Disaster Relief Services Business Plan and Project Report 2026: Industry Trends, Business Setup, Revenue Model, Investment Opportunities, Income, Expenses, and Profitability

Disaster Relief Services Business Plan Report Summary

- Purpose: A business plan for disaster relief services provides a structured pathway for building a responsive, resilient, and scalable operational model that helps organizations deliver coordinated emergency assistance, strengthen preparedness, and support rapid community recovery during crises.

- Market Opportunity: Growing climate-related disruptions, rising urban vulnerabilities, and increasing demand for organized emergency support create a strong market need for specialized disaster relief services that enable governments, non-profits, and private entities to improve preparedness and response ecosystems.

- Investment Required: Initial investment focuses on developing skilled response teams, securing essential equipment, establishing partnerships, building communication capabilities, strengthening operational infrastructure, and supporting outreach and organizational development activities necessary to launch and sustain service delivery.

- Technical Requirements: A successful setup requires robust communication systems, emergency logistics planning, expert staffing, reliable coordination frameworks, secure information management, and alignment with recognized standards governing humanitarian operations, continuity planning, and crisis response protocols.

- Regulatory Approval: The service must comply with national emergency management guidelines, humanitarian coordination frameworks, safety regulations, data protection rules, and sector-specific requirements that govern disaster response activities for both domestic and international operations.

- Financial Analysis: A financial assessment evaluates projected operating needs, service delivery expenses, potential funding streams, risk mitigation costs, partnership-driven engagements, and long-term sustainability considerations to determine the overall financial health and growth prospects of the service.

- ROI & Viability: Returns are supported by consistent demand, mission-critical service relevance, strong institutional partnerships, and scalable operating models, positioning disaster relief services as a viable long-term initiative with stable opportunities for expansion and community impact.

What are Disaster Relief Services?

- Disaster relief services encompass organized efforts designed to prepare for, respond to, and recover from natural or human-made emergency events. These services include early warning communication, evacuation support, medical assistance, temporary shelter, supply distribution, debris clearance, and community restoration activities. They operate across the entire emergency cycle, from preparedness and risk mitigation to immediate response and long-term recovery. Providers may include humanitarian organizations, private response firms, logistics companies, and specialized contractors working with governments, non-profits, and international agencies.

- Modern disaster relief increasingly relies on integrated technologies such as geospatial mapping, real-time incident monitoring, digital command centers, and data-driven assessment tools. These capabilities enable faster situational awareness, better coordination among stakeholders, and more targeted deployment of resources. With rising environmental risks, population density, and infrastructure vulnerabilities, demand for professional, scalable, and technology-supported services continues to expand. The sector also emphasizes community resilience, focusing on training, capacity building, and preventive planning. As extreme events become more frequent, disaster relief services play a pivotal role in safeguarding lives, stabilizing communities, and supporting long-term rehabilitation.

Disaster Relief Services Business Setup:

Setting up a disaster relief services business involves building operational capacity, establishing response protocols, and forming partnerships with government bodies, aid agencies, and local authorities. It requires investment in equipment, trained personnel, command systems, and logistics networks capable of rapid deployment. The setup also includes compliance preparation, certification processes, and development of emergency plans aligned with humanitarian standards. Strategic planning focuses on service specialization, such as medical support, supply chain logistics, rescue operations, or recovery programs. To ensure sustainability, the business must develop a strong contracting framework, public-sector engagement strategy, and continuous training programs that maintain operational readiness. IMARC Group’s report, titled “Disaster Relief Services Business Plan and Project Report 2026: Industry Trends, Business Setup, Revenue Model, Investment Opportunities, Income, Expenses, and Profitability,” provides a complete roadmap for setting up a disaster relief services facility.

Key Requirements for Setting up a Disaster Relief Services Facility

- Detailed Business Model & Operations Plan:

- Service Overview

- Service Workflow

- Revenue Generation Model

- SOPs and Service Quality Standards

The report outlines the core aspects of the service, including a clear overview of the offering and the step-by-step workflow that drives daily operations. It explains the revenue generation mechanisms, highlighting how the business creates and captures value. It also covers standard operating procedures (SOPs) and service quality standards to ensure consistent delivery and customer satisfaction, providing a practical blueprint for effective management and scalability.

- Technical Feasibility:

- Site Selection Criteria

- Space Requirement and Costs

- Equipment Requirement and Cost

- List of Equipment Suppliers

- Furniture, Fixtures, and Interior Setup

- Utility Requirement and Cost

- Human Resource Requirements and Wages

The feasibility study evaluates the practical aspects of setting up and operating the disaster relief services. It covers criteria for selecting an ideal site, detailing space requirements and associated costs. The report also outlines the necessary equipment, along with estimated costs and a list of reliable suppliers. It also addresses the furniture, fixtures, interior setup, utility needs, with cost estimates, and human resource requirements, including wage considerations, ensuring a comprehensive understanding of the infrastructure and operational essentials.

- Project Economics:

- Capital Investments

- Operating Costs

- Expenditure Projections

- Revenue Projections

- Taxation and Depreciation

- Profit Projections

- Financial Analysis

The report also covers a detailed analysis of the project economics for setting up a disaster relief service. This includes the analysis and detailed understanding of capital expenditure (CapEx), operating expenditure (OpEx), income projections, taxation, depreciation, liquidity analysis, profitability analysis, payback period, NPV, uncertainty analysis, and sensitivity analysis. Furthermore, the report provides a detailed analysis of the licenses and approvals required, information on financial assistance, and a comprehensive list of certifications necessary to set up a disaster relief service.

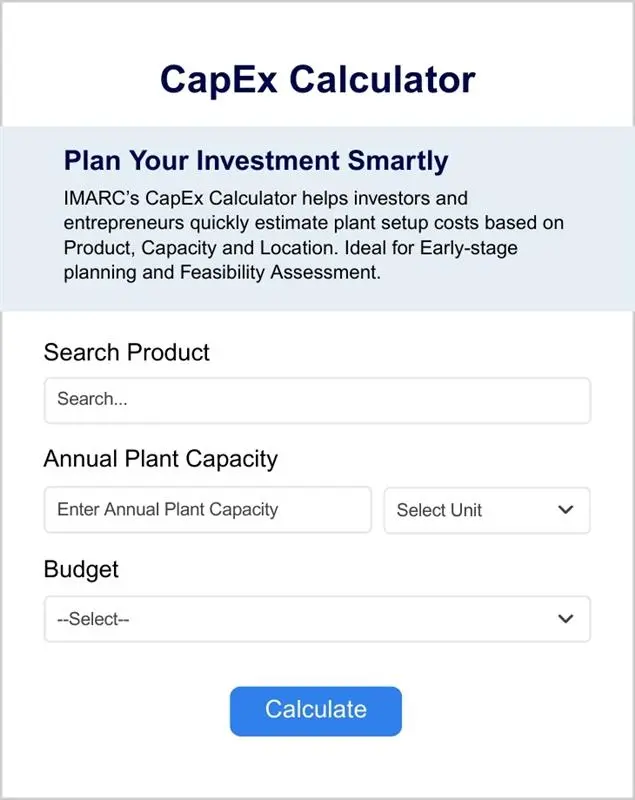

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Capital Investment (CapEx): Equipment & Machinery costs account for the largest portion of the total capital expenditure. The cost of facility development forms another substantial part of the overall capital investment. This allocation ensures a solid foundation for safe and efficient operations.

Operating Expenditure (OpEx): In the first year of operations, the operating cost for the disaster relief services is projected to be significant, covering salaries & wages, utilities, overheads, depreciation, taxes, among others. By the fifth year, the total operational cost is expected to increase substantially due to factors such as inflation, market fluctuations, and a potential increase in labor costs.

Capital Expenditure Breakdown:

|

Particulars |

Cost (in US$) |

|

Facility Development Costs |

XX |

|

Civil Works Costs |

XX |

|

Equipment & Machinery Costs |

XX |

|

Other Capital Costs |

XX |

Operational Expenditure Breakdown:

|

Particulars |

In % |

|

Salaries & Wages |

XX |

|

Finance costs |

XX |

|

Depreciation and Amortization Expense |

XX |

|

Other Expenses |

XX |

Profitability Analysis:

|

Particulars |

Unit |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

Total Income |

US$ |

XX |

XX |

XX |

XX |

XX |

|

Total Expenditure |

US$ |

XX |

XX |

XX |

XX |

XX |

|

Gross Profit |

US$ |

XX |

XX |

XX |

XX |

XX |

|

Gross Margin |

% |

XX |

XX |

XX |

XX |

XX |

|

Net Profit |

US$ |

XX |

XX |

XX |

XX |

XX |

|

Net Margin |

% |

XX |

XX |

XX |

XX |

XX |

Market Analysis:

- Market Trends

- Market Breakup by Segment

- Market Breakup by Region

- Cost Structure

- Market Forecast

- Competitive Landscape

The report also provides a concise evaluation of the market landscape, covering key trends, market segmentation, regional demand variations, cost structures, future growth projections, and the competitive landscape with major players and entry barriers. This section offers critical insights to assess the viability and strategic opportunities for establishing a disaster relief service.

Disaster Relief Services Market Trends and Growth Drivers:

- Increasing Climate-Related Disasters

More frequent severe weather events are expanding the need for structured emergency response services. Businesses offering coordinated relief, advanced preparedness tools, and scalable recovery operations are increasingly relied upon to support governments and communities facing growing environmental risks and disruptions.

- Integration of Digital Response Technologies

The adoption of real-time monitoring systems, geospatial tools, remote sensing, and digital coordination platforms is transforming disaster relief operations. These technologies enhance situational awareness, improve resource allocation, and strengthen multi-agency collaboration, driving demand for technologically capable service providers.

- Rising Focus on Community Resilience

Demand is growing for training programs, risk assessments, and preparedness planning aimed at strengthening local capacities before disasters strike. Service providers that support resilience initiatives gain relevance as institutions prioritize proactive approaches rather than solely reactive interventions.

Latest Industry Developments:

- November 2025: The National Disaster Relief Services Centre increased weekly disaster relief services payments to Rs. 2,100 for individuals and Rs. 10,500 for a family of five. Divisional Secretaries gained the authority to procure dry rations up to Rs. 50 million and deliver food under Circulars 1(2025) and 3(2025), addressing disaster conditions and economic pressures.

- April 2025: Thousands of residents across the Midwest and South faced extensive cleanup after recent floods and tornadoes, while disaster relief services mobilized swiftly. The American Red Cross deployed over 1,325 responders across seven states, providing 52 shelters, more than 99,600 meals, 69,000 relief products, and critical medical support to over 17,400 households.

- March 2025: India launched immediate disaster relief services following the 7.7-magnitude earthquake in Myanmar, deploying an 80-member NDRF USAR team with four rescue dogs and advanced equipment to Nay Pyi Taw. The mission includes essential supplies, medical support, and coordination with local authorities under Operation Brahma to aid recovery efforts.

Report Coverage:

|

Report Features |

Details |

|

Product Name |

Disaster Relief Services |

|

Report Coverage |

Business Model & Operations Plan: Business Overview, Business Workflow, Revenue Generation Model, SOPs, and Service Quality Standards Technical Feasibility: Site Selection Criteria, Space Requirement and Costs, Equipment Requirement, Cost & List of Equipment Suppliers, Furniture, Fixtures, and Interior Setup, Utility Requirement and Cost, and Human Resource Requirements and Wages Financial Feasibility: Capital Cost of the Project, Techno-Economic Parameters, Income Projections, Expenditure Projections, Pricing and Margins, Taxation, Depreciation, Financial Analysis, Profitability Analysis, Sensitivity Analysis, and Economic Analysis. Market Analysis: Global Market Trends, Segmentation, Regional Breakup, cost structure, competitive landscape Marketing and Sales Strategy: Branding and positioning, offline and online marketing channels, pricing strategy, customer retention and loyalty programs, and strategic partnerships. Risk Assessment and Mitigation: Operational risks, market risks, financial risks, legal and regulatory risks, and risk mitigation strategies. Other Analysis Covered in The Report: Licenses and Approvals Required, Certifications Required, Strategic Recommendations, Case Study of a Successful Venture |

|

Currency |

US$ (Data can also be provided in the local currency) |

|

Customization Scope |

The report can also be customized based on the requirements of the customer. |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- What are the key operational steps involved in establishing a disaster relief service?

- What is the total space required for setting up a disaster relief service?

- What equipment is necessary for setting up a disaster relief service?

- What are the human resource requirements and associated wage structures in setting up a disaster relief service?

- What are the key marketing & branding strategies involved in a disaster relief services business?

- What are the associated risks and mitigation strategies in a disaster relief services business?

- What are the capital expenditure requirements in setting up a disaster relief services facility?

- What are the operational costs involved in a disaster relief services facility?

- What is the cost structure of a disaster relief service?

- What are the projected income and expenditure involved in a disaster relief services facility?

- What is the estimated break-even period in a disaster relief services business?

- What profit margins can be expected in a disaster relief services business?

- What are the key licenses and approvals required in setting up a disaster relief services facility?

- Which certifications are necessary to operate a disaster relief service legally and effectively?

- How has the global disaster relief services market performed, and what are the future growth prospects?

- What are the key segments within the global disaster relief services market?

- How is the disaster relief services market distributed across different regions worldwide?

- How is the disaster relief services industry structured, and who are the major players?

Report Customization

While we have aimed to create an all-encompassing disaster relief services feasibility study, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include:

- The report can be customized based on the location (country/region) of your facility.

- Equipment and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why Buy IMARC Reports?

- The insights provided in our reports enable stakeholders to make informed business decisions by assessing the feasibility of a business venture.

- Our extensive network of consultants, machinery suppliers, and subject matter experts spans over 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our feasibility study team can assist you in understanding the most complex service models. With domain experts across numerous categories, we can assist you in determining how sensitive each component of the cost model is and how it can affect the final cost and prices.

- We keep a constant track of facility costs, utility costs, and labor costs across 100+ countries and update them regularly.

- Our client base consists of over 3000 organizations, including prominent corporations, governments, and institutions, who rely on us as their trusted business partners. Our clientele varies from small and start-up businesses to Fortune 500 companies.

- Our strong in-house team of engineers, statisticians, modeling experts, chartered accountants, architects, etc., has played a crucial role in constructing, expanding, and optimizing business setups worldwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Frequently Asked Questions

The India cheese market size was valued at INR 128.89 Billion in 2025.

The India cheese market is expected to grow at a compound annual growth rate of 19.07% from 2026-2034 to reach INR 619.88 Billion by 2034.

Mozzarella dominates the India cheese market with a 35% share, driven by its widespread application in pizzas, pastas, and Italian cuisine that has gained immense popularity among Indian consumers.

Key factors driving the India cheese market include increasing westernization of dietary habits and consumer preferences, rapid expansion of quick-service restaurants and foodservice industry, and rising middle-class population with increasing disposable incomes.

Major challenges include strong cultural preference for traditional dairy products like paneer, price sensitivity and premium positioning challenges, and cold chain infrastructure limitations restricting distribution beyond metropolitan markets.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization