand for better-quality cameras among influencers and content marketers, propelling industry growth. According to the digital camera market forecast, the market will experience steady growth over the next few years, fueled by continued product innovation and increasing demand in emerging markets.

The report provides a comprehensive analysis of the competitive landscape in the digital camera market with detailed profiles of all major companies, including:

- Canon Inc.

- Nikon Corporation

- Sony Corporation

- Panasonic Corporation

- Olympus Corporation

Latest News and Developments:

- April 2025: Blackmagic Design unveiled the Pyxis 12K digital camera, a customizable 35mm full-frame device offering 16-stop HDR, 12K resolution, and live streaming. Priced at USD 4,995, it supports remote editing via Davinci Cloud and includes Davinci Resolve software, targeting filmmakers, streamers, and studios seeking high-end production capabilities.

- April 2025: Echolens unveiled a retro-style digital camera inspired by the Leica M series, featuring an optical viewfinder and omitting a rear display. Designed for fully automatic operation, it offers Wi-Fi connectivity and analog-style filters to emulate vintage film aesthetics. The camera is set to launch via Kickstarter in mid-2025, targeting enthusiasts seeking a nostalgic photography experience.

- February 2025: Nikon released the COOLPIX P1100 digital camera, featuring a 125x optical zoom covering 24 mm to 3000 mm focal range. It supports 4K UHD/30p video with enhanced Birdwatching and Moon modes and Dual Detect Optical VR.

- February 2025: Nikon, in collaboration with RED Digital Cinema, introduced the V-RAPTOR [X] Z Mount and KOMODO-X Z Mount digital cinema cameras, marking the debut of the Z CINEMA series. These cameras integrate Nikon's Z mount system, offering filmmakers enhanced lens flexibility by supporting both NIKKOR Z and F lenses. This partnership combines RED's advanced cinema technology with Nikon's optical expertise, aiming to deliver superior cinematic quality and versatility for professional content creators.

Digital Camera Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Canon Inc., Nikon Corporation, Sony Corporation, Panasonic Corporation and Olympus Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital camera market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global digital camera market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital camera market was valued at USD 8.17 Billion in 2024.

The digital camera market is projected to exhibit a CAGR of 4.13% during 2025-2033, reaching a value of USD 11.29 Billion by 2033.

The market is driven by the increasing demand for high-quality imaging in various industries such as photography, videography, and surveillance. The rise of social media content creation, advancements in camera technology, and growing adoption of digital photography in smartphones also contribute significantly to market growth.

Asia Pacific currently dominates the digital camera market with a market share of around 39.8%. The dominance is fueled by the presence of leading camera manufacturers in countries like Japan, high consumer demand for advanced imaging devices, and the growing popularity of photography and videography in emerging markets like China and India.

Some of the major players in the digital camera market include Canon Inc., Nikon Corporation, Sony Corporation, Panasonic Corporation and Olympus Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)