Digital Remittance Market Report by Type (Inward Digital Remittance, Outward Digital Remittance), Channel (Bank Transfer, Money Transfer Operators, Online Platforms, and Others), End Use (Migrant Labor Workforce, Individual, Small Businesses, and Others), and Region 2025-2033

Digital Remittance Market Size:

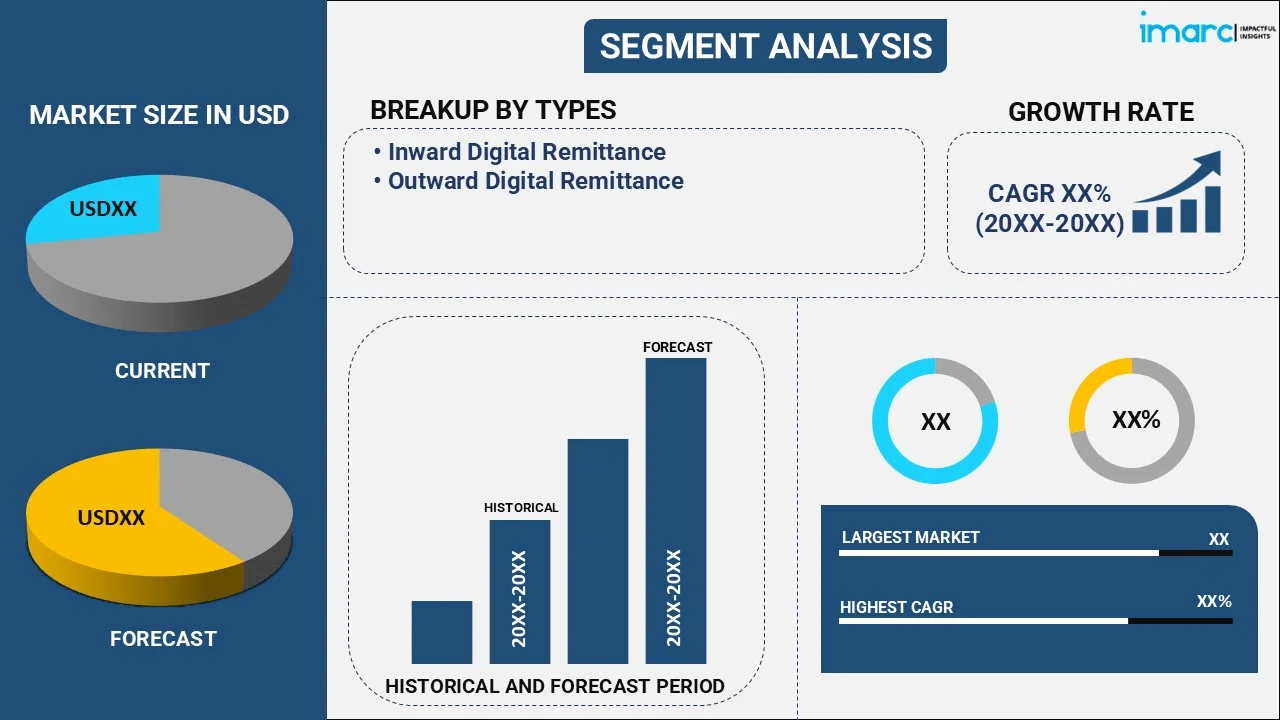

The global digital remittance market size reached USD 24.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 78.2 Billion by 2033, exhibiting a growth rate (CAGR) of 12.7% during 2025-2033. The market is experiencing steady growth driven by the growing need for cost-effective financial solutions, increasing adoption of smartphones and the easy availability of high speed internet connectivity, and integration of advanced technologies that make cross-border money transfers more efficient, secure, and accessible.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 24.4 Billion |

|

Market Forecast in 2033

|

USD 78.2 Billion |

| Market Growth Rate 2025-2033 | 12.7% |

Digital Remittance Market Analysis:

- Market Growth and Size: The market is witnessing robust growth, driven by the increasing demand for seamless international payment solutions, along with rapid digitalization.

- Technological Advancements: Innovations are leading to enhanced security features, such as biometric authentication and blockchain-based transactions. In addition, the integration of artificial intelligence (AI) and data analytics is improving fraud prevention and user experience, which is bolstering the market growth.

- Industry Applications: Digital remittances are widely used for peer-to-peer money transfers, family support, and cross-border e-commerce payments. Organizations worldwide are relying on these platforms for international payroll and supplier payments.

- Geographical Trends: North America leads the market, driven by the presence of a huge number of foreign-born residents and immigrants. However, Asia Pacific is emerging as a fast-growing market due to the rising usage of smartphones, along with easy internet access.

- Competitive Landscape: Key players are continuously focusing on improving user interfaces, implementing advanced security measures, and incorporating innovations like blockchain for faster and more secure transactions.

- Challenges and Opportunities: While the market faces challenges, such as regulatory compliance, it also encounters opportunities in the increasing focus on environmental sustainability.

- Future Outlook: The future of the market looks promising, with the rising focus on offering innovative features. Additionally, the integration of advanced technologies is anticipated to propel the market growth.

To get more information on this market, Request Sample

Digital Remittance Market Trends:

Increasing adoption of smartphones

The rising focus on digital remittance on account of the rapid digitalization is propelling the growth of the market. In line with this, people are increasingly preferring digital solutions for financial transactions. Moreover, digital remittance platforms offer a convenient and efficient way to send money around the world while eliminating the need for physical visits to brick-and-mortar financial institutions. Besides this, the increasing adoption of smartphones and the ease of internet connectivity are contributing to the market growth. Furthermore, users can easily access digital remittance services through user-friendly mobile applications or websites. This accessibility in financial transactions allows people to send and receive money internationally with ease. Apart from this, digitalization enables real-time tracking and notifications and enhances transparency and security in remittance transactions, which is supporting the market growth. In addition, financial technology (FinTech) companies are investing in innovative solutions, ensuring that digital remittance remains a preferred choice for users seeking simplicity and convenience in cross-border money transfers.

Rising focus on cost-effective solutions

The rising focus on cost-effective financial solutions among individuals is impelling the growth of the market. Apart from this, traditional methods of sending money across borders, such as bank transfers and wire transfers, often involve high fees and unfavorable exchange rates. In contrast, digital remittance services offer lower fees and more competitive exchange rates, making them an attractive option for users looking to save on transaction costs. In addition, users are increasingly becoming cost-conscious and are actively seeking ways to maximize the value of their money when sending remittances. Furthermore, the transparent fee structures and competitive exchange rates offered by digital remittance providers resonate with these users, making them choose digital platforms over traditional alternatives. In line with this, the cost-effectiveness of digital remittances is particularly beneficial for users sending smaller amounts of money, as high fees and poor exchange rates can significantly erode the value of the funds being sent. Additionally, digital remittance services cater to a wide spectrum of users, making cross-border transactions accessible and affordable for individuals.

Technological Innovations

Technological advancements in digital remittance make cross-border money transfers more efficient, secure, and accessible. In addition, the introduction of blockchain in digital remittance assists in offering secure, transparent, and real-time transactions. Digital remittance providers leverage blockchain to reduce the time and cost associated with cross-border transfers while enhancing security and traceability. Besides this, the rising usage of mobile wallets in digital remittance is propelling the market growth. Users can store funds and make instant cross-border payments directly from their smartphones, eliminating the need for traditional bank accounts. Moreover, the integration of biometric verification methods, such as fingerprint recognition and facial recognition, is widely used for identity verification during remittance transactions, enhancing security and reducing fraud. Furthermore, artificial intelligence (AI)-driven algorithms are employed for risk assessment, fraud detection, and transaction monitoring. AI helps identify unusual patterns and flags potentially suspicious transactions, improving security. Apart from this, advanced data analytics enable digital remittance providers to gain insights into the behavior of individuals and transaction trends.

Digital Remittance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, channel, and end use.

Breakup by Type:

- Inward Digital Remittance

- Outward Digital Remittance

Outward digital remittance accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes inward digital remittance and outward digital remittance. According to the report, outward digital remittance represented the largest segment.

Outward digital remittance is the transfer of funds from a sender in one country to a recipient located in another country or region using digital channels and platforms. The sender initiates the transaction, and the recipient receives the funds. In addition, outward digital remittance is when an individual or business residing in one country or location sends money to family members, friends, or business partners located abroad. It is typically used to support loved ones, pay for international services, or conduct cross-border business transactions. Users access a digital remittance platform or service provider, input the details of the recipient and the amount to be sent, and then choose the preferred payment method. The funds are electronically transferred to the account of the recipient or made available for cash pickup at a local partner agent in the country of the recipient.

Inward digital remittance involves the receipt of funds by an individual or company located in one country from a sender residing in another country or region using digital channels and platforms. In addition, inward digital remittance is the process of receiving money sent by family members working or residing abroad, receiving payments for goods or services, or collecting funds from international clients or individuals. The sender initiates the transfer, and the recipient receives the funds electronically in their local currency or can choose to collect it in cash at a designated pickup location.

Breakup by Channel:

- Bank Transfer

- Money Transfer Operators

- Online Platforms

- Others

Money transfer operators hold the largest market share

A detailed breakup and analysis of the market based on the channel have also been provided in the report. This includes bank transfer, money transfer operators, online platforms, and others. According to the report, money transfer operators accounted for the largest market share.

Money transfer operators are companies or service providers that specialize in facilitating the transfer of funds from one location to another, usually for remittance purposes. They often have a network of physical agent locations worldwide. Users can visit physical agent locations to initiate remittance transactions. They can provide cash to the agent, who then processes the transfer to be received by the recipient at another location of the agent.

Bank transfer involves the use of traditional banking institutions to send and receive money across borders. Banks provide various services, such as wire transfers and international payment services. Moreover, users can initiate remittance transactions by visiting their local bank branch or using online banking platforms. The bank of the sender facilitates the transfer to the bank of the recipient, which then credits the funds to the account of the recipient.

Online platforms encompass a wide range of digital channels, including mobile apps and websites. These platforms offer users the convenience of sending and receiving money from their computers or mobile devices. In line with this, users can access several online platforms to initiate remittance transactions. These platforms allow users to send money directly from their bank accounts, credit cards, or digital wallets to the account or mobile wallet of the recipient.

Breakup by End Use:

- Migrant Labor Workforce

- Individual

- Small Businesses

- Others

Individual represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use. This includes migrant labor workforce, individual, small businesses, and others. According to the report, individual represented the largest segment.

Individual, also known as personal remittance recipients, is ordinary people who receive remittances from family members, friends, or acquaintances living or working abroad. The funds are generally used for personal expenses, family support, education, healthcare, and other everyday needs. Individuals receiving remittances have the funds in various forms, including direct bank deposits, mobile wallet credits, or cash pickup at local agent locations. They rely on funds to improve their living standards and meet essential financial requirements.

Migrant labor workforce comprises individuals who work in foreign countries, often far from their home countries, to earn income and send a portion of it back to their families and dependents. These workers include expatriates, laborers, and professionals working abroad. Migrant laborers use digital remittance services to send money to their families and dependents residing in their home countries. These funds are vital for supporting their education, healthcare, and housing.

Small businesses, including microenterprises and startups, can also be recipients of digital remittances. These businesses may receive payments from international clients, individuals, or partners for goods and services rendered. Small businesses use digital remittance services to receive payments from international clients and individuals, facilitating cross-border trade and commerce.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

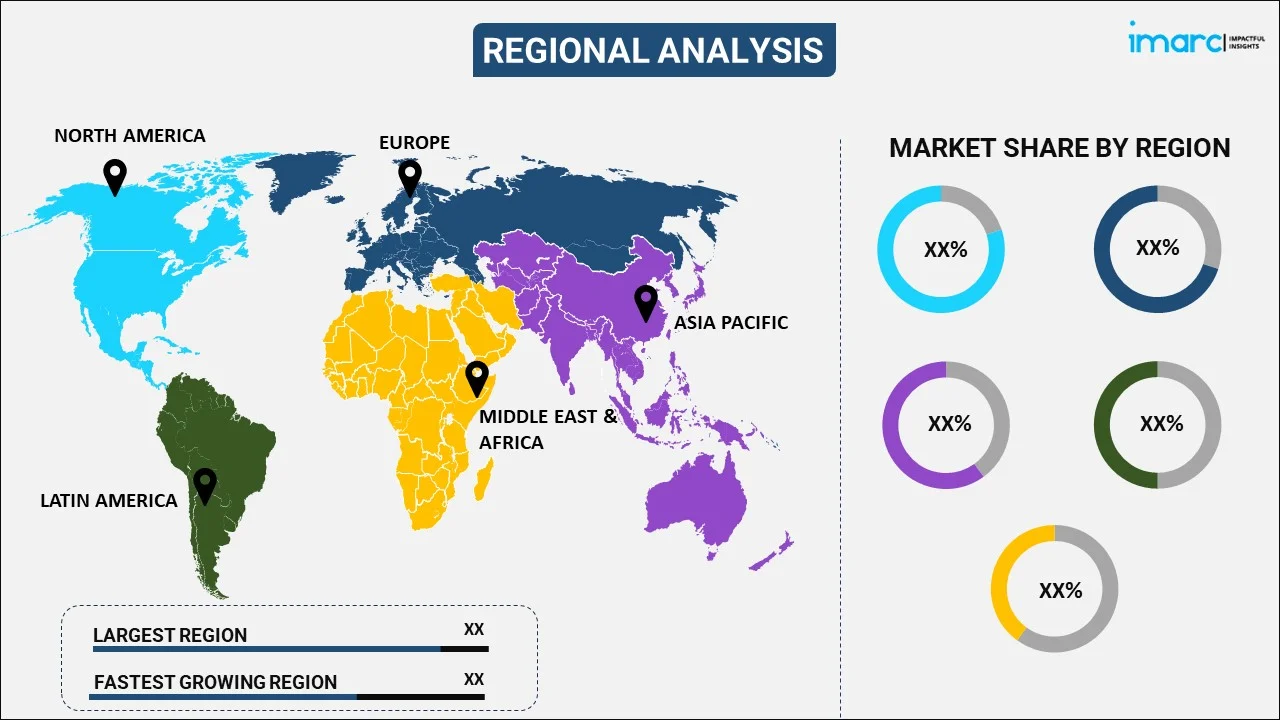

North America leads the market, accounting for the largest digital remittance market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to the presence of a huge number of foreign-born residents and immigrants who regularly send remittances to their home countries. In addition, the rising adoption of advanced technologies and user-friendly platforms to offer efficient and cost-effective cross-border money transfer services is propelling the growth of the market. Moreover, stringent regulatory environment ensures security and compliance in the digital remittance sector, which is contributing to the growth of the market in the region.

Asia Pacific stands as another key region in the market, driven by the increasing need for efficient and affordable digital remittance services among the masses. Apart from this, the growing adoption of digital remittance platforms on account of the rising usage of smartphones, along with easy internet access, is offering a positive market outlook. In addition, fintech companies are offering user-friendly mobile apps and online platforms for cross-border money transfers, which is bolstering the market growth in the region.

Europe maintains a strong presence in the market, with the increasing number of expatriates and migrant workers requiring remittance services to send money back to their home countries In line with this, Europe has a highly developed and interconnected financial ecosystem. The presence of established banks, fintech startups, and digital payment platforms is supporting the growth of the market. Furthermore, the rising focus on enhanced transparency in financial services is impelling the market growth.

Latin America exhibits growing potential in the digital remittance market on account of the increasing demand for remittance services, as individuals and families rely on these funds to support their livelihoods, education, healthcare, and other essential needs. Besides this, the rising adoption of digital technologies and mobile devices is contributing to the growth of the market. Moreover, the presence of both established financial institutions and innovative fintech startups in Latin America is bolstering the market growth.

The Middle East and Africa region show a developing market for digital remittance, primarily driven by the increasing utilization of smartphones among the masses.

Leading Key Players in the Digital Remittance Industry:

Key players in the market are continuously focusing on improving user interfaces, implementing advanced security measures, and incorporating innovations like blockchain for faster and more secure transactions. In line with this, companies are expanding their network of partner agents and banking institutions to increase their presence in both sending and receiving countries. This ensures that users can access their services conveniently and receive funds easily. They are also focusing on making their platforms user-friendly, with features like real-time tracking, instant notifications, and multilingual support to provide a seamless and transparent user experience. Moreover, companies are diversifying their payment options by integrating with various payment methods, such as bank transfers, credit cards, mobile wallets, and cryptocurrency.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Azimo Limited

- Digital Wallet Corporation

- Moneygram International Inc.

- NIUM Pte. Ltd.

- PayPal Holdings Inc.

- Remitly Inc.

- Ria Financial Services Ltd.

- Ripple Labs Inc.

- TransferGo Ltd.

- Western Union Holdings Inc.

- Wise Payments Limited (Earlier TransferWise Limited)

- WorldRemit Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- September 12, 2022: Western Union Holdings Inc. acquired Te Enviei, a Brazil-based digital wallet, to expand its value proposition to individuals by offering a broader set of digital financial services. Western Union plans to enable its consumers to store funds, send money overseas and domestically, and pay their bills, all from the convenience of their phones by introducing its digital wallet in Brazil.

- August 12, 2021: WorldRemit Ltd. a leading digital cross-border payments company launched its money transfer services from Malaysia. It allows individuals to send money from Malaysia, in addition to 50 other countries including the UK and the USA, to more than 130 destinations. In addition, people can choose from multiple payout methods for the recipient including bank deposits, payments to mobile wallets, cash pick-up and mobile airtime top-up.

- May 12, 2021: PayPal Holdings Inc., a global leader in digital payments, introduced an automated process to obtain the monthly foreign inward remittance advice (FIRA). At a zero-cost, PayPal merchants will be able to download their monthly digital FIRA issued by the bank by simply logging into their PayPal account. The fully automated process will not require sellers to place manual and individual requests, thereby reducing the time taken to file the paperwork.

Digital Remittance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Inward Digital Remittance, Outward Digital Remittance |

| Channels Covered | Bank Transfer, Money Transfer Operators, Online Platforms, Others |

| End Uses Covered | Migrant Labor Workforce, Individual, Small Businesses, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Azimo Limited, Digital Wallet Corporation, Moneygram International Inc., NIUM Pte. Ltd., PayPal Holdings Inc., Remitly Inc., Ria Financial Services Ltd., Ripple Labs Inc., TransferGo Ltd., Western Union Holdings Inc., Wise Payments Limited (Earlier TransferWise Limited), WorldRemit Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the digital remittance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global digital remittance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the digital remittance industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global digital remittance market to exhibit a CAGR of 12.7% during 2025-2033.

The growing adoption of digital and automated payment and money transfer solutions, such as digital remittance, along with the introduction of real-time banking technology to leverage Immediate Payment Service (IMPS), is primarily driving the global digital remittance market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing deployment of digital remittance to transfer funds effectively and quickly to combat the spread of the coronavirus infection upon cash transactions.

Based on the type, the global digital remittance market can be categorized into inward digital remittance and outward digital remittance. Currently, outward digital remittance accounts for the majority of the global market share.

Based on the channel, the global digital remittance market has been segregated into bank transfer, money transfer operators, online platforms, and others. Among these, money transfer operators currently hold the largest market share.

Based on the end use, the global digital remittance market can be bifurcated into migrant labor workforce, individual, small businesses, and others. Currently, individual exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global digital remittance market include Azimo Limited, Digital Wallet Corporation, Moneygram International Inc., NIUM Pte. Ltd., PayPal Holdings Inc., Remitly Inc., Ria Financial Services Ltd., Ripple Labs Inc., TransferGo Ltd., Western Union Holdings Inc., Wise Payments Limited (Earlier TransferWise Limited), and WorldRemit Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)